Overview

The article titled "10 Essential Insights on Non GAAP Reporting for CFOs" underscores the critical importance and ramifications of non-GAAP reporting for Chief Financial Officers. It asserts that non-GAAP reporting offers a flexible framework for effectively showcasing a company's financial performance. This approach empowers CFOs to present a more transparent depiction of economic health, adeptly navigating regulatory challenges while bolstering investor trust through enhanced transparency and customized financial narratives.

Introduction

Non-GAAP reporting has emerged as a transformative tool for CFOs, particularly within small to medium enterprises, enabling them to present a more nuanced view of their financial health. By focusing on adjusted earnings and cash flows, organizations can effectively communicate their operational performance, fostering growth and enhancing investor confidence.

However, as the landscape of financial reporting evolves, the challenge remains: how can CFOs navigate the complexities and potential pitfalls of non-GAAP measures while ensuring transparency and compliance?

This article delves into ten essential insights that equip financial leaders with the knowledge to leverage non-GAAP reporting effectively, addressing both its advantages and the regulatory scrutiny it faces.

Transform Your Small/ Medium Business: Expert Guidance on Non-GAAP Reporting

Non GAAP reporting offers companies a flexible framework to showcase their performance, enabling CFOs to highlight critical operational outcomes while reducing the distractions associated with traditional accounting methods. By concentrating on adjusted earnings and cash flows, organizations can communicate their economic health and strategic direction more effectively, fostering transformation and growth. This approach is particularly advantageous for small to medium enterprises, which often encounter unique economic challenges and require tailored solutions for successful navigation.

Statistics reveal that the adoption of alternative accounting methods has surged from 55% in 2003 to nearly 80% in 2020 among S&P 500 companies. This trend indicates enhanced transparency in financial communication and increased investor trust. Successful transformations in non GAAP reporting have been documented across various small enterprises, demonstrating how customized economic narratives can enhance operational efficiency and support sustainable growth. As one CFO remarked, 'Non GAAP reporting measures have allowed us to present a clearer picture of our financial health, enabling better decision-making and strategic planning.'

Moreover, by mastering the cash conversion cycle and leveraging real-time analytics, CFOs can streamline decision-making processes, ensuring their organizations remain agile and responsive to market fluctuations. However, it is crucial to remain cognizant of the potential risks associated with alternative financial measures, including the SEC's concerns regarding misleading presentations. This underscores the importance of transparency and adherence to established guidelines.

Understanding the Key Differences Between GAAP and Non-GAAP Reporting

GAAP (Generally Accepted Accounting Principles) establishes a standardized framework for fiscal disclosures, ensuring consistency and comparability among companies. In contrast, non-GAAP reporting allows companies to modify their statements by excluding specific items, such as one-time expenses or non-cash charges. This flexibility in non-GAAP reporting provides a clearer view of ongoing operational performance. Understanding these distinctions empowers chief financial officers to present a more precise narrative of their organization's economic status. This approach addresses the needs of investors and stakeholders who demand transparency and clarity in financial reporting.

The Importance of Non-GAAP Earnings in Financial Reporting

Non-GAAP reporting increasingly holds significant value for its capacity to provide a more nuanced understanding of a company's financial performance. By excluding irregular or non-recurring items, non-GAAP reporting metrics yield a clearer representation of ongoing profitability and operational efficiency. This clarity is essential for CFOs when interacting with investors, as it enables a more precise assessment of the company's growth potential and sustainability through non-GAAP reporting.

For instance, businesses that successfully communicate their alternative earnings often experience heightened investor confidence and improved market perceptions. This strategic deployment of alternative metrics not only enhances financial analysis but also fosters informed decision-making, solidifying their role as an indispensable tool in the CFO's arsenal.

