Overview

The essential steps for distressed company recovery plans are paramount in navigating financial turmoil.

- Conducting comprehensive financial assessments allows organizations to gauge their true financial health.

- Developing clear action plans sets the stage for targeted interventions.

- Implementing operational restructuring strategies optimizes efficiency.

- Establishing continuous monitoring mechanisms ensures adaptability and responsiveness to changing circumstances.

These steps are critical for identifying financial health, setting actionable goals, optimizing operations, and ensuring adaptability, thereby facilitating effective recovery from distress.

Introduction

In a world where financial stability can shift in an instant, businesses must be equipped to navigate turbulent waters and emerge stronger than ever. The journey to recovery begins with a thorough financial assessment, where key metrics are analyzed to uncover hidden challenges and opportunities. From there, actionable recovery plans are crafted, focusing on specific goals and resource allocation to steer the company back on course.

As operational restructuring takes center stage, efficiency and cost management become paramount, ensuring that every aspect of the business is optimized for success. However, the journey doesn’t end with implementation; continuous monitoring and adaptability are essential to respond to ever-changing market dynamics.

This article delves into the critical steps businesses can take to not only recover but thrive in an unpredictable economic landscape.

Conduct Comprehensive Financial Assessments

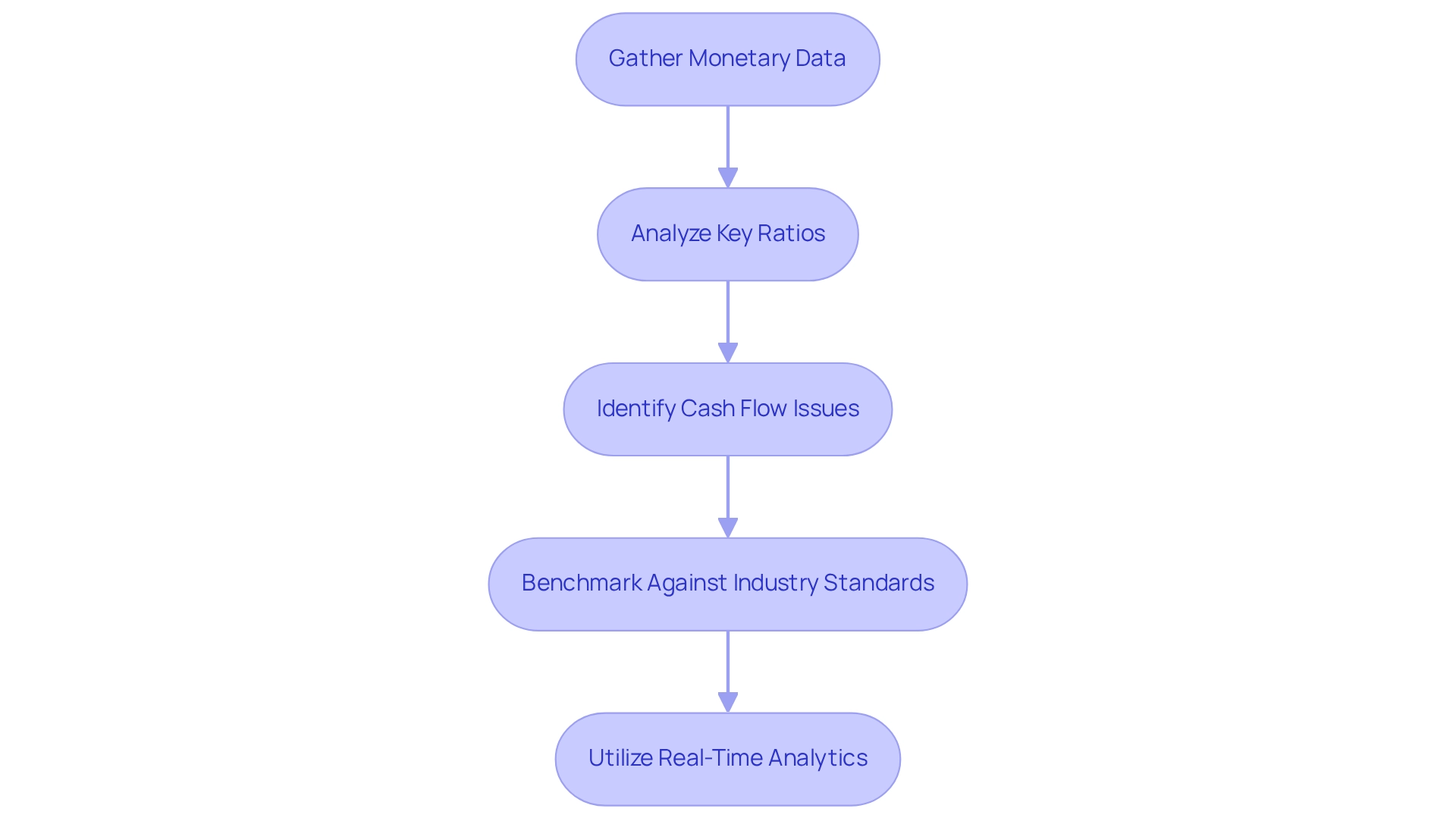

