Overview

This article presents ten strategic approaches to mitigate bankruptcy risk in businesses, underscoring the critical role of proactive financial management and operational efficiency. By executing thorough financial assessments, interim management solutions, and continuous monitoring systems, companies can significantly bolster their economic stability and reduce potential threats. These strategies are substantiated by a variety of examples and industry insights that illustrate their effectiveness. Moreover, the implementation of these practices not only enhances resilience but also positions businesses to navigate financial uncertainties with confidence.

Introduction

In the competitive landscape of small and medium businesses, the threat of financial instability looms large, often leading to the risk of bankruptcy. Comprehensive turnaround consulting emerges as a beacon of hope, offering tailored strategies designed to assess and enhance operational efficiency while ensuring financial stability.

By delving into:

- Financial assessments

- Interim management solutions

- Proactive risk management

companies can not only navigate immediate challenges but also establish a sustainable foundation for future growth.

As businesses face mounting pressures, understanding the nuances of:

- Effective cash flow management

- Compliance with regulations

- The integration of technology

becomes essential. This article explores the multifaceted approach to turnaround consulting, providing actionable insights that empower businesses to thrive amidst uncertainty.

Transform Your Small/ Medium Business: Comprehensive Turnaround Consulting for Bankruptcy Risk Management

Comprehensive turnaround consulting necessitates a meticulous assessment of an organization's operations, finances, and market positioning. By pinpointing weaknesses and opportunities, consultants craft tailored strategies that not only tackle immediate monetary challenges but also lay the groundwork for sustainable success. This method proves particularly advantageous for small to medium enterprises, which often face resource constraints when confronting complex financial issues.

Engaging a turnaround consultant, such as those from Transform Your Small/Medium Business, can yield significant enhancements in operational efficiency and economic stability, thereby supporting bankruptcy risk reduction. Our extensive services include:

- Financial evaluation

- Interim management

- Bankruptcy case oversight

This empowers companies to focus on their core operations while we navigate the complexities of turnaround strategies. Our customized 'Rapid30' plan exemplifies our commitment to transforming enterprises, underscoring client satisfaction and professional success.

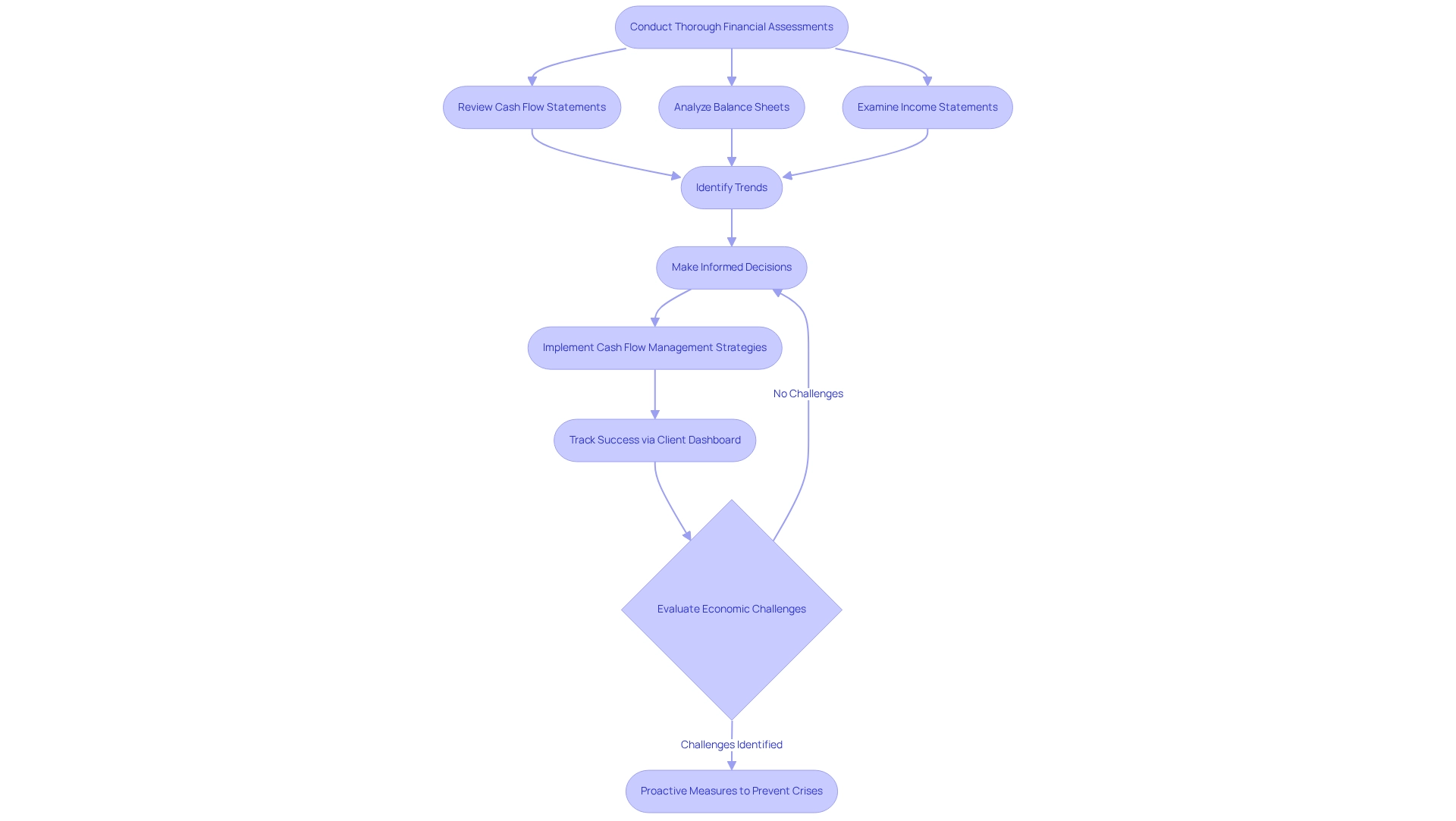

Conduct Thorough Financial Assessments: Identify Risks and Preserve Cash Flow

Conducting a comprehensive monetary evaluation is essential for companies aiming for bankruptcy risk reduction while sustaining cash flow and identifying potential risks. This process involves a meticulous review of cash flow statements, balance sheets, and income statements to uncover trends that could impact economic stability. By understanding their financial position, companies can make informed decisions that bolster operational viability during challenging times.

