Overview

Creating a financial institution risk assessment template requires a systematic approach that encompasses identifying risks, assessing their likelihood and impact, and developing mitigation strategies tailored to specific threat categories. This article outlines a structured six-step process for crafting the template, underscoring the necessity of regular reviews and stakeholder feedback. Such measures are essential to ensure its effectiveness in managing risks and maintaining compliance within the organization. By adhering to these steps, institutions can enhance their risk management frameworks and bolster their operational integrity.

Introduction

Creating a financial institution risk assessment template is not merely a procedural task; it is a critical strategy for safeguarding an organization's future. By systematically identifying and evaluating potential threats, institutions can prioritize risks and implement effective mitigation strategies.

However, the challenge lies in developing a template that is both comprehensive and adaptable to the ever-evolving financial landscape.

How can organizations ensure their risk assessment frameworks remain relevant and effective in the face of new challenges and compliance demands?

Understand Financial Institution Risk Assessment Basics

A financial institution risk assessment template is a systematic procedure employed to identify, evaluate, and prioritize threats that could impact the organization's operations and compliance. It entails comprehending different categories of danger, including credit exposure, operational challenges, market threats, and compliance issues. Each category presents unique challenges and requires tailored strategies for mitigation. Familiarizing yourself with these concepts will assist you in developing a robust evaluation framework that meets the specific requirements of your organization.

