Overview

The article presents four crisis-driven business solutions for effective financial management:

- Conducting comprehensive financial assessments

- Implementing proactive operational strategies

- Utilizing technology-enabled consulting services

- Embracing continuous improvement and adaptation

Each solution is bolstered by practical steps and supporting evidence. For instance, the importance of benchmarking and contingency planning is emphasized, alongside the role of technology in enhancing operational efficiency. Furthermore, fostering a culture of ongoing enhancement is crucial to ensuring organizations can navigate crises successfully. By adopting these strategies, businesses can not only survive but thrive in challenging times.

Introduction

In a landscape marked by economic uncertainties and operational challenges, businesses must implement robust strategies to secure financial stability and resilience. This article explores the essential components of financial assessments, proactive operational strategies, and the use of technology-enabled consulting services, alongside the significance of continuous improvement. By leveraging these elements, organizations can navigate crises effectively and position themselves for sustainable growth in an ever-evolving marketplace. Through a comprehensive approach that encompasses:

- Benchmarking

- Risk management

- The integration of technology

Businesses can enhance their operational efficiency and financial performance, ultimately thriving in the face of adversity.

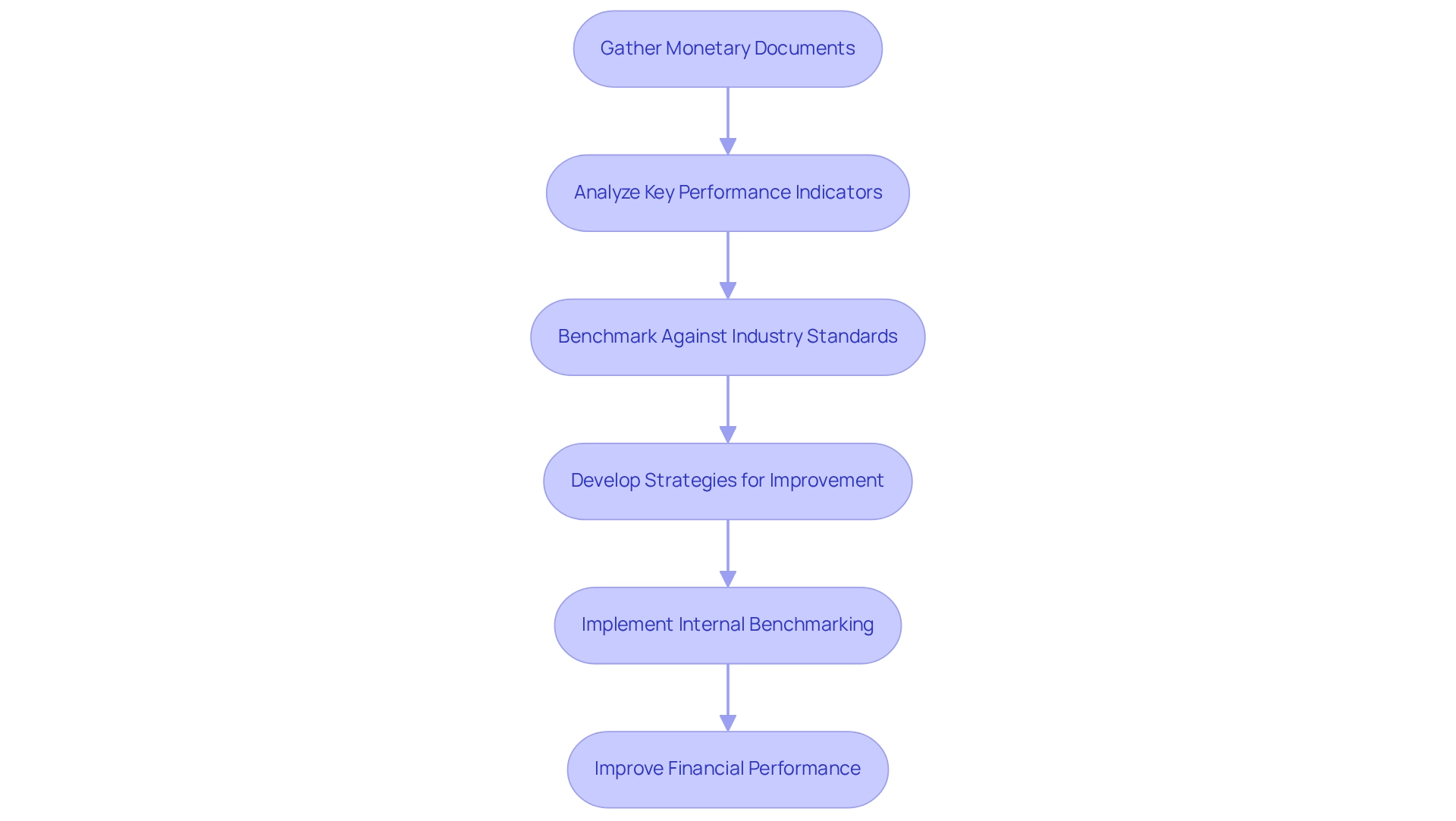

Conduct Comprehensive Financial Assessments

To perform a comprehensive evaluation of finances, organizations must begin by gathering all relevant monetary documents, including balance sheets, income statements, and cash flow statements. This analysis is crucial for identifying key performance indicators (KPIs) such as liquidity ratios, profitability margins, and debt levels. Notably, the typical liquidity ratio for small enterprises in 2025 is anticipated to be approximately 1.5, signifying a healthy equilibrium between current assets and liabilities—an essential standard for evaluating economic well-being.

Benchmarking performance against industry standards is vital for gaining insights into economic health. For instance, a retail company can assess its inventory turnover ratio against competitors to measure operational efficiency. As Jamie Smith aptly states, "Comparing your forecasts against industry benchmarks is an important step in evaluating the accuracy of your predictions." Recent best practices emphasize the significance of budget benchmarking, optimizing resource allocation, and enhancing organizational performance. This practice not only facilitates effective crisis-driven business solutions but also supports strategic planning, allowing organizations to remain agile and responsive to evolving market conditions.

By recognizing fundamental organizational challenges and collaboratively developing strategies to address them, companies can reinvest in key strengths and enhance their economic performance. Additionally, a pragmatic approach to data testing ensures that every hypothesis is rigorously evaluated, maximizing returns on invested capital. Case studies illustrate that companies engaging in competitive benchmarking can adopt successful techniques that improve financial performance and operational efficiency, ultimately leading to sustainable growth.