We advocate for a streamlined decision-making cycle during the turnaround process, empowering your team to take decisive actions to protect your organization. Regular evaluations not only help companies anticipate economic challenges but also support bankruptcy risk reduction by enabling them to implement proactive measures, preventing crises from escalating.

For example, effective cash flow management strategies—such as establishing clear payment terms, timely invoicing, and comprehending customer payment behaviors—have proven beneficial for small enterprises. These strategies lead to improved economic stability and stronger relationships with suppliers and banks.

Furthermore, we consistently track the success of our strategies through our client dashboard, which provides real-time analytics to assess your organization’s health. In 2023, the European Investment Bank underscored the importance of monetary evaluations by allocating approximately €20 billion in support for small and medium-sized enterprises, highlighting the critical need for robust fiscal planning in today’s challenging lending environment.

With the average small enterprise loan amount hovering around $663,000, securing such loans becomes imperative, making it essential for CFOs to prioritize thorough evaluations to safeguard their organizations’ futures.

Implement Interim Management Solutions: Stabilize Operations During Financial Distress

Interim leadership solutions are essential for bankruptcy risk reduction by stabilizing operations during financial distress through the placement of seasoned executives in critical roles. These professionals bring extensive expertise, enabling them to swiftly assess challenges, implement necessary changes, and guide organizations toward recovery. Their immediate focus on operational needs ensures that essential functions remain intact while longer-term strategies are developed. Notably, interim managers are characterized by a performance-driven mindset, with 96.9% reporting consistent peak performance levels—an essential factor during crises. This results-oriented approach not only facilitates rapid decision-making but also fosters a culture of accountability and results, which is vital for navigating turbulent times.

Moreover, interim managers leverage real-time analytics through a client dashboard to consistently track performance, allowing for prompt adjustments and the incorporation of lessons learned throughout the turnaround process. Their relevant experience also extends to overseeing mergers or acquisitions, significantly enhancing the success of these endeavors by ensuring smooth transitions and operational continuity. By effectively managing risks and addressing supply chain challenges, organizations can position themselves for sustainable growth and achieve bankruptcy risk reduction, ultimately benefiting from the strategic insights and operational efficiencies that interim management provides.

