Overview

The article presents a comprehensive four-step process for conducting a financial crime risk assessment, essential for ensuring compliance with FCA regulations. This process encompasses:

- Risk identification

- Threat assessment

- Risk prioritization

- Stakeholder engagement

Emphasizing a structured approach, it highlights the critical need to manage vulnerabilities effectively. Moreover, continuous monitoring and thorough documentation are necessary to adapt to evolving financial crime risks and uphold regulatory standards. By following this framework, organizations can enhance their resilience against financial crime while maintaining compliance.

Introduction

Understanding the landscape of financial crime is crucial for organizations striving to protect their assets and comply with regulatory standards. As financial misconduct evolves, the importance of a thorough financial crime risk assessment becomes increasingly clear, particularly for small to medium enterprises navigating the complex compliance requirements set forth by the Financial Conduct Authority (FCA). However, many organizations grapple with how to effectively implement these assessments and adapt to the shifting nature of threats. What are the essential steps to not only identify and prioritize risks but also ensure ongoing compliance and resilience against financial crime?

To effectively navigate this landscape, organizations must first recognize the dynamic nature of financial crime. Moreover, they should prioritize developing robust risk assessment frameworks that are adaptable to emerging threats. In addition, leveraging authoritative statistics and expert insights can significantly enhance the effectiveness of these assessments. Consequently, organizations will not only improve their compliance posture but also foster a culture of resilience against financial crime.

In conclusion, the journey to safeguarding assets against financial crime begins with a commitment to understanding and addressing the risks involved. By taking proactive steps to implement comprehensive risk assessments, organizations can position themselves as leaders in compliance and security within their respective industries.

