Overview

The article titled "10 Stakeholder Management Experience Examples for CFOs" presents essential strategies that Chief Financial Officers can employ to adeptly manage stakeholder relationships and optimize financial results. It delves into various techniques, including:

- Clear communication

- Stakeholder mapping

- Feedback collection

This demonstrates that proactive engagement with stakeholders not only improves organizational performance but also enhances profitability. CFOs are encouraged to implement these practices to drive better outcomes in their financial endeavors.

Introduction

CFOs navigate an increasingly complex landscape where effective stakeholder management is pivotal to financial success. By implementing strategic communication, mapping techniques, and leveraging feedback, financial leaders can transform their organizations and foster resilience amid economic challenges. However, the critical question persists: how can CFOs adeptly navigate the diverse interests of stakeholders while ensuring alignment with financial objectives? This article explores ten compelling stakeholder management experience examples that provide actionable insights for CFOs seeking to enhance engagement and drive profitability.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

Turnaround and restructuring consulting provides essential, tailored solutions for small to medium enterprises facing economic challenges. By performing comprehensive monetary evaluations, consultants from Transform Your Small/ Medium Business pinpoint critical areas for improvement, streamline operations, and implement strategies that enhance cash flow while reducing liabilities. This proactive approach not only stabilizes businesses but also positions them for sustainable long-term growth.

Chief Financial Officers can leverage these consulting services to ensure their organizations remain resilient and adaptable in the face of shifting market conditions, ultimately boosting operational efficiency and profitability.

Client testimonials underscore the effectiveness of these services, illustrating successful turnaround experiences that highlight the value of consulting in navigating economic challenges.

Effective Communication Strategies: Enhancing Stakeholder Engagement for Financial Success

CFOs must implement clear and transparent communication strategies to serve as a stakeholder management experience example that effectively involves interested parties. Regular updates on financial performance, strategic initiatives, and organizational changes are crucial. Utilizing various communication methods—such as emails, newsletters, and meetings—ensures interested parties stay informed and appreciated. This method promotes open conversation, which is crucial for establishing trust and encouraging involvement from interested parties, serving as a stakeholder management experience example.