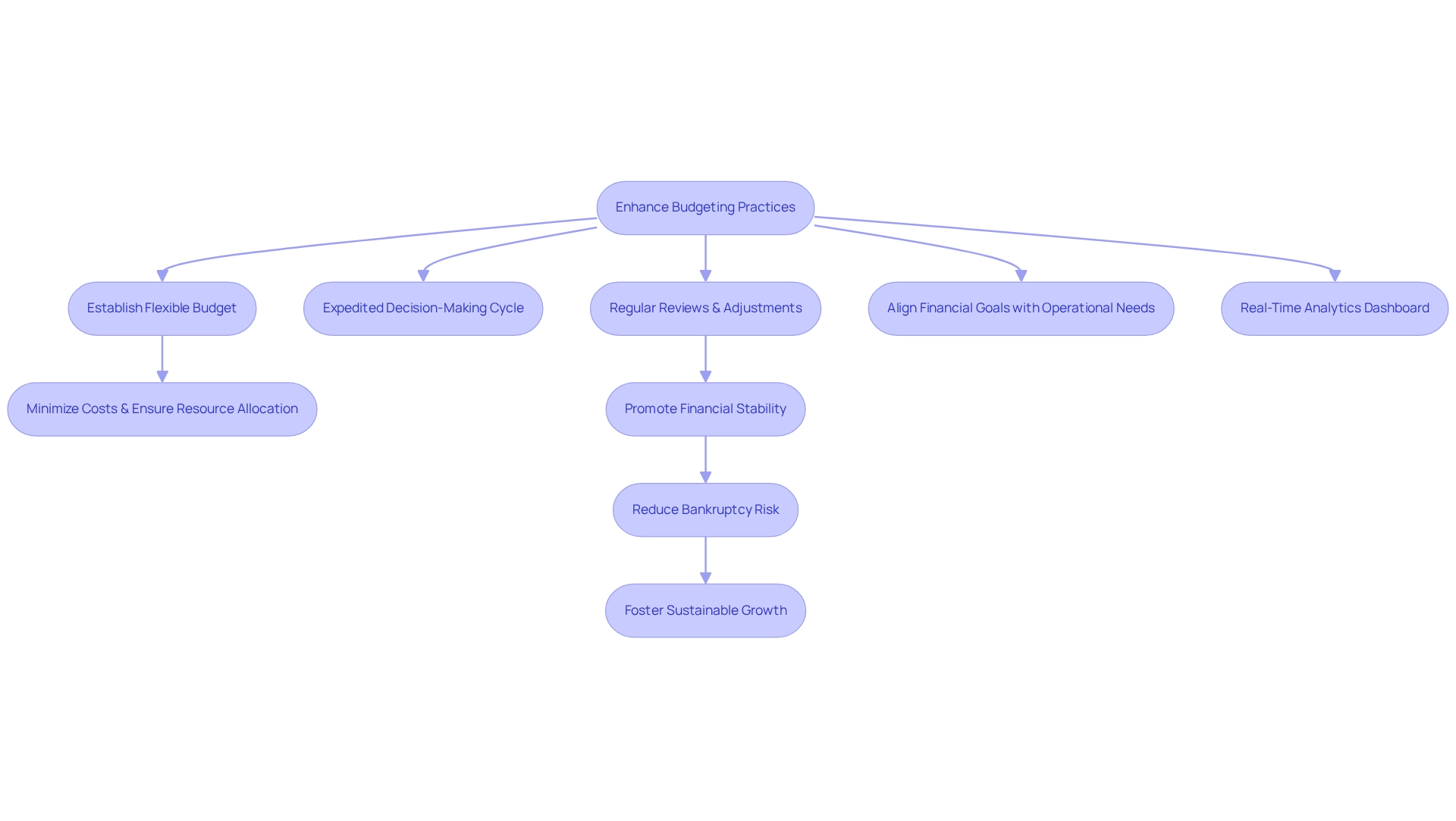

Enhance Budgeting Practices: Align Financial Goals with Operational Needs

Enhancing budgeting methods requires the establishment of a flexible budget that accurately reflects current economic realities and future aspirations. Our team advocates for an expedited decision-making cycle during the turnaround process, empowering your organization to take decisive actions to safeguard its financial health.

Regular reviews and adjustments to the budget are crucial to accommodate fluctuations in revenue and expenses. By aligning financial goals with operational needs, companies can minimize unnecessary costs and ensure optimal resource allocation. This proactive budgeting approach not only promotes financial stability but also plays a crucial role in bankruptcy risk reduction by significantly lowering the risk of distress.

For example, a coffee shop operating at 120% capacity reported an impressive 60.1% increase in its ending cash balance, illustrating the tangible benefits of effective budgeting. Furthermore, implementing flexible budgeting strategies allows organizations to adapt to changing environments, improving performance assessment and strategic resource planning.

Our client dashboard provides real-time analytics to continuously evaluate your organization's health, highlighting the importance of ongoing performance monitoring. As demonstrated in various case studies, such practices enhance financial management efficiency, ultimately fostering sustainable growth.

Gabriel Freitas, an AI Engineer, emphasizes that a culture of agility enables organizations to pivot and drive changes within their sectors, underscoring the importance of adaptable budgeting. Additionally, a one-page budget overview is recommended for effective business management while facilitating deeper analysis as needed.

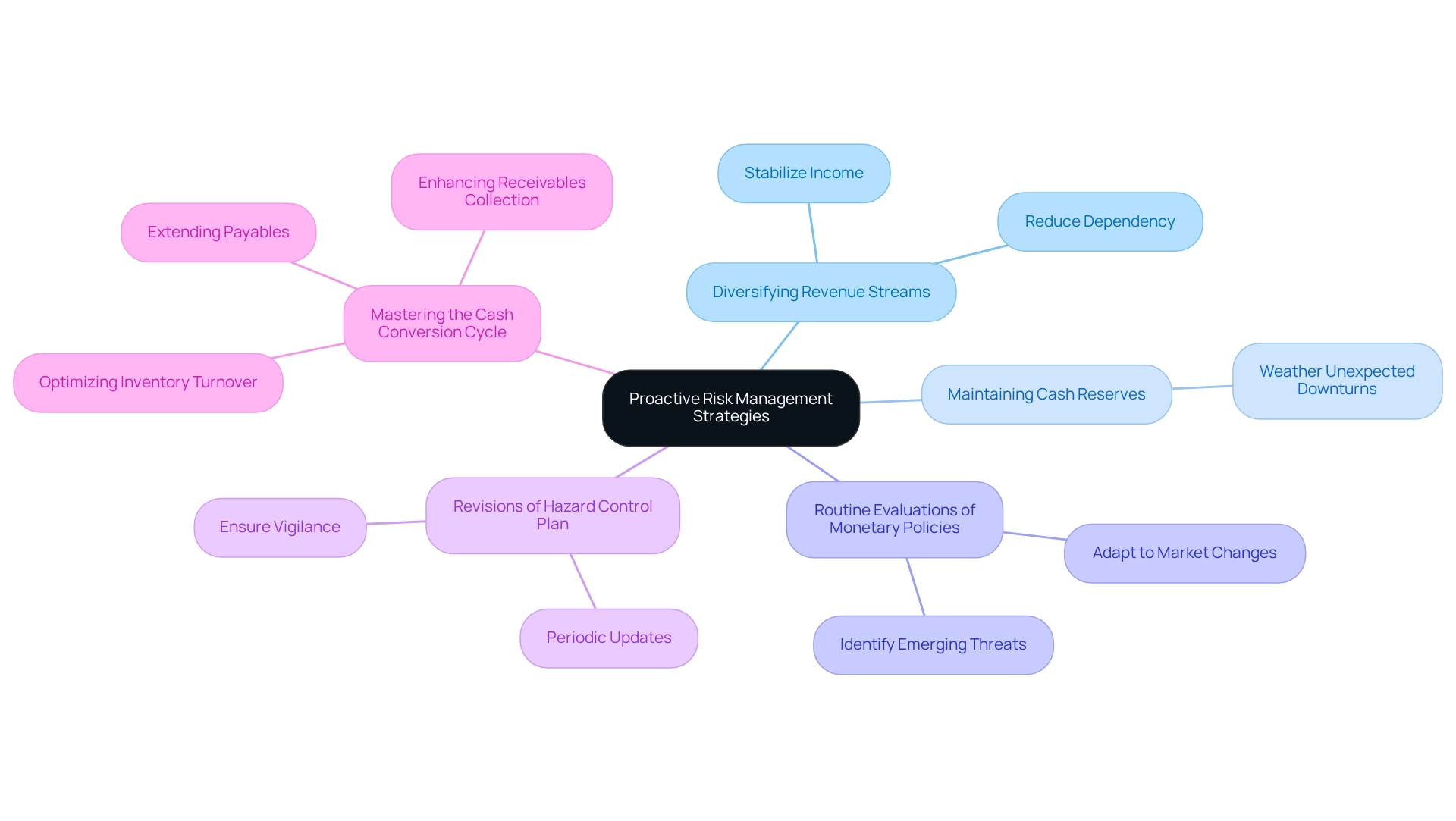

Adopt Proactive Risk Management Strategies: Safeguard Against Financial Instability

Applying proactive threat handling strategies is crucial for recognizing potential economic dangers and developing effective mitigation plans. Key approaches include:

- Diversifying revenue streams to stabilize income and reduce dependency on a single source.

