Overview

This article delineates four pivotal strategies for financial survival planning:

- Conducting comprehensive financial assessments

- Implementing effective cash flow management techniques

- Aligning long-term financial goals with short-term needs

- Adopting robust risk management practices

Furthermore, these strategies are bolstered by detailed methodologies, including ratio analysis and liquidity forecasting, which empower businesses to comprehend their financial health. Consequently, this understanding enables them to make informed decisions, effectively navigating economic challenges.

Introduction

In the dynamic landscape of business, financial health is paramount for success. Companies must navigate an array of challenges, from cash flow management to risk mitigation, while aligning long-term goals with immediate needs. By conducting comprehensive financial assessments, organizations can unlock insights that drive strategic decisions and foster sustainable growth.

With a focus on effective cash flow techniques and robust risk management practices, businesses can not only survive but thrive in an increasingly competitive environment. This article delves into essential strategies that empower companies to enhance their financial acumen and position themselves for future success.

Conduct Comprehensive Financial Assessments

A thorough monetary evaluation is essential for grasping a company's economic condition and entails a detailed examination of all fiscal statements, including balance sheets, income statements, and cash flow statements. To commence this process, companies should collect historical monetary data and examine trends over time. Key steps in conducting these assessments include:

- Review Fiscal Statements: Examine the previous three to five years of fiscal statements to identify trends in revenue, expenses, and profitability. This historical perspective is vital for recognizing patterns that can inform future strategies.

- Conduct Ratio Analysis: Utilize financial ratios—such as liquidity, profitability, and leverage ratios—to evaluate financial health and operational efficiency. This quantitative analysis provides insights into areas needing improvement.

- Identify Financial Flow Patterns: Scrutinize financial flow statements to understand monetary inflows and outflows, pinpointing periods of shortages or surpluses. Effective cash flow management is crucial, particularly as 57% of mention high interest rates as a major drawback of credit card usage.

- Benchmark Against Industry Standards: Compare metrics against industry benchmarks to evaluate performance in relation to competitors. This benchmarking can highlight strengths and weaknesses, guiding strategic adjustments.

- Engage Stakeholders: Involve key stakeholders, including CFOs and department heads, to gather insights and validate findings. Involving these individuals guarantees that the evaluation represents a thorough perspective of the organization's economic environment, which is critical for effective financial survival planning.

By conducting thorough monetary evaluations, companies can develop a clear understanding of their economic situation, essential for informed decision-making and strategic planning. Integrating real-time analytics into this process facilitates continuous monitoring of performance, allowing teams to make timely adjustments that maintain organizational health. Recent trends suggest that 51-53% of companies utilize customer service, email marketing, and eCommerce software, emphasizing the significance of combining economic insights with operational strategies. Moreover, 79% of small enterprises indicate better customer interaction via personalized marketing, demonstrating the opportunity for improved performance when economic evaluations guide wider organizational strategies.

However, CFOs should be aware of common pitfalls in monetary evaluations, such as overlooking critical ratios or failing to engage all relevant stakeholders, which can lead to incomplete analyses. Furthermore, the case study titled 'Small Enterprise Environment: Optimism About the Future' emphasizes that despite no significant rise in expectations for revenue, 69% of small enterprises anticipate revenue growth in the coming year, illustrating the positive outlook that can be backed by thorough financial evaluations. Ultimately, these assessments are not just about survival; they are about positioning for sustainable growth in an increasingly competitive environment.

