Overview

Interim restructuring officers possess the power to transform businesses by offering expert guidance during critical transitions. Their ability to facilitate swift operational changes not only stabilizes but also enhances performance. This article delves into their multifaceted roles, encompassing:

- Crisis management

- Financial assessments

- Stakeholder engagement

It illustrates how their strategic interventions significantly improve cash flow, operational efficiency, and foster long-term organizational resilience.

Introduction

In an increasingly volatile business landscape, small and medium enterprises confront unique challenges that can jeopardize their very existence. Interim restructuring officers (IROs) emerge as vital allies during these turbulent times, offering a wealth of experience and an objective perspective capable of transforming a company's trajectory. By conducting in-depth assessments and implementing tailored strategies, IROs not only stabilize operations but also lay the groundwork for sustainable growth. Their multifaceted approach addresses immediate concerns, from enhancing cash flow management to rebuilding stakeholder trust, while paving the way for long-term success. As organizations grapple with financial distress and operational inefficiencies, the expertise of IROs becomes indispensable in navigating crises and driving impactful change.

Transform Your Small/ Medium Business: Expert Interim Restructuring Officer Services

Interim restructuring officers are pivotal professionals who enter organizations during critical transitions, bringing a wealth of experience and a fresh perspective. Their expertise empowers companies to implement swift changes that stabilize operations and foster growth.

Investment organizations conduct thorough evaluations of financial stability, which are essential for maintaining cash flow, minimizing obligations, optimizing procedures, and developing strategic plans tailored to address the unique challenges faced by small to medium enterprises. This proactive approach enables organizations to manage crises effectively.

Studies indicate that firms employing investor relations officers experience significantly improved turnaround success rates. For example, during Malaysia's COVID-19 fiscal stimulus initiatives, targeted interventions stabilized affected sectors, illustrating the transformative impact of strategic management in times of crisis.

As Gabriela Oxby, Division Manager at Robert Half, asserts, 'Interim restructuring officers are not mere crisis managers, but also experts who contribute their experience to companies to enhance processes, systems, tools, and teams, elevating them to the next level.'

By leveraging the talents of investor relations professionals, organizations can not only navigate challenging periods but also emerge stronger and more adaptable.

With the comprehensive turnaround and reorganization consulting services offered by Transform Your Small/Medium Company, including bankruptcy case management and the innovative 'Rapid30' plan, organizations can expect a transformative experience that emphasizes operational efficiency and long-term performance enhancement.

Stabilize Operations: Address Immediate Financial Distress

Interim restructuring officers play a crucial role in stabilizing operations during financial distress. They conduct comprehensive assessments to identify cash flow challenges, operational inefficiencies, and potential cost-saving opportunities. Notably, statistics indicate that approximately 54% of U.S. small companies sought a loan or line of credit in 2018, highlighting the prevalence of cash flow issues among small to medium enterprises.

By leveraging real-time analytics through client dashboards, interim restructuring officers can continuously monitor organizational health and make data-driven decisions that help companies regain control over their financial wellbeing. For example, by renegotiating supplier contracts or optimizing inventory management, these professionals can implement swift changes that not only address immediate concerns but also establish a foundation for sustainable growth. This proactive approach is vital in a landscape where timely decision-making can significantly influence outcomes.

Furthermore, it is noteworthy that the healthcare and social assistance sectors boast the highest survival rates among small enterprises, attributed to a steady demand for services. Case studies demonstrate that organizations engaging an interim restructuring officer experience enhanced cash flow management and operational stability, ultimately positioning them for long-term success.

As Jared Sorensen aptly stated, 'Raising business capital is one of the most critical challenges entrepreneurs face when starting or expanding a business,' underscoring the importance of effective financial management during periods of distress.

