Overview

The article titled "10 Business Insolvency Strategies for CFOs to Navigate Crisis" primarily aims to equip CFOs with effective strategies for managing and mitigating business insolvency during financial crises. It outlines various approaches, including:

- Early intervention strategies

- Effective debt management

- Continuous financial performance monitoring

This emphasis on proactive measures and expert guidance is crucial for enhancing financial stability and ensuring compliance during challenging economic times.

Introduction

In an increasingly volatile economic landscape, small and medium enterprises (SMEs) encounter unique challenges that can jeopardize their survival. Comprehensive turnaround consulting emerges as a vital lifeline, offering tailored strategies that not only address immediate financial crises but also pave the way for sustainable growth.

From debt restructuring to operational optimization, these consulting services equip CFOs with the essential tools necessary to navigate financial distress effectively. As businesses grapple with the complexities of 2025, understanding the nuances of turnaround strategies and the importance of early intervention can significantly enhance their resilience and long-term success.

This article delves into essential practices for SMEs, highlighting the critical role of:

- Financial assessments

- Stakeholder communication

- Expert guidance

in fostering a robust recovery.

Transform Your Small/ Medium Business: Comprehensive Turnaround Consulting

Transform Your Small/Medium Enterprise: Extensive Turnaround Consulting

Extensive turnaround consulting involves a thorough assessment of an enterprise's operations, economic health, and market positioning. By identifying inefficiencies and opportunities for enhancement, consultants develop tailored strategies that address pressing financial challenges while establishing a foundation for sustainable growth. This approach typically encompasses business insolvency strategies such as debt restructuring, operational optimization, improved cash flow management, and interim management services—critical elements for small to medium enterprises facing crises. Transform Your Small/Medium Enterprise offers a customized strategy, leveraging their expertise in turnaround and restructuring consulting to help organizations save money, streamline operations, and boost revenues.

A compelling success story highlights a $68 million multi-state commercial bakery in Arizona, which faced significant economic and operational challenges. Through strategic collaboration and the execution of the Rapid-30 plan, the bakery realized operational improvements and is projected to achieve an adjusted EBITDA of $3.4 million by 2024. Such transformations illustrate the power of clear recovery plans, fostering trust and alignment among stakeholders, ultimately driving business stability and growth.

As chief financial officers navigate the complexities of 2025, utilizing comprehensive turnaround consulting can markedly enhance financial health and operational resilience. It is crucial to understand that transformation processes often demand more detailed guidance compared to turnaround consulting, underscoring the depth and intricacy of the consulting process.

