Overview

This article highlights ten essential insolvency consulting services crucial for business recovery. It emphasizes strategies for financial assessment, interim management, and sustainable growth. By detailing how these services empower organizations to navigate economic challenges, enhance cash flow, and ultimately secure long-term success, it presents tailored consulting approaches and expert guidance as vital components of the recovery process.

Introduction

In the dynamic landscape of small and medium businesses, the threat of financial distress looms large, often leaving leaders grappling with uncertainty. As organizations navigate these turbulent waters, comprehensive turnaround and restructuring consulting emerges as a beacon of hope. This article delves into the multifaceted strategies designed to stabilize and revitalize struggling enterprises, from in-depth financial assessments to interim management solutions. By integrating innovative approaches and industry-specific insights, businesses can not only weather the storm but also lay the groundwork for sustainable growth and resilience. Explore how tailored consulting services can transform challenges into opportunities, ensuring that organizations not only survive but thrive in an ever-evolving market.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

Our extensive advisory offerings in insolvency consulting services empower small and medium enterprises to navigate economic difficulties with confidence. These insolvency consulting services encompass a comprehensive monetary evaluation designed to pinpoint opportunities for cash preservation and liability reduction, alongside an in-depth analysis of the organization's operations and market stance. By identifying key areas for enhancement, our insolvency consulting services develop customized strategies that address specific challenges, such as restructuring debt, optimizing operations, and implementing innovative models to boost profitability and sustainability. Moreover, we provide bankruptcy case oversight to ensure a holistic approach to financial recovery.

Our hands-on interim management services deliver executive leadership during crisis resolution, enabling organizations to navigate through difficulties effectively. The ultimate aim is not only to stabilize the enterprise but also to position it for future growth and success, leveraging over 100 years of combined experience in the field.

Reach out to us today to discover how we can assist your enterprise in flourishing.

Financial Assessment Services: Preserve Cash and Reduce Liabilities

Financial assessment services are essential for businesses focused on preserving cash and minimizing liabilities. By conducting a comprehensive review of financial statements, cash flow forecasts, and operational expenses, consultants can identify inefficiencies and uncover potential savings. This thorough financial evaluation not only reveals opportunities to renegotiate contracts and optimize costs but also enhances cash management practices. Consequently, implementing these strategies can significantly improve a company's liquidity, enabling it to navigate challenging economic conditions more effectively.

Furthermore, this process aids in strategic business improvement by identifying root causes, planning solutions, and measuring investment returns. To fully leverage the advantages of financial evaluations, consider partnering with specialists in insolvency consulting services who can tailor strategies to your specific needs, ultimately leading to enhanced cash flow and profitability.

