Overview

The article presents four pivotal strategies for business performance recovery in 2025:

- Conducting a comprehensive financial health check

- Utilizing SWOT analysis for strategic planning

- Revising business plans to reflect current realities

- Embracing innovation and efficiency

Each strategy underscores the critical need for thorough assessment and adaptability in response to market fluctuations, bolstered by real-time analytics and decision-making processes that enhance organizational resilience and performance.

Moreover, these strategies are not merely theoretical; they are grounded in data-driven insights and expert opinions that highlight their effectiveness. By adopting these approaches, businesses can navigate the complexities of the market landscape and position themselves for sustained success.

In conclusion, organizations must take decisive action to implement these strategies, ensuring they are well-prepared to meet the challenges of 2025 and beyond. The time to act is now—embrace these strategies to secure a robust future.

Introduction

In the wake of unprecedented challenges, businesses must adopt a proactive approach to ensure their survival and growth. A comprehensive financial health check serves as the foundation for navigating crises, enabling organizations to assess their liquidity, profitability, debt levels, and cash flow management.

However, financial scrutiny is just one piece of the puzzle; integrating strategic recovery planning through SWOT analysis can uncover strengths, weaknesses, opportunities, and threats that inform robust decision-making.

Moreover, as market dynamics shift, revising and updating business plans becomes essential, allowing companies to adapt to current realities and set clear objectives. Embracing innovation and efficiency further empowers businesses to streamline operations and enhance customer engagement.

This article explores these critical strategies, offering insights into how organizations can thrive amidst uncertainty and position themselves for sustainable success in 2025.

Conduct a Comprehensive Financial Health Check

Conduct a Comprehensive Financial Health Check

A thorough financial health check is essential for businesses aiming to navigate crises effectively. This process begins with an in-depth examination of key monetary statements, including the balance sheet, income statement, and cash flow statement. Focus on the following critical areas:

- Liquidity: Assess current assets in relation to current liabilities to measure short-term economic stability. In 2025, maintaining a robust liquidity ratio is crucial, as it directly impacts a company's ability to meet immediate obligations.

- Profitability: Scrutinize profit margins and revenue streams to pinpoint opportunities for enhancement. Understanding average profit margins for small to medium enterprises in 2025 can provide valuable benchmarks for performance improvement.

- Debt Levels: Evaluate the debt-to-equity ratio to understand monetary leverage and associated risks. High levels of debt can strain resources, particularly during downturns.

- Cash Flow Management: Regularly monitor cash inflows and outflows to ensure adequate liquidity for ongoing operations. Effective cash flow management is vital for sustaining operations and supporting growth initiatives.

By concentrating on these areas, organizations can formulate strategies aimed at business performance recovery by preserving cash, minimizing liabilities, and bolstering overall financial stability. Our group advocates for a condensed decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard your organization. Furthermore, we continually monitor the success of our plans through our client dashboard, which provides real-time business analytics to diagnose your business health continuously. This ongoing monitoring allows for prompt updates and modifications based on effectiveness metrics.

For instance, the Metro Supply Chain Group successfully integrated operational metrics with monetary results, enhancing customer insights into cost impacts related to liquidity and profitability, ultimately improving their economic performance. Such examples underscore the significance of a thorough economic health evaluation in crisis management, which facilitates business performance recovery and enables enterprises to adapt and thrive in challenging conditions.

As noted, "A profound comprehension of monetary ratios ultimately enables decision-makers to navigate complexities, seize opportunities, and guide their companies toward sustainable growth and long-term success in an ever-evolving corporate landscape." It is also crucial to recognize common pitfalls in conducting financial health checks, such as overlooking key metrics or failing to adapt assessments to current market conditions, which can lead to misapplication of the practice.

Utilize SWOT Analysis for Strategic Recovery Planning

To effectively utilize SWOT analysis for strategic restoration planning, businesses should follow these key steps:

- Identify Strengths: Catalog internal capabilities that confer a competitive edge, such as a skilled workforce, innovative products, or strong brand recognition. As Salesforce demonstrates with its strong focus on continuous product development, adapting and evolving internal strengths is crucial for recovery. Additionally, testing hypotheses about these strengths can help ensure they are effectively utilized in the turnaround process.