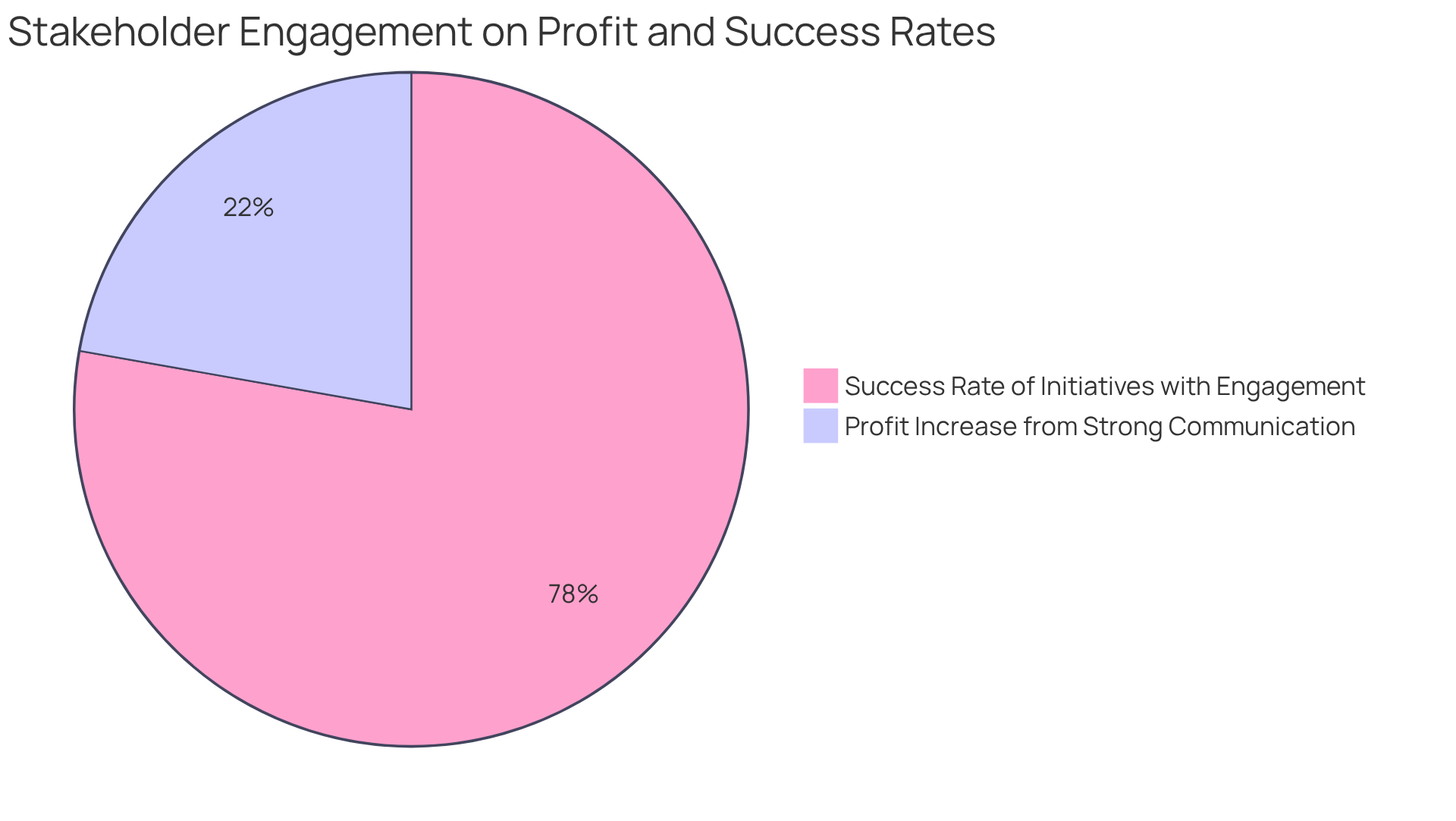

Data indicates that firms with robust participant involvement can experience up to a 20% boost in profits, highlighting the economic advantages of efficient communication. Moreover, initiatives with strong participant involvement have a 70% success rate, illustrating the vital importance of communication in reaching monetary goals. By prioritizing transparency and consistency in reporting, and by adopting a shortened decision-making cycle, financial leaders can align expectations of interested parties with organizational goals, ultimately driving better financial outcomes.

Stakeholder Mapping Techniques: Identifying Key Players and Their Interests

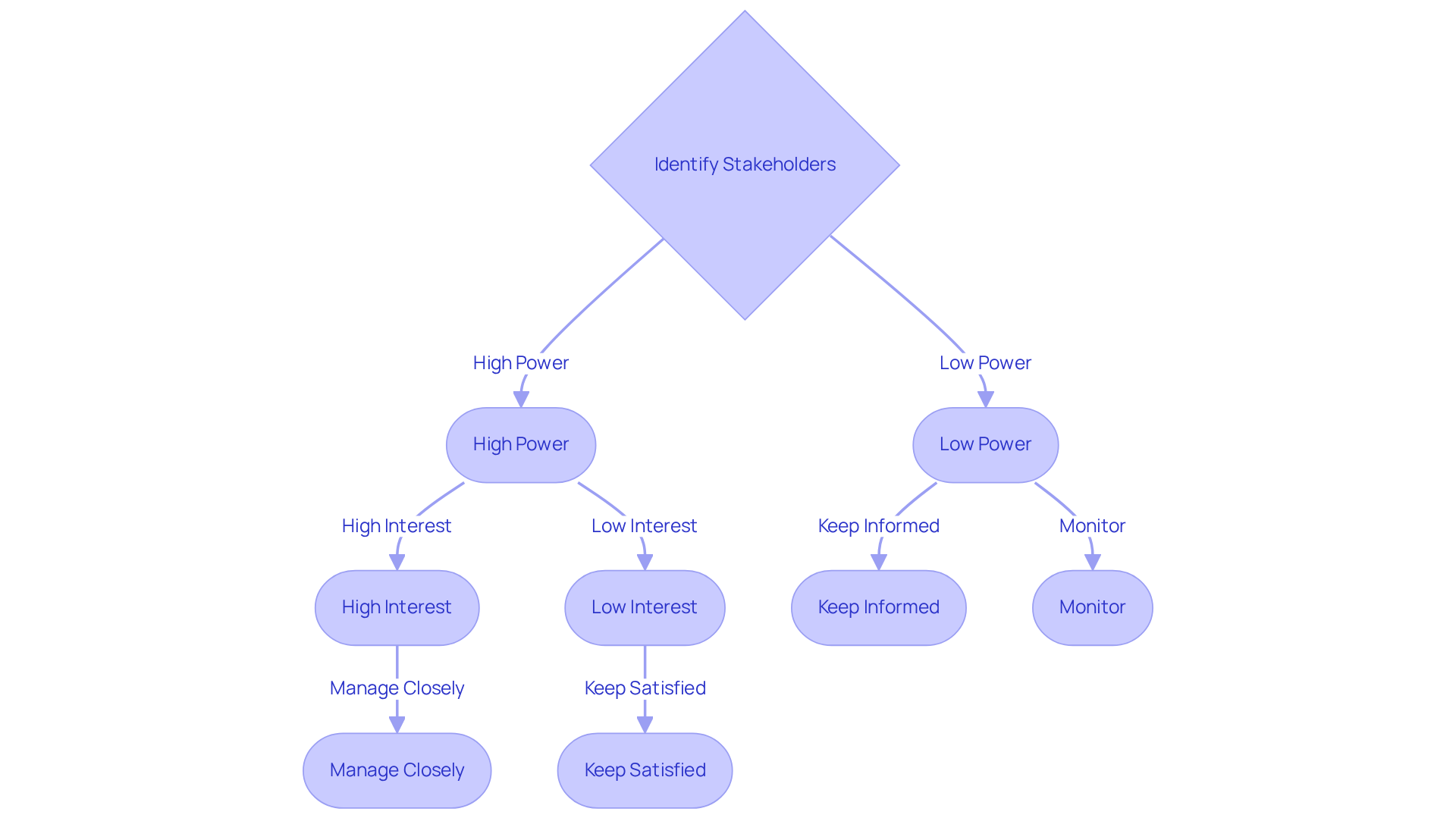

A stakeholder management experience example highlights the importance of stakeholder mapping techniques for identifying key players and categorizing them based on their influence and interest within the organization. Utilizing tools such as the Power-Interest Grid allows financial leaders to visualize participant dynamics effectively, prioritizing engagement efforts accordingly. This grid differentiates parties with high power and high interest—who require close management—from those with lower influence.

