Overview

This article offers critical insights for CFOs regarding the distinctions between carve-outs and divestitures, highlighting their significant implications for corporate strategy and asset management. Carve-outs enable companies to maintain partial control while raising capital, whereas divestitures entail complete asset sales. Each option presents unique benefits and challenges that demand careful navigation for effective financial leadership.

Moreover, understanding these differences is essential for strategic decision-making. CFOs must consider how these approaches align with their overall business objectives. Consequently, a thorough analysis of both options can lead to informed choices that enhance financial performance and corporate value.

In conclusion, CFOs are encouraged to delve deeper into the nuances of carve-outs and divestitures. By doing so, they can leverage these strategies to optimize their asset management and drive corporate success.

Introduction

Understanding the nuances between carve-outs and divestitures is essential for chief financial officers navigating the complexities of corporate restructuring. These strategic maneuvers not only impact a company’s financial health but also dictate its operational focus and market positioning.

As organizations face increasing pressure to optimize their asset portfolios, the question arises: how can CFOs effectively determine which approach—partial separation or complete divestiture—aligns best with their long-term goals?

This exploration delves into key insights that illuminate the distinct advantages and challenges of each strategy, empowering financial leaders to make informed decisions in an ever-evolving business landscape.

Define Carve Outs and Divestitures

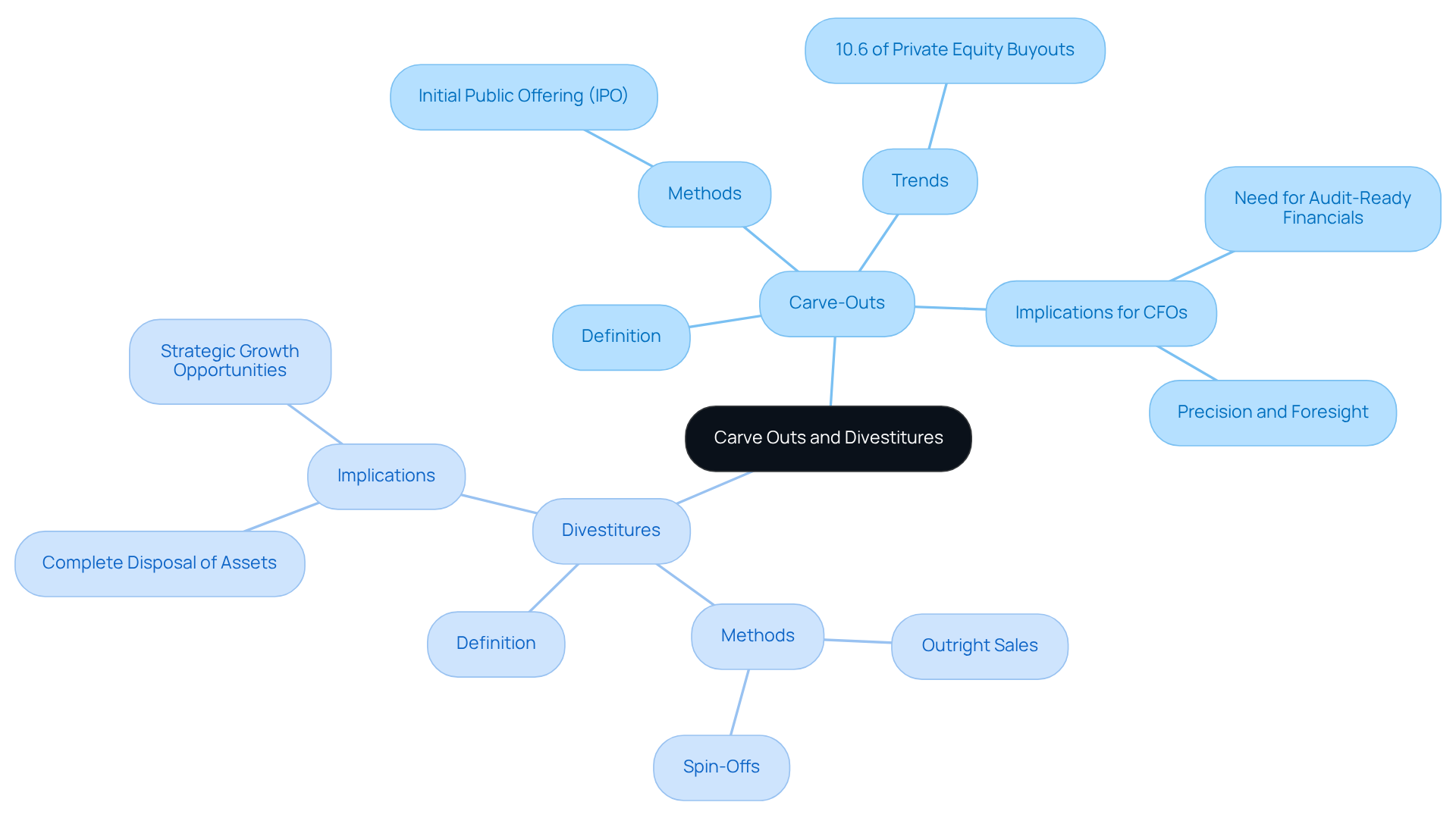

A carve-out vs divestiture signifies the partial or complete separation of a unit, product line, or group of assets from its parent organization, often resulting in the formation of a new entity. This process may involve selling a minority stake in the subsidiary through an Initial Public Offering (IPO), allowing the parent entity to retain some ownership while simultaneously raising capital. Conversely, the concept of carve-out vs divestiture entails the complete disposal of a business unit or asset, where the parent entity relinquishes all ownership and control. Various methods can execute this, including outright sales or spin-offs.

For chief financial officers, grasping these distinctions is crucial for effective asset management and corporate restructuring strategies. Recent trends indicate that carve-outs constituted 10.6% of private equity buyout transactions in 2025, surpassing the five-year average. However, many companies are currently delaying asset sales due to uncertainties in trade policies. Successful examples of carve-out vs divestiture within small to medium enterprises underscore the potential for strategic growth and operational efficiency. This reality emphasizes the necessity for financial executives to navigate these processes with precision and foresight.

To enhance decision-making, financial leaders can leverage real-time analytics through client dashboards, which offer critical insights into business health. Moreover, testing hypotheses and focusing on optimizing return on invested capital are essential strategies that financial executives should employ during these processes. As Greg Bryen aptly noted, 'Carve-outs are strategic inflection points that demand precision, foresight, and financial leadership.' Consequently, CFOs must ensure they deliver audit-ready carve-out financials that meet regulatory scrutiny and investor expectations.