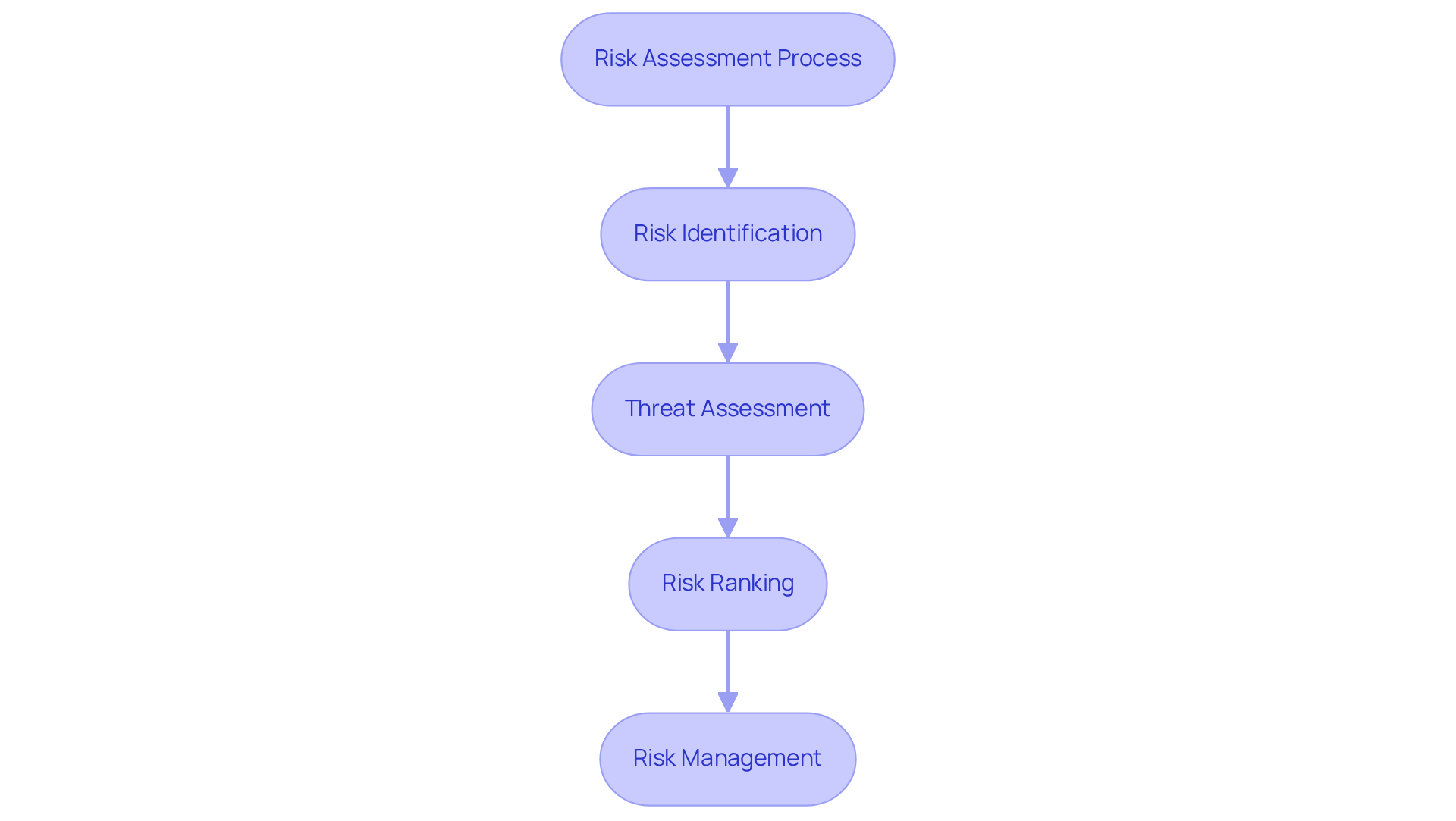

Key components of risk assessment include:

- Risk Identification: Recognizing potential risks that could impact the institution.

- Threat Assessment: Evaluating the likelihood and impact of identified hazards.

- Risk Ranking: Ranking threats according to their possible impacts on the organization.

- Risk Management: Creating strategies to reduce or handle identified threats.

Grasping these fundamentals will empower you to create a comprehensive evaluation framework that aligns with your organization's goals and compliance obligations.

Identify Key Components of the Risk Assessment Template

Creating a financial institution risk assessment template involves several essential components that are crucial for effective risk management.