For example, internal benchmarking assists organizations in eliminating waste and concentrating resources on areas needing enhancement by comparing historical data, allowing companies to identify best practices and enhance efficiency. Furthermore, it is crucial to remember that benchmarks can vary significantly across different sectors, underscoring the necessity for contextualized evaluations.

Implement Proactive Operational Strategies

Implementing proactive operational strategies is essential for businesses aiming to effectively navigate crises through crisis-driven business solutions. A crucial initial step involves conducting comprehensive evaluations to identify weaknesses within operations. For instance, eateries should assess their supply networks, ensuring they have multiple providers for critical components to mitigate the risks associated with relying on a single source. Establishing robust contingency plans is equally important; these plans must clearly outline the crisis-driven business solutions to implement during crises, such as sudden sales declines or supply chain disruptions. Regular training sessions and simulations can equip staff with the necessary skills to respond effectively to emergencies, clarifying roles and responsibilities. By fostering a culture of preparedness, organizations can enhance their resilience and develop crisis-driven business solutions, ensuring smoother navigation through crises and maintaining operational continuity.

Statistics indicate that organizations with well-defined contingency plans are significantly more likely to recover swiftly from disruptions, which underscores the effectiveness of crisis-driven business solutions in crisis management. According to a case study titled "Streamlining Risk Evaluation Processes," organizations can enhance the efficiency of their evaluation processes through automation and technology, integrating the management of uncertainties into daily operations. This approach enables companies to proactively recognize and address challenges as they arise by implementing crisis-driven business solutions.

Additionally, Transform Your Small/Medium Business employs advanced threat evaluation tools to analyze market trends and identify potential dangers, illustrating the importance of leveraging technology in threat management. However, leaders, particularly CFOs, often face challenges in implementing evaluations effectively, including incomplete data, subjectivity, and resistance to change. Acknowledging these challenges is crucial for CFOs as they execute these strategies, especially when considering interim management and financial evaluation services that can support their efforts.

To summarize, here are actionable steps for implementing proactive operational strategies:

- Conduct thorough risk assessments to identify vulnerabilities.

- Evaluate supply chains and diversify suppliers.

- Develop and regularly update contingency plans.

- Conduct training sessions and simulations for staff.

- Leverage technology for risk assessment and management.

By following these steps, organizations can better prepare for crises and enhance their operational resilience with crisis-driven business solutions.

Utilize Technology-Enabled Consulting Services

To fully leverage the advantages of technology-driven consulting services, organizations must prioritize investments in software that enhances resource visibility and operational efficiency. Mastering the cash conversion cycle is essential; implementing cloud-based financial management systems allows for real-time tracking of financial metrics, enabling organizations to respond swiftly to emerging challenges.