Understand Financial Crime Risk Assessment Basics

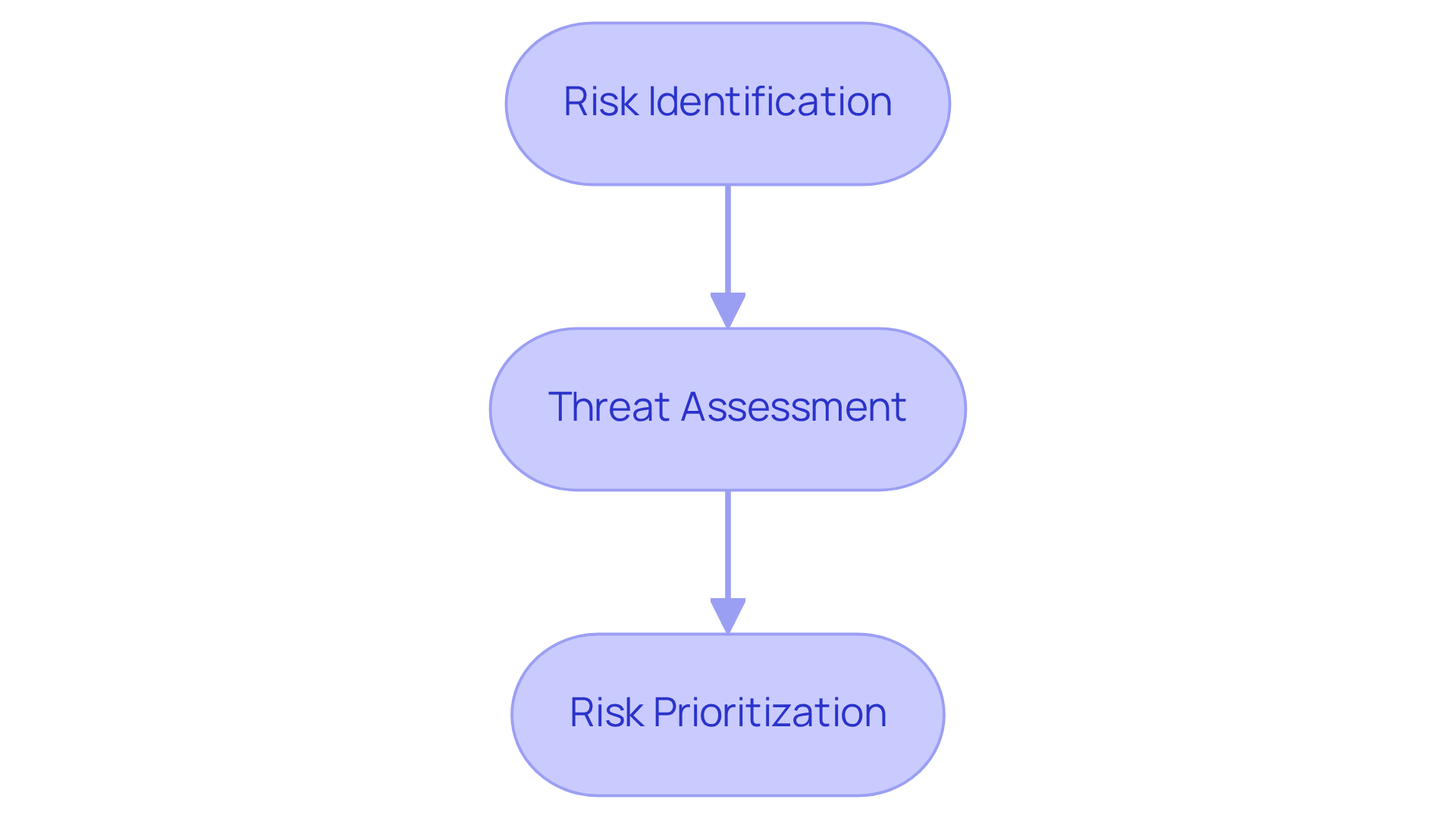

Evaluating the potential for monetary misconduct is an essential procedure for organizations, particularly small to medium enterprises. This process involves recognizing, examining, and appraising possible threats linked to monetary offenses such as , fraud, and terrorist funding. Such a systematic approach allows organizations to comprehend their vulnerabilities and the potential effects of these threats on their operations. The key components of this assessment include:

- Risk Identification: Recognizing the various types of financial crimes that could affect the organization is crucial for developing a comprehensive understanding of potential threats.

- Threat Assessment: Evaluating the likelihood and potential impact of the identified dangers enables organizations to gauge the severity of each threat.

- Risk Prioritization: Prioritizing dangers based on their severity and the organization's tolerance for vulnerabilities ensures that resources are allocated effectively to mitigate the most pressing challenges.

Grasping these fundamental components equips organizations to manage the intricacies of monetary offenses and enhances their capability to enforce efficient compliance strategies. As monetary offenses continue to evolve—particularly with the challenges posed by mobile money transactions and digital currencies—the significance of a robust evaluation procedure cannot be overstated. According to LexisNexis® Risk Solutions, SMB lending fraud is a prevalent concern across industries, with most companies anticipating it to impact overall losses by 6% to 10%. By proactively managing these challenges, businesses can protect their operations and uphold compliance with regulatory standards, including those required by the financial crime risk assessment FCA and the Financial Action Task Force (FATF).

