Overview

The article presents three pivotal strategies for effectively navigating bankruptcy support:

- Understanding the bankruptcy landscape

- Implementing strategic management practices

- Addressing the emotional impacts on employees

These strategies are crucial, as they furnish a comprehensive framework for businesses to make informed decisions, enhance operational efficiency, and support their workforce during financially challenging times. Ultimately, this approach significantly improves their chances for recovery.

Introduction

In the intricate world of bankruptcy, understanding the various types and processes is essential for businesses facing financial turmoil. As economic pressures mount, many organizations find themselves grappling with the complexities of Chapter 7, Chapter 11, and Chapter 13 bankruptcies, each offering distinct pathways to recovery or restructuring. This article delves into the nuances of these bankruptcy options, highlighting the importance of strategic practices and emotional support for teams navigating this challenging landscape. By equipping businesses with insights on effective decision-making and the emotional impacts of bankruptcy, it aims to foster resilience and pave the way for future success in an increasingly uncertain economic environment.

Understand the Bankruptcy Landscape: Types and Processes

Navigating financial insolvency can be a complex and daunting process for companies, which is where becomes essential. A thorough understanding of the different forms of financial insolvency is crucial for effective bankruptcy navigation support, particularly when leveraging streamlined decision-making and real-time analytics to enhance recovery strategies. The three primary types relevant to businesses include:

- Chapter 7: Known as liquidation, this option involves selling a company's assets to pay off creditors. It is usually sought when an enterprise cannot maintain operations and looks to settle its debts. Recent statistics indicate a notable increase in personal insolvency filings, with a 13% rise to 47,462 in March 2025 compared to the previous year. This trend emphasizes the increasing financial pressures on enterprises, particularly among middle-class and female submitters, which may indicate wider economic challenges.

- Chapter 11 Bankruptcy: This reorganization bankruptcy permits companies to keep functioning while reorganizing their debts. It provides a framework for negotiating with creditors and developing a plan aimed at returning to profitability. Success rates for Chapter 11 reorganizations among small enterprises have demonstrated improvement, indicating a more advantageous environment for recovery in 2025. Employing real-time analytics can assist in monitoring the effectiveness of restructuring efforts and modifying strategies as required.

- Chapter 13 Bankruptcy: Primarily designed for individuals, this type allows for debt restructuring through a repayment plan. However, it can also be utilized by small enterprises operated by individuals, offering a pathway to manage debts while maintaining operations.

Moreover, Chapter 15 submissions, which have been monitored since 2005, signify another facet of the insolvency environment that may be pertinent for certain enterprises functioning globally.

Comprehending these insolvency types allows companies to evaluate their situations and choose the most appropriate approach, ensuring they have the necessary bankruptcy navigation support for the following phases in the process. Insights from insolvency lawyers highlight the significance of assessing the expenses related to filing, especially for Chapter 7, which can vary from $2,910 to $3,660, encompassing filing and legal fees. This financial burden can significantly influence the decision to pursue insolvency as a relief option, as highlighted in the case study titled "Costs Associated with Filing for Chapter 7 Insolvency." Understanding these costs is essential for potential filers, as it can impact their decision-making process. By implementing lessons learned from prior cases and continuously tracking organizational health through analytics, companies can improve their chances of a successful turnaround.