- Maintaining sufficient cash reserves to weather unexpected downturns.

- Routine evaluations of monetary policies to adapt to changing market circumstances and emerging threats.

- Regular revisions of the hazard control plan to ensure that organizations remain vigilant to alterations.

For instance, companies that have adopted robust strategies for managing uncertainty have successfully navigated financial difficulties, demonstrating the effectiveness of these approaches in preventing bankruptcy. Current trends indicate that small to medium enterprises (SMEs) are increasingly prioritizing risk identification and management, concentrating on ongoing risk monitoring systems that clarify responsibilities for tracking risks and evaluating response strategies. This proactive stance enhances organizational resilience and positions businesses to capitalize on opportunities amidst uncertainty.

Furthermore, mastering the cash conversion cycle through strategies such as:

- Optimizing inventory turnover.

- Enhancing receivables collection.

- Extending payables.

can significantly contribute to economic stability. As Ash Noah, Vice President & Managing Director at the Association of International Certified Professional Accountants, states, "While predictable and unpredictable global disruptions continue to create new and worsen ongoing threat triggers, this research reinforces that enterprise threat oversight needs to be prioritized more for CFOs."

By adopting these strategies, including efficient decision-making and real-time analysis, companies can substantially reduce the likelihood of economic instability and promote sustainable growth. Additionally, CFOs should reflect on the questions outlined in recent case studies to assess their organization's risk readiness and identify tactical steps for enhancing risk management processes. For those interested in refining their approach, the program "Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance" is available for $99.00.

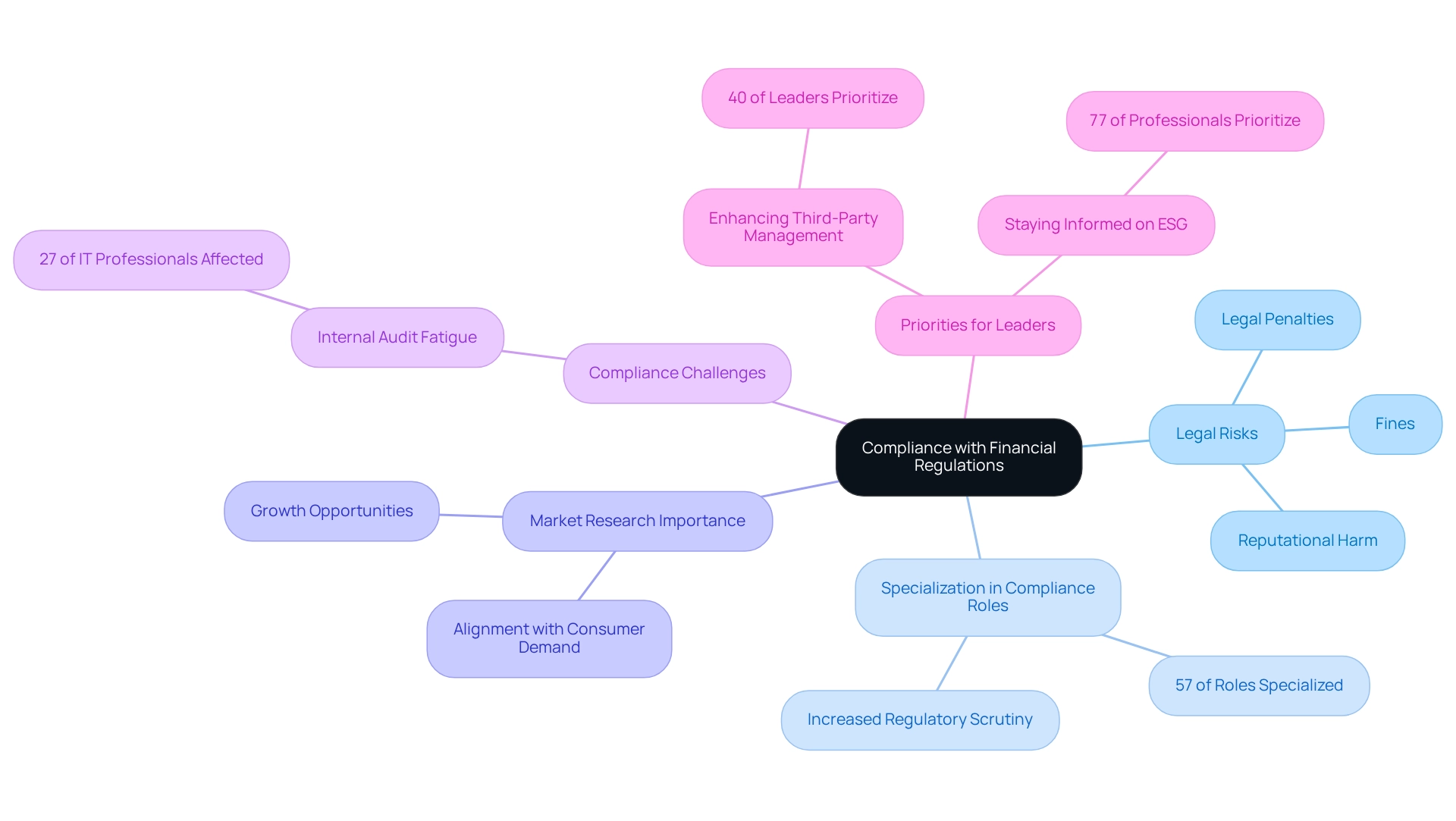

Ensure Compliance with Financial Regulations: Protect Your Business from Legal Risks

Ensuring adherence to monetary regulations is crucial for companies striving to navigate difficult periods successfully. This necessity encompasses a thorough understanding of tax laws, labor laws, and industry-specific regulations. Non-compliance can result in severe consequences, including legal penalties, fines, and reputational harm, which can further complicate financial recovery efforts. Implementing comprehensive compliance programs not only protects against these legal risks but also boosts the overall resilience of the organization. In fact, 57% of compliance roles have become more specialized due to increased regulatory scrutiny, emphasizing the necessity for organizations to adapt and prioritize compliance.

