Overview

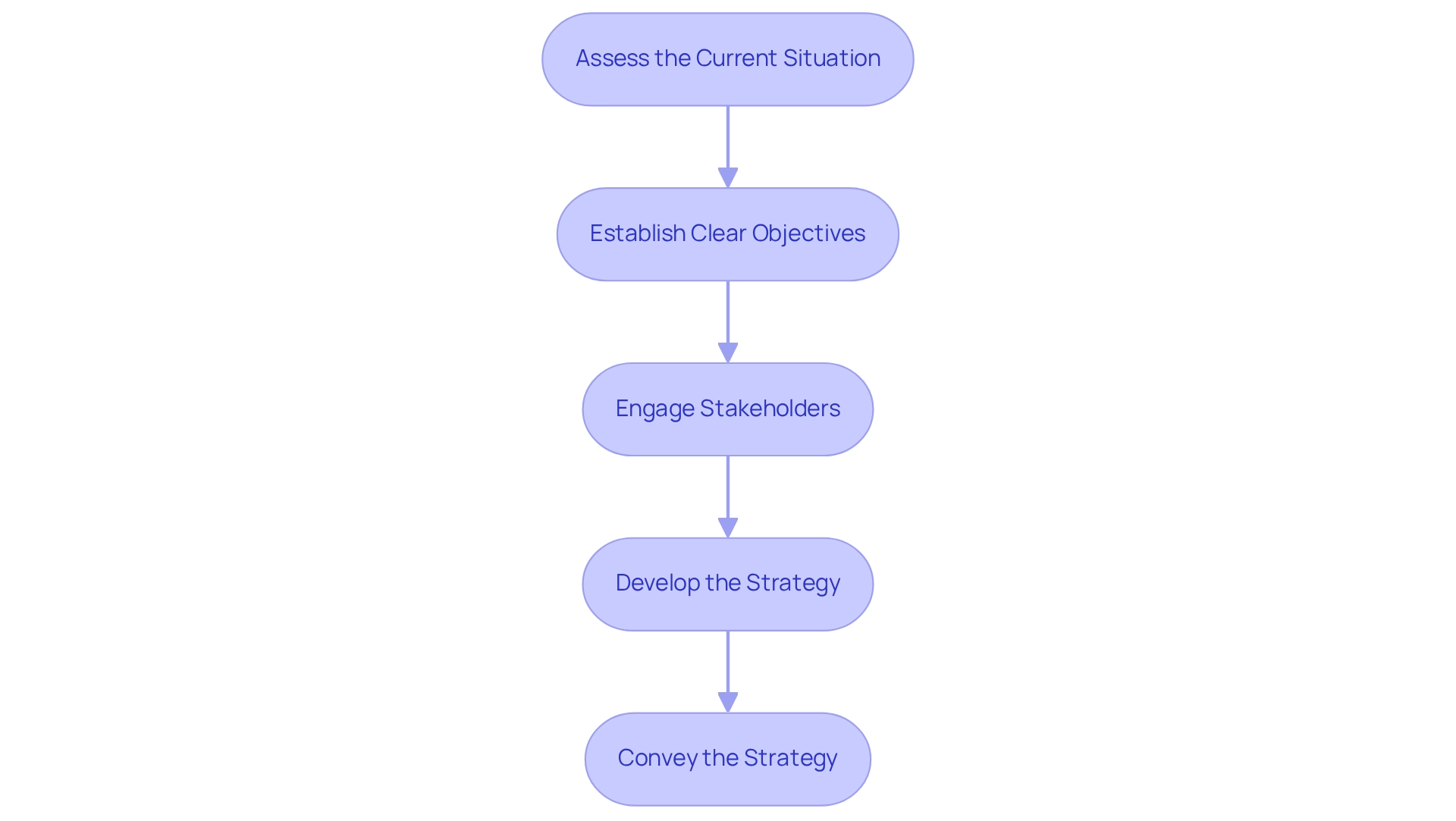

This article delineates four essential steps for crafting effective restructuring execution plans:

- Assessing the current situation

- Establishing clear objectives

- Engaging stakeholders

- Developing a data-driven strategy

These steps are crucial; they ensure a comprehensive approach to reorganization, which can lead to improved operational efficiency and profitability, particularly for small to medium enterprises facing economic pressures.