- Recognize Weaknesses: Pinpoint areas needing improvement, including outdated technology, inefficient processes, or high operational costs that may hinder performance. This self-assessment is akin to the personal development approach highlighted in case studies, where individuals identify their weaknesses to guide growth. By operationalizing lessons learned from past experiences, organizations can address these weaknesses more effectively.

- Explore Opportunities: Analyze external factors that can be harnessed for growth, such as emerging market trends, shifts in consumer behavior, or potential partnerships that align with organizational goals. For example, environmental non-profits are increasingly discovering opportunities through corporate collaborations, a strategy that can be tailored by organizations in various sectors. Utilizing real-time analytics can help identify these opportunities swiftly and accurately.

- Assess Threats: Identify potential challenges that could affect the enterprise, including economic fluctuations, regulatory changes, or intensified competition. Comprehending these threats is crucial for developing a robust restoration strategy. Ongoing observation through analytics enables companies to stay ahead of these threats and modify their strategies accordingly.

By systematically assessing these factors, organizations can develop a strong strategic plan that not only leverages their strengths and opportunities but also proactively tackles weaknesses and threats. As Emet GÜREL notes, the classification of a variable depends on the purpose of the practice, underscoring the importance of context in strategic planning. Moreover, although SWOT analysis is a valuable tool, it should be complemented with methodologies that emphasize quick decision-making and real-time performance monitoring, ensuring a comprehensive approach to navigating the complexities of business performance recovery in 2025 and achieving sustainable growth.