Familiarize with FCA Regulations and Expectations

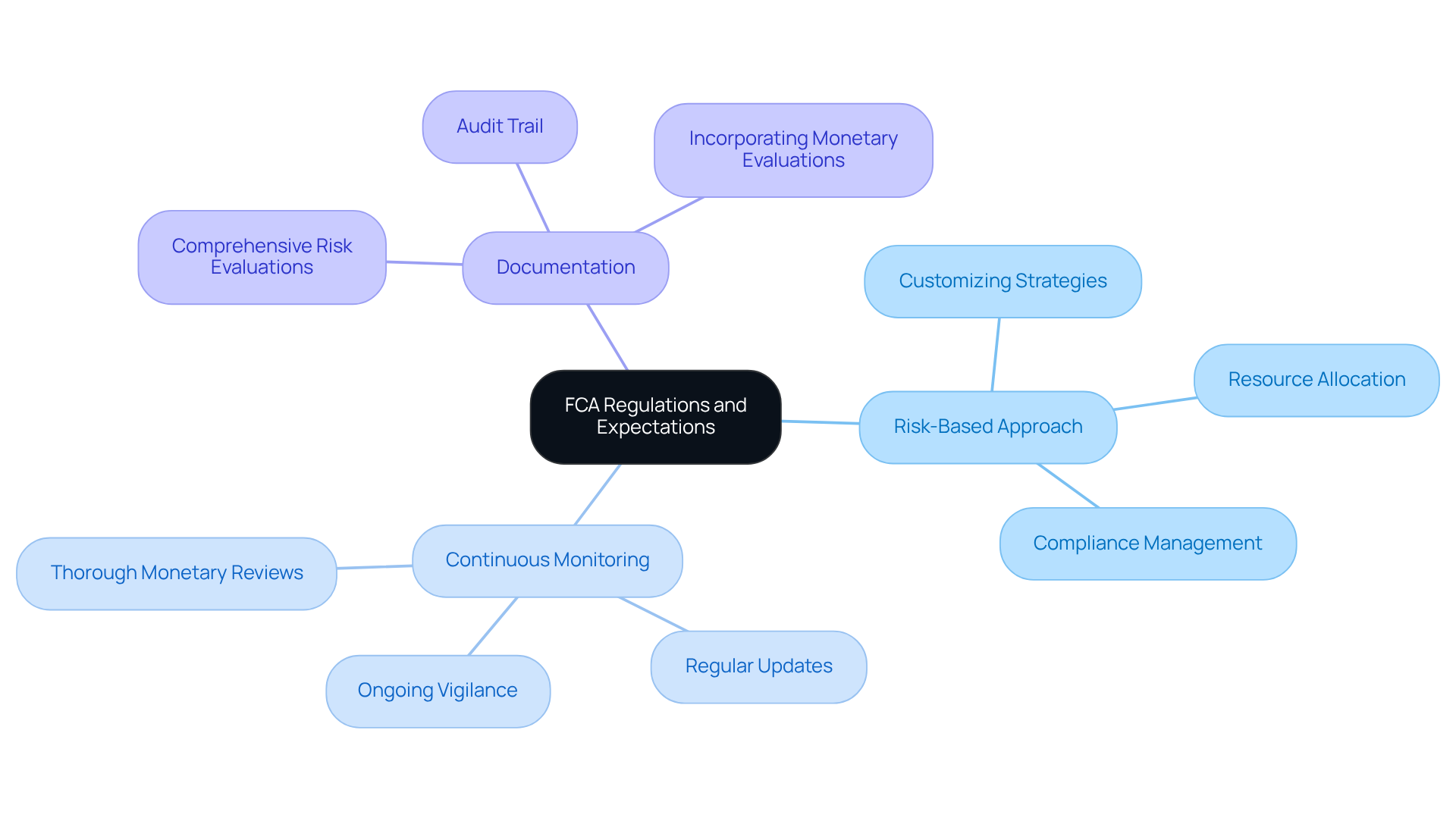

The Financial Conduct Authority (FCA) mandates that firms conduct comprehensive financial crime risk assessments, with several key expectations outlined in their updated Financial Crime Guide (FCG) for April 2025:

- Risk-Based Approach: Organizations must implement a risk-based approach to effectively identify and mitigate financial crime risks. This involves customizing strategies to address the specific threats they encounter, ensuring that resources are allocated where they are most needed. Statistics indicate that firms adopting a risk-based approach are better positioned to manage compliance effectively, reducing the likelihood of costly breaches. A comprehensive evaluation can help identify opportunities to conserve cash and lessen liabilities, further enhancing this approach.

- Continuous Monitoring: Firms are required to maintain ongoing vigilance over their risk environment, regularly updating their assessments to reflect new threats and changes in business operations. This proactive stance is essential for adapting to the changing environment of economic crime. Thorough monetary reviews focusing on can uncover value and reduce costs, making continuous monitoring more effective.

- Documentation: Comprehensive documentation of risk evaluations and the reasoning behind decisions is essential. This not only demonstrates compliance but also provides a clear audit trail that can be referenced during regulatory reviews. By incorporating detailed monetary evaluations into this documentation, firms can better demonstrate their commitment to cash preservation and liability reduction.

The FCA emphasizes that senior management must take proactive ownership of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) controls, reinforcing the importance of accountability at the highest levels. By understanding these regulations and incorporating them into your compliance framework, your organization can improve its resilience against monetary misconduct while aligning with FCA expectations. Moreover, including self-evaluation questions can offer practical insights for assessing monetary offenses controls, and promoting public-private collaborations can further enhance compliance strategies.

