Overview

The article delineates ten supplier cost reduction strategies that CFOs can implement to enhance financial efficiency and profitability within their organizations. Strategies such as renegotiating vendor contracts and implementing e-procurement software are substantiated by evidence demonstrating how these approaches can yield significant savings and bolster operational effectiveness. Ultimately, these strategies foster a cost-conscious culture that propels sustainable growth.

Introduction

In an increasingly competitive landscape, small and medium businesses are actively pursuing innovative strategies to enhance profitability and streamline operations. Cost reduction consulting has emerged as a vital resource, offering tailored solutions that identify inefficiencies and implement strategic changes. Organizations can leverage a variety of tactics—from renegotiating vendor contracts to embracing e-procurement software—to optimize their financial health.

As businesses navigate the complexities of modern economic challenges, integrating technology and fostering a cost-conscious culture become essential for sustainable growth. This article explores key strategies that can transform financial management practices, ultimately leading to significant cost savings and improved operational efficiency.

Transform Your Small/ Medium Business: Comprehensive Cost Reduction Consulting

Harnessing supplier cost reduction strategies through a comprehensive consulting service can profoundly impact small and medium enterprises. At Transform Your Small/Medium Company, we offer extensive turnaround and restructuring consulting, which includes thorough financial evaluations that identify inefficiencies and implement strategic modifications tailored to each organization’s unique needs. By focusing on customized solutions, companies can adopt supplier cost reduction strategies to streamline operations, reduce overhead, and significantly enhance profitability. Our expertise empowers us to help enterprises save money and boost revenues effectively.

For example, our advisors analyze expenditure trends to propose actionable supplier cost reduction strategies that yield immediate savings while positioning the organization for sustainable long-term growth. Current statistics reveal that businesses implementing supplier cost reduction strategies experience a notable increase in profitability, with many reporting enhanced operational efficiency and diminished liabilities.

Importantly, the supplier cost reduction strategies market is projected to grow at a CAGR of 10.1% from 2025 to 2032, underscoring the growing importance of these consulting services for small and medium enterprises. Furthermore, case studies demonstrate that firms in North America, driven by a competitive market landscape, have successfully leveraged these consulting services to implement supplier cost reduction strategies, optimize expenditures, and achieve remarkable transformations. The insights derived from these case studies will contribute to the development of more effective advisory programs for SMEs, emphasizing the critical role of supplier cost reduction strategies in fostering long-term organizational success.

Renegotiate Vendor Contracts: Unlock Savings with Strategic Negotiation

CFOs must prioritize the regular review and renegotiation of vendor contracts as part of their supplier cost reduction strategies to achieve improved pricing and terms. This strategic process involves:

- A thorough assessment of existing agreements

- A clear understanding of current market rates

- The effective utilization of the company's purchasing power to develop supplier cost reduction strategies

For example, implementing supplier cost reduction strategies such as negotiating volume discounts or extended payment terms can yield substantial savings. Engaging in transparent discussions with vendors not only enhances relationships but also paves the way for more favorable terms over time.

By operationalizing lessons learned from previous negotiations and leveraging real-time analytics, CFOs can continuously monitor vendor performance and identify areas for improvement. In fact, businesses that implement strategic management of travel expenses have reported significant savings while maintaining essential travel activities.

By utilizing automated expense management tools, organizations can pinpoint inefficiencies in spending patterns, further refining their negotiation strategies. On average, companies can achieve savings of 10-20% through effective renegotiation of vendor contracts, which emphasizes the critical nature of supplier cost reduction strategies in driving financial efficiency.

Notably, contract formation, negotiation, and approval account for 18% of a company’s sales cycle, highlighting the importance of this process. As Raymond Tsang, a partner at Bain, states, 'By bringing procurement into the routine process of decision making, the entire leadership team is more attuned to opportunities to liberate cash that can be invested in growth.'

Moreover, employing AI-driven solutions can simplify vendor negotiations and enhance overall expense management, ensuring that CFOs have the necessary resources for effective decision-making. To bolster these efforts, CFOs should adopt a practical approach to data by testing various negotiation methods and assessing their outcomes, enabling continuous improvement in vendor management.

Consolidate Suppliers: Streamline Procurement for Cost Efficiency

Implementing supplier cost reduction strategies can lead to substantial savings for businesses through the consolidation of suppliers. By minimizing the number of suppliers, organizations can effectively utilize supplier cost reduction strategies to negotiate more favorable terms and take advantage of bulk purchasing discounts. This strategy not only simplifies procurement processes but also fortifies supplier relationships, fostering collaboration on product consistency and quality control.

