Overview

The article focuses on effective strategies that businesses can implement to reduce overhead costs. It outlines various approaches, such as negotiating with suppliers, implementing energy efficiency programs, and regularly reviewing expenses, all supported by evidence demonstrating how these strategies can lead to significant savings and improved operational efficiency.

Introduction

In a landscape where every dollar counts, understanding and managing overhead costs can be the key to unlocking significant financial efficiency for businesses. Overhead costs, encompassing everything from fixed expenses like rent to variable costs such as utilities, can often slip under the radar, leading to unnoticed drains on resources.

By categorizing and scrutinizing these costs, organizations not only identify areas for potential savings but also enhance their operational effectiveness. This article delves into practical strategies for:

- Reducing overhead costs

- Leveraging technology for better management

- The transformative power of outsourcing non-core functions

With insights drawn from industry case studies and expert recommendations, businesses can equip themselves with the tools needed to navigate financial complexities and drive sustainable growth.

Understanding Overhead Costs: Definition and Types

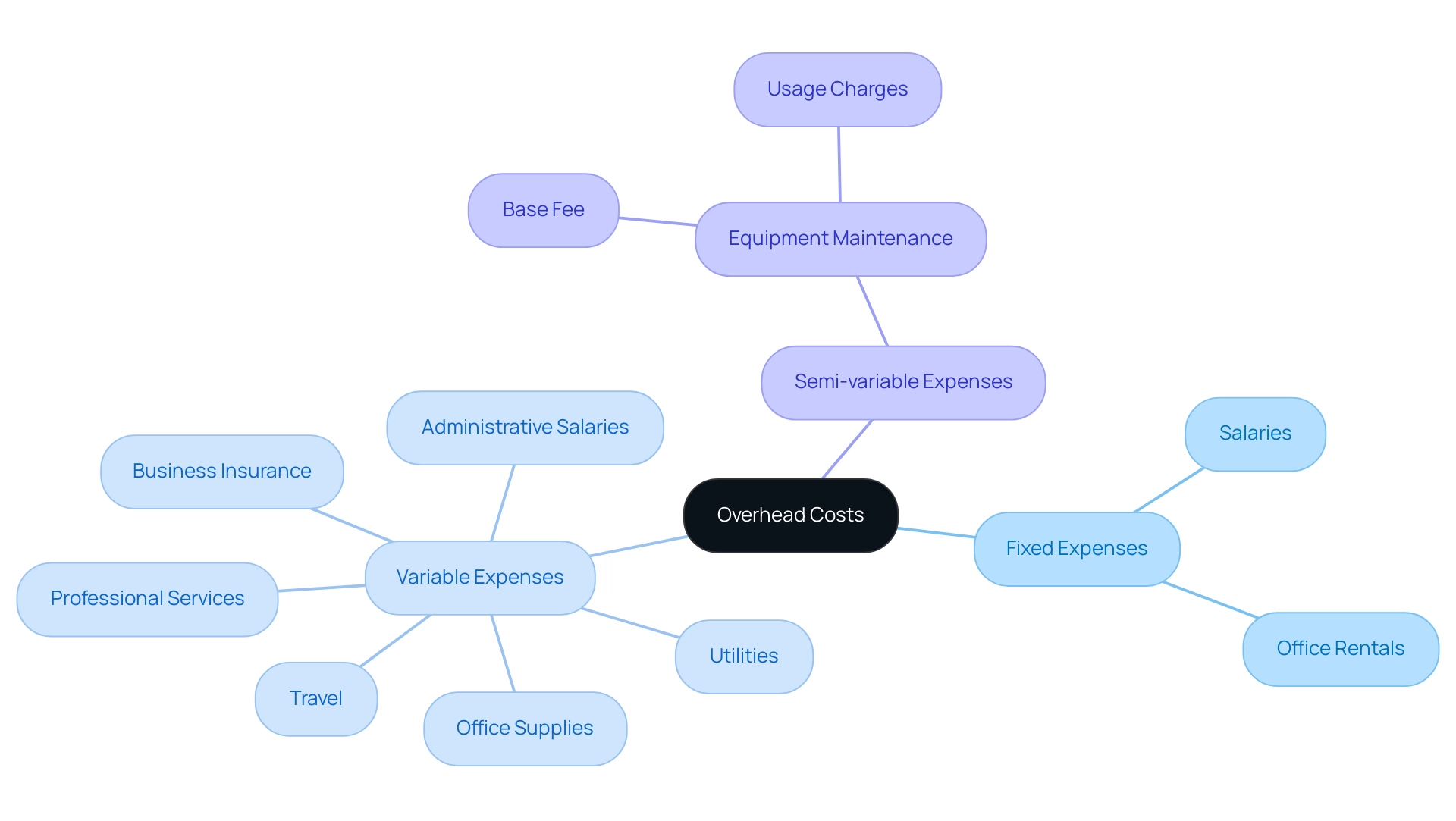

Overhead expenses are the recurring charges that are not directly linked to the production of goods or services, and comprehending them is essential for effective financial management. These expenses are typically categorized into three main types: fixed, variable, and semi-variable.

- Fixed expenses, which remain constant regardless of production levels, include charges such as office rentals and salaries.

- Variable expenses vary with production output, encompassing items like utilities and office supplies. Common expenses, as highlighted by industry specialists, also encompass business insurance, administrative salaries, professional services, and travel, which further demonstrate the varied nature of these expenditures.

- Semi-variable expenses exhibit characteristics of both fixed and variable expenses; an example is the maintenance of equipment, which may have a base fee plus additional charges based on usage.

For example, with a 200% markup rate, the overall expense of a gasket can reach $52.50, illustrating how even seemingly minor outlays can add up considerably. By diligently categorizing and monitoring these expenses, businesses can implement overhead cost reduction strategies to identify opportunities for savings and enhance their operational efficiency.

