Overview

This article outlines four essential bankruptcy navigation strategies that CFOs can employ to ensure their companies effectively manage financial distress. By:

- Grasping bankruptcy fundamentals,

- Developing comprehensive strategies,

- Leveraging technology for informed decision-making,

- Collaborating with legal and financial experts,

CFOs can significantly enhance their capacity to navigate insolvency. This strategic approach not only positions their organizations for recovery but also fosters resilience in challenging financial landscapes.

Introduction

In an increasingly complex financial landscape, the role of Chief Financial Officers (CFOs) has never been more critical, particularly when navigating the tumultuous waters of bankruptcy. As businesses confront mounting pressures from economic fluctuations, grasping the intricacies of bankruptcy is essential for effective crisis management. This article explores the fundamental aspects of bankruptcy, outlining strategies for:

- Developing comprehensive plans

- Leveraging technology for informed decision-making

- Emphasizing the importance of collaboration with legal and financial experts

By mastering these elements, CFOs can not only steer their companies through financial distress but also position them for future growth and stability.

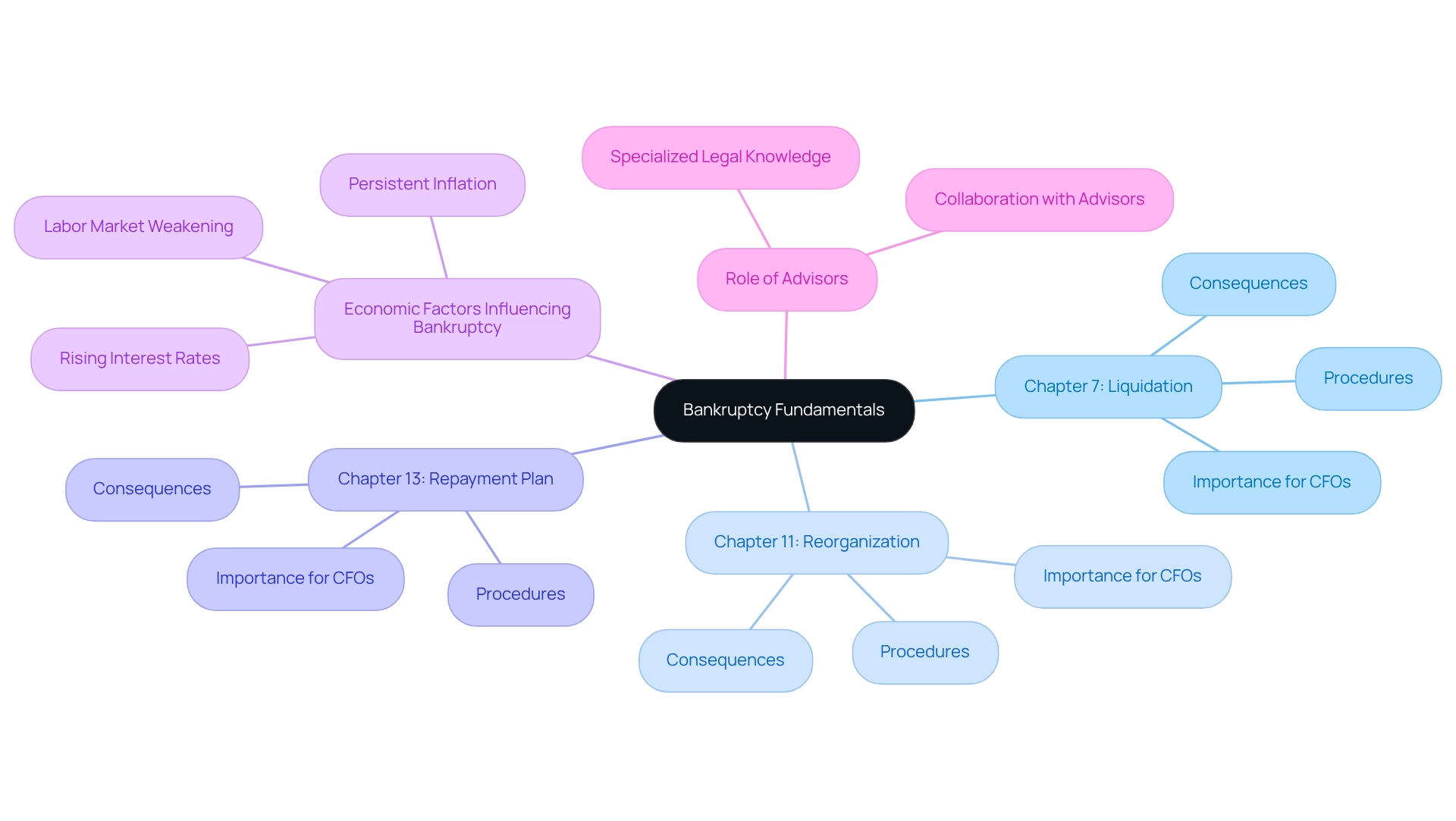

Understand Bankruptcy Fundamentals

Grasping the fundamentals of insolvency is essential for CFOs, as it equips them with the knowledge necessary to implement effective bankruptcy navigation strategies when facing financial challenges. Insolvency serves as a legal process that allows companies to remove or reorganize debts under the supervision of the insolvency court. The primary categories of insolvency filings include:

- Chapter 7, which involves the liquidation of assets

- Chapter 11, focused on reorganization

- Chapter 13, which establishes a repayment plan

Each category encompasses distinct procedures and consequences that significantly impact a company's operations and financial obligations, which is why bankruptcy navigation strategies are crucial for financial leaders to comprehend in order to accurately assess their organization's financial health and determine the most effective path forward.