Moreover, organizations that engage in market research are more likely to align their offerings with consumer demand, ultimately supporting compliance and growth. By focusing on robust compliance strategies, businesses can better position themselves for bankruptcy risk reduction and sustainable growth. As per the Gartner for Legal, Compliance & Governance Leaders July 2025 Survey, 40% of leaders identified 'enhancing third-party management processes and/or technology' as one of their top five priorities, highlighting the essential nature of adherence in managing legal challenges. Furthermore, 77% of corporate compliance experts prioritize staying informed about ESG advancements, reflecting the changing environment of regulatory obligations that CFOs must manage.

It is also important to highlight that 27% of security and IT professionals identified reducing internal audit fatigue from assessments as a leading compliance program challenge, demonstrating the practical difficulties organizations encounter in upholding compliance. To avoid legal risks, companies must perform comprehensive monetary evaluations to preserve cash and reduce liabilities, ensuring adherence to key fiscal regulations that are essential for long-term sustainability and success. For a comprehensive evaluation of your financial health, consider our Financial Assessment service, designed to identify opportunities for cash preservation and liability reduction.

Optimize Cash Flow Management: Maintain Liquidity and Operational Viability

Optimize Cash Flow Oversight: Maintain Liquidity and Operational Viability

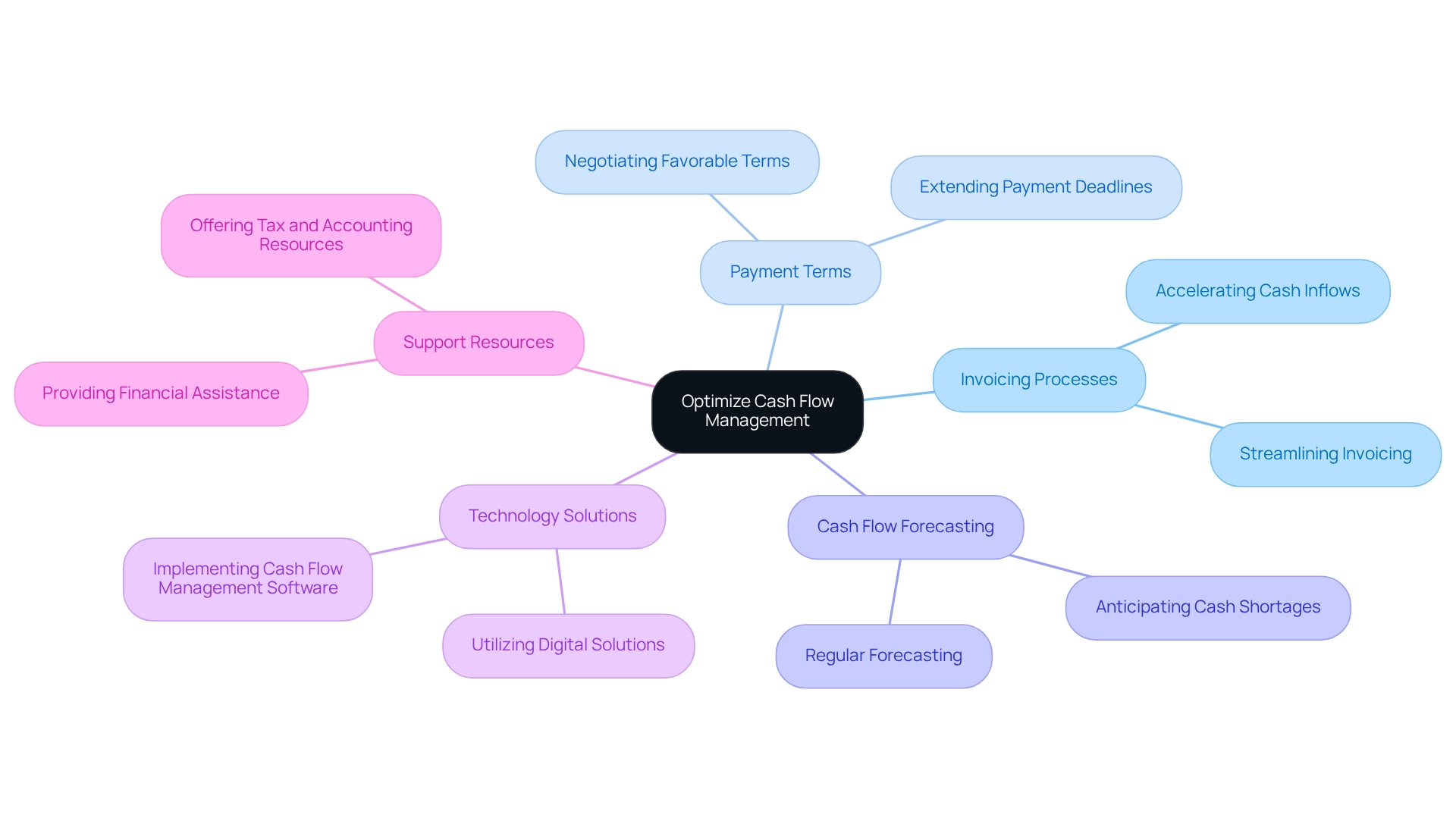

Effective cash flow oversight is essential for ensuring that an enterprise maintains sufficient liquidity to meet its obligations and achieve bankruptcy risk reduction. This entails a proactive approach to monitoring cash inflows and outflows, which can significantly aid in bankruptcy risk reduction through several strategies:

- Implement Efficient Invoicing Processes: Streamlining invoicing can accelerate cash inflows, reducing the time between service delivery and payment.