Common Non-GAAP Metrics Every CFO Should Know

CFOs must exhibit proficiency in crucial metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and free cash flow. These indicators are essential for evaluating a company's operational performance. EBITDA, often reported by S&P 500 companies, enables stakeholders to concentrate on core earnings by excluding nonrecurring or non-cash expenses, thereby offering a clearer picture of profitability. Notably, the average discrepancy between GAAP earnings and non GAAP reporting among S&P 500 firms has diminished to just 10%, indicating a more conservative approach to non GAAP adjustments in light of regulatory scrutiny.

Free cash flow (FCF) stands as another vital metric, representing the cash generated available for distribution to security holders. This measure not only underscores a company's cash-generating capability but also serves as a critical indicator for investment decisions. As businesses navigate economic fluctuations, comprehending these metrics becomes increasingly important for presenting a compelling monetary narrative.

Specialists emphasize the importance of these measures in financial disclosures. For instance, one expert noted that linking auditors to alternative accounting metrics enhances trust and discipline in management's reporting practices. Furthermore, the SEC advocates for transparency in alternative financial disclosures, underscoring the necessity for Chief Financial Officers to effectively communicate the significance and calculations of these metrics to stakeholders.

Statistics reveal that nearly all public companies disclose both GAAP and non GAAP reporting, with chief financial officers increasingly using these metrics to provide a comprehensive perspective on financial health. By adeptly utilizing EBITDA and free cash flow, financial leaders can facilitate improved investment and operational decisions, ultimately driving sustainable growth.

Navigating Regulatory Guidelines for Non-GAAP Reporting

CFOs face a formidable regulatory landscape when it comes to non-GAAP reporting of alternative financial measures. The SEC mandates that these measures be reconciled with the most comparable GAAP figures, a requirement that promotes transparency and mitigates the risk of misleading financial representations. Recent statistics reveal that over half of compliance remarks from the SEC pertain to the nature of alternative accounting adjustments, underscoring the scrutiny these measures endure.

To navigate this complex environment effectively, financial executives must implement robust internal controls and remain informed about evolving regulations. Compliance experts assert that clear labeling and comprehensive descriptions of non-GAAP reporting measures are essential to prevent misleading investors. By adhering to these guidelines, CFOs can bolster the credibility of their fiscal disclosures and sustain investor trust.

Critiques of Non-GAAP Measures: What CFOs Need to Consider

Non-GAAP reporting metrics offer valuable insights but often face substantial criticism for their potential misuse in reporting. Critics argue that these metrics can be manipulated to present a more favorable view of a company's financial health, potentially misleading investors. Notably, over 70 percent of S&P 500 companies now disclose adjusted earnings, raising concerns about the accuracy and reliability of these figures. Chief financial officers must exercise caution in their use of alternative financial metrics, ensuring they are clearly defined, consistently applied, and reconciled to GAAP measures. This reconciliation is essential, as the SEC mandates that public companies disclose the most directly comparable GAAP metric alongside non-GAAP reporting to prevent confusion and misrepresentation.

To effectively address these criticisms, CFOs should adopt a proactive strategy focused on enhancing the clarity of their financial disclosures. This includes:

- Providing comprehensive explanations of the modifications made in alternative financial metrics

- Ensuring that these measures align with internal management assessments

Firms such as Energen Corporation exemplify best practices by transparently sharing the rationale behind their financial adjustments, thereby preserving credibility with stakeholders.

Moreover, economic analysts emphasize the importance of financial literacy among corporate board members to mitigate the risks associated with non-GAAP reporting. Experts note that the lack of standardization in non-GAAP metrics can result in significant discrepancies, making it crucial for financial executives to educate their boards on the intricacies of these measures. By directly addressing these critiques and fostering a culture of transparency, CFOs can enhance the credibility of their financial reports and build trust among investors and stakeholders alike.