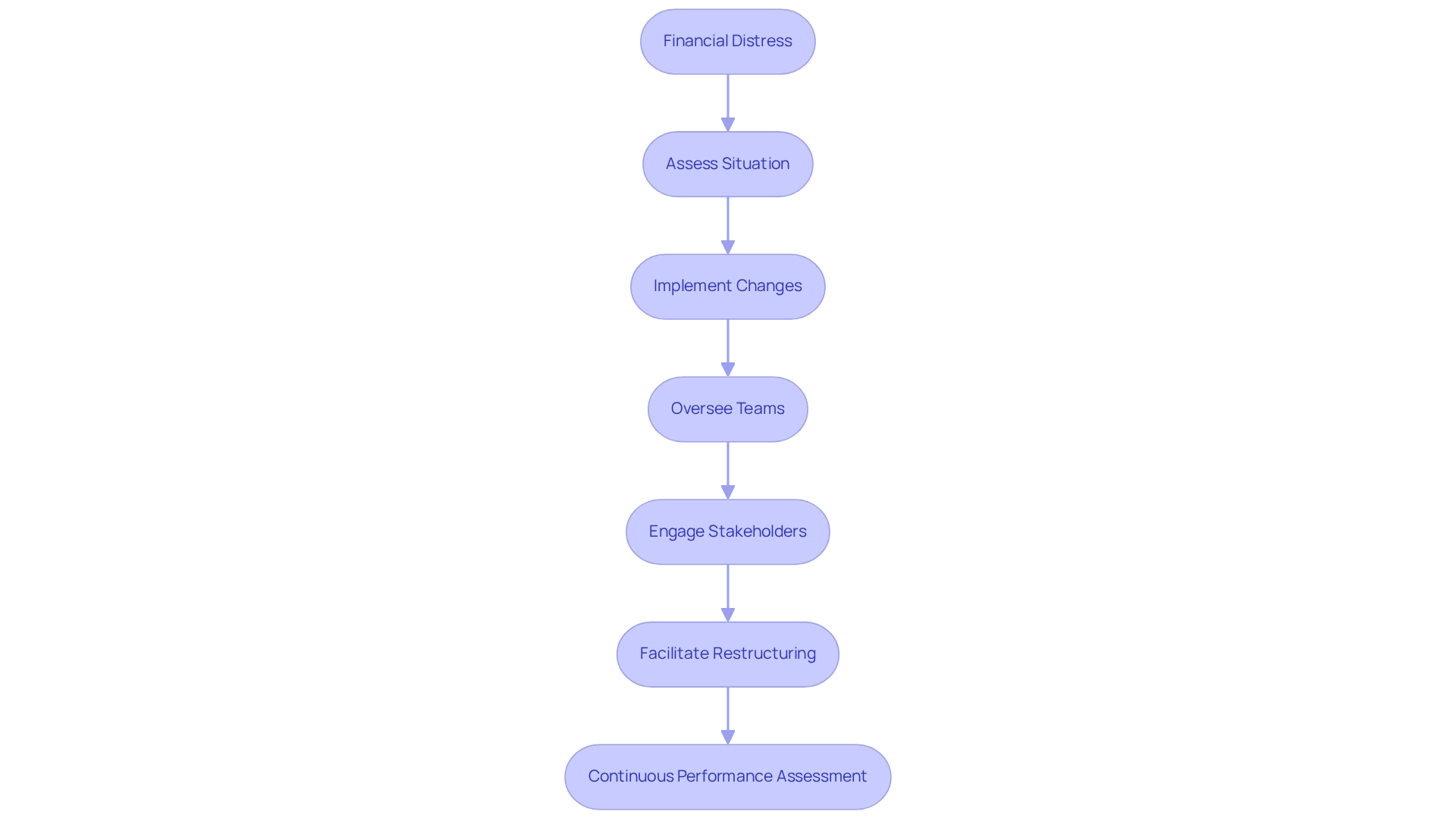

Interim Management Solutions: Maintain Operations During Financial Distress

Interim management solutions are vital for sustaining operations during periods of financial distress. When an organization faces leadership gaps due to crises, interim managers from Transform Your Small/ Medium Business can provide essential guidance and stability. With over 100 years of combined experience, these professionals possess a wealth of expertise, allowing them to quickly assess situations, implement immediate changes, and ensure that day-to-day operations continue seamlessly. Their role often includes overseeing teams, engaging with stakeholders, and facilitating the restructuring process, all while minimizing operational disruptions.

Moreover, our approach emphasizes efficient decision-making and real-time analytics, enabling continuous performance assessment and the incorporation of lessons learned throughout the turnaround process. We also provide insolvency consulting services along with comprehensive financial evaluation and bankruptcy case oversight to help companies navigate their challenges effectively.

To discover how our temporary solutions can empower your enterprise to thrive during challenging times, reach out to us today.

Bankruptcy Case Management: Navigate Proceedings with Expert Guidance

Assistance in bankruptcy case management is essential for companies seeking insolvency consulting services. Expert guidance is crucial in navigating the complexities of bankruptcy proceedings, ensuring compliance with legal requirements and safeguarding the interests of stakeholders.