By understanding the motivations and concerns of each interest group, financial leaders can create a stakeholder management experience example that tailors their communication strategies to meet specific needs, fostering collaboration and support for financial initiatives. Organizations that excel in managing interests report a 20% increase in customer satisfaction and a 35% boost in employee engagement, underscoring the tangible benefits of effective interest collaboration.

Moreover, by implementing efficient decision-making processes and leveraging real-time analytics, financial leaders can consistently monitor participant engagement and business performance. This proactive approach, which includes regular updates to anticipate shifts in participant behavior, ensures that financial strategies remain aligned with evolving stakeholder interests. Consequently, this drives improved project outcomes and enhances organizational resilience.

Leveraging Stakeholder Feedback: Informing Financial Strategies and Decisions

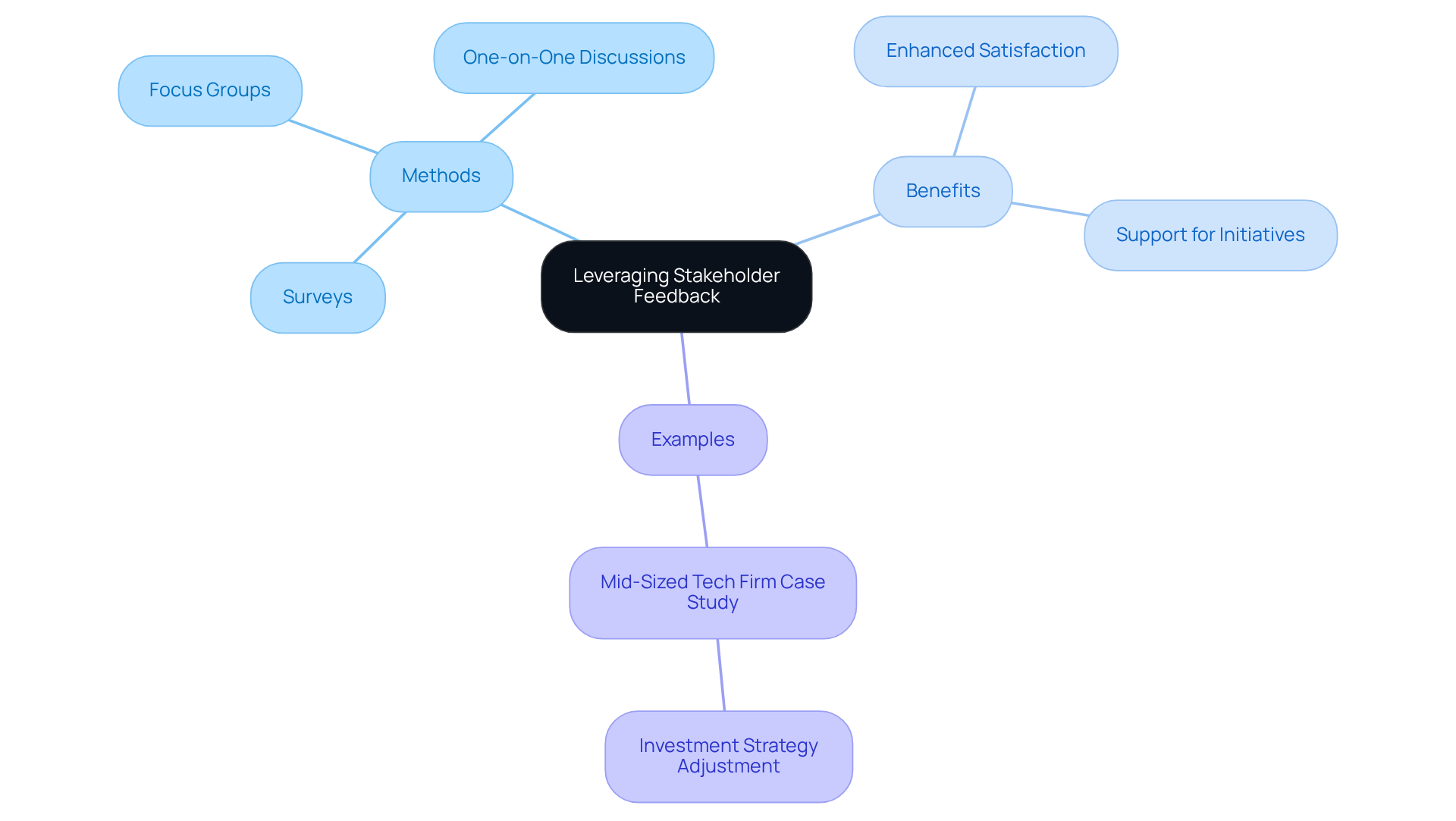

Chief financial officers must prioritize the active gathering and use of input from interested parties as a stakeholder management experience example to effectively shape their monetary strategies and choices. This can be effectively accomplished through various methods such as:

- Surveys

- Focus groups

- One-on-one discussions

By gaining insights into interested parties' perspectives, CFOs can align their decisions with the interests of key players, thereby enhancing satisfaction and garnering support for monetary initiatives. Regular evaluations of participant sentiment not only emphasize areas for enhancement but also foster a culture of continuous involvement.