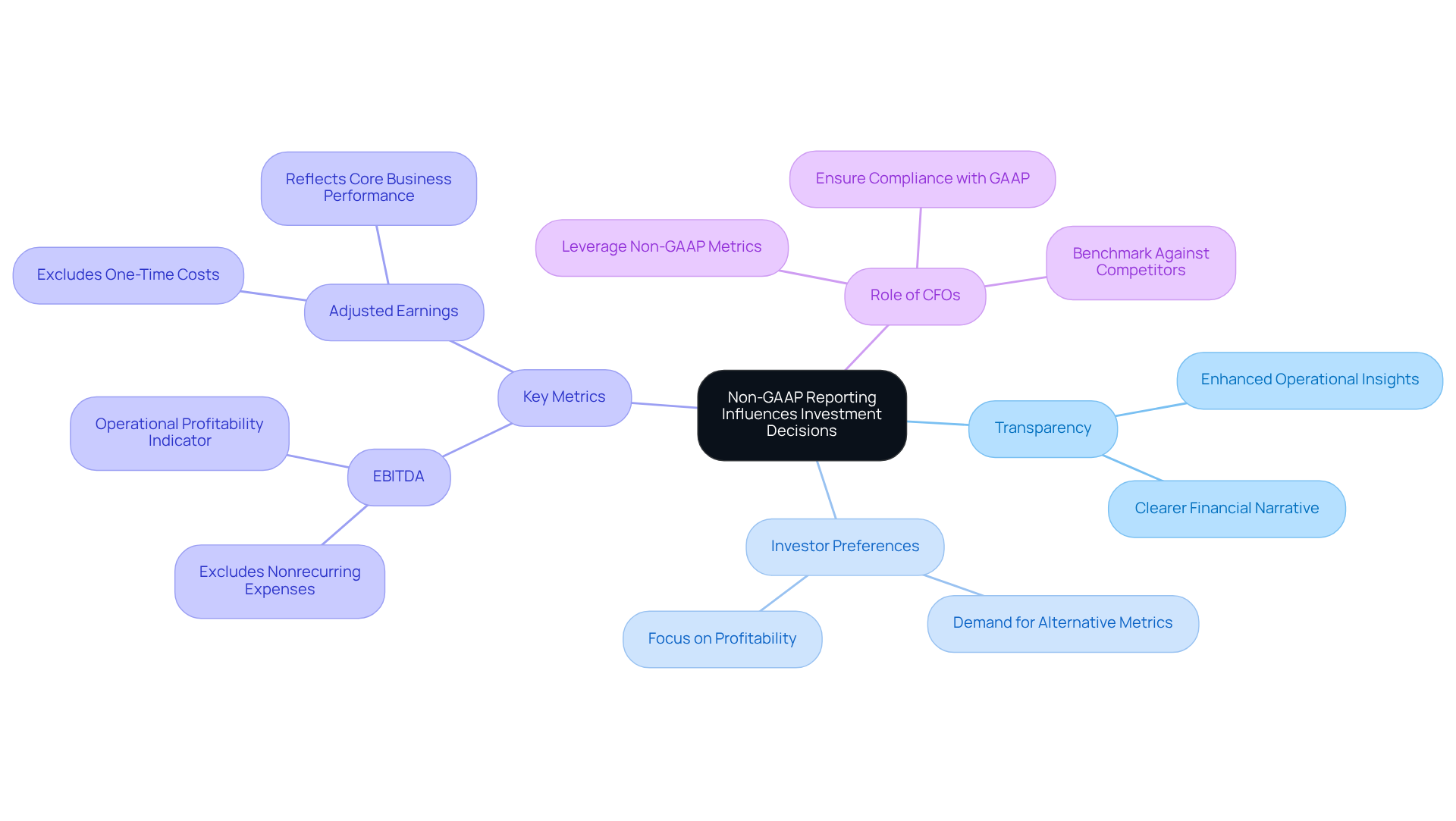

How Non-GAAP Reporting Influences Investment Decisions

Non GAAP reporting is crucial in shaping investment decisions by providing investors with a more transparent view of a company's operational performance and growth potential. By 2025, an increasing number of investors are turning to alternative metrics to evaluate economic health, as these measures often reveal insights that traditional GAAP metrics may overlook. For example, companies that adeptly communicate adjusted earnings—excluding one-time costs or non-cash expenses—can attract investors who value transparency and a nuanced understanding of profitability. This trend is underscored by the fact that nearly all public companies report both GAAP and alternative earnings, thereby enriching the overall economic narrative presented to stakeholders.