Implement Effective Cash Flow Management Techniques

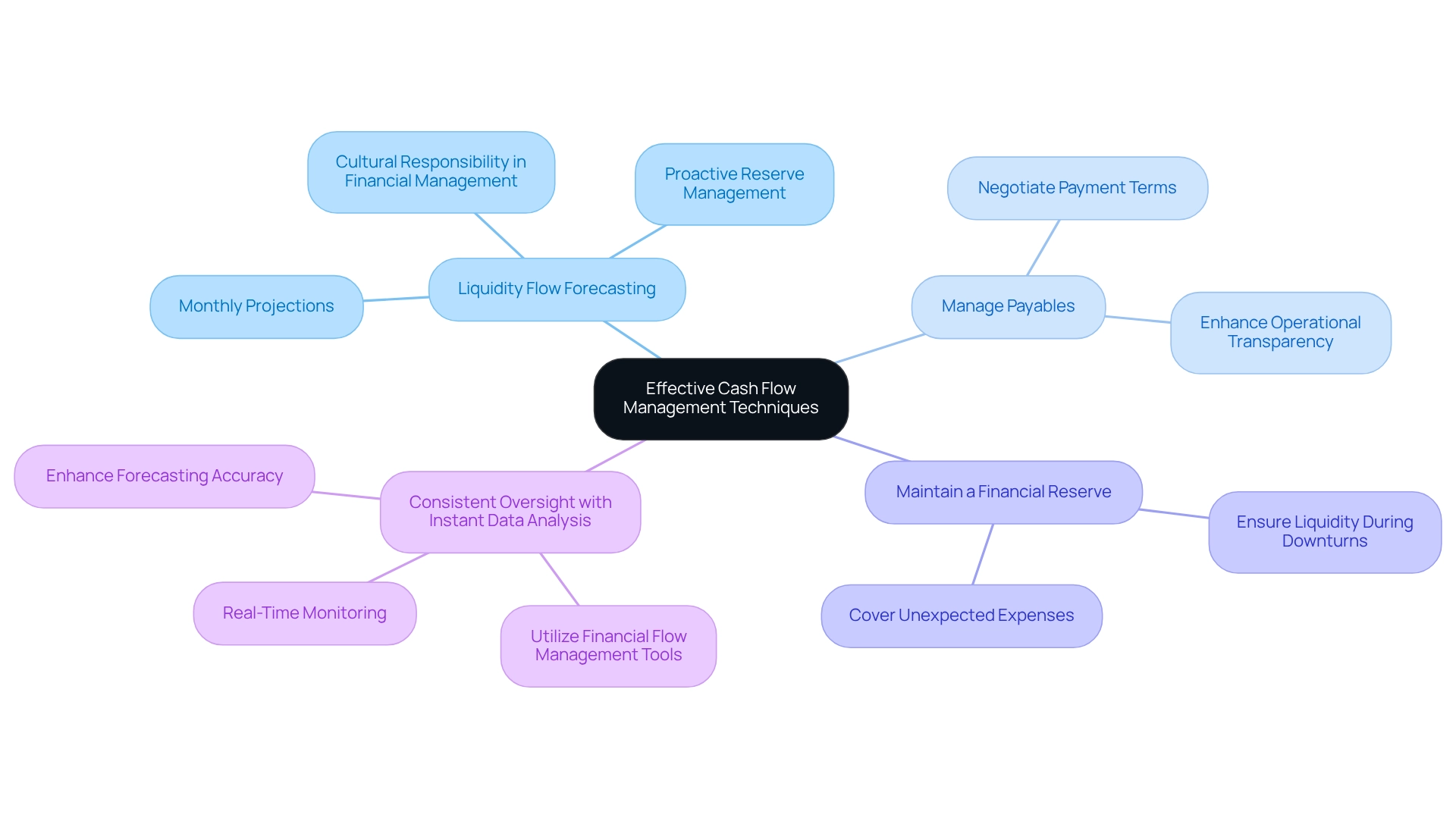

To effectively manage currency flow, companies must adopt several essential techniques:

- Liquidity Flow Forecasting: Develop monthly liquidity flow projections to anticipate monetary inflows and outflows, enabling proactive management of reserves. This practice is crucial, especially considering that 37% of have contemplated shutting down due to late payment issues. Effective financial survival planning is even more vital during economic downturns, empowering businesses to navigate challenges and seize opportunities. This approach not only enhances liquidity but also fosters a culture of responsibility in financial management, which is essential for long-term economic health.

