Overview

This article presents a systematic approach to conducting a personal financial risk assessment, underscoring the critical importance of identifying and managing various financial risks, including market, credit, liquidity, operational, and currency exposure. It details a comprehensive four-step process designed to enhance financial stability and resilience against potential economic threats. The process involves:

- Gathering financial documents

- Analyzing income and expenses

- Evaluating assets and liabilities

- Developing a robust risk management strategy

By following these steps, individuals can effectively navigate financial uncertainties and safeguard their financial future.

Introduction

Understanding personal financial risk is crucial in a world where economic uncertainties can arise at any moment. A personal financial risk assessment not only helps individuals identify potential threats to their financial well-being but also empowers them to make informed decisions to safeguard their future. As financial landscapes evolve, the question remains: how can individuals effectively navigate their unique vulnerabilities to achieve lasting stability and peace of mind? This guide outlines four essential steps for conducting a successful personal financial risk assessment, providing valuable insights for anyone looking to enhance their financial resilience.

Define Personal Financial Risk Assessment

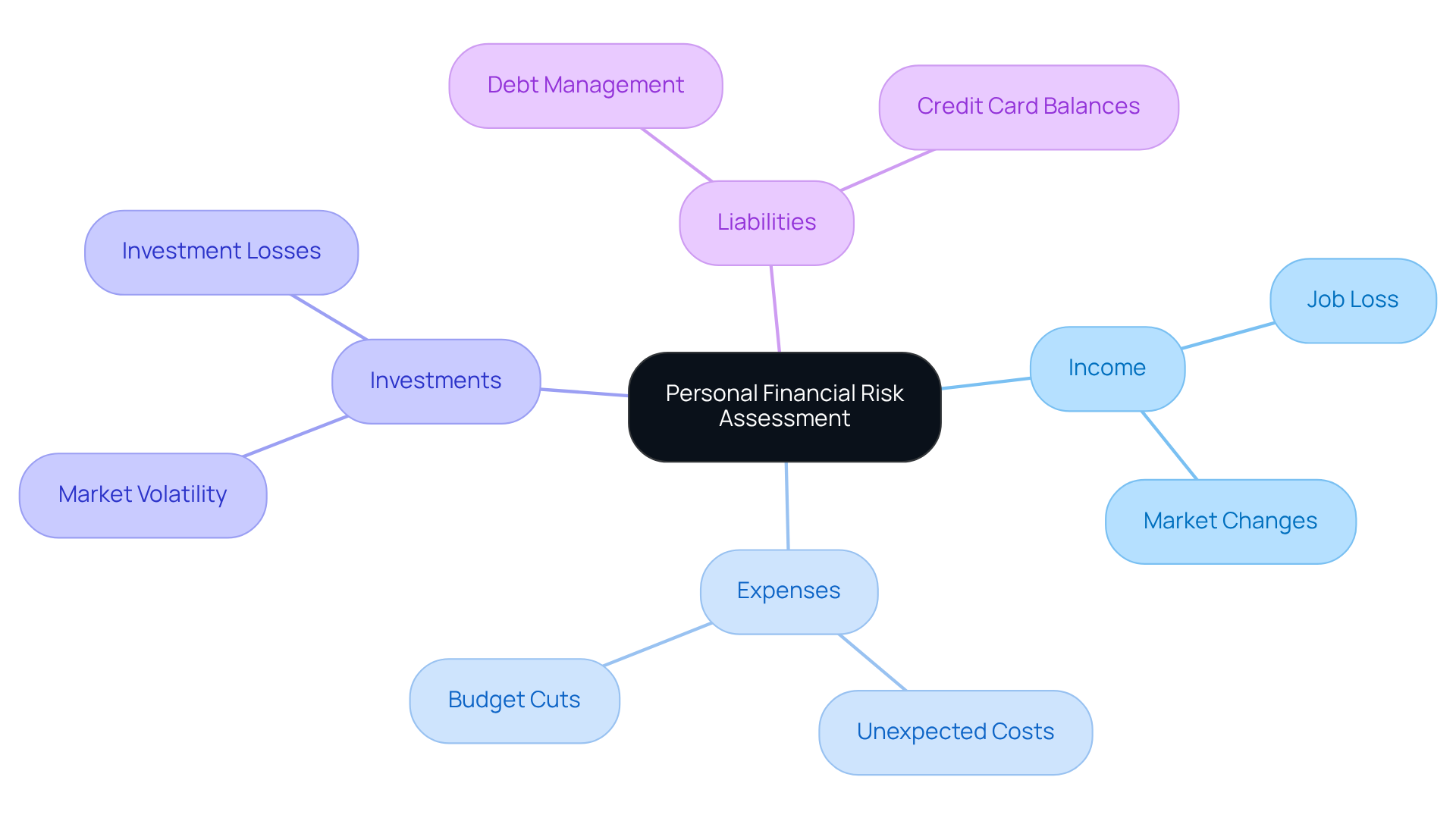

A personal financial risk assessment is a systematic method for recognizing and analyzing potential threats that may jeopardize an individual's economic welfare. This process involves a comprehensive analysis of various elements, including income, expenses, investments, and liabilities, to pinpoint vulnerabilities. By acknowledging these hazards, individuals can make informed decisions that protect their financial future.

Essential elements of this evaluation involve assessing the likelihood of negative occurrences, such as job loss, market changes, or unexpected costs, and understanding their potential impact on overall economic stability. Defining personal financial risk assessment highlights its crucial role in effective budgeting, enabling individuals to proactively address challenges and enhance their financial resilience.

Successful instances of personal monetary evaluations illustrate how individuals have navigated economic uncertainties, leading to improved financial well-being and stability. For instance, a study revealed that 53% of consumers report that money is a source of stress, highlighting the psychological implications of monetary risk. Professional insights emphasize that regular evaluations not only enhance financial decision-making but also empower individuals to adapt to changing circumstances, ultimately contributing to sustained economic success.

Moreover, with 79% of consumers expecting proactive notifications from financial providers about their budgets, the significance of continuous monetary evaluations becomes even more evident, particularly for CFOs aiming to strengthen their organizations' fiscal health.

