Overview

This article delves into the critical questions and answers surrounding project stakeholder management for CFOs, underscoring the necessity of effective engagement strategies. It delineates essential steps including:

- Conducting a party analysis

- Managing conflicting interests

- Prioritizing stakeholder relationships

Such a structured approach to stakeholder engagement not only enhances project success but also bolsters organizational effectiveness. By implementing these strategies, CFOs can significantly improve their influence and outcomes in project management.

Introduction

In the intricate landscape of modern business, effective stakeholder engagement is essential for organizational success. Chief Financial Officers (CFOs) play a pivotal role in navigating this complex web of relationships, where understanding and addressing the diverse needs of stakeholders can significantly impact project outcomes.

This article explores key strategies for CFOs, including:

- Identifying key stakeholders

- Managing conflicting interests

- Adjusting communication styles

- Ensuring transparency

By prioritizing robust relationships and incorporating feedback, CFOs can cultivate an environment of collaboration that not only enhances stakeholder satisfaction but also propels successful initiatives.

As organizations pursue excellence in their financial projects, the significance of systematic stakeholder engagement cannot be overstated.

Identify Stakeholders: Key Steps for Effective Engagement

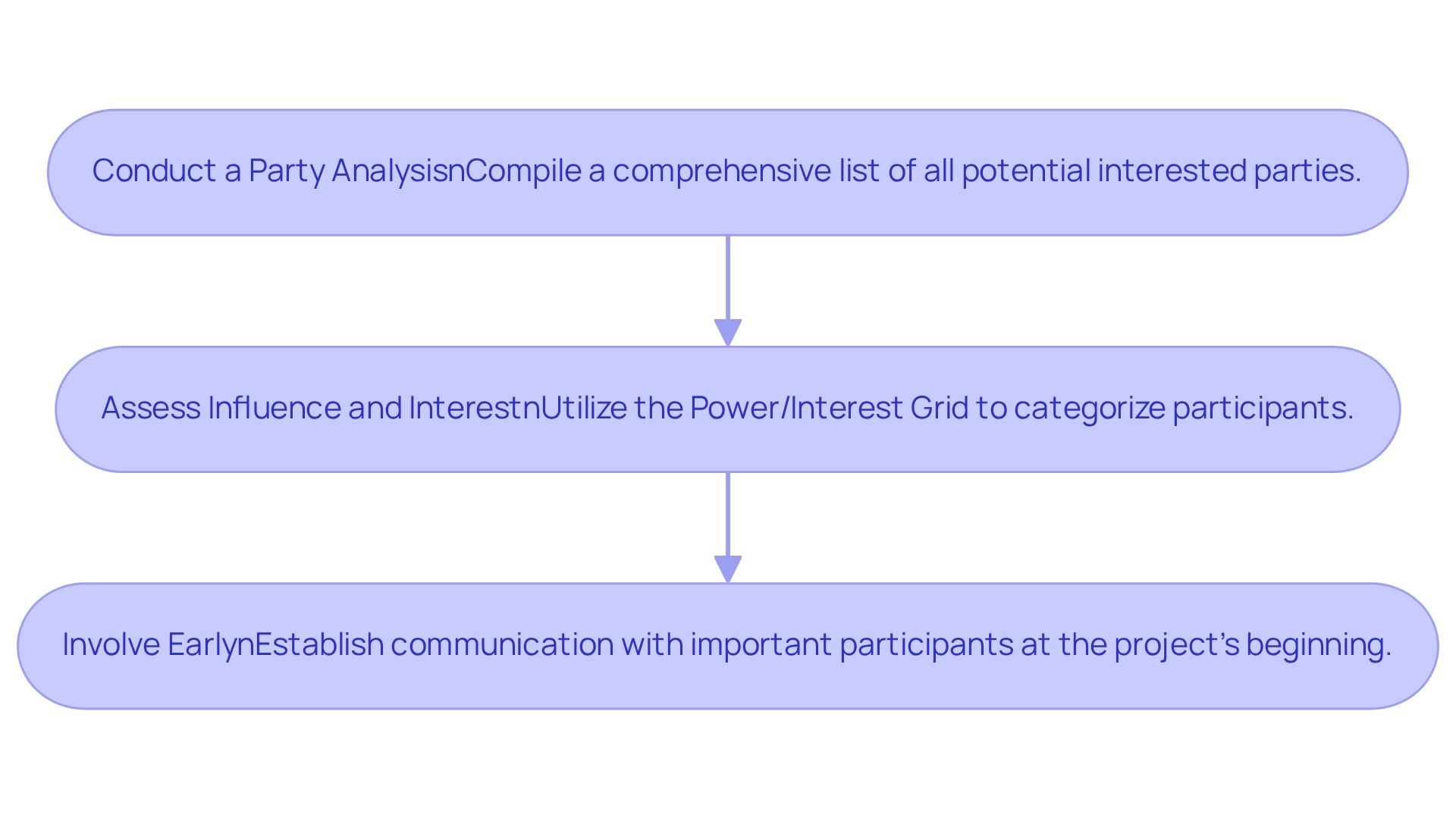

To effectively identify interested parties, CFOs should implement the following key steps:

-

Conduct a Party Analysis: Begin by compiling a comprehensive list of all potential interested parties, which includes internal teams, external partners, and clients. This fundamental step guarantees that no essential participant is disregarded.

-

Assess Influence and Interest: Utilize tools such as the Power/Interest Grid to categorize participants based on their level of influence over the initiative and their interest in its outcomes. This evaluation aids in prioritizing involvement initiatives efficiently.