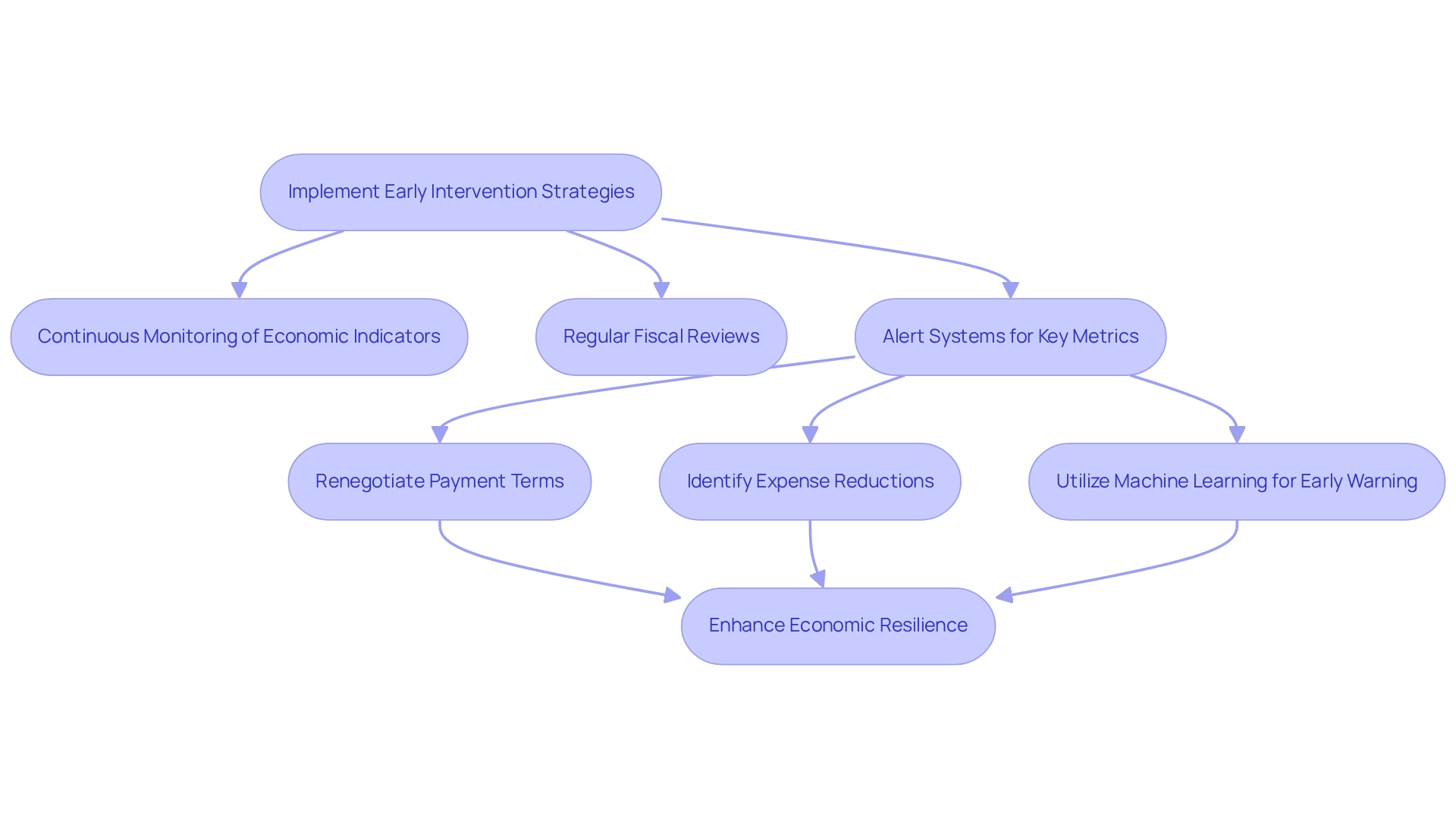

Implement Early Intervention Strategies to Mitigate Insolvency Risks

Implementing early intervention strategies is essential for mitigating risks associated with business insolvency strategies. CFOs must prioritize the continuous monitoring of economic indicators and operational performance through real-time analytics. Establishing regular fiscal reviews and alert systems for key metrics—such as cash flow, debt levels, and operational costs—enables timely responses to emerging issues.

For instance, proactively renegotiating payment terms with suppliers or identifying areas to reduce unnecessary expenses can significantly enhance a company's economic resilience. Our pragmatic approach to data emphasizes testing every hypothesis to deliver maximum return on invested capital, which is crucial in this context.

A recent study highlights that machine learning can enhance early warning systems for economic distress, with random prediction accuracy noted at 33%, emphasizing the importance of early detection for stakeholders. Additionally, case studies demonstrate that utilizing regularization methods in predictive models can improve the precision of bankruptcy forecasts, underscoring the necessity of robust economic monitoring systems.

As Hamori, S. states, "A Multi-Stage Financial Distress Early Warning System: Analyzing Corporate Insolvency with Random Forest" illustrates the critical role of structured frameworks in early detection. By implementing these business insolvency strategies, companies can not only prevent insolvency but also sustain operational stability and encourage sustainable growth. It is essential for chief financial officers to apply these practical strategies to ensure their organizations are well-equipped to handle monetary challenges.

Conduct Thorough Financial Assessments for Cash Preservation

Conducting comprehensive economic evaluations is essential for identifying trends and potential issues within a business's monetary health. Chief Financial Officers must meticulously analyze cash flow statements, balance sheets, and income statements, focusing on critical areas such as:

- Accounts receivable

- Inventory management

- Operational expenses

Tracking vital working capital metrics, including Days Sales Outstanding (DSO) and inventory turnover rates, can significantly enhance cash flow dependability and support informed economic decisions. By leveraging real-time business analytics through our client dashboard, CFOs can consistently assess their business health and adjust strategies as necessary.

Moreover, identifying non-essential expenses and implementing business insolvency strategies, such as lease-back financing—which involves selling assets to free up liquidity while retaining essential assets—can effectively protect liquidity and bolster economic resilience during challenging times. Current trends indicate that small to medium enterprises (SMEs) must implement business insolvency strategies through proactive evaluations of resources to successfully navigate crises, with an emphasis on optimizing working capital to ensure sustainable growth.