Significantly, firms that interact with interested parties are 30% more likely to thrive with new products, highlighting the essential role of input from these parties in promoting economic success. For instance, a mid-sized tech firm modified its investment approach based on input from interested parties, serving as a stakeholder management experience example that resulted in enhanced operational efficiency and client satisfaction. Such examples demonstrate the tangible advantages of utilizing contributor feedback in financial decision-making.

In conclusion, CFOs are encouraged to actively engage with interested parties, as this practice not only informs better financial decisions but also cultivates a supportive environment for future initiatives. The commitment to continuous feedback can lead to sustained success in the competitive financial landscape.

Conflict Resolution Techniques: Balancing Diverse Stakeholder Interests

CFOs have the capacity to effectively balance diverse party interests by employing a range of conflict resolution techniques. Active listening is paramount, as it empowers leaders to fully comprehend the concerns of all parties involved, fostering an environment of open communication. Techniques such as mediation and collaborative problem-solving not only resolve conflicts constructively but also cultivate mutual respect among all stakeholders. Notably, organizations that prioritize effective conflict management report a remarkable increase in employee engagement, with only 20% of employees currently feeling engaged in their work. This proactive approach not only addresses conflicts but also strengthens relationships and enhances trust among involved parties, ultimately leading to improved organizational performance.

Statistics reveal that unresolved conflicts can cost employers up to $359 billion annually due to lost productivity, while workplace disputes and personality clashes consume approximately 2.8 hours of each employee's time weekly. Furthermore, a staggering 85% of employees encounter some form of conflict at work, underscoring the necessity for financial leaders to implement effective conflict resolution strategies. Successful stakeholder management experience examples, such as the Volkswagen AG Emissions Scandal, demonstrate that when financial leaders actively engage in dispute resolution, they can achieve mutually beneficial solutions that satisfy all parties involved, thereby fostering a more collaborative and productive work environment.

In conclusion, it is imperative for CFOs to adopt these conflict resolution strategies to not only mitigate disputes but also to enhance overall organizational effectiveness and employee satisfaction.