Introduction

In the dynamic landscape of modern business, the ability to adapt through restructuring is not merely a strategy; it is a necessity for survival. As companies confront mounting economic pressures and shifting market conditions, reorganizing operations, finances, and management becomes crucial for enhancing efficiency and ensuring long-term viability.

This article delves into the multifaceted nature of restructuring, outlining its significance for small to medium enterprises and providing a comprehensive guide to developing and executing a successful restructuring plan.

From assessing financial health to engaging stakeholders and implementing effective monitoring systems, the insights presented here will equip businesses with the tools needed to navigate challenges and emerge stronger in a competitive environment.

Define Restructuring and Its Importance

Restructuring execution plans represent a strategic initiative aimed at reorganizing a company's structure, operations, or finances to enhance efficiency and adapt to shifting market conditions. This often entails significant changes, such as downsizing, reallocating resources, and restructuring execution plans within the management.

The significance of restructuring execution plans is profound; they act as a vital response to financial distress, empowering businesses to streamline operations, cut costs, and ultimately boost profitability. For small to medium enterprises, effective reorganization can be the critical determinant of survival versus failure. As economic pressures mount, the imperative for restructuring execution plans becomes increasingly evident.

Research indicates that companies that implement restructuring execution plans not only navigate challenges more adeptly but also position themselves for sustainable growth. Notably, the success of small enterprises is intricately linked to the overall health of the economy, underscoring the necessity for reorganization in today's landscape.

A compelling case study illustrates this: a medium-sized firm on the brink of bankruptcy successfully transformed into a market leader by optimizing existing resources and cultivating new capabilities, exemplifying how strategic renewal can confer competitive advantages. This transformation was underpinned by a pragmatic approach to data, where every hypothesis was rigorously tested to maximize return on invested capital, highlighting the role of real-time analytics in monitoring business health via a client dashboard.

As Stefan Mayr noted, this transformation provides empirical evidence from Austria, reinforcing the idea that effective reorganization is essential for enhancing operational resilience and securing long-term success. Furthermore, as George S. Patton aptly stated, 'good tactics can save a poor strategy,' illustrating that effective restructuring execution plans serve as a tactical response to strategic challenges.

By applying lessons learned throughout the turnaround process, companies can make swifter decisions and continuously refine their strategies based on real-time insights. As the economy evolves, the importance of reorganization for small businesses cannot be overstated; it is crucial for bolstering operational resilience and ensuring long-term success.

Outline Steps for Developing a Restructuring Execution Plan

To create an effective restructuring execution plan, follow these essential steps:

- Assess the Current Situation: Conduct a thorough evaluation of the company's financial health, operational efficiency, and market position. Identify critical issues that require reorganization, ensuring a comprehensive understanding of the challenges at hand.

- Establish Clear Objectives: Clearly outline the aims of the reorganization. Objectives may include cost reduction, improved operational efficiency, or enhanced competitiveness in the market. Setting quantifiable goals will direct the reorganization efforts.

- Engage Stakeholders: Actively involve key stakeholders—management, employees, and investors—in the planning process. This engagement fosters buy-in and allows for the incorporation of diverse perspectives, which is crucial for successful implementation. Notably, statistics indicate that only 43% of employees feel their organization effectively manages change, highlighting the importance of stakeholder involvement in overcoming resistance.

- Develop the Strategy: Formulate a detailed restructuring strategy that specifies the changes to be implemented, the timeline for execution, and the resources required. This strategy of restructuring execution plans should be data-driven, leveraging insights from relevant data sources to inform strategic decisions and enhance performance. For instance, utilizing real-time analytics can help identify specific areas for improvement, allowing for a pragmatic approach to testing hypotheses and measuring investment returns. Continuous monitoring via a client dashboard can aid in ongoing evaluation of the strategy's effectiveness, ensuring that modifications can be implemented as required to align with the established objectives.