Our comprehensive insolvency consulting services include:

- Facilitating the preparation of necessary documentation

- Negotiation with creditors

- Development of a viable reorganization plan

Moreover, we emphasize streamlined decision-making and real-time analytics through our client dashboard, which is vital for effective turnaround strategies. The expertise of our consultants in insolvency consulting services can significantly influence the outcome of the bankruptcy process, enabling companies to emerge stronger and more resilient.

Industry-Specific Consulting: Tailored Services for Retail and Restaurant Sectors

Sector-specific consulting assistance is crucial for enterprises in the retail and restaurant sectors, which face unique challenges such as shifting consumer preferences and operational complexities. At Transform Your Small/Medium Business, our consulting expertise in these industries enables us to deliver tailored solutions that enhance operational efficiency, improve customer engagement, and drive revenue growth.

We initiate every client interaction with a comprehensive review to align key stakeholders and gain a deeper insight into your operations. This process encompasses:

- Assessing financial health

- Providing insolvency consulting services

- Managing bankruptcy cases to uncover underlying issues

By collaborating to develop a strategic plan, we empower organizations to adapt to market trends and implement strategies that ensure long-term success. Our Rapid-30 process fosters transformational change and client engagement, facilitating streamlined decision-making and real-time analytics for effective performance monitoring.

Operational Efficiency Consulting: Streamline Processes for Better Results

Operational Efficiency Consulting: Streamline Processes for Better Results

Operational efficiency consulting is essential for organizations aiming to streamline processes and achieve superior results. By meticulously analyzing workflows, identifying bottlenecks, and implementing best practices, our team at Transform Your Small/ Medium Company empowers organizations to reduce costs and enhance productivity. We provide a comprehensive suite of insolvency consulting services, including:

- Temporary oversight

- Fiscal evaluation

- Bankruptcy case coordination

This ensures a holistic approach to turnaround and restructuring.

Moreover, our technology-enabled solutions significantly enhance decision-making through real-time analytics, which may include adopting innovative technologies and improving employee training programs. We are steadfast in our commitment to transparency and measurable results, ultimately striving to cultivate a more agile and responsive organization that can adapt to evolving market conditions and drive sustainable growth.

To learn more about how we can support your enterprise, reach out to us today.

Technology-Enabled Consulting: Leverage Innovation in Insolvency Solutions

Technology-enabled consulting is transforming insolvency consulting services by leveraging advanced tools and platforms that significantly enhance data analysis and operational efficiency. This innovation facilitates precise forecasting, robust risk management, and informed decision-making, empowering consultants to respond swiftly to economic challenges. Our approach is customized to meet the unique needs of small to medium businesses, emphasizing collaboration and our core values of transparency, results, and innovation. We work closely with your team, ensuring that our strategies align with your specific goals and challenges.

According to the Insolvency and Bankruptcy Board of India, there were 3,100 registered insolvency professionals utilizing case software in 2023, underscoring the industry's reliance on technology. Businesses that incorporate technology into their consulting strategies experience significantly faster recovery times. While specific statistics on recovery times were not available, the focus on technology-driven approaches has resulted in improved outcomes during financial distress. Our commitment to confidentiality, combined with our extensive experience in the field, further enhances our insolvency consulting services, while our group advocates for a streamlined decision-making cycle during the turnaround process, enabling your team to take decisive action to protect your enterprise. As the landscape of monetary consulting evolves, the emphasis on technology continues to grow, with current trends highlighting the importance of data analytics and real-time communication in driving effective recovery strategies. The ongoing advancements in insolvency software illustrate the necessity for companies to adapt and innovate in their recovery efforts.

To maximize your recovery potential, consider integrating technology-driven strategies into your consulting approach.

