Overview

This article presents four essential steps for CFOs to master distressed asset management. It emphasizes the significance of:

- Understanding distressed assets

- Conducting thorough financial assessments

- Implementing strategies for operational efficiency

- Continuously monitoring management approaches

Each step underscores the critical role of collaboration, data analysis, and adaptability. By illustrating these points, the article demonstrates how effective management can mitigate losses and potentially restore value in underperforming assets. CFOs are encouraged to adopt these strategies to enhance their asset management practices.

Introduction

In the intricate realm of modern finance, the management of distressed assets has become a pivotal focus for CFOs navigating turbulent economic waters. As organizations confront underperforming assets, grasping the fundamentals of distressed asset management is essential.

This article explores vital strategies that financial leaders can implement to assess and revitalize struggling assets, underscoring the significance of collaboration among key stakeholders.

By conducting comprehensive financial assessments, executing operational efficiency strategies, and adopting a flexible management approach, CFOs can not only mitigate losses but also lay the groundwork for sustainable growth.

Drawing insights from industry experts and successful case studies, this exploration equips financial professionals with the necessary tools to transform challenges into opportunities for recovery.

Understand Distressed Asset Management Fundamentals

Distressed asset management includes the strategies and processes used to tackle assets that are underperforming or facing economic challenges. For CFOs, understanding the following key concepts is essential:

- Definition of Distressed Assets: These assets have experienced significant depreciation in value due to operational inefficiencies, market downturns, or financial mismanagement. Recognizing these factors is crucial for effective intervention. The importance of distressed asset management is highlighted by the fact that proficient management can mitigate further losses and potentially restore value, underscoring the necessity for financial leaders to grasp the underlying issues affecting these assets. Recent trends indicate that organizations can enhance their recovery efforts by engaging in distressed asset management. Data suggest that chief financial officers must embrace flexibility and create global strategies to adapt to rapidly evolving environments. Organizations employing robust strategies have seen a notable improvement in their overall fiscal well-being.

- Key Players: Beyond Chief Financial Officers, stakeholders such as investors, creditors, and operational managers play a crucial role in the management process. Their collaboration is vital for a comprehensive approach to recovery. For example, in bankruptcy disputes, valuation experts can offer comprehensive analysis and trial testimony, ensuring that valuations are conducted fairly and accurately, benefiting all parties involved.

Transform Your Small/Medium Business provides extensive turnaround and restructuring consulting services, including detailed evaluations that help identify opportunities to conserve cash and reduce liabilities. Our temporary management services deliver practical executive guidance for crisis resolution and transformational change, empowering financial leaders to take decisive action and stabilize their positions. As Camille Soulier aptly stated, "If you want the team to move in the same direction, you need to show them how the work they do every day translates into numbers and facts." By mastering these fundamentals and leveraging our expertise, financial leaders can adeptly navigate the complexities of distressed asset management, positioning their organizations for successful interventions and sustainable growth.

Conduct Comprehensive Financial Assessments

To conduct a comprehensive financial assessment, CFOs should follow these essential steps:

- Gather Financial Reports: Collect the most recent balance sheets, income statements, and cash flow statements to obtain a holistic view of the company's monetary health. This essential step is vital, as small to mid-sized businesses often depend on detailed evaluations to pinpoint economic challenges. In fact, many of these businesses often need third-party financial consultants for thorough evaluations.

- Analyze Key Metrics: Focus on critical indicators such as liquidity ratios, profitability margins, and debt levels. For instance, a declining current ratio can signal potential liquidity issues, necessitating immediate attention. By testing various hypotheses related to these metrics, CFOs can maximize returns on invested capital and make informed decisions. This hypothesis testing is essential for identifying the most effective approaches for improvement.

- Evaluate Cash Flow: Scrutinize cash flow statements to track cash inflows and outflows. Recognizing patterns in cash flow can uncover inefficiencies in operations or revenue shortfalls that may worsen distressed asset management. Employing real-time analytics via a client dashboard can improve this assessment, facilitating prompt modifications to approaches as necessary.

- Identify underlying issues by leveraging the gathered data to uncover specific problems, such as elevated operational costs or declining sales, that contribute to distressed asset management. This analysis is vital for developing targeted recovery strategies. Ongoing observation via client dashboards can offer insights into business wellness, allowing financial leaders to implement lessons learned from past evaluations and develop actionable strategies to address recognized vulnerabilities.

As Brian Roberts, CFO of Lyft, emphasizes, "From a finance hiring perspective, you need to hire the best athletes who want to be part of a high-performance team." This principle applies to assembling a capable finance team to support the assessment process.

By conducting these evaluations, financial leaders can gain a thorough understanding of the economic landscape, allowing them to prioritize interventions effectively and promote sustainable recovery. The organization is dedicated to providing value through comprehensive financial evaluations, and citing successful case studies can further demonstrate effective financial assessment approaches in troubled companies.

