Overview

Interim management financial services provide substantial advantages for small and medium enterprises, such as:

- Improved cash flow

- Risk mitigation

- Enhanced operational efficiency

These elements are vital for navigating financial challenges and fostering sustainable growth. Notably, temporary leadership can:

- Stabilize companies during crises

- Implement effective strategies

- Deliver tailored assessments that facilitate informed decision-making and pave the way for long-term success

By leveraging these services, businesses can not only survive but thrive in a competitive landscape.

Introduction

Temporary leadership is emerging as a transformative force for small and medium enterprises facing critical challenges. By harnessing the expertise of interim management financial services, businesses can navigate turbulent waters with agility and precision, ultimately enhancing their operational efficiency and financial stability.

However, the pressing question remains: how can these temporary professionals effectively drive long-term success while ensuring compliance and mitigating risks?

Exploring the key benefits of interim management reveals not only immediate advantages but also strategic insights that can propel organizations toward sustainable growth.

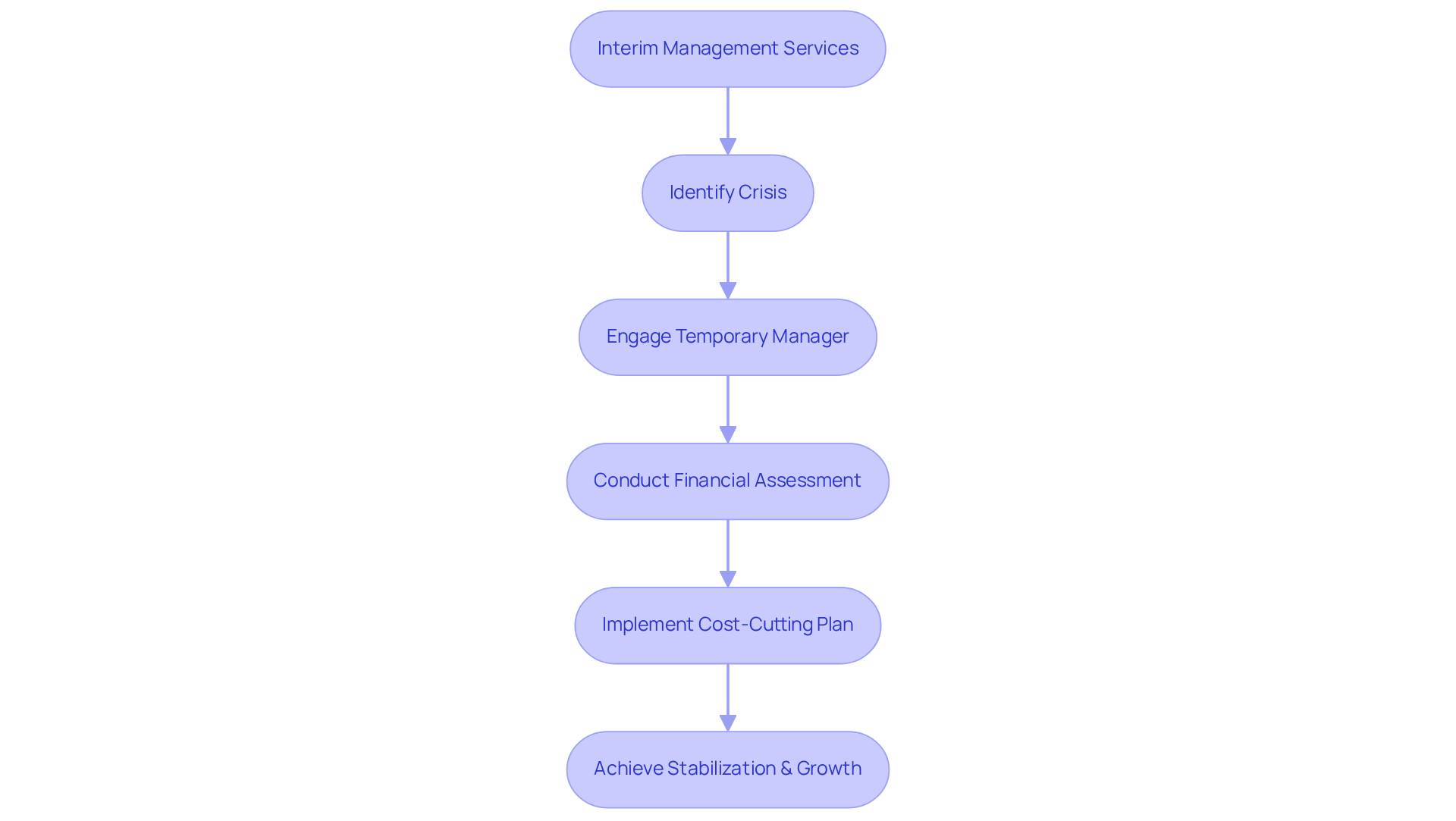

Transform Your Small/ Medium Business: Expert Interim Management Financial Services

Temporary oversight services empower small and medium enterprises by granting access to seasoned professionals who can intervene during critical junctures. These experts, equipped with extensive experience and a fresh perspective, facilitate immediate changes that drive significant improvements. For instance, a retail company grappling with cash flow issues successfully stabilized its financial health after utilizing interim management financial services by enlisting an external temporary finance manager. This manager conducted a thorough financial assessment, identifying opportunities to preserve cash and reduce liabilities through a strategic cost-cutting plan.

By leveraging temporary leadership, including comprehensive turnaround and restructuring advisory services, companies can navigate crises more effectively, ensuring competitiveness and resilience in challenging environments. The adaptability of temporary managers allows for rapid adjustments to evolving organizational needs, with appointments often occurring within just a few weeks. This offers prompt assistance without the long-term commitment of permanent staff, enhancing operational efficiency while fostering a culture of resilience that enables organizations to thrive even in turbulent times.

Moreover, the demand for interim management financial services, especially for temporary CFOs, has surged significantly in the past year, reflecting the essential role these leaders play in guiding companies through transitions and strategic realignments, including bankruptcy case oversight. Ultimately, temporary leadership serves as a vital resource for organizations striving to optimize performance and achieve sustainable growth.

