Overview

This article delineates four essential steps to optimize Tucson financial risk assessment services:

- Understanding the basics of financial risk assessment

- Identifying business needs and goals

- Evaluating financial risk assessment providers

- Ensuring continuous support and adaptation

Each step underscores the criticality of thorough risk identification, strategic alignment with business objectives, careful provider selection, and ongoing evaluation. These elements are vital for effectively managing financial threats and enhancing organizational resilience.

Introduction

In an increasingly complex financial landscape, businesses encounter a multitude of risks that can jeopardize their stability and growth. It is essential for any organization aiming to protect its financial health to understand how to effectively assess and manage these risks. This article delves into four crucial steps to optimize Tucson financial risk assessment services, offering valuable insights into:

- Identifying threats

- Aligning business goals

- Evaluating service providers

- Ensuring ongoing adaptability

How can organizations transform their approach to financial risk assessment not only to guard against uncertainties but also to seize new opportunities for growth?

Understand Financial Risk Assessment Basics

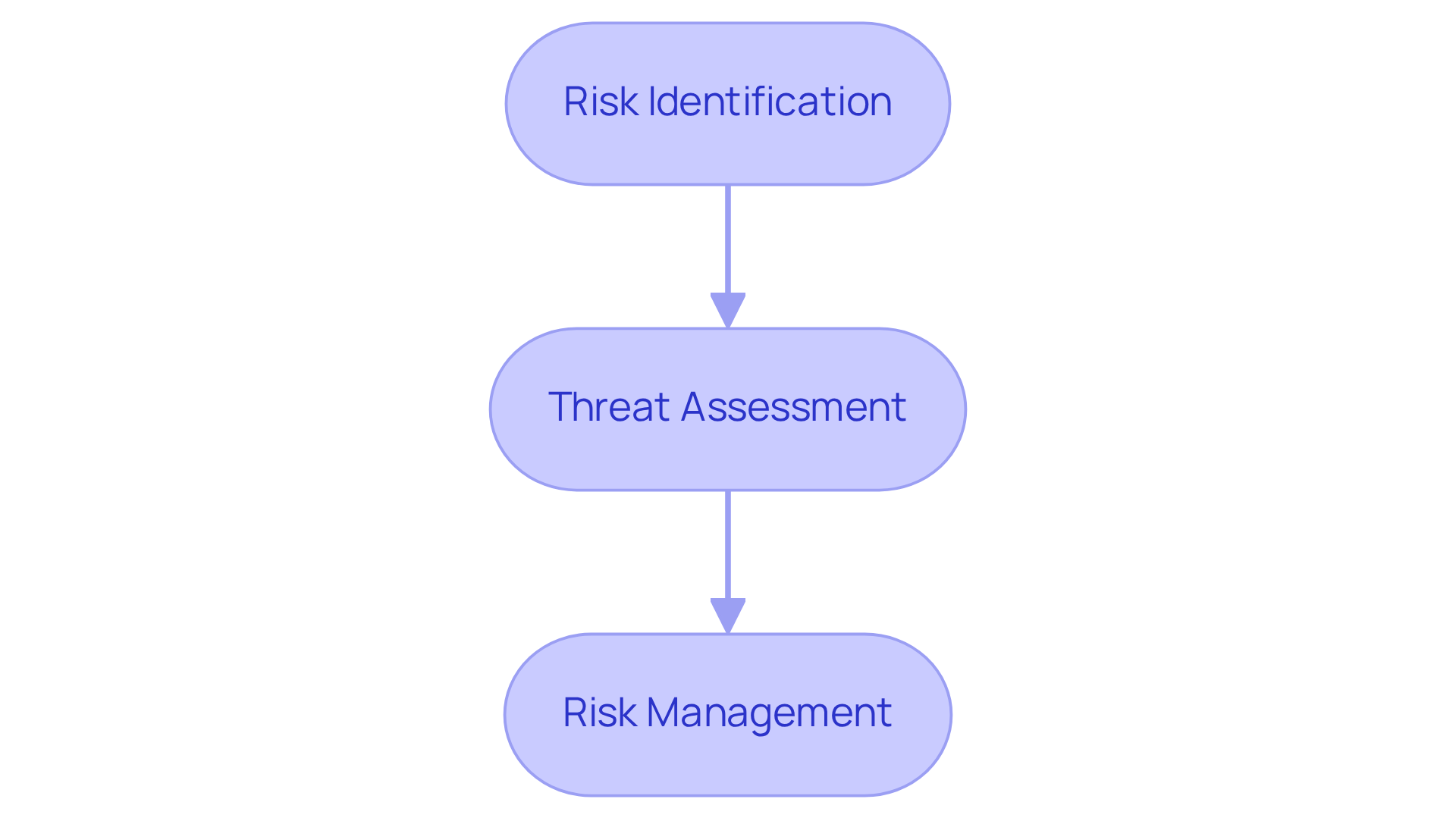

Evaluating financial threats is essential for safeguarding a business's financial health, which can be effectively achieved through tucson financial risk assessment services by identifying, analyzing, and mitigating potential risks. The core components of this process include:

-

Risk Identification: Recognizing various potential risks is the first step. These can include market fluctuations, credit risks, operational risks, and liquidity risks. Notably, 40% of executives cite cyber attacks as a significant concern, underscoring the importance of vigilance in identifying threats.

-

Threat Assessment: After identifying hazards, it is crucial to assess their likelihood and potential impact on the organization. This evaluation helps prioritize threats based on their severity, enabling companies to allocate resources effectively.

-

Risk Management: Developing strategies to minimize the effects of identified threats is vital. This may involve diversifying investments, improving cash flow management, or implementing robust internal controls. For instance, firms that proactively address financial uncertainties can stabilize cash flow and protect assets, ensuring long-term sustainability.

Understanding these fundamentals empowers organizations to make informed decisions regarding their financial strategies and utilize tucson financial risk assessment services for effective risk management practices. Effective risk identification is not merely a defensive tactic; it is a cornerstone of financial well-being, enabling businesses to navigate uncertainties and capitalize on growth opportunities.