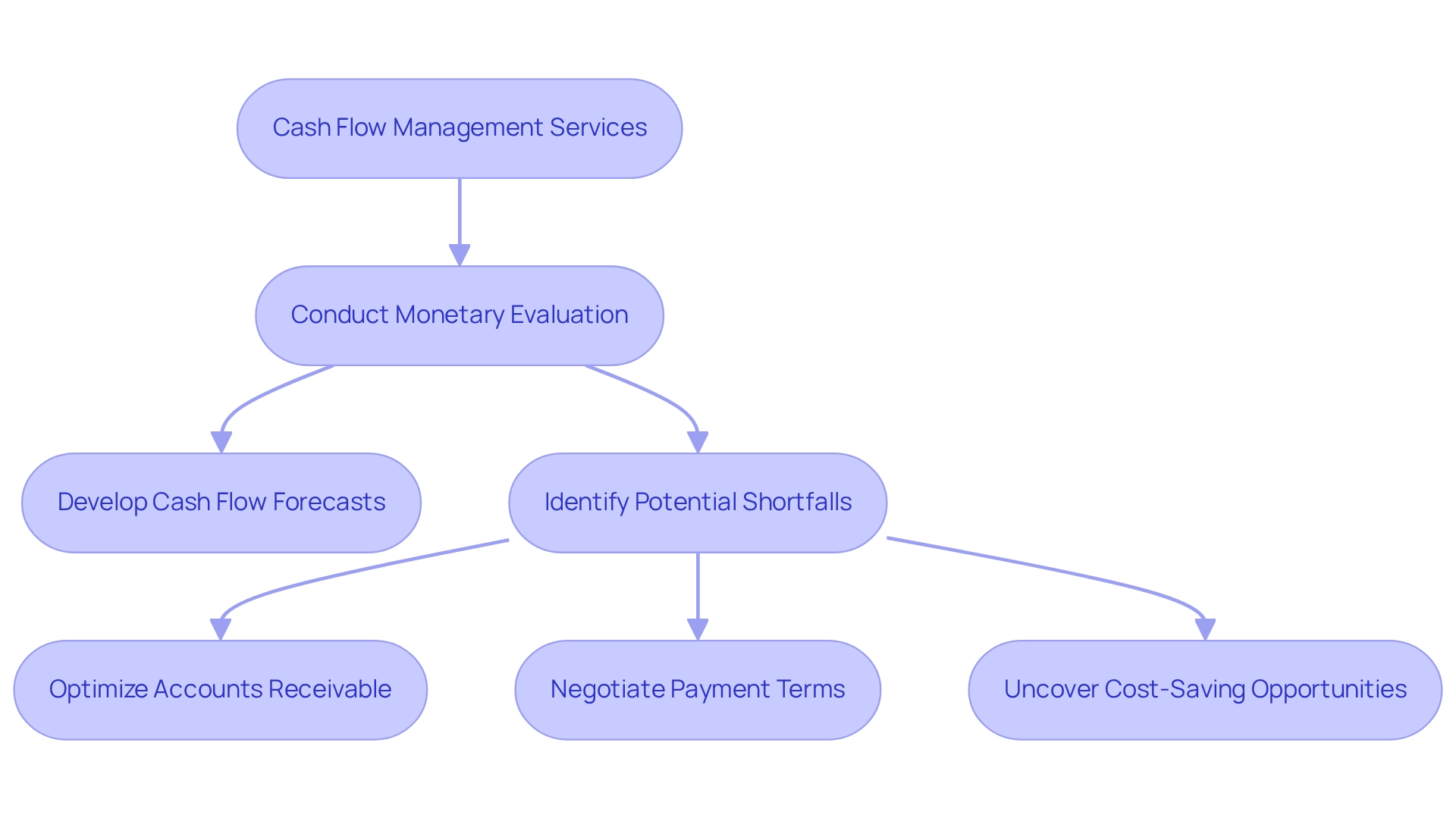

Cash Flow Management Services: Ensure Financial Stability During Crisis

Cash flow management services play an essential role in ensuring economic stability during a crisis. A comprehensive monetary evaluation assists in identifying opportunities to conserve cash and reduce obligations, empowering companies to navigate economic challenges more effectively.

Consultants partner with enterprises to develop robust cash flow forecasts, identify potential shortfalls, and implement strategies to enhance liquidity. This process may involve:

- Optimizing accounts receivable practices

- Negotiating improved payment terms with suppliers

- Uncovering cost-saving opportunities

By sustaining a healthy cash flow and taking decisive action based on thorough financial assessments, businesses can strategically position themselves for recovery and enhance their operational efficiency.