- Manage Payables: Negotiate favorable payment terms with suppliers to extend payables without incurring penalties, thereby conserving funds. This strategy is particularly important during economic downturns when financial survival planning becomes increasingly crucial for preserving financial reserves. Enhancing transparency in operational processes, such as sales and procurement, can further improve financial flow management.

- Maintain a Financial Reserve: Establish a financial reserve to cover unexpected expenses or revenue downturns, ensuring liquidity during challenging times. This reserve serves as a monetary cushion, allowing companies to manage uncertainties more effectively.

- Consistent Oversight with Instant Data Analysis: Utilize financial flow management tools and client dashboards for real-time data analysis to continuously monitor financial flow, enabling swift responses to emerging issues. This method reduces the decision-making cycle, allowing companies to take decisive actions to maintain their economic well-being. Consistent supervision can significantly enhance forecasting accuracy, which is vital for financial survival planning. By implementing these strategies, including insights from 'Mastering the Cash Conversion Cycle,' companies can strengthen their liquidity management, ensuring they retain the resources necessary for operational success and growth.

Align Long-Term Financial Goals with Short-Term Needs

To effectively align long-term financial goals with short-term needs, businesses should implement the following strategies:

- Set SMART Goals: Establish Specific, Measurable, Achievable, Relevant, and Time-bound goals that integrate . This approach not only clarifies priorities but also enhances accountability across the organization.

- Prioritize Investments: Assess potential investments by their alignment with long-term objectives while ensuring they meet immediate operational requirements. This dual focus helps in maximizing resource utilization and fostering sustainable growth.

- Create a Balanced Budget: Formulate a budget that allocates resources effectively between short-term operational necessities and . This balance is crucial for maintaining operational health while pursuing growth opportunities.

- Conduct Thorough Fiscal Evaluations: Regular monetary reviews, including our Fiscal Assessment service, can help identify opportunities to preserve cash and reduce liabilities. By comprehending the economic environment, companies can reveal value and lower expenses, ensuring a more effective distribution of resources.

- Regularly Review Goals: Conduct quarterly evaluations of monetary objectives to monitor progress and adapt to evolving circumstances. This practice ensures that companies remain agile and responsive to market changes.

- Engage Leadership: Involve leadership in the goal-setting process to ensure alignment across all departments. This collaborative approach fosters a unified direction and enhances the likelihood of achieving both short-term and long-term objectives.

- Build an Emergency Fund: Aim to establish an emergency fund that covers 3 to 6 months' worth of wages. This monetary cushion is essential for addressing unexpected short-term needs while maintaining focus on long-term goals.

By implementing these strategies, companies can establish a thorough financial survival planning that meets current requirements while setting the stage for future achievement. As Jean Chatzky aptly states, "By definition, saving for anything requires us not to get things now so that we can get bigger ones later." Comprehending the distinction between saving and investing is essential for attaining economic success, as emphasized in the case study on the difference between the two. By prioritizing actionable strategies and conducting comprehensive evaluations, including testing and measuring results, organizations can ensure they are well-prepared for both current challenges and future opportunities.