Identify Your Business Needs and Goals

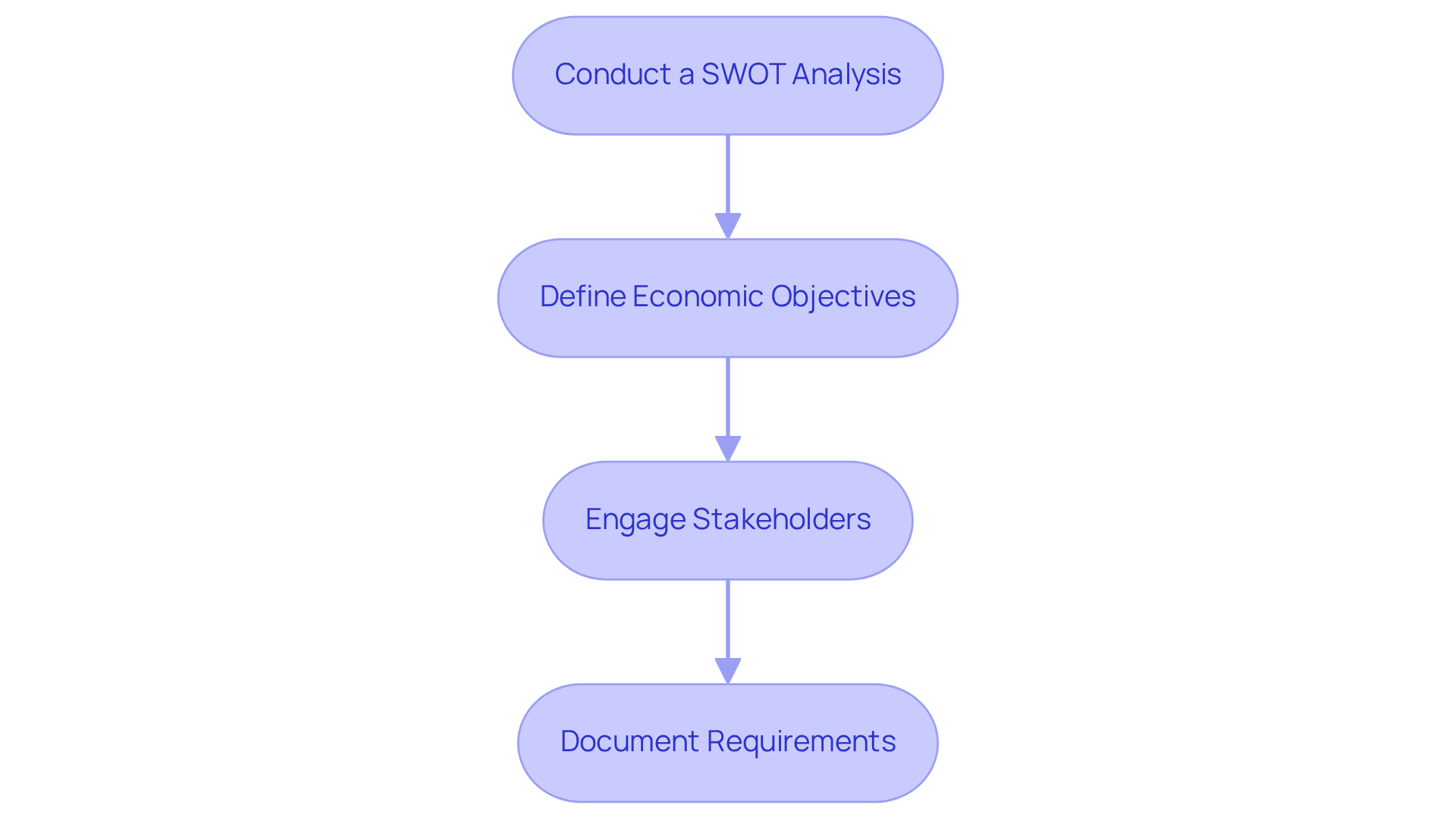

To effectively identify your business needs and goals, follow these steps:

-

Conduct a SWOT Analysis: Assess your business's Strengths, Weaknesses, Opportunities, and Threats to understand its current position. This analysis assists in identifying areas for enhancement and potential risks that could affect economic stability using tucson financial risk assessment services.

-

Define Economic Objectives: Establish clear monetary goals, such as increasing revenue, reducing costs, or improving cash flow. In 2025, small to medium enterprises should concentrate on SMART objectives—specific, measurable, achievable, relevant, and time-bound—to improve their economic performance and resilience.

-

Engage Stakeholders: Involve key stakeholders, including management and accounting teams, to gather diverse perspectives on business priorities. Engaging stakeholders is crucial, as 67% of well-formulated strategies fail due to poor execution, often stemming from a lack of alignment among team members.

-

Document Requirements: Develop a thorough list of recognized needs and objectives to direct the monetary assessment procedure. This documentation guarantees that all stakeholders share a common understanding and that the monetary evaluation corresponds with the strategic goals of the organization.

By distinctly outlining your organization's requirements and goals, you can ensure that the tucson financial risk assessment services are aligned with your strategic objectives, ultimately improving your capacity to manage fiscal challenges and attain sustainable growth.

