Overview

The article delineates four strategic restructuring solutions that CFOs can implement to elevate financial performance and enhance organizational agility. It underscores the necessity of comprehensive financial assessments, robust communication strategies, and a systematic implementation process. These elements are vital for navigating the complexities of change and nurturing sustainable growth within organizations.

Introduction

In today's dynamic business landscape, the ability to adapt and restructure is not merely a strategic advantage; it is a necessity for survival. Organizations grappling with rapid market changes and operational challenges find strategic restructuring to be a critical approach for enhancing financial performance and fostering resilience.

This article explores the vital role of CFOs in orchestrating successful restructuring efforts. It outlines key steps for implementation, emphasizes the importance of thorough financial assessments, and highlights the development of effective communication strategies.

By understanding the intricacies of this process, businesses can navigate crises and position themselves for sustainable growth in an ever-evolving environment.

Define Strategic Restructuring and Its Importance

Strategic reorganization reshapes a company's operations, structure, and resources to enhance financial performance and competitiveness. This process is particularly crucial for CFOs, as it equips them to recognize when reorganization is necessary and to implement impactful modifications that foster sustainable growth.

In 2025, the significance of strategic reorganization is underscored by its capacity to enhance organizational agility and reduce expenses, aligning resources with long-term goals. By proactively identifying underlying issues and collaboratively planning solutions, businesses can adeptly navigate crises and emerge more resilient.

Our approach emphasizes testing hypotheses and measuring investment returns to ensure maximum effectiveness in both the short and long term. Current trends indicate that companies are increasingly adopting strategic restructuring solutions to adapt to market changes and operational challenges, with many reporting improved economic outcomes.

For instance, case studies reveal that small to medium enterprises that undertook reorganization not only optimized operations but also positioned themselves for future expansion. The benefits of strategic restructuring solutions extend beyond immediate economic relief; they lay the groundwork for long-term success, making them an essential strategy for financial leaders aiming to guide their organizations through challenging times.

Chief Financial Officers should also consider leveraging services such as turnaround consulting, financial assessment, and interim management to facilitate this process. By understanding these dynamics and applying lessons learned, financial leaders can more effectively manage the complexities of strategic reorganization and utilize it for sustainable growth.

Outline Key Steps for Effective Restructuring Implementation

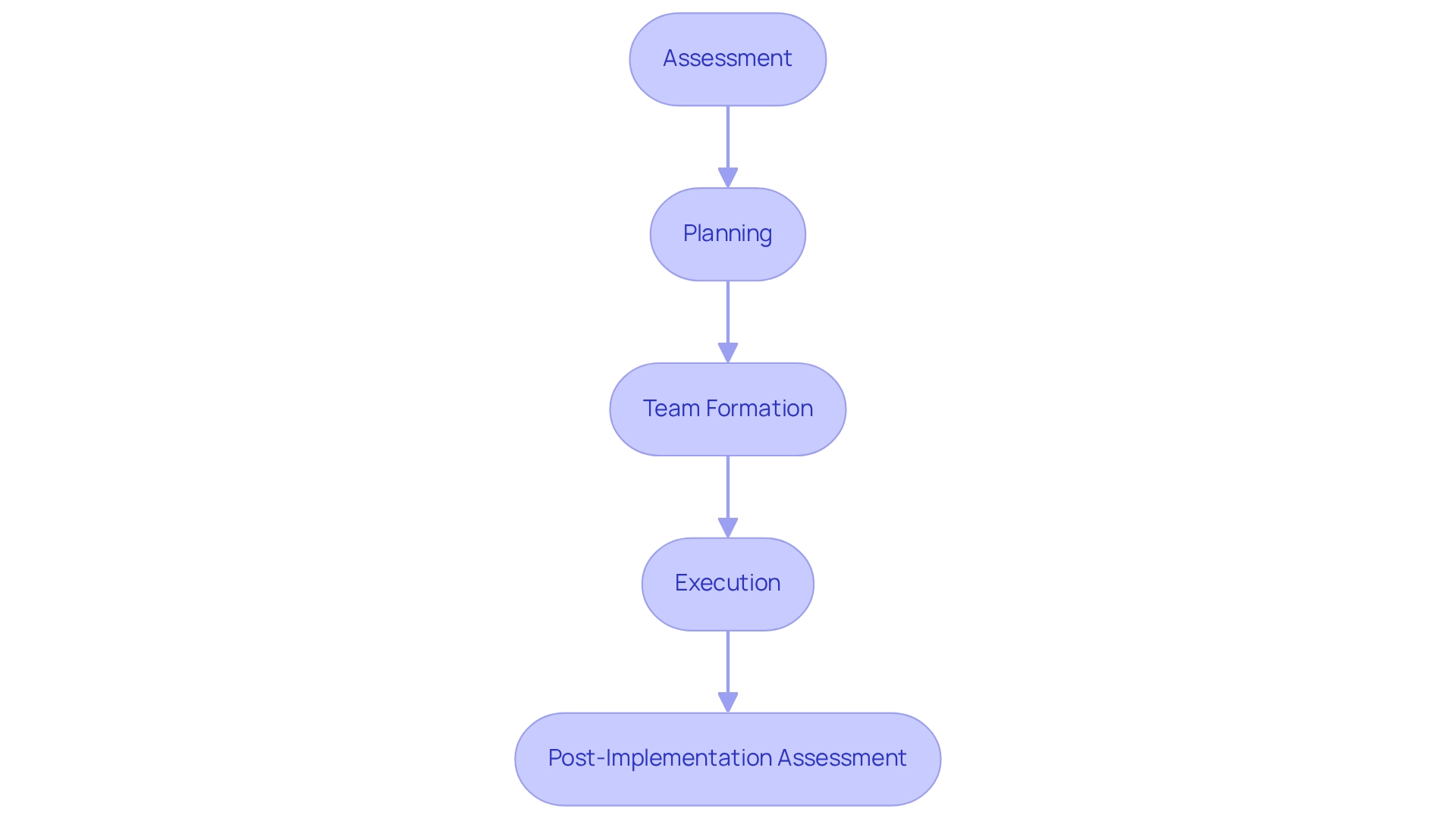

To execute effective reorganization, CFOs should adhere to the following key steps:

- Assessment: Begin with a comprehensive analysis of the organization’s financial and operational landscape to pinpoint areas that require transformation. This involves collaboratively identifying underlying business issues that can be resolved through strategic restructuring solutions.

- Planning: Develop a comprehensive reorganization strategy that clearly outlines objectives, timelines, and resource distribution, ensuring alignment with overall business goals. This plan should incorporate methods for testing hypotheses to maximize returns on investment in both the short and long term.

- Team Formation: Create a cross-functional team that encompasses key stakeholders, fostering diverse perspectives and expertise essential for informed decision-making. This collaborative approach is crucial for operationalizing lessons learned throughout the turnaround process.

- Execution: Roll out the reorganization plan while diligently monitoring progress through real-time analytics via a client dashboard. This allows for quick decision-making and necessary adjustments in response to emerging challenges, ensuring that the organization remains agile and responsive.

- Assessment: After implementation, assess the results against the initial goals to measure the effectiveness of the changes made. Continuous monitoring via client dashboards can offer insights into business health and performance, enabling ongoing adjustments and enhancements.

Research shows that organizations with five or more success factors in their transformation initiatives report complete success 88% of the time. Additionally, project timelines and ROI on change initiatives are critical metrics for evaluating change management effectiveness. It is also essential to involve employees in creating change strategies; while 74% of leaders claim to do so, only 42% of employees feel truly included. This disconnect can obstruct buy-in and ownership, highlighting the necessity for financial leaders to enhance engagement practices during organizational changes. By following these structured steps, financial executives can minimize disruption and significantly enhance the likelihood of achieving strategic restructuring solutions for sustainable growth.

Conduct Thorough Financial Assessments for Optimal Outcomes

Conducting thorough financial assessments is essential for effective restructuring and involves several key components:

- Cash Flow Analysis: Assess current cash flow patterns to pinpoint potential liquidity challenges and identify areas for enhancement. This analysis is crucial, as 43% of CFOs are increasingly approached for new opportunities, highlighting the need for robust financial management. Utilizing advanced analytics can streamline decision-making and provide real-time insights into cash flow dynamics, which is vital for turnaround strategies.

- Debt Structure Review: Examine current debt obligations to uncover opportunities for renegotiation or modification. Understanding the cash flow coverage ratio (CFCR) is vital; for instance, a CFCR of 13.37% indicates a company's ability to meet its debt obligations, which is critical for informing strategic decisions regarding debt management and restructuring strategies. Professional advice can further improve this process, ensuring that corporate leaders are equipped with the necessary tools to navigate intricate economic environments.

- Cost Structure Examination: Evaluate both fixed and variable costs to discover areas where expenses can be trimmed without compromising quality. This step is critical as businesses adapt to changing market conditions and seek to automate processes for efficiency. Implementing AI/ML strategies can optimize cost management, allowing for more agile responses to market demands.

- Performance Metrics Evaluation: Utilize key performance indicators (KPIs) to assess economic health and operational efficiency. In 2025, technology fluency will be as crucial as conventional monetary knowledge in planning and analysis (FP&A) roles, making it essential for CFOs to incorporate advanced analytical tools into their evaluations. Mastering the cash conversion cycle through strategic metrics can significantly enhance business performance.

- Common Pitfalls: Be aware of common pitfalls in monetary evaluations, such as overlooking the impact of external market conditions or failing to involve key stakeholders in the assessment process. Addressing these issues can prevent misapplications of monetary strategies. Continuous performance monitoring and relationship-building through real-time analytics are essential to operationalizing turnaround lessons effectively.

As Camille Soulier aptly stated, "If you want the team to move in the same direction, you need to show them how the work they do every day translates into numbers and facts." By utilizing these evaluation methods, financial leaders can cultivate a thorough comprehension of their organization's economic environment, facilitating informed choices that promote strategic restructuring solutions and ensure long-term sustainability.

Develop Effective Communication Strategies to Manage Change

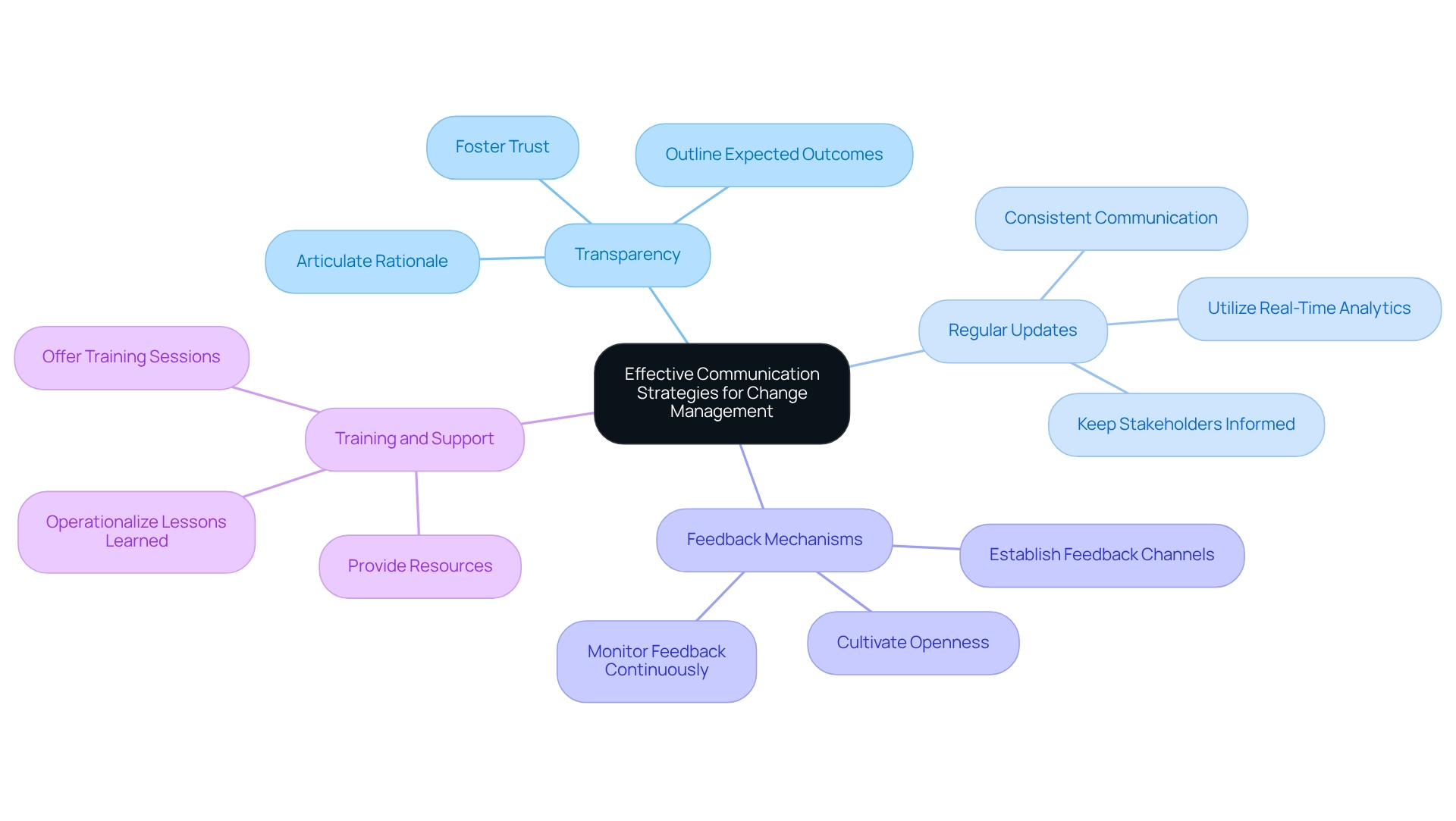

To navigate the complexities of organizational changes, CFOs must implement robust communication strategies that prioritize clarity and engagement, while also leveraging strategic restructuring solutions alongside streamlined decision-making and real-time analytics. Key components include:

- Transparency: Clearly articulate the rationale behind the reorganization, outlining expected outcomes and potential impacts on employees. This openness fosters trust and reduces anxiety.

- Regular Updates: Consistent communication throughout the reorganization process is essential. Keeping stakeholders informed helps maintain engagement and mitigates uncertainty. Utilizing real-time business analytics can enhance these updates, providing stakeholders with immediate insights into the restructuring's progress.

- Feedback Mechanisms: Establishing channels for staff to express concerns and provide feedback cultivates a culture of openness. This approach not only addresses issues swiftly but also empowers staff during transitions. Continuous monitoring of feedback through analytics can help identify areas needing attention.

- Training and Support: Offering training sessions and resources prepares staff to adjust to new roles or processes, boosting their confidence and effectiveness in the restructured environment. Operationalizing lessons learned from the turnaround process can further strengthen these training initiatives.

Prioritizing effective communication can significantly reduce resistance to change. Research indicates that organizations implementing strategic restructuring solutions with strong communication practices are more likely to succeed in their transformation efforts, as evidenced by the fact that 70% of change initiatives fail due to poor communication. Moreover, with merely 43% of staff believing their organization excels at managing change, it is essential for financial leaders to understand that effective communication strategies, backed by real-time analytics, are crucial in bridging this gap.

The case study from Pollack Peacebuilding Systems emphasizes the significance of reducing staff resistance through customized change management approaches. By improving communication during change processes and utilizing strategic restructuring solutions to track progress, organizations can greatly diminish workplace stress and increase the chances of long-term success in their transformation efforts. Furthermore, it is essential to recognize that communication goes beyond verbal interactions; nonverbal communication is vital in transmitting messages and promoting understanding among staff. CFOs should also be aware of common pitfalls in communication during restructuring, such as lack of clarity or failure to engage employees, which can hinder the overall effectiveness of the process.

By fostering a supportive environment and prioritizing effective communication, alongside the use of real-time analytics, CFOs can encourage collaboration and commitment to restructuring goals, ultimately driving sustainable growth and improving employee engagement.

Conclusion

Strategic restructuring is a critical process that empowers organizations to adapt to shifting market conditions and operational challenges. It necessitates a comprehensive approach, encompassing thorough financial assessments, effective planning, and robust communication strategies. CFOs play an essential role in this transformation, expertly guiding their organizations through the complexities of restructuring to achieve sustainable growth and enhanced financial performance.

Key steps in the restructuring process include:

- Conducting detailed assessments to identify areas needing change.

- Developing a well-defined restructuring plan.

- Forming a cross-functional team to foster collaboration.

- Executing the plan with agility.

- Evaluating outcomes to ensure alignment with initial objectives.

By adhering to these structured steps, organizations can minimize disruption and significantly enhance their likelihood of success.

Moreover, conducting thorough financial assessments is paramount. By analyzing cash flow, debt structures, cost management, and performance metrics, CFOs can make informed decisions that drive effective restructuring. This analytical approach not only facilitates immediate financial relief but also lays the groundwork for long-term organizational viability.

Effective communication is equally vital in managing change. Transparent and consistent communication fosters trust, mitigates uncertainty, and empowers employees during transitions. By integrating real-time analytics into communication strategies, CFOs can keep stakeholders informed and engaged, ultimately enhancing the overall success of restructuring initiatives.

In conclusion, strategic restructuring is not merely a reactive measure; it is a proactive strategy that positions organizations for future growth and resilience. By embracing these practices, CFOs can navigate the complexities of the business landscape, ensuring their organizations not only survive but thrive in an ever-evolving environment.

Frequently Asked Questions

What is strategic reorganization?

Strategic reorganization reshapes a company's operations, structure, and resources to enhance financial performance and competitiveness.

Why is strategic reorganization important for CFOs?

It equips CFOs to recognize when reorganization is necessary and to implement impactful modifications that foster sustainable growth.

How does strategic reorganization enhance organizational agility?

It aligns resources with long-term goals, reduces expenses, and helps businesses proactively identify underlying issues and collaboratively plan solutions.

What are the benefits of strategic restructuring solutions?

They optimize operations, position companies for future expansion, and lay the groundwork for long-term success, leading to improved economic outcomes.

What trends are observed in strategic restructuring among companies?

Companies are increasingly adopting strategic restructuring solutions to adapt to market changes and operational challenges, with many reporting improved economic outcomes.

What services should CFOs consider during the reorganization process?

CFOs should consider leveraging turnaround consulting, financial assessment, and interim management services to facilitate the strategic reorganization process.

How can measuring investment returns contribute to strategic reorganization?

Testing hypotheses and measuring investment returns ensures maximum effectiveness in both the short and long term during the reorganization process.

What is the overall goal of strategic reorganization?

The overall goal is to manage the complexities of reorganization effectively and utilize it for sustainable growth, especially during challenging times.