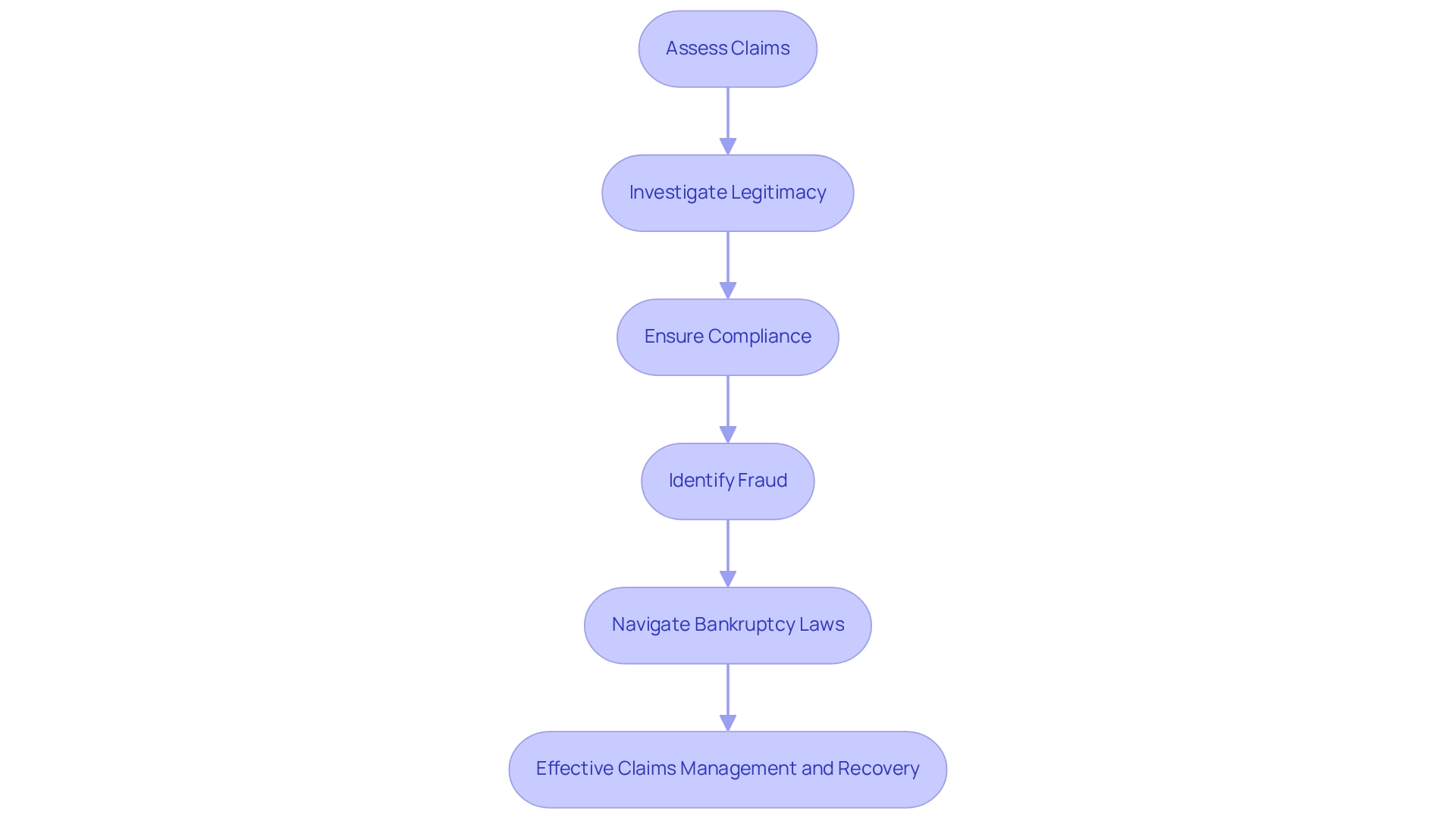

Forensic Claims Review: Validate and Manage Claims Effectively

Forensic claims assessment options are essential for validating and managing claims effectively in insolvency consulting services during insolvency proceedings. Our comprehensive insolvency consulting services encompass thorough investigations to ensure that all claims are legitimate and accurately documented. This meticulous process not only safeguards the interests of stakeholders but also guarantees compliance with legal requirements.