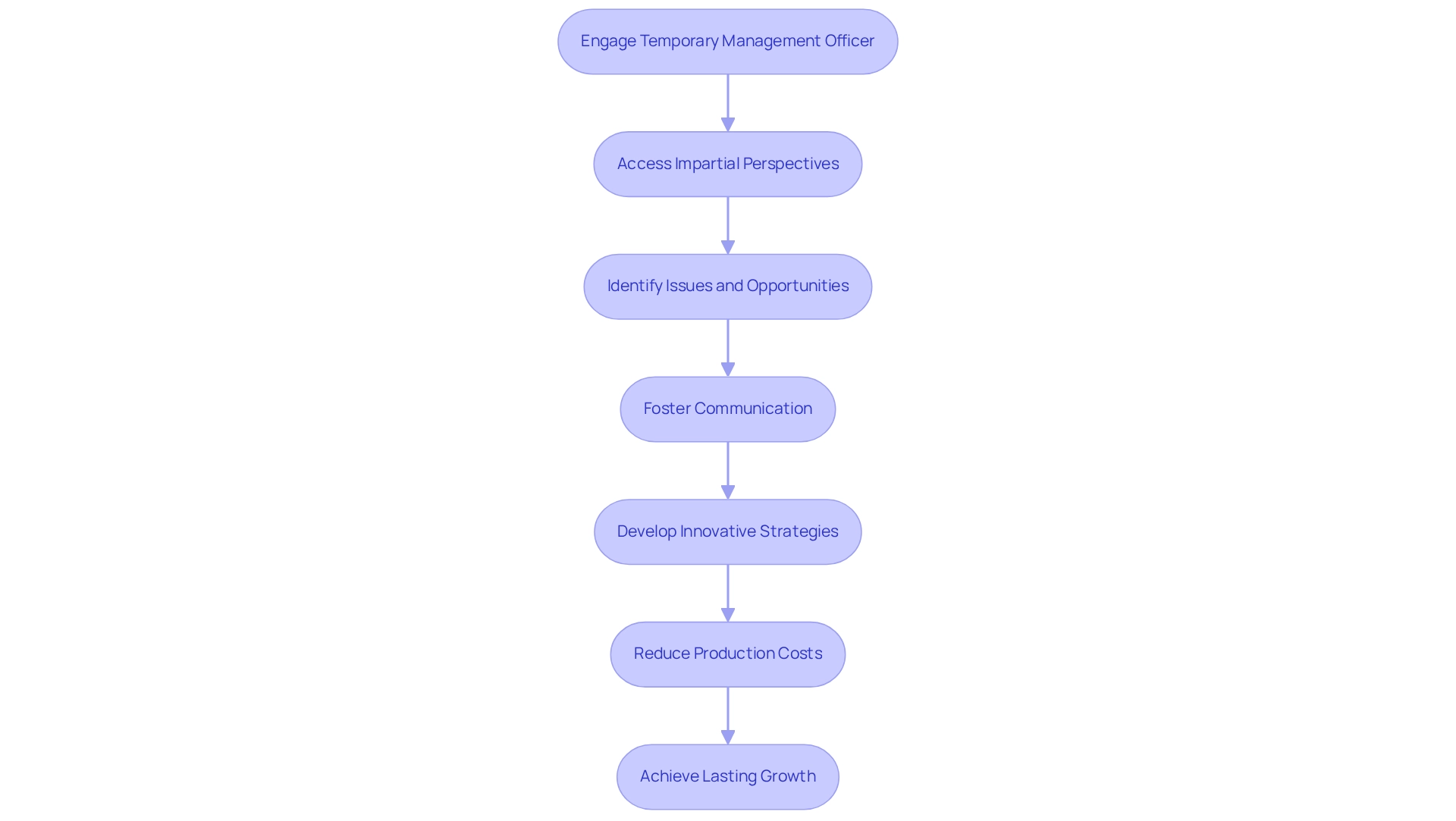

Gain Unbiased Insights: Leverage External Expertise

One of the main advantages of involving a temporary management officer is the access to impartial perspectives. These professionals provide an external viewpoint capable of uncovering underlying issues and opportunities that internal teams may overlook due to their familiarity with the organization. Data indicates that the interim restructuring officer fosters effective communication with stakeholders, including employees, investors, and customers, which is crucial during organizational changes. This external perspective enables organizations to develop innovative strategies that not only enhance operations but also improve overall performance, aligning with effective change management principles that boost adoption and ensure intended results from reorganization. Notably, production costs can be reduced by as much as 15% during the restructuring process when external expertise is applied effectively.

