Overview

This article presents four essential steps for achieving long-term business stabilization:

- Conducting a comprehensive financial assessment

- Implementing effective cash flow management strategies

- Establishing a continuous improvement framework

- Recognizing the significance of business stabilization

Each step is bolstered by detailed strategies and insights, including:

- Resource optimization

- Stakeholder confidence enhancement

- The promotion of a culture of continuous improvement

Collectively, these strategies empower organizations to navigate economic fluctuations and operational challenges effectively.

Introduction

In the ever-evolving landscape of business, stability emerges as a cornerstone for success. As companies navigate economic fluctuations and operational hurdles, the need for a robust foundation becomes increasingly critical. Business stabilization not only mitigates risks but also optimizes resources and fosters stakeholder confidence, setting the stage for sustainable growth.

This article delves into essential strategies for achieving business stabilization, including:

- Conducting comprehensive financial assessments

- Implementing effective cash flow management techniques

By embracing a continuous improvement framework, organizations can not only weather the storms of uncertainty but also thrive in a competitive environment.

Understand the Importance of Business Stabilization

Long-term business stabilization is the process of creating a solid foundation that allows a company to withstand economic fluctuations and operational challenges. It is essential for several reasons:

- Risk Mitigation: A stable organization can better manage risks associated with market volatility, ensuring that it can survive downturns. Comprehensive financial reviews focusing on cash preservation and efficiency can uncover value and reduce costs, further enhancing risk management strategies.

- Resource Optimization: Stabilization enables enterprises to streamline operations, reduce waste, and allocate resources more effectively. Our turnaround and restructuring consulting services deliver customized strategies that assist small to medium enterprises in optimizing their resources and enhancing operational efficiency. By concentrating on stability, companies can establish a foundation for long-term business stabilization, which allows them to seek expansion opportunities without endangering their core operations. Interim management services provide practical executive leadership that can promote transformational change and pinpoint key organizational issues, ensuring that growth strategies are well-informed and effective.

- Stakeholder Confidence: A stable enterprise instills confidence in stakeholders, including employees, investors, and customers, which is vital for maintaining relationships and securing future investments. Continuous performance monitoring and relationship-building through real-time analytics can enhance stakeholder trust and engagement. In periods of significant financial hardship, efficient bankruptcy case oversight can provide the essential assistance to navigate intricate legal and financial obstacles, ensuring that enterprises can emerge more robust and resilient, which is crucial for long-term business stabilization. By utilizing extensive crisis management and restructuring services, including bankruptcy case management, organizations can navigate challenges effectively and position themselves for future growth.

Reach out to Transform Your Small/ Medium Enterprise today to discover how we can help you in stabilizing and expanding your operations.

Conduct a Comprehensive Financial Assessment

A comprehensive financial assessment is crucial for long-term business stabilization and involves several key steps:

- Gather Financial Statements: Collect your balance sheet, income statement, and liquidity statement for the past three years. This data provides a clear snapshot of your financial health and is essential for informed decision-making.

- Analyze Key Ratios: Calculate important financial ratios, including liquidity, profitability, and debt-to-equity ratios. These metrics are vital for assessing your business's performance and financial stability, allowing you to benchmark against industry standards.

- Identify Trends: Analyze trends in revenue, expenses, and liquidity. Identifying these patterns can assist you in foreseeing possible problems before they intensify, allowing for proactive oversight. For example, 36% of companies indicated that understaffed shifts were a major cause of low productivity, emphasizing the necessity for efficient financial handling and operational effectiveness.

- Evaluate Financial Resources: Assess your financial management practices to ensure adequate liquidity for operational costs and unforeseen expenses. A robust liquidity position is essential, as highlighted by Sal Amato, Director of FP&A at Excision BioTherapeutics, who mentioned, "As we expand, we will need to comprehend how our liquidity transitions into our P&Ls and distinguish between liquid and accrual accounting." Understanding cash flow in relation to overall financial health is essential for CFOs.

- Conduct a SWOT Analysis: Identify your organization's strengths, weaknesses, opportunities, and threats. This analysis provides insight into your market position and highlights areas that require attention. Additionally, understanding your financial health can inform marketing strategies and customer engagement, as noted in case studies highlighting the importance of adapting to changing consumer behaviors.

By performing a comprehensive financial evaluation, you can identify areas for enhancement and create focused strategies to improve your organization's financial well-being. This method not only assists in addressing present issues, such as inflation and labor shortages, but also prepares your enterprise for long-term business stabilization in the future. The perspective for small enterprises stays positive in 2024, emphasizing the significance of proactive financial oversight.

Implement Strategies for Cash Flow Management

Implementing effective financial management strategies is essential for maintaining business stability and achieving long-term business stabilization and success. Here are key strategies to consider:

- Create a Financial Projection: Develop a comprehensive financial forecast to estimate your monetary inflows and outflows over the next 12 months. This proactive method enables you to foresee possible shortages and surpluses, facilitating prompt decision-making and improving your conversion cycle.