To initiate distressed company recovery plans successfully, businesses must first conduct a thorough economic assessment. This entails examining important monetary reports, including the balance sheet, income statement, and flow of funds statement. The goal is to identify critical metrics such as liquidity ratios, profitability margins, and cash flow trends, while also leveraging real-time analytics to monitor ongoing performance and make informed decisions.

Gather Monetary Data: Collect historical monetary information for at least the past three years to identify trends and anomalies. This data will serve as a foundation for real-time monitoring and adjustments.

Analyze Key Ratios: Focus on liquidity ratios (such as the current ratio and quick ratio) to assess short-term economic health, and leverage ratios (like debt-to-equity) to understand long-term solvency. Employing real-time analytics can improve this analysis by offering prompt insights into economic health.

Identify Cash Flow Issues: Examine cash flow statements to pinpoint periods of cash shortfalls and understand the underlying causes, such as delayed receivables or excessive inventory. Continuous monitoring through analytics can help in quickly addressing these issues.

Benchmark Against Industry Standards: Compare metrics against industry benchmarks to gauge performance relative to peers. This can emphasize areas requiring urgent focus and guide tactical planning. By performing these evaluations and incorporating real-time analytics, companies can establish a clear understanding of their economic condition, which is crucial for formulating effective distressed company recovery plans.

