Overview

This article presents a curated list of the best books on stakeholder management tailored specifically for CFOs, highlighting their critical role in enhancing engagement strategies and driving financial success. Each book offers actionable insights and strategies, supported by robust statistics and case studies. These resources underscore how effective stakeholder management can significantly elevate organizational outcomes, particularly during financial restructuring or project execution.

Moreover, these texts provide CFOs with the tools necessary to navigate complex financial landscapes, fostering better relationships with stakeholders. By leveraging the insights contained within these books, financial leaders can not only improve their engagement strategies but also drive sustainable growth and success within their organizations.

Consequently, CFOs are encouraged to explore this collection to enhance their understanding and application of stakeholder management principles. The path to improved financial performance begins with informed decision-making, and these resources are essential for any CFO aiming to excel in today’s dynamic business environment.

Introduction

In a landscape where effective stakeholder management is paramount, CFOs are increasingly recognizing the need for comprehensive strategies that foster collaboration and drive financial success. As organizations navigate complex financial landscapes, the ability to engage and align with key stakeholders becomes crucial. This collection of insights from various resources sheds light on the importance of:

- Clear communication

- Trust-building

- Proactive engagement

in enhancing organizational resilience and performance. By leveraging these strategies, CFOs can not only address current challenges but also transform them into opportunities for growth, ensuring that their organizations thrive amidst evolving market dynamics.

Aligned: Stakeholder Management for Product Leaders by Bruce McCarthy and Melissa Appel

Aligned: Management of Interests for Product Leaders by Bruce McCarthy and Melissa Appel offers a comprehensive examination of interest management, distilling complex concepts into actionable strategies. The authors underscore the critical importance of trust and effective communication in engaging stakeholders, a factor that is particularly vital for financial executives navigating financial restructuring or turnaround situations.

Notably, 67% of North American Chief Financial Officers rely significantly on their Chief Administrative Officers (CAOs), highlighting the pivotal role these positions play in relationship management. Furthermore, the statistic indicating that 50% of a company’s value often derives from just 15-20 key positions emphasizes the necessity of managing stakeholders to preserve company worth during financial restructuring.

This resource is considered one of the best books on stakeholder management, equipping financial leaders with the tools to enhance their interactions with stakeholders and fostering stronger connections that can lead to improved financial outcomes. Additionally, the case study on financial executives' focus on employee well-being illustrates how engagement strategies—particularly regarding employee satisfaction and financial literacy—contribute to heightened productivity and organizational health.

By prioritizing these aspects, including transparency as a guiding principle for recovery from the COVID-19 pandemic, financial leaders can bolster their organizations' resilience and adaptability in challenging times. The commitment to applying insights gained from turnaround experiences, combined with continuous performance assessment through real-time analytics, further aids CFOs in making informed decisions that strengthen relationships with stakeholders and drive business success, as discussed in the best books on stakeholder management.

Engaging Stakeholders on Projects: How to Harness People Power by APM

APM's 'Engaging Participants on Projects' presents essential strategies for harnessing the collective power of contributors. This resource, regarded as one of the best books on stakeholder management, equips project managers with practical tools and techniques, including:

- Stakeholder mapping

- Communication plans

to effectively engage stakeholders, ensuring their voices are heard and their needs addressed. For chief financial officers, this book serves as a vital guide to fostering collaboration and securing support during critical financial initiatives. By implementing these strategies, CFOs can enhance alignment between business and project objectives, ultimately driving project success. Notably, 44% of projects fail due to a lack of alignment between business and project goals, which underscores the necessity for efficient involvement of interested parties as discussed in the best books on stakeholder management.

Furthermore, entities that adopt formal project management methods report a 73% success rate in achieving their objectives, emphasizing the importance of the best books on stakeholder management in attaining desired results. The book also stresses the significance of efficient decision-making and real-time analytics, which enable quicker responses to participant needs and enhance overall project performance.

As a structured framework, the five essential phases of the PM lifecycle—project initiation, project planning, project execution, project monitoring and control, and project closure—are discussed in some of the best books on stakeholder management, which can assist financial leaders in their interactions with relevant parties. Additionally, 41% of participants struggle to demonstrate the added value of the PMO, emphasizing the need for financial executives to prioritize engagement with involved parties to address these challenges and implement lessons learned for continuous improvement.