Moreover, the SMB team's 'Rapid30' strategy exemplifies a transformative method, demonstrating how temporary managers can implement lessons learned and consistently track performance through real-time analytics. A satisfied client remarked, "The SMB team's insights were invaluable; they helped us identify cost-saving opportunities that we had missed, leading to a significant improvement in our cash flow."

Case studies reveal that temporary managers play a pivotal role in engaging stakeholders, as highlighted in the case study titled 'Engaging Stakeholders in Turnaround Efforts,' where they organize town hall meetings to discuss recovery plans and align everyone with the organization's goals. By leveraging the knowledge of an interim restructuring officer, companies can address challenges more efficiently and achieve lasting growth.

While hiring a temporary management officer typically incurs an expense that varies based on the range of services, the potential for enhanced cash flow and reduced operational costs often justifies the investment.

Rebuild Stakeholder Trust: Enhance Credibility with Investors

Restoring stakeholder trust is paramount during reorganization efforts. The role of interim restructuring officers is pivotal in enhancing credibility with investors through transparent communication and consistent updates on progress. By employing streamlined decision-making processes and leveraging real-time analytics, they can swiftly address trust-damaging issues—a priority for 32% of executives, as research indicates.

Regular interactions are essential for forging bonds of trust among employees, positively influencing overall stakeholder confidence. Encouraging open discussion and demonstrating a commitment to effective financial management allows organizations to build trust among investors. This proactive engagement not only reassures stakeholders but also lays the groundwork for long-term support and success.

Furthermore, ongoing observation of organizational performance via client dashboards enables temporary officers to modify strategies in real-time, ensuring that stakeholder concerns are addressed promptly. Case studies reveal that trust, once lost, can take years to rebuild, underscoring the necessity of careful relationship management during these critical times.

As Jack Welch aptly stated, "Leadership is the relentless pursuit of truth and ceaseless creation of trust," emphasizing the vital role of trust in effective leadership. Ultimately, the strategies employed by the interim restructuring officer can profoundly affect investor trust, making their position essential in managing the complexities of organizational change.

Drive Operational Turnaround: Enhance Efficiency and Performance

Interim restructuring officers play a crucial role in facilitating operational turnarounds for distressed businesses. They conduct thorough analyses of existing processes to pinpoint inefficiencies and implement best practices that enhance productivity. By concentrating on key performance indicators (KPIs) and ensuring that operations align with strategic objectives, investor relations officers can drive significant improvements in overall performance. A study of Taiwanese semiconductor companies during a financial crisis revealed that applying bootstrap techniques led to notable enhancements in efficiency scores, demonstrating that investor relations officers can effectively identify and implement strategies that yield measurable operational improvements.

Moreover, these professionals utilize various methods to foster operational turnaround, including:

- Streamlining workflows

- Optimizing resource allocation

- Enhancing employee training

A case study in the restaurant industry highlighted how prioritizing customer service through effective staff training not only improved customer satisfaction but also contributed to higher retention rates, ultimately boosting profitability. This transformation was supported by interim restructuring officers who directed the execution of these essential changes, demonstrating their effect on operational success. Statistics show that companies involving interim restructuring officers frequently witness significant operational efficiency enhancements after restructuring. Organizations that focus on enhancing operational agility can free up capital and human resources, which can then be redirected toward innovation and improving customer experiences. This compounding effect on financial performance is critical for long-term sustainability, as noted in recent analyses of operational strategies. Furthermore, IROs are committed to a pragmatic approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term. They support a shortened decision-making cycle throughout the turnaround process, allowing teams to take decisive action to preserve the business.