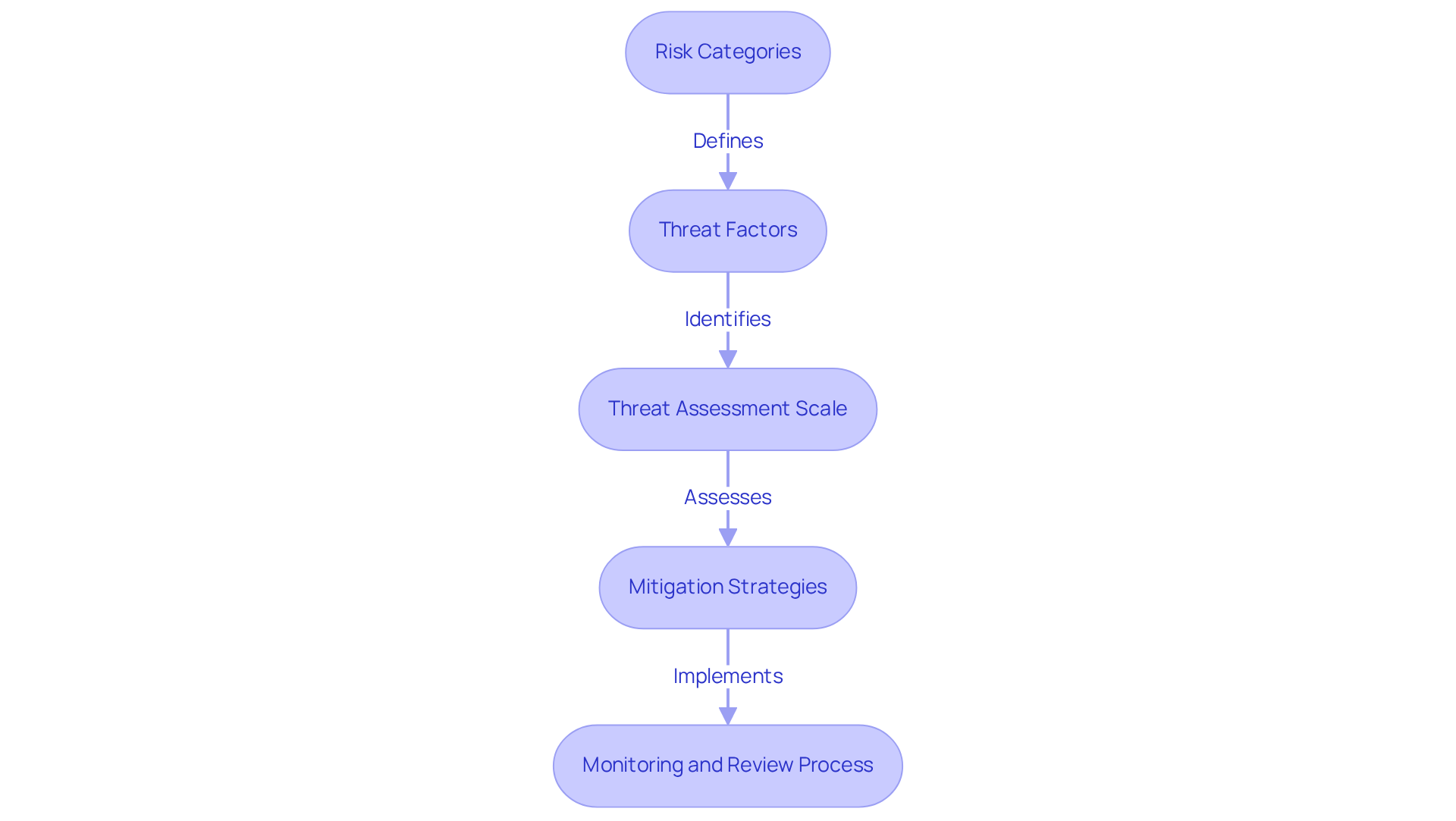

Risk Categories: Clearly define the relevant categories of concern, including credit, operational, market, and compliance challenges. This categorization systematically addresses the various threats that institutions face.

Threat Factors: Under each danger category, identify specific threat factors. For example, operational uncertainties may include technology failures, employee mistakes, or fraud occurrences, facilitating focused analysis.

Threat Assessment Scale: Create a rating system to assess the probability and effect of each hazard element. A straightforward scale from 1 to 5 can be effective, where 1 indicates low threat and 5 signifies high threat, facilitating a clear understanding of severity.

Mitigation Strategies: For each recognized threat, outline potential mitigation strategies. This may involve establishing policies, procedures, or technologies aimed at reducing vulnerability and improving operational resilience.

Monitoring and Review Process: Establish a structured procedure for the routine evaluation and revision of the hazard evaluation framework. This guarantees that the framework remains pertinent and efficient in tackling changing challenges and compliance needs.

Integrating these elements prepares your evaluation framework to effectively address the distinct challenges encountered by financial entities, using a financial institution risk assessment template to promote a proactive management culture. As Zoya Khan highlights, "Frequent evaluations assist in avoiding financial losses due to fraud, cyberattacks, and operational failures, protecting the organization’s assets." Moreover, utilizing platforms such as VComply’s RiskOps can simplify the evaluation process, ensuring that analyses remain impartial and aligned with performance metrics.