Dealing with Resistant Stakeholders by Bridging the Gap

In 'Dealing with Resistant Stakeholders', Bridging the Gap presents essential strategies for identifying and addressing the concerns of stakeholders resistant to change. This resource is invaluable for chief financial officers navigating pushback during financial restructuring or turnaround efforts.

By implementing the techniques outlined in the book, CFOs can foster a more collaborative environment, which is crucial for facilitating smoother transitions. Effective communication emerges as a key factor in reducing resistance; organizations that prioritize clear messaging can alleviate employee anxiety and foster a sense of pride, ultimately enhancing the success of change initiatives.

The findings from the case study titled 'The Role of Communication in Change Management' demonstrate that emphasizing clear communication methods can significantly diminish employee frustration and unease, while enhancing optimism and pride in the workplace. Moreover, case studies from industry leaders such as IBM and Johnson & Johnson illustrate that a well-executed change management approach not only mitigates pushback but also enhances organizational resilience during crises.

As Dr. Jeremy Pollack, Founder of Pollack Peacebuilding Systems, asserts, 'At Pollack Peacebuilding Systems, we help organizations craft effective change management strategies that minimize employee resistance, reduce workplace stress, and boost long-term success.'

By utilizing these insights, alongside the statistic that by 2025, 50% of all employees will require reskilling, financial leaders can effectively manage interactions and achieve successful results in challenging economic environments. Furthermore, the commitment to implementing insights gained from turnaround processes can further strengthen relationships with interested parties, ensuring that their concerns are addressed through real-time analytics and streamlined decision-making.

Stakeholder Analysis: A Roadmap to PMO Excellence by PMI

PMI's 'Stakeholder Analysis: A Roadmap to PMO Excellence' is considered one of the best books on stakeholder management, providing a robust framework for conducting interest group analysis, making it an essential resource for Chief Financial Officers. This guide enables the identification of key participants, a comprehensive understanding of their interests, and the development of effective engagement strategies.

By applying the principles outlined in the best books on stakeholder management, CFOs can significantly enhance their management practices concerning interested parties, which is critical for achieving project success. Notably, companies that actively engage with their interested parties experience a 15% improvement in strategic results, underscoring the importance of aligning financial initiatives with stakeholder expectations.

Moreover, with 71% of project management experts reporting an increase in the use of collaboration software over the past year, the growing significance of these tools in managing involved parties is undeniable. As project manager Marc G. observes, "Easy to use, it ensures a quick start without constraining training," emphasizing the usability of such frameworks.

Furthermore, given that 80% of financial executives allocate substantial time to interacting with their boards, effective communication is paramount in managing interested parties. The integration of real-time analytics and streamlined decision-making processes, as highlighted in contemporary business practices, further empowers financial leaders to leverage turnaround lessons and enhance collaboration within their organizations.

Stakeholder Engagement Best Practice Guide by Simply Stakeholders

The 'Engagement Best Practice Guide' by Simply Stakeholders is considered one of the best books on stakeholder management for CFOs who seek to strengthen relationships and enhance project outcomes. This guide outlines effective strategies for involving interested parties, emphasizing the critical role of clear communication in garnering support for financial strategies, as discussed in the best books on stakeholder management.

Notably, metrics indicate that communication quality, task completion rate, participant satisfaction, and alignment with goals significantly influence engagement ROI. By adopting the best books on stakeholder management, CFOs can markedly improve satisfaction and alignment with organizational goals.

Furthermore, case studies, such as 'Mapping and Impact Evaluations,' illustrate that organizations employing robust mapping techniques and impact evaluations can adapt more swiftly to challenges, thereby fostering a more agile operational environment. Continuous monitoring of business performance through real-time analytics is vital for operationalizing turnaround lessons and enhancing decision-making processes.

Real-time analytics not only facilitates effective participant involvement but also allows for the testing of hypotheses to ensure maximum return on invested capital. Additionally, it is noteworthy that 50% of a company’s worth often stems from just 15-20 essential roles, underscoring the crucial importance of effective engagement with key stakeholders.

As participant dynamics evolve in 2025, leveraging these insights will be imperative for financial leaders to navigate complexities and promote sustainable growth.

Why Stakeholder Engagement Differs from Stakeholder Management by Vibrant Publishers

In 'Why Stakeholder Engagement Differs from Stakeholder Management', Vibrant Publishers explores the critical distinctions between these two concepts, which are also discussed in some of the best books on stakeholder management, underscoring their implications for organizational success. For CFOs, grasping this distinction is vital, as it facilitates the implementation of more effective strategies for engaging stakeholders. The book reveals that proactive stakeholder involvement can lead to a 30% increase in the success rate of new products, highlighting the strategic advantage of cultivating robust relationships.