Adopt Robust Risk Management Practices

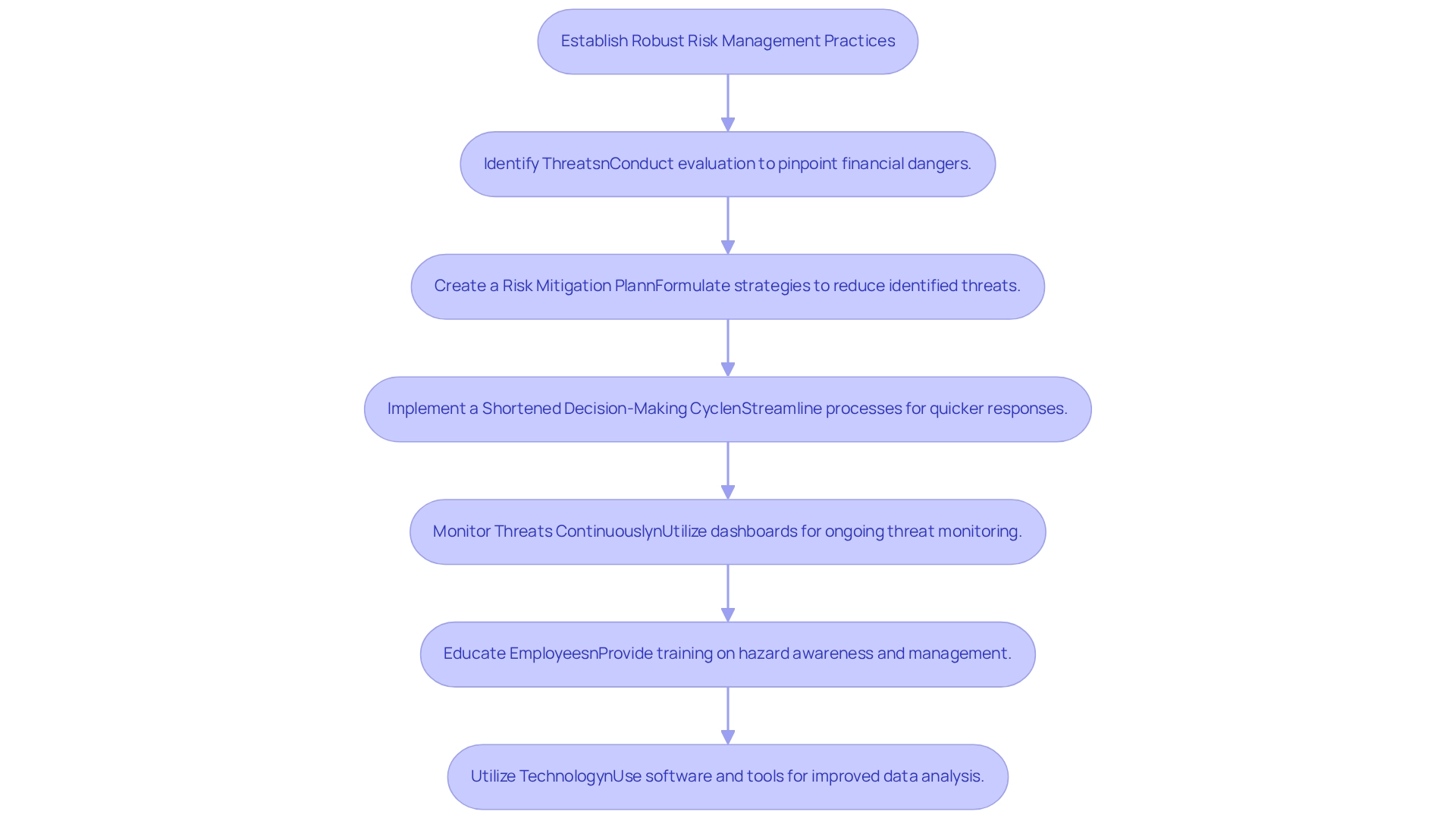

To establish robust risk management practices, businesses must follow these essential steps:

- Identify Threats: Conduct a thorough evaluation to pinpoint potential financial dangers, such as market volatility, credit issues, and operational challenges.

- Create a Risk Mitigation Plan: Formulate a detailed strategy that outlines approaches for reducing identified threats, including contingency measures for worst-case scenarios.

- Implement a Shortened Decision-Making Cycle: Streamline the decision-making process to allow for quicker responses to emerging challenges, ensuring that your team can take decisive action to preserve operational health.

- Monitor Threats Continuously: Utilize a client dashboard for ongoing threat monitoring, leveraging real-time analytics to identify shifts in the threat landscape and adapt strategies as necessary. This method enables organizations to make informed choices swiftly, maintaining their operational well-being.

- Educate Employees: Provide training for employees on hazard awareness and management practices, fostering a culture of proactive management across the organization.

- Utilize Technology: Use management software and analytical tools to improve data analysis and reporting capabilities, enabling more informed decision-making and ensuring that businesses can respond effectively to emerging challenges.