Develop the Risk Assessment Template Step-by-Step

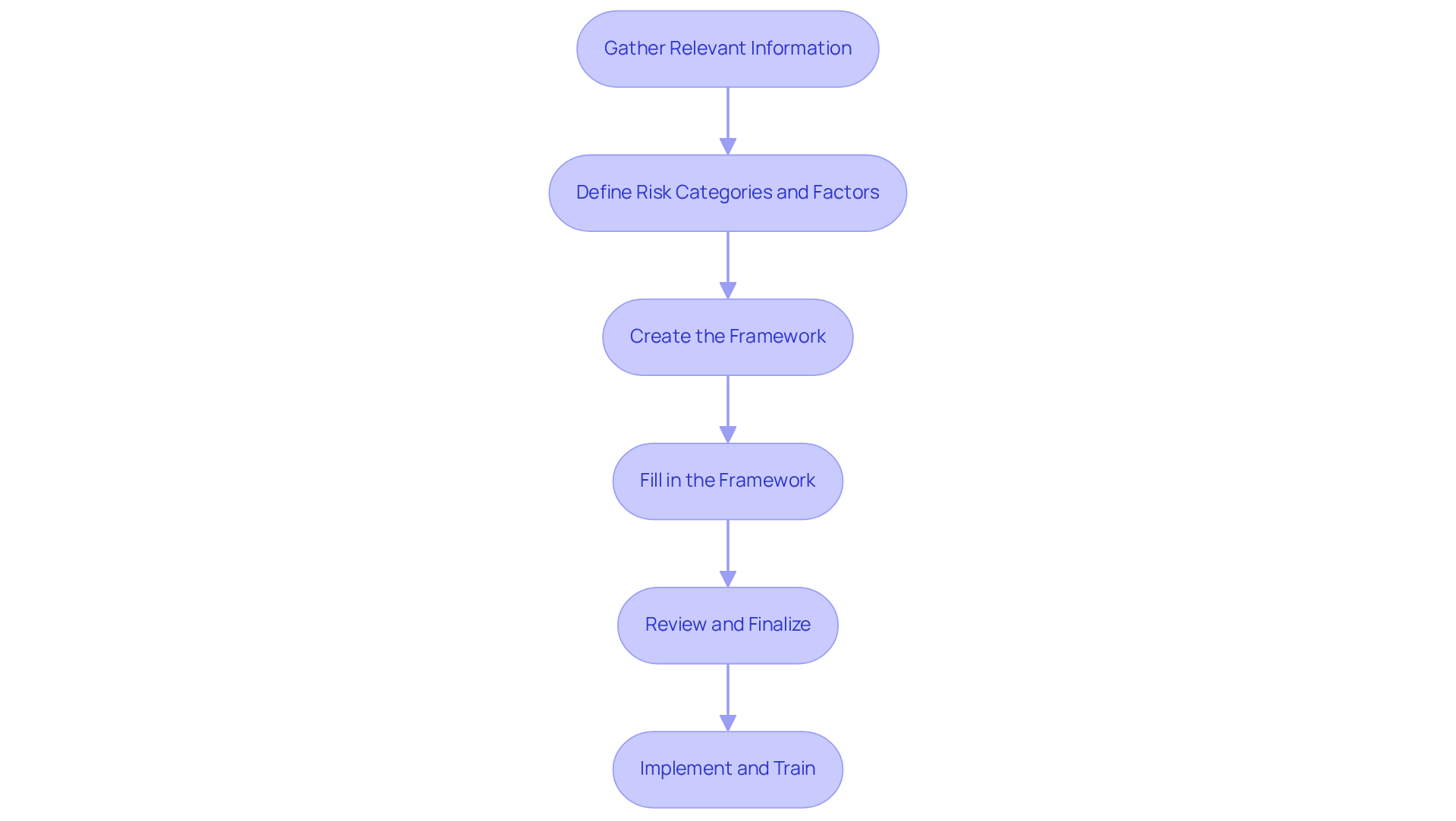

To develop an effective risk assessment template for your financial institution, follow these structured steps:

-

Gather Relevant Information: Start by collecting extensive data on your organization's operations, financial statements, and current management practices. This foundational information is crucial for a thorough evaluation.

-

Define Risk Categories and Factors: Based on your research, outline the risk categories and specific factors pertinent to your institution. Ensure these categories are exhaustive and tailored to your operational context, as this will enhance the relevance of your assessment.

-

Create the Framework: Utilize a spreadsheet or document format to design your layout. Include essential sections for threat categories, threat factors, threat ratings, mitigation strategies, and monitoring processes. This structured approach facilitates clarity and usability, allowing for streamlined decision-making. Incorporate a section for real-time analytics, referencing the client dashboard to monitor ongoing performance effectively.

-

Fill in the Framework: Begin entering the identified risks, their associated ratings, and suggested mitigation strategies. Engage with relevant stakeholders, such as department heads and compliance officers, to ensure the accuracy and completeness of the information. Utilize real-time analytics from the client dashboard to consistently evaluate the well-being of your organization and modify strategies as needed.

-

Review and Finalize: After filling in the layout, conduct a thorough review for clarity and completeness. Integrate feedback from stakeholders to make necessary modifications, ensuring the document fulfills the institution's requirements and aids ongoing performance monitoring.