Investors utilize alternative metrics to assess companies by focusing on key indicators such as EBITDA, which omits nonrecurring expenses, thus providing a clearer perspective on operational profitability. This method facilitates more informed decision-making, enabling investors to evaluate a company's capacity to generate cash flow and sustain growth. Moreover, as highlighted in recent discussions among financial experts, the strategic use of non GAAP reporting can align with investor expectations, ultimately enhancing a company's appeal in the capital markets.

CFOs are urged to leverage these metrics in their communications, ensuring compliance with regulatory standards while resonating with investor interests. By establishing a robust policy for alternative measure reporting, companies can benchmark themselves against competitors and adhere to GAAP principles, thereby fostering trust and transparency with their investors.

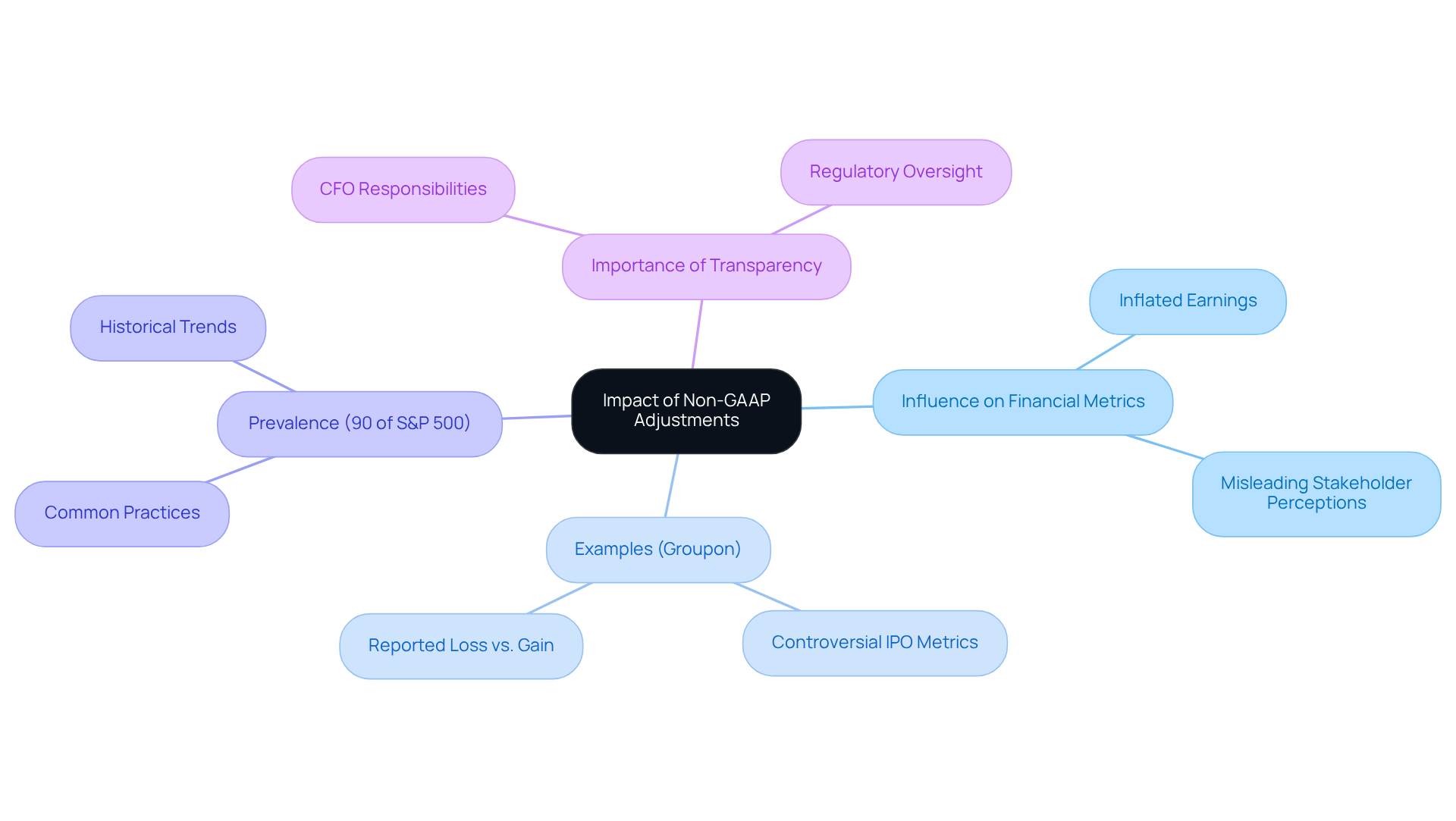

Impact of Non-GAAP Adjustments on Financial Statements

Non-GAAP reporting adjustments can profoundly influence accounting statements by modifying key performance indicators and overall economic metrics. For instance, when companies exclude one-time expenses, they may present inflated earnings figures that can mislead stakeholders if not adequately disclosed. This practice has been notably observed in various companies, including Groupon, which faced criticism for its deceptive use of alternative financial metrics during its IPO. Significantly, 90% of firms in the S&P 500 disclose adjusted earnings as part of their non-GAAP reporting alongside GAAP net income, underscoring the prevalence of these metrics and their impact on financial reporting.

Chief financial officers must prioritize transparent communication regarding any alternative accounting adjustments, particularly non-GAAP reporting, ensuring that these are fully justified and accompanied by reconciliations to GAAP measures. As investment analysts like David Trainer caution, the risks associated with inflated earnings through alternative accounting measures can undermine the integrity of capital markets. Therefore, it is crucial for senior financial executives to manage these adjustments with diligence and care. Moreover, the SEC's historical enforcement actions against firms for deceptive financial disclosures highlight the importance of maintaining transparency and precision in financial documentation.