-

Involve Early: Establish communication with important participants at the project's beginning. Timely involvement enables CFOs to acquire understanding of their viewpoints and anticipations, encouraging a cooperative atmosphere from the outset.

In 2025, optimal methods for interest group analysis highlight the importance of a systematic approach. High-performance entities acknowledge the significance of structured interaction with interested parties. For small to medium enterprises, effective strategies for involving interested parties can greatly improve results. By addressing inconsistencies in participation across departments, organizations can improve overall effectiveness and drive successful data and analytics initiatives. Case studies show that integrated participation strategies result in improved relationships with interested parties and successful initiatives.

CFOs should also take into account expert views on participant strategies, which highlight the significance of comprehending the distinct requirements of each interested group. By following these essential steps, financial leaders can ensure effective participant engagement, ultimately contributing to the success of their projects and the organization as a whole.

Manage Conflicting Interests: Strategies for CFOs

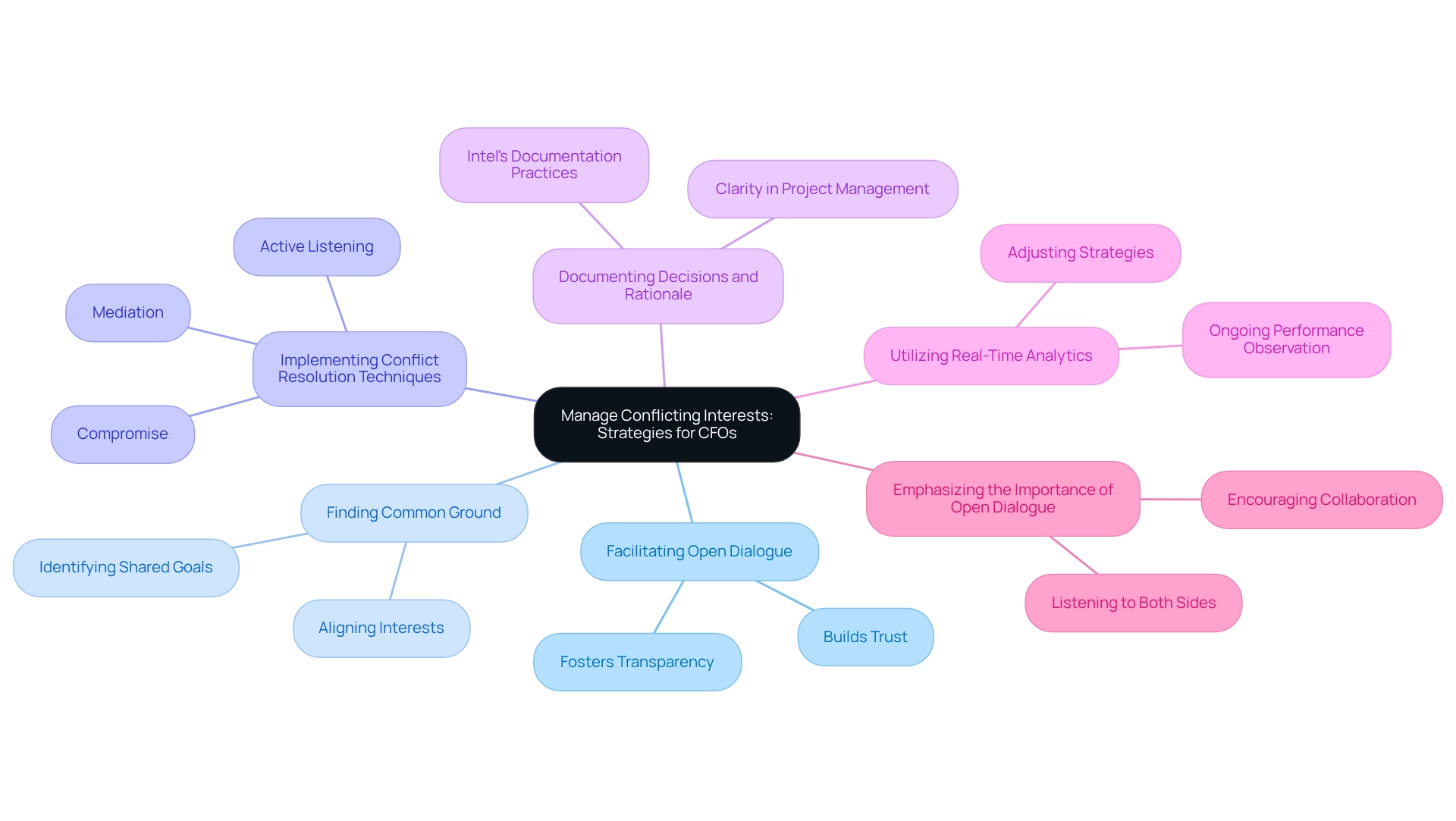

Chief Financial Officers can effectively handle conflicting interests among involved parties by employing several key strategies:

- Facilitating Open Dialogue: Creating an environment where participants feel comfortable expressing their concerns and viewpoints is crucial. Open dialogue not only fosters transparency but also builds trust, which is essential for collaborative problem-solving.

- Finding Common Ground: Identifying shared goals among stakeholders can significantly enhance collaboration. By concentrating on shared goals, financial leaders can align interests and minimize friction, paving the way for more effective decision-making.

- Implementing Conflict Resolution Techniques: Utilizing structured negotiation strategies is vital for addressing and resolving conflicts. Techniques such as active listening, mediation, and compromise can help balance differing interests and lead to satisfactory outcomes for all parties involved.