Develop Clear and Actionable Recovery Plans

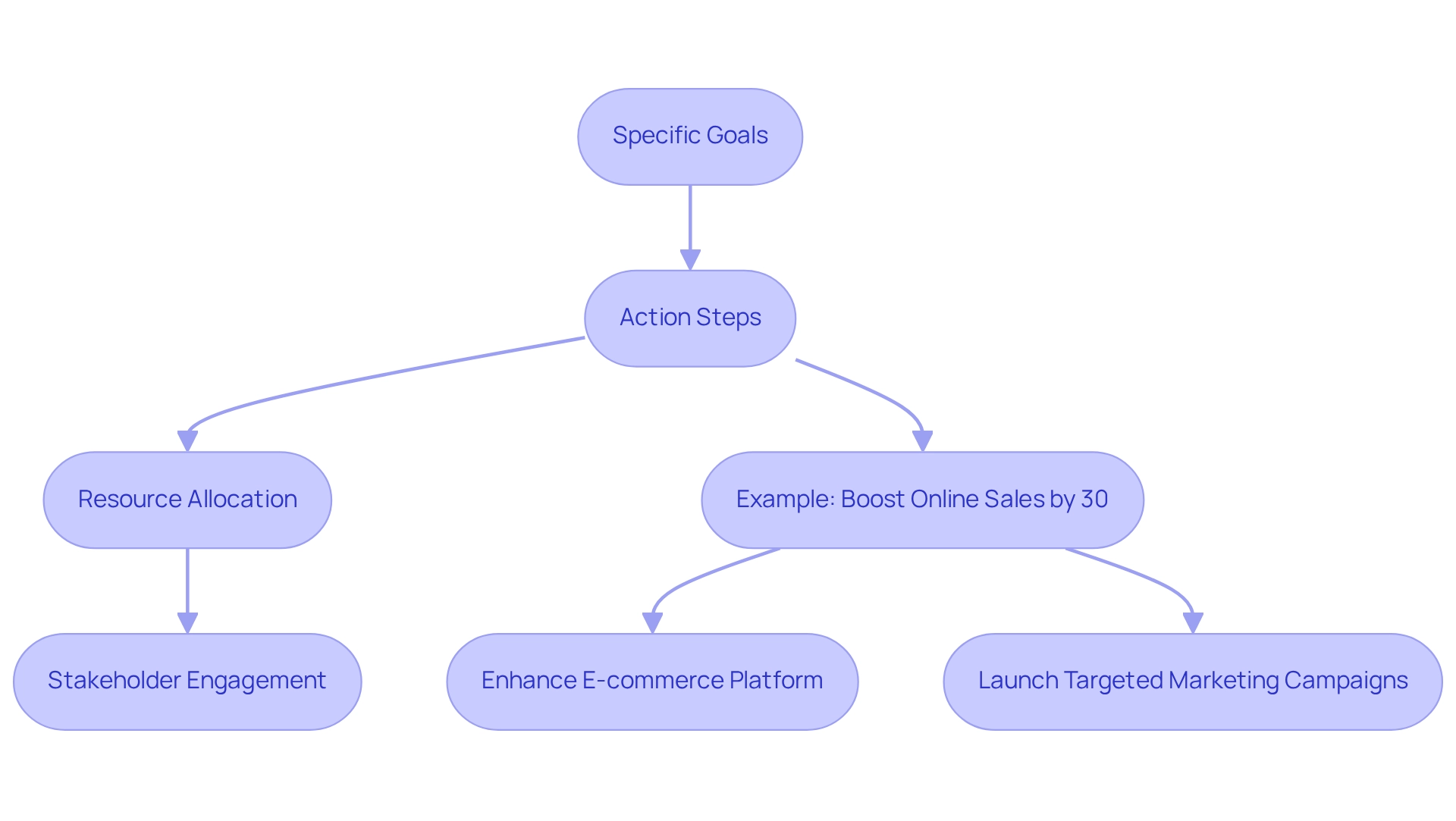

Upon completion of a comprehensive economic evaluation, the next step is to devise distressed company recovery plans that are clear and actionable, effectively leveraging strategies for mastering the cash conversion cycle. This plan should encompass:

- Specific Goals: Clearly define both short-term and long-term financial objectives, such as reducing debt by a specific percentage or achieving a targeted profit margin.

- Action Steps: Detail the specific action steps necessary to accomplish these goals, including timelines and designated responsible parties. Incorporate real-time analytics to monitor progress and adapt strategies as required.

- Resource Allocation: Identify the essential resources, including financial, human, and technological, needed to effectively implement the recovery plan.

- Stakeholder Engagement: Ensure that all stakeholders—employees, creditors, and investors—are informed and actively involved in the recovery process.

For instance, a retail company experiencing declining sales might establish a goal to boost online sales by 30% within six months, with concrete actions such as enhancing their e-commerce platform and launching targeted marketing campaigns. This method not only addresses immediate challenges but also utilizes distressed company recovery plans to operationalize lessons learned for future resilience.