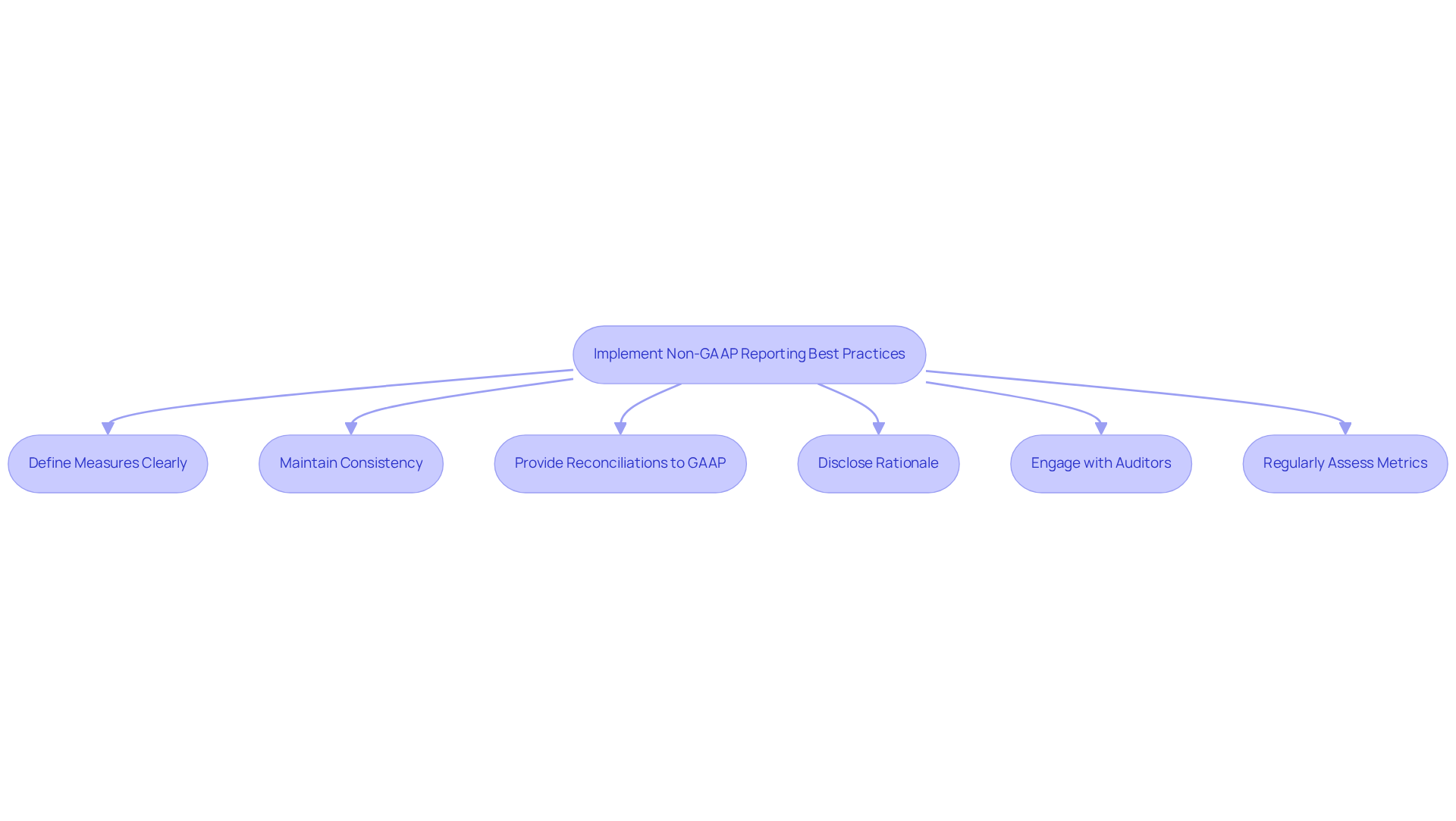

Best Practices for Implementing Non-GAAP Reporting

To effectively apply alternative financial measures, CFOs must adhere to several best practices that enhance both clarity and compliance. First and foremost, it is crucial to define these measures clearly, ensuring stakeholders grasp their significance and context. Maintaining consistency in the application of these measures across reporting periods is vital for preserving credibility. By providing reconciliations to GAAP metrics, CFOs promote clarity, enabling stakeholders to see how alternative figures relate to standard accounting methods. Furthermore, disclosing the rationale behind the use of non GAAP reporting measures is essential for building trust among investors and stakeholders.

Engagement with auditors and legal advisors represents another critical step in ensuring compliance with regulatory guidelines. This collaboration aids in identifying potential areas of non-compliance and aligns documentation practices with the best standards established by the SEC. By following these guidelines, financial leaders can significantly enhance the trustworthiness of their financial disclosures, ultimately fostering stronger connections with investors and stakeholders.

Moreover, financial leaders must remain vigilant regarding the SEC's concerns surrounding alternative accounting measures, as this awareness can guide their disclosure practices. For instance, the SEC underscores the necessity of accurate and complete publicly reported information, emphasizing the importance of compliance and disclosure interpretations.

To further refine their disclosures, financial leaders should implement practical measures, such as:

- Regularly assessing the relevance and precision of their alternative performance indicators.

- Ensuring that all stakeholders are informed about the significance of these metrics.

By adopting these best practices, financial leaders can drive business success while ensuring compliance, transparency, and non GAAP reporting.