Moreover, it emphasizes the evolving business landscape towards capitalistic approaches that encompass all involved parties, illustrating the importance of engaging diverse groups, especially during financial restructuring. By employing efficient decision-making processes and real-time analytics, financial leaders can consistently monitor the effectiveness of their engagement initiatives, ensuring that allocated resources yield measurable benefits. This approach allows for enhanced evaluation of the return on investment in stakeholder involvement, ultimately promoting sustainable growth, and the best books on stakeholder management provide valuable theoretical frameworks and methodological considerations that can aid financial executives in their strategic decision-making.

Managing Your Stakeholders: Set Expectations, Gain Advantage, Get Results by HBR

Among the best books on stakeholder management, Harvard Business Review's 'Managing Your Stakeholders: Set Expectations, Gain Advantage, Get Results' offers vital strategies for effectively setting and managing the expectations of interested parties. This resource is considered one of the best books on stakeholder management for financial leaders aiming to align monetary goals with the interests of involved parties. This book is one of the best books on stakeholder management, as it provides techniques that financial executives can implement to cultivate stronger relationships and drive more favorable outcomes in their financial projects.

Notably, studies indicate that:

- 50% of a company’s worth often derives from just 15-20 crucial positions, underscoring the importance of focusing on the right stakeholders.

- Establishing trust with interested parties can enhance employee retention by up to 10% in the tech industry, potentially leading to reduced turnover costs and increased productivity—key financial indicators that executives closely monitor.

Engaging underutilized participants in significant projects, as illustrated in the case study 'Waiting to be Shaped and Deployed: Lower Voice and Value,' can foster their development and track progress through relationship analysis tools, ultimately resulting in improved financial outcomes.

By aligning financial goals with investor interests and leveraging real-time analytics via our client dashboard to assess business health, financial leaders can not only secure immediate project success but also contribute to sustainable growth. Additionally, a special preview event for financial officers is being offered to explore management concepts further, presenting an excellent opportunity for financial leaders to deepen their understanding of this strategic imperative.