Conduct the Financial Crime Risk Assessment

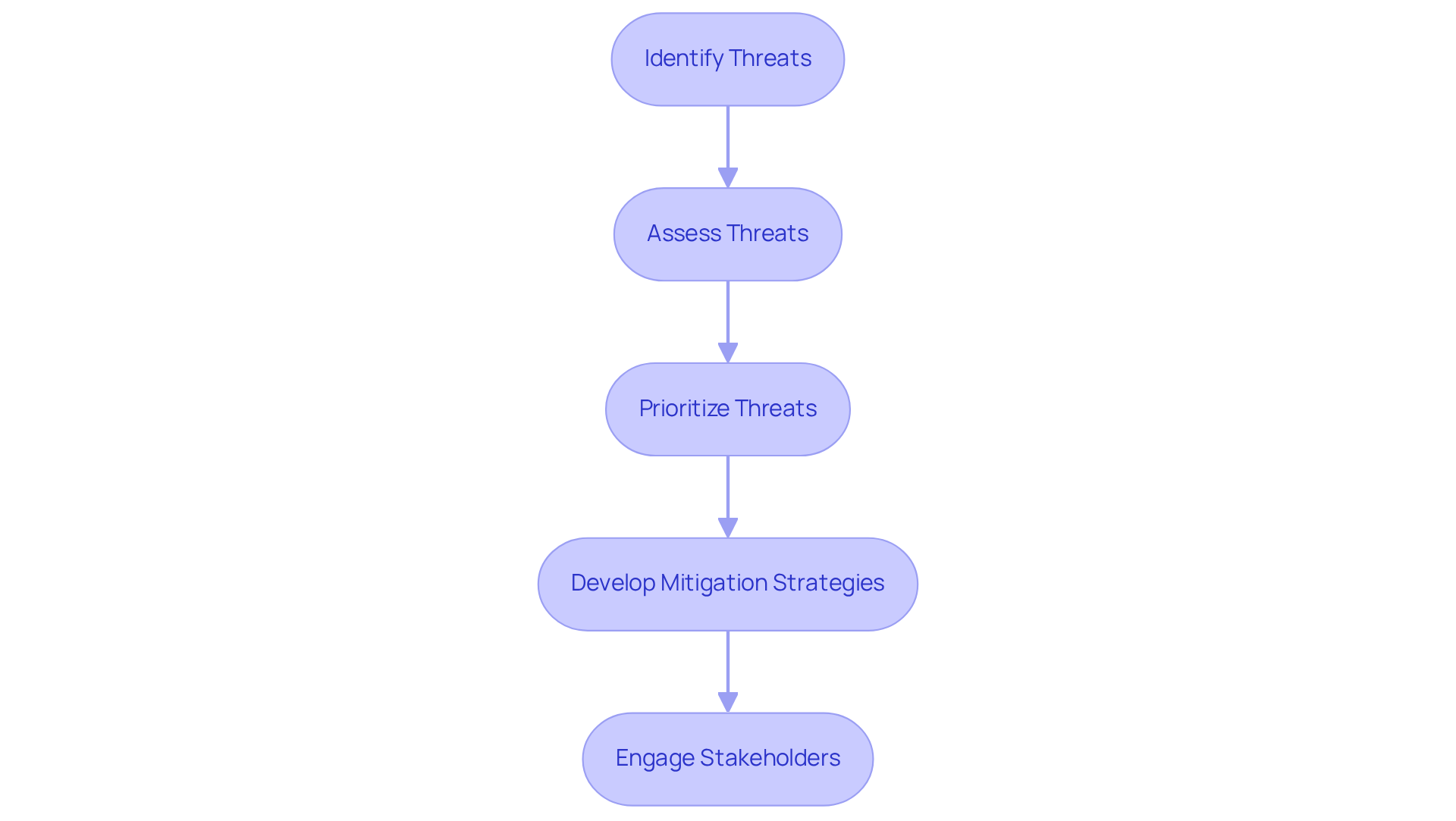

To effectively conduct a financial crime risk assessment, organizations must adhere to a structured approach that encompasses several critical steps:

- Identify Threats: Begin by gathering comprehensive information on potential monetary misconduct challenges specific to your organization. This process includes analyzing past incidents, consulting industry reports, and following regulatory guidance to pinpoint specific vulnerabilities. As Tyler York emphasizes, 'The financial crime risk assessment FCA is essential for combating financial crimes like fraud, money laundering, and cyberattacks.'

- Assess Threats: Evaluate the likelihood and potential impact of each identified threat. Utilize both qualitative and quantitative techniques to assign scores based on severity, ensuring a at hand. Notably, the global cost of financial crime compliance reached $274 billion in 2022, underscoring the necessity of thorough financial crime risk assessment FCA.

- Prioritize Threats: Rank the identified threats according to their scores to ascertain which require immediate attention and resource allocation. This prioritization is crucial, enabling organizations to concentrate on the most pressing threats.