As W. Buffet aptly stated, "I believe that a CEO must not delegate management of uncertainties. It’s simply too important." This underscores the vital role of leadership in effective management of uncertainties. Furthermore, with more than 330,803 hits on discussions related to management practices, it is clear that this subject holds considerable interest and significance in today's corporate landscape.

Moreover, understanding the distinctions in , as illustrated in the case study "The Nature of Risk in Investment," can provide valuable insights into effective strategies. By adopting these practices, businesses can enhance their resilience against financial uncertainties through financial survival planning, which positions them to navigate challenges effectively and capitalize on emerging opportunities.

Conclusion

Navigating the complexities of financial health is essential for any business aiming for success in today's competitive landscape. Comprehensive financial assessments provide organizations with valuable insights into their financial status, enabling informed decision-making and strategic planning. By diligently reviewing financial statements, conducting ratio analyses, and benchmarking against industry standards, businesses can gain a clearer understanding of their strengths and weaknesses, ultimately positioning themselves for sustainable growth.

Implementing effective cash flow management techniques is equally crucial. By forecasting cash flows, optimizing receivables, and maintaining cash reserves, companies can ensure liquidity and operational success. These practices not only help in managing immediate financial needs but also provide a solid foundation for long-term strategic investments.

Moreover, aligning long-term financial goals with short-term needs creates a balanced approach that fosters accountability and resource optimization. Establishing SMART goals, conducting regular reviews, and engaging leadership are vital steps in this process, ensuring that businesses remain agile and responsive to market changes.

Finally, adopting robust risk management practices allows organizations to identify potential threats and implement strategies to mitigate them effectively. By continuously monitoring risks and leveraging technology, businesses can enhance their resilience against uncertainties and capitalize on emerging opportunities.

In conclusion, by focusing on comprehensive financial assessments, effective cash flow management, strategic alignment of goals, and robust risk management, businesses can not only survive but thrive. Embracing these essential strategies will empower organizations to navigate challenges and foster a culture of financial acumen, ultimately paving the way for future success.

Frequently Asked Questions

What is the purpose of a thorough monetary evaluation?

A thorough monetary evaluation is essential for grasping a company's economic condition and involves a detailed examination of all fiscal statements, including balance sheets, income statements, and cash flow statements.

What are the key steps in conducting a monetary evaluation?

The key steps include reviewing fiscal statements, conducting ratio analysis, identifying financial flow patterns, benchmarking against industry standards, and engaging stakeholders.

How far back should companies review fiscal statements?

Companies should examine the previous three to five years of fiscal statements to identify trends in revenue, expenses, and profitability.

What is the significance of ratio analysis in monetary evaluations?

Ratio analysis utilizes financial ratios, such as liquidity, profitability, and leverage ratios, to evaluate financial health and operational efficiency, providing insights into areas needing improvement.

Why is it important to identify financial flow patterns?

Scrutinizing financial flow statements helps understand monetary inflows and outflows, allowing companies to pinpoint periods of shortages or surpluses, which is crucial for effective cash flow management.

How can benchmarking against industry standards benefit a company?

Benchmarking against industry standards allows companies to evaluate their performance in relation to competitors, highlighting strengths and weaknesses that can guide strategic adjustments.

Who should be involved in the monetary evaluation process?

Key stakeholders, including CFOs and department heads, should be engaged to gather insights and validate findings, ensuring a comprehensive perspective of the organization's economic environment.

What role does real-time analytics play in monetary evaluations?

Integrating real-time analytics facilitates continuous monitoring of performance, allowing teams to make timely adjustments that maintain organizational health.

What common pitfalls should CFOs be aware of during monetary evaluations?

CFOs should avoid overlooking critical ratios and failing to engage all relevant stakeholders, as these can lead to incomplete analyses.

What does the case study 'Small Enterprise Environment: Optimism About the Future' indicate about small enterprises' expectations for revenue?

The case study indicates that despite no significant rise in expectations for revenue, 69% of small enterprises anticipate revenue growth in the coming year, reflecting a positive outlook supported by thorough financial evaluations.