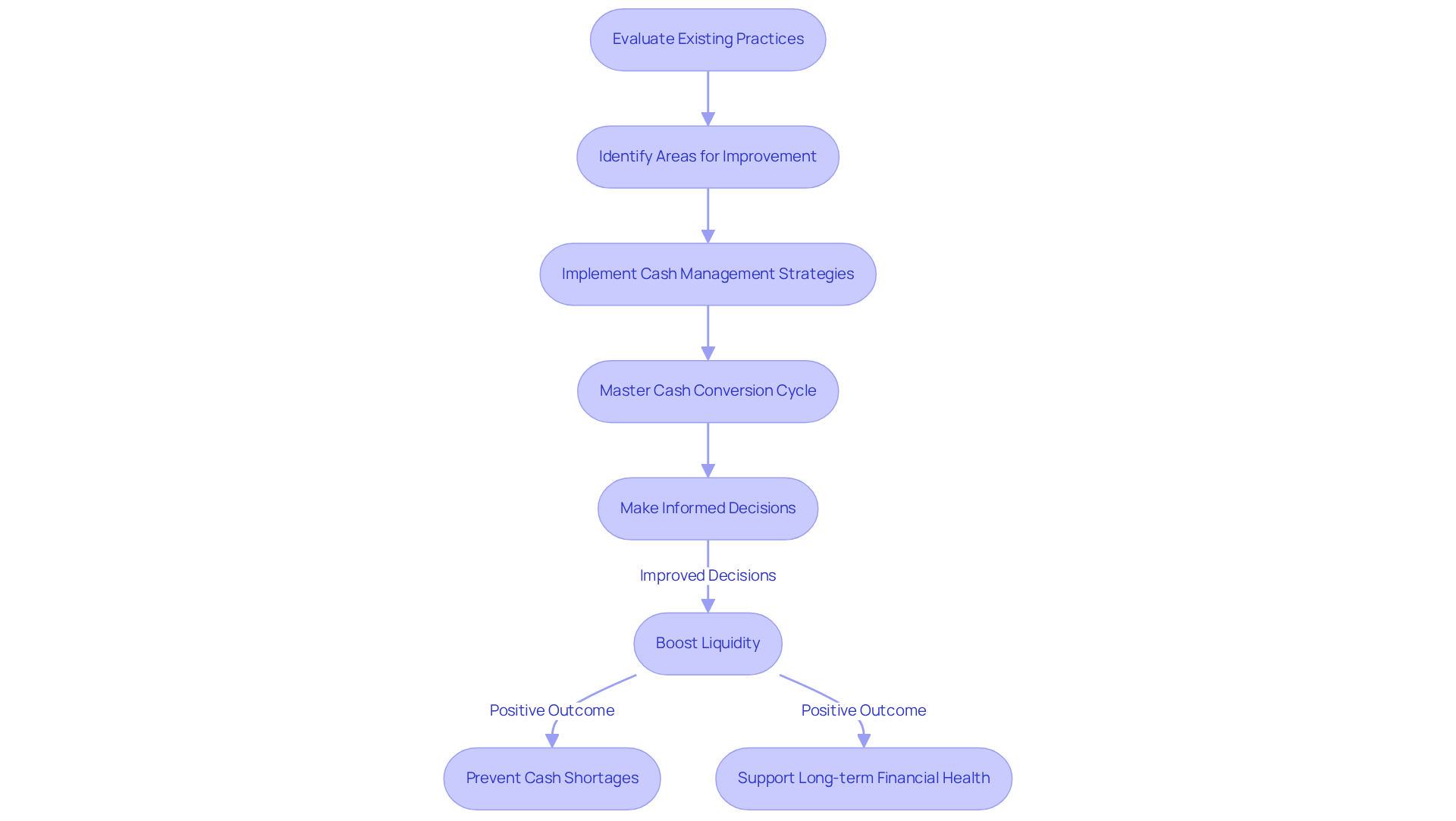

Cash Flow Optimization: Enhance Liquidity with Interim Management

Temporary oversight services focus on enhancing cash flow by evaluating existing monetary practices and identifying areas for improvement. By implementing effective cash management strategies, organizations can boost liquidity, ensuring they possess the necessary funds to meet operational needs and invest in growth opportunities. This proactive approach not only helps prevent cash shortages but also supports long-term financial health.

Moreover, mastering the cash conversion cycle through efficient decision-making and real-time analytics empowers organizations to make informed choices swiftly, ultimately improving cash flow and profitability. Our commitment to testing hypotheses and applying lessons learned ensures that your organization can adapt and thrive in a dynamic environment.

