Overview

CFOs can drive success through three executive turnaround strategies:

- Conducting thorough financial assessments

- Leveraging interim management

- Implementing strategic planning

These strategies involve detailed financial evaluations to identify issues, stabilizing leadership during transitions, and developing actionable plans aligned with the organization's vision. Such approaches are essential for navigating challenges and fostering long-term growth. Moreover, by focusing on these key areas, CFOs can not only address immediate concerns but also set the foundation for sustainable success.

Introduction

In the dynamic landscape of business, organizations frequently encounter pivotal moments that demand decisive action to address financial distress and operational inefficiencies. For CFOs, the journey toward a successful turnaround relies on a multifaceted strategy that includes:

- Comprehensive financial assessments

- Strategic interim management

- Robust planning

By meticulously evaluating financial health, leveraging seasoned leaders, and developing actionable strategies, companies can stabilize their current operations and establish a foundation for sustained growth. This article explores the essential steps CFOs can undertake to drive effective turnarounds, ensuring their organizations emerge stronger and more resilient in the face of challenges.

Conduct Thorough Financial Assessments for Effective Turnarounds

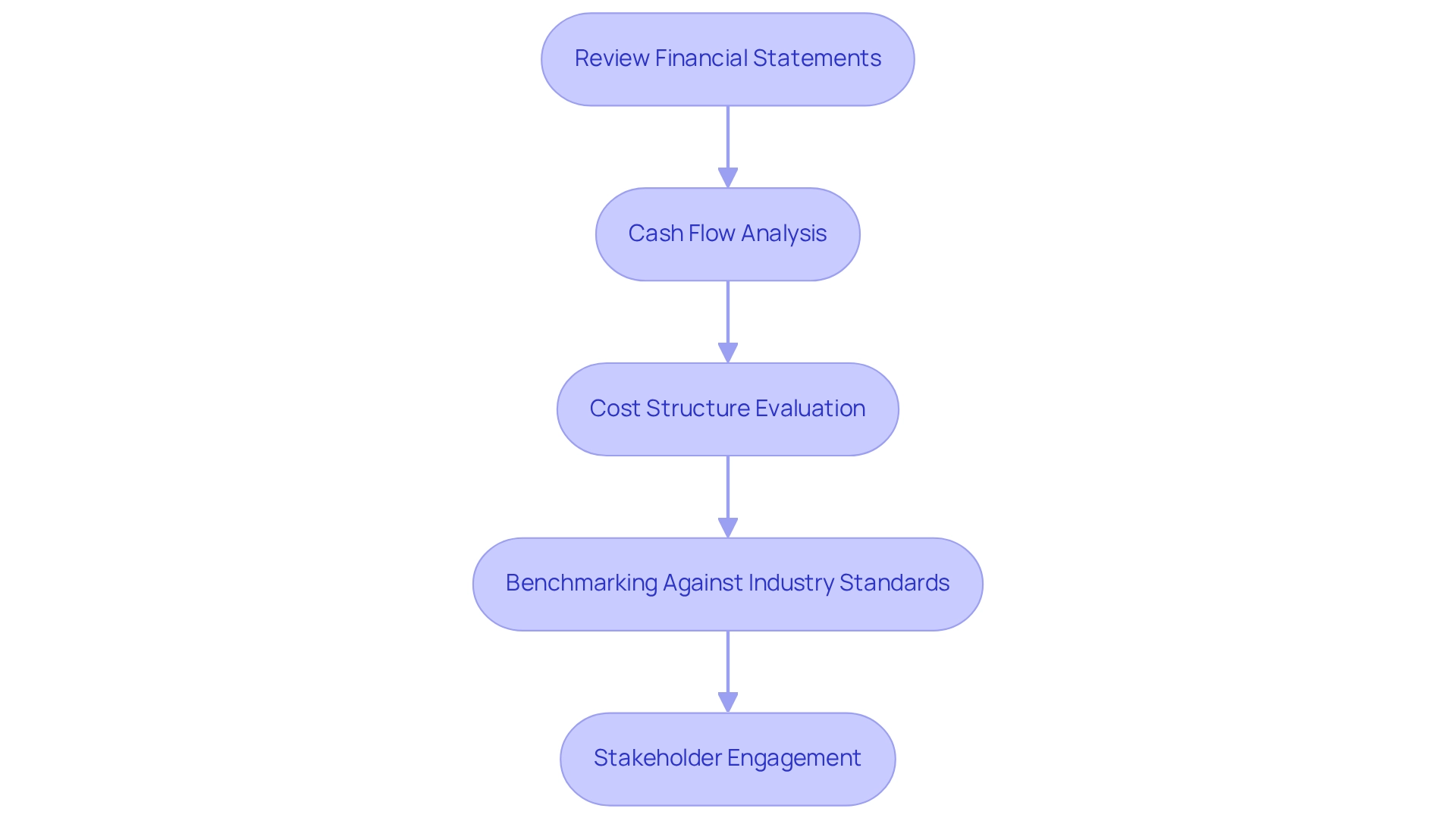

To initiate a successful turnaround, CFOs must conduct a detailed financial assessment that includes:

-

Reviewing Financial Statements: Analyze balance sheets, income statements, and cash flow statements to recognize trends and anomalies. Look for patterns in revenue, expenses, and profitability, utilizing AI-driven analytics to enhance accuracy and speed.