Successful CFOs emphasize the importance of restructuring efforts in improving efficiency. They acknowledge that temporary management not only tackles current challenges but also establishes the foundation for future growth. As emphasized by ING, the improved operational agility contributed to consistent outperformance in return on equity metrics, highlighting how IROs can assist organizations in navigating crises effectively and emerging stronger, with a clear path toward enhanced operational performance.

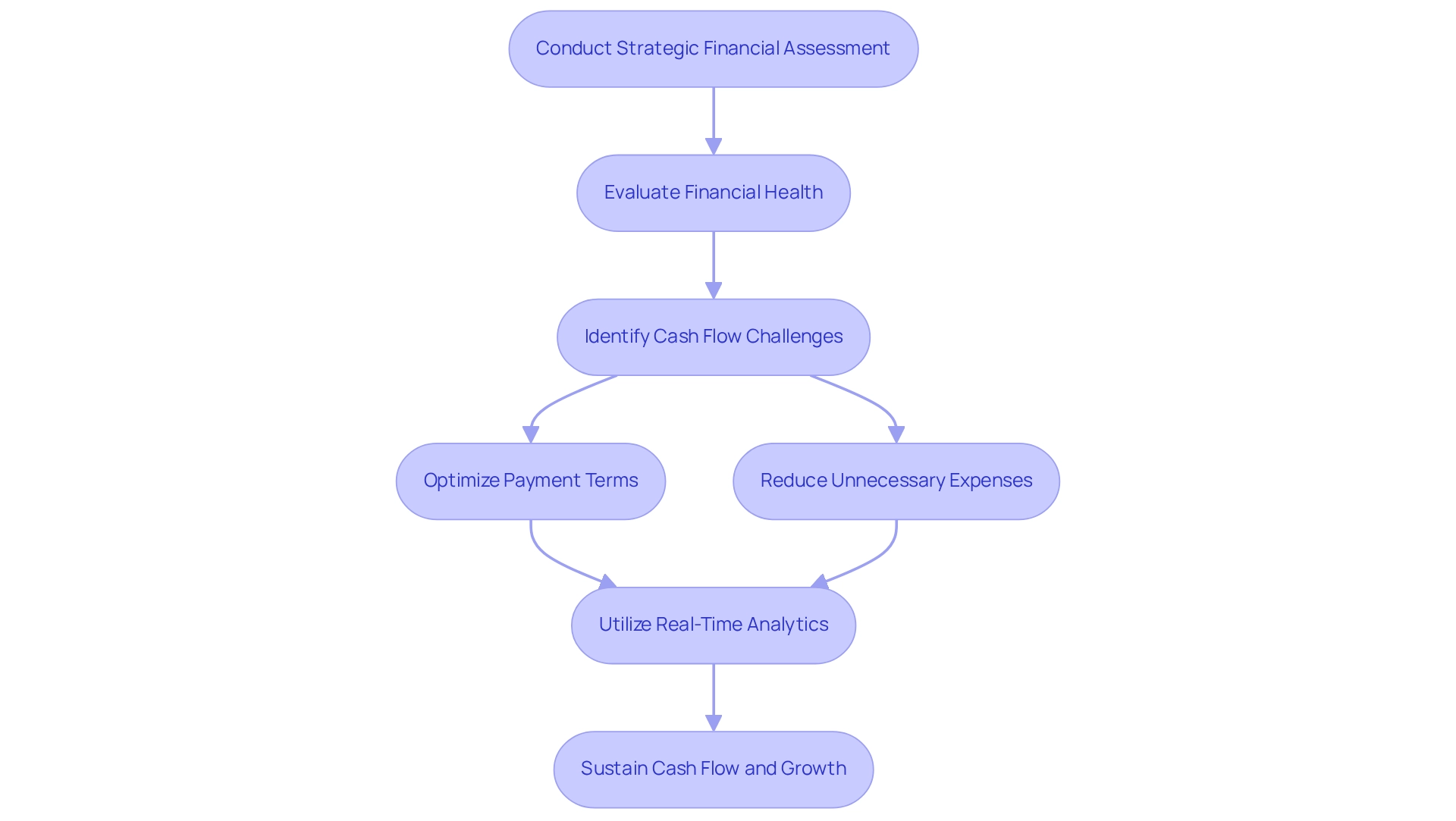

Conduct Strategic Financial Assessments: Preserve Cash Flow

Conduct Strategic Financial Assessments: Preserve Cash Flow

Strategic financial assessments are crucial for interim restructuring officers, as they play a pivotal role in evaluating a company's financial health and identifying cash flow challenges. A significant percentage of small businesses face cash flow issues, underscoring the critical need for effective financial management. These assessments lead to the development of targeted strategies aimed at preserving liquidity. Key techniques include:

- Optimizing payment terms, which can significantly enhance cash flow

- Reducing unnecessary expenses to streamline operations

For instance, an interim restructuring officer might negotiate extended payment terms with suppliers to improve cash flow.

Utilizing the 'Decide & Execute' framework, an interim restructuring officer can make informed decisions quickly. Moreover, the 'Update & Adjust' framework allows for ongoing evaluation and refinement of strategies based on real-time data. Utilizing real-time analytics via client dashboards facilitates ongoing observation of organizational health, permitting rapid modifications to strategies as required. Specific metrics such as:

- Cash flow forecasts

- Accounts receivable aging

- Expense tracking

can be monitored to provide actionable insights. Investigating different funding solutions can offer additional assistance during the reorganization. As Grant Cardone wisely stated, "Avoid debt that doesn’t pay you." By sustaining steady cash flow and applying insights gained from previous experiences, organizations are better prepared to manage the challenges of reorganization and establish themselves for enduring growth ahead. A case study demonstrating the successful implementation of these strategies, such as a company that improved its cash flow by 30% through optimized payment terms and real-time analytics, further illustrates the effectiveness of strategic financial assessments in preserving cash flow.