- Negotiate Favorable Payment Terms: Establishing advantageous terms with suppliers can enhance cash flow by extending payment deadlines, allowing organizations to retain cash longer.

- Regularly Forecast Cash Flow Needs: Accurate forecasting helps entities anticipate cash shortages and plan accordingly, enabling timely interventions to maintain liquidity.

Maintaining a healthy cash flow not only prevents liquidity crises but also supports operational viability, contributing to bankruptcy risk reduction. Indeed, a recent survey showed that 40% of small enterprise owners face difficulties with taxes and accounting, which greatly affects their cash flow oversight. By offering resources and support in these areas, companies can improve their economic stability and tackle these challenges efficiently, contributing to bankruptcy risk reduction, as well as enhancing liquidity through optimized cash flow management techniques that are essential for managing monetary distress.

As CFOs emphasize, maintaining liquidity during crises is vital for ensuring bankruptcy risk reduction and positioning the organization for recovery. The average interest rate of debt is at 20%, emphasizing the economic pressures that CFOs encounter in managing cash flow effectively. In 2025, small enterprises must implement innovative tactics to enhance cash flow oversight, such as utilizing digital solutions to address obsolete payment systems. Additionally, implementing technology tools like cash flow management software can provide CFOs with real-time insights, enhancing their financial resilience.

Our team facilitates a condensed decision-making cycle via the 'Decide & Execute' framework during the turnaround process, enabling your team to take decisive action to protect your organization. We continually monitor the success of our plans through our client dashboard, which provides real-time business analytics to diagnose your business health effectively. Incorporating the '20 Strategies for Optimal Business Performance' can further enhance these efforts, ensuring a comprehensive approach to cash flow management.

Reduce Overhead Costs: Streamline Operations for Financial Efficiency

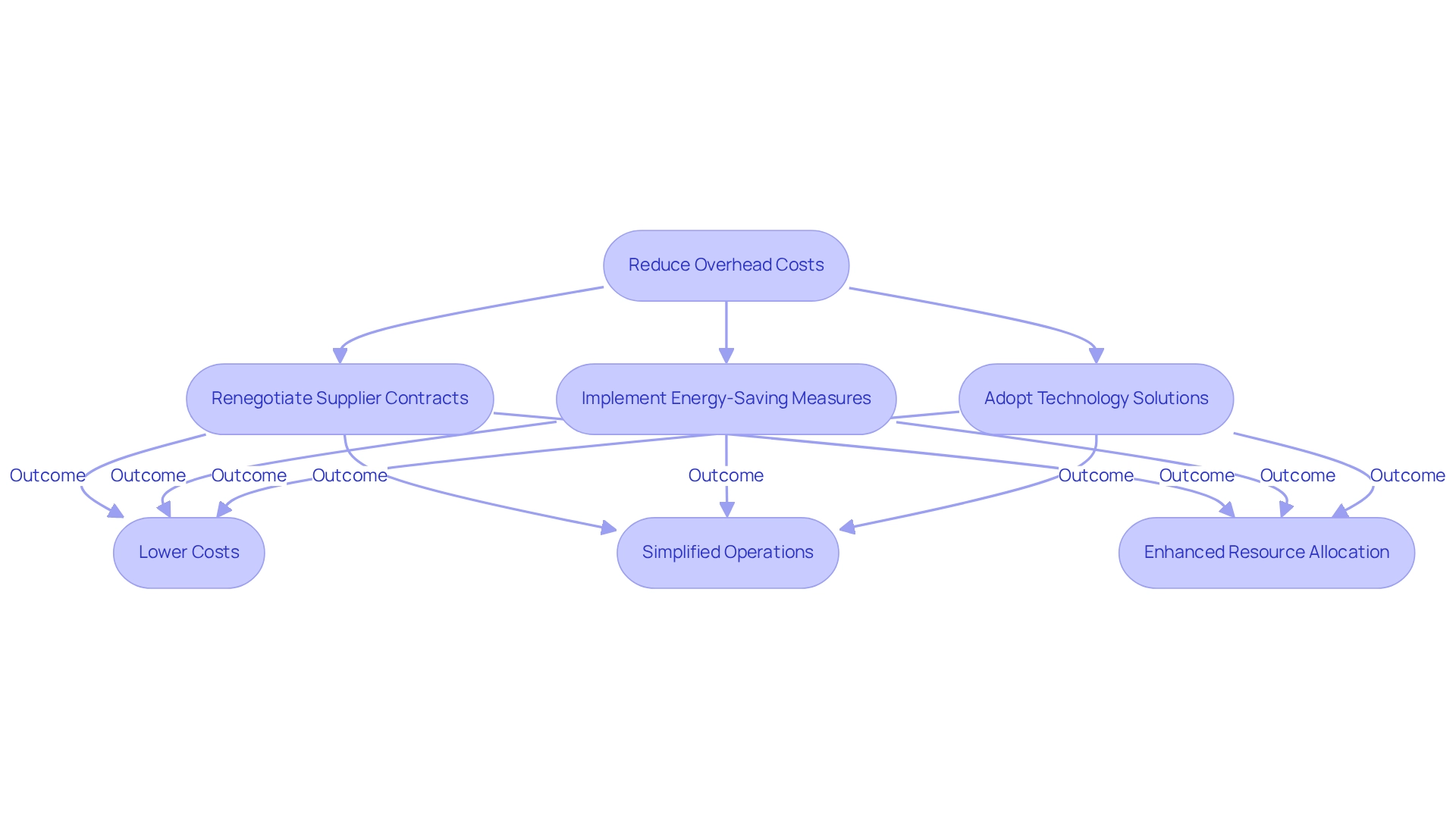

Minimizing overhead expenses is crucial for enhancing economic efficiency without sacrificing quality or service. Businesses can achieve this by:

- Renegotiating contracts with suppliers to secure better terms

- Implementing energy-saving measures to lower utility expenses

- Adopting technology solutions that automate routine processes

These strategies not only simplify operations but also enable companies to allocate resources more efficiently, which leads to bankruptcy risk reduction. In fact, monetary advisors indicate that companies embracing operational efficiency can save significantly—up to 85% on costs, translating to an average annual saving of $87,012.