The automatic stay, which halts all collection activities upon filing, is a vital element that financial leaders must understand, as it provides immediate relief from creditor actions and allows time to develop effective bankruptcy navigation strategies. Current projections indicate that approximately 390,949 additional insolvencies are expected to be filed in the remaining weeks of 2025, underscoring the urgency for financial executives to be well-versed in these procedures.

Rising interest rates, persistent inflation affecting household finances, and potential labor market weakening could all contribute to increased bankruptcy rates in the coming years, making bankruptcy navigation strategies imperative for financial leaders to remain informed. In this context, the ability to test hypotheses and make swift decisions is paramount. Chief Financial Officers should leverage real-time analytics to continuously monitor business performance, enabling timely adjustments to strategies as necessary.

Collaborating with specialized advisors, such as those from Transform Your Small/ Medium Business, can further enhance the decision-making process, ensuring that financial leaders are prepared to operationalize lessons learned from past experiences. Real-world examples, particularly from , illustrate the importance of specialized legal knowledge in managing corporate economic distress. These filings often concentrate in specific jurisdictions, highlighting the necessity for chief financial officers to engage with knowledgeable advisors who can navigate the complexities of reorganization.

By mastering these insolvency fundamentals and adopting bankruptcy navigation strategies for crisis management, CFOs can better position their companies to tackle economic challenges and emerge stronger.

Develop a Comprehensive Bankruptcy Strategy

Creating utilizing bankruptcy navigation strategies is essential for managing economic hardship efficiently. Attention: Begin with a structured approach that begins with a comprehensive financial assessment. Interest: Conduct a detailed review to ascertain the company's current standing, focusing on cash flow, liabilities, and assets. This foundational step is crucial, as statistics show that 77% of individuals filing for financial relief cite overwhelming debt as a primary factor in their financial crises. A study indicates that these individuals frequently encounter substantial debts instead of income problems, with median gross household incomes for those filing for insolvency varying from $35,000 to $70,000, which is below the national median but above the poverty threshold. Desire: Establish a robust communication plan to keep all stakeholders—employees, creditors, and investors—well-informed. As observed by the Consumer Bankruptcy Project, the age range of individuals seeking financial relief has grown considerably, emphasizing the necessity for customized communication approaches that connect with various demographics. This clarity promotes trust and enables smoother negotiations during the insolvency process. Action: Implement operational adjustments by streamlining costs and enhancing efficiency. Utilize a client dashboard to monitor real-time business analytics, which helps in assessing the success of your plans and allows for timely updates and adjustments.

Moreover, create a timeline with key milestones to ensure that the plan remains focused and adaptable. Regular reviews of progress against this timeline are vital to address any emerging challenges promptly. While the typical duration required to formulate a bankruptcy plan may differ, having a defined timeline assists in establishing expectations for everyone involved. By following these recommended practices, financial leaders can develop effective bankruptcy navigation strategies that not only address urgent issues but also prepare the organization for future recovery and expansion. This approach operationalizes the lessons learned through the turnaround process, ensuring a commitment to continuous improvement.

Utilize Technology for Informed Decision-Making

In the current digital environment, technology is essential for effectively implementing bankruptcy navigation strategies to manage economic distress. Chief financial officers should utilize management software that offers real-time insights into cash flow, costs, and revenue projections to effectively apply bankruptcy navigation strategies.

By mastering the cash conversion cycle, financial executives can implement bankruptcy navigation strategies that enhance business performance and optimize capital utilization. Predictive analytics can greatly improve decision-making by forecasting future economic situations, enabling top executives to act quickly and strategically, particularly when implementing bankruptcy navigation strategies.

As Jorge Martinez pointed out, '95% of chief financial officers indicate that current policies from the Trump administration influence business decision-making,' emphasizing the complexities executives encounter in managing economic issues. Moreover, adopting cloud-based solutions fosters collaboration among team members and external advisors, ensuring that all stakeholders have access to the most up-to-date financial information.

Notably, 67% of rely heavily on their CAOs, underscoring the importance of teamwork in leveraging technology during bankruptcy navigation strategies. By operationalizing lessons learned through testing hypotheses and continually updating strategies based on real-time analytics, financial leaders can enhance their responsiveness to evolving circumstances.

This is further supported by the growing confidence in AI—reflected in the case study where around 70% of chief financial officers plan to increase their investment in AI over the next five years—enabling informed decisions that facilitate the company's recovery.