Implement Strategic Practices for Bankruptcy Management

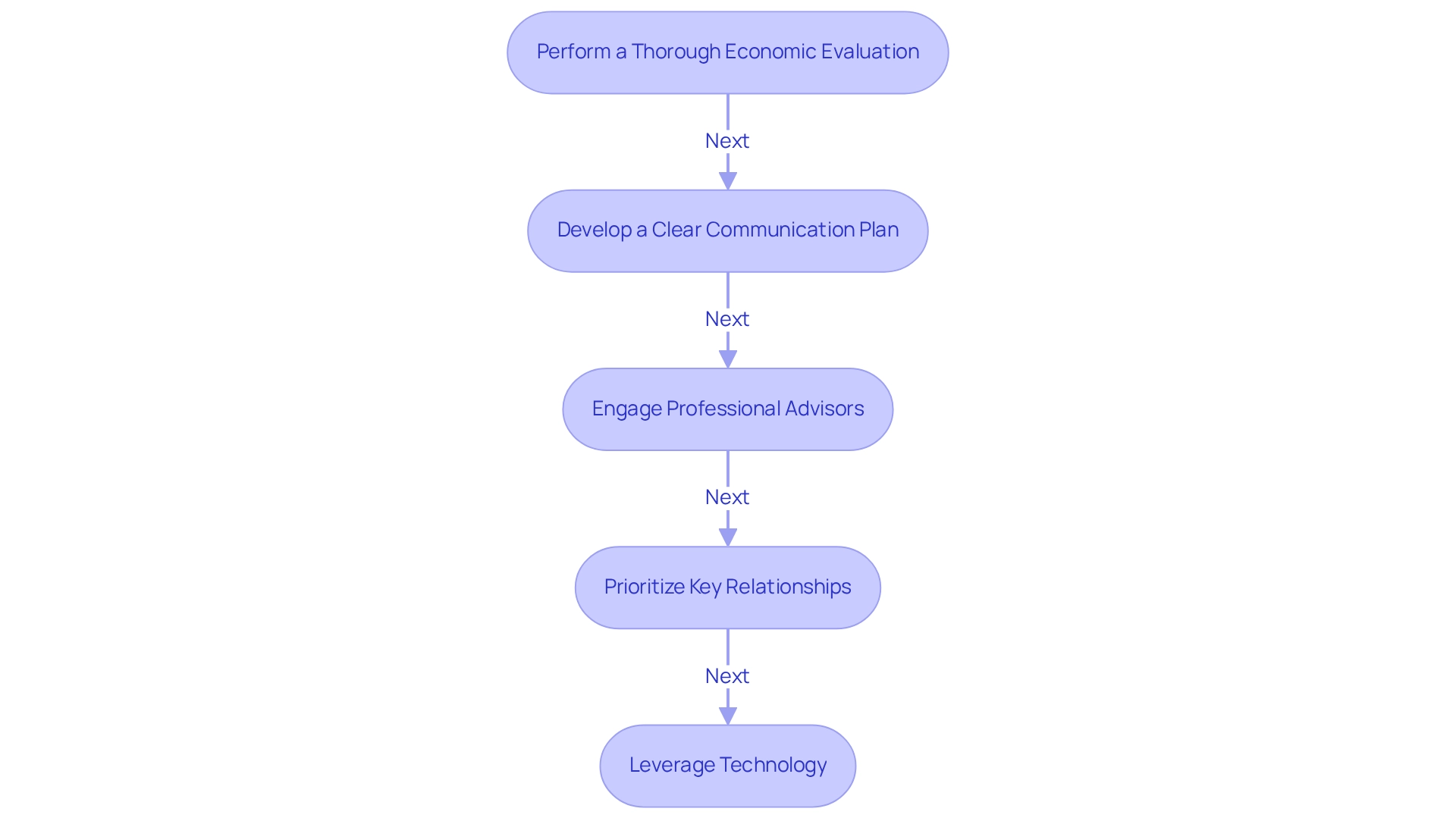

To manage insolvency effectively, enterprises should embrace several strategic practices:

- Perform a Thorough Economic Evaluation: Before submitting for insolvency, it is essential for companies to carry out a detailed examination of their monetary condition. This assessment should encompass cash flow analysis, outstanding debts, and operational costs, enabling the identification of areas ripe for improvement. A thorough financial review can help identify opportunities to preserve cash and reduce liabilities, positioning businesses better to manage their obligations effectively. With projections indicating that weekly insolvency filings could reach 15,000 by late next year, the urgency of this practice cannot be overstated.

- Develop a Clear Communication Plan: Transparency is essential during bankruptcy proceedings. Establishing a robust communication plan that delineates how information will be disseminated to employees, creditors, and stakeholders fosters trust and mitigates uncertainty. Statistics indicate that companies with clearly outlined communication plans encounter less disruption and sustain higher morale among employees during difficult periods. As increasing interest rates and ongoing inflation influence household finances, a clear communication approach becomes even more essential.

- Engage Professional Advisors: The complexities of insolvency law necessitate the involvement of seasoned professionals. Employing experienced insolvency lawyers and financial advisors can offer essential support during the process, assisting in maneuvering through legal complexities and developing effective restructuring plans. Their knowledge is crucial in ensuring adherence and enhancing results, particularly as the environment of financial distress becomes more intricate due to economic pressures.

- Prioritize Key Relationships: Maintaining strong connections with essential suppliers and customers is crucial during financial distress. Open dialogues regarding payment terms and expectations can help sustain operations and facilitate smoother negotiations, ultimately aiding in the recovery process.

- Leverage Technology: Implementing technology-enabled solutions can significantly enhance operational efficiency. Using financial management software enables organizations to benefit from , allowing them to monitor expenses and handle cash flow more efficiently, which is especially crucial in a bankruptcy situation where every dollar matters. The application of real-time analytics can continually diagnose organizational health, providing insights that are crucial for decision-making. As companies encounter rising interest rates and growing debt burdens, technology can act as a crucial ally in managing these challenges. The correlation between rising consumer debt and bankruptcy filings underscores the need for effective financial management solutions. By implementing the insights gained through these approaches, organizations can enhance their readiness for recovery and future achievement.

Address Emotional Impacts: Supporting Teams Through Bankruptcy

Bankruptcy can impose a profound emotional burden on employees, necessitating thoughtful strategies for support. As Chapter 7 filings are likely to rise moderately due to increasing consumer credit pressures, businesses should consider the following approaches to effectively assist their teams:

- Foster Open Communication: Cultivating an environment where employees feel secure in voicing their concerns is essential. Regular check-ins and open forums can alleviate fears and uncertainties, allowing for transparent discussions about the company's situation.