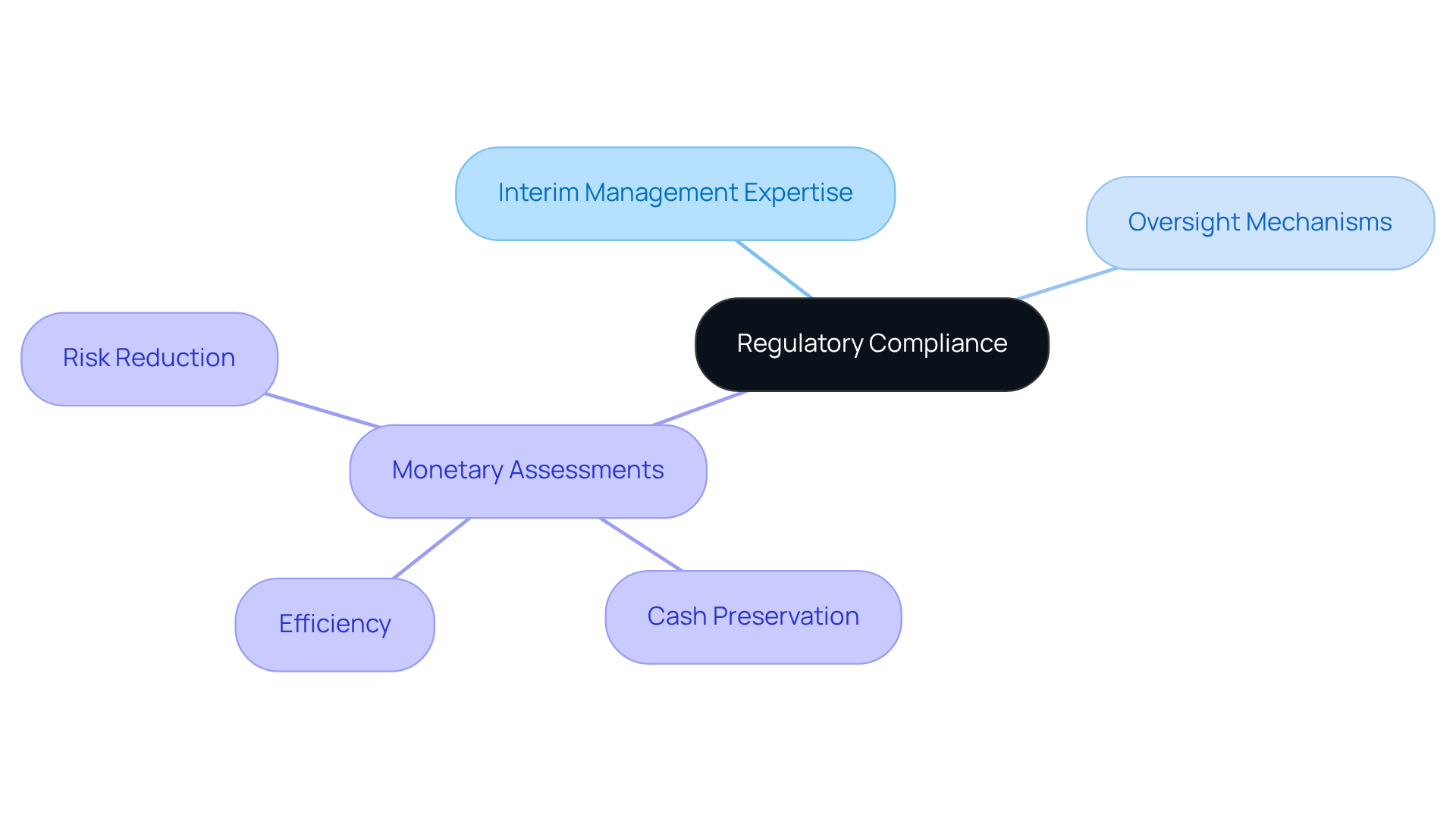

Regulatory Compliance: Ensure Adherence with Interim Financial Oversight

Specialists in interim management financial services command expertise in regulatory compliance, ensuring organizations meet fiscal regulations and reporting standards. They implement robust oversight mechanisms that empower organizations to navigate complex regulatory environments, significantly reducing the risk of non-compliance.

Moreover, by conducting thorough monetary assessments with a focus on cash preservation, efficiency, and risk reduction, these experts uncover hidden value and identify opportunities to cut costs. This dual focus on compliance and economic efficiency in interim management financial services not only protects the enterprise but also enhances its credibility with stakeholders, fostering trust and reliability.

Risk Mitigation: Strengthen Financial Stability through Interim Solutions

Interim management financial services are pivotal in mitigating risks by pinpointing potential monetary threats and executing strategies to counteract them. Through comprehensive risk assessments, temporary managers devise contingency plans that shield the business from unexpected challenges. This proactive methodology not only fortifies financial stability but also cultivates confidence among stakeholders in the realm of interim management financial services.

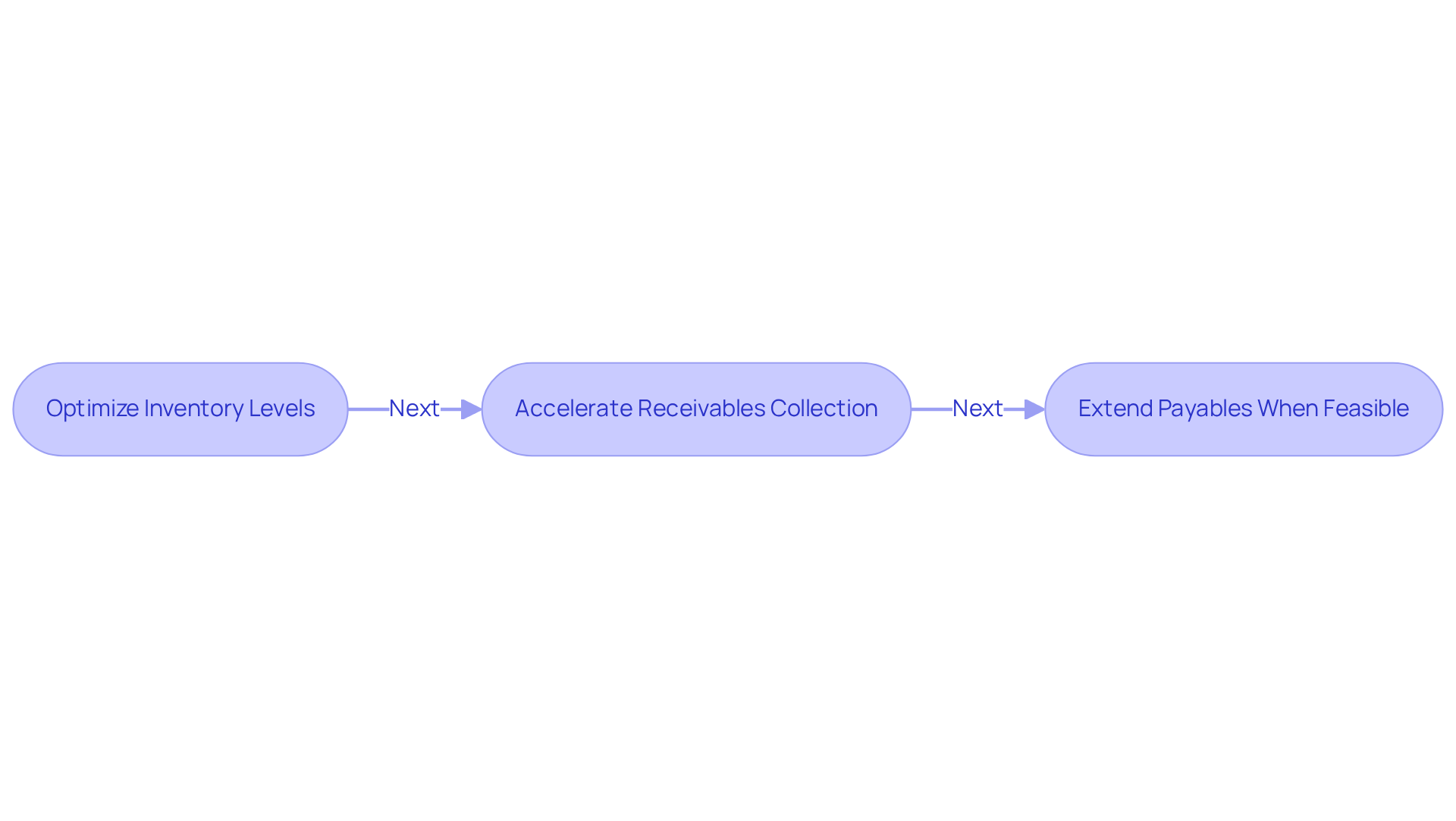

To excel in mastering the cash conversion cycle, interim managers can adopt strategies such as:

- Optimizing inventory levels

- Accelerating receivables collection

- Extending payables when feasible

By leveraging real-time analytics, they can refine decision-making processes, ensuring organizations swiftly adapt to evolving circumstances. This continuous performance evaluation facilitates the integration of lessons learned, fostering robust relationships and bolstering overall organizational resilience. Consequently, CFOs should routinely scrutinize cash flow metrics to identify trends and make informed decisions that enhance economic stability.