For example, businesses that optimize their supplier network often find that it costs up to $1,400 in internal expenses to identify, onboard, and manage transactions with each new supplier. By focusing on fewer providers who can meet multiple requirements, companies can markedly reduce administrative expenses and enhance overall supply chain efficiency.

Successful case studies illustrate that leveraging data analytics for decision-making supports sourcing costs and supplier evaluation, which are key components of supplier cost reduction strategies, enabling companies to optimize vendor relationships. This leads to targeted cost improvements and increased resilience during supply chain disruptions.

Our team advocates for a shortened decision-making cycle during the turnaround process, facilitating decisive actions that sustain organizational health. Moreover, we consistently track the success of our strategies through a client dashboard that provides real-time analytics, ensuring effective supplier management and compliance with service-level agreements.

Ultimately, supplier consolidation is a powerful strategy for small enterprises aiming to achieve financial efficiency and operational effectiveness in 2025.

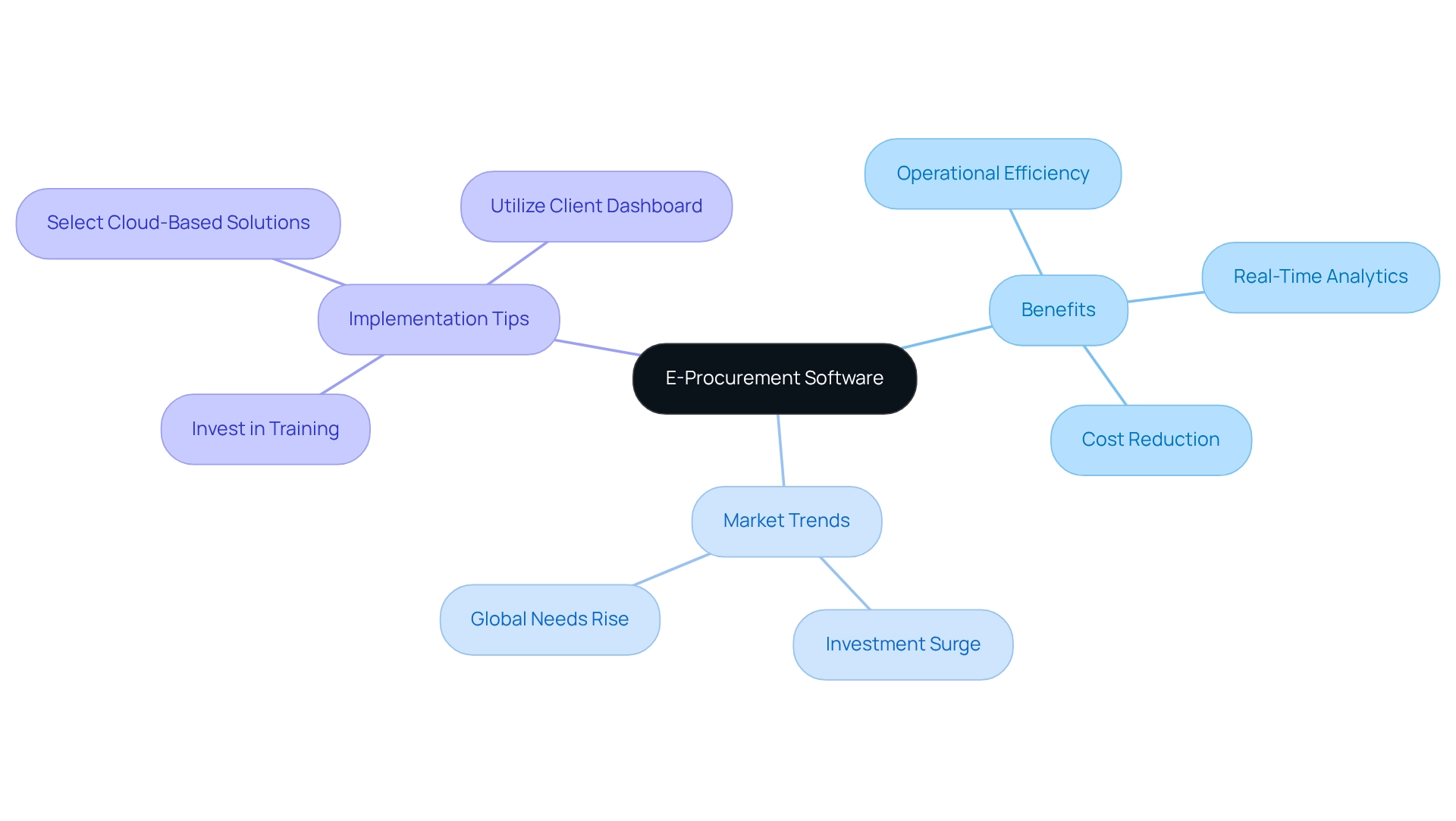

Implement E-Procurement Software: Automate and Reduce Costs

Implementing e-procurement software can revolutionize purchasing processes and support supplier cost reduction strategies. These systems automate critical tasks such as order processing, invoice management, and supplier communications, resulting in enhanced accuracy and operational efficiency. For instance, organizations adopting cloud-based procurement solutions have reported significant improvements in operational efficiency, with many planning to increase investments in multi-cloud and hybrid cloud systems. This shift is indicative of a broader trend, as the procurement software market is projected to grow significantly, fueled by a 10.6% rise in global procurement needs amid a shortage of skilled professionals.