As the shift to remote work continues, integrating digital-first operations and advanced collaboration tools becomes increasingly vital. For instance, a small enterprise that adopted a comprehensive digital collaboration platform experienced a 30% reduction in operational costs within the first year.

By concentrating on these sectors, small to medium enterprises can position themselves for sustainable growth and enhanced economic stability. Furthermore, fostering inclusivity within teams can lead to more innovative solutions for reducing overhead costs, further enhancing operational efficiency.

Additionally, utilizing real-time analytics permits companies to consistently observe their economic status and operational performance, facilitating faster decision-making and modifications to strategies as required. This proactive approach not only supports immediate cost-saving measures but also plays a crucial role in bankruptcy risk reduction while establishing the foundation for long-term economic resilience.

Leverage Technology Solutions: Improve Financial Operations and Decision-Making

Utilizing technology solutions is essential for improving monetary operations and decision-making. Advanced software tools, including accounting systems, cash flow management applications, and data analytics platforms, enable organizations to gain real-time insights into their economic performance. This capability is crucial for informed decision-making, particularly during periods of economic hardship. For instance, 71% of retail businesses recognize that digital transformation is vital for their technology strategy, underscoring the sector's commitment to adopting innovative solutions that enhance operational efficiency and meet evolving consumer expectations.

By leveraging these technologies, organizations can streamline their monetary processes, minimize errors, and enhance overall efficiency—key factors that contribute to bankruptcy risk reduction. With three-quarters of banks embarking on digital transformation initiatives and nearly half reporting significant progress, it is evident that the economic landscape is rapidly evolving. This shift emphasizes the necessity of adopting technology solutions to remain competitive and resilient. Our consulting services are tailored to assist organizations through these transformations, ensuring effective implementation of the necessary technologies to enhance their financial operations.

Moreover, our pragmatic approach to data allows us to test every hypothesis, delivering maximum return on invested capital in both the short and long term. We advocate for a reduced decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard your enterprise. With 54% of employees anticipated to require significant reskilling by 2025 due to digital advancements, organizations must prioritize technology integration to prepare their teams for these changes effectively. Our expertise in training and technology adoption can facilitate this transition, helping organizations adapt to new tools and processes. The advantages of utilizing technology in monetary operations extend beyond short-term efficiency improvements; they also foster a culture of adaptability and innovation, which is crucial for long-term success. As highlighted by the U.S. Chamber of Commerce, "technology is a driver of economic success for small enterprises," emphasizing the essential role our services play in enabling organizations to thrive in a digital economy.

Establish Continuous Monitoring Systems: Quickly Identify and Address Financial Risks