- Documenting Decisions and Rationale: As demonstrated by Intel's rigorous documentation practices, maintaining clarity and accountability in project management is essential. Recording choices and their reasoning aids in avoiding conflicts and guarantees that all parties are aligned.

- Utilizing Real-Time Analytics: Ongoing observation of business performance via real-time analytics can offer financial executives valuable insights into participant dynamics. By utilizing tools that provide real-time business analytics, financial officers can assess the health of their relationships and modify strategies accordingly, ensuring that interests of involved parties are aligned with business objectives.

- Emphasizing the Importance of Open Dialogue: Research indicates that effective mediation involves listening to both sides and encouraging collaboration. This method not only resolves disputes but also improves participant satisfaction, as individuals feel acknowledged and appreciated, which is relevant to project stakeholder management questions and answers.

By applying these strategies, financial leaders can manage the intricacies of participant relations, ensuring that conflicts are handled effectively and that projects stay on course.

Adjust Communication Styles: Engaging Diverse Stakeholders

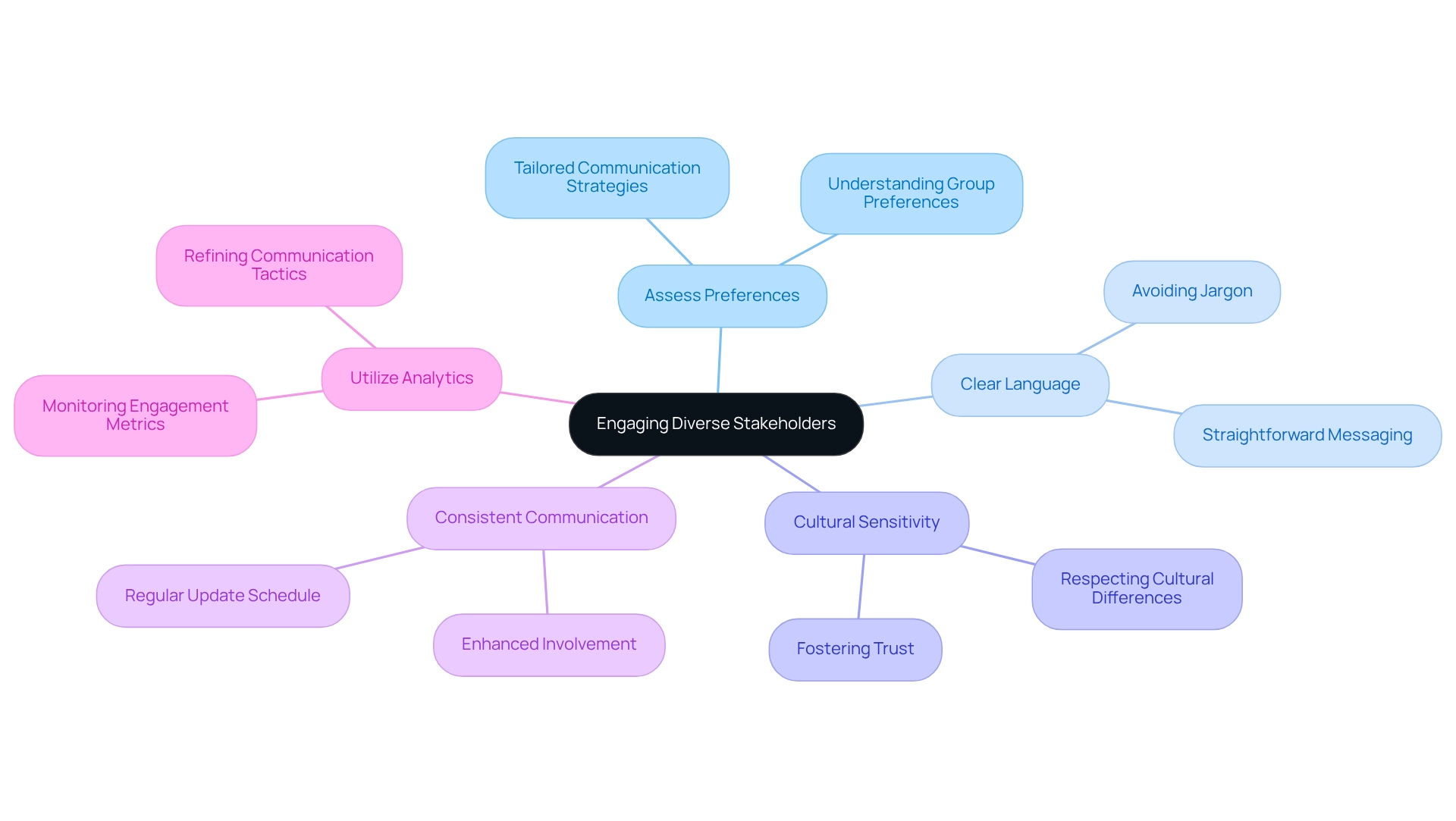

To effectively involve various parties, CFOs must take strategic actions:

- Assess Preferences of Involved Parties: Understanding how different groups prefer to receive information—be it through emails, meetings, or reports—can significantly enhance involvement. Research indicates that tailored communication strategies lead to higher satisfaction and involvement among stakeholders.

- Use Clear and Concise Language: Avoiding jargon and ensuring messages are straightforward and accessible is essential. Clear communication fosters understanding and minimizes the risk of misinterpretation, which is crucial in financial discussions.

- Be Culturally Sensitive: Recognizing and respecting cultural differences that may influence communication styles is vital. Culturally aware communication not only fosters trust but also improves cooperation among varied groups.