As Jared Sorensen noted, "Raising business capital is one of the most critical challenges entrepreneurs face when starting or expanding a business." This underscores the importance of comprehensive monetary evaluations in addressing such challenges. Furthermore, staying informed about current trends in accounts receivable management can provide financial officers with additional strategies to enhance cash flow management.

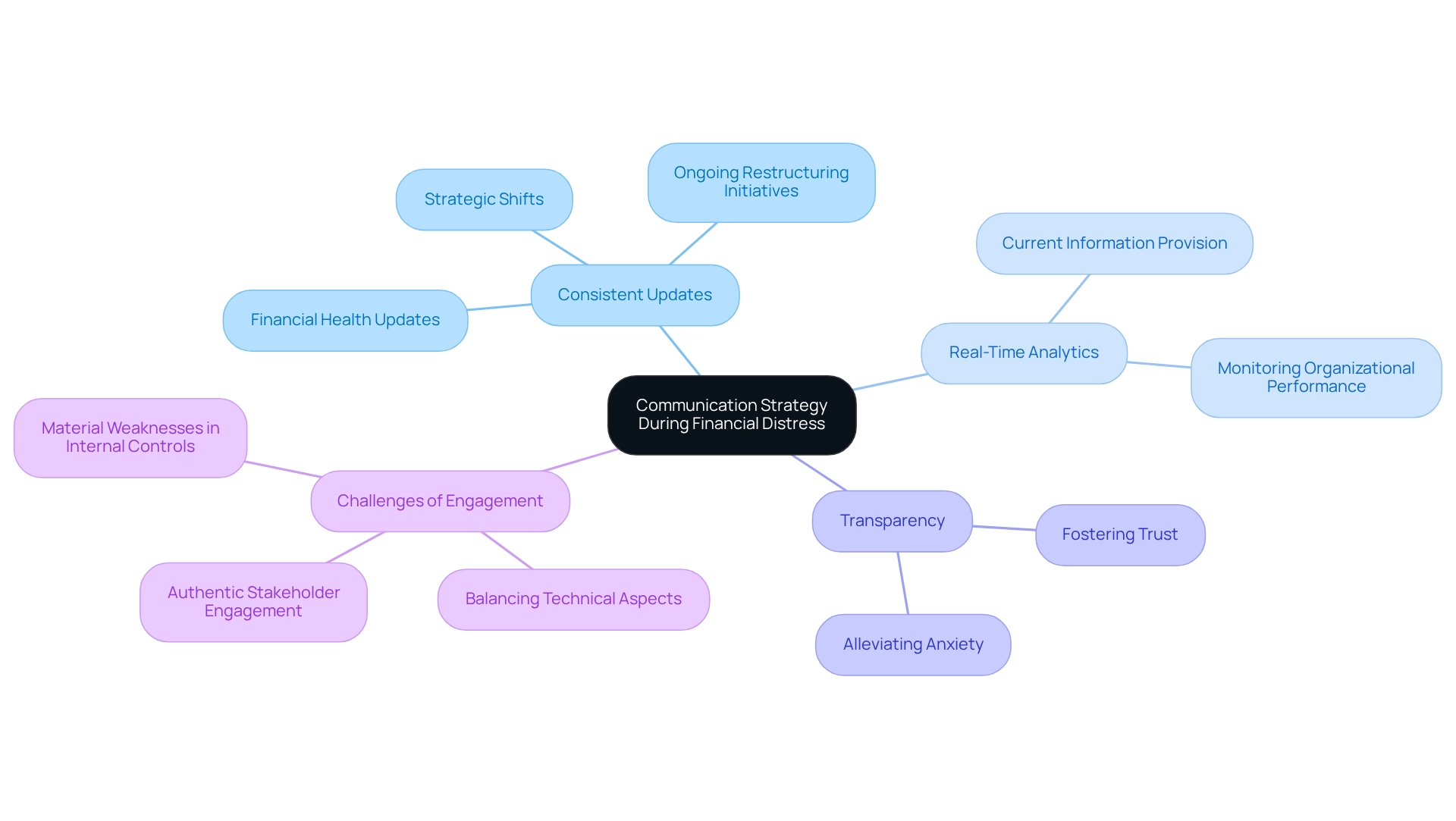

Communicate Effectively with Stakeholders During Financial Distress

In times of monetary hardship, it is imperative for chief financial officers to develop a comprehensive communication strategy that clearly delineates how and when to engage with stakeholders. This plan must encompass consistent updates regarding the company's financial health, ongoing restructuring initiatives, and any strategic shifts.