Moreover, the Canadian market is anticipated to see a significant increase due to a surge in investment by procurement software vendors, highlighting the growing importance of these solutions. By utilizing e-procurement software, organizations gain real-time insight into expenditures, promoting informed decision-making and compliance with budgetary limits. This real-time analytics capability allows CFOs to continuously monitor business health through a client dashboard, enabling them to adjust strategies as needed and ensure that procurement decisions align with overall business objectives. The automation of routine tasks not only streamlines operations but also allows staff to concentrate on strategic initiatives that drive growth. CFOs have observed that automating purchasing processes results in enhanced compliance and savings, establishing e-procurement as a crucial instrument for contemporary financial management, especially in implementing supplier cost reduction strategies. As organizations progressively automate their procurement activities, the advantages of adopting e-procurement software for expense reduction become increasingly evident. However, it is essential for CFOs to recognize that the numbers game can often be perceived as tedious by procurement managers, who are more familiar with negotiations and sourcing.

To effectively implement e-procurement software, CFOs should consider the following actionable tips:

- Invest in training for procurement staff to enhance their comfort with data systems.

- Evaluate and select cloud-based solutions that align with organizational needs.

- Utilize the client dashboard to monitor and analyze procurement data regularly, identifying areas for further savings and ensuring continuous improvement.

By addressing these aspects, CFOs can ensure a smoother transition to automated procurement processes while fostering a culture of strategic decision-making.