- Develop Mitigation Strategies: For high-priority threats, formulate detailed action plans that outline specific measures to mitigate these risks. This should include establishing robust policies, procedures, and controls tailored to address the identified vulnerabilities. The Australian government's investment of AUD 166 million to enhance its anti-money laundering defenses exemplifies the importance of proactive measures in risk management.

- Engage Stakeholders: Involve key stakeholders, including compliance officers, senior management, and other relevant parties throughout the assessment process. Their engagement is vital for securing buy-in and support for the proposed mitigation strategies, fostering a culture of compliance within the organization. Recognizing that connections are a vital asset in managing monetary offenses, as emphasized in external references, can significantly enhance cooperation and efficiency.

By systematically following these steps, organizations can effectively address their monetary threats, thereby strengthening their compliance posture and safeguarding against potential dangers.

Document Findings and Implement Changes

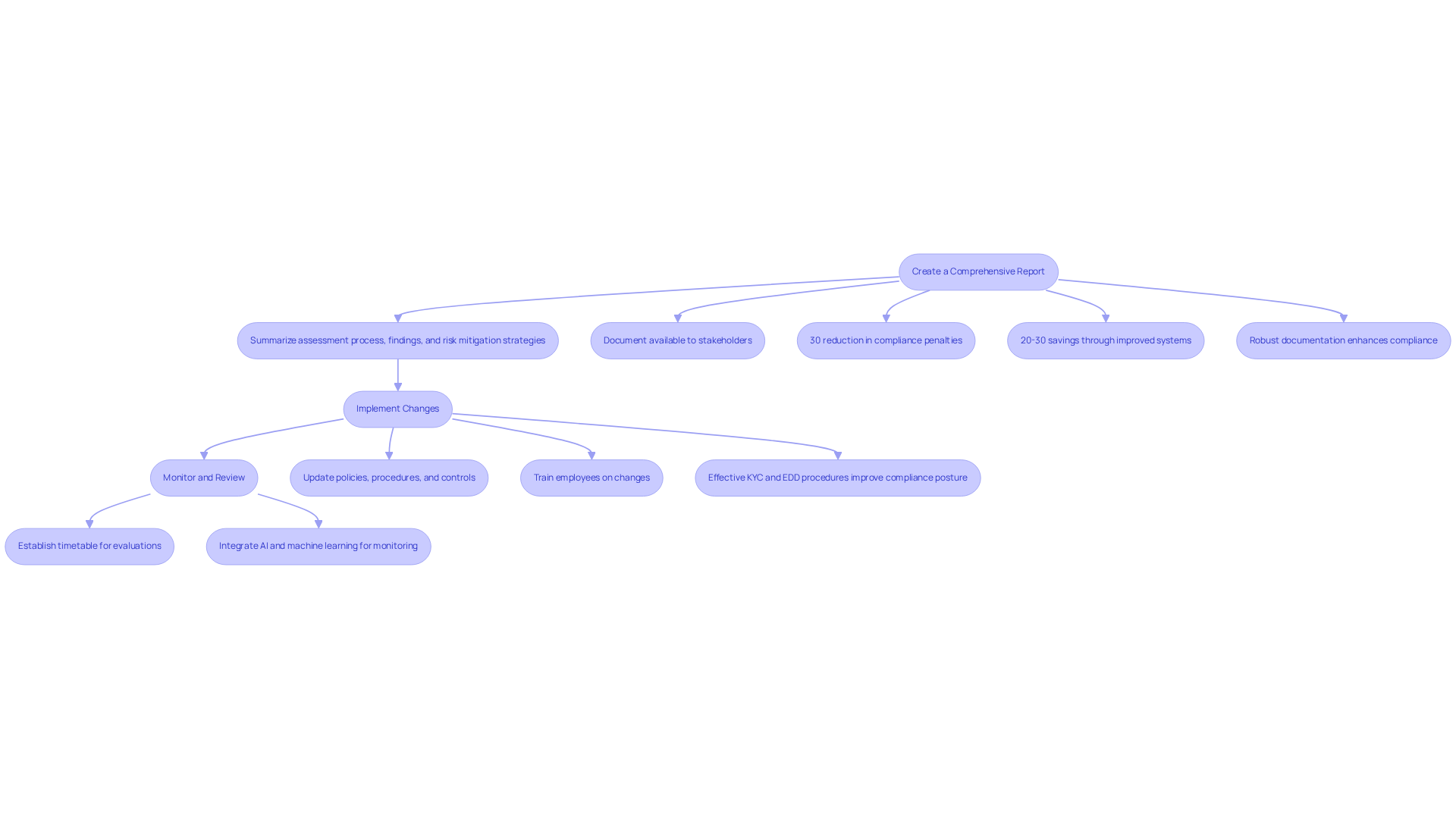

After conducting the financial crime risk assessment, it is essential to document your findings and implement necessary changes:

- Create a Comprehensive Report: Summarize the assessment process, findings, and risk mitigation strategies in a detailed report. This document should be available to pertinent stakeholders and serve as a guide for future evaluations. Statistics indicate that organizations that efficiently record their financial crime evaluation findings can reduce compliance-related penalties by as much as 30%. Moreover, companies can achieve savings of 20-30% through improved systems and processes, underscoring the importance of thorough documentation.

- Implement Changes: Based on the findings, update policies, procedures, and controls to address identified issues. Ensure that all employees are trained on these changes to cultivate a culture of compliance. Expert opinions suggest that a robust documentation process not only enhances compliance but also strengthens overall management frameworks. For instance, organizations that have implemented effective Know Your Customer (KYC) and Enhanced Due Diligence (EDD) procedures for high-risk clients have experienced significant improvements in their compliance posture.

- Monitor and Review: Establish a timetable for regular evaluations of the assessment process and the effectiveness of implemented changes. This will help ensure that your organization and can adapt to new challenges. Current trends reveal that integrating AI and machine learning into transaction monitoring systems is becoming essential for enhancing compliance and detecting suspicious activities more effectively.

By documenting findings and implementing changes, organizations can establish a robust framework for managing financial crime risk assessment FCA and ensuring ongoing compliance.

Conclusion

Understanding the intricacies of financial crime risk assessment is vital for organizations striving to maintain compliance with FCA regulations. By systematically identifying, assessing, and prioritizing potential threats, businesses can fortify their defenses against various forms of financial misconduct, including fraud and money laundering. This proactive approach not only safeguards operations but also aligns with regulatory expectations, ensuring that organizations remain resilient in the face of evolving risks.

Key insights from the article highlight the importance of adopting a risk-based approach, continuous monitoring, and thorough documentation as fundamental aspects of effective financial crime risk assessment. Engaging stakeholders throughout the process further enhances compliance culture and fosters collaboration, which is essential for implementing robust mitigation strategies. The outlined steps provide a clear roadmap for organizations to navigate the complexities of financial crime risks and enhance their overall compliance posture.

Ultimately, the significance of a comprehensive financial crime risk assessment cannot be overstated. Organizations are encouraged to take decisive action by implementing the strategies discussed, regularly reviewing their processes, and adapting to new challenges. By doing so, they not only protect their assets but also contribute to a safer financial ecosystem, reinforcing the integrity of their operations and the trust of their stakeholders.

Frequently Asked Questions

What is the purpose of a financial crime risk assessment?

The purpose of a financial crime risk assessment is to evaluate the potential for monetary misconduct within organizations, particularly small to medium enterprises, by recognizing, examining, and appraising possible threats linked to financial offenses such as money laundering, fraud, and terrorist funding.

What are the key components of a financial crime risk assessment?

The key components of a financial crime risk assessment include Risk Identification, Threat Assessment, and Risk Prioritization.

What does Risk Identification involve?

Risk Identification involves recognizing the various types of financial crimes that could affect the organization to develop a comprehensive understanding of potential threats.

How does Threat Assessment contribute to the risk assessment process?

Threat Assessment contributes by evaluating the likelihood and potential impact of the identified dangers, allowing organizations to gauge the severity of each threat.

What is the importance of Risk Prioritization in the assessment?

Risk Prioritization is important as it ensures that dangers are prioritized based on their severity and the organization's tolerance for vulnerabilities, allowing for effective allocation of resources to mitigate the most pressing challenges.

Why is it crucial for organizations to manage financial crime risks proactively?

Proactively managing financial crime risks is crucial as it helps organizations protect their operations, uphold compliance with regulatory standards, and address evolving challenges posed by mobile money transactions and digital currencies.

What are some statistics related to financial crime risk for small to medium businesses?

According to LexisNexis® Risk Solutions, SMB lending fraud is a prevalent concern across industries, with most companies anticipating it to impact overall losses by 6% to 10%.

Which regulatory standards should organizations comply with regarding financial crime risk assessments?

Organizations should comply with regulatory standards required by the financial crime risk assessment FCA and the Financial Action Task Force (FATF).