By leveraging real-time analytics, financial leaders can furnish stakeholders with current information that accurately reflects the company's status, thereby fostering trust and alleviating anxiety. Transparency is paramount; it not only cultivates confidence among employees and investors but also establishes a collaborative atmosphere conducive to recovery.

Research indicates that 13.7% of firms facing bankruptcy have loan-equity holders, underscoring the necessity for clear communication to sustain stakeholder confidence. Furthermore, the challenges inherent in implementing dialogic communication accentuate the importance of balancing technical aspects with authentic stakeholder engagement.

As Yoshimitsu Goto, CFO of SoftBank, remarked regarding WeWork's difficulties, the necessity to analyze what went wrong highlights the critical role of effective communication strategies during crises. By prioritizing open dialogue and applying lessons learned from previous experiences, financial leaders can adeptly navigate the complexities of crisis management and implement business insolvency strategies to lay the groundwork for a successful turnaround.

Additionally, the prevalence of material weaknesses in internal control systems among firms serves as a cautionary reminder of the consequences of insufficient reporting and communication. By reinforcing the significance of transparency with stakeholders and continuously monitoring organizational performance through real-time analytics, financial leaders can enhance their communication strategies and promote a more resilient corporate environment.

Develop Strategic Restructuring Plans to Enhance Financial Stability

Creating effective business insolvency strategies is essential for improving economic stability, especially during times of crisis. CFOs must conduct a comprehensive evaluation to identify opportunities for cash preservation and liability reduction, which can significantly impact the overall well-being of the company. Options such as downsizing, divesting non-core assets, or pursuing mergers and acquisitions should be carefully considered. In fact, 98% of leaders recognize that executing plans often requires more time than anticipated, underscoring the need for a well-organized approach that not only addresses urgent economic issues but also prepares the company for sustainable growth.

Aligning resources with tactical goals is crucial. As noted by restructuring specialists, this alignment ensures that every action taken contributes to the overarching objectives of the organization. A pertinent statistic from WTW indicates that only 43% of employees believe their organization excels at managing change, highlighting the importance of effective change management during restructuring efforts. For instance, a case study on incremental progress illustrates that achieving significant goals often stems from small, consistent efforts rather than immediate transformations. This perspective encourages organizations to focus on incremental advancements, fostering a sustainable approach to economic recovery.

Current trends reveal an uptick in mergers and acquisitions among struggling enterprises, as companies seek to consolidate resources and enhance operational efficiency. However, 61% of executives report feeling unprepared for strategic challenges when stepping into senior roles, emphasizing the necessity of equipping leadership with the requisite skills and insights to navigate these complexities. Incorporating digital transformation strategies, including training programs as highlighted by Gartner, can be vital in addressing this preparedness gap, and by 2025, CFOs must prioritize the development of business insolvency strategies that not only stabilize finances but also lay the groundwork for future success. By leveraging expert insights and focusing on efficient organizational model evaluations, including thorough fiscal reviews and temporary management services, entities can improve their positioning to thrive in a constantly evolving market environment.

Explore Alternative Financing Options to Sustain Operations

Exploring business insolvency strategies is crucial for companies aiming to sustain operations during challenging times. Avenues such as crowdfunding, peer-to-peer lending, and revenue-based financing provide quick access to capital, often with fewer requirements than traditional bank loans. In 2021, 23% of small businesses turned to alternative financing, up from 20% the previous year, reflecting a growing trend as companies seek flexible solutions to immediate financial challenges.

CFOs must carefully weigh the pros and cons of each option. Crowdfunding can foster community support and involvement; however, it frequently necessitates a persuasive marketing approach to attract backers. Peer-to-peer lending offers faster approval times and less documentation, making it an appealing choice for urgent funding needs, despite potentially higher interest rates. A comparative analysis of traditional versus alternative financing highlights these differences, emphasizing the speed and flexibility of alternative options.

Successful examples of crowdfunding illustrate its impact on sustainability within enterprises. Companies that effectively leverage these platforms not only secure necessary funds but also cultivate a loyal customer base. Insights from financial advisors underscore the importance of aligning financing strategies with overall organizational goals, especially when considering business insolvency strategies to ensure that the selected method supports long-term growth. As Jim Pendergast noted, "Your working capital is one of the most important measurements," highlighting the critical nature of managing finances during crises.