By identifying potential fraudulent claims or discrepancies, organizations can mitigate risks and enhance their prospects for a successful recovery. Furthermore, our insolvency consulting services provide expert guidance in navigating complex bankruptcy laws, coupled with extensive financial reviews focused on cash preservation and efficiency, which significantly bolsters the recovery process.

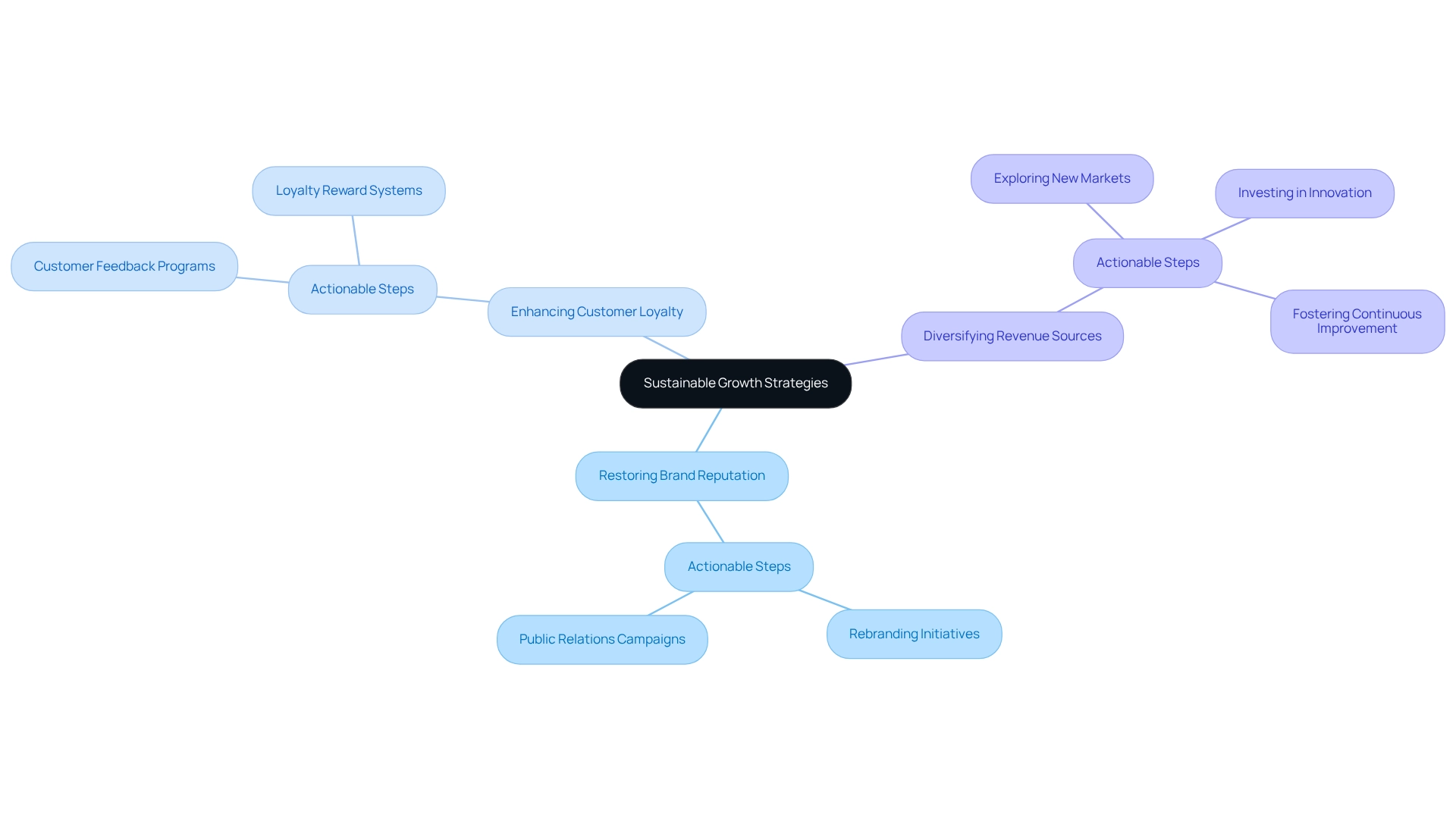

Sustainable Growth Strategies: Achieve Long-Term Success After Insolvency

Sustainable growth strategies are essential for achieving long-term success, which can be facilitated by insolvency consulting services. At Transform Your Small/Medium Enterprise, our consultants partner with organizations to develop comprehensive strategies that focus on:

- Restoring brand reputation

- Enhancing customer loyalty

- Diversifying revenue sources

This may involve exploring new markets, investing in innovation, and fostering a culture of continuous improvement.

Our tailored approach ensures we identify underlying organizational issues and create actionable plans to address weaknesses while reinforcing key strengths. By prioritizing sustainability in their growth strategies, businesses can not only recover from financial distress but also position themselves for future success.

Leverage our expertise in insolvency consulting services and interim management to navigate this critical journey effectively.

Conclusion

Navigating financial distress can be a formidable challenge for small and medium businesses; however, comprehensive turnaround and restructuring consulting provides a viable pathway to recovery and growth. By implementing a variety of strategies—such as thorough financial assessments, interim management, and industry-specific insights—organizations can stabilize operations effectively and establish a foundation for sustainable success. The significance of cash flow management, operational efficiency, and technology-enabled solutions is paramount, as these elements are essential in maneuvering through turbulent financial landscapes.

