Overview

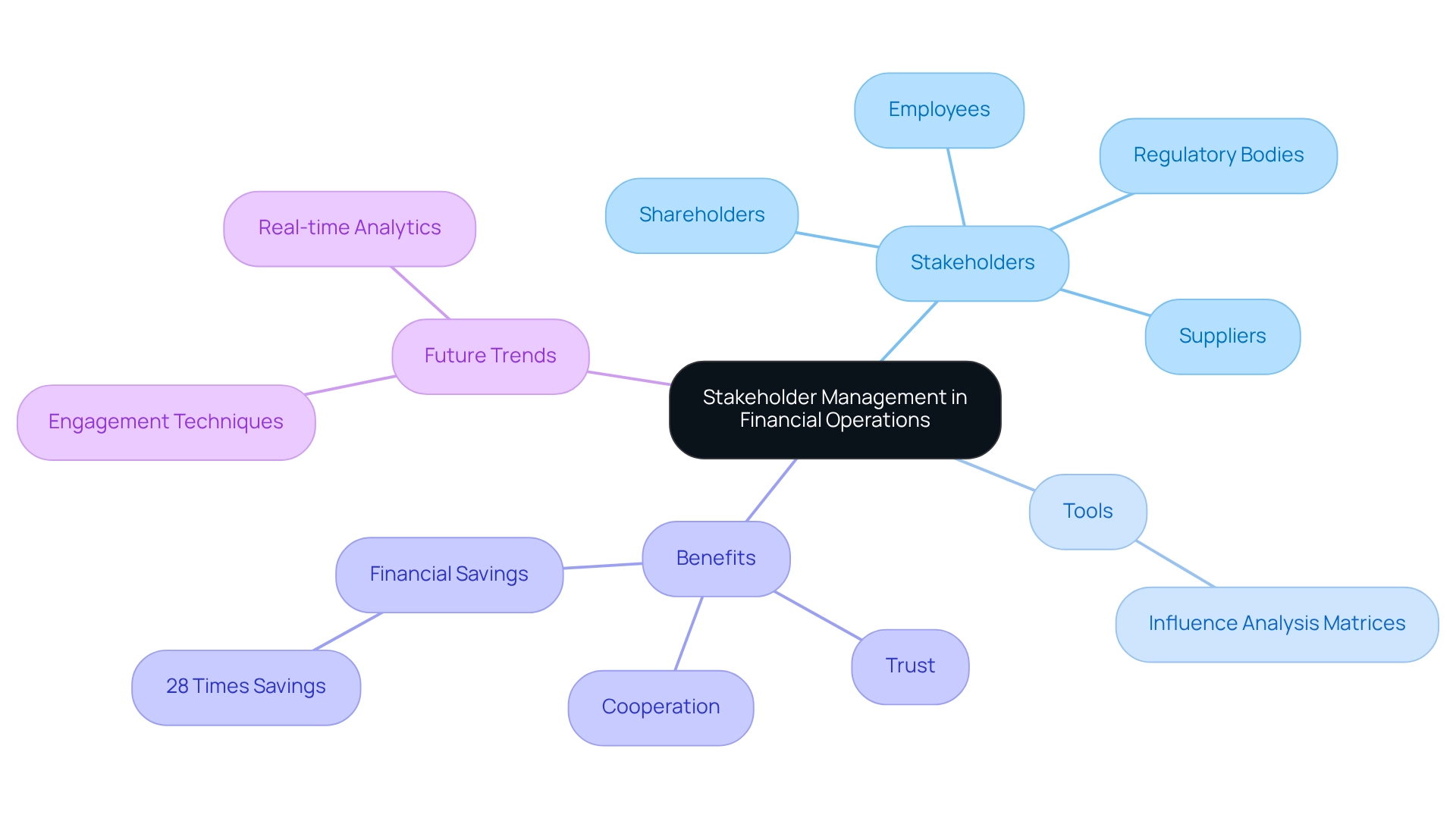

Effective matrix stakeholder management in finance is essential for success. It involves identifying key stakeholders, developing tailored engagement strategies, and continuously monitoring and adapting practices to enhance collaboration and project outcomes. By utilizing tools such as influence analysis matrices and maintaining open communication, finance professionals can foster trust and cooperation among stakeholders. This approach ultimately leads to improved financial outcomes and increased project efficiency.

Moreover, the ability to engage stakeholders effectively is not just a best practice; it is a necessity in today's complex financial landscape. By employing targeted strategies, finance professionals can ensure that all parties are aligned, thus minimizing risks and maximizing returns.

Consequently, organizations that prioritize stakeholder engagement are better positioned to navigate challenges and seize opportunities. Therefore, it is imperative for finance professionals to adopt these practices and tools to drive success in their projects. Take action now to enhance your stakeholder management strategies and witness the positive impact on your financial projects.