Setting Clear Goals: Aligning Stakeholder Expectations with Financial Objectives

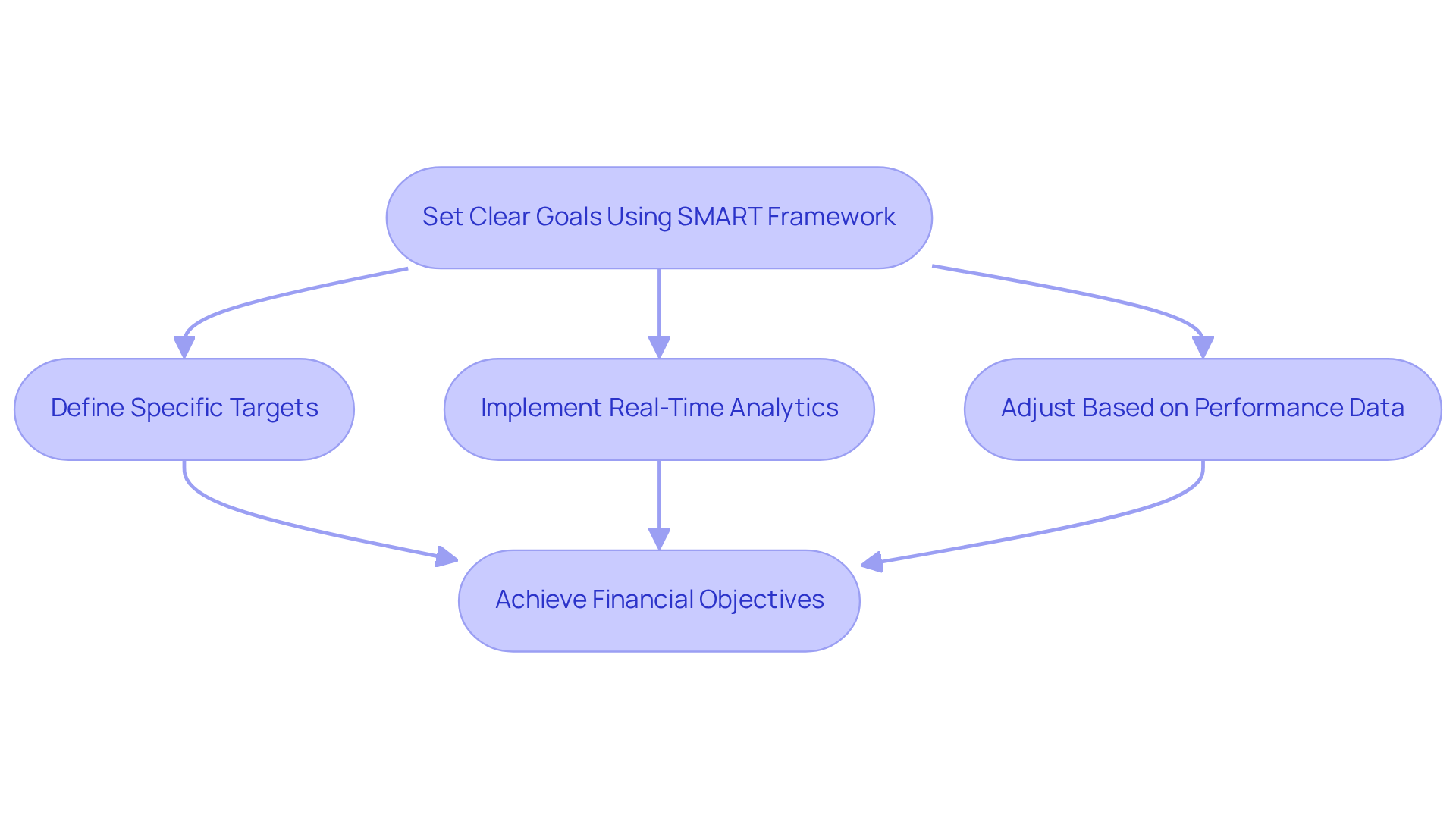

Chief Financial Officers must establish clear, measurable targets that align participant expectations with the organization's monetary objectives. By implementing the SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—CFOs can adopt a structured approach to defining these goals. Organizations employing SMART goals report a significant rise in participant engagement and commitment; employees are 6.7 times more likely to feel proud of their companies when clear objectives are established. By effectively conveying these objectives to stakeholders, financial executives can demonstrate a stakeholder management experience example that fosters a shared understanding of priorities, encouraging teamwork towards common financial goals.

Moreover, utilizing real-time business analytics through client dashboards enables financial leaders to consistently track goal achievement and make prompt adjustments based on client feedback. This proactive approach not only enhances alignment but also reinforces commitment, as studies indicate that 90% of businesses fail to reach their goals due to a lack of accountability and clear communication. Furthermore, adopting a shortened decision-making cycle empowers financial leaders to act decisively in response to insights gained from analytics. Successful instances of SMART objectives in finance serve as a stakeholder management experience example, illustrating that organizations emphasizing clarity and alignment, supported by real-time analytics, can achieve improved financial results and satisfaction among stakeholders.

To implement these strategies effectively, financial leaders should regularly review and adjust their goals based on performance data and input from involved parties, showcasing a stakeholder management experience example.