Explore Benefits of Carve Outs and Divestitures

The comparison of carve out vs divestiture presents unique advantages, enabling firms to raise capital while retaining control over the divested unit. This strategy fosters improved operational focus, allowing the parent organization to concentrate on its core business, highlighting the differences between carve out vs divestiture as the entity operates independently.

Moreover, carve-outs can lead to tax benefits and enhance financial metrics by lowering debt levels. In contrast, asset sales provide immediate cash inflows, empowering organizations to reinvest in more profitable ventures or decrease debt. They facilitate the streamlining of operations by eliminating non-core or underperforming assets, ultimately enhancing overall corporate value.

Significantly, a study revealed that 60% of asset sales correlated with enhanced EBITDA growth, underscoring their potential to significantly bolster an organization's financial health and strategic direction. Successful case studies, such as Kraft Foods' separation into Kraft Heinz and Mondelez International, illustrate how asset sales can unlock value by creating focused companies tailored for specific markets.

For CFOs, these strategies not only improve cash flow but also enhance operational efficiency, positioning the organization for sustainable growth.

Analyze Challenges in Carve Outs and Divestitures

The challenges presented by carve-out vs divestiture require careful navigation. Carve-outs, in particular, involve untangling shared resources, systems, and contracts between the parent organization and the newly independent entity. This complexity can lead to significant operational disruptions if not managed effectively. For instance, in 2021, over 9,155 carve-outs were executed, reflecting a 67% increase from the previous year—underscoring the growing trend and the associated operational challenges. Determining a fair valuation for the carved-out unit is another critical hurdle, as inaccuracies can jeopardize the transaction's success. The Business Valuation Report, priced at $3,500.00, provides essential insights into business worth, aiding CFOs in this process.

Conversely, asset sales frequently contend with challenges related to market perception and the potential loss of synergies that the separated unit previously had with the parent firm. Legal and regulatory hurdles further complicate the divestiture process, necessitating a thorough understanding of compliance requirements. Chief Financial Officers must be acutely aware of these challenges to devise effective strategies that mitigate risks and ensure smooth transitions. As the role of CFOs evolves, they are increasingly tasked with ensuring that back-office processes and shared services are seamlessly transitioned, optimizing transition services to eliminate unnecessary costs. Utilizing a client dashboard for real-time business analytics is crucial for continuous monitoring and adjustment of strategies. Tackling these complexities is essential for achieving successful results in both carve-out vs divestiture processes and asset sales. By testing hypotheses and operationalizing lessons learned, CFOs can enhance their decision-making processes and drive better results during these critical transitions.