Identify Types of Financial Risks

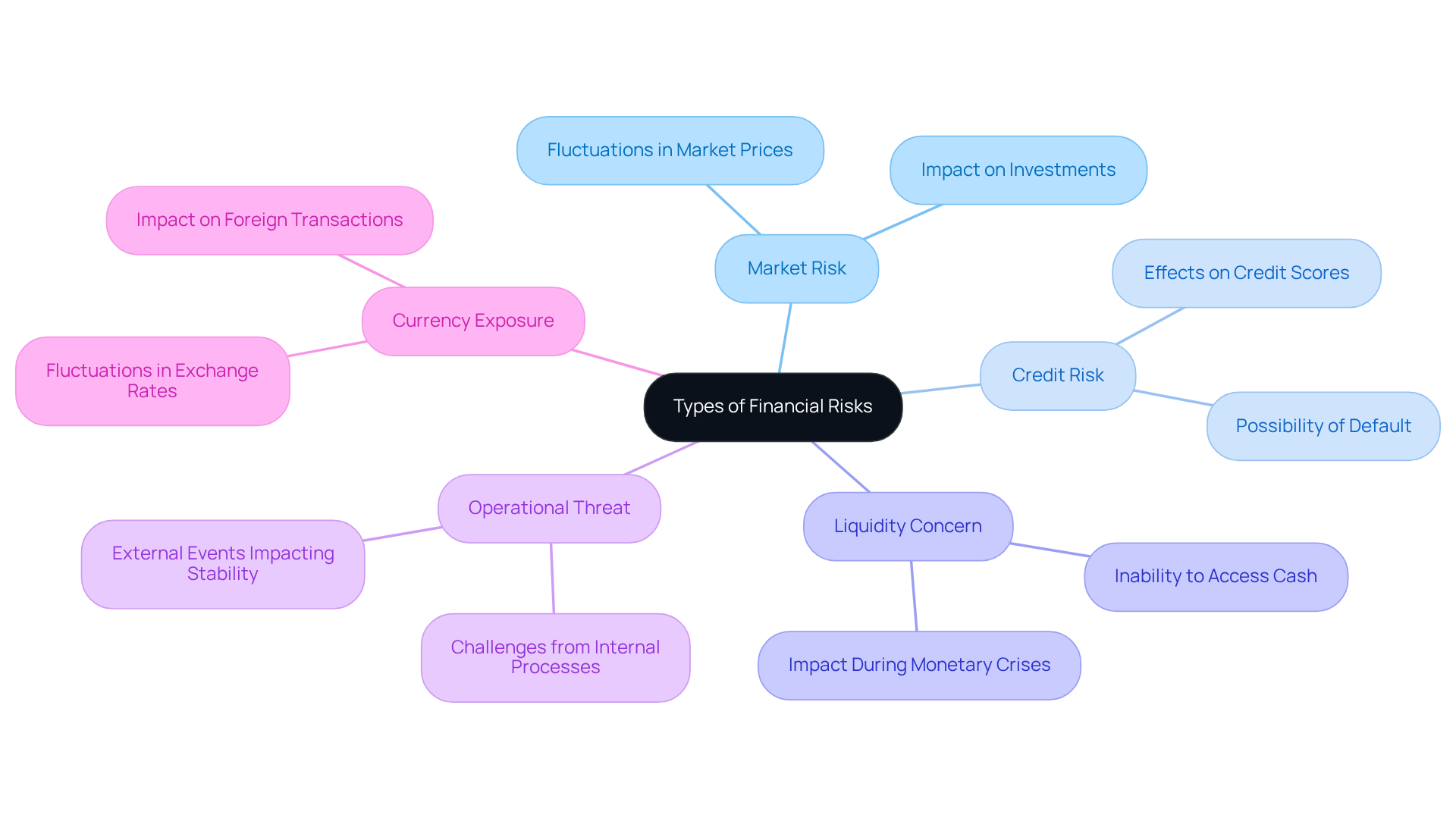

Individuals conducting a personal financial risk assessment must recognize several key types of financial risks:

-

Market Risk: This involves the potential for losses stemming from fluctuations in market prices, which can significantly impact investments and savings. A sudden decline in the stock market, for instance, can diminish the value of investment portfolios, thereby affecting long-term monetary objectives.

-

Credit Risk: This refers to the possibility of default on debt obligations, which can adversely affect credit scores and borrowing capacity. When a borrower fails to meet payment obligations, it can lead to higher interest rates on future loans and reduced access to credit.

-

Liquidity Concern: This issue arises when individuals find themselves unable to access cash or liquidate assets quickly without incurring substantial losses. During monetary crises, possessing illiquid assets can obstruct the ability to cover urgent expenses, resulting in significant economic pressure.

-

Operational Threat: This encompasses challenges arising from insufficient or malfunctioning internal processes, systems, or external events. Issues such as fraud, mismanagement, or unforeseen market fluctuations can disrupt economic stability and influence overall performance.

-

Currency Exposure: This exposure affects individuals and businesses that engage in transactions involving foreign currencies. Fluctuations in exchange rates can lead to unexpected losses, particularly for those with investments or obligations in foreign currencies.

By recognizing and comprehending these threats, individuals can better prepare for potential monetary vulnerabilities through a personal financial risk assessment and formulate plans to mitigate their impact. As Allianz Trade indicates, 'Monetary uncertainty pertains to the chance of losing funds or facing a monetary loss due to various elements.' Understanding these dangers is essential for effective monetary management.