Implement Operational Restructuring Strategies

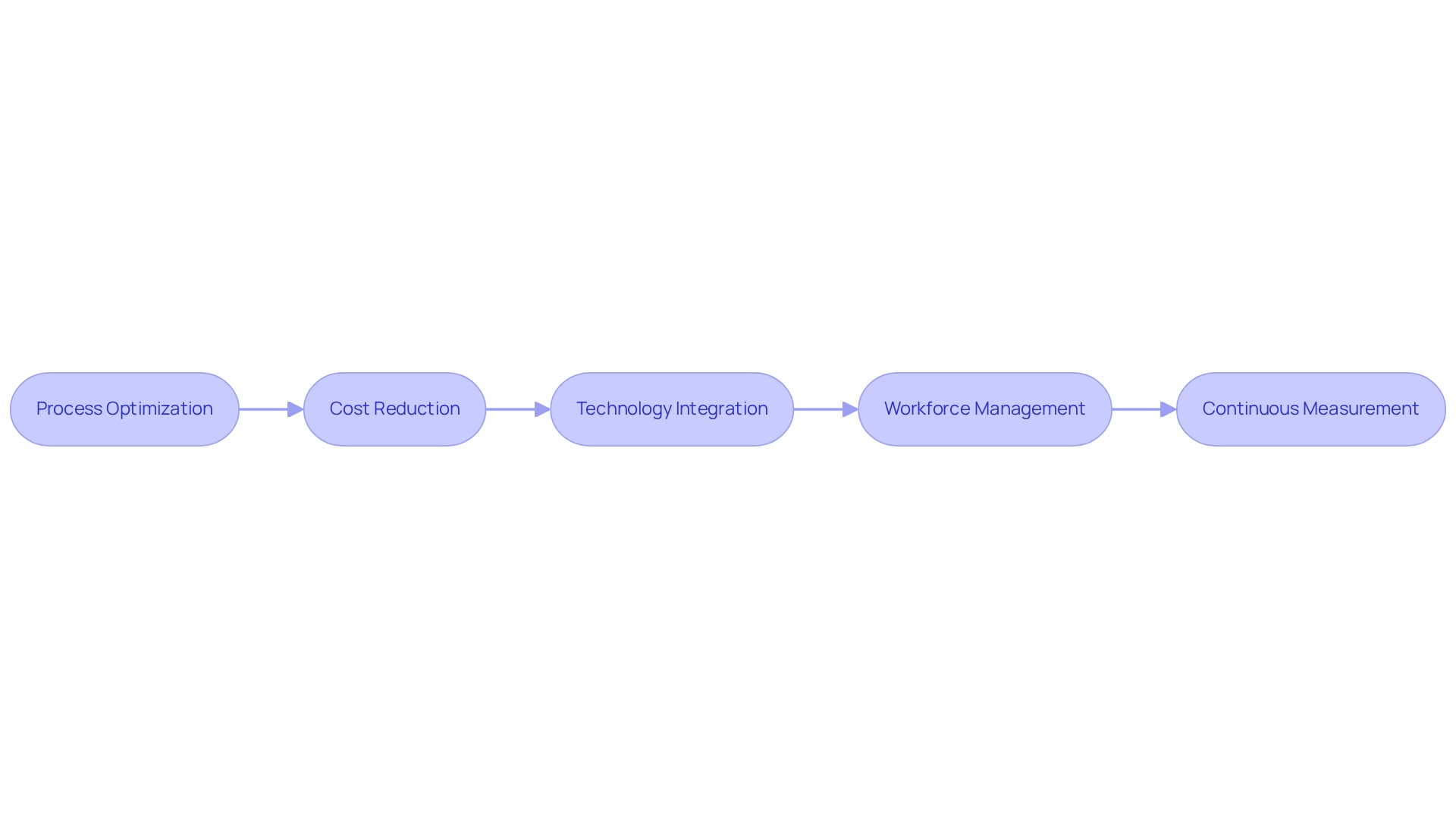

Implementing operational restructuring approaches is a key element of distressed company recovery plans. This process may involve:

-

Process Optimization: Analyze existing workflows to identify bottlenecks and inefficiencies. Apply lean management strategies to optimize operations, greatly improving the conversion cycle and overall business performance. This aligns with mastering the cash conversion cycle by ensuring that processes are efficient and effective.

-

Cost Reduction: Review all operational costs and identify areas for reduction, such as renegotiating supplier contracts or reducing overhead expenses. This strategic approach ensures effective resource allocation, maximizing returns on investment.

-

Technology Integration: Leverage technology to automate processes and improve data management, facilitating real-time analytics that support informed decision-making. This can lead to significant cost savings and efficiency gains, essential for monitoring performance during recovery.