Revise and Update Your Business Plan for Current Realities

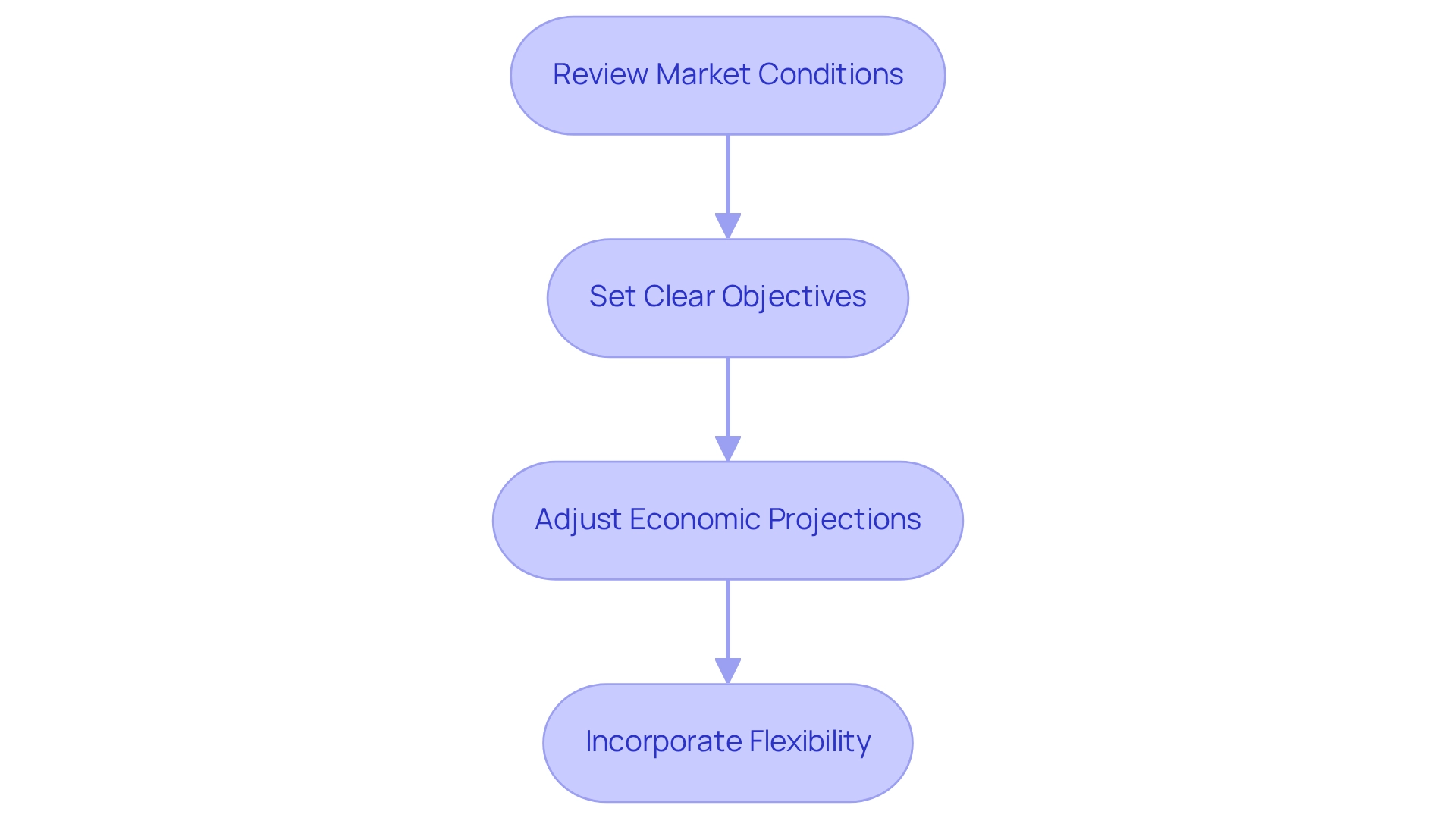

To effectively revise and update a plan for the enterprise, follow these essential steps:

- Review Market Conditions: Conduct a thorough analysis of current market trends, customer behaviors, and the competitive landscape. This insight will guide essential strategic modifications, especially considering the rising utilization of automation and AI technologies among small enterprises. For instance, family-owned enterprises, which account for around 27.3% of companies in the U.S., are increasingly utilizing these technologies to optimize operations and improve customer engagement.

- Set Clear Objectives: Establish specific, measurable goals that align with the revised market realities and the organization’s capabilities. With 65.3% of small enterprises currently profitable and 80% of owners expressing optimism about their future, establishing clear objectives is essential for sustained growth. Furthermore, it’s essential to acknowledge that 91% of shoppers favor purchasing from small enterprises when convenient, emphasizing the necessity to align organizational goals with consumer preferences.

- Adjust Economic Projections: Revise revenue forecasts and expense estimates based on the latest monetary assessments and market analyses. This step is crucial, particularly given that companies must adjust to economic transitions and evolving consumer preferences. Thorough evaluations concentrating on cash conservation and efficiency can reveal value and lower expenses, ensuring that organizations are well-prepared for upcoming challenges. Incorporating interim management and bankruptcy case management services can further enhance financial stability during this process.

- Incorporate Flexibility: Design the plan to permit modifications as circumstances change, enabling the organization to pivot swiftly when needed. Flexibility is essential in today’s dynamic environment, where 60% of enterprises impacted by cyberattacks shut down within six months, highlighting the importance of resilience in strategic planning. Streamlined decision-making processes and real-time analytics can support this adaptability, allowing organizations to monitor business performance recovery continuously and make informed choices. This proactive approach ensures that the plan remains a living document, effectively guiding business performance recovery efforts and positioning the organization for enhanced performance in 2025. By utilizing our customized method, small to medium enterprises can gain from our knowledge in turnaround and restructuring consulting, guaranteeing a thorough strategy for success.

Embrace Innovation and Efficiency to Drive Recovery

To effectively embrace innovation and efficiency, organizations should consider the following strategies:

- Invest in Technology: Adopting digital tools and platforms, such as automation software and customer relationship management (CRM) systems, can significantly enhance productivity and streamline operations. Companies that prioritize technology investments often see a 20-50% increase in economic gains, particularly when focusing on customer experience. As noted by IBM, a survey found that over half of consumers (55%) prefer using chatbots or virtual assistants while shopping, highlighting the importance of integrating technology to meet customer expectations. Moreover, utilizing real-time analytics can offer insights into the cash conversion cycle, allowing companies to enhance their financial performance.

- Foster a Culture of Innovation: Creating an environment where employees feel empowered to share ideas for process improvements and new product development is crucial. This culture not only fosters innovation but also assists enterprises in adjusting to evolving market needs, which is essential for business performance recovery during revitalization periods.

- Optimize Processes: A comprehensive review of existing workflows can reveal bottlenecks and inefficiencies. By making specific adjustments, companies can improve operational efficiency and lower overhead expenses, which is crucial for business performance recovery. However, organizations must navigate significant challenges, such as high implementation costs and economic uncertainty, as highlighted in the case study on economic challenges in digital transformation. Streamlined decision-making processes supported by real-time analytics, including insights from the client dashboard, can facilitate quicker adaptations to these challenges.

- Monitor Effectiveness Metrics: Establishing key indicators (KPIs) enables organizations to assess the success of new initiatives. Data-driven decision-making is vital for assessing progress and ensuring that strategies align with the overall business performance recovery goals. Ongoing performance monitoring through real-time analytics not only assists in operational adjustments but also promotes relationship-building with stakeholders. Additionally, small businesses can explore grants and financing options available to help cover the costs of technology adoption, making it easier to implement necessary changes.

By prioritizing innovation and efficiency, businesses can navigate challenges more effectively and position themselves for sustainable growth in the evolving landscape of 2025.

Conclusion

Navigating the complexities of today's business environment necessitates a multifaceted approach that prioritizes financial health, strategic planning, and innovation. Conducting a comprehensive financial health check serves as the foundation of this strategy, enabling organizations to evaluate their liquidity, profitability, debt levels, and cash flow management. By gaining insight into these critical areas, businesses can make informed decisions that preserve cash and enhance stability during turbulent times.

Incorporating SWOT analysis into recovery planning further empowers organizations to identify their strengths, weaknesses, opportunities, and threats. This systematic evaluation equips businesses to develop robust strategies that leverage internal capabilities while addressing external challenges. By acknowledging the importance of context and adaptability, companies can ensure their plans remain relevant and effective in a rapidly changing market.

Revising and updating business plans is essential for alignment with current realities. By establishing clear objectives, adjusting financial projections, and incorporating flexibility, businesses can adeptly navigate economic shifts and changing consumer preferences. This proactive approach transforms business plans into living documents that guide recovery efforts and foster sustained growth.

Finally, embracing innovation and efficiency through technology investments and a culture of innovation is vital for driving recovery. By optimizing processes and monitoring performance metrics, organizations can enhance productivity and adaptability, positioning themselves for long-term success in 2025 and beyond.

In conclusion, the combination of financial scrutiny, strategic planning, and a commitment to innovation creates a resilient framework for businesses to thrive amid uncertainty. By implementing these strategies, organizations can not only survive but emerge stronger, ready to capitalize on future opportunities.

Frequently Asked Questions

Why is a comprehensive financial health check important for businesses?

A comprehensive financial health check is essential for businesses to navigate crises effectively by examining key monetary statements and ensuring economic stability.

What key monetary statements should be examined during a financial health check?

The key monetary statements to examine include the balance sheet, income statement, and cash flow statement.

What areas should businesses focus on during a financial health check?

Businesses should focus on liquidity, profitability, debt levels, and cash flow management during a financial health check.

How is liquidity assessed in a financial health check?

Liquidity is assessed by measuring current assets in relation to current liabilities to evaluate short-term economic stability.

Why is profitability important in a financial health check?

Profitability is important as it helps scrutinize profit margins and revenue streams to identify opportunities for enhancement and performance improvement.

What does evaluating debt levels involve?

Evaluating debt levels involves assessing the debt-to-equity ratio to understand monetary leverage and associated risks, particularly during downturns.

How can businesses effectively manage cash flow?

Businesses can effectively manage cash flow by regularly monitoring cash inflows and outflows to ensure adequate liquidity for ongoing operations.

What benefits can arise from focusing on these financial areas?

Focusing on these financial areas can help organizations preserve cash, minimize liabilities, and bolster overall financial stability, facilitating business performance recovery.

How does ongoing monitoring contribute to financial health?

Ongoing monitoring through tools like client dashboards provides real-time business analytics to continuously diagnose business health, allowing for prompt updates and modifications based on effectiveness metrics.

What common pitfalls should be avoided during a financial health check?

Common pitfalls include overlooking key metrics and failing to adapt assessments to current market conditions, which can lead to misapplication of the financial health check practice.