- Implement Consistent Communication: Establishing a regular schedule for updates can help involved parties feel supported and connected to the organization. Consistent communication is associated with enhanced involvement and satisfaction, as underscored by research emphasizing its significance in organizational contexts.

- Utilize Analytics for Participation Measurement: Leveraging tools that monitor metrics such as view counts and interaction rates can provide insights into participant involvement levels. This data-focused approach enables financial leaders to refine their communication tactics based on feedback from involved parties.

By implementing these practices, financial executives can elevate communication, facilitating more effective engagement with interested groups and smoother transitions within their organizations.

Build Strong Relationships: Techniques for Stakeholder Engagement

CFOs can cultivate robust relationships with interested parties through several key techniques:

- Investing Time: Schedule regular meetings with these individuals to understand their needs and concerns, fostering a collaborative environment.

- Demonstrating Value: Clearly articulate how their input directly contributes to project success, reinforcing their importance in the process.

- Being Transparent: Maintain open lines of communication by sharing project updates and challenges. This transparency not only builds trust but also encourages timely feedback, which is crucial for informed decision-making. The dangers of keeping information hidden can result in misunderstandings and distrust, while the transformative benefits of openness can greatly improve relationships with involved parties.

- Engaging Proactively: Anticipate the needs of those involved and tackle potential issues before they escalate, demonstrating a commitment to their interests. For example, addressing the gap between boards and interested parties through proactive interaction can enhance alignment with their interests, ultimately leading to better outcomes in financial projects.

- Utilizing Technology: Leverage technology-enabled tools, such as the client dashboard and real-time business analytics, to streamline communication and enhance involvement. These tools ensure that all parties are aware and engaged, facilitating a reduced decision-making cycle that fosters prompt action during the turnaround process.

The effect of these methods is considerable; organizations that emphasize transparency and proactive involvement frequently observe enhanced trust levels among interested parties, resulting in more efficient collaboration and outcomes. Continuous monitoring of business performance through analytics not only aids in relationship-building but also operationalizes lessons learned from the turnaround process, further emphasizing the importance of these techniques.

Prioritize Stakeholders: Focus on High-Impact Relationships

To efficiently prioritize interested parties, financial leaders should adopt the following approaches:

- Develop a Party Matrix: This instrument assists in classifying participants according to their degrees of influence and engagement in the endeavor. By visualizing these connections, financial leaders can better grasp who to interact with and how to distribute resources efficiently.

- Focus on Key Players: It is essential to devote more time and resources to individuals who greatly influence the success of the initiative. Involving these individuals can result in more advantageous outcomes and smoother execution of tasks.

- Regularly Reassess Priorities: Stakeholder dynamics are not fixed; they can change over time. Chief Financial Officers should regularly assess and modify their priorities for involved parties to account for any shifts in influence or interest, ensuring that engagement strategies remain pertinent and efficient.

These methods not only enhance engagement with interested parties but also lead to better outcomes. Case studies emphasize the significance of prioritizing connections in financial initiatives. By fostering high-impact relationships, financial executives can navigate challenges more effectively and drive organizational success.