Furthermore, the focus on tailored consulting services ensures that businesses not only confront immediate challenges but also cultivate resilience for the future. By integrating sustainable growth strategies and emphasizing innovation, companies can rise from insolvency not merely as survivors but as stronger, more agile competitors in their respective markets. Ultimately, the right consulting partnership can transform obstacles into opportunities, enabling organizations to thrive amidst uncertainty and adapt to the continuously evolving business environment. Embracing these strategies is crucial for any business aiming to secure its future and attain long-term success.

Frequently Asked Questions

What services do insolvency consulting services provide for small and medium enterprises?

Insolvency consulting services offer a comprehensive monetary evaluation to identify opportunities for cash preservation and liability reduction, alongside an in-depth analysis of an organization's operations and market position. They develop customized strategies to address challenges such as restructuring debt, optimizing operations, and enhancing profitability and sustainability.

How do interim management services assist organizations in crisis?

Interim management services provide executive leadership during crisis resolution, helping organizations navigate difficulties effectively. These professionals ensure stability and position the enterprise for future growth by utilizing their extensive experience to implement immediate changes and maintain day-to-day operations.

What is the goal of financial assessment services?

The goal of financial assessment services is to preserve cash and minimize liabilities by conducting a thorough review of financial statements, cash flow forecasts, and operational expenses. This evaluation identifies inefficiencies, uncovers potential savings, and enhances cash management practices, ultimately improving a company’s liquidity.

How can businesses benefit from financial evaluations?

Businesses can benefit from financial evaluations by identifying root causes of financial issues, planning solutions, and measuring investment returns. Tailored strategies from insolvency consulting specialists can lead to enhanced cash flow and profitability, enabling companies to navigate challenging economic conditions more effectively.

What expertise do interim managers bring to an organization?

Interim managers bring over 100 years of combined experience, allowing them to quickly assess situations, implement immediate changes, and ensure seamless day-to-day operations. They play a crucial role in overseeing teams, engaging with stakeholders, and facilitating the restructuring process while minimizing operational disruptions.