-

Cash Flow Analysis: Focus on cash flow projections to understand liquidity issues. Determine if the business can meet its short-term obligations and recognize periods of cash shortfall, employing real-time analytics to monitor cash flow dynamics continuously.

-

Cost Structure Evaluation: Break down fixed and variable costs to identify areas where expenses can be reduced without sacrificing quality or service. This may involve renegotiating contracts or eliminating non-essential expenditures, guided by data-driven insights from performance monitoring tools.

-

Benchmarking Against Industry Standards: Compare financial metrics with industry benchmarks to gauge performance. This can emphasize areas where the business is lacking and offer insights into possible enhancements, backed by AI/ML approaches that provide predictive analytics.

-

Stakeholder Engagement: Involve key stakeholders in the assessment process to gather insights and foster buy-in for future changes. This joint method can improve the precision of the evaluation and enable more seamless execution of plans, ensuring that insights gained during the recovery process are applied effectively, particularly through executive turnaround strategies.

By performing these evaluations, CFOs can develop a clear understanding of the organization's financial condition, which is crucial for formulating focused recovery plans that utilize technology for enhanced decision-making and performance tracking. Furthermore, integrating insights from the Business Valuation Report and expert advice from Peter Griscom, David Bates, and Chase Hudson will further enhance the recovery plans and implement the lessons learned.