As demonstrated in the case study named 'Proactive Overhead Management,' regular monitoring enables decision-makers to recognize concerning trends and implement overhead cost reduction strategies to lower expenses, thereby maximizing profits.

Paycor's workforce management solutions demonstrate how companies can effectively manage labor expenses, increasing productivity and ensuring compliance with evolving regulations. Regular tracking of overhead expenditures is crucial for decision-makers to identify troubling trends early, allowing for the implementation of overhead cost reduction strategies that ultimately maximize profitability.

Effective Strategies for Reducing Overhead Costs

- Negotiate with Suppliers: Utilizing overhead cost reduction strategies by regularly reviewing contracts and negotiating better terms with suppliers can significantly lower costs. Poor negotiation skills can lead to losses exceeding 5% in profits; however, enhancing these skills presents an opportunity for up to a 50% improvement in profit margins. Engaging in thorough market research and leveraging competitive bids can empower organizations to secure more favorable agreements. Our comprehensive turnaround and restructuring consulting services focus on this area, ensuring that enterprises can mitigate weaknesses and capitalize on strengths through effective negotiation strategies.

- Implement Energy Efficiency Programs: Investing in energy-saving technologies not only reduces utility bills but also positions companies as environmentally conscious. Recent statistics indicate that energy efficiency programs can result in savings of around 25-30% on energy expenses, making them a wise long-term investment. Our financial evaluations can assist in pinpointing the most impactful energy initiatives for your organization, potentially saving thousands annually.

- Streamline Operations: Conducting a thorough analysis of workflows can uncover inefficiencies and eliminate redundant processes. By embracing advanced contract management systems, organizations can navigate complex international regulations and enhance operational efficiency, ultimately leading to reductions in expenses across departments. Our structured approach ensures that you can operationalize lessons learned effectively while avoiding the limitations of using basic tools like Excel for spend analysis.

- Evaluate Real Estate Needs: In the current economic climate, considering downsizing or relocating can yield substantial rent savings. Performing a real estate audit assists in recognizing underused areas, enabling companies to make knowledgeable choices regarding their physical presence and related expenses, in line with our strategic business enhancement approaches.