Technology-Enabled Stakeholder Management: Tools for Streamlined Communication

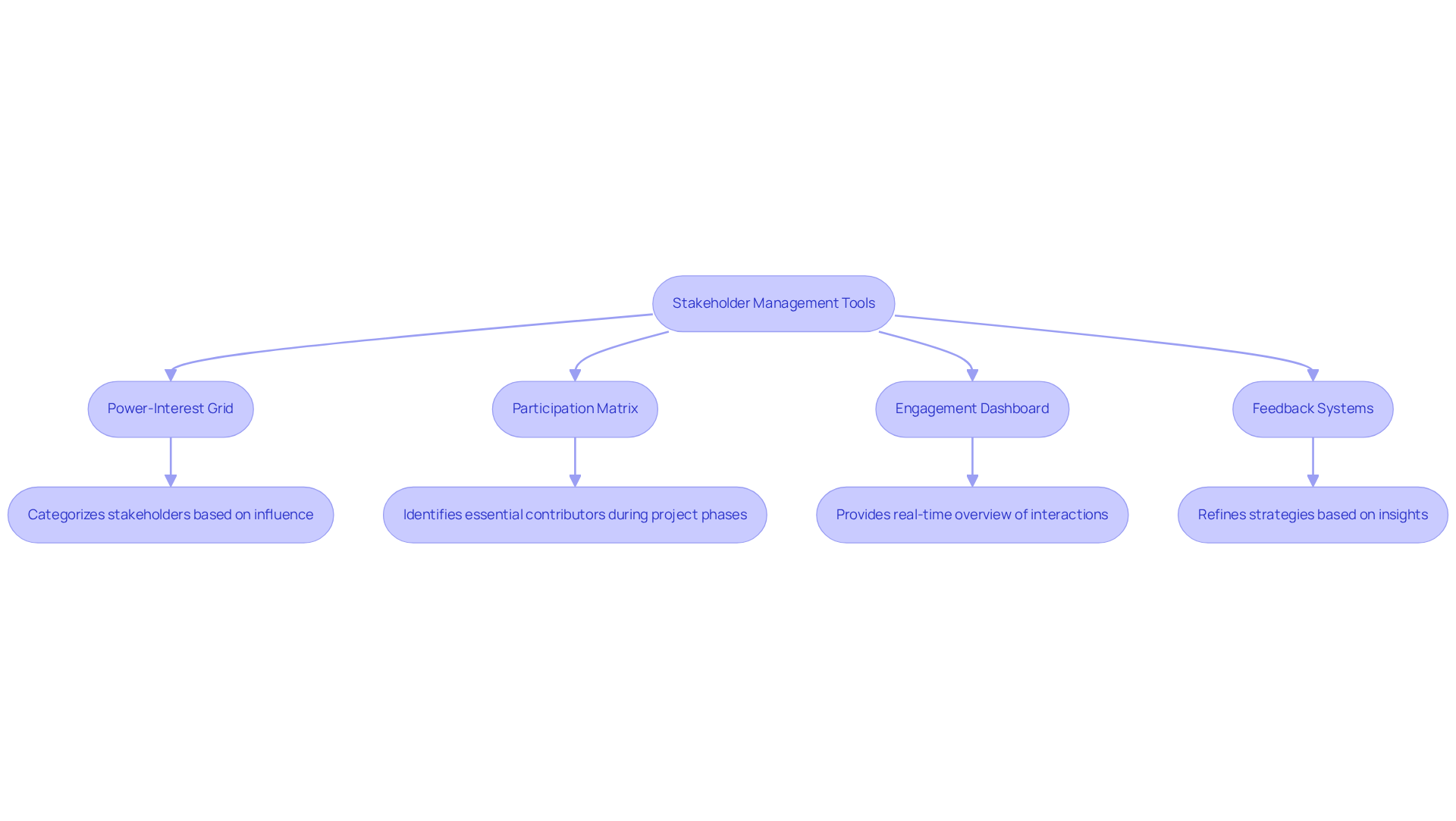

Chief Financial Officers can significantly enhance engagement from interested parties by leveraging technology-driven management resources. Management tools for participants, project management systems, and communication applications serve as a stakeholder management experience example by facilitating real-time updates and fostering collaboration among stakeholders.

For instance, a stakeholder management experience example is utilizing a Power-Interest Grid within these tools, allowing CFOs to categorize interested parties based on their influence and interest, ensuring that communication efforts are prioritized effectively.

Furthermore, the Participation Matrix is a valuable stakeholder management experience example, as it aids in identifying which parties should be involved during specific project phases, preventing unnecessary participation while ensuring essential contributors are engaged.

This strategic approach serves as a stakeholder management experience example, as it keeps interested parties informed and streamlines decision-making processes, ultimately leading to improved operational efficiency.

Our team advocates for a reduced decision-making cycle during the turnaround process, empowering financial leaders to take decisive action to protect their business. Additionally, incorporating feedback systems through these platforms enables CFOs to refine their strategies based on contributor insights, thereby strengthening trust and loyalty.

The Engagement Dashboard provides a real-time overview of participant interactions, enhancing the ability to monitor engagement levels and consistently assess business health. As organizations increasingly embrace these technologies, the benefits of improved participant management become evident, fostering innovation and supporting long-term success.

Moreover, integrating environmental, social, and governance (ESG) factors into interest group management is crucial, aligning with the growing focus on responsible business practices. By utilizing these tools, financial leaders can ensure that their engagement strategies are not only effective but also aligned with broader organizational objectives.