Leverage Interim Management to Stabilize Leadership and Drive Change

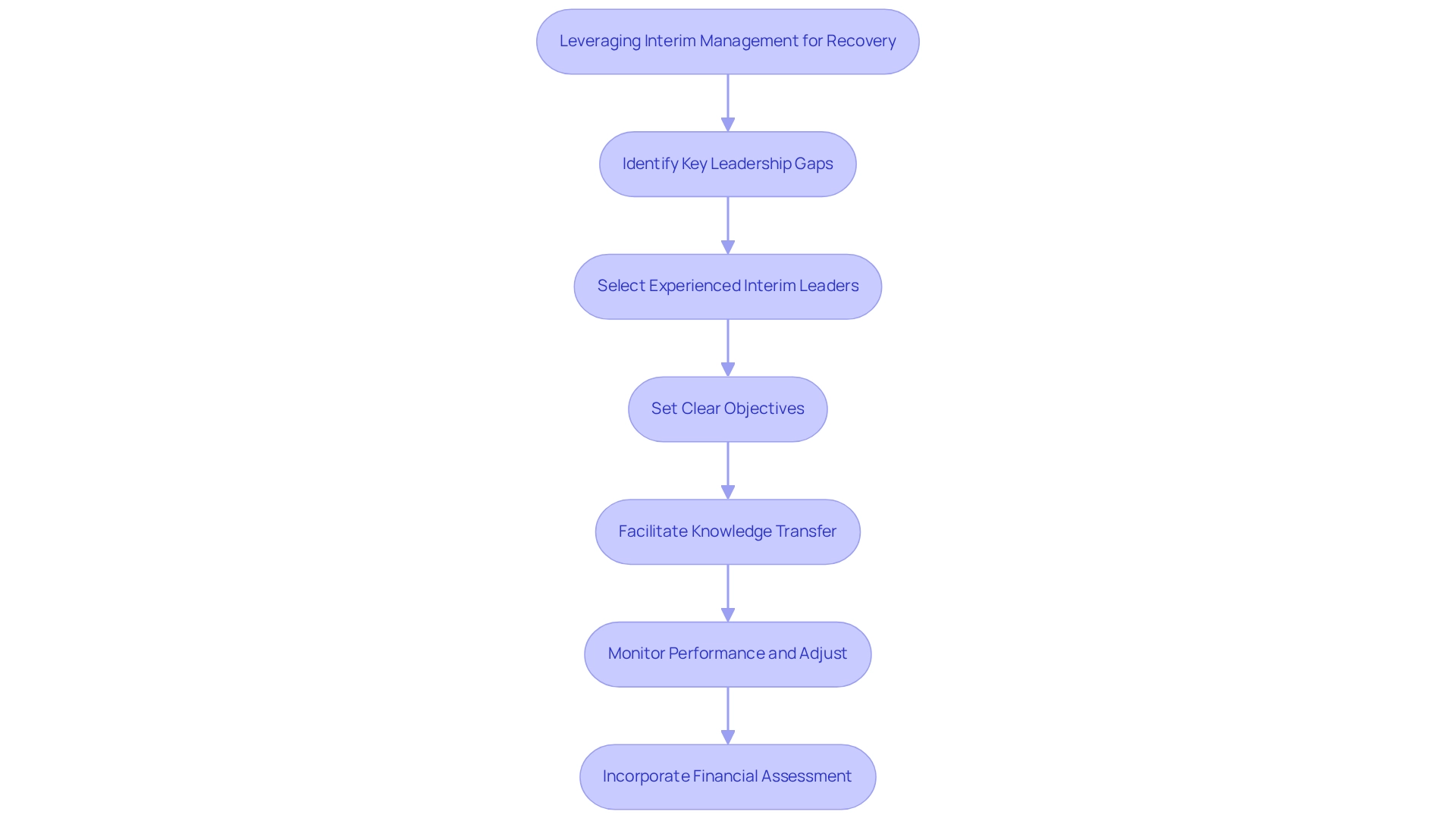

To effectively utilize interim management during a recovery, CFOs should consider the following strategies:

-

Identify Key Leadership Gaps: Assess the current leadership structure to identify critical roles that need immediate attention. This may include positions such as CFO, COO, or department heads.

-

Select Experienced Interim Leaders: Choose interim executives with a demonstrated history in recovery situations. Their experience can provide the necessary guidance and stability during turbulent times, ensuring that your organization can navigate challenges effectively.

-

Set Clear Objectives: Define specific goals and expectations for interim leaders. This clarity will help them focus on critical areas that require immediate attention and drive results quickly, aligning with the executive turnaround strategies.

-

Facilitate Knowledge Transfer: Ensure that interim leaders document their processes and decisions to facilitate a smooth transition when permanent leaders are appointed. This can help maintain continuity and prevent loss of institutional knowledge, which is vital for long-term success.

-

Monitor Performance and Adjust as Needed: Regularly evaluate the performance of interim leaders against established objectives. Be ready to make modifications to plans or personnel if the desired outcomes are not being achieved. Utilizing real-time analytics can enhance this monitoring process, allowing for quick decision-making and operational adjustments.

-

Incorporate Financial Assessment and Bankruptcy Case Management: Utilize financial assessment tools to recognize areas of concern and potential recovery strategies. Additionally, consider bankruptcy case management services as part of executive turnaround strategies to navigate complex financial situations effectively.

By effectively utilizing interim management as one of the executive turnaround strategies, organizations can stabilize operations, maintain momentum, and implement necessary changes while searching for long-term leadership solutions. This approach not only addresses immediate challenges but also sets the foundation for sustainable growth and operational efficiency, tailored specifically for small to medium businesses.