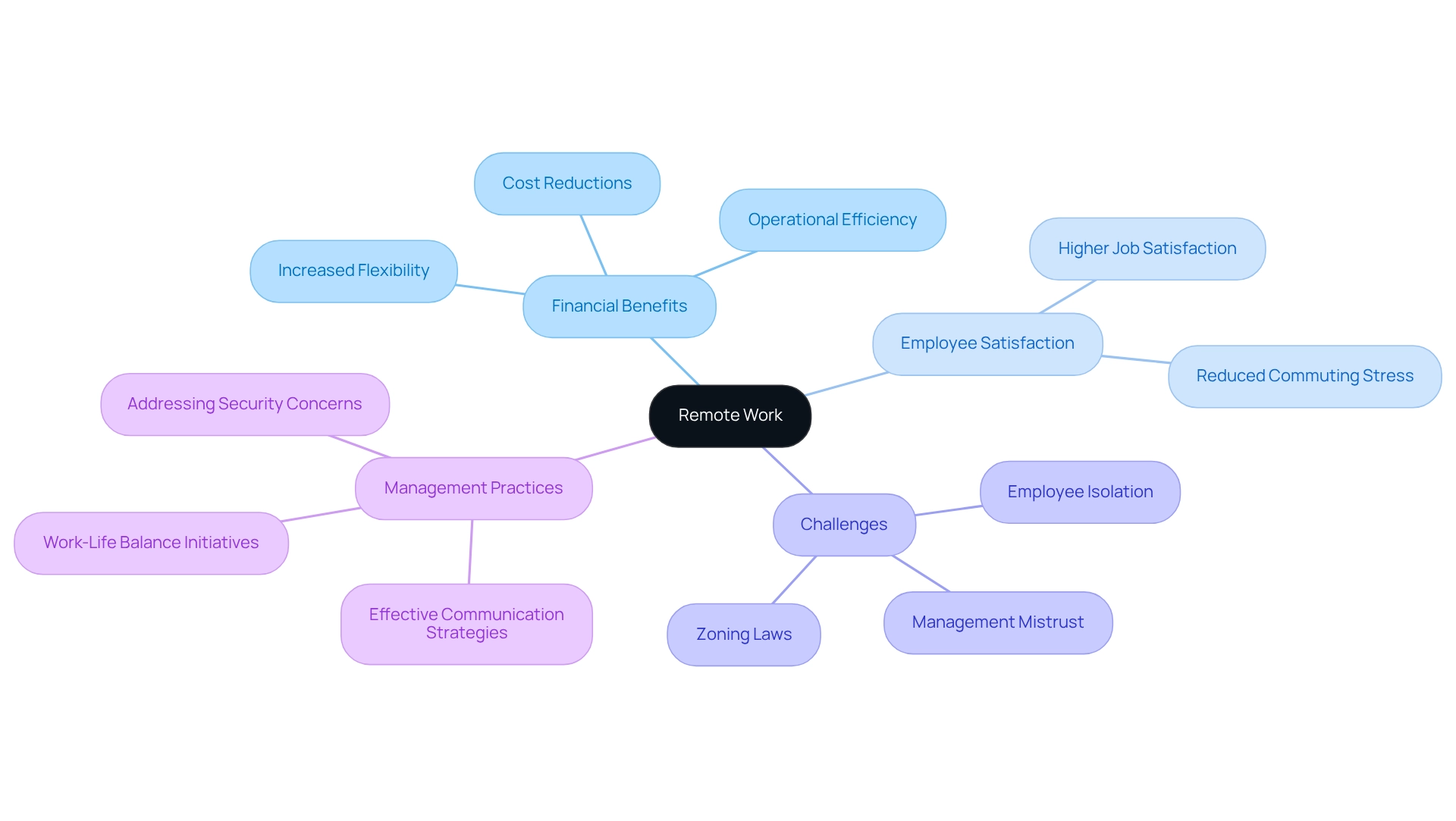

Embrace Remote Work: Cut Overhead and Increase Flexibility

Implementing remote work strategies can lead to substantial reductions in expenses tied to physical office spaces. Companies can significantly lower costs related to rent, utilities, and office supplies, all while enhancing employee flexibility and satisfaction. For example, transitioning to a hybrid work model allows companies to minimize their office space, resulting in decreased operational expenses.

However, organizations must also address challenges associated with telecommuting, such as management mistrust and potential employee isolation, which may impact productivity and morale. Furthermore, local zoning laws can restrict home office setups, adding another layer of complexity to remote work implementation.

Despite these challenges, remote work has been associated with improved productivity; employees often report higher job satisfaction and reduced stress from commuting. Notably, 90% of security personnel in large organizations do not perceive home-based workers as a security risk, indicating a shift in perception that bolsters remote work initiatives. Effectively addressing security concerns can further amplify the financial benefits of remote work.

As organizations embrace these changes, they can uncover new avenues for savings and operational efficiency by implementing supplier cost reduction strategies. Nonetheless, it is crucial to acknowledge that 22% of employees struggle to disengage from work at the end of the day, highlighting the necessity for effective management practices to sustain productivity and satisfaction.

Review and Renegotiate Office Leases: Optimize Real Estate Expenses

Regularly reviewing and renegotiating office leases is essential for businesses aiming to optimize their real estate expenses. As market conditions evolve, companies can uncover opportunities to secure lower rental rates or more favorable lease terms. For instance, negotiating shorter lease terms or reducing the leased space can align real estate commitments with current operational needs. This proactive approach not only improves monetary flexibility but can also result in significant savings.

Successful renegotiations have demonstrated average savings of up to 30% on real estate expenses, as highlighted in various case studies. By nurturing a cost-aware environment, organizations enable employees to participate in fiscal discipline, ultimately utilizing collective creativity for supplier cost reduction strategies.

Moreover, with the aid of real-time business analytics, CFOs can consistently oversee the success of their renegotiation plans and modify them as needed, ensuring that they stay aligned with the company's fiscal objectives. The incorporation of real-time analytics enables a reduced decision-making cycle, permitting faster modifications to lease approaches based on current data.