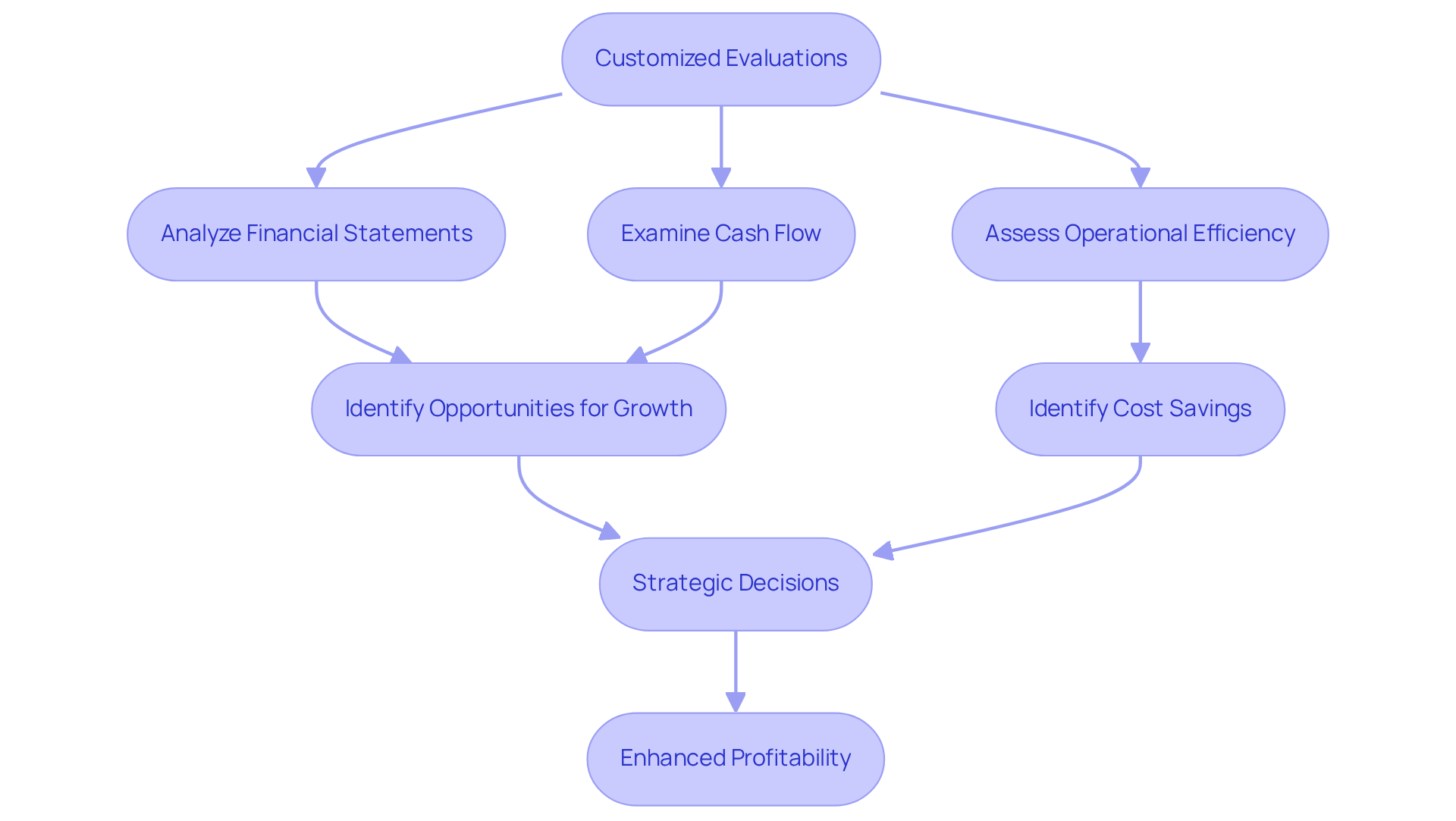

Tailored Financial Assessments: Identify Opportunities for Growth

Temporary management services provide customized evaluations that deliver essential perspectives on a company's economic well-being. By thoroughly analyzing financial statements, cash flow, and operational efficiency, interim management financial services can identify opportunities for growth and cost savings. This comprehensive approach not only aids in cash preservation and liability reduction but also supports interim management financial services that empower organizations to make strategic decisions, thereby enhancing profitability and driving long-term success. Moreover, with an emphasis on real-time analytics and ongoing performance monitoring, our services ensure that organizations can adapt swiftly and efficiently to evolving situations.