- Convey the Strategy: Transparently convey the reorganization strategy to all stakeholders to minimize uncertainty and opposition. A well-organized communication strategy should outline key messages, target audiences, communication channels, and a timeline for updates. Ongoing monitoring and evaluation of the plan's implementation are crucial to track progress and make necessary adjustments, reinforcing the importance of continuous assessment as part of the execution strategy.

Conduct Financial Assessments for Cash Preservation

Carrying out comprehensive financial evaluations is crucial for maintaining cash during organizational changes. Here’s an effective approach:

- Review Financial Statements: Begin by analyzing balance sheets, income statements, and cash flow statements to gain a comprehensive understanding of the company's financial health. This foundational step reveals critical insights into liquidity and operational efficiency, allowing for a streamlined decision-making process that can adapt quickly to changing circumstances.

- Identify Cost-Saving Opportunities: Scrutinize operational expenses to pinpoint areas for reduction without jeopardizing essential functions. Strategies may include renegotiating supplier contracts, streamlining overhead costs, and eliminating non-essential services. Businesses that implement targeted cost-saving measures often see significant improvements in their operating cash cycle (OCC), which is crucial for maintaining liquidity. The relationship between specific cash flow measures and corporate performance metrics indicates that effective management of these measures can lead to substantial financial improvements.

- Evaluate Revenue Streams: Assess the performance of various revenue streams to identify underperforming segments. This evaluation may lead to restructuring or even phasing out certain offerings that do not contribute positively to the bottom line, thereby optimizing overall revenue generation. Continuous monitoring through real-time analytics can provide insights into these performance metrics, enabling timely adjustments.

- Implement Cash Flow Forecasting: Develop a robust cash flow forecast to project future cash needs and identify potential shortfalls. This proactive step enables informed decision-making regarding resource allocation and financial management, ensuring that the organization can navigate through challenging periods effectively. It is important to note that the OCC does not account for payables, making accurate forecasting even more critical. Utilizing a client dashboard for real-time commercial analytics can enhance this forecasting process, allowing for ongoing adjustments based on current data.

- Engage Financial Advisors: Collaborate with financial consultants who focus on reorganization, such as those providing the Financial Assessment service. Their expertise can provide tailored insights and strategies that align with your specific circumstances, enhancing the effectiveness of your financial assessment efforts. As noted by María de las Nieves López García, "Cash flow management and its effect on firm performance" underscores the importance of effective cash flow strategies in achieving positive outcomes.

By adhering to these steps, businesses can not only maintain cash during reorganization but also set themselves up for sustainable growth in the long term through effective restructuring execution plans. Additionally, firms should be cautious of negative cash flow from investments, as evidenced by reports of companies facing significant cash outflows, which highlight the necessity of effective cash flow management strategies.

Implement and Monitor the Restructuring Plan

Once the restructuring plan is developed, the next step is implementation and monitoring:

- Execute the Plan: Initiate the changes outlined in the restructuring execution plans, ensuring that all stakeholders are aware of their roles and responsibilities during this critical phase. Our team endorses a shortened decision-making cycle throughout the turnaround phase, enabling your team to take decisive action to safeguard your business.

- Establish Key Performance Indicators (KPIs): Define specific KPIs to measure the success of the reorganization efforts. These indicators may encompass financial metrics, operational efficiency, and employee engagement levels, providing a comprehensive view of progress. According to recent statistics, organizations that effectively implement KPIs see a 30% increase in operational efficiency following their restructuring execution plans. This procedure also entails testing hypotheses to ensure that the KPIs are relevant and effective.

- Monitor Progress Regularly: Conduct frequent reviews of the restructuring process to evaluate progress against the established KPIs. This ongoing evaluation is essential for identifying areas that may require adjustments in the restructuring execution plans, ensuring that the strategy remains aligned with organizational goals. We consistently track the success of our strategies through a client dashboard that offers real-time analytics, enabling ongoing assessment of your company's health. This method puts into action the insights gained from earlier stages, improving the efficiency of the reform initiatives. As emphasized in a case study on assessing the effectiveness of business consulting services, collecting client testimonials and benchmarking performance can greatly improve the appraisal of restructuring execution plans.