As mentioned in a recent case study, promoting a cost-conscious culture can significantly improve fiscal discipline across the organization. Furthermore, with 58% of industry experts expecting that flexible workspace will make up more than 10% of their portfolios in the upcoming years, adjusting lease approaches to align with these trends is essential for ongoing financial stability.

As Teddy Collins, Vice President of Finance at SeatGeek, stated, "With fully integrated spend management and travel, we were able to reduce T&E expenses by 50% with only a 15% decrease in travel." This emphasizes the significance of integrated strategies and real-time analytics in attaining supplier cost reduction strategies.

Leverage Accounting Automation: Enhance Efficiency and Cut Costs

Harnessing accounting automation is essential for boosting efficiency and adopting supplier cost reduction strategies. Automated systems streamline processes such as invoicing, expense tracking, and financial reporting, significantly decreasing reliance on manual input and minimizing potential errors. Organizations that adopt automated accounting solutions frequently experience accelerated month-end closes and enhanced cash flow management, crucial for mastering the cash conversion cycle.

Specific strategies include:

- Optimizing invoice processing times

- Improving cash flow forecasting

These strategies directly contribute to better management of working capital. This efficiency not only conserves valuable time but also empowers finance teams to concentrate on supplier cost reduction strategies rather than routine tasks. Indeed, research shows that automation can lead to a significant decrease in operational expenditures, with numerous enterprises adopting supplier cost reduction strategies that support sustainable development and enhanced productivity.

Notably, 54% of AI projects successfully scale from pilot to production, underscoring the broader success of automation initiatives, including accounting. Additionally, a case study on the overall benefits of AP automation highlights how this shift not only cuts costs through supplier cost reduction strategies but also enhances productivity, supporting organizations in achieving operational efficiency.

As CFOs increasingly acknowledge the significance of aligning automation with organizational needs, it is essential to emphasize that automation is crucial for fostering positive results in accounting and enabling streamlined decision-making. The 'Decide & Execute' framework further emphasizes the need for quick, informed decisions in the automation process. Consequently, the transition to automated systems becomes a pivotal strategy for driving financial efficiency and effectiveness, especially considering that 60% of an employee’s day is spent on 'work about work' instead of skilled work.