Set and Manage Expectations: Aligning Stakeholder Goals

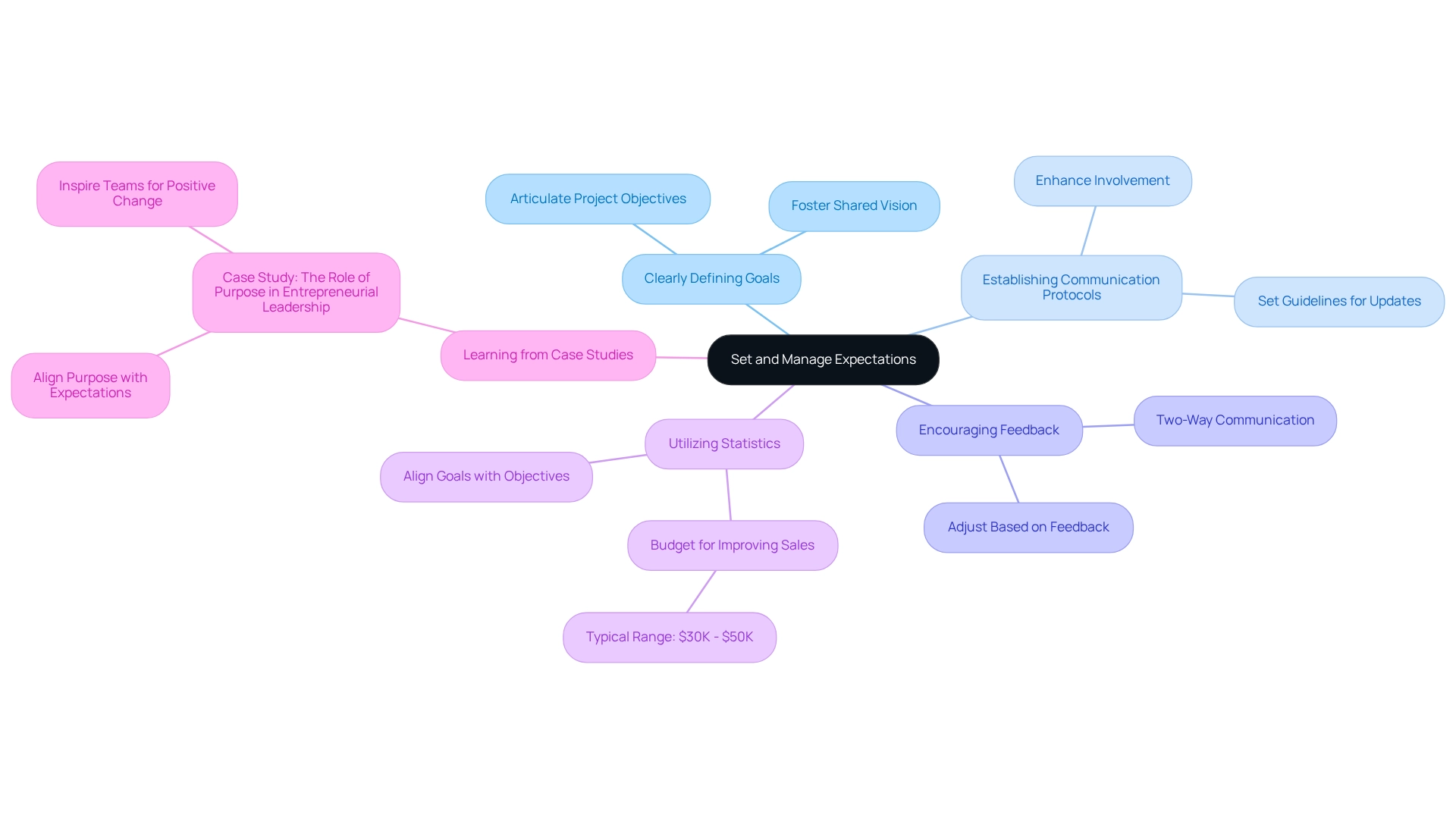

CFOs can effectively set and manage expectations by implementing the following strategies:

- Clearly Defining Goals: Articulating project objectives and desired outcomes to all stakeholders is crucial. This clarity ensures alignment and understanding of the initiative's purpose, fostering a shared vision, particularly in family-owned businesses, which can be crucial for addressing project stakeholder management questions and answers.

- Establishing Communication Protocols: Setting clear guidelines for how and when involved parties will receive updates is vital. Efficient communication protocols enhance involvement and guarantee that participants remain informed throughout the lifecycle, thus minimizing uncertainty and fostering trust.

- Encouraging Feedback: Establishing avenues for project stakeholder management questions and answers is essential for interested parties to express their expectations and concerns. This two-way communication not only assists in managing expectations but also allows for adjustments based on participant feedback, resulting in enhanced outcomes.

- Utilizing Statistics: Research indicates that organizations with a dedicated budget for improving sales, typically ranging from $30K to $50K, are more likely to succeed in aligning the goals of interested parties with project objectives. This financial commitment highlights the significance of investing in managing interested parties.

- Learning from Case Studies: The case study titled "The Role of Purpose in Entrepreneurial Leadership" demonstrates how leaders who express and align their purpose with the expectations of involved parties can motivate their teams and promote positive change. Such alignment is essential for sustained organizational success and serves as a guide for financial executives in effectively managing relationships with interested parties.

Incorporate Feedback: Enhancing Stakeholder Satisfaction

To effectively incorporate feedback, CFOs must:

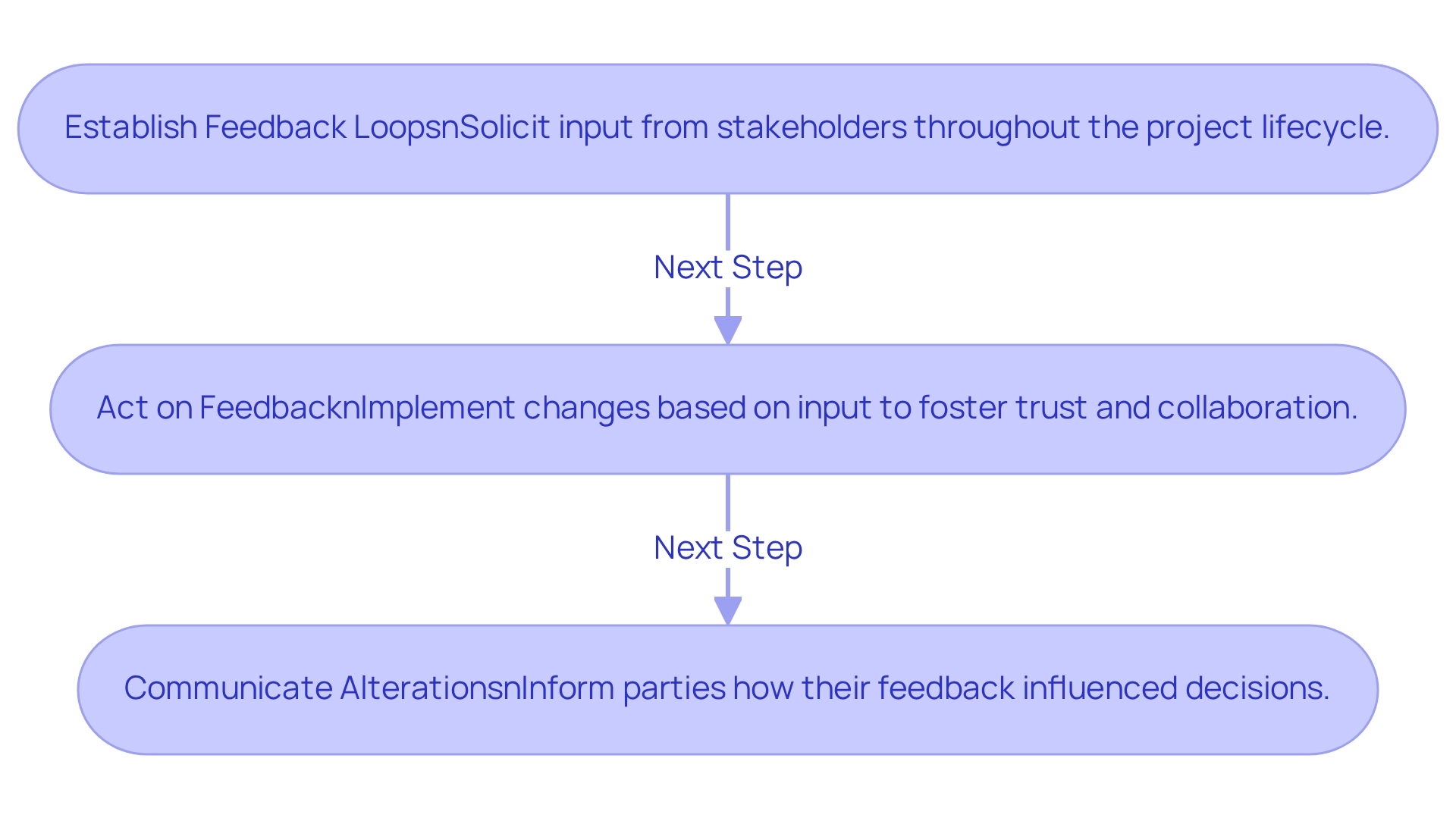

-

Establish Feedback Loops: Regularly solicit input from stakeholders throughout the project lifecycle to ensure their perspectives are considered at every stage. This approach supports a shortened decision-making cycle, allowing for quick adjustments based on real-time analytics.

-

Act on Feedback: Demonstrate responsiveness by implementing changes based on input from participants, fostering trust and collaboration. By operationalizing lessons learned from feedback, CFOs can enhance their teams' performance and drive better organizational outcomes.

-

Communicate Alterations: Keep involved parties informed about how their feedback has influenced decisions, reinforcing their value in the process. Utilizing a client dashboard for real-time business analytics can help track the success of these changes and sustain engagement from interested parties.

The creation of effective feedback loops is essential in financial initiatives, as it not only improves participant satisfaction but also propels initiative success. Research indicates that organizations actively incorporating input from project stakeholder management questions and answers observe a significant enhancement in project results. For instance, the case study titled "Empowering Finance Teams with Tools" illustrates how comprehensive financial management tools can streamline operations and enhance team performance, ultimately contributing to better organizational performance. By prioritizing feedback and continuously monitoring business health, financial leaders can navigate risks more effectively, aligning with the strategic goals of their organizations. Moreover, establishing systems for continuous assessment and modification in the feedback process is crucial for sustaining effective participant engagement.

Ensure Transparency: Building Trust with Stakeholders

CFOs can ensure transparency by:

- Providing Regular Updates: Consistently sharing project progress, challenges, and changes with interested parties is crucial. Frequent updates not only keep stakeholders informed about project stakeholder management questions and answers but also cultivate a sense of involvement and trust. In fact, 61% of employees believe that opportunities for career advancement—linked to transparency in communication—are essential for building trust.

- Being Honest About Challenges: Acknowledging difficulties openly and outlining strategies for addressing them enhances participant confidence. This honesty demonstrates a commitment to transparency and accountability, which are vital in fostering trust.

- Encouraging Open Dialogue: Creating an environment where individuals feel comfortable asking questions and expressing concerns is essential. Open dialogue facilitates the exchange of ideas and feedback, ultimately leading to stronger relationships and increased trust.

- Utilizing Technology for Communication: Leveraging technology can significantly enhance transparent communication. Video updates or transcripts from board and committee chairs engage participants and promote transparency, making individuals feel more connected to the organization.

- Measuring Engagement Metrics: Regularly assessing communication quality, task completion rates, and participant satisfaction is necessary to evaluate transparency efforts. Metrics provide valuable insights into how well stakeholders perceive the organization’s commitment to transparency and trust-building, which can be explored through project stakeholder management questions and answers, while learning from case studies that examine successful interventions, such as those that improved community satisfaction regarding local economic development, can offer valuable lessons. These case studies highlight the positive impact of openness on perceptions among involved parties and serve as models for financial leaders aiming to enhance their management strategies.

Document Interactions: Maintaining Clarity in Stakeholder Management

To document interactions effectively, financial executives should:

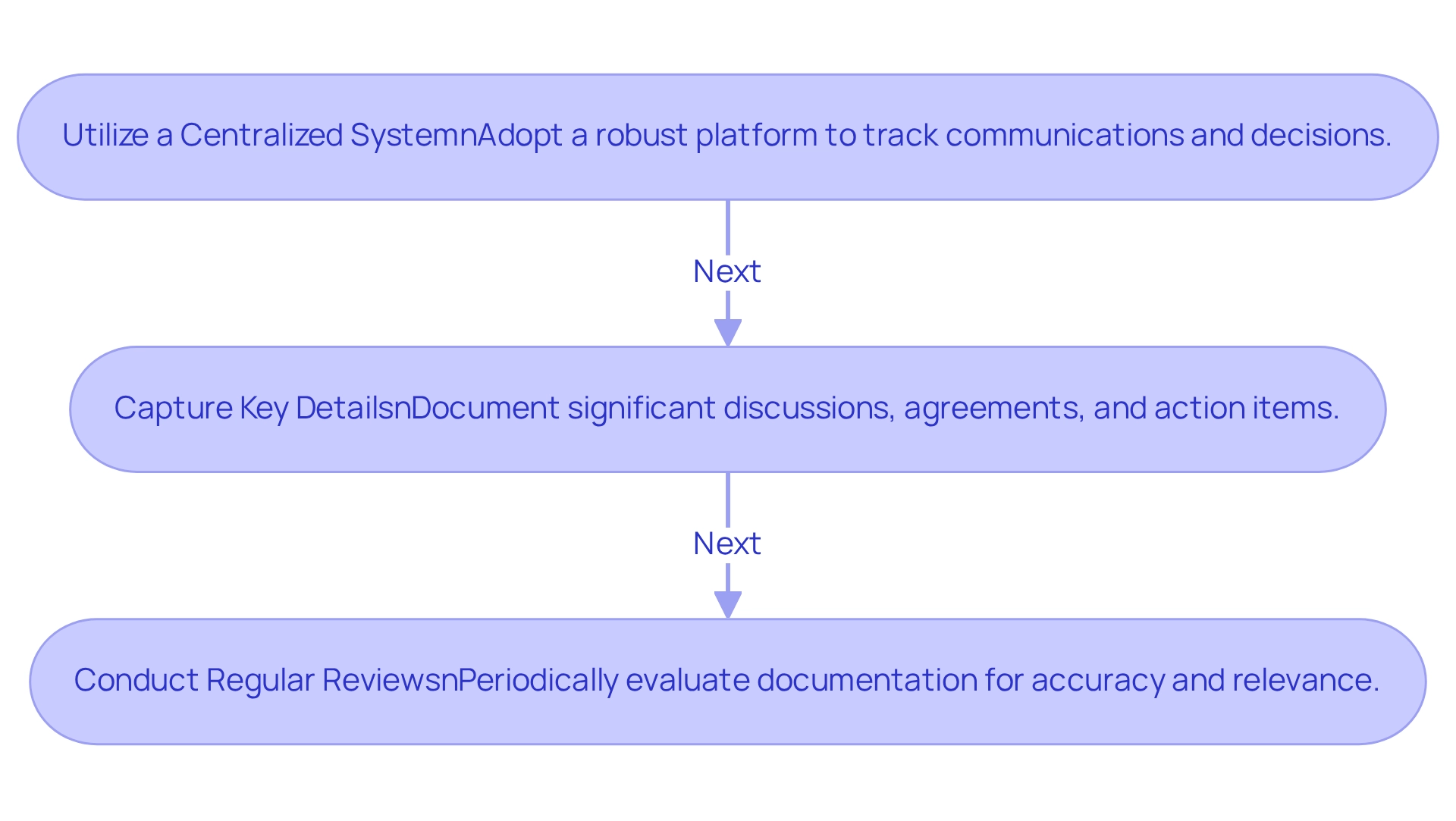

-

Utilize a Centralized System: Adopt a robust platform to systematically track all involved parties' communications and decisions. This ensures that information is easily accessible and organized.

-

Capture Key Details: Meticulously document significant discussions, agreements, and action items. This practice fosters accountability and provides a clear reference for future interactions.

-

Conduct Regular Reviews: Periodically evaluate the documentation to confirm its accuracy and relevance. This ongoing evaluation aids in preserving clarity and guarantees that all parties are aligned with current objectives and commitments.