Manage Complex Debt Restructuring: Negotiate Better Terms

Overseeing intricate debt realignment stands as a pivotal responsibility for temporary officers (IROs), who are instrumental in negotiating favorable terms with creditors. Their expertise empowers them to secure lower interest rates, extend repayment terms, and even achieve debt forgiveness, thereby alleviating financial pressures on struggling enterprises.

Data indicate that companies utilizing temporary executives for debt modification experience notable success rates, with average enhancements in negotiated debt conditions reported at approximately 20%. Effective negotiation strategies are paramount; for instance, an interim restructuring officer can maintain proactive communication with creditors, cultivating goodwill and heightening the probability of attaining mutually beneficial outcomes.

Moreover, investor relations officers leverage real-time analytics to evaluate the effectiveness of their strategies, facilitating rapid adjustments and informed decision-making during the restructuring process. As Thomas H. Curran, Managing Partner at Thomas H. Curran Associates, LLC, asserts, "Effective negotiation is crucial in bankruptcy and insolvency proceedings, as it can lead to significant improvements in a company's financial standing."

A compelling case study exemplifies this: an owner confronting financial difficulties adeptly navigated negotiations by being transparent about their situation, resulting in improved terms and a more manageable debt structure. By applying the lessons learned from these negotiations and continuously monitoring organizational performance through analytics, investor relations officers not only aid companies in restructuring their debts but also pave a smoother path to recovery, ultimately fostering sustainable growth.

Navigate Crisis Management: Implement Effective Solutions

Interim restructuring professionals excel in crisis management, implementing targeted solutions that not only address immediate challenges but also establish a foundation for long-term stability. Their approach often begins with the development of comprehensive crisis response plans tailored to the unique needs of the organization. By enhancing operational resilience, information resource officers ensure that businesses can swiftly adapt to evolving circumstances, minimizing disruptions and maintaining momentum in recovery efforts.