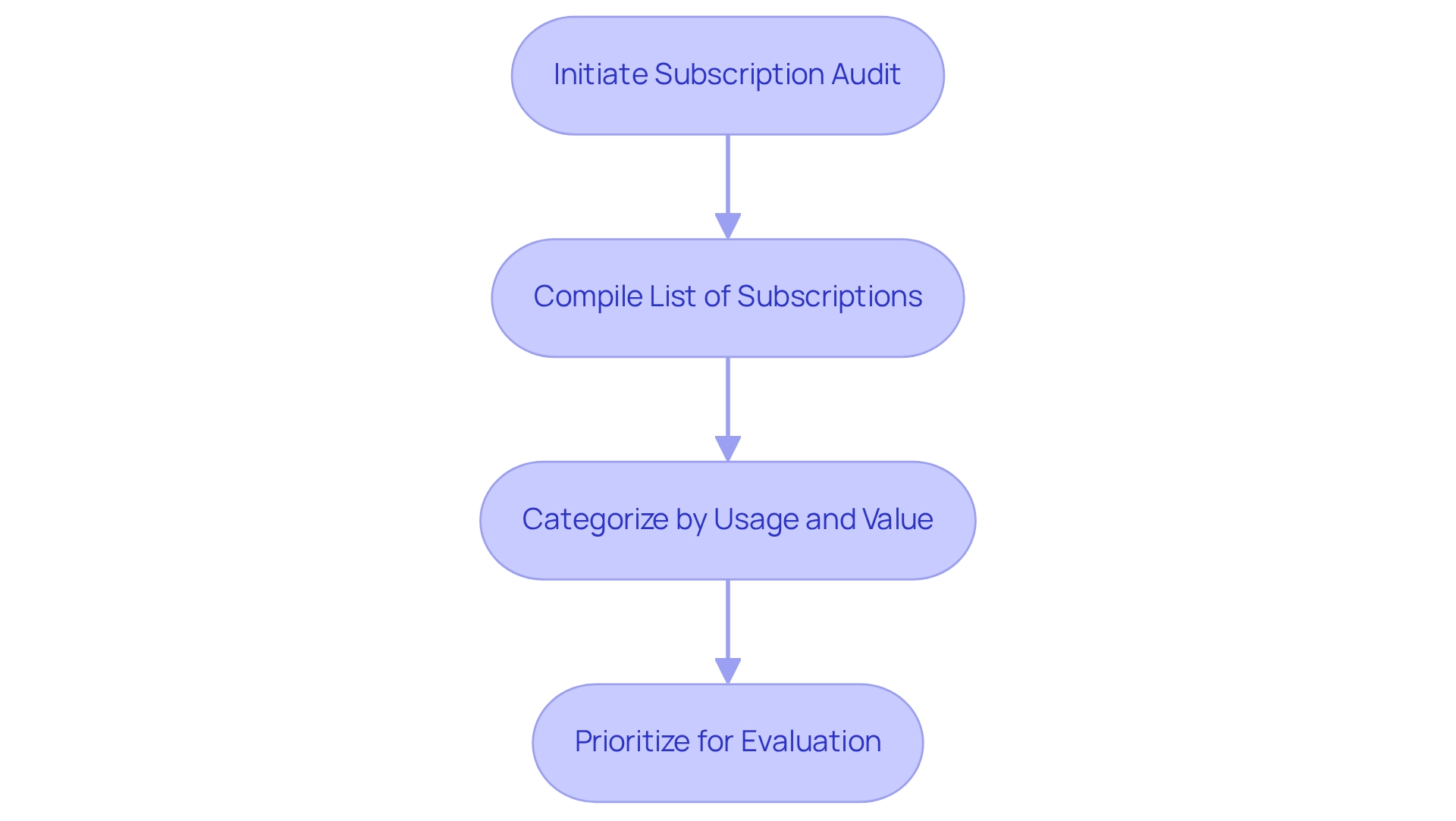

Review and Reduce Subscriptions: Eliminate Unnecessary Costs

Consistent evaluation of subscriptions is essential for companies aiming to identify and eliminate unnecessary expenses. Many organizations inadvertently continue to pay for services that no longer meet their needs. A thorough audit of all subscriptions can uncover opportunities to cancel those that do not provide adequate value.

For example, a company might discover it is financing multiple software licenses with overlapping functionalities, enabling consolidation and significant cost savings. Indeed, audits have shown that approximately 30% of subscriptions may be deemed unnecessary, highlighting a considerable opportunity for savings.

As the subscription economy evolves, with over one in four users employing tools to monitor and terminate subscriptions, companies must adapt by reassessing their ongoing costs. The average monthly churn rate for subscriptions is 4.1%, emphasizing the frequency of cancellations and the critical nature of regular audits. Furthermore, economic pressures have led to 27.1% of respondents terminating subscriptions due to the rising cost of living, underscoring the need for companies to remain proactive in managing their subscriptions.

This proactive strategy not only streamlines operations but also implements supplier cost reduction strategies to align spending with current organizational needs, ultimately fostering a more sustainable economic model.

To enhance this process, CFOs can implement supplier cost reduction strategies by utilizing real-time analytics through a client dashboard that continuously tracks subscription usage and performance. This dashboard offers insights into subscription value, empowering CFOs to make informed decisions that facilitate a streamlined decision-making cycle.

To effectively initiate a subscription audit, CFOs should begin by:

- Compiling a comprehensive list of all current subscriptions.

- Categorizing them by usage and value.

- Prioritizing those that require further evaluation.