- Utilize Remote Work Options: Embracing flexible working arrangements can minimize office space requirements and reduce overhead costs. Implementing remote work strategies has demonstrated overhead cost reduction strategies significantly, offering prompt relief while enhancing employee satisfaction and productivity. Our expertise in interim management services supports the transition to the modern work practices, ensuring a smooth adaptation.

- Bankruptcy Case Management: For organizations facing financial distress, effective bankruptcy case management is crucial. Our services provide guidance through complex legal processes, helping businesses navigate their options and emerge stronger.

Case Study on Sievo: Sievo offers actionable procurement analytics designed for large enterprises, providing a future-proof solution with immediate ROI. Their approach empowers various teams to overcome data chaos and capture insights, driving savings and improving performance, making them a valuable partner in implementing overhead cost reduction strategies.

Leveraging Technology to Optimize Overhead Management

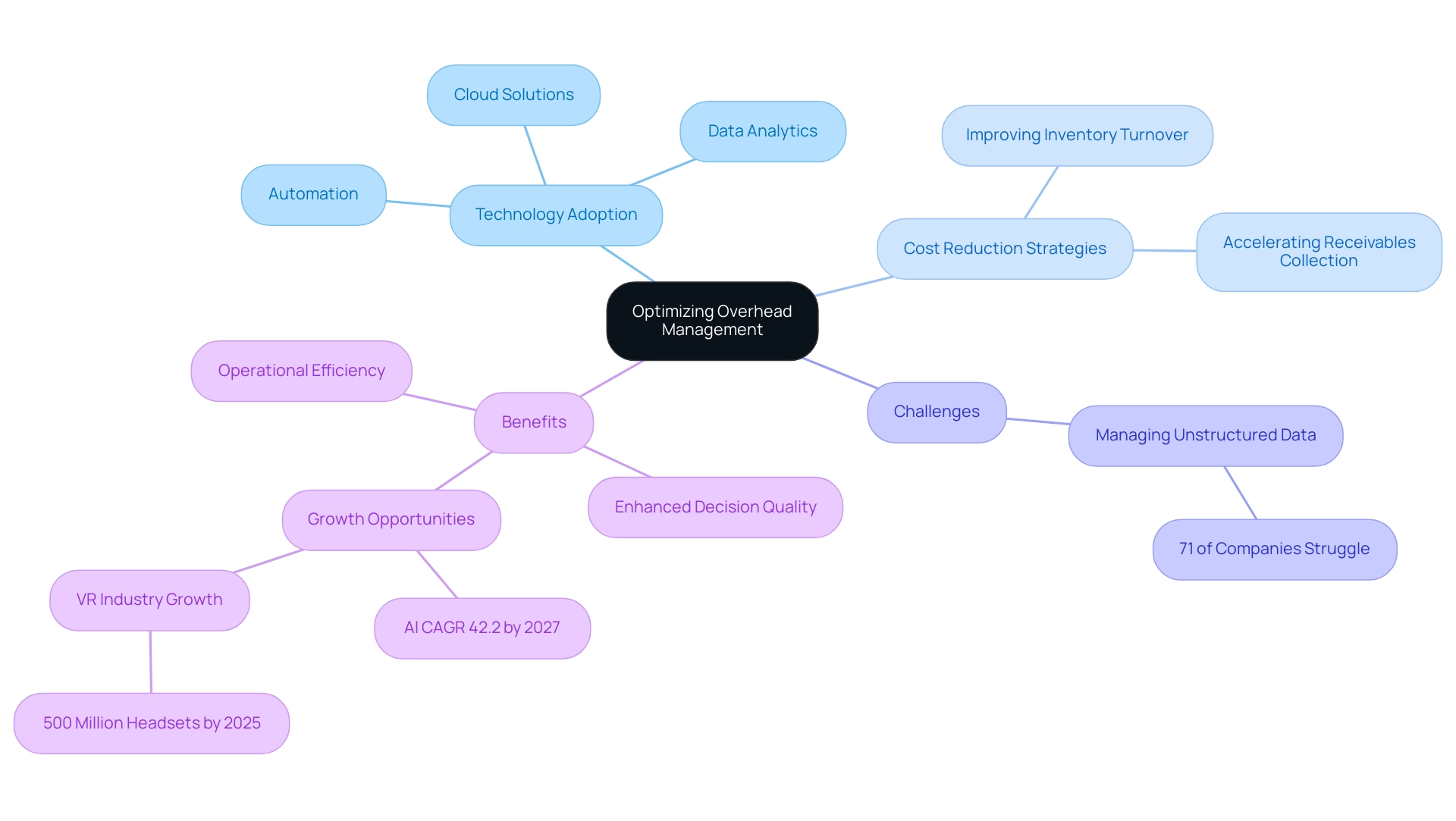

Leveraging technology is essential for mastering the cash conversion cycle and implementing overhead cost reduction strategies, as it streamlines operations through automation and real-time data analytics. The adoption of cloud-based solutions minimizes the need for extensive physical infrastructure and enhances flexibility in financial management. By automating routine tasks, organizations can allocate their human resources to more strategic initiatives, ultimately driving higher value.

Advanced data analytics not only scrutinizes spending patterns but also uncovers significant cost-saving opportunities, which is vital for continuous performance monitoring. Significantly, 71% of companies find it challenging to protect and manage unstructured data, emphasizing the complexities in management. Furthermore, guided attention technology can improve decision quality and reduce distractions, enhancing operational efficiency.

With the Compound Annual Growth Rate (CAGR) for AI projected at an impressive 42.2% by 2027, investing in such technologies becomes crucial for decision-making and performance monitoring. Cloud technologies have demonstrated effectiveness in lowering expenses through the implementation of overhead cost reduction strategies, as evidenced by various enterprises successfully adopting these approaches to optimize their financial operations and improve overall efficiency. For instance, the VR industry, projected to sell 500 million headsets by 2025, exemplifies how technology adoption drives growth across various sectors, including gaming and military applications.

To further optimize the cash conversion cycle, companies should implement specific overhead cost reduction strategies, including:

- Improving inventory turnover

- Accelerating receivables collection

Additionally, adopting a 'Decide & Execute' approach allows organizations to make informed decisions quickly, ensuring agility in their operations and responsiveness to market changes.