Statistics reveal that companies equipped with a crisis management plan are 3.5 times more likely to recover quickly from setbacks. This underscores the importance of structured preparedness, as highlighted in a case study that examined the gap between theoretical crisis management frameworks and practical readiness. The study advocates for regular simulation exercises and cross-functional training to bolster organizational resilience. These organizations play a crucial role in addressing these gaps by implementing structured training programs and ensuring that teams are well-prepared to execute crisis plans effectively.

Effective crisis management strategies utilized by investor relations officers include proactive communication, decisive leadership, and the establishment of clear priorities. Leadership during crises must model calm and decisive behavior, setting a tone that fosters confidence throughout the organization. As Beth Revis aptly stated, "Power isn’t control at all. Power is strength and giving that strength to others." This viewpoint highlights the significance of empowering team members during difficult periods, a principle that investor relations officers embody in their leadership style.

Moreover, investor relations officers utilize real-time analytics to continually monitor the success of their strategies, allowing for timely updates and adjustments based on performance metrics. Measuring the effectiveness of these strategies through evaluations and key performance indicators (KPIs) is essential for continuous improvement. IROs implement specific metrics to assess the impact of their crisis management strategies, allowing organizations to refine their approaches and ensure they are well-prepared for future challenges. Ultimately, the role of interim restructuring officers is pivotal in transforming crisis situations into opportunities for growth and resilience.

Enhance Communication Strategies: Keep Stakeholders Informed

Effective communication strategies are crucial during organizational changes. Temporary management officials must prioritize clear and consistent communication to keep stakeholders informed about progress, challenges, and changes. By leveraging diverse communication channels—such as newsletters, meetings, and digital platforms—Investor Relations Officers (IROs) can engage all stakeholders, ensuring they are aware of the organization's direction. This approach not only cultivates trust but also enhances collaboration, which is essential for successful transformation.

Research indicates that organizations in the tech industry that maintain transparent communication can see a 10% improvement in employee retention, underscoring the importance of stakeholder engagement across sectors. Moreover, expert insights suggest that while change can induce insecurity, effective leadership and communication can facilitate a smooth transition for teams. As Nick Candito aptly states, "Companies that change may survive, but companies that transform thrive." This highlights the necessity for IROs to focus on transformation rather than simple adaptation.

By applying best practices in communication and incorporating insights from the case study 'Engagement ROI: Quantifying the Value of Stakeholder Involvement,' IROs can significantly enhance stakeholder engagement, ultimately leading to more successful organizational changes. In addition, the SMB team's 'Rapid30' plan exemplifies how a structured approach can result in transformative business experiences, showcasing client satisfaction and professional success. John Wooden's advice resonates here: it is crucial not to allow what cannot be accomplished to hinder what can be achieved, emphasizing the importance of focusing on practical strategies during reorganization.

Achieve Long-Term Success: Invest in Interim Restructuring Expertise

Investing in an interim restructuring officer for temporary organizational expertise is essential for achieving sustained success. These professionals, including the interim restructuring officer, tackle immediate challenges while establishing a robust foundation for sustainable growth. By implementing strategic changes and enhancing operational efficiency, temporary management officials not only optimize costs—potentially reducing production expenses and improving profit margins through lean manufacturing techniques—but also build stakeholder trust. This enables organizations to navigate crises effectively and emerge stronger.

Organizations that utilize this expertise, particularly through the comprehensive turnaround and consulting services offered by Transform Your Small/Medium Business, are better prepared to thrive in a competitive environment. Our team, boasting over 100 years of combined experience, has successfully implemented the 'Rapid30' plan, showcasing significant improvements in operational performance and profitability.