Implement Strategies for Operational Efficiency

To enhance functional efficiency, financial leaders should consider the following approaches:

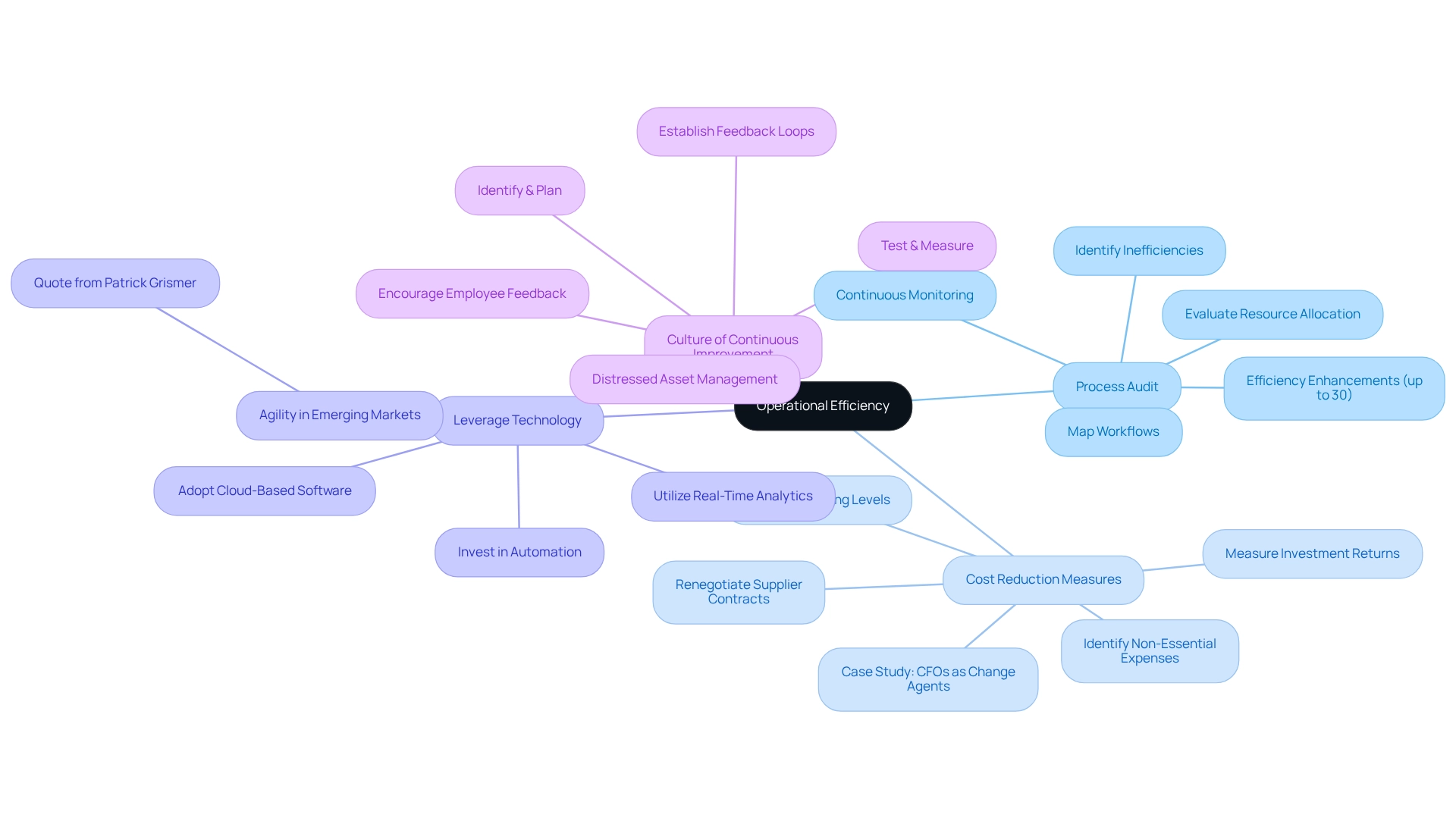

- Conduct a Process Audit: Systematically review existing processes to identify inefficiencies and bottlenecks. This involves mapping workflows and evaluating resource allocation to ensure optimal performance. According to recent statistics, organizations that conduct thorough process audits can observe efficiency enhancements of up to 30%. Continuous business performance monitoring is essential, allowing CFOs to identify issues in real-time and adjust strategies accordingly. This aligns with the cash conversion cycle by ensuring that cash flow is optimized throughout the business processes.

- Implement Cost Reduction Measures: Identify non-essential expenses and explore avenues for reducing overhead. This could include renegotiating supplier contracts or optimizing staffing levels to align with current operational needs. A case study titled 'CFOs as Change Agents' emphasizes how financial leaders successfully spearheaded cost reduction initiatives that led to substantial savings and enhanced financial well-being. By strategically planning solutions and measuring investment returns, financial leaders can ensure that resources are allocated effectively, directly impacting the cash conversion cycle.