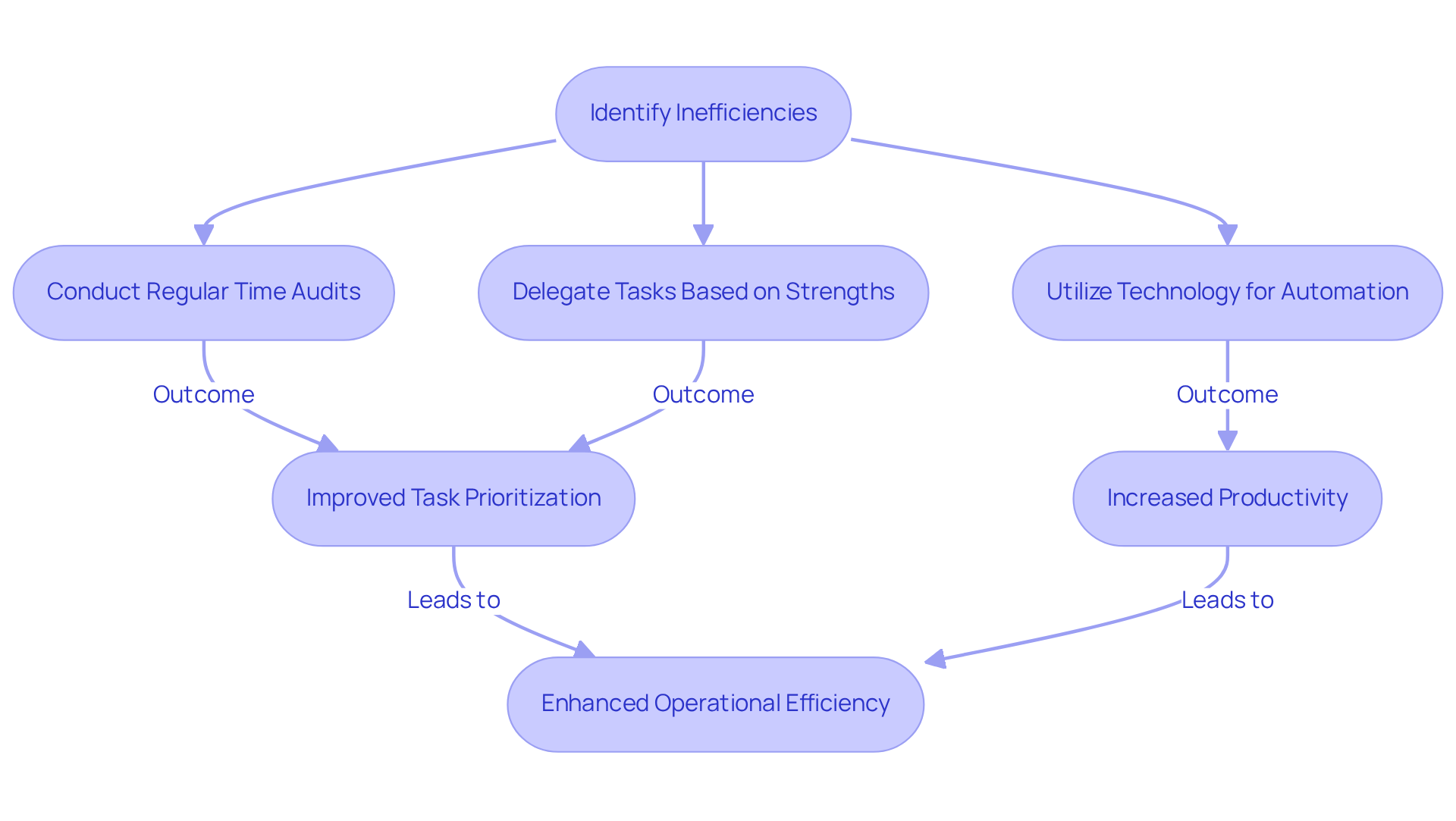

Operational Efficiency: Streamline Processes with Interim Expertise

Interim leadership professionals are pivotal in streamlining operational processes to enhance efficiency. By meticulously assessing existing workflows and identifying bottlenecks, they can implement best practices that significantly minimize waste and boost productivity.

For example, organizations that adopt structured time management systems often witness a remarkable improvement in task prioritization, leading to better resource allocation and increased operational efficiency. This focus on operational efficiency not only curtails expenses but also positions companies for sustainable growth.

Industry leaders assert that empowering teams and leveraging technology are vital for realizing these efficiencies. Indeed, operational efficiency is not merely a luxury; it is a necessity for small to medium enterprises striving to excel in a competitive environment. Engaging employees in the identification of inefficiencies fosters a culture of continuous improvement, ultimately enhancing productivity and customer satisfaction.

Effective strategies for streamlining processes encompass:

- Regular time audits

- Judicious task delegation based on individual strengths

- The utilization of technology to automate repetitive tasks

These approaches not only refine workflows but also liberate valuable time for employees to focus on high-value activities, propelling overall organizational success.

Furthermore, by mastering the cash conversion cycle and employing real-time analytics, interim management financial services can facilitate streamlined decision-making and ongoing performance monitoring. This strategic methodology enables enterprises to uncover underlying issues, collaboratively devise effective solutions, and assess investment returns, ultimately driving enhanced organizational performance.