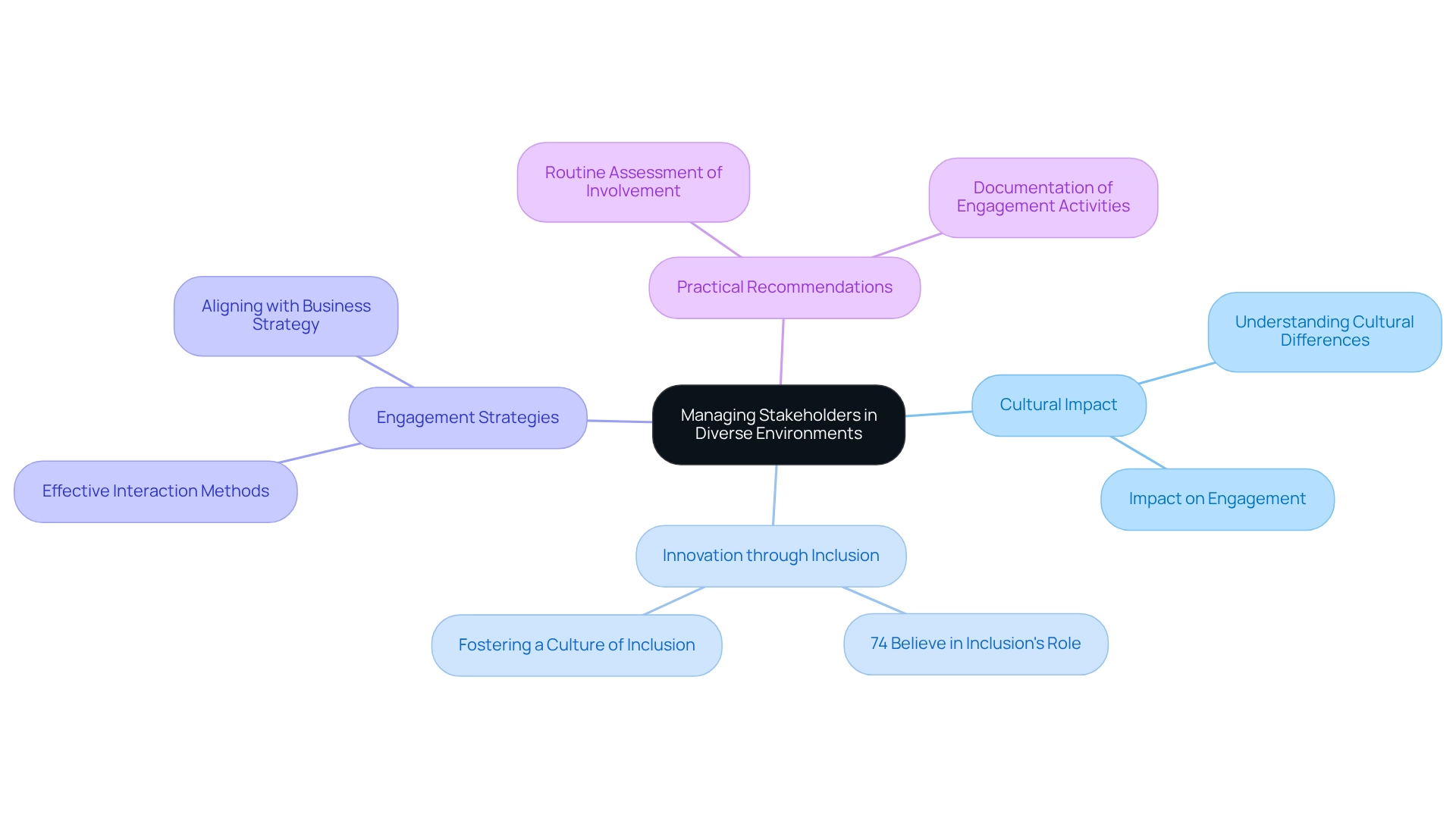

Culture of Stakeholders: Managing Stakeholders in Diverse Environments by OpenTextBC

In 'Culture of Stakeholders: Managing Participants in Diverse Environments', OpenTextBC delves into the complexities of managing individuals with interests across diverse cultural contexts. This resource is indispensable for financial executives operating in varied settings, as it underscores the significant impact of cultural differences on stakeholder engagement. By comprehending these dynamics, financial leaders can refine their engagement strategies, ultimately enhancing financial performance.

Notably, research reveals that 74% of individuals believe organizations stimulate greater innovation when they foster a culture of inclusion. Furthermore, as participant capitalism gains momentum, prioritizing effective interaction methods that align with overarching business strategies becomes essential for sustainable growth.

A case study emphasizing participant involvement illustrates that improved documentation and strategic focus can yield substantial advancements in business outcomes, highlighting the imperative for financial leaders to embrace these practices. By leveraging real-time analytics through client dashboards, financial leaders can monitor participant engagement efforts and make informed decisions that sustain business health and boost performance.

A practical recommendation for financial leaders is to routinely assess and document participant involvement activities, ensuring alignment with broader business objectives to enhance effectiveness while benefiting from a shortened decision-making timeline.