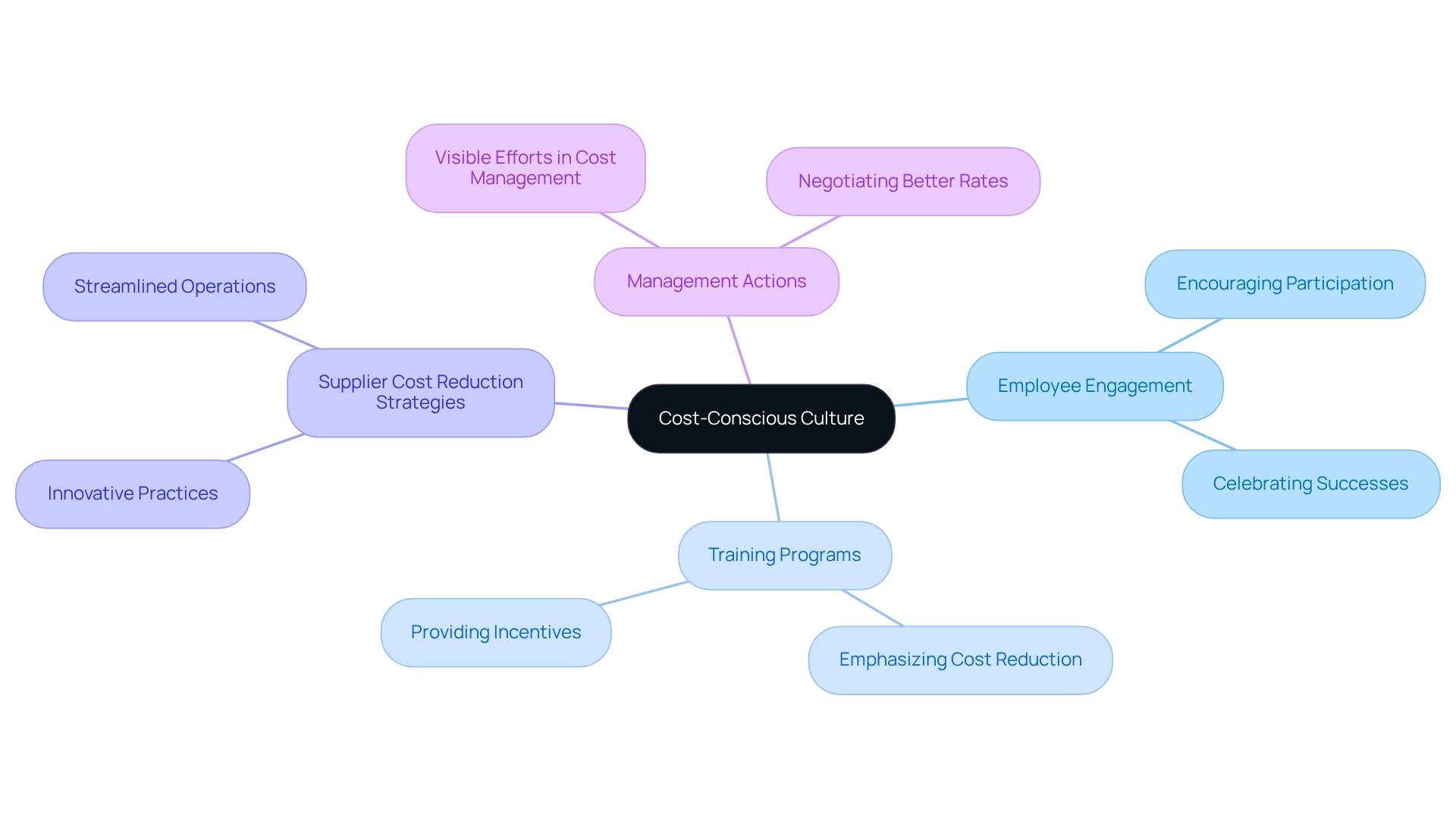

Promote a Cost-Conscious Culture: Foster Savings Mindset Across Teams

Cultivating a cost-conscious culture within an organization can enhance supplier cost reduction strategies and yield substantial savings. By fostering a mindset of fiscal responsibility among employees, businesses can unlock innovative supplier cost reduction strategies and cost-saving practices. Implementing training programs that emphasize the significance of supplier cost reduction strategies is essential, as is providing incentives for employees who identify savings opportunities. This collaborative method not only increases engagement but also supports supplier cost reduction strategies to improve economic performance.

For example, organizations like Secoda have successfully fostered a cost-conscious culture by centralizing information and automating processes, enabling teams to analyze cost-related data effectively. Such initiatives, including supplier cost reduction strategies, have led to streamlined operations and a culture of fiscal accountability, ultimately resulting in improved collaboration and informed decision-making. Encouraging employee participation in supplier cost reduction strategies and celebrating their successes can further reinforce this culture, driving ongoing commitment to financial prudence across all levels of the organization.

As one expert noted, "When management makes a visible effort to manage travel expenses or negotiate for better rates, it sends a powerful message to the rest of the organization." Additionally, with the Consumer Price Index (CPI) reflecting changes in the average price level of consumer goods and services, fostering a cost-conscious culture becomes increasingly vital for organizations aiming to navigate economic fluctuations effectively.