Moreover, it is essential to acknowledge that 70% of small enterprise loans are offered by banks with under $250 billion in assets, underscoring the role of smaller banks in the financing environment. As the landscape of alternative financing continues to evolve, financial leaders must stay informed about current statistics and trends to make strategic decisions that will help their organizations thrive in 2025 and beyond. Additionally, incorporating real-time analytics into the decision-making process can enhance the effectiveness of these financing strategies, enabling financial leaders to monitor company health continuously and adjust plans as necessary.

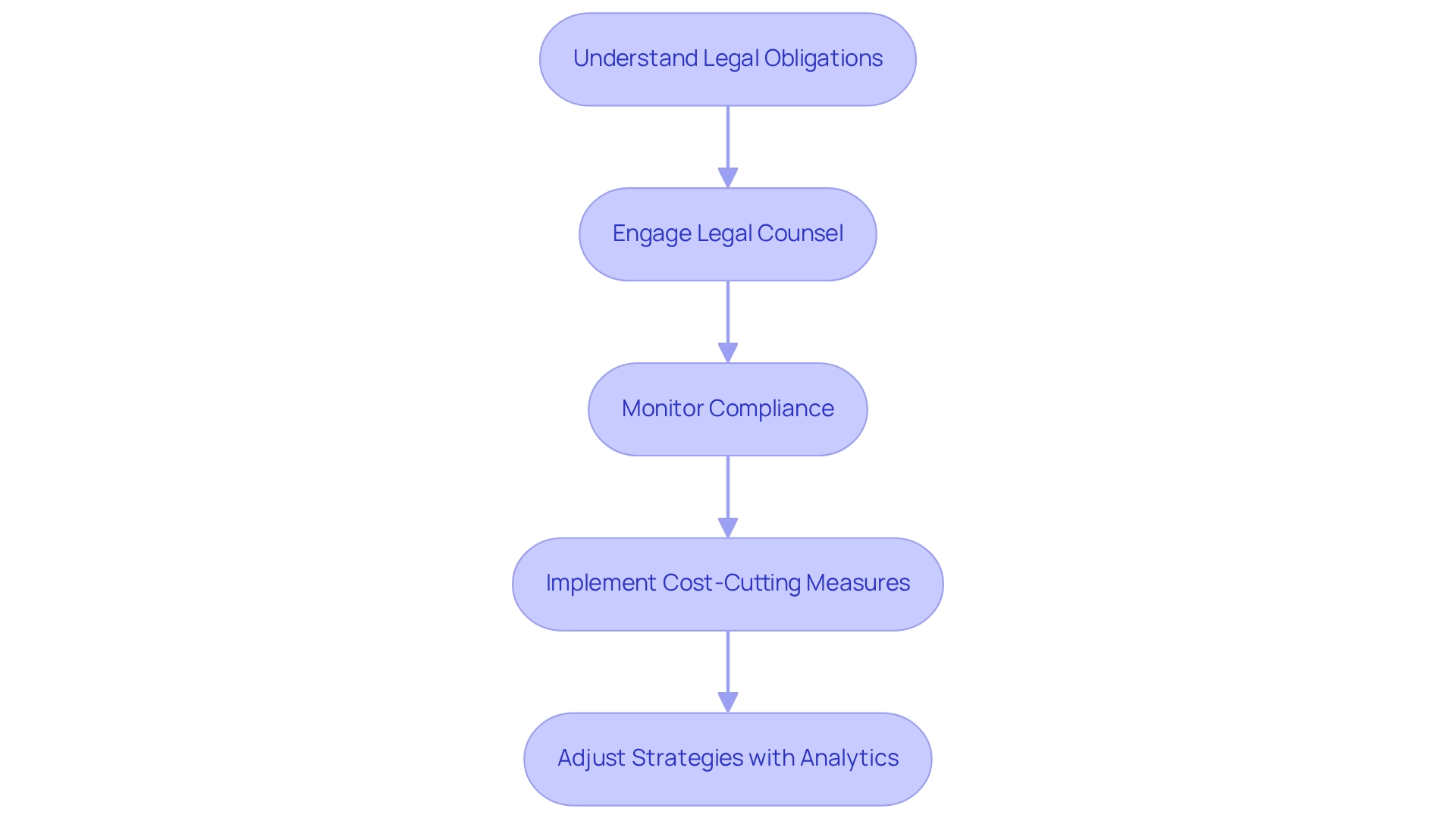

Understand Legal Obligations to Ensure Compliance During Insolvency

CFOs must thoroughly grasp the legal obligations that arise during insolvency, encompassing crucial elements such as filing requirements, creditor notifications, and compliance with bankruptcy laws. In Q1 2024, a total of 214 corporate insolvencies were recorded, underscoring the imperative for companies to be well-prepared and proactive in their strategies to tackle economic challenges.