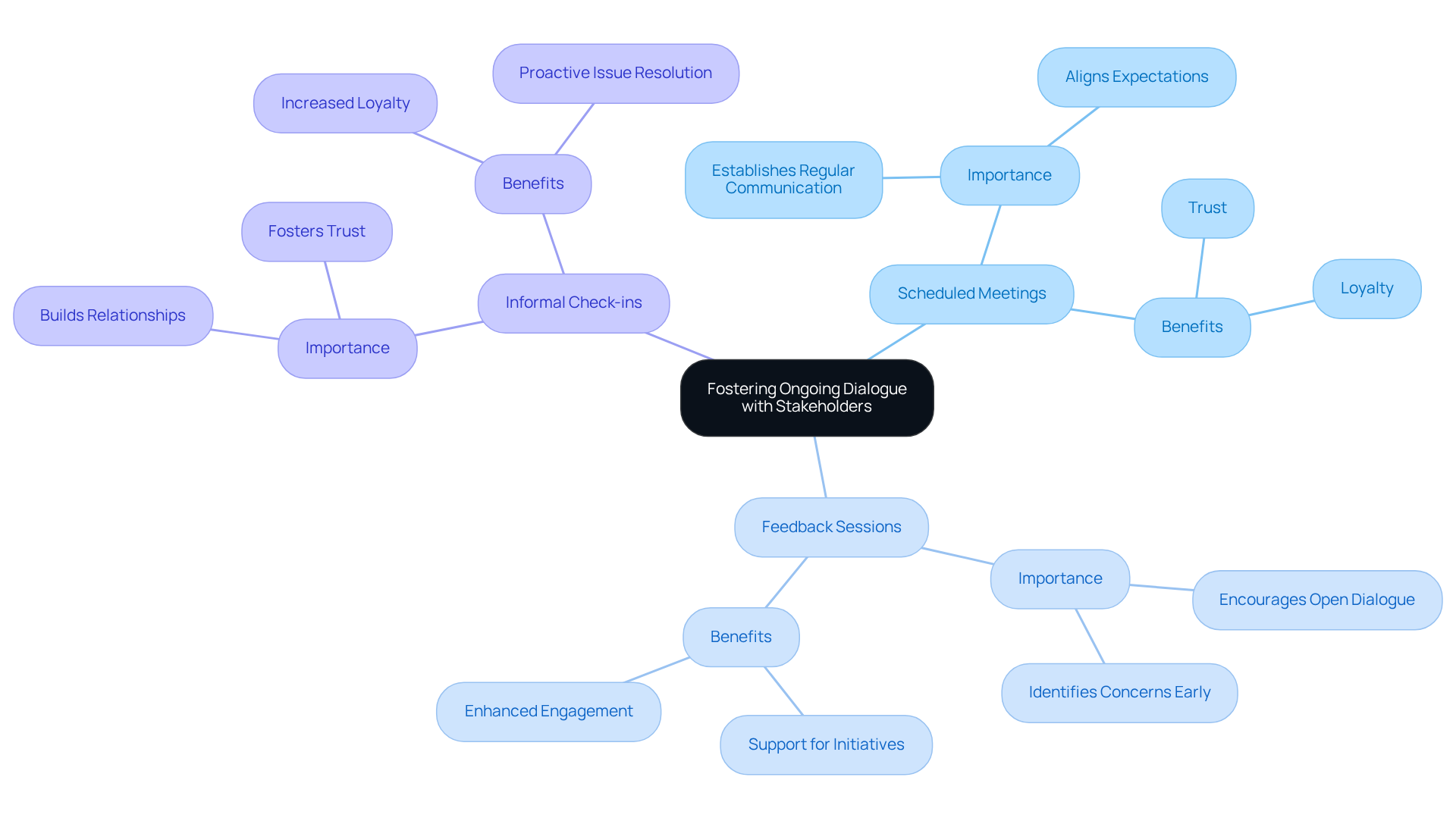

Regular Consultations: Fostering Ongoing Dialogue with Stakeholders

Chief Financial Officers must prioritize frequent discussions with interested parties as a stakeholder management experience example to foster continuous conversation and enhance connections. This can encompass:

- Scheduled meetings

- Feedback sessions

- Informal check-ins

By maintaining communication channels, CFOs can proactively tackle concerns of interested parties, which serves as a stakeholder management experience example, and ensure their interests are integrated into financial decision-making. Such ongoing involvement is a stakeholder management experience example that not only establishes trust but also greatly improves loyalty and support from interested parties for organizational initiatives.

Statistics suggest that organizations with robust participant engagement experience a 20% rise in customer satisfaction and a 35% enhancement in employee involvement, highlighting the significance of these interactions. Successful examples of continuous participant dialogue show that when contributors feel acknowledged and appreciated, they are more inclined to support organizational objectives, resulting in sustainable growth and resilience during difficult periods.

Risk Management through Stakeholder Engagement: Mitigating Financial Risks

Chief financial officers can significantly enhance their risk management approaches by using a stakeholder management experience example that actively involves interested parties throughout the process. Engaging key participants in identifying potential monetary risks and discussing mitigation strategies serves as a stakeholder management experience example that enables CFOs to gather diverse perspectives to inform their risk management strategies. This collaborative approach not only aids in the early detection of risks but also fosters a sense of collective accountability among all involved.

Statistics reveal that organizations with engaged participants are 78% more likely to succeed in their projects, underscoring the effectiveness of this strategy in achieving economic stability. Moreover, case studies demonstrate that companies leveraging participation from stakeholders in their risk management processes serve as a stakeholder management experience example, leading to improved outcomes, including reduced vulnerabilities and enhanced decision-making capabilities.

By promoting open dialogue and teamwork, financial leaders can harness expert insights to develop robust risk management strategies that align with organizational objectives, ultimately leading to sustainable financial results.