A report from Harvard Business Review reveals that adaptive projects can enhance performance metrics by up to 25%, highlighting the significant value of these technologies. For instance, a hospitality establishment can utilize a property management system that seamlessly integrates with its accounting software, facilitating real-time monitoring of occupancy rates and revenue.

Furthermore, data analytics platforms empower organizations to analyze customer behavior and market trends, providing valuable insights for informed strategic decision-making. Continuous monitoring of organizational performance and relationship-building through real-time analytics are vital for operationalizing turnaround lessons.

However, organizations must remain vigilant about potential misapplications of these technologies, as they can undermine effectiveness. By embracing these technologies, organizations not only bolster their crisis response capabilities but also lay the groundwork for crisis-driven business solutions in an increasingly dynamic environment.

Additionally, a cost-benefit analysis of technology investments indicates that organizations can anticipate a return of approximately $3 for every $1 invested in technology initiatives, underscoring the transformative potential of targeted IT investments.

To further enhance performance, companies should contemplate implementing specific strategies such as:

- Optimizing inventory management

- Refining receivables collection processes

- Leveraging predictive analytics to forecast cash flow needs

These strategies can provide a structured approach to mastering the cash conversion cycle and ensuring long-term financial health.

Embrace Continuous Improvement and Adaptation

To foster a culture of ongoing enhancement, organizations must establish regular review processes that evaluate operational efficiency and pinpoint areas for growth. Our team will identify underlying organizational issues and collaborate to create a plan that mitigates weaknesses, enabling the entity to reinvest in key strengths. Techniques such as Lean and Six Sigma can be employed to streamline processes and eliminate waste. For instance, a manufacturing company might analyze its production line to identify bottlenecks and implement changes that enhance efficiency.

Moreover, organizations should encourage employee feedback and involvement in improvement initiatives, creating an environment where innovation is valued. By committing to continuous improvement and leveraging real-time analytics, businesses can implement crisis-driven business solutions to adapt to market changes and bolster their resilience against future crises.

Conclusion

Navigating today’s business landscape demands a multifaceted strategy centered on financial stability and operational resilience. Comprehensive financial assessments empower organizations to identify key performance indicators and benchmark against industry standards, thereby enhancing crisis management and resource allocation.

Equally vital are proactive operational strategies. By conducting thorough risk assessments and establishing contingency plans, businesses can effectively prepare for disruptions and ensure continuity. Furthermore, training staff and integrating technology into risk management significantly enhance an organization’s ability to respond to challenges.

Utilizing technology-enabled consulting services is essential for boosting operational efficiency. Investing in advanced financial management systems and data analytics delivers real-time insights that facilitate informed decision-making. The potential for substantial returns on these technology investments highlights their critical role in driving growth.

Moreover, fostering a culture of continuous improvement is crucial for adaptability. Regular process reviews, employee involvement, and methodologies such as Lean and Six Sigma streamline operations and encourage innovation. This unwavering commitment to improvement positions organizations not only to withstand crises but also to thrive in dynamic environments.

In conclusion, the integration of thorough financial assessments, proactive operational strategies, technology adoption, and a focus on continuous improvement equips businesses to navigate uncertainties and seize opportunities for sustainable growth.

Frequently Asked Questions

What documents are necessary for a comprehensive financial evaluation?

Organizations must gather all relevant monetary documents, including balance sheets, income statements, and cash flow statements.

Why is analyzing financial documents important?

Analyzing financial documents is crucial for identifying key performance indicators (KPIs) such as liquidity ratios, profitability margins, and debt levels.

What is the typical liquidity ratio expected for small enterprises in 2025?

The typical liquidity ratio for small enterprises in 2025 is anticipated to be approximately 1.5, indicating a healthy balance between current assets and liabilities.

How can organizations benchmark their performance?

Organizations can benchmark their performance by comparing their metrics, such as inventory turnover ratios, against industry standards and competitors to gain insights into their economic health.

What are the benefits of budget benchmarking?

Budget benchmarking enhances resource allocation, improves organizational performance, facilitates effective crisis-driven solutions, and supports strategic planning.

How can companies improve their economic performance?

Companies can improve their economic performance by recognizing fundamental challenges, collaboratively developing strategies, and reinvesting in their key strengths.

What role does data testing play in financial evaluation?

A pragmatic approach to data testing ensures that every hypothesis is rigorously evaluated, maximizing returns on invested capital.

How does internal benchmarking benefit organizations?

Internal benchmarking helps organizations eliminate waste and focus resources on areas needing enhancement by comparing historical data to identify best practices and improve efficiency.

Why is it important to consider sector differences in benchmarking?

Benchmarks can vary significantly across different sectors, highlighting the necessity for contextualized evaluations to ensure accurate assessments.