Engaging legal counsel from the outset is essential; this not only aids in navigating the complexities of these obligations but also ensures adherence to all regulations, thereby mitigating the risk of legal repercussions. As companies face economic difficulties, the importance of compliance cannot be overstated.

Expert insights reveal that maintaining adherence to bankruptcy laws is vital for safeguarding the company’s interests and facilitating a smoother recovery process. Furthermore, partnerships with external experts, such as HR consultants, can offer invaluable support in implementing strategic cost-cutting measures while ensuring legal compliance. The emotional challenge of managing payroll expenditure cuts often necessitates this external support, making such collaborations critical during financial turmoil.

Additionally, leveraging real-time analytics through client dashboards enables CFOs to consistently monitor organizational health and adjust strategies as necessary. As Lucy Cotterell, an HR Consultant, aptly states, "In these challenging times, such collaborations may indeed be the lifeline organizations need to remain viable and prosper in the future."

This collaborative approach not only aids in compliance but also fortifies the overall strategy for navigating insolvency, facilitating quicker decision-making and operationalizing lessons learned from past experiences.

Engage with Insolvency Specialists for Expert Guidance

Consulting with insolvency experts is crucial for companies that are developing business insolvency strategies while encountering bankruptcy. These professionals possess a profound grasp of the intricacies involved in restructuring and recovery. Their expertise is invaluable in crafting a comprehensive recovery plan, negotiating effectively with creditors, and ensuring compliance with legal requirements. Transform Your Small/Medium Company provides extensive turnaround and restructuring consulting, interim management services, and economic evaluations tailored specifically for small to medium enterprises. This comprehensive approach centers not only on cash preservation and efficiency but also emphasizes risk mitigation to reveal value and lower costs.

Recent statistics indicate that insolvency practitioners anticipate the concerning trend of increasing insolvencies will persist throughout 2024, highlighting the urgency for companies to take action. Firms that actively engage insolvency specialists, such as those from Transform Your Small/Medium Business, are better equipped to handle economic distress through effective business insolvency strategies, with many reporting enhanced outcomes in their recovery efforts. The Rapid-30 plan exemplifies this transformative experience, showcasing how expert support can lead to significant strategic and economic improvements within a short timeframe.

The case study titled 'Economic Pressures and Future Outlook' underscores that economic pressures on businesses are expected to persist, reinforcing the necessity of engaging specialists to tackle these challenges effectively. As Chris French, Manager of media relations at PwC, states, 'At PwC, our purpose is to build trust in society and solve important problems.' This sentiment reinforces the importance of not waiting for external interventions, which may be too late to prevent crises. By leveraging the insights of these specialists, companies can enhance their chances of a successful turnaround, ultimately preserving value and fostering sustainable growth.

Implement Effective Debt Management Strategies to Negotiate with Creditors

Adopting effective business insolvency strategies is essential for chief financial officers aiming to successfully navigate economic crises. This involves:

- Prioritizing debts based on urgency and impact

- Negotiating favorable payment terms

- Exploring viable debt restructuring options

Open communication with creditors is crucial; CFOs should present a transparent repayment plan that reflects a genuine commitment to resolving outstanding obligations. Such proactive involvement can yield more advantageous conditions, preserving vital supplier relationships and enhancing the company's economic stability.

Statistics reveal that organizations under court oversight during debt repayment often achieve fairer outcomes, with studies indicating these organizations have a 30% higher chance of successful debt resolution compared to those without oversight. Successful negotiation examples from small enterprises illustrate that presenting a well-considered monetary plan can significantly influence creditor responses. Furthermore, the case study titled "Role of Credit Counseling in Debt Management" underscores how engaging with credit counseling services empowers financial leaders to formulate realistic debt management plans, improve financial well-being, and negotiate effectively with creditors.

Incorporating real-time analytics into the decision-making process allows financial executives to continually monitor the effectiveness of their debt management strategies. By leveraging data-driven insights, financial executives can make informed adjustments to their plans, ensuring responsiveness to evolving circumstances. As Maureen O'Connell, former CFO of Scholastic, remarked, "Just as organizations continuously evolve with the ever-changing global economic environment, the role of a CFO is bound to change." This highlights the necessity for financial officers to adapt their business insolvency strategies in response to current trends in debt restructuring for small businesses. By utilizing expert insights and case studies, financial leaders can refine their approaches to debt management, ensuring sustainable growth even in challenging times. Moreover, understanding the implications of wage garnishment can provide additional context for chief financial officers as they navigate these economic challenges.