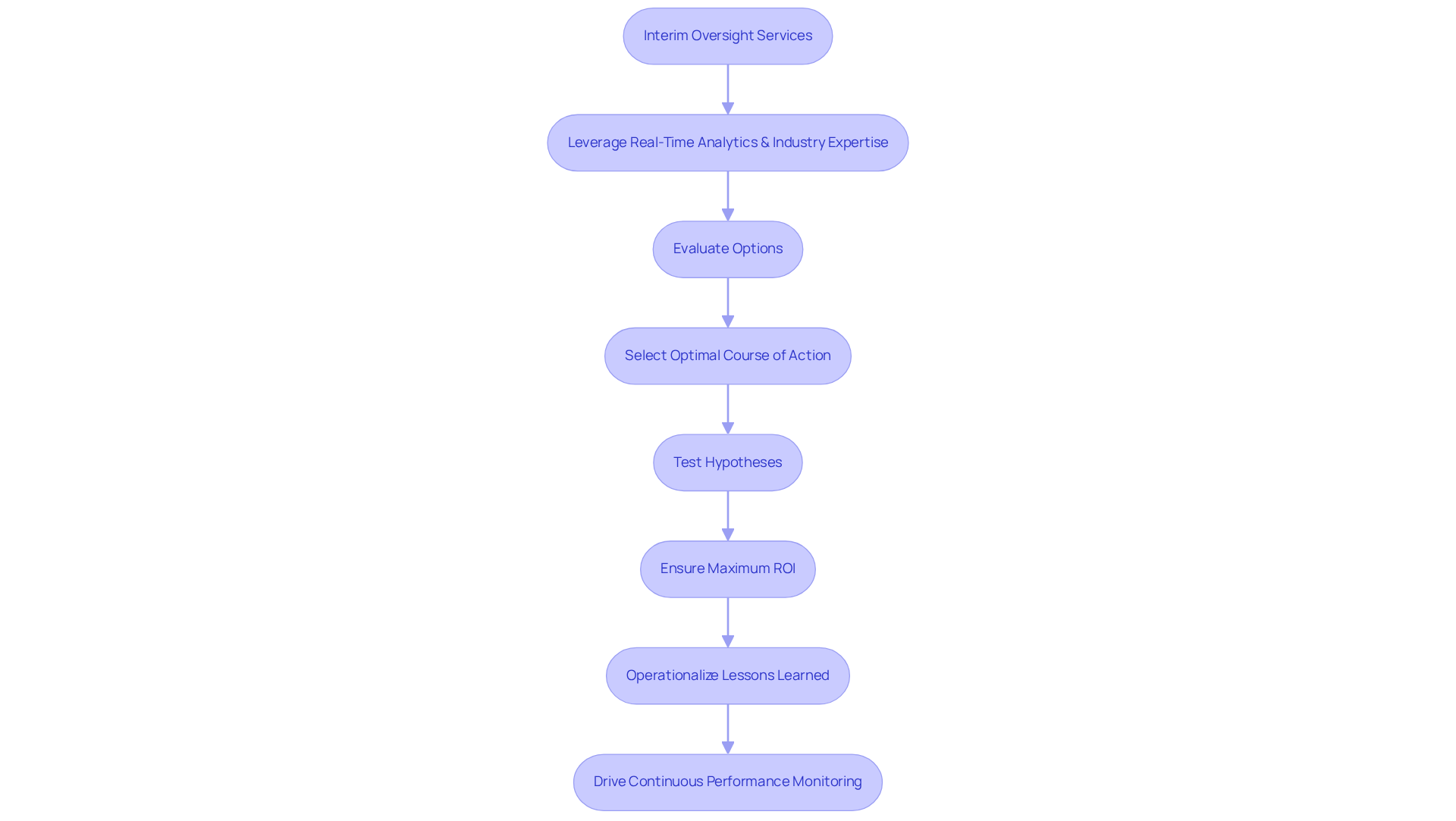

Strategic Decision-Making: Leverage Interim Management for Informed Choices

Interim oversight services provide companies with the strategic insight essential for informed decision-making. By leveraging real-time analytics and industry expertise, temporary managers assist organizations in evaluating options and selecting the optimal course of action. This pragmatic approach encompasses testing hypotheses to ensure maximum return on invested capital, facilitating swift decision-making that aligns with long-term goals and market trends. Moreover, a commitment to operationalizing lessons learned cultivates strong relationships and continuous performance monitoring, ultimately driving success.

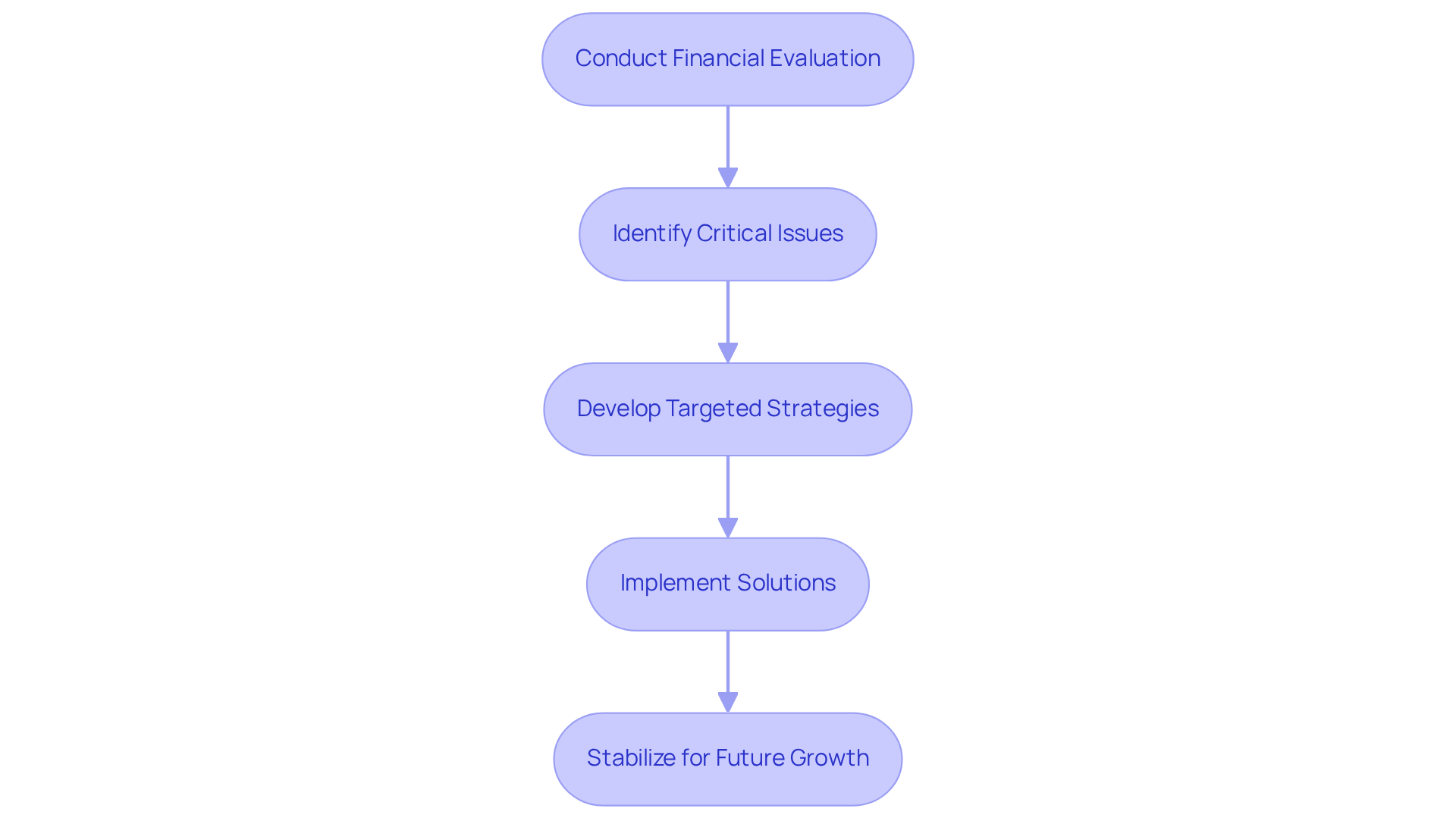

Turnaround Strategies: Navigate Financial Challenges with Interim Support

Interim management financial services are pivotal in crafting turnaround strategies for companies facing economic distress. By conducting thorough evaluations, temporary managers can pinpoint critical issues and develop targeted strategies that tackle immediate challenges. This financial assessment is vital for preserving cash and reducing liabilities, enabling companies to effectively navigate turbulent times.

For example, organizations that engaged interim management during the COVID-19 pandemic saw a significant reduction in operational costs and improved cash flow management, both essential for survival. These strategies not only stabilize the business but also lay the groundwork for sustainable growth and future success.