- Provide Access to Counseling Services: Professional counseling can be instrumental in assisting employees in managing stress and anxiety during financial difficulties. By offering these services, companies can support their workforce in navigating the emotional challenges that arise during this period.

- Implement Employee Assistance Programs (EAPs): EAPs are valuable resources that provide mental health support, budgeting advice, and stress management workshops. These programs equip employees with essential tools to cope with their circumstances effectively.

- Recognize and Validate Emotions: Acknowledging the emotional toll of financial distress fosters a sense of understanding among employees. Leadership should express empathy and reassure staff about the company's future direction, reinforcing a sense of stability. As Louie Anderson wisely remarked, 'We all believe we're going to escape debt,' emphasizing the shared emotional challenges encountered during economic hardship.

- Encourage Team Building Activities: Engaging in team-building exercises can strengthen relationships among employees, creating a supportive community during challenging times. Such initiatives can enhance morale and foster resilience within the workforce.

Moreover, district-level analysis shows significant differences in insolvency filings, with some regions facing higher rates than others. This highlights the significance of localized approaches to tackle financial distress and assist employees effectively.

As economic unpredictability and growing consumer debt keep impacting insolvency patterns, these approaches become more essential. Companies that prioritize emotional support not only provide to help their employees navigate difficult transitions but also lay the groundwork for a more resilient organizational culture. Insights from the Weil European Distress Index further emphasize the need for businesses to adapt to current market trends affecting bankruptcy, reinforcing the urgency of these support strategies.

Conclusion

Navigating the complexities of bankruptcy is essential for businesses confronting financial challenges. Understanding the distinct types of bankruptcy—Chapter 7, Chapter 11, and Chapter 13—equips organizations with the knowledge necessary to make informed decisions about their recovery strategies. Each bankruptcy type presents unique pathways, from liquidation to reorganization, underscoring the importance of tailored approaches based on specific circumstances.

Strategic practices are vital for successfully managing bankruptcy. Conducting a comprehensive financial assessment, developing clear communication plans, engaging professional advisors, and leveraging technology can significantly enhance a company's ability to navigate this challenging landscape. By prioritizing relationships with key stakeholders and utilizing real-time analytics, businesses can foster resilience and better position themselves for recovery.

Moreover, addressing the emotional impacts of bankruptcy on employees is crucial for maintaining morale and productivity. Implementing support systems such as open communication, counseling services, and employee assistance programs can help teams cope with the stress of financial distress. Recognizing and validating the emotional challenges faced by employees not only aids in their well-being but also strengthens the organizational culture, paving the way for future success.

As economic uncertainty and rising consumer debt continue to influence bankruptcy trends, businesses must adopt a proactive stance. By understanding the bankruptcy landscape, implementing strategic practices, and supporting their teams emotionally, organizations can effectively navigate financial turmoil and emerge stronger, fostering a path toward long-term stability and growth.

Frequently Asked Questions

What is bankruptcy navigation support and why is it important?

Bankruptcy navigation support is essential for companies facing financial insolvency, as it helps them understand the different forms of insolvency and enhances their recovery strategies through streamlined decision-making and real-time analytics.

What are the primary types of bankruptcy relevant to businesses?

The three primary types of bankruptcy relevant to businesses are: 1. Chapter 7: Involves liquidation, where a company's assets are sold to pay off creditors. 2. Chapter 11: A reorganization bankruptcy that allows companies to continue operating while restructuring their debts. 3. Chapter 13: Primarily designed for individuals, but can also be used by small enterprises for debt restructuring through a repayment plan.

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy, known as liquidation, involves selling a company's assets to pay off creditors. It is typically sought when a business cannot maintain operations and aims to settle its debts.

What is Chapter 11 bankruptcy?

Chapter 11 bankruptcy allows companies to reorganize their debts while continuing to operate. It provides a framework for negotiating with creditors and developing a plan to return to profitability.

How have success rates for Chapter 11 reorganizations changed?

Success rates for Chapter 11 reorganizations among small enterprises have shown improvement, indicating a more favorable environment for recovery in 2025.

What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy allows individuals to restructure their debts through a repayment plan. It can also be utilized by small enterprises operated by individuals, enabling them to manage debts while maintaining operations.

What are Chapter 15 submissions?

Chapter 15 submissions pertain to insolvency cases involving companies that operate globally, providing a framework for addressing cross-border insolvency issues.

Why is it important to understand the costs associated with filing for bankruptcy?

Understanding the costs related to filing for bankruptcy, especially for Chapter 7, which can range from $2,910 to $3,660, is crucial as it can significantly influence a company's decision to pursue insolvency as a relief option.

How can companies improve their chances of a successful turnaround during bankruptcy?

Companies can enhance their chances of a successful turnaround by implementing lessons learned from prior cases and continuously monitoring their organizational health through analytics.