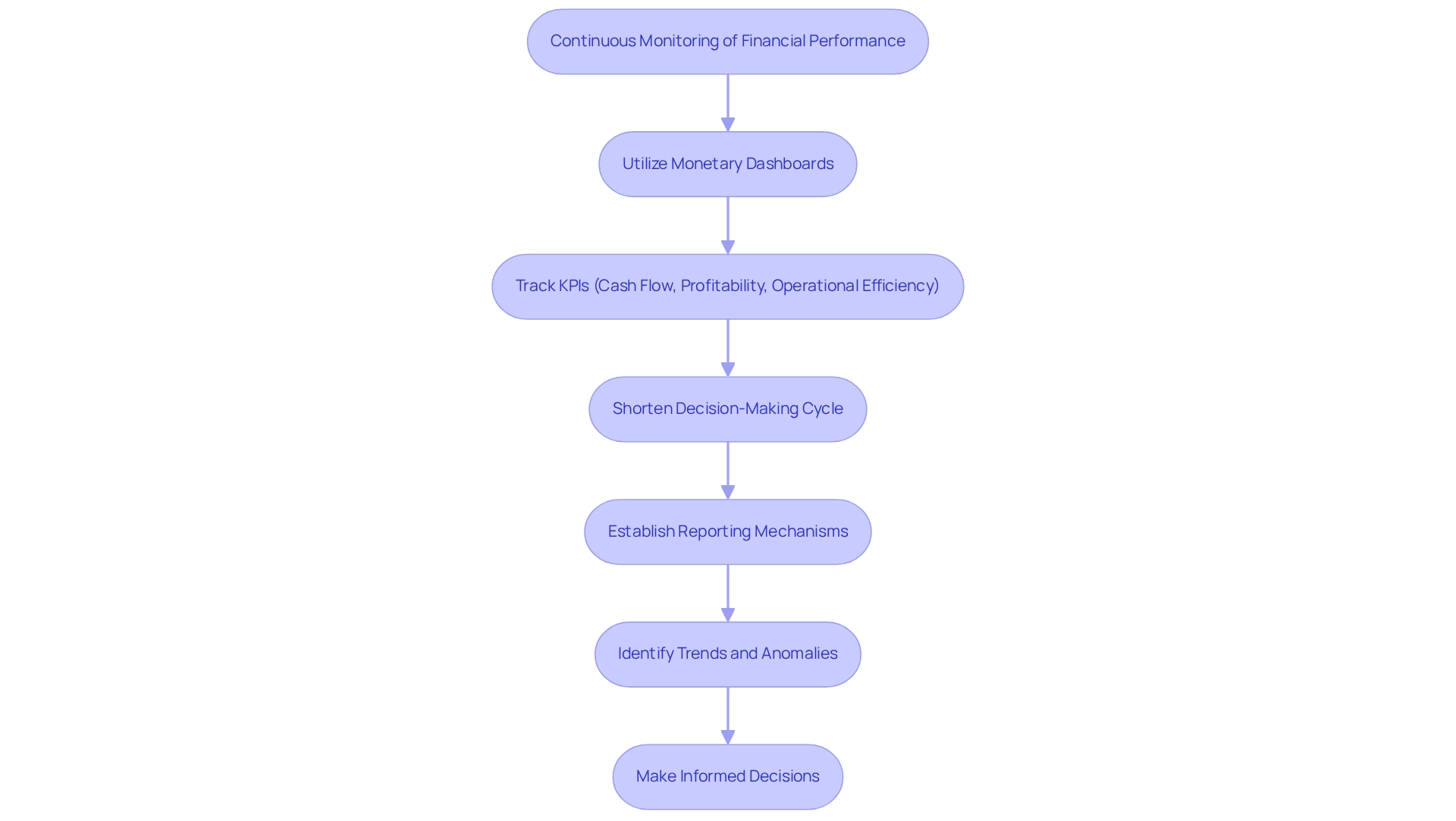

Monitor Financial Performance Continuously to Identify Risks Early

Ongoing observation of monetary performance is crucial for CFOs aiming to uphold stability and mitigate risks. By utilizing monetary dashboards and advanced analytics tools, effective tracking of key performance indicators (KPIs) such as cash flow, profitability, and operational efficiency becomes achievable.