As turnaround specialists frequently emphasize, proactively addressing financial challenges can greatly enhance a company's resilience and adaptability within a competitive landscape. Our 'Rapid30' plan exemplifies this transformative approach, demonstrating how decisive actions and collaborative strategies can stabilize economic positions and improve operations in turnaround scenarios.

As one satisfied client noted, 'The financial evaluation provided by the temporary leadership team was crucial in identifying our cash flow issues and implementing effective solutions.' This underscores the critical need for companies to leverage interim management to overcome financial hurdles and thrive.

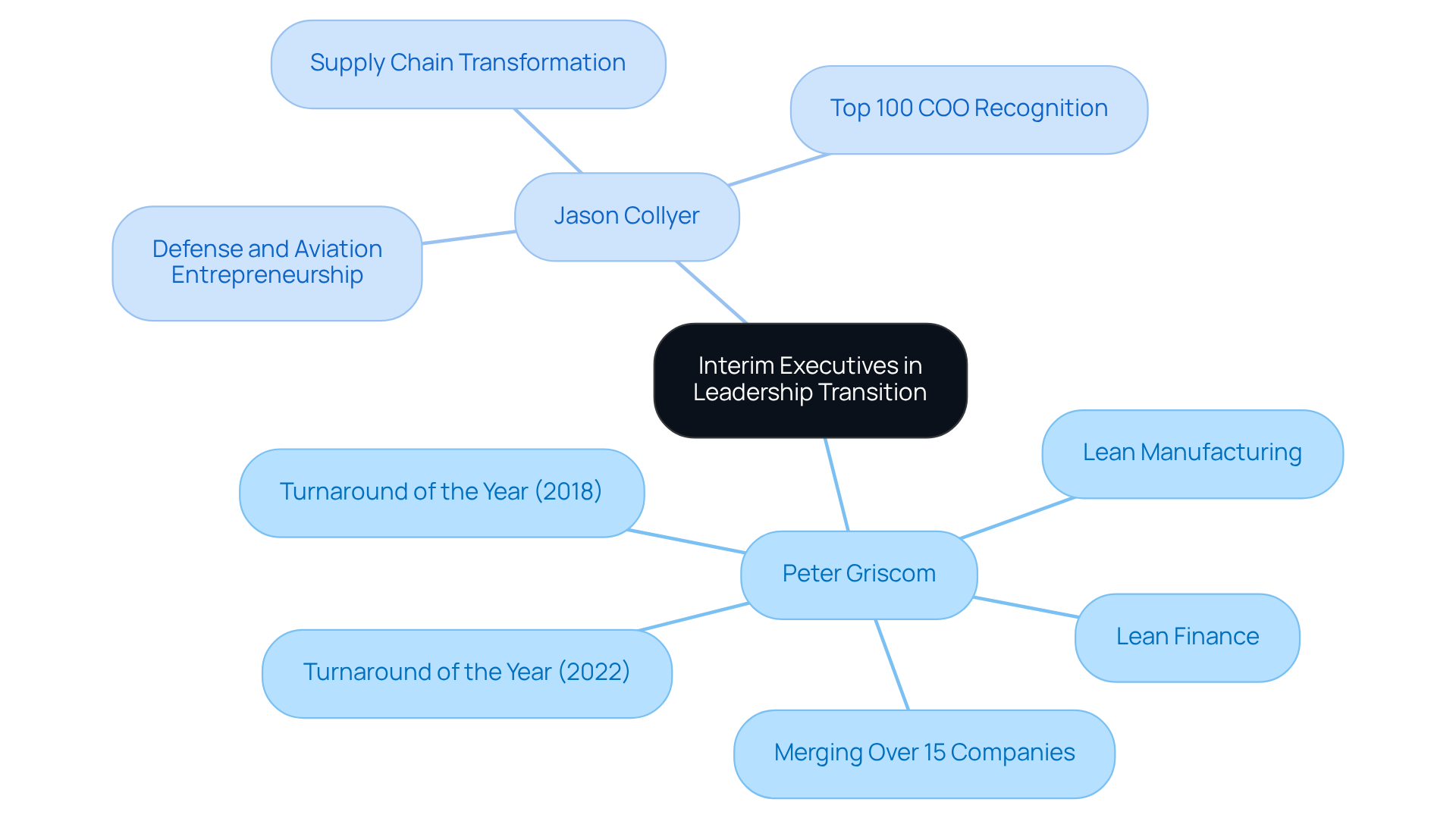

Leadership Transition: Maintain Stability with Interim Executives

Interim executives are pivotal in ensuring stability during leadership transitions. They bring a wealth of experience and expertise that can effectively guide organizations through uncertain times. For instance, Peter Griscom, M.S., a renowned integration and turnaround specialist, has successfully merged over 15 companies and was recognized as Turnaround of the Year in both 2018 and 2022. His hands-on leadership style, combined with proficiency in Lean Finance and Lean Manufacturing, guarantees smooth operations, minimizing disruption and preserving employee morale.

Similarly, Jason Collyer, a Top 100 COO, specializes in defense, aviation entrepreneurship, and supply chain transformation, further illustrating the caliber of temporary executives available. By providing robust leadership and clear direction, temporary executives like Griscom and Collyer facilitate streamlined decision-making processes and leverage real-time analytics to monitor business performance, ensuring organizations can adapt swiftly and effectively during transitions.

To fully capitalize on the advantages of interim management financial services, organizations should leverage the unique skills of these executives to implement effective turnaround strategies that promote resilience and growth.