Conduct the Financial Risk Assessment

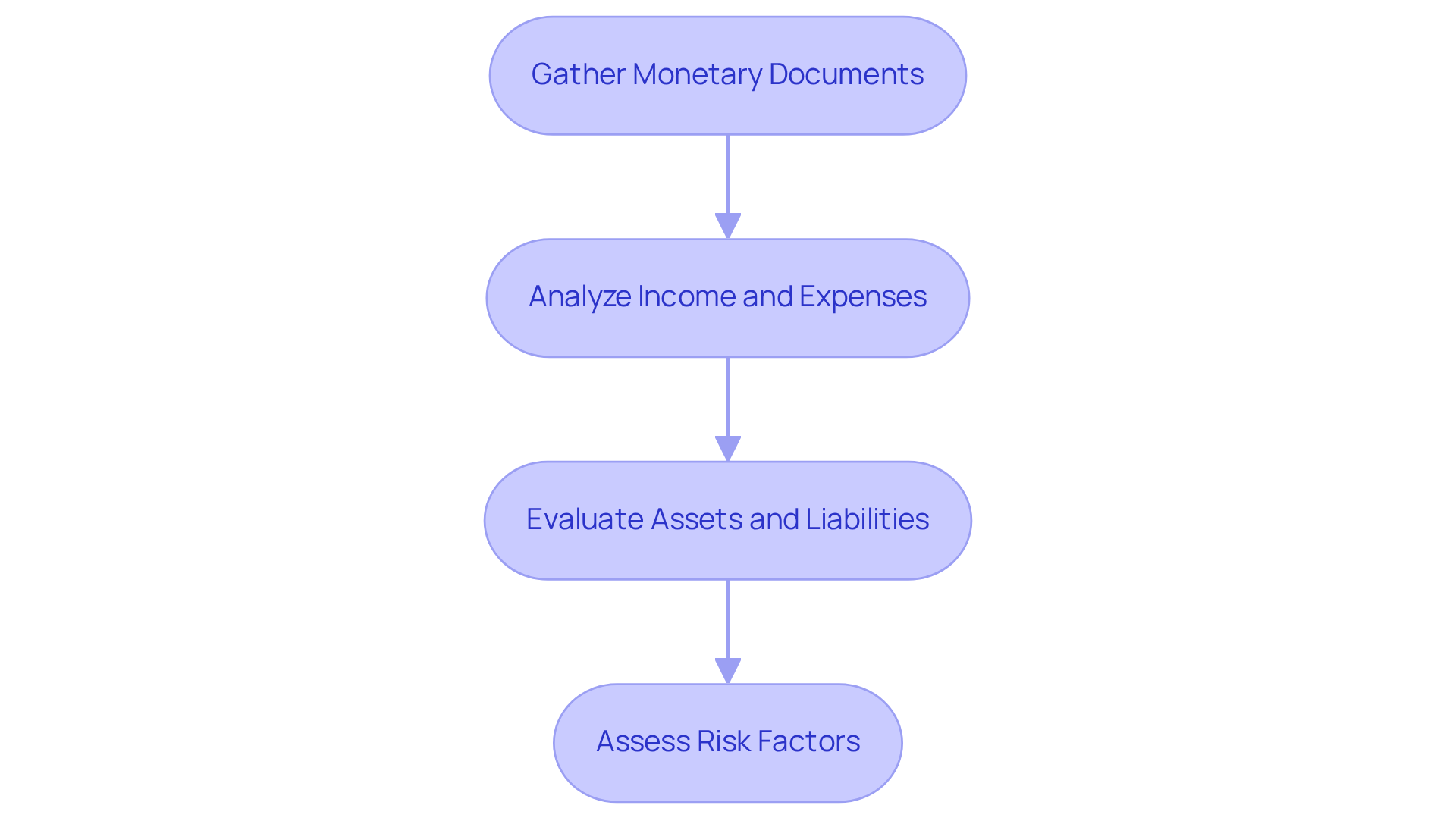

To conduct a personal financial risk assessment, follow these steps:

-

Gather Monetary Documents: Collect all relevant monetary documents, including bank statements, investment portfolios, debt statements, and income records. Typical documents consist of tax returns, pay stubs, and credit reports, which offer a comprehensive view of your monetary situation. Utilizing budgeting calculators can streamline this process and ensure you have all necessary information.

-

Analyze Income and Expenses: Create a detailed list of your monthly income and expenses. This will help you understand your cash flow and identify areas where you can cut costs. Economic specialists suggest keeping an emergency fund of three to six months' worth of expenses to protect against unforeseen monetary difficulties. Remember, waiting just 10 years to begin investing can reduce your wealth by more than half, highlighting the urgency of effective money management.

-

Evaluate Assets and Liabilities: List all your assets (e.g., savings, investments, property) and liabilities (e.g., loans, credit card debt). This will give you a clear picture of your net worth. Comprehending your economic situation is essential for performing a personal financial risk assessment, as it enables you to make informed choices regarding investments and savings strategies.