Our team supports a shortened decision-making cycle throughout the turnaround process, enabling timely corrective actions before issues escalate. Furthermore, establishing regular reporting mechanisms facilitates the early identification of trends and anomalies, which is essential for preserving business health.

A compelling case study on payment automation illustrates how implementing such technology can streamline processes, reduce manual errors, and enhance cash flow forecasting, ultimately driving organizational success.

As 2025 approaches, the significance of technological proficiency in planning and analysis roles cannot be overstated, with 81% of chief financial officers intending to boost technology investments to support finance transformation initiatives. This trend underscores the increasing demand for CFOs, as 43% report being contacted for new opportunities more frequently, emphasizing their vital role in monitoring performance.

By leveraging these tools and continuously updating strategies based on real-time analytics, CFOs can ensure ongoing financial stability and make informed decisions that foster sustainable growth.

Conclusion

Comprehensive turnaround consulting stands as a vital ally for small and medium enterprises navigating the tumultuous waters of today's economy. By implementing tailored strategies that encompass financial assessments, stakeholder communication, and expert guidance, businesses can effectively address immediate crises while laying the groundwork for sustainable growth. The importance of early intervention cannot be overstated; proactive measures such as continuous monitoring of financial health and engaging with insolvency specialists significantly mitigate risks associated with insolvency.

Moreover, developing strategic restructuring plans and exploring alternative financing options are essential steps in enhancing financial stability. By understanding legal obligations and maintaining open lines of communication with stakeholders, CFOs can foster an environment of trust and collaboration, which is vital for recovery. The stories of successful transformations, such as the $68 million bakery in Arizona, illustrate the tangible benefits of well-executed turnaround strategies.

As the complexities of 2025 loom, it is imperative for SMEs to prioritize these practices. By leveraging expert insights and real-time analytics, businesses can navigate financial challenges with agility and resilience. Ultimately, the path to recovery and growth lies in a proactive, informed approach that embraces the expertise of turnaround consulting, ensuring organizations are not only prepared to survive but also to thrive in an ever-evolving market landscape.

Frequently Asked Questions

What is extensive turnaround consulting?

Extensive turnaround consulting involves a thorough assessment of an enterprise's operations, economic health, and market positioning. It identifies inefficiencies and opportunities for enhancement to develop tailored strategies that address financial challenges while establishing a foundation for sustainable growth.

What strategies does extensive turnaround consulting typically include?

It typically includes business insolvency strategies such as debt restructuring, operational optimization, improved cash flow management, and interim management services, which are critical for small to medium enterprises facing crises.

Can you provide an example of a successful turnaround consulting case?

A notable success story is a $68 million multi-state commercial bakery in Arizona that faced significant challenges. Through strategic collaboration and the execution of the Rapid-30 plan, the bakery achieved operational improvements and is projected to attain an adjusted EBITDA of $3.4 million by 2024.

How can comprehensive turnaround consulting benefit CFOs?

Comprehensive turnaround consulting can enhance financial health and operational resilience for CFOs as they navigate complex business environments. It provides detailed guidance necessary for effective transformation processes.

Why is early intervention important in business insolvency strategies?

Early intervention is crucial for mitigating risks associated with business insolvency. Continuous monitoring of economic indicators and operational performance helps in timely responses to emerging issues.

What tools can CFOs use to monitor economic health?

CFOs can use real-time analytics, regular fiscal reviews, and alert systems for key metrics, such as cash flow, debt levels, and operational costs, to monitor economic health and address potential issues proactively.

How can machine learning aid in detecting economic distress?

Machine learning can enhance early warning systems for economic distress, with studies indicating that it can improve prediction accuracy for potential bankruptcy, emphasizing the need for robust economic monitoring systems.

What are some critical areas CFOs should analyze for economic evaluations?

CFOs should meticulously analyze cash flow statements, balance sheets, and income statements, focusing on accounts receivable, inventory management, and operational expenses.

What strategies can help improve cash flow dependability?

Tracking vital working capital metrics like Days Sales Outstanding (DSO) and inventory turnover rates can significantly enhance cash flow dependability and support informed economic decisions.

How can businesses protect liquidity during challenging times?

Businesses can protect liquidity by identifying non-essential expenses and implementing strategies such as lease-back financing, which involves selling assets to free up liquidity while retaining essential assets.