Collaborate with Legal and Financial Experts

Effectively navigating insolvency necessitates a multidisciplinary approach, particularly for CFOs employing . Engaging legal counsel with expertise in bankruptcy navigation strategies is essential to ensure compliance with legal requirements and safeguard the company's interests. This collaboration not only mitigates risks but also enhances the likelihood of a favorable outcome. Moreover, collaborating with investment advisors can provide invaluable insights into bankruptcy navigation strategies and restructuring alternatives. These experts play a pivotal role in negotiating with creditors, formulating repayment plans, and identifying alternative financing avenues.

Research indicates that 77% of individuals filing for financial relief cite debt collection as a significant factor in their decision to file, underscoring the importance of having a robust advisory team. A structured debt resolution plan is one of the essential bankruptcy navigation strategies that can lead to improved credit scores, creditor protection, and financial savings, making it a crucial element of the insolvency process.

Steve Rhode highlights the efficacy of financial restructuring, stating, "I’ve lived through it. I know it is painful. But with the authority of legislation supporting it and the total count of discharges to filings backing it, financial insolvency would appear to be the most cost-effective method for debtors to manage their obligations in the least amount of time and achieve the most thorough result."

To effectively collaborate with legal and financial experts, CFOs should consider the following steps:

- Identify and engage qualified legal counsel with a strong background in bankruptcy law.

- Work closely with financial advisors to explore various bankruptcy navigation strategies and develop comprehensive repayment plans.

- Create transparent communication pathways among all participants to ensure alignment on objectives and plans.

- Utilize real-time analytics to monitor the success of strategies and adjust plans as necessary, ensuring a responsive approach to evolving circumstances.

- Operationalize lessons learned from the turnaround process to build stronger relationships and enhance future decision-making.

By building a strong coalition of legal and financial experts and leveraging streamlined decision-making and real-time analytics, CFOs can significantly improve their company's chances of a successful turnaround by utilizing bankruptcy navigation strategies to equip themselves with the necessary support to navigate this challenging landscape effectively.

Conclusion

The journey through bankruptcy presents not only challenges but also an invaluable opportunity for transformation and growth. For CFOs, understanding the fundamentals of bankruptcy is paramount; it empowers them to navigate the complexities of financial distress with confidence. By grasping the various types of bankruptcy filings and their implications, CFOs can more accurately assess their company's financial health and develop tailored strategies for recovery.

Creating a comprehensive bankruptcy strategy is essential for guiding organizations through tough times. This process involves:

- Conducting thorough financial assessments

- Establishing robust communication plans

- Implementing operational adjustments

- Setting clear timelines with milestones

Each of these steps is crucial, addressing immediate concerns while laying a solid foundation for future stability and growth.

In today's digital age, leveraging technology is indispensable for informed decision-making. Utilizing financial management software and predictive analytics allows CFOs to gain real-time insights that enhance responsiveness and strategic planning. Furthermore, collaboration with legal and financial experts cannot be overstated. This multidisciplinary approach ensures compliance, mitigates risks, and equips CFOs with the necessary tools to negotiate effectively and explore viable restructuring options.

Ultimately, by mastering bankruptcy fundamentals, developing comprehensive strategies, harnessing technology, and collaborating with experts, CFOs can navigate the storm of financial distress and emerge stronger. This proactive stance safeguards not only the present but also paves the way for sustainable growth and resilience in the future, reinforcing the crucial role of CFOs in steering their companies through turbulent times.

Frequently Asked Questions

Why is understanding insolvency important for CFOs?

Understanding insolvency is essential for CFOs as it equips them with the knowledge necessary to implement effective bankruptcy navigation strategies when facing financial challenges.

What is insolvency?

Insolvency is a legal process that allows companies to remove or reorganize debts under the supervision of the insolvency court.

What are the primary categories of insolvency filings?

The primary categories of insolvency filings include Chapter 7 (liquidation of assets), Chapter 11 (reorganization), and Chapter 13 (establishment of a repayment plan).

What is the automatic stay in insolvency proceedings?

The automatic stay is a vital element that halts all collection activities upon filing for insolvency, providing immediate relief from creditor actions and allowing time to develop effective bankruptcy navigation strategies.

What factors are contributing to the expected increase in bankruptcy rates?

Rising interest rates, persistent inflation affecting household finances, and potential labor market weakening are contributing factors that could increase bankruptcy rates in the coming years.

How can CFOs leverage real-time analytics during financial distress?

CFOs should leverage real-time analytics to continuously monitor business performance, enabling timely adjustments to strategies as necessary during financial distress.

Why is collaboration with specialized advisors important for CFOs?

Collaborating with specialized advisors can enhance the decision-making process, ensuring that financial leaders are prepared to operationalize lessons learned from past experiences.

What is the significance of Chapter 11 filings for CFOs?

Chapter 11 filings illustrate the importance of specialized legal knowledge in managing corporate economic distress and often concentrate in specific jurisdictions, highlighting the necessity for CFOs to engage knowledgeable advisors.

How can mastering insolvency fundamentals help CFOs?

By mastering insolvency fundamentals and adopting bankruptcy navigation strategies for crisis management, CFOs can better position their companies to tackle economic challenges and emerge stronger.