Evaluate and Compare Financial Risk Assessment Providers

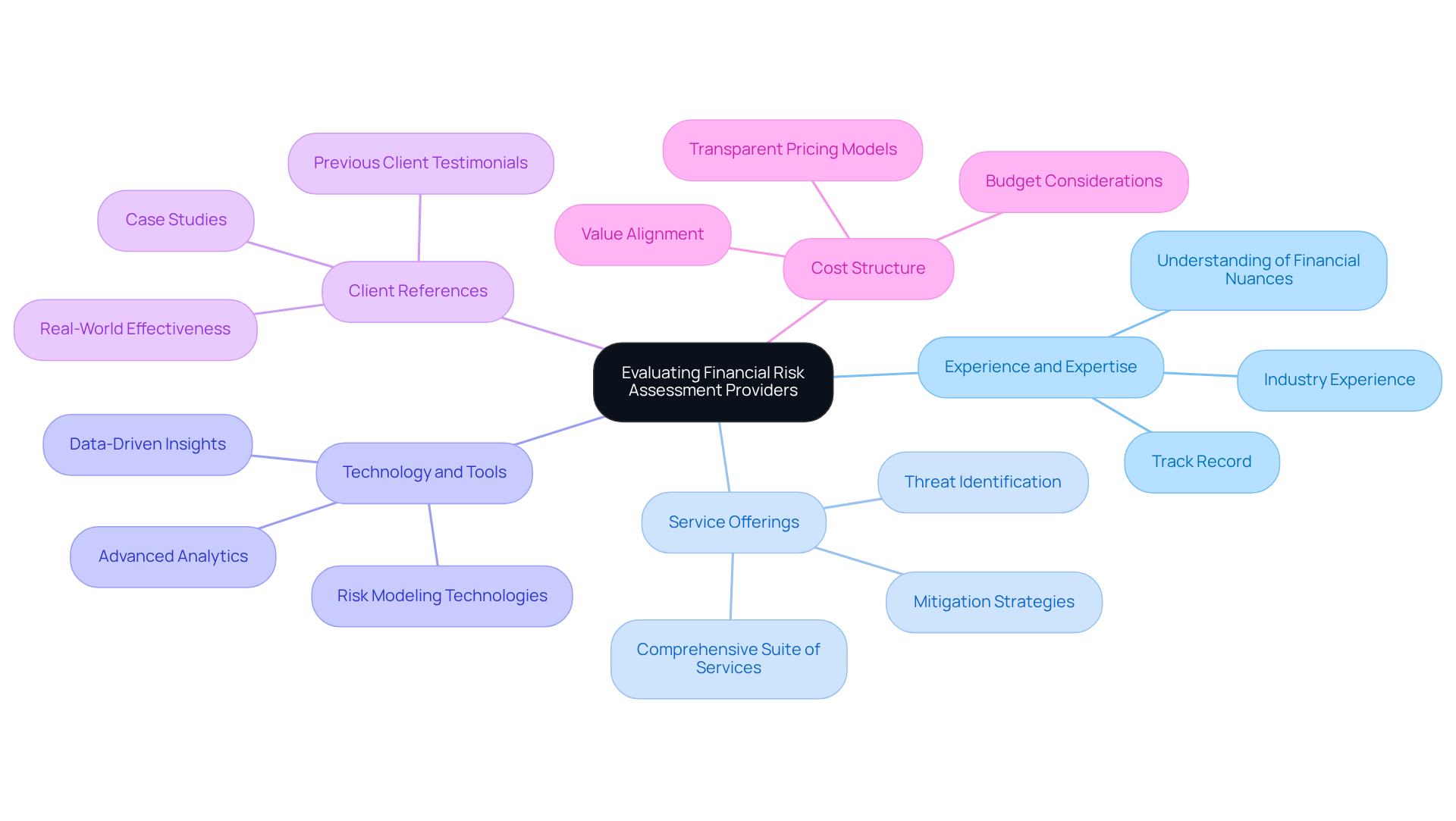

When evaluating financial risk assessment providers, it is essential to consider several key criteria to ensure you select a partner that meets your business's specific needs:

-

Experience and Expertise: Prioritize providers with a solid track record in financial evaluation, particularly those with experience in your industry. As Peter Bernstein emphasizes, "effective management of uncertainty relies on grasping the nuances of the field," highlighting the significance of experienced professionals.

-

Service Offerings: Ensure the provider offers a comprehensive suite of services, including threat identification, analysis, and mitigation strategies. This breadth of service is crucial for addressing the multifaceted nature of financial challenges with tucson financial risk assessment services.

-

Technology and Tools: Evaluate the technology and tools employed by the provider. Advanced analytics and risk modeling technologies, including tucson financial risk assessment services, are essential for delivering accurate and timely assessments, aligning with current trends that leverage data-driven insights for better decision-making.

-

Client References: Request references or case studies from previous clients to assess the provider's effectiveness and reliability. Real-world examples can provide valuable insights into how the provider has navigated challenges similar to those your business may face, highlighting the need for organizations to be prepared for unexpected shocks and uncertainties.

-

Cost Structure: Compare pricing models to ensure the services align with your budget while delivering value. A transparent cost structure is essential for making informed monetary decisions.

By carefully assessing these criteria, you can find a partner for evaluation that not only comprehends the intricacies of your sector but also offers tucson financial risk assessment services to strengthen your organization's durability against possible economic uncertainties.

Ensure Continuous Support and Adaptation

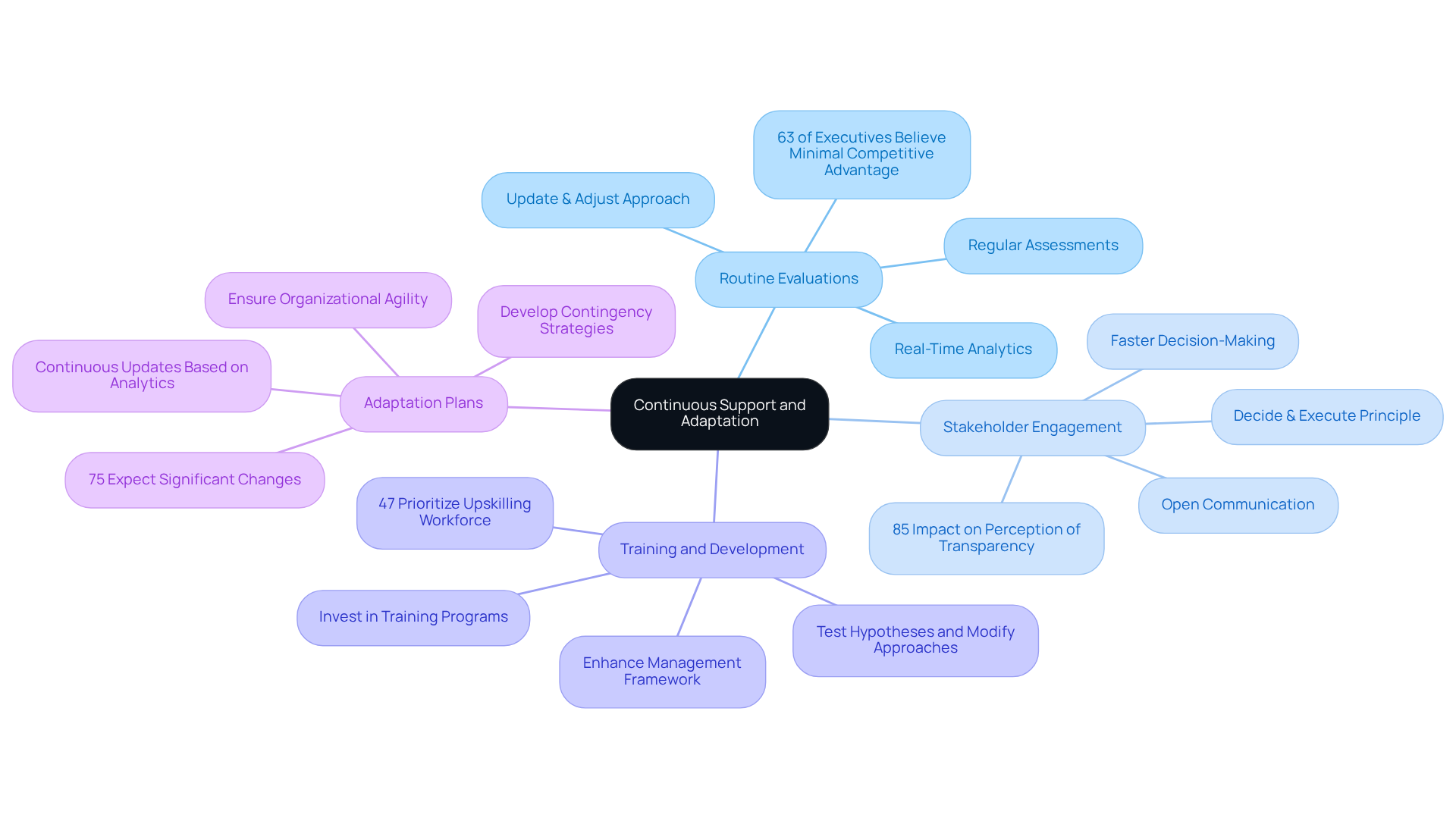

To ensure ongoing support and adaptability in your financial risk assessment process, consider implementing the following strategies:

-

Routine Evaluations: Conduct regular assessments of your financial threat analysis to identify new challenges and evaluate the effectiveness of existing approaches. This practice is essential, as 63% of executives believe their organization's risk management processes provide minimal competitive advantage, highlighting the need for continuous evaluation. By utilizing real-time analytics via our client dashboard, you can consistently track the success of your approaches and make informed modifications as necessary. This aligns with the 'Update & Adjust' approach, ensuring your strategies remain relevant and effective.

-

Stakeholder Engagement: Foster open communication with stakeholders to collect feedback and insights regarding evolving business conditions. Engaging stakeholders can significantly influence perceptions of organizational transparency, with 85% of stakeholders indicating that engagement impacts their views. Moreover, this involvement promotes faster decision-making procedures, enabling your team to react efficiently to emerging challenges, embodying the 'Decide & Execute' principle.

-

Training and Development: Invest in training programs for your team to deepen their understanding of management practices and tools. With 47% of organizations prioritizing upskilling their workforce on emerging technologies, this investment can improve your team's efficiency in handling uncertainties. Implementing the lessons gained from training can further enhance your management framework, ensuring that your team is ready to test hypotheses and modify approaches as needed.

-

Adaptation Plans: Develop contingency strategies to quickly address unexpected challenges or alterations in the commercial environment. As 75% of executives foresee significant changes in their organization's approach to continuity planning, having strong adaptation strategies is essential for resilience. By continuously updating and adjusting your plans based on real-time analytics, you can ensure your organization remains agile in the face of challenges.

By cultivating a culture of continuous improvement and adaptability, your business can effectively navigate financial risks while capitalizing on growth opportunities.

Conclusion

Optimizing Tucson financial risk assessment services is essential for businesses seeking to protect their financial health and adeptly navigate uncertainties. By employing a structured approach that includes risk identification, assessment, management, and ongoing support, organizations can bolster their resilience against potential threats while seizing growth opportunities.

Key points discussed emphasize the significance of:

- Grasping the fundamentals of financial risk assessment

- Pinpointing specific business needs and goals through techniques such as SWOT analysis

- Evaluating potential assessment providers based on their experience, service offerings, technology, and cost structures

Moreover, fostering continuous support and adaptability within the organization guarantees that financial strategies remain pertinent and effective amidst evolving challenges.

Ultimately, adopting these best practices not only strengthens a business's financial position but also equips it to respond swiftly to shifting market dynamics. By prioritizing effective financial risk assessment, organizations can construct a robust framework that safeguards their assets and propels sustainable growth in an unpredictable environment.

Frequently Asked Questions

What is the purpose of financial risk assessment?

The purpose of financial risk assessment is to evaluate financial threats to safeguard a business's financial health by identifying, analyzing, and mitigating potential risks.

What are the core components of financial risk assessment?

The core components of financial risk assessment include risk identification, threat assessment, and risk management.

What does risk identification involve?

Risk identification involves recognizing various potential risks such as market fluctuations, credit risks, operational risks, and liquidity risks. Cyber attacks are also a significant concern for many executives.

How is threat assessment conducted?

Threat assessment involves evaluating the likelihood and potential impact of identified hazards on the organization, which helps prioritize threats based on their severity.

What is the role of risk management in financial risk assessment?

Risk management involves developing strategies to minimize the effects of identified threats, such as diversifying investments, improving cash flow management, or implementing robust internal controls.

Why is effective risk identification important for businesses?

Effective risk identification is important because it is a cornerstone of financial well-being, enabling businesses to navigate uncertainties and capitalize on growth opportunities.

How can tucson financial risk assessment services help organizations?

Tucson financial risk assessment services can help organizations make informed decisions regarding their financial strategies and implement effective risk management practices.