- Optimize Receivables: Encourage prompt payments from customers by offering incentives such as discounts for early payments or by enforcing stricter credit terms. This can greatly enhance liquidity and decrease the risk of delayed payments, which 37% of small enterprise owners mention as a reason for contemplating operational cessation. Furthermore, U.S. Bank business cardholders can utilize complimentary services that aid in enhancing liquidity oversight, offering an economical solution for CFOs. The strategies can be purchased for $99.00, providing valuable insights for effective financial oversight.

- Negotiate Payment Terms: Collaborate with suppliers to negotiate favorable payment terms. Prolonging your payables can offer extra liquidity, enabling you to handle finances more efficiently without facing penalties. This strategy supports a streamlined decision-making process, crucial during turnaround situations.

- Control Expenses: Conduct regular reviews of your expenses to identify areas for cost reduction without compromising quality. This may involve renegotiating contracts or cutting discretionary spending, which can enhance operational efficiency. The case study titled "Tax and Accounting Challenges for Small Enterprises" emphasizes that 40% of small enterprise owners consider taxes and accounting to be considerable obstacles, complicating financial flow management. Seeking professional assistance can alleviate these issues and improve operational efficiency.

- Maintain a Financial Reserve: Create a financial reserve that encompasses at least three to six months of operating expenses. This financial cushion is essential for navigating lean periods and unexpected challenges, reinforcing your enterprise's resilience.

By applying these tactics, companies can greatly improve their liquidity oversight, ensuring long-term business stabilization and the ability to fulfill commitments even during difficult periods. Effective cash flow forecasting not only assists in crisis oversight but also empowers entrepreneurs, as noted by industry specialists who stress the significance of comprehending cash flow dynamics and employing real-time analytics via a client dashboard to observe organizational health.