Introduction

In the intricate world of financial operations, stakeholder management stands as a vital component for success. Engaging with individuals and groups who have a vested interest in financial projects not only fosters trust but also drives the collaboration essential for achieving objectives. As organizations navigate the complexities of stakeholder relationships—ranging from shareholders to regulatory bodies—they must develop strategic approaches to ensure all voices are heard and valued.

Moreover, with the right tools and frameworks, finance professionals can enhance their engagement efforts, ultimately leading to improved project outcomes and organizational efficiency. This article delves into the critical aspects of stakeholder management, offering insights on:

- Identifying key players

- Crafting tailored engagement strategies

- Continuously adapting practices to meet the ever-evolving landscape of financial operations.

Understand Stakeholder Management in Financial Operations

Effective matrix stakeholder management in financial operations is crucial for identifying and involving individuals or groups with a vested interest in a project's financial results. This includes shareholders, employees, suppliers, and regulatory bodies. Efficient administration ensures that all participants are informed, their concerns are addressed, and their contributions are acknowledged. By understanding the dynamics of these relationships, finance professionals can foster trust and cooperation, which are vital for achieving financial goals and overcoming challenges through matrix stakeholder management.

Employing tools such as influence analysis matrices is part of matrix stakeholder management, allowing for the visualization and prioritization of key individuals based on their impact and interest levels, thereby promoting more strategic interaction efforts. Entities that implement uniform project oversight techniques have demonstrated savings 28 times greater than those that do not, underscoring the financial advantages of effective participant collaboration in achieving project success.

Looking ahead to 2025, the importance of strong participant involvement is highlighted by its ability to enhance public awareness and trust. For instance, a case study on the influence of participant involvement in innovation revealed that such engagement fosters new insights, collaborative problem-solving, and the creation of sustainable products and services. By establishing a comprehensive framework for engaging interested parties that emphasizes hypothesis testing, swift decision-making, and real-time analytics, finance professionals can continuously monitor business performance and apply lessons learned from past experiences.

As noted by the Quixy Editorial Team, 'Project oversight has become an integral part of many organizations across various industries.' As the discipline of overseeing initiatives evolves with advancements in technology and methodologies, finance experts must stay informed about contemporary trends in interest group engagement to enhance their operational efficiency.

Identify and Analyze Key Stakeholders

Successful engagement of interested parties is facilitated by matrix stakeholder management, which begins with a comprehensive identification and examination of key individuals, a vital component for the success of financial initiatives. Start by creating an extensive list that includes both internal participants—such as employees and management—and external entities like investors and regulatory agencies.

Once identified, utilize tools such as the Power-Interest Grid to classify participants according to their degree of influence and interest in the initiative. This strategic analysis enables finance teams to prioritize their engagement efforts, ensuring that influential, highly interested parties receive the necessary attention to support objectives.

Furthermore, incorporating streamlined decision-making processes can significantly enhance this engagement. Our team advocates for a shortened decision-making cycle throughout the turnaround process, empowering your team to take decisive action to preserve your business.

In addition, we continuously monitor the success of our plans through a client dashboard that provides real-time business analytics, facilitating ongoing diagnosis of business health. Regularly revisiting participant analysis is essential, as dynamics can shift, influencing project outcomes. Notably, research indicates that 50% of a company's worth often derives from just 15-20 crucial roles, underscoring the importance of thorough analysis of key participants in optimizing financial success.

By prioritizing these key parties through matrix stakeholder management, CFOs can greatly enhance their strategic decision-making. Moreover, proactive problem-solving and robust partner relationships can reduce conflict resolution expenses, further improving project efficiency.

As emphasized in the case study 'Collaboration as a Business Strategy,' aligning the interests of involved parties fosters cooperative efforts that benefit everyone engaged. Ultimately, we are committed to providing value to all parties involved, ensuring the future success of our companies, our communities, and our country.

Develop Tailored Engagement Strategies for Stakeholders

Recognizing and examining involved parties is just the beginning; the next vital step in matrix stakeholder management is to create customized engagement strategies. This process initiates with the development of communication strategies that detail how and when to engage each interested party in the context of matrix stakeholder management.

For example, individuals with significant influence may require consistent updates and opportunities for feedback, while those with lesser influence could benefit from occasional newsletters or briefings. Employing a variety of communication channels—such as meetings, emails, and reports—is essential for effective matrix stakeholder management to ensure that messages are conveyed effectively.

In the framework of matrix stakeholder management, it is essential to consider the preferences of each interested party group; some may favor face-to-face interactions, while others might prefer digital communication. In the context of matrix stakeholder management, involving interested parties in a manner that aligns with their preferences not only cultivates stronger connections but also enhances their commitment to the initiative's success.

Our commitment to partnership means we work collaboratively with your team to identify underlying business issues and create a strategic plan that reinforces strengths while addressing weaknesses.