-

Assess Risk Factors: Consider external factors that could impact your financial situation, such as job stability, market conditions, and health issues. Evaluate each threat factor according to its possible effect and probability. This evaluation will assist you in prioritizing areas that need urgent focus and formulating plans to reduce risks. As Warren Buffett advises, 'Do not save what is left after spending; instead, spend what is left after saving.'

By systematically analyzing these components, you can identify your economic vulnerabilities and areas that require attention, ultimately leading to a more secure monetary future. For example, a CFO who executed these measures was able to reorganize their monetary approach, leading to a 20% rise in cash flow within a year.

Develop a Risk Management Strategy

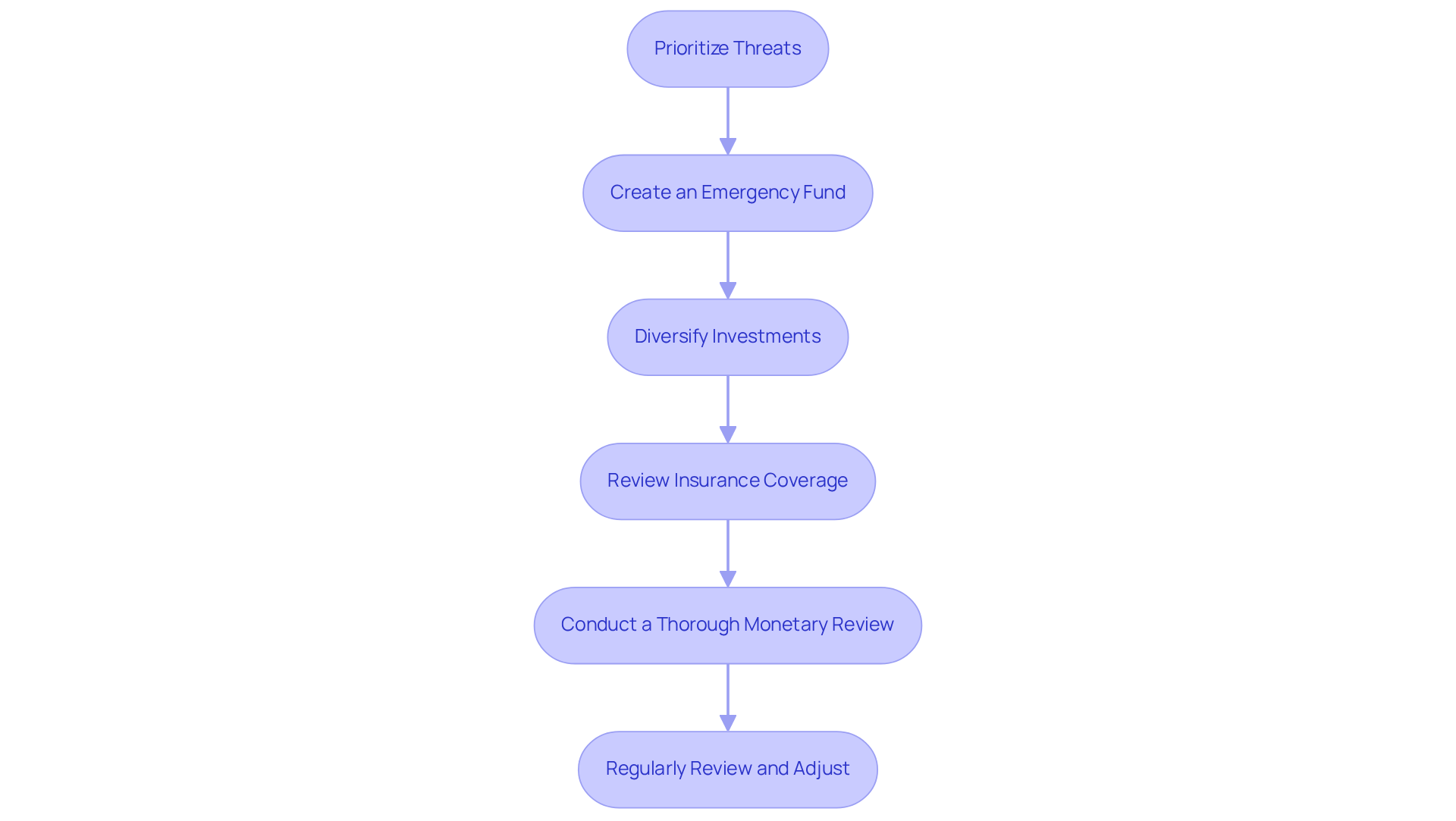

Upon completing your personal financial risk assessment, the next step is to formulate a robust management strategy. Here’s how to proceed:

- Prioritize Threats: Identify and rank the dangers that pose the most significant challenges to your economic stability. This prioritization allows you to focus on the most critical areas first.

- Create an Emergency Fund: Aim to save at least three to six months' worth of living expenses in a high-yield savings account. This fund serves as a monetary buffer against unforeseen expenses, such as medical emergencies or significant repairs.

- Diversify Investments: Mitigate market volatility by spreading your investments across various asset classes. This strategy not only reduces risk but also enhances potential returns, aligning with trends in personal finance that emphasize the importance of diversification.

- Review Insurance Coverage: Ensure that your insurance policies—health, life, and property—are adequate to shield you from unforeseen events. Comprehensive coverage can prevent substantial monetary setbacks.

- Conduct a Thorough Monetary Review: Regularly assess your economic situation to identify opportunities for cash preservation and liability reduction. A thorough economic assessment can reveal value and lower expenses, ensuring that your management approach is both efficient and effective. Consider utilizing our service for personal financial risk assessment to guide you through this process.

- Regularly Review and Adjust: Financial situations change, making it essential to periodically reassess your management approach. Modify your plans to account for alterations in your economic situation or market conditions.

By implementing these strategies, you can effectively manage financial risks and work towards achieving long-term financial stability. For more assistance, click the Financial Assessment button.

Conclusion

A personal financial risk assessment is an indispensable tool for safeguarding one's economic future. By systematically identifying and analyzing potential financial threats, individuals can make informed decisions that bolster their financial resilience. This proactive approach not only enhances budgeting capabilities but also empowers individuals to navigate the complexities of their financial landscapes effectively.

The article outlines a structured process for conducting a personal financial risk assessment, which includes:

- Defining financial risks

- Identifying various types of risks such as:

- Market

- Credit

- Liquidity

- Operational

- Currency exposure

Implementing a comprehensive risk management strategy is crucial. Each step, from gathering financial documents to developing a tailored management plan, plays a vital role in understanding and mitigating vulnerabilities. By prioritizing threats and regularly reviewing financial situations, individuals can adapt to changes and safeguard their monetary well-being.

Ultimately, taking the time to perform a personal financial risk assessment is not merely a best practice; it is a necessary step toward achieving long-term financial stability. Individuals are encouraged to engage in this process regularly, ensuring they remain proactive in managing their financial risks. By doing so, they can cultivate a secure financial future, reducing stress and enhancing their overall quality of life.

Frequently Asked Questions

What is a personal financial risk assessment?

A personal financial risk assessment is a systematic method for recognizing and analyzing potential threats that may jeopardize an individual's economic welfare, involving a comprehensive analysis of income, expenses, investments, and liabilities.

Why is a personal financial risk assessment important?

It is important because it helps individuals identify vulnerabilities and make informed decisions to protect their financial future, enhancing budgeting effectiveness and financial resilience.

What elements are considered in a personal financial risk assessment?

The assessment considers elements such as income, expenses, investments, liabilities, and the likelihood of negative occurrences like job loss, market changes, or unexpected costs.

How does personal financial risk assessment impact financial decision-making?

Regular evaluations enhance financial decision-making by empowering individuals to adapt to changing circumstances, contributing to sustained economic success.

What are the psychological implications of financial risk?

Financial risk can lead to stress, as highlighted by a study revealing that 53% of consumers report money as a source of stress.

What do consumers expect from financial providers regarding their budgets?

79% of consumers expect proactive notifications from financial providers about their budgets, underscoring the importance of continuous monetary evaluations.

How can personal financial risk assessments contribute to overall financial well-being?

Successful evaluations can help individuals navigate economic uncertainties, leading to improved financial well-being and stability.