-

Implement and Train: Distribute the finalized template to your team and provide training on its effective use. Ensure that all team members comprehend their responsibilities in the evaluation process, fostering a culture of adherence and proactive management of potential issues. By implementing turnaround lessons acquired, your team can improve its management capabilities.

By following these steps, you will develop a useful and efficient evaluation framework using a financial institution risk assessment template that corresponds with your institution's particular needs, ultimately improving your management capabilities.

Review and Refine the Risk Assessment Template Regularly

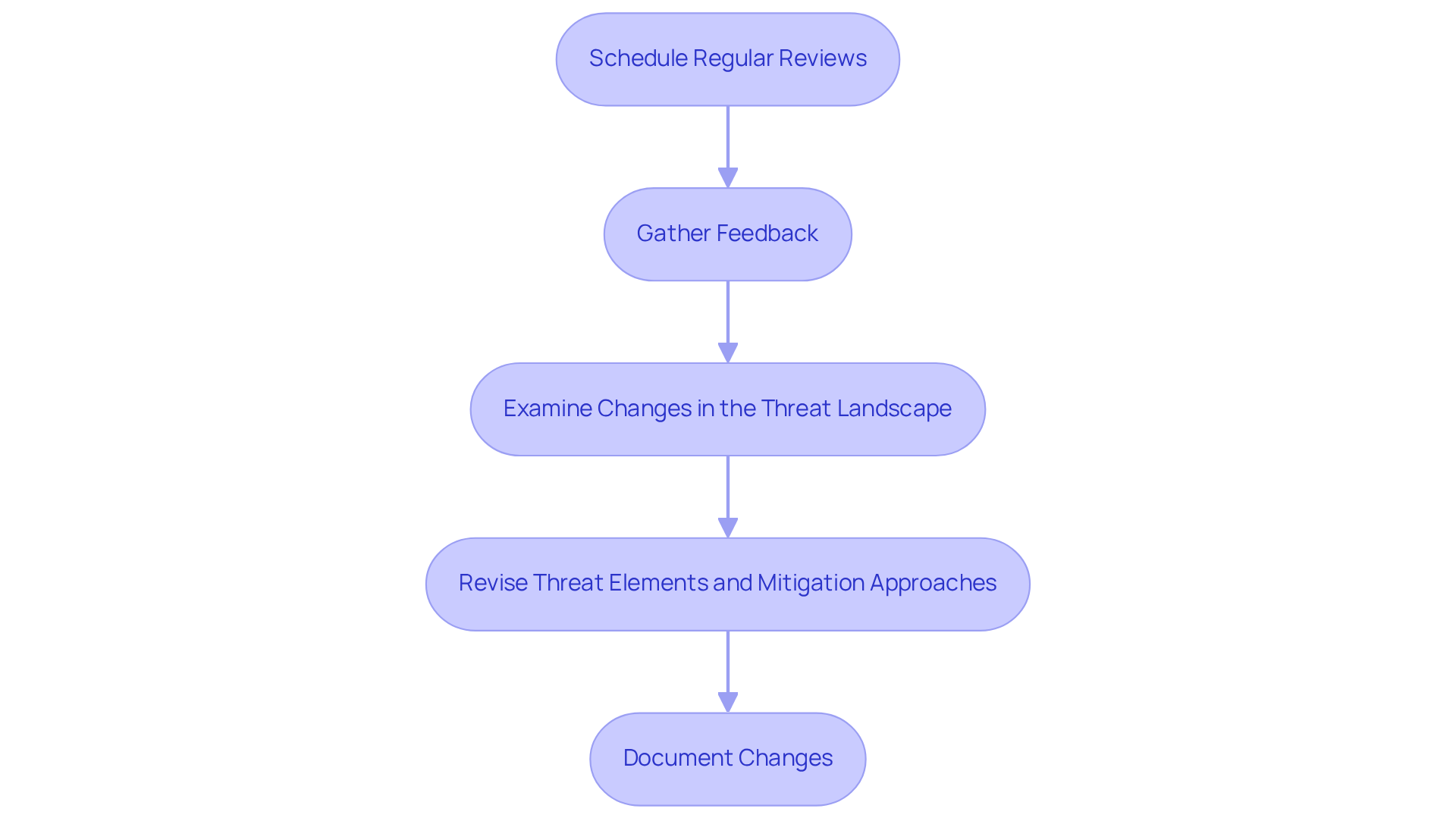

To maintain the effectiveness of your risk assessment template, it is imperative to establish a systematic review and refinement process:

-

Schedule Regular Reviews: Establish a consistent timetable for evaluating the risk assessment document, ideally on a quarterly or bi-annual basis. This practice guarantees that the framework is revised to reflect any operational changes or shifts in the external environment.

-

Gather Feedback: Actively solicit feedback from users of the template, including team members and stakeholders. Their insights are invaluable for identifying areas that require enhancement, as 87% of professionals in the field feel their processes are not widely accepted, emphasizing the need for inclusive feedback mechanisms.

-

Examine Changes in the Threat Landscape: Stay informed about developments in the regulatory environment, market conditions, and emerging challenges that could impact your institution. Consistently modifying the framework to respond to these alterations is essential, particularly as 65% of senior finance executives recognize that the intricacy of corporate challenges has considerably grown.

-

Revise Threat Elements and Mitigation Approaches: As new threats emerge or current ones change, swiftly revise the threat elements and associated mitigation approaches within the document. This proactive method is crucial, considering that 41% of organizations have indicated encountering three or more significant threat events in the past year.

-

Document Changes: Maintain a comprehensive record of all modifications made to the framework, including the rationale for each update. This documentation is not only beneficial for audits but also serves as a reference for future enhancements.

By committing to regular reviews and refinements, your risk assessment template will remain an essential tool for effective risk management and compliance with regulatory requirements.

Conclusion

Creating a financial institution risk assessment template is not merely a procedural task; it is a vital component of safeguarding an organization’s operational integrity and compliance. By systematically identifying, evaluating, and prioritizing potential risks, institutions can develop a robust framework that effectively addresses the unique challenges they face. This proactive approach is essential for fostering a culture of risk awareness and management within the organization.

The article outlines a comprehensive four-step process to develop an effective risk assessment template:

- Understanding the basics of risk assessment

- Identifying key components

- Methodically creating the template

- Regularly reviewing and refining the framework to adapt to evolving threats and regulatory changes

Each step is designed to ensure that the risk assessment remains relevant and effective, ultimately enhancing the institution's ability to mitigate potential threats.

In conclusion, the significance of a well-structured financial institution risk assessment template cannot be overstated. By implementing these best practices and committing to ongoing evaluation, financial organizations can protect their assets and ensure compliance in an increasingly complex risk landscape. It is imperative for institutions to prioritize this process, as regular updates and stakeholder engagement will not only enhance risk management capabilities but also contribute to long-term operational resilience.

Frequently Asked Questions

What is a financial institution risk assessment template?

A financial institution risk assessment template is a systematic procedure used to identify, evaluate, and prioritize threats that could affect the organization's operations and compliance.

What categories of risks are involved in financial institution risk assessments?

The categories of risks include credit exposure, operational challenges, market threats, and compliance issues.

Why is it important to understand different categories of danger in risk assessment?

Understanding different categories of danger is important because each presents unique challenges that require tailored strategies for mitigation.

What are the key components of risk assessment?

The key components of risk assessment include risk identification, threat assessment, risk ranking, and risk management.

What does risk identification involve?

Risk identification involves recognizing potential risks that could impact the institution.

What is involved in threat assessment?

Threat assessment involves evaluating the likelihood and impact of identified hazards.

How are risks ranked in a financial institution risk assessment?

Risks are ranked according to their possible impacts on the organization.

What is the purpose of risk management in this context?

The purpose of risk management is to create strategies to reduce or handle the identified threats.

How can understanding these fundamentals benefit an organization?

Grasping these fundamentals will empower an organization to create a comprehensive evaluation framework that aligns with its goals and compliance obligations.