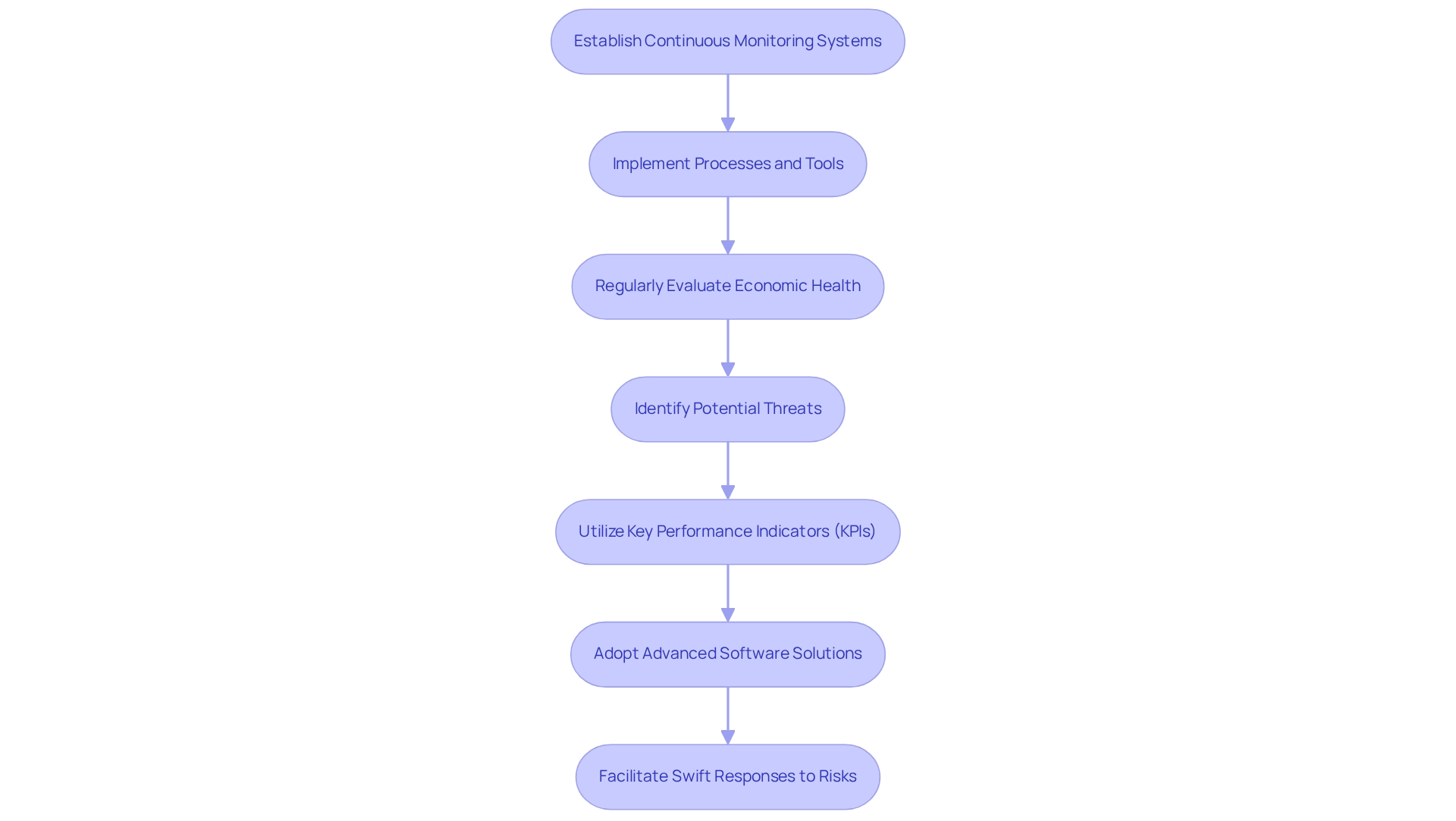

Creating ongoing monitoring systems is crucial for companies aiming to proactively manage economic risks and achieve bankruptcy risk reduction while enhancing their performance. This involves implementing processes and tools that regularly evaluate economic health and identify potential threats. Key performance indicators (KPIs) serve as essential benchmarks for monetary assessments, alerting management to anomalies. Companies that have effectively integrated KPIs into their fiscal monitoring have reported improved decision-making and hazard identification, which ultimately leads to bankruptcy risk reduction.

Moreover, the adoption of advanced software solutions enables real-time tracking of monetary metrics, facilitating swift responses to emerging risks. Continuous monitoring is not merely a defensive strategy; it is a vital component of prudent investment management. Statistics indicate that organizations utilizing continuous monitoring systems experience a significant reduction in monetary discrepancies, thereby enhancing overall stability. Notably, fintech innovations in countries such as Kenya and India have greatly improved access to funds, illustrating broader trends in economic monitoring systems.

Experts emphasize the necessity of establishing these systems, particularly in 2025, as the economic landscape becomes increasingly complex. As Michelle Chibogu Nezianya notes, "This study investigates the influence of technology in finance (fintech) on improving access to capital for unbanked and underbanked communities," underscoring the critical role of ongoing observation in this context. Furthermore, enterprises employing adaptive AI models for monetary threat management have successfully navigated evolving challenges, demonstrating the effectiveness of automated retraining procedures in keeping threat management strategies relevant and resilient. By maintaining a vigilant oversight approach, companies can swiftly identify and address monetary threats, which aids in bankruptcy risk reduction. Proactive financial risk control is essential to protect against adverse outcomes that could diminish investment value.

Conclusion

Comprehensive turnaround consulting equips small and medium businesses with essential tools to combat financial instability and mitigate bankruptcy risks. By conducting thorough financial assessments, organizations can pinpoint vulnerabilities and make informed decisions that enhance cash flow and operational viability. The implementation of interim management solutions ensures that businesses remain stable during financial distress, leveraging experienced professionals who navigate immediate challenges while laying the groundwork for long-term recovery.

Moreover, adopting proactive risk management strategies and optimizing cash flow management are critical for safeguarding against potential financial threats. Businesses that embrace flexible budgeting and compliance with financial regulations are better equipped to adapt to changing market conditions, ensuring resilience in an increasingly competitive landscape. The integration of technology solutions further enhances operational efficiency, enabling real-time insights that inform strategic decision-making.

Ultimately, the multifaceted approach to turnaround consulting not only addresses immediate financial concerns but also fosters a sustainable foundation for future growth. By prioritizing continuous monitoring and leveraging the expertise of turnaround consultants, businesses can navigate uncertainty with confidence, positioning themselves for success in a dynamic economic environment. Embracing these strategies is not merely a reactive measure—it's a proactive commitment to securing a prosperous future.

Frequently Asked Questions

What is comprehensive turnaround consulting?

Comprehensive turnaround consulting involves a thorough assessment of an organization’s operations, finances, and market positioning to identify weaknesses and opportunities. Consultants develop tailored strategies to address immediate financial challenges and establish a foundation for sustainable success.

Who can benefit from turnaround consulting services?

Small to medium enterprises, which often face resource constraints when dealing with complex financial issues, can particularly benefit from turnaround consulting services.

What services are included in turnaround consulting?

The services include financial evaluation, interim management, and bankruptcy case oversight, all aimed at enhancing operational efficiency and economic stability.

How does financial evaluation contribute to bankruptcy risk reduction?

Financial evaluation involves a detailed review of cash flow statements, balance sheets, and income statements to uncover trends that could impact economic stability. This understanding helps companies make informed decisions to bolster operational viability and reduce bankruptcy risk.

What strategies can improve cash flow management for small enterprises?

Effective cash flow management strategies include establishing clear payment terms, timely invoicing, and understanding customer payment behaviors, which can lead to improved economic stability and stronger relationships with suppliers and banks.

How do interim leadership solutions aid in financial distress?

Interim leadership solutions provide experienced executives to stabilize operations during financial distress. These professionals assess challenges, implement changes, and ensure essential functions remain intact while developing longer-term strategies.

What is the performance level of interim managers during crises?

Interim managers typically maintain high performance levels, with 96.9% reporting consistent peak performance, which is crucial for effective decision-making during crises.

How do interim managers utilize analytics in the turnaround process?

Interim managers use real-time analytics through a client dashboard to track performance, allowing for prompt adjustments and learning from experiences throughout the turnaround process.

What role do interim managers play in mergers or acquisitions?

Interim managers enhance the success of mergers or acquisitions by ensuring smooth transitions and operational continuity, effectively managing risks, and addressing supply chain challenges.

Why is thorough financial evaluation important for securing loans?

With the average small enterprise loan amount around $663,000, thorough financial evaluations are essential for CFOs to prioritize in order to safeguard their organizations' futures and improve their chances of securing necessary funding.