Reduce Business Travel Expenses: Optimize Travel Budgets

Cutting travel costs is crucial for enhancing overall budgets. Companies can adopt several effective supplier cost reduction strategies, including:

- Establishing travel caps

- Encouraging early bookings

- Leveraging technology for efficient travel management

For instance, negotiating corporate rates with airlines and hotels can yield significant savings. The case study on technological developments in business travel emphasizes the potential of artificial intelligence to improve efficiency in travel management, which can further lead to savings.

Moreover, the increase in virtual meetings has changed travel expenditures, with many organizations acknowledging that encouraging remote interactions can significantly reduce travel expenses while preserving productivity. In fact, a notable 79% of employees feel that their company's travel policy prioritizes cost and time savings over employee well-being, underscoring the need for a balanced approach.

As companies get ready for 2024, adopting these approaches will be essential in addressing anticipated budget reductions required to meet 2030 objectives in the U.S. Furthermore, with projected hotel room prices expected to be 11% lower in the first half of 2025 compared to 2024, there is a considerable chance for savings. By implementing supplier cost reduction strategies, CFOs can effectively optimize travel budgets and enhance overall financial performance.

Conclusion

Engaging in comprehensive cost reduction consulting can significantly transform small and medium businesses by identifying inefficiencies and implementing tailored strategic changes. By prioritizing:

- Vendor contract renegotiation

- Consolidating suppliers

- Adopting e-procurement software

organizations can streamline operations and enhance profitability. Each strategy not only drives immediate cost savings but also positions businesses for sustainable growth in an increasingly competitive landscape.

Moreover, fostering a cost-conscious culture is equally vital, as it encourages employees to actively participate in identifying savings opportunities. By promoting financial responsibility and innovative cost-saving practices, organizations can unlock substantial savings while enhancing overall operational efficiency. Embracing remote work and reviewing office lease agreements further contribute to reducing overhead costs, allowing businesses to adapt to evolving market conditions.

Ultimately, leveraging technology, such as accounting automation and e-procurement solutions, is essential for modern financial management. These tools provide real-time insights that empower decision-makers to optimize budgeting and enhance financial performance. As businesses navigate economic challenges, adopting these strategies will not only lead to significant cost reductions but also ensure long-term resilience and success in the ever-changing market landscape.

Frequently Asked Questions

What is the significance of supplier cost reduction strategies for small and medium enterprises?

Supplier cost reduction strategies can significantly impact small and medium enterprises by streamlining operations, reducing overhead, and enhancing profitability through customized solutions.

How does Transform Your Small/Medium Company assist businesses with supplier cost reduction?

Transform Your Small/Medium Company offers extensive consulting services that include financial evaluations to identify inefficiencies and implement strategic modifications tailored to each organization's needs, ultimately helping enterprises save money and boost revenues.

What are the benefits of analyzing expenditure trends in supplier cost reduction?

Analyzing expenditure trends allows advisors to propose actionable supplier cost reduction strategies that yield immediate savings while positioning the organization for sustainable long-term growth.

What is the projected growth rate for the supplier cost reduction strategies market?

The supplier cost reduction strategies market is projected to grow at a CAGR of 10.1% from 2025 to 2032, indicating its increasing importance for small and medium enterprises.

How can CFOs improve pricing and terms through vendor contracts?

CFOs can achieve improved pricing and terms by regularly reviewing and renegotiating vendor contracts, which involves assessing existing agreements, understanding current market rates, and utilizing purchasing power.

What savings can businesses expect from effective renegotiation of vendor contracts?

Companies can achieve savings of 10-20% through effective renegotiation of vendor contracts, highlighting the importance of supplier cost reduction strategies in driving financial efficiency.

What role does automation play in expense management and vendor negotiations?

Automated expense management tools help organizations identify inefficiencies in spending patterns and enhance negotiation strategies, simplifying vendor negotiations and improving overall expense management.

How does supplier consolidation contribute to cost reduction?

Supplier consolidation allows businesses to minimize the number of suppliers, negotiate more favorable terms, and take advantage of bulk purchasing discounts, leading to reduced administrative expenses and enhanced supply chain efficiency.

What is the impact of leveraging data analytics in supplier cost reduction strategies?

Leveraging data analytics supports sourcing costs and supplier evaluation, enabling companies to optimize vendor relationships, achieve targeted cost improvements, and increase resilience during supply chain disruptions.

How does Transform Your Small/Medium Company track the success of its strategies?

The company tracks the success of its strategies through a client dashboard that provides real-time analytics, ensuring effective supplier management and compliance with service-level agreements.