-

Workforce Management: Assess staffing needs and consider restructuring teams to align with new operational goals. This may involve retraining employees or making difficult decisions regarding layoffs to ensure that the workforce is optimized for the company's strategic direction as part of the distressed company recovery plans. Incorporating the 'Identify & Plan' approach, it is crucial to collaboratively create a plan that addresses these operational strategies while continuously measuring their effectiveness through the 'Test & Measure' process. For example, a manufacturing firm may adopt a just-in-time inventory system to decrease holding expenses and enhance liquidity, thereby boosting overall operational efficiency and facilitating ongoing performance assessment.

Establish Continuous Monitoring and Adjustment Mechanisms

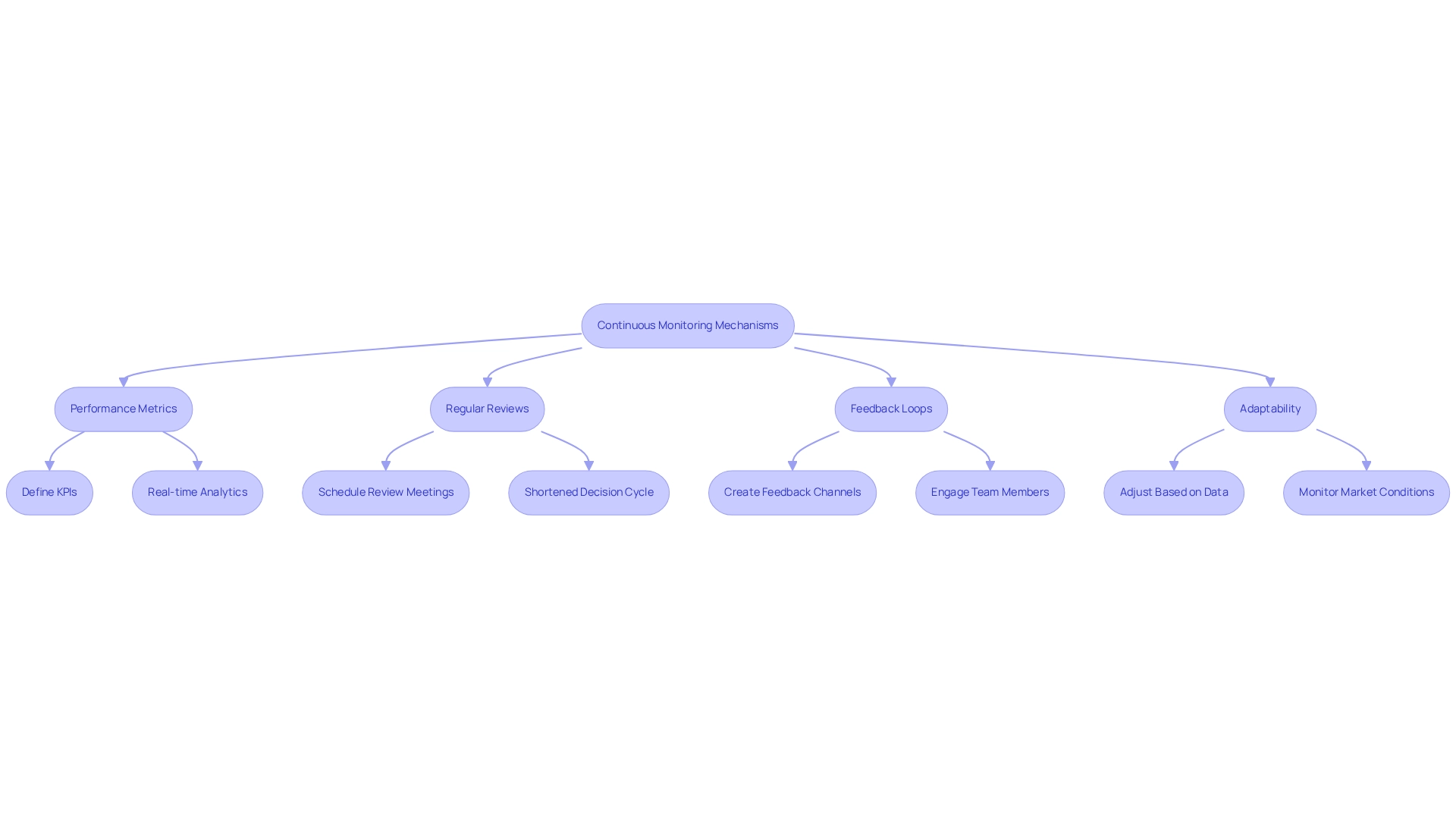

To ensure the success of distressed company recovery plans, businesses must establish continuous monitoring and adjustment mechanisms. This includes:

- Performance Metrics: Define key performance indicators (KPIs) that align with restoration goals, such as cash flow forecasts, sales growth, and expense ratios. Employing real-time business analytics via our client dashboard assists in consistently assessing the effectiveness of distressed company recovery plans and modifying approaches accordingly.

- Regular Reviews: Schedule regular review meetings to assess progress against the restoration plan and make adjustments as needed. This process should be supported by a shortened decision-making cycle that allows for quick, decisive actions to implement the distressed company recovery plans.

- Feedback Loops: Create channels for feedback from employees and stakeholders to identify issues early and foster a culture of continuous improvement. Engaging with team members provides insights that inform operational adjustments and enhance morale.

- Adaptability: Be prepared to adjust approaches based on performance data and external market conditions. For example, if a specific cost-reduction strategy adversely affects employee morale, tracking feedback can inform changes that sustain a motivated workforce while still reaching financial objectives.

By incorporating distressed company recovery plans based on the insights gained through these processes, companies can establish robust, enduring relationships that aid continuous improvement efforts. Additionally, testing hypotheses throughout this process ensures that decisions are data-driven and aligned with the overall recovery strategy.

Conclusion

In navigating the unpredictable landscape of modern business, a comprehensive financial assessment serves as the foundation for recovery. By meticulously analyzing key financial metrics and leveraging real-time analytics, organizations can identify critical challenges and opportunities that lie ahead. This thorough understanding not only facilitates the development of clear and actionable recovery plans but also sets specific goals that drive focused efforts toward financial stability.

Operational restructuring emerges as a vital component of the recovery journey, emphasizing the importance of efficiency and cost management. By optimizing processes, reducing unnecessary expenditures, and integrating technology, businesses can enhance their overall performance and better position themselves for success. Moreover, engaging and aligning stakeholders throughout this process fosters a collaborative environment that is essential for implementing effective strategies.

Ultimately, establishing continuous monitoring and adjustment mechanisms ensures that businesses remain agile and responsive to changing market dynamics. By defining key performance indicators and maintaining regular reviews, organizations can adapt their strategies as needed, fostering a culture of improvement and resilience. Embracing these critical steps not only aids in recovery but empowers businesses to thrive in the face of uncertainty, reinforcing the message that proactive measures are essential for long-term success.

Frequently Asked Questions

What is the first step in initiating distressed company recovery plans?

The first step is to conduct a thorough economic assessment, which involves examining key monetary reports like the balance sheet, income statement, and flow of funds statement.

What are the key metrics to identify during the economic assessment?

Important metrics to identify include liquidity ratios, profitability margins, and cash flow trends.

How far back should businesses collect monetary data for analysis?

Businesses should gather historical monetary information for at least the past three years to identify trends and anomalies.

What key ratios should be analyzed to assess a company's economic health?

Focus should be on liquidity ratios (such as the current ratio and quick ratio) for short-term economic health, and leverage ratios (like debt-to-equity) for understanding long-term solvency.

How can real-time analytics improve the analysis of key ratios?

Real-time analytics can provide prompt insights into economic health, enhancing the analysis of key ratios.

What should be examined to identify cash flow issues?

Cash flow statements should be examined to pinpoint periods of cash shortfalls and understand their underlying causes, such as delayed receivables or excessive inventory.

Why is continuous monitoring important in addressing cash flow issues?

Continuous monitoring through analytics allows for quick identification and resolution of cash flow issues.

How can companies benchmark their performance?

Companies can benchmark their performance by comparing metrics against industry standards, which helps gauge their performance relative to peers.

What is the significance of understanding a company's economic condition?

Establishing a clear understanding of the economic condition is crucial for formulating effective distressed company recovery plans.