Establish a Continuous Improvement Framework

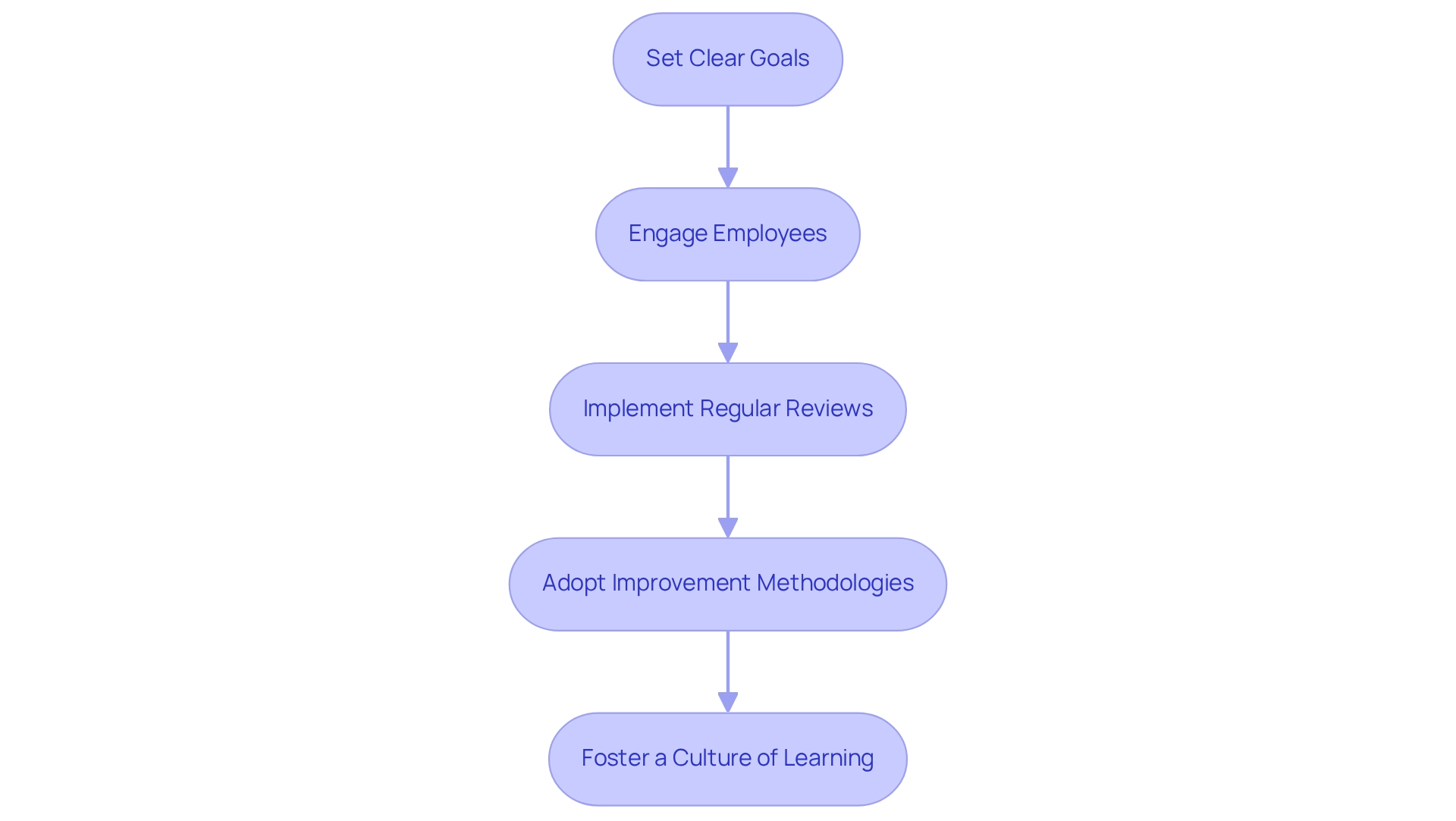

Establishing a continuous improvement framework involves:

-

Set Clear Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for your improvement initiatives. Ensure these goals align with your overall turnaround strategy and the services offered by Transform Your Small/ Medium Business.

-

Engage Employees: Involve employees at all levels in the improvement process. Encourage them to share ideas and feedback on how to enhance operations, fostering a collaborative environment that supports your restructuring efforts and interim management services.

-

Implement Regular Reviews: Schedule regular reviews of processes and performance metrics to identify areas for improvement. Utilize real-time commercial analytics from your client dashboard to guide your decisions and monitor the success of your turnaround plans, including financial assessments and bankruptcy case management.

-

Adopt Improvement Methodologies: Consider adopting methodologies such as Lean, Six Sigma, or Kaizen to structure your improvement efforts and ensure consistency. Integrate lessons learned from previous turnaround experiences to enhance effectiveness.

-

Foster a Culture of Learning: Encourage a culture where learning and adaptation are valued. Provide training and resources to help employees develop their skills and contribute to improvement efforts. This is crucial for maintaining operational efficiency during transitions.

By establishing a continuous improvement framework, your business can adapt to changing market conditions, enhance operational efficiency, and drive sustainable growth. Ultimately, this approach preserves and stabilizes your business, contributing to long-term business stabilization while focusing on saving money and growing revenues.

Conclusion

Business stabilization is not merely a strategy; it is a fundamental necessity for achieving long-term success in a volatile environment. The significance of conducting comprehensive financial assessments cannot be overstated, as it lays the groundwork for understanding a company's financial health and identifying areas for improvement. By analyzing key financial ratios and trends, businesses can proactively manage risks and position themselves for sustainable growth.

Effective cash flow management is equally critical. Implementing strategies such as cash flow forecasting, optimizing receivables, and negotiating favorable payment terms can significantly enhance a company's liquidity and operational efficiency. Ensuring a robust cash reserve further fortifies a business against unforeseen challenges, allowing it to navigate economic fluctuations with confidence.

Moreover, establishing a continuous improvement framework fosters a culture of adaptability and resilience. By setting clear goals, engaging employees, and regularly reviewing performance metrics, businesses can continuously refine their operations and enhance stakeholder trust. This proactive approach not only addresses current challenges but also prepares organizations for future growth opportunities.

In conclusion, by prioritizing business stabilization through financial assessments, effective cash flow strategies, and a commitment to continuous improvement, companies can build a solid foundation that supports sustainable success. Embracing these principles not only mitigates risks but also empowers businesses to thrive in a competitive landscape, ensuring they are well-equipped to face whatever challenges lie ahead.

Frequently Asked Questions

What is long-term business stabilization?

Long-term business stabilization is the process of creating a solid foundation that allows a company to withstand economic fluctuations and operational challenges.

Why is long-term business stabilization important?

It is essential for several reasons, including risk mitigation, resource optimization, and instilling stakeholder confidence.

How does long-term business stabilization help with risk management?

A stable organization can better manage risks associated with market volatility, ensuring survival during downturns. Comprehensive financial reviews can uncover value and reduce costs, enhancing risk management strategies.

What role does resource optimization play in business stabilization?

Stabilization enables enterprises to streamline operations, reduce waste, and allocate resources more effectively. Customized strategies from turnaround and restructuring consulting services assist small to medium enterprises in optimizing resources and enhancing operational efficiency.

How does a stable enterprise affect stakeholder confidence?

A stable enterprise instills confidence in stakeholders, including employees, investors, and customers, which is vital for maintaining relationships and securing future investments. Continuous performance monitoring and relationship-building through real-time analytics enhance stakeholder trust and engagement.

What services can help businesses during financial hardship?

Efficient bankruptcy case oversight can provide essential assistance to navigate legal and financial obstacles during significant financial hardship. Extensive crisis management and restructuring services, including bankruptcy case management, help organizations navigate challenges effectively and position themselves for future growth.