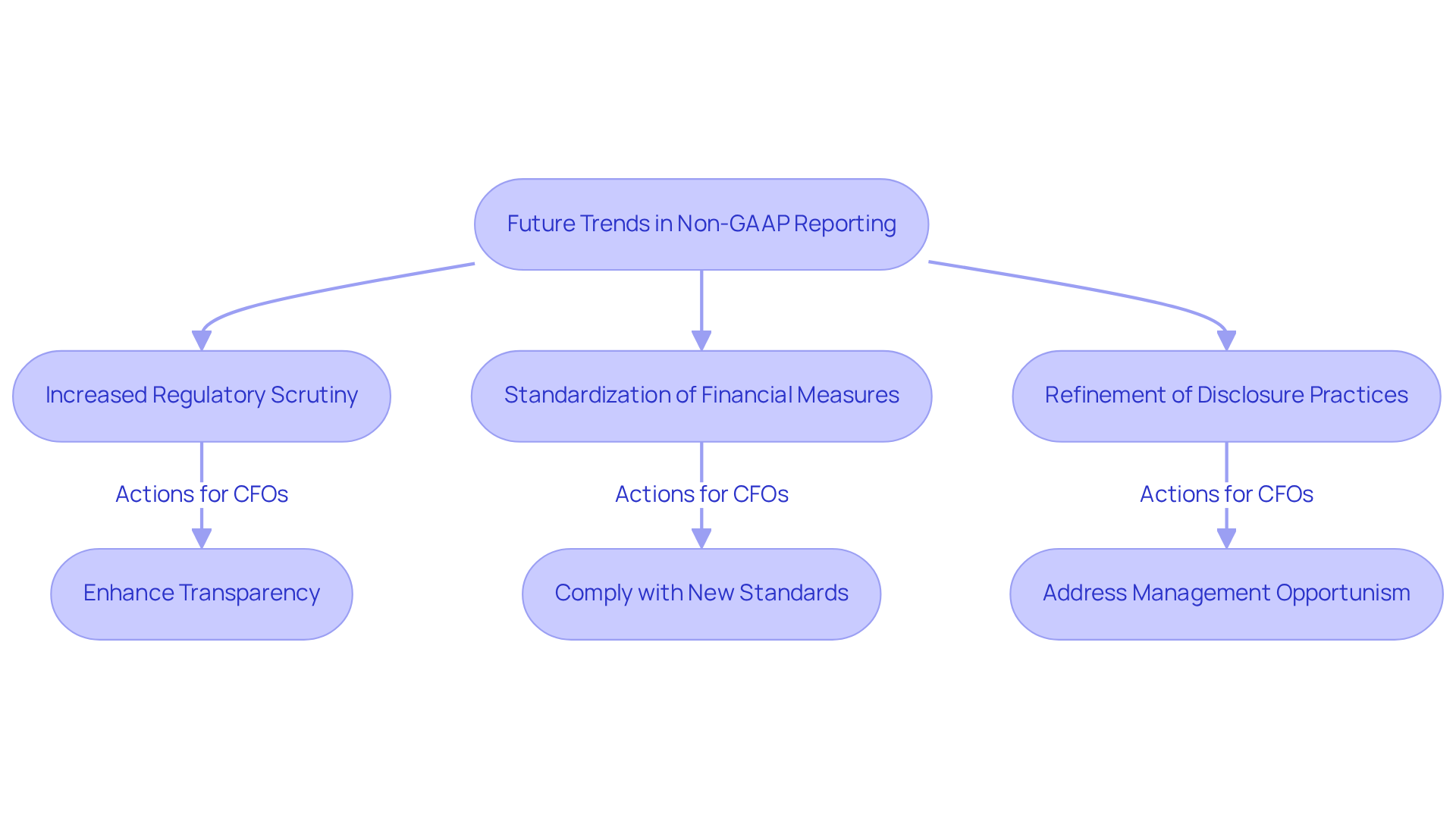

Future Trends in Non-GAAP Reporting: What CFOs Should Anticipate

As financial reporting evolves, CFOs must prepare for significant trends in non GAAP reporting. A primary concern is the expected surge in regulatory scrutiny, with the Financial Accounting Standards Board (FASB) poised to finalize new accounting rules by 2025. This initiative focuses on standardizing alternative financial measures to bolster transparency and accountability. Notably, studies reveal that 84% of organizations in unregulated sectors report higher pro forma earnings compared to GAAP earnings, suggesting a potential for management opportunism that regulators are keen to address.