Significantly, groups that emphasize matrix stakeholder management have been shown to achieve higher success rates in initiatives and better financial results, underscoring the essential role of effective communication strategies in finance. A study revealed that 43% of organizations that seldom or never utilize formal project management techniques complete projects on time, highlighting the significance of structured interaction strategies.

Furthermore, the case study titled 'Waiting to be Shaped and Deployed: Lower Voice and Value' illustrates how matrix stakeholder management can foster participants for future contributions. According to AccountAbility, organizations that prioritize matrix stakeholder management and engage participants at high levels are more likely to be viewed as trustworthy and legitimate.

Notably, 50% of a company's worth often arises from just 15-20 crucial roles, highlighting the necessity of matrix stakeholder management to effectively identify and involve these important individuals.

Monitor and Adapt Stakeholder Management Practices

Effective management of participants within matrix stakeholder management is an ongoing process that demands continuous monitoring and adaptation. Consistently requesting input from involved parties is essential for evaluating their satisfaction and addressing any arising issues. This can be accomplished through various methods such as:

- Surveys

- One-on-one meetings

- Informal check-ins

Analyzing this feedback allows finance teams to identify trends and pinpoint areas for improvement in their engagement strategies.

Moreover, it is crucial to stay flexible in matrix stakeholder management as the dynamics of involved parties change; new participants may emerge, or current ones may modify their degrees of interest or influence. By being responsive and adaptable, finance teams can ensure that their relationship management practices not only align with objectives but also foster positive connections. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business. Ultimately, by promoting a culture of open dialogue and cooperative problem-solving, initiatives can improve matrix stakeholder management and develop stronger connections with interested parties. This proactive strategy improves results and trust among involved parties.

Furthermore, clarity in bonus management fosters trust and guarantees equity, which is essential in engaging with interested parties. We continually monitor the success of our plans and teams through our client dashboard, which provides real-time business analytics to continually diagnose your business health. A case study titled 'Waiting to be Shaped and Deployed: Lower Voice and Value' illustrates how effective measurement of stakeholder impact through matrix stakeholder management can lead to improved business outcomes, reinforcing the importance of monitoring stakeholder satisfaction in finance projects with real-time analytics.

Conclusion

The significance of stakeholder management in financial operations is paramount. By effectively identifying and engaging key stakeholders, organizations can cultivate trust and collaboration, essential elements for achieving financial objectives. Understanding the dynamics within stakeholder relationships allows finance professionals to prioritize their engagement efforts, ensuring that high-power, high-interest stakeholders receive the necessary attention to drive project success.

Crafting tailored engagement strategies is crucial. By developing communication plans that align with the preferences of various stakeholder groups, organizations can enhance commitment and fortify relationships. Data clearly indicates that effective communication not only improves project outcomes but also contributes to the overall financial health of the organization. As firms adapt their engagement practices, they are likely to witness a significant increase in project success rates and stakeholder satisfaction.

Moreover, continuous monitoring and adaptation of stakeholder management practices are vital. By soliciting feedback and remaining responsive to shifts in stakeholder dynamics, finance teams can refine their strategies and nurture positive relationships. This proactive approach fosters a culture of collaboration and transparency, ultimately leading to improved project outcomes and stronger stakeholder trust.

In conclusion, investing in robust stakeholder management practices is essential for organizations seeking to navigate the complexities of financial operations successfully. By prioritizing stakeholder engagement, developing tailored strategies, and remaining adaptable, finance professionals can ensure that all voices are heard and valued, paving the way for enhanced project performance and organizational success.

Frequently Asked Questions

Why is effective matrix stakeholder management important in financial operations?

Effective matrix stakeholder management is crucial for identifying and involving individuals or groups with a vested interest in a project’s financial results, such as shareholders, employees, suppliers, and regulatory bodies. It ensures that all participants are informed, their concerns are addressed, and their contributions are acknowledged, fostering trust and cooperation necessary for achieving financial goals.

What tools are used in matrix stakeholder management?

Tools such as influence analysis matrices are employed in matrix stakeholder management to visualize and prioritize key individuals based on their impact and interest levels, promoting more strategic interaction efforts.

What financial advantages are associated with effective stakeholder collaboration?

Entities that implement uniform project oversight techniques have demonstrated savings 28 times greater than those that do not, highlighting the financial benefits of effective participant collaboration in achieving project success.

How does participant involvement impact public awareness and trust?

Strong participant involvement enhances public awareness and trust, as it fosters new insights, collaborative problem-solving, and the creation of sustainable products and services.

What framework should finance professionals establish for engaging interested parties?

Finance professionals should establish a comprehensive framework that emphasizes hypothesis testing, swift decision-making, and real-time analytics to continuously monitor business performance and apply lessons learned from past experiences.

How is project oversight evolving in organizations?

Project oversight is becoming integral across various industries and is evolving with advancements in technology and methodologies, requiring finance experts to stay informed about contemporary trends in interest group engagement to enhance operational efficiency.