Implement Strategic Planning for Operational Efficiency and Long-Term Growth

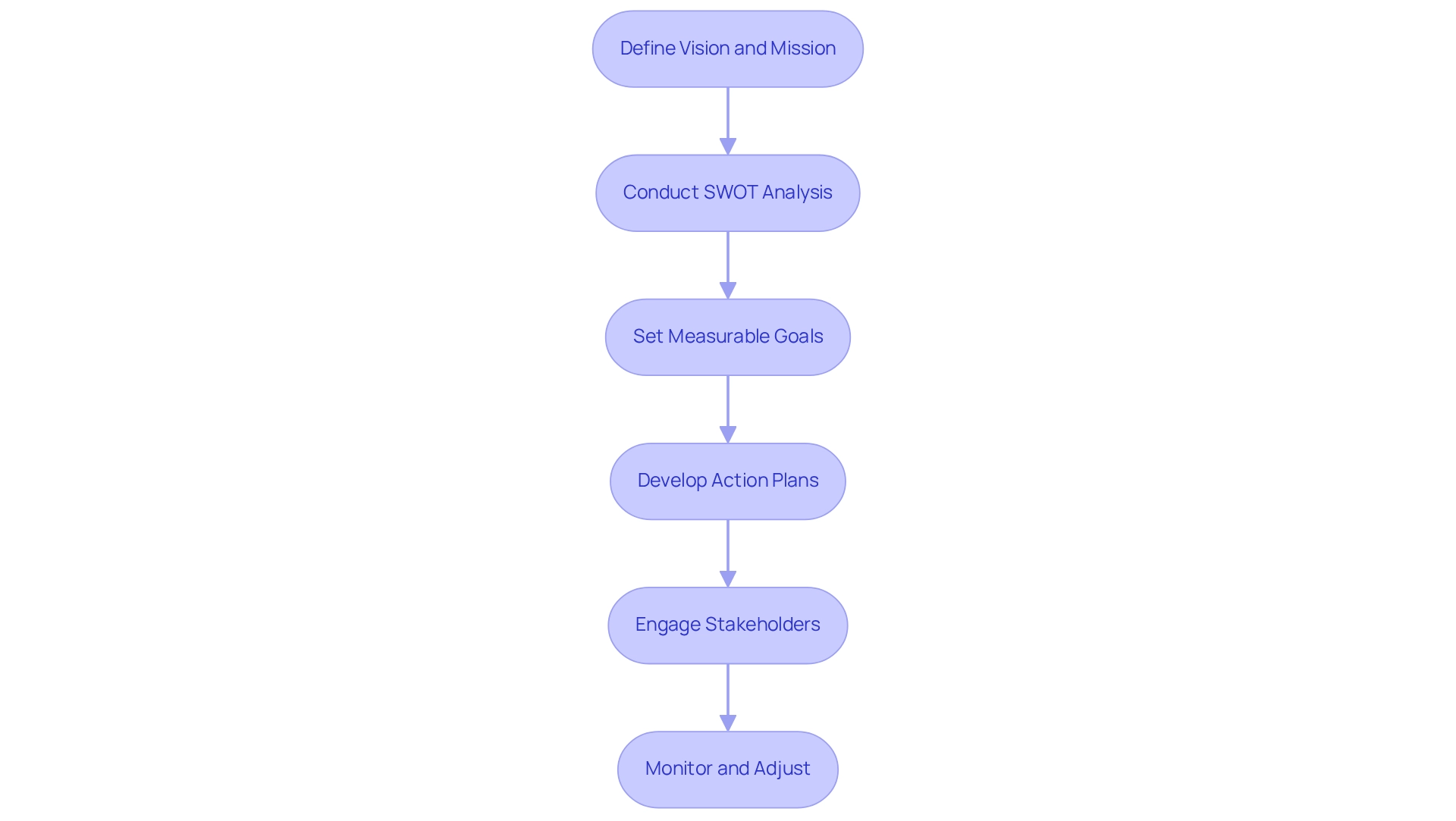

To implement effective strategic planning as part of executive turnaround strategies, CFOs should focus on the following steps:

-

Define Vision and Mission: Reassess the organization's vision and mission statements to ensure they align with current market conditions and stakeholder expectations. This foundational step sets the tone for all strategic initiatives.