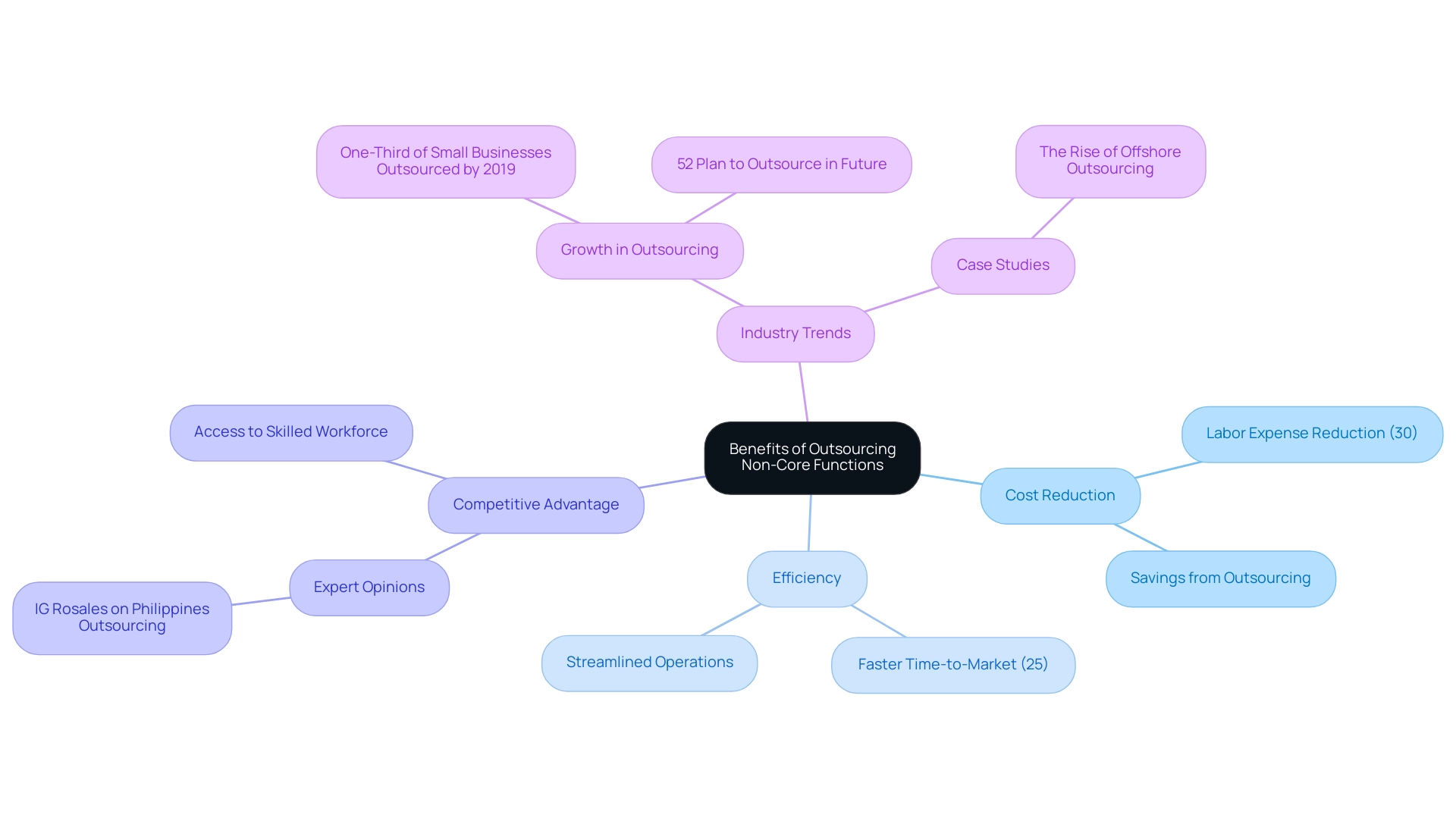

The Benefits of Outsourcing Non-Core Functions

Outsourcing non-core functions—including payroll, IT support, and customer service—offers businesses significant opportunities to implement overhead cost reduction strategies. By delegating these specialized tasks to expert firms, companies can focus on their core objectives while simultaneously reducing labor expenses and simplifying operational complexities. In fact, 90% of organizations recognize cloud computing as a pivotal force in their outsourcing strategies, with many reporting a remarkable 25% faster time-to-market for product launches.

This rapid deployment is crucial for gaining competitive advantage in today's fast-paced market. Additionally, as mentioned by industry specialist IG Rosales,

Because of its lower living expenses and wage ranges, outsourcing to the Philippines offers substantial savings and enables companies to offer a decent income for local workers.

A case study titled 'The Rise of Offshore Outsourcing' highlights how companies in IT and manufacturing are increasingly turning to countries like India, which boasts a skilled workforce and lower expenses, to reduce expenditures while ensuring quality work.

With over one-third of small enterprises having outsourced at least one process by 2019—and 52% intending to do so in the near future—it’s evident that outsourcing is not merely a trend but a strategic approach toward achieving financial efficiency. On average, companies can anticipate labor expense reductions of up to 30% through outsourcing as part of their overhead cost reduction strategies, enabling them to reinvest those savings into core operations. By leveraging external expertise and technology that might be prohibitively expensive to maintain in-house, businesses can not only drive efficiency but also enhance overall profitability.

Current trends in 2024 suggest that more companies are adopting outsourcing as a fundamental strategy for savings, focusing on non-core functions to streamline operations and enhance financial health.