- Communicate Updates: Maintain open lines of communication with all stakeholders regarding the progress of restructuring efforts. Regular updates not only help sustain morale but also support the restructuring execution plans to ensure that everyone remains aligned with the overarching objectives.

- Be Prepared to Adapt: Flexibility is key; be ready to make necessary adjustments to the plan as circumstances evolve. The commercial environment can change swiftly, and the ability to pivot effectively through restructuring execution plans is essential for attaining long-term success. As Bakeel Hassan ALashwal, a Procurement & Operations Manager, states, "If not, you may need to investigate why and make adjustments."

Incorporating custom event tracking and analytics can further enhance the monitoring process, allowing organizations to pinpoint areas of friction in change processes. By leveraging these insights, businesses can improve their restructuring execution plans and enhance overall outcomes. Custom event tracking helps organizations identify specific bottlenecks and inefficiencies, enabling targeted interventions that drive successful restructuring.

Conclusion

The multifaceted nature of restructuring is critical for businesses, particularly small to medium enterprises, as they navigate the complexities of modern economic challenges. By defining restructuring as a strategic process, this article highlights its importance in boosting efficiency and ensuring long-term viability. Through effective restructuring, companies can respond to financial distress, streamline operations, and enhance profitability, ultimately positioning themselves for sustainable growth in an ever-evolving marketplace.

A successful restructuring plan requires a methodical approach, beginning with a thorough assessment of the current situation and setting clear objectives. Engaging stakeholders throughout the process fosters collaboration and minimizes resistance, which is essential for successful implementation. The importance of data-driven decision-making and continuous monitoring is emphasized, enabling businesses to adapt in real-time and maintain alignment with their goals.

Financial assessments play a pivotal role in preserving cash during restructuring. By identifying cost-saving opportunities and evaluating revenue streams, businesses can optimize financial health and ensure they are equipped to weather economic storms. Furthermore, the necessity of robust cash flow forecasting and the value of engaging financial advisors to guide the restructuring process cannot be overstated.

Ultimately, the ability to implement and monitor a restructuring plan effectively is vital for achieving desired outcomes. Establishing key performance indicators and maintaining open communication with stakeholders not only tracks progress but also sustains morale throughout the transition. Flexibility and adaptability in the face of changing circumstances are crucial for long-term success, reinforcing the message that strategic restructuring is not merely a response to challenges but a proactive approach to thriving in a competitive environment.

Frequently Asked Questions

What are restructuring execution plans?

Restructuring execution plans are strategic initiatives aimed at reorganizing a company's structure, operations, or finances to enhance efficiency and adapt to changing market conditions. This often involves significant changes such as downsizing, reallocating resources, and restructuring management.

Why are restructuring execution plans significant?

They are significant as they serve as a vital response to financial distress, enabling businesses to streamline operations, cut costs, and boost profitability. For small to medium enterprises, effective reorganization can be crucial for survival.

How do restructuring execution plans affect small to medium enterprises?

Effective reorganization through restructuring execution plans can be a critical determinant for the survival of small to medium enterprises, especially as economic pressures increase.

What benefits do companies gain from implementing restructuring execution plans?

Research shows that companies that implement these plans can navigate challenges more effectively and position themselves for sustainable growth.

Can you provide an example of a successful restructuring execution plan?

A compelling case study describes a medium-sized firm on the brink of bankruptcy that transformed into a market leader by optimizing resources and developing new capabilities, demonstrating how strategic renewal can provide competitive advantages.

What role does data play in restructuring execution plans?

A pragmatic approach to data is essential, where every hypothesis is rigorously tested to maximize return on invested capital. Real-time analytics can help monitor business health and guide decision-making.

What is the relationship between the economy and the need for restructuring?

The success of small enterprises is closely linked to the overall health of the economy, making reorganization increasingly necessary in today's economic landscape.

How can companies learn from the restructuring process?

By applying lessons learned during the turnaround process, companies can make quicker decisions and continuously refine their strategies based on real-time insights.

What is the overall importance of restructuring for small businesses?

The importance of reorganization for small businesses is crucial for enhancing operational resilience and ensuring long-term success as the economy evolves.