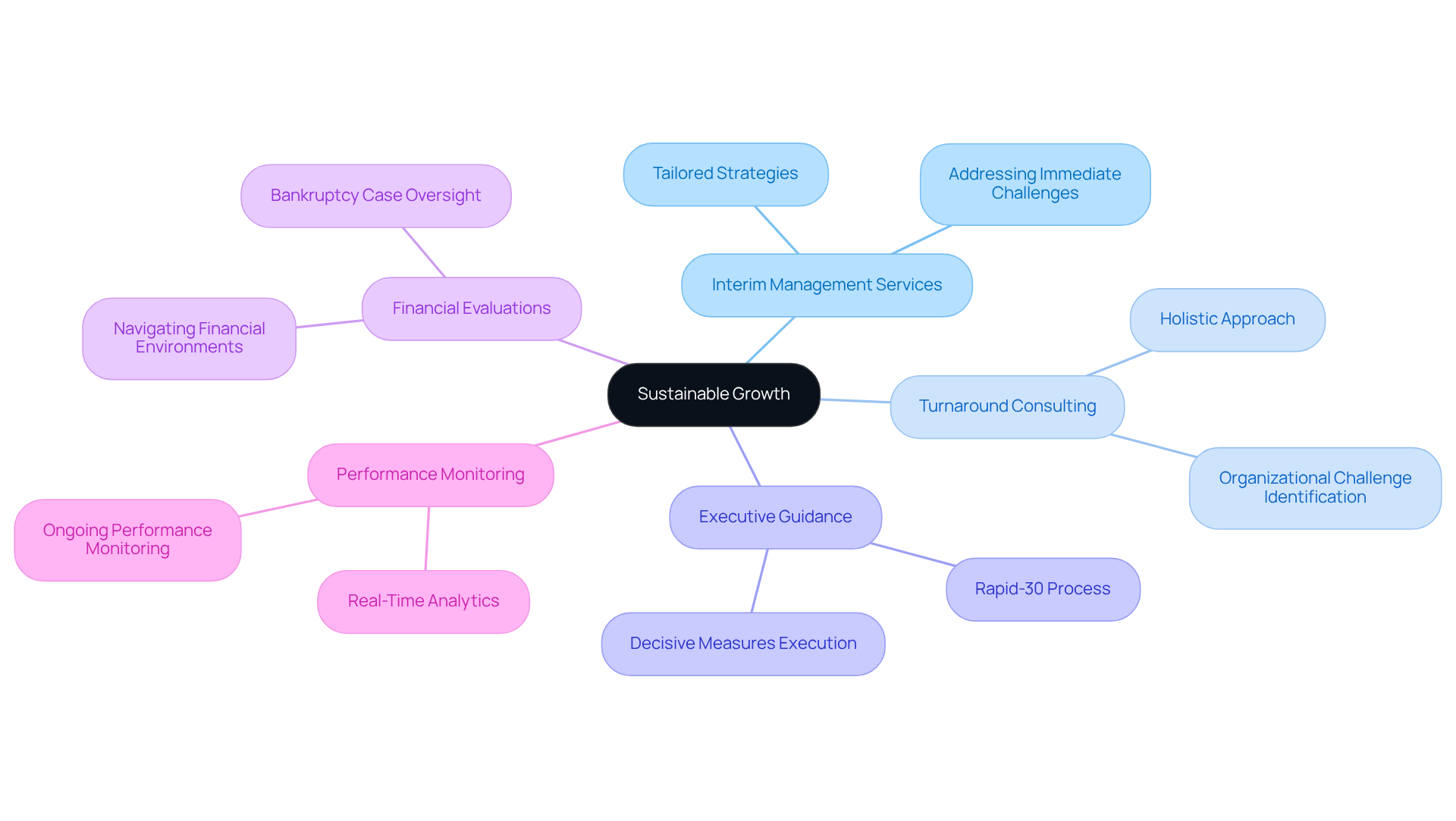

Sustainable Growth: Achieve Long-Term Success with Interim Management

Interim management financial services are pivotal in achieving sustainable growth by implementing strategies that align with long-term objectives. Our comprehensive turnaround and restructuring consulting services are meticulously tailored for small to medium enterprises, ensuring that immediate challenges are addressed while also planning for the future. By leveraging practical executive guidance through our Rapid-30 process, interim management financial services help managers adeptly identify organizational challenges and execute decisive measures that stabilize monetary situations and enhance operations. This holistic approach not only ensures that organizations are surviving but thriving in their respective markets, establishing a solid foundation for ongoing success.

Moreover, our interim management financial services include thorough financial evaluations and bankruptcy case oversight, which are essential for navigating intricate financial environments. Ongoing performance monitoring and relationship-building through real-time analytics further empower organizations to operationalize turnaround lessons and effectively measure investment returns. To discover how our interim management services can transform your business, contact us today.

Conclusion

Interim management financial services play a crucial role in transforming small and medium enterprises by providing expert guidance during pivotal moments. These temporary leaders not only facilitate immediate improvements but also lay the groundwork for sustainable growth, ensuring organizations can navigate challenges with resilience and adaptability.

Throughout this article, we have highlighted the key benefits of interim management, including:

- Cash flow optimization

- Regulatory compliance

- Risk mitigation

- Operational efficiency

By leveraging the expertise of interim executives, businesses can make informed decisions, streamline processes, and develop effective turnaround strategies that enhance overall financial health and stability. The demand for such services has surged, underscoring their importance in today’s dynamic business environment.

Ultimately, embracing interim management can be a game-changer for organizations seeking to thrive amid uncertainty. By prioritizing strategic oversight and leveraging tailored financial assessments, businesses are better equipped to identify growth opportunities and implement sustainable practices. Engaging interim management services is not just a reactive measure; it is a proactive strategy for long-term success and resilience in the ever-evolving marketplace.

Frequently Asked Questions

What are interim management financial services?

Interim management financial services provide temporary oversight by experienced professionals who can help small and medium enterprises during critical times, facilitating immediate changes that drive improvements.

How can interim management financial services benefit a business facing cash flow issues?

These services can stabilize a company's financial health by conducting thorough financial assessments, identifying opportunities to preserve cash, and implementing strategic cost-cutting plans.

What is the role of temporary managers in an organization?

Temporary managers offer rapid adjustments to evolving organizational needs, provide comprehensive turnaround and restructuring advisory services, and enhance operational efficiency without the long-term commitment of permanent staff.

Why has the demand for interim management financial services increased recently?

There has been a significant surge in demand for interim management financial services, particularly for temporary CFOs, as these leaders play a crucial role in guiding companies through transitions and strategic realignments.

How do interim management financial services enhance cash flow?

They focus on evaluating existing monetary practices, identifying areas for improvement, and implementing effective cash management strategies to boost liquidity and ensure funds are available for operational needs and growth opportunities.

What is the cash conversion cycle, and why is it important?

The cash conversion cycle is the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. Mastering this cycle through efficient decision-making and analytics helps improve cash flow and profitability.

How do interim managers ensure regulatory compliance?

Interim management financial services specialists ensure organizations adhere to fiscal regulations and reporting standards by implementing robust oversight mechanisms and conducting thorough monetary assessments.

What additional benefits do interim management financial services provide?

These services not only protect enterprises from non-compliance risks but also enhance credibility with stakeholders, uncover hidden value, and identify opportunities to cut costs, fostering trust and reliability.