Compare Suitability for Business Scenarios

The decision between carve-out vs divestiture is fundamentally influenced by an organization's strategic objectives and prevailing market conditions. Carve-outs are particularly advantageous for organizations that wish to maintain a degree of control over the divested unit while simultaneously securing capital. This method is ideal for enterprises with promising growth potential in specific segments that require operational streamlining. By utilizing a client dashboard for real-time analytics, organizations can continuously monitor the performance of their segments, enabling informed decisions that align with their turnaround strategies. For instance, FIS's equity carve-out of Worldpay allowed both entities to focus on their distinct strategies while generating significant capital, valued at $18.5 billion.

On the other hand, sell-offs are better suited for organizations aiming to fully withdraw from a market or business segment that no longer corresponds with their primary strategy. This method is often preferred when rapid cash generation or debt reduction is necessary. A significant instance is DuPont's sale of its Mobility & Materials segment to Celanese for $11 billion, allowing DuPont to focus on high-margin operations.

Statistically, firms that effectively execute carve-outs often observe improved financial health after the transaction. For instance, sellers with accelerated EBITDA growth post-divestiture reported median transaction prices nearly double those without such growth. Moreover, more than 60% of businesses that sold to U.S. purchasers saw enhanced EBITDA growth, emphasizing the possible financial advantages of strategic sales.

Ultimately, the decision regarding carve-out vs divestiture should be informed by a comprehensive analysis of the company's financial health, market positioning, and long-term strategic goals. Engaging in proactive planning and due diligence, supported by real-time analytics from tools like the client dashboard, can significantly enhance the likelihood of achieving favorable outcomes in either scenario.

Conclusion

Understanding the distinctions between carve-outs and divestitures is essential for CFOs aiming to optimize asset management and corporate restructuring strategies. Each approach presents unique benefits and challenges:

- Carve-outs enable companies to retain some control while raising capital.

- Divestitures facilitate complete ownership relinquishment.

The strategic choice between these options can significantly influence an organization’s operational focus and financial health.

Throughout this article, we have presented key insights that highlight the advantages of both strategies.

- Carve-outs can enhance operational efficiency and provide tax benefits.

- Divestitures offer immediate cash inflows and the opportunity to streamline operations.

Successful case studies, such as Kraft Foods and DuPont, illustrate how these approaches can unlock value and drive growth. However, the complexities involved—including resource untangling and valuation challenges—necessitate careful planning and execution.

Ultimately, the decision to pursue a carve-out or divestiture should be guided by a thorough analysis of the company’s strategic objectives and market conditions. By leveraging real-time analytics and engaging in proactive planning, CFOs can navigate these processes effectively, ensuring that their organizations are well-positioned for sustainable growth and success. Embracing these strategies not only enhances financial performance but also contributes to a more focused and resilient business model. It is imperative for CFOs to act decisively, applying the insights gained to foster an environment of continuous improvement and adaptability.

Frequently Asked Questions

What is the difference between a carve-out and a divestiture?

A carve-out involves the partial separation of a unit, product line, or group of assets from its parent organization, often resulting in the formation of a new entity. This can include selling a minority stake through an Initial Public Offering (IPO). In contrast, a divestiture refers to the complete disposal of a business unit or asset, where the parent entity relinquishes all ownership and control.

What are some methods used for divestiture?

Divestiture can be executed through various methods, including outright sales or spin-offs.

Why is it important for chief financial officers (CFOs) to understand carve-outs and divestitures?

Understanding carve-outs and divestitures is crucial for CFOs for effective asset management and corporate restructuring strategies.

What recent trends have been observed regarding carve-outs in private equity transactions?

In 2025, carve-outs constituted 10.6% of private equity buyout transactions, surpassing the five-year average.

Why are many companies delaying asset sales currently?

Many companies are delaying asset sales due to uncertainties in trade policies.

How can financial leaders enhance their decision-making during carve-outs and divestitures?

Financial leaders can enhance decision-making by leveraging real-time analytics through client dashboards, which provide critical insights into business health, and by focusing on optimizing return on invested capital.

What is the significance of delivering audit-ready carve-out financials?

Delivering audit-ready carve-out financials is essential for meeting regulatory scrutiny and investor expectations.

What did Greg Bryen note about carve-outs?

Greg Bryen noted that 'carve-outs are strategic inflection points that demand precision, foresight, and financial leadership.'