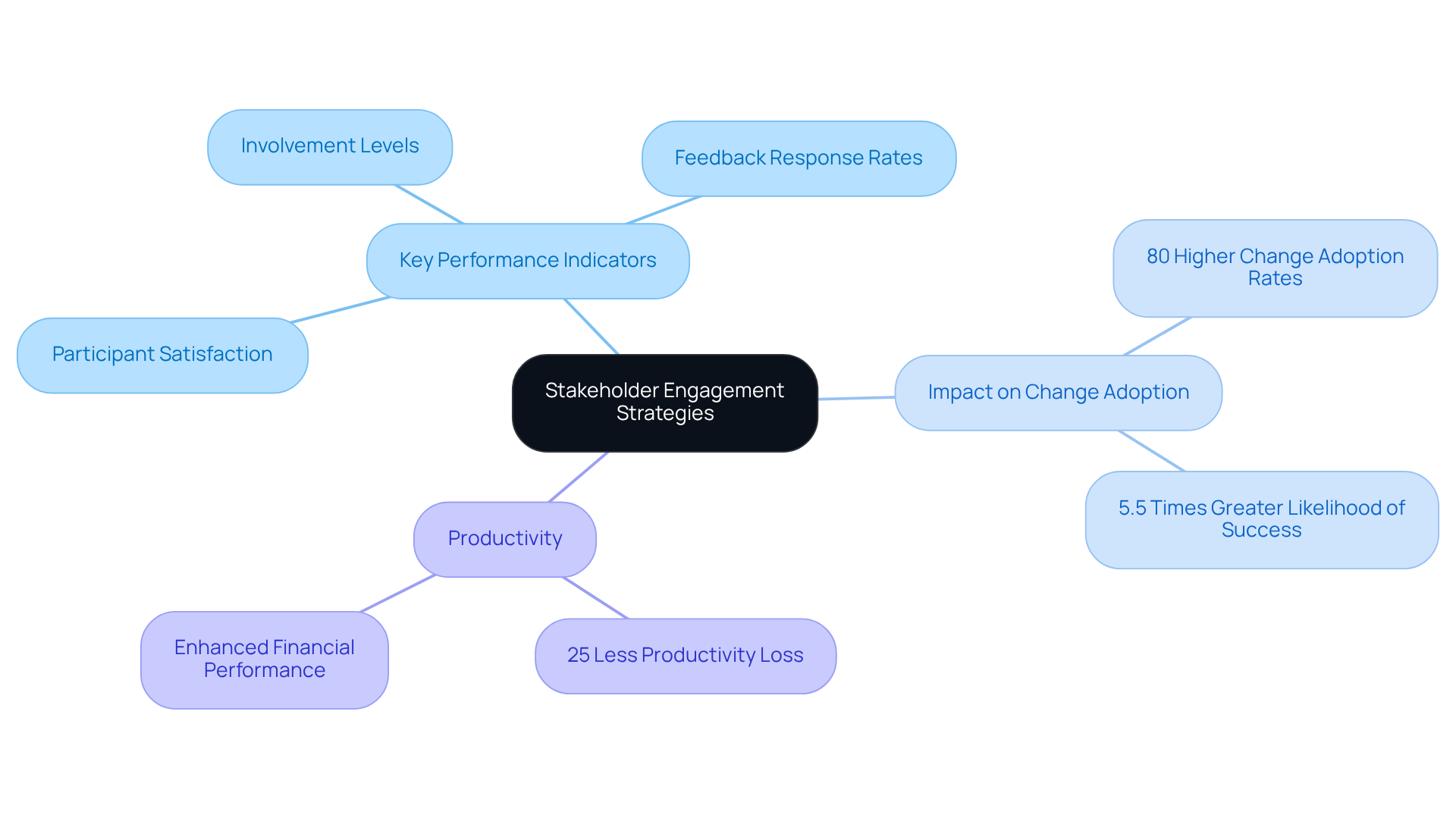

Measuring Success: Evaluating Stakeholder Engagement Strategies for Financial Impact

CFOs must establish strong metrics to evaluate the effectiveness of their partner interaction strategies. Key performance indicators (KPIs) such as participant satisfaction, involvement levels, and feedback response rates are crucial for obtaining insights into the effectiveness of these efforts. Research shows that organizations with robust participant involvement metrics achieve 80% higher rates of change adoption and experience 25% less productivity loss during transitions.

By systematically monitoring these metrics, CFOs can identify areas requiring enhancement and adjust their strategies, using a stakeholder management experience example to strengthen relationships with interested parties and improve financial performance. Moreover, firms that actively involve interested parties are 30% more likely to thrive with new products, highlighting the essential role of effective interaction in promoting business success.

In 2025, implementing KPIs tailored to stakeholder engagement in finance will be crucial, as organizations with effective stakeholder management experience examples are 5.5 times more likely to implement successful changes. Regular evaluations of these KPIs will facilitate better decision-making and foster a culture of continuous improvement, ultimately enhancing overall business health.

Conclusion

CFOs play a crucial role in navigating the complexities of stakeholder management, an essential component for achieving financial success. By employing strategic communication, mapping techniques, and actively leveraging feedback, financial leaders can enhance engagement and ensure their organizations remain resilient amidst economic challenges.

This article outlines ten impactful stakeholder management experience examples that provide actionable insights for CFOs. Key strategies include:

- Establishing clear communication channels

- Utilizing stakeholder mapping techniques

- Fostering ongoing dialogue to align stakeholder expectations with financial objectives

Moreover, the importance of conflict resolution and leveraging technology to streamline stakeholder engagement is emphasized, illustrating how these practices can lead to improved financial outcomes and organizational stability.

Ultimately, effective stakeholder management transcends mere relationship maintenance; it is a strategic imperative that drives profitability and fosters sustainable growth. By prioritizing engagement and utilizing the insights shared, CFOs can create a collaborative environment that addresses the diverse interests of stakeholders while aligning them with the overarching financial goals of the organization. Embracing these strategies will undoubtedly enhance decision-making and contribute to long-term success in the ever-evolving financial landscape.

Frequently Asked Questions

What is the purpose of turnaround and restructuring consulting for small to medium businesses?

Turnaround and restructuring consulting provides tailored solutions for small to medium enterprises facing economic challenges by identifying critical areas for improvement, streamlining operations, and implementing strategies that enhance cash flow while reducing liabilities.

How can CFOs benefit from consulting services?

CFOs can leverage consulting services to ensure their organizations remain resilient and adaptable to changing market conditions, which ultimately boosts operational efficiency and profitability.

What do client testimonials reveal about the effectiveness of consulting services?

Client testimonials illustrate successful turnaround experiences, highlighting the value of consulting in navigating economic challenges.

What are the key components of effective communication strategies for CFOs?

Effective communication strategies include providing regular updates on financial performance, strategic initiatives, and organizational changes through various methods such as emails, newsletters, and meetings to keep stakeholders informed and engaged.

What impact does participant involvement have on a firm's profits?

Firms with robust participant involvement can experience up to a 20% boost in profits, demonstrating the economic advantages of efficient communication.

What is stakeholder mapping and why is it important?

Stakeholder mapping is a technique used to identify key players and categorize them based on their influence and interest. It helps financial leaders prioritize engagement efforts and tailor communication strategies to meet specific needs.

How can the Power-Interest Grid be utilized in stakeholder management?

The Power-Interest Grid allows financial leaders to visualize participant dynamics, differentiating parties with high power and high interest who require close management from those with lower influence.

What are the benefits of effective interest collaboration?

Organizations that excel in managing interests report a 20% increase in customer satisfaction and a 35% boost in employee engagement, underscoring the tangible benefits of effective collaboration.

How can financial leaders monitor participant engagement and business performance?

Financial leaders can implement efficient decision-making processes and leverage real-time analytics to consistently monitor participant engagement and business performance, ensuring alignment with evolving stakeholder interests.