-

Conduct SWOT Analysis: Perform a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to identify internal capabilities and external market conditions. This analysis will inform strategic priorities and resource allocation.

-

Set Measurable Goals: Establish clear, measurable goals that align with the overall vision. These goals should be specific, achievable, and time-bound to facilitate tracking progress.

-

Develop Action Plans: Create detailed action plans that outline the steps needed to achieve each goal. Assign responsibilities and timelines to ensure accountability and focus.

-

Engage Stakeholders: Involve key stakeholders in the planning process to gather diverse perspectives and foster commitment to the strategic plan. This engagement can improve buy-in and facilitate smoother implementation.

Monitor and Adjust: Regularly review progress against the strategic plan and utilize the client dashboard for real-time business analytics to assess business health. Be ready to make changes as needed, operationalizing lessons learned to improve decision-making and maximize return on invested capital. Flexibility is key in a turnaround situation, as market conditions and organizational needs may change rapidly. By implementing executive turnaround strategies that focus on streamlined decision-making, continuous performance monitoring, and strong relationship-building, CFOs can enhance operational efficiency, align resources effectively, and position the organization for long-term growth.

Conclusion

The journey toward a successful turnaround in any organization hinges on a strategic approach that encompasses thorough financial assessments, effective interim management, and robust strategic planning. By conducting comprehensive financial evaluations, CFOs can uncover critical insights into the organization’s fiscal health, allowing for targeted strategies that address inefficiencies and capitalize on opportunities. This meticulous analysis not only aids in immediate recovery but also lays the groundwork for sustained growth.

Moreover, leveraging interim management plays a vital role in stabilizing leadership and driving necessary changes during turbulent times. By appointing experienced interim leaders and setting clear objectives, organizations can maintain momentum and ensure continuity while navigating the complexities of a turnaround. This transitional phase is essential in fostering a culture of adaptability and responsiveness, which is crucial for long-term success.

In addition, implementing a strategic planning framework that aligns with the organization’s vision and market realities enables CFOs to set measurable goals and drive operational efficiency. Engaging stakeholders throughout this process enhances buy-in and commitment, while ongoing performance monitoring ensures that the organization can pivot as needed in response to changing circumstances.

In summary, the intersection of financial acumen, leadership stability, and strategic foresight equips organizations to not only overcome immediate challenges but also emerge more resilient and competitive in the marketplace. By embracing these critical components, CFOs can effectively steer their organizations toward a brighter, more sustainable future.

Frequently Asked Questions

What is the first step CFOs should take to initiate a successful turnaround?

The first step is to conduct a detailed financial assessment, which includes reviewing financial statements such as balance sheets, income statements, and cash flow statements to recognize trends and anomalies.

How can CFOs analyze cash flow effectively?

CFOs should focus on cash flow projections to understand liquidity issues, determine if the business can meet its short-term obligations, and recognize periods of cash shortfall by employing real-time analytics to continuously monitor cash flow dynamics.

What does cost structure evaluation involve?

Cost structure evaluation involves breaking down fixed and variable costs to identify areas where expenses can be reduced without sacrificing quality or service, which may include renegotiating contracts or eliminating non-essential expenditures.

Why is benchmarking against industry standards important?

Benchmarking against industry standards is important because it allows CFOs to compare financial metrics with industry benchmarks to gauge performance, identify areas where the business is lacking, and gain insights into possible enhancements.

How should stakeholder engagement be incorporated into the assessment process?

Stakeholder engagement should involve key stakeholders in the assessment process to gather insights and foster buy-in for future changes, improving the precision of the evaluation and enabling more seamless execution of recovery plans.

What is the benefit of integrating insights from the Business Valuation Report?

Integrating insights from the Business Valuation Report and expert advice enhances recovery plans and helps implement lessons learned, providing a clearer understanding of the organization's financial condition for focused recovery strategies.