- Leverage Technology: Invest in technology solutions that automate processes and enhance data management. For instance, adopting cloud-based software can enhance collaboration and significantly reduce expenses, resulting in improved efficiency. Real-time analytics empower financial leaders to make swift decisions based on current data. As Patrick Grismer, financial officer of Starbucks, noted, 'Emerging markets are growing at a much faster pace than the rest of the world,' underscoring the need for agility and technological adaptation in today's fast-paced environment. This technological leverage is crucial for effectively monitoring the cash conversion cycle.

- Foster a Culture of Continuous Improvement: Encourage employees to share ideas for enhancing efficiency and minimizing waste. Establishing a feedback loop can help sustain these initiatives over time, ensuring that the organization remains agile and responsive to changes. Financial institutions that excel systematically identify, measure, and optimize their functional capabilities, which is vital for maintaining a competitive edge. By implementing turnaround insights and consistently evaluating hypotheses, financial executives can drive significant enhancements in performance through distressed asset management, aligning with the 'Identify & Plan' and 'Test & Measure' methodologies. Concentrating on distressed asset management approaches allows financial executives to significantly improve the operational performance of struggling assets, paving the way for recovery and lasting success.

Monitor and Adjust Management Strategies Continuously

To ensure ongoing success in distressed asset management, CFOs must adopt a proactive approach that incorporates several critical strategies, including establishing Key Performance Indicators (KPIs) that align directly with recovery objectives, focusing on metrics such as revenue growth, cost savings, and operational efficiency. This alignment is crucial for tracking progress and making informed decisions.

- Regularly Review Performance Data: Implement a schedule for frequent reviews of both financial and functional data. This practice enables timely identification of issues and ensures that the organization remains on track to meet its recovery goals. Moreover, utilizing real-time business analytics through a client dashboard can enhance this process, allowing for continuous monitoring of business health and facilitating necessary adjustments, especially in the context of distressed asset management where being prepared to pivot is paramount. If specific approaches fail to yield the anticipated outcomes, be prepared to modify tactics. This may involve reallocating resources or shifting focus to different operational areas to optimize recovery efforts. A practical method for evaluating hypotheses can assist in identifying the most efficient plans for your organization.

- Engage Stakeholders: Maintain open lines of communication with all stakeholders, including employees, investors, and creditors. Engaging these groups fosters alignment and support for ongoing initiatives, which is vital for successful recovery. Negotiating consent and support from creditors may involve making concessions, such as offering higher interest rates or sharing future profits in exchange for cooperation. By implementing a robust framework for monitoring and adjusting management strategies, financial leaders can significantly enhance their effectiveness in distressed asset management, ultimately driving sustainable recovery and growth. Additionally, with an available budget for improving sales between $30K and $50K, CFOs should strategically allocate resources to support these initiatives. Case studies on monetary restructuring and debt management demonstrate that effective monetary restructuring can enhance cash flow and liquidity for distressed assets, although it involves risks such as loss of control and potential adverse effects on credit ratings. A holistic approach is necessary to address the financial, operational, and human challenges faced by distressed businesses.

Conclusion

Navigating the complexities of distressed asset management is paramount for CFOs aiming to restore financial health and drive sustainable growth. By grasping the fundamentals of distressed assets, conducting thorough financial assessments, and implementing strategies for operational efficiency, financial leaders can effectively tackle the challenges posed by underperforming assets. Moreover, the collaborative efforts of stakeholders further enhance the potential for successful interventions, ensuring a unified approach to recovery.

Continuous monitoring and adaptability are essential components of a successful management strategy. Establishing key performance indicators and regularly reviewing performance data enable CFOs to make informed decisions and pivot when necessary. In addition, engaging stakeholders fosters alignment and support, creating a robust framework for recovery.

Ultimately, the proactive management of distressed assets not only mitigates losses but also lays the groundwork for future opportunities. By embracing these strategies, CFOs can transform challenges into pathways for recovery, positioning their organizations for long-term success in an ever-evolving economic landscape. The journey may be complex, but with the right tools and strategies in place, the potential for revitalization and growth is within reach.

Frequently Asked Questions

What is distressed asset management?

Distressed asset management includes the strategies and processes used to address assets that are underperforming or facing economic challenges.

What defines distressed assets?

Distressed assets are those that have experienced significant depreciation in value due to operational inefficiencies, market downturns, or financial mismanagement.

Why is understanding distressed asset management important for CFOs?

Understanding distressed asset management is crucial for CFOs because proficient management can mitigate further losses and potentially restore value to underperforming assets.

Who are the key players involved in distressed asset management?

Key players include Chief Financial Officers, investors, creditors, and operational managers, all of whom play vital roles in the management process.

How do stakeholders collaborate in distressed asset management?

Collaboration among stakeholders is essential for a comprehensive approach to recovery, especially in situations like bankruptcy disputes where valuation experts can provide analysis and testimony.

What services does Transform Your Small/Medium Business offer in relation to distressed asset management?

They provide turnaround and restructuring consulting services, including evaluations to identify cash conservation opportunities and reduce liabilities, as well as temporary management services for crisis resolution.

What is the significance of mastering the fundamentals of distressed asset management?

Mastering these fundamentals enables financial leaders to navigate the complexities of distressed asset management effectively, positioning their organizations for successful interventions and sustainable growth.