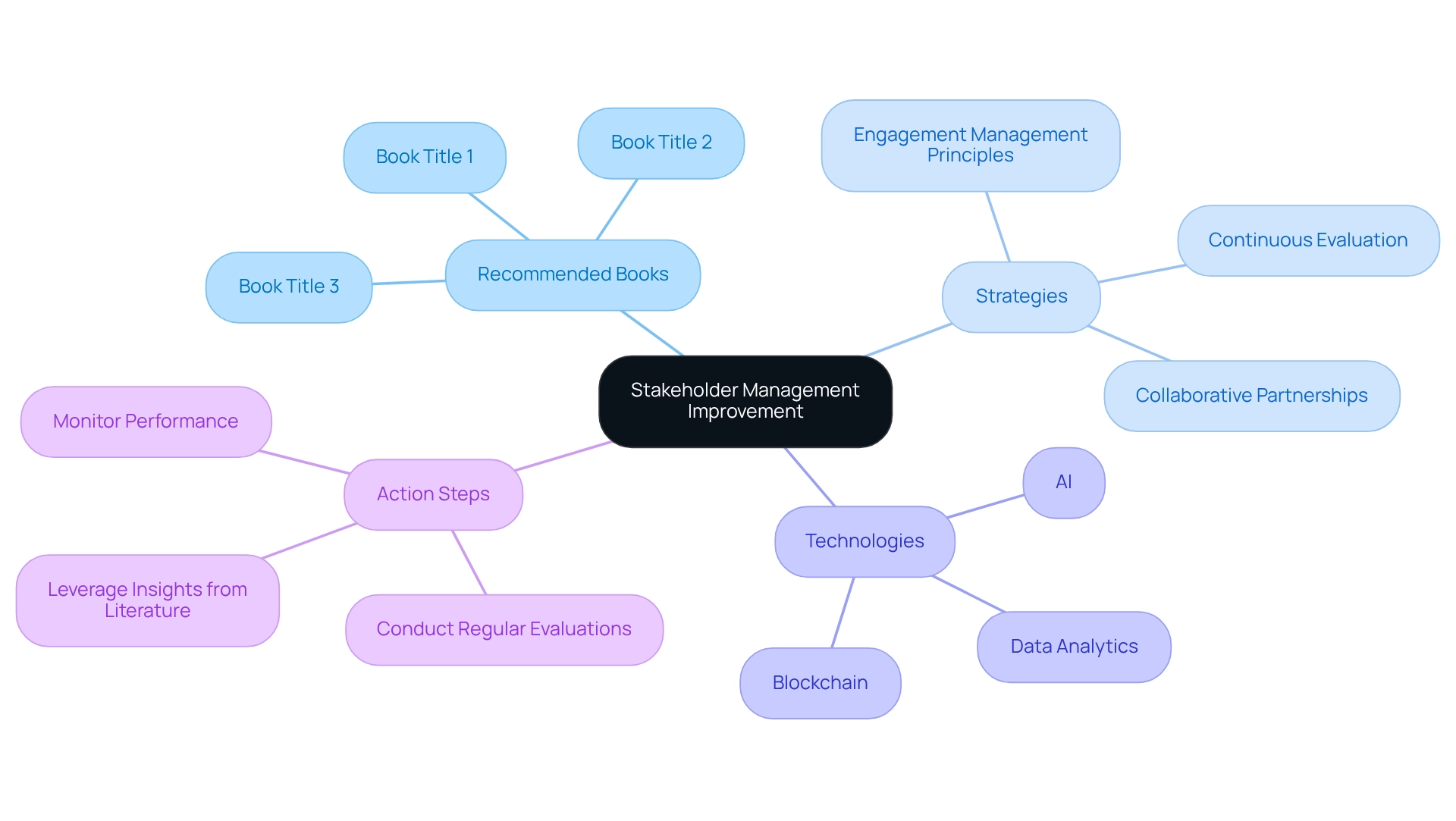

Top 10 Books on Stakeholder Management Strategies by SOBRIEF

SOBRIEF's 'Top 10 Best Books on Stakeholder Management' offers a curated selection of essential readings that explore the multifaceted nature of stakeholder management. This resource is particularly advantageous for financial executives who seek to deepen their understanding and refine their engagement strategies. By engaging with these recommended texts, financial executives can uncover effective practices that not only address current challenges but also transform them into opportunities for growth.

The emphasis on streamlined decision-making and real-time analytics is crucial; these tools, including our client dashboard, empower CFOs to continuously monitor business performance and make informed decisions that preserve and enhance business value. Notably, saving a dollar and reinvesting it into the business can significantly boost its future value, underscoring the importance of effective management strategies.

Furthermore, it is essential to recognize that 50% of a company’s worth often stems from merely 15-20 key positions, highlighting the critical need to involve interested parties. The case study titled 'Waiting to be Shaped and Deployed: Lower Voice and Value' illustrates how engaging low-influence participants in high-value projects can foster their development and enhance their contributions to the organization.

The insights gained from the best books on stakeholder management can greatly enhance involvement from interested parties, ultimately contributing to the organization's long-term success while operationalizing lessons learned from turnaround processes.

10 Books to Improve Your Stakeholder Management Game as a Product Manager by Medium

Medium's '10 Best Books on Stakeholder Management' offers a carefully curated selection of literature aimed at improving engagement management skills. While primarily directed at product managers, the principles and strategies outlined in these texts are equally advantageous for financial executives. By embracing these insights, financial officers can significantly improve their methods of engaging with stakeholders, ultimately leading to enhanced financial outcomes.

For instance, successful participant involvement has been shown to correlate with increased employee satisfaction and productivity. A notable example is a biotech company boasting a high Employee Satisfaction Index (ESI) and experiencing low turnover rates, illustrating the direct impact of effective interest management on organizational success.

