Overview

The article delineates four pivotal strategies for achieving success in the recovery of distressed businesses:

- Conducting thorough financial assessments

- Developing customized turnaround strategies

- Implementing interim management

- Enhancing operational efficiency

Each strategy is underpinned by actionable steps and recommendations, underscoring the significance of comprehensive analysis, stakeholder engagement, and continuous improvement. These elements are essential for navigating challenges and fostering sustainable growth. By embracing these strategies, businesses can position themselves effectively for recovery and long-term success.

Introduction

In the tumultuous landscape of modern business, organizations frequently grapple with financial distress and operational inefficiencies. Navigating these challenges necessitates a strategic approach that includes:

- Thorough financial assessments

- Tailored turnaround strategies

- Implementation of interim management

Moreover, by leveraging advanced technologies and real-time data analytics, businesses can not only stabilize their operations but also enhance overall efficiency. This article explores the essential steps and strategies that empower distressed businesses to recover and thrive, providing a roadmap to sustainable growth and resilience in the face of adversity.

Conduct Thorough Financial Assessments for Effective Recovery