Evaluate Engagement: Continuous Improvement in Stakeholder Relations

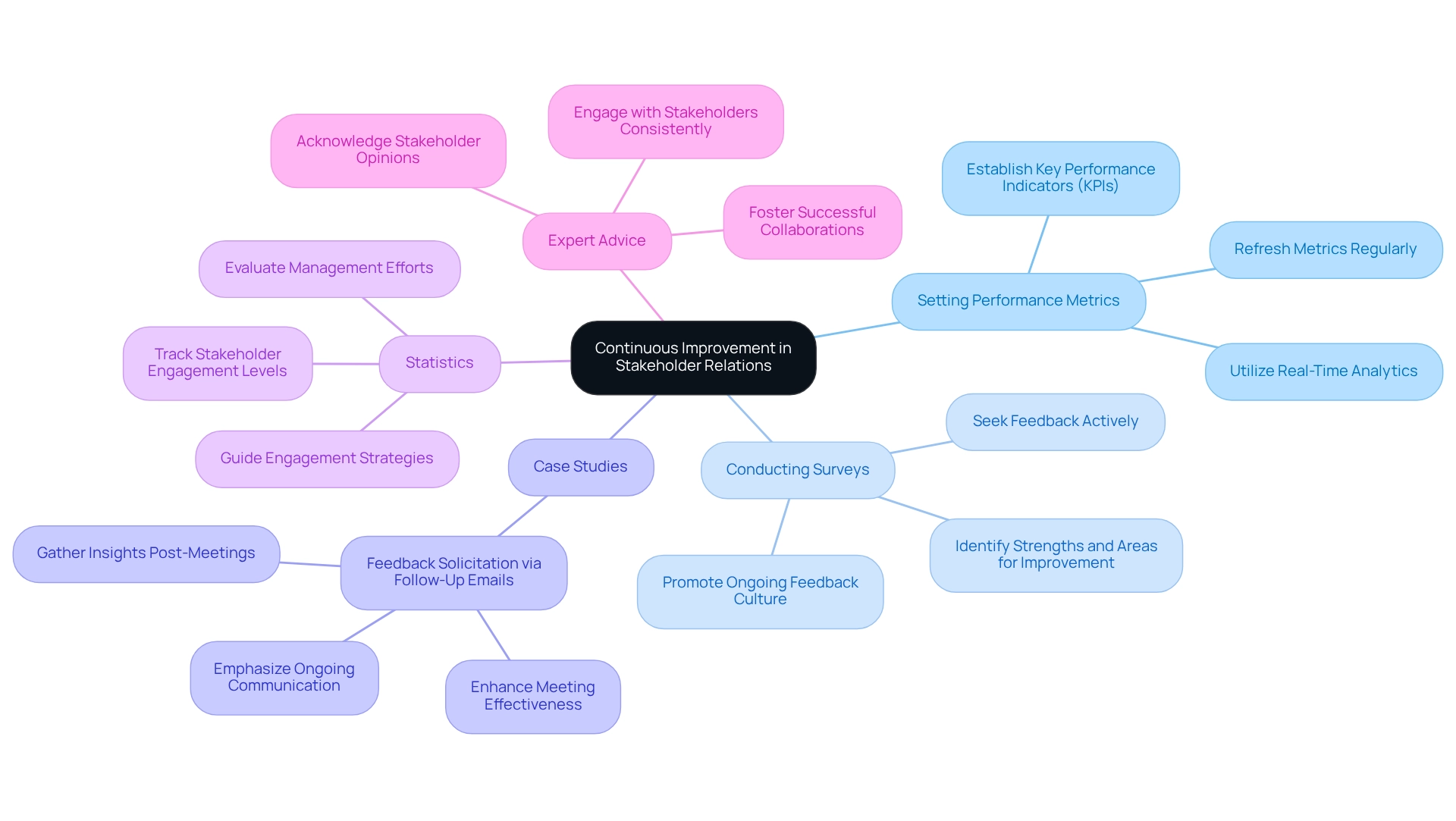

Chief Financial Officers can assess involvement by using project stakeholder management questions and answers, such as Setting Performance Metrics: Establishing key performance indicators (KPIs) is crucial for measuring the effectiveness of interested parties. Consistently refreshing these metrics guarantees they represent the changing dynamics of relationships with interested parties, enabling prompt modifications based on real-time analytics via our client dashboard.

Conducting Surveys: Actively seeking feedback through surveys enables financial executives to assess satisfaction and involvement levels. This practice not only identifies strengths but also emphasizes areas for enhancement, promoting a culture of ongoing feedback that can be tracked through client dashboards, which includes project stakeholder management questions and answers. Utilizing the insights gained from evaluations enables CFOs to refine their interaction strategies. By adapting approaches based on contributor feedback and real-time business analytics, organizations can enhance their relationships and drive better outcomes.

Case Studies: For instance, a study on feedback solicitation via follow-up emails demonstrated the effectiveness of gathering insights from collaborator partners after advisory board meetings. While the initiative aimed to enhance meeting effectiveness and participant involvement, the lack of detailed outcomes may restrict its impact, emphasizing the necessity for ongoing communication and performance monitoring.

Statistics: Monitoring the number of individuals involved in collaborative decision-making can provide valuable data on participation levels. This quantitative measure aids CFOs in evaluating the effect of their management efforts and guides their engagement strategies, ensuring that decisions are made promptly and efficiently.

Expert Advice: Ongoing enhancement in relations with interested parties is crucial. Interacting with interested parties consistently and making sure that their opinions are acknowledged can result in more successful collaborations and improved project results. As emphasized by industry expert Ts. Shasikumar Nandakumaran, being well-acquainted with stakeholders is fundamental to successful management.

Conclusion

Effective stakeholder engagement serves as a cornerstone of successful financial management within any organization. By implementing the strategies outlined in this article—identifying key stakeholders, managing conflicting interests, adjusting communication styles, and ensuring transparency—CFOs can cultivate a collaborative environment that significantly enhances project outcomes.

Prioritizing robust relationships and actively incorporating feedback not only fosters stakeholder satisfaction but also propels organizations toward achieving their strategic goals. The emphasis on clear communication, open dialogue, and the use of technology underscores the necessity of adapting to the diverse needs of stakeholders and cultivating trust.

As the business landscape continues to evolve, the role of CFOs in stakeholder engagement becomes increasingly critical. By adopting systematic approaches to stakeholder management, organizations can navigate complexities more effectively, drive successful initiatives, and ultimately secure a competitive advantage. The commitment to stakeholder engagement transcends mere project success; it lays the foundation for long-term organizational resilience and growth.

Frequently Asked Questions

What are the key steps CFOs should take to identify interested parties?

CFOs should conduct a party analysis to compile a list of potential interested parties, assess their influence and interest using tools like the Power/Interest Grid, and involve key participants early in the project to foster understanding and cooperation.

Why is it important for CFOs to assess the influence and interest of participants?

Assessing influence and interest helps prioritize involvement initiatives efficiently, ensuring that the most crucial participants are engaged appropriately in the project.

How can CFOs facilitate effective communication with interested parties?

CFOs can facilitate effective communication by assessing the preferences of involved parties, using clear and concise language, being culturally sensitive, implementing consistent communication, and utilizing analytics to measure participation.

What strategies can CFOs use to manage conflicting interests among involved parties?

CFOs can manage conflicting interests by facilitating open dialogue, finding common ground among stakeholders, implementing conflict resolution techniques, documenting decisions and rationale, and utilizing real-time analytics to monitor participant dynamics.

How does early involvement of participants benefit a project?

Early involvement allows CFOs to understand the viewpoints and expectations of important participants, creating a cooperative atmosphere that enhances project outcomes.

What role does clear communication play in stakeholder engagement?

Clear communication fosters understanding and minimizes the risk of misinterpretation, which is crucial for effective stakeholder engagement in financial discussions.

Why is it beneficial to document decisions and their rationale?

Documenting decisions and their rationale ensures clarity and accountability in project management, helping to avoid conflicts and align all parties involved.

How can real-time analytics assist CFOs in managing stakeholder relationships?

Real-time analytics provide insights into participant dynamics, allowing CFOs to assess the health of relationships and adjust strategies to align the interests of involved parties with business objectives.