Furthermore, with 64% of financial executives actively seeking new technologies to transform their roles, understanding how these innovations can refine interest management practices becomes essential. By leveraging tools such as AI and data analytics, financial executives can cultivate more collaborative partnerships and foster long-term resilience within their organizations. The emphasis on efficient decision-making and real-time analytics empowers financial leaders to make quicker, data-informed choices that align with stakeholder expectations, thereby enhancing operational effectiveness and strategic decision-making.

Moreover, the ongoing trend of digital transformation and automation signifies a profound evolution in the role of financial leaders. By integrating these advancements, financial leaders can improve participant interaction, ensuring their organizations remain adaptable and responsive to changing market conditions.

As a final actionable suggestion, CFOs should consider conducting regular evaluations of engagement strategies, utilizing insights from the recommended literature to continuously adapt and refine their approaches. This proactive approach, supported by ongoing performance monitoring and the operationalization of lessons learned, will not only strengthen stakeholder relationships but also drive sustainable financial performance.

Conclusion

Effective stakeholder management stands as a vital component for CFOs navigating today’s complex financial landscape. Insights gathered from various resources illustrate that clear communication, trust-building, and proactive engagement are not merely best practices; they are essential strategies that can transform challenges into opportunities for growth. By focusing on these key elements, CFOs can forge stronger relationships with stakeholders, ultimately enhancing organizational resilience and performance.

Moreover, the importance of aligning financial objectives with stakeholder interests cannot be overstated. Statistics highlight that a significant portion of a company’s value is tied to a small number of key roles, emphasizing the necessity of effective stakeholder engagement. By leveraging tools such as real-time analytics and streamlined decision-making processes, CFOs can ensure that their organizations are not only responsive to stakeholder needs but also positioned for sustainable success.

As organizations continue to evolve, the commitment to refining stakeholder engagement strategies will be crucial. This proactive approach, supported by continuous learning and adaptation, empowers CFOs to foster a culture of inclusion and collaboration. In doing so, they will not only drive immediate project success but also lay the groundwork for long-term financial health and organizational agility.

Frequently Asked Questions

What is the main focus of the book "Aligned: Management of Interests for Product Leaders" by Bruce McCarthy and Melissa Appel?

The book focuses on interest management, emphasizing the importance of trust and effective communication in engaging stakeholders, particularly for financial executives in restructuring situations.

How significant is the role of Chief Administrative Officers (CAOs) according to the article?

The article states that 67% of North American Chief Financial Officers rely significantly on their Chief Administrative Officers, highlighting their pivotal role in relationship management.

What does the statistic about a company's value indicate?

The statistic indicates that 50% of a company’s value often derives from just 15-20 key positions, underscoring the necessity of managing stakeholders to preserve company worth during financial restructuring.

How does the book help financial leaders improve their stakeholder interactions?

It equips financial leaders with tools to enhance their interactions with stakeholders, fostering stronger connections that can lead to improved financial outcomes.

What is the significance of employee well-being in financial executive strategies?

The case study within the book illustrates that engagement strategies related to employee satisfaction and financial literacy contribute to heightened productivity and organizational health.

How can financial leaders bolster their organizations' resilience during challenging times?

By prioritizing transparency and applying insights from turnaround experiences, financial leaders can enhance their organizations' resilience and adaptability.

What are some essential strategies presented in "APM's 'Engaging Participants on Projects'"?

The book presents stakeholder mapping and communication plans as essential strategies for effectively engaging stakeholders.

What is the impact of project alignment on project success?

The article notes that 44% of projects fail due to a lack of alignment between business and project goals, highlighting the need for efficient stakeholder involvement.

What success rate do entities that adopt formal project management methods report?

Entities that adopt formal project management methods report a 73% success rate in achieving their objectives.

What challenges do financial executives face regarding the PMO's added value?

The article states that 41% of participants struggle to demonstrate the added value of the PMO, emphasizing the need for financial executives to prioritize engagement with stakeholders.

What strategies can CFOs use to address resistance from stakeholders during change management?

CFOs can use effective communication and collaboration strategies to reduce resistance and facilitate smoother transitions during financial restructuring.

How can clear communication impact employee sentiment during change initiatives?

Clear communication can significantly diminish employee frustration and unease, while enhancing optimism and pride in the workplace.

What is the projected need for employee reskilling by 2025?

The article mentions that by 2025, 50% of all employees will require reskilling, indicating a need for financial leaders to manage interactions effectively in changing economic environments.