Companies are increasingly refining their disclosure practices to meet investor expectations amid this heightened scrutiny. Financial specialists emphasize the importance of transparency in disclosures, given the ongoing concerns regarding the quality of adjusted earnings. Myungsoo Son, PhD, CPA, notes that "the discovery that earnings not in accordance with GAAP, which aim to reveal recurring and core operational performance, are consistently greater than GAAP operating income indicates the potential for opportunistic (i.e., aggressive) disclosures."

By proactively refining their non GAAP reporting strategies, CFOs can ensure that their financial communications accurately reflect their company’s performance while complying with evolving regulatory standards.

Conclusion

Non-GAAP reporting stands as a crucial instrument for CFOs, offering a flexible framework that enables companies to present a more transparent view of their financial health. By highlighting adjusted earnings and cash flows, organizations can effectively convey their operational performance, fostering growth and transformation, especially in small to medium-sized enterprises that encounter unique challenges.

The insights throughout this article emphasize the rising significance of non-GAAP metrics, such as EBITDA and free cash flow, which provide a more nuanced perspective on profitability and operational efficiency. Furthermore, the necessity of adhering to regulatory guidelines is underscored to ensure transparency and maintain investor trust, alongside the potential risks and criticisms linked to the misuse of these alternative measures. By adopting best practices and remaining informed about evolving regulations, CFOs can adeptly navigate the complexities of non-GAAP reporting while enhancing the credibility of their financial disclosures.

Looking forward, it is imperative for CFOs to anticipate emerging trends in non-GAAP reporting, particularly the anticipated increase in regulatory scrutiny. Embracing transparency and refining disclosure practices will not only align with investor expectations but also strengthen the integrity of financial communications. By effectively leveraging non-GAAP measures, CFOs can drive informed decision-making and promote sustainable growth, ultimately reinforcing their organization's standing in the capital markets.

Frequently Asked Questions

What is non-GAAP reporting and why is it beneficial for small to medium businesses?

Non-GAAP reporting offers a flexible framework for companies to showcase their performance by highlighting critical operational outcomes. It allows CFOs to focus on adjusted earnings and cash flows, effectively communicating the organization's economic health and strategic direction, which is particularly advantageous for small to medium enterprises facing unique economic challenges.

How has the adoption of non-GAAP reporting changed over the years?

The adoption of alternative accounting methods has significantly increased from 55% in 2003 to nearly 80% in 2020 among S&P 500 companies. This trend reflects enhanced transparency in financial communication and increased investor trust.

What are the key differences between GAAP and non-GAAP reporting?

GAAP (Generally Accepted Accounting Principles) provides a standardized framework for fiscal disclosures, ensuring consistency and comparability among companies. Non-GAAP reporting, on the other hand, allows companies to modify their financial statements by excluding specific items, such as one-time expenses or non-cash charges, offering a clearer view of ongoing operational performance.

Why is non-GAAP reporting important for financial reporting?

Non-GAAP reporting is valuable as it provides a more nuanced understanding of a company's financial performance by excluding irregular or non-recurring items. This results in a clearer representation of ongoing profitability and operational efficiency, which is essential for CFOs when interacting with investors.

How can mastering the cash conversion cycle and using real-time analytics benefit CFOs?

By mastering the cash conversion cycle and leveraging real-time analytics, CFOs can streamline decision-making processes, ensuring their organizations remain agile and responsive to market fluctuations.

What risks are associated with non-GAAP reporting?

There are potential risks associated with non-GAAP reporting, including concerns from the SEC regarding misleading presentations. This highlights the importance of transparency and adherence to established guidelines in financial reporting.

How does non-GAAP reporting impact investor confidence?

Businesses that effectively communicate their non-GAAP earnings often experience heightened investor confidence and improved market perceptions, which enhances financial analysis and supports informed decision-making.