As Steve Collins, Acting Operations Director, observes, 'Employing a temporary company director provides several advantages, including their extensive knowledge in organizational transformation and change management.' The long-term benefits of involving an interim restructuring officer include increased resilience, improved financial health, and a clear pathway to growth.

Furthermore, defining specific requirements and objectives is crucial for selecting the right interim restructuring officer to meet a company's needs. Thus, these professionals are invaluable assets in today's dynamic business environment.

Conclusion

Engaging interim restructuring officers (IROs) represents a vital strategy for small and medium enterprises grappling with financial distress and operational hurdles. These professionals offer invaluable expertise and a fresh perspective, essential for stabilizing operations and fostering sustainable growth. By conducting thorough assessments and implementing targeted strategies, IROs effectively tackle immediate concerns such as cash flow management and operational inefficiencies, ultimately positioning organizations for long-term success.

The multifaceted approach of IROs not only enhances financial health through strategic financial assessments but also rebuilds stakeholder trust via transparent communication and engagement. Their capacity to provide unbiased insights and facilitate effective crisis management cultivates a culture of resilience and adaptability within organizations. Case studies illustrate that businesses leveraging the expertise of IROs frequently experience substantial improvements in operational efficiency and performance, critical for navigating today’s complex business landscape.

Ultimately, investing in interim restructuring expertise transcends mere crisis management; it constitutes a proactive measure towards sustained growth and operational excellence. As companies embrace the transformative potential of IROs, they empower themselves to thrive in an increasingly competitive environment, ensuring they are not only surviving but also positioning themselves for future success.

Frequently Asked Questions

What is the role of interim restructuring officers?

Interim restructuring officers are professionals who help organizations during critical transitions by providing expertise to implement swift changes that stabilize operations and foster growth.

How do investment organizations support small to medium enterprises?

Investment organizations evaluate financial stability to maintain cash flow, minimize obligations, optimize procedures, and develop strategic plans tailored to the unique challenges faced by small to medium enterprises, enabling effective crisis management.

What impact do investor relations officers have on firms?

Studies show that firms employing investor relations officers experience significantly improved turnaround success rates, particularly evident during crisis interventions, such as Malaysia's COVID-19 fiscal stimulus initiatives.

How do interim restructuring officers enhance organizational processes?

According to Gabriela Oxby, they not only manage crises but also contribute their experience to enhance processes, systems, tools, and teams within the organization.

What services does Transform Your Small/Medium Company offer?

They provide comprehensive turnaround and reorganization consulting services, including bankruptcy case management and the 'Rapid30' plan, focusing on operational efficiency and long-term performance enhancement.

What challenges do small companies face regarding cash flow?

Approximately 54% of U.S. small companies sought loans or lines of credit in 2018, indicating the prevalence of cash flow issues among small to medium enterprises.

How do interim restructuring officers use real-time analytics?

They utilize client dashboards to monitor organizational health and make data-driven decisions, helping companies regain control over their financial wellbeing through actions like renegotiating supplier contracts or optimizing inventory management.

Which sectors have the highest survival rates among small enterprises?

The healthcare and social assistance sectors have the highest survival rates, attributed to a steady demand for their services.

What is the significance of involving a temporary management officer?

They provide impartial perspectives that can uncover underlying issues and opportunities, fostering effective communication with stakeholders and enhancing overall performance during organizational changes.

How can temporary managers reduce production costs?

Effective application of external expertise during the restructuring process can lead to a reduction in production costs by as much as 15%.

What is the 'Rapid30' strategy?

It is a transformative method employed by the SMB team that demonstrates how temporary managers can implement lessons learned and consistently track performance through real-time analytics.

How do temporary managers engage stakeholders?

They organize town hall meetings to discuss recovery plans and align stakeholders with the organization’s goals, facilitating a more efficient response to challenges.

Is hiring a temporary management officer cost-effective?

While there is an associated expense, the potential for enhanced cash flow and reduced operational costs often justifies the investment.