The Importance of Regular Cost Reviews and Audits

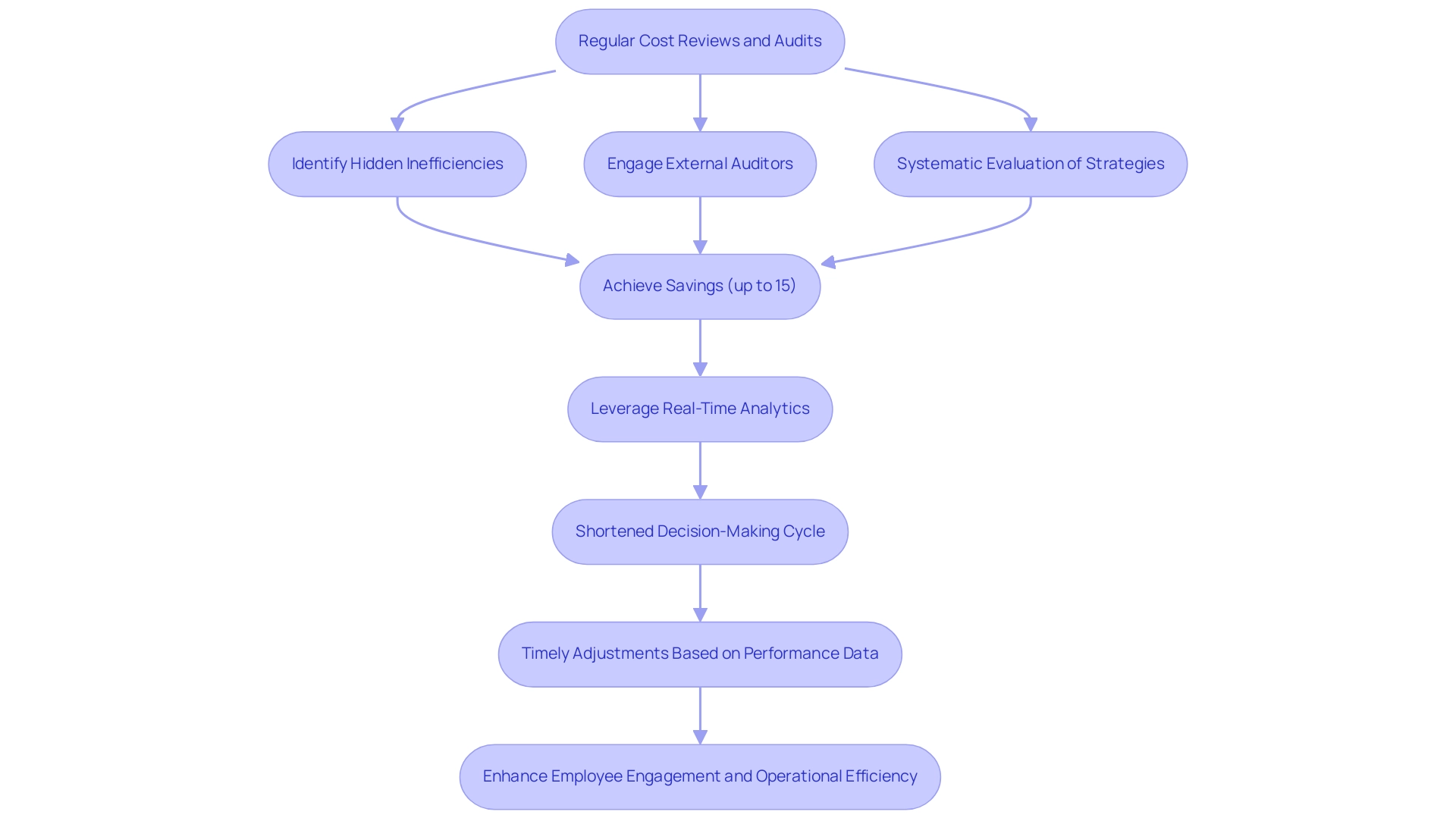

Implementing regular expense reviews and audits is essential for organizations aiming to uncover hidden inefficiencies and identify significant areas for savings using overhead cost reduction strategies. Creating a regular timetable for these assessments enables companies to systematically evaluate overhead cost reduction strategies for both fixed and variable expenses. Engaging external auditors can be particularly beneficial, as they provide an objective perspective that helps identify overhead cost reduction strategies and unnecessary expenditures.

Based on recent evaluations, organizations that utilize overhead cost reduction strategies through regular audits can achieve average savings of up to 15% on their operational expenses. In 2024, statistics indicate that effective expense evaluations are more essential than ever for developing overhead cost reduction strategies, as they can result in significant monetary enhancements. Furthermore, by leveraging real-time analytics through our client dashboard, businesses can continuously monitor their performance and engage in a shortened decision-making cycle.

This cycle enables decisive actions that maintain economic health, directly contributing to overhead cost reduction strategies by allowing for timely adjustments based on performance data. A culture of continuous improvement promotes adaptability to evolving market conditions, ensuring economic stability and resilience. Financial experts emphasize that only 32.5% of U.S. employees are actively engaged in their jobs, indicating a need for companies to not only assess costs but also enhance employee engagement through effective performance management.

A Mercer poll reveals that despite the belief in the importance of performance management, only 64% of firms feel they have an effective strategy, and just 2% believe their approach provides outstanding value. By addressing these challenges and optimizing their financial health, businesses can also create a more motivated workforce, ultimately driving overall productivity and profitability. Additionally, with 22% of customers unlikely to engage with brands that do not respond to reviews, companies must recognize that operational efficiency, customer responsiveness, and overhead cost reduction strategies are interconnected, making regular audits a critical component of their strategy.

Conclusion

Understanding and managing overhead costs is not just a financial necessity; it’s a strategic advantage that can propel businesses toward sustainable growth. By categorizing overhead costs into fixed, variable, and semi-variable types, organizations can gain clarity on where their resources are allocated and identify significant opportunities for cost reduction.

Implementing effective strategies such as:

- Negotiating with suppliers

- Investing in energy efficiency

- Streamlining operations

can yield substantial savings. Additionally, leveraging technology not only facilitates better management of these costs but also enhances decision-making capabilities. The case studies presented illustrate how innovative approaches can lead to remarkable improvements in operational efficiency and profitability.

Outsourcing non-core functions emerges as a powerful solution, allowing businesses to focus on their primary objectives while reducing labor costs. As more organizations recognize the financial benefits of outsourcing, the potential for significant savings becomes increasingly clear. Regular cost reviews and audits further reinforce this strategy, enabling businesses to uncover inefficiencies and adapt responsively to changing market conditions.

In conclusion, by proactively managing overhead costs through these strategies, organizations position themselves for enhanced financial health and operational effectiveness. Now is the time to take decisive action and implement these recommendations to drive sustainable growth and profitability.

Frequently Asked Questions

What are overhead expenses?

Overhead expenses are recurring charges that are not directly linked to the production of goods or services. Understanding these expenses is essential for effective financial management.

What are the three main types of overhead expenses?

The three main types of overhead expenses are fixed, variable, and semi-variable expenses.

What are fixed expenses?

Fixed expenses remain constant regardless of production levels and include charges such as office rentals and salaries.

What are variable expenses?

Variable expenses vary with production output and include items like utilities and office supplies. They can also encompass business insurance, administrative salaries, professional services, and travel.

What are semi-variable expenses?

Semi-variable expenses exhibit characteristics of both fixed and variable expenses. An example is the maintenance of equipment, which may have a base fee plus additional charges based on usage.

How can overhead expenses impact a business?

Even seemingly minor outlays, like the cost of a gasket with a 200% markup, can add up considerably. Diligently categorizing and monitoring these expenses can help identify opportunities for savings and enhance operational efficiency.

Why is regular monitoring of overhead expenses important?

Regular monitoring enables decision-makers to recognize concerning trends and implement overhead cost reduction strategies, ultimately maximizing profits.

What strategies can businesses use to reduce overhead costs?

Strategies include negotiating with suppliers, implementing energy efficiency programs, streamlining operations, evaluating real estate needs, utilizing remote work options, and effective bankruptcy case management.

How can energy efficiency programs help reduce overhead costs?

Investing in energy-saving technologies can result in savings of around 25-30% on energy expenses, making them a wise long-term investment.

What is the benefit of utilizing remote work options?

Embracing flexible working arrangements can minimize office space requirements and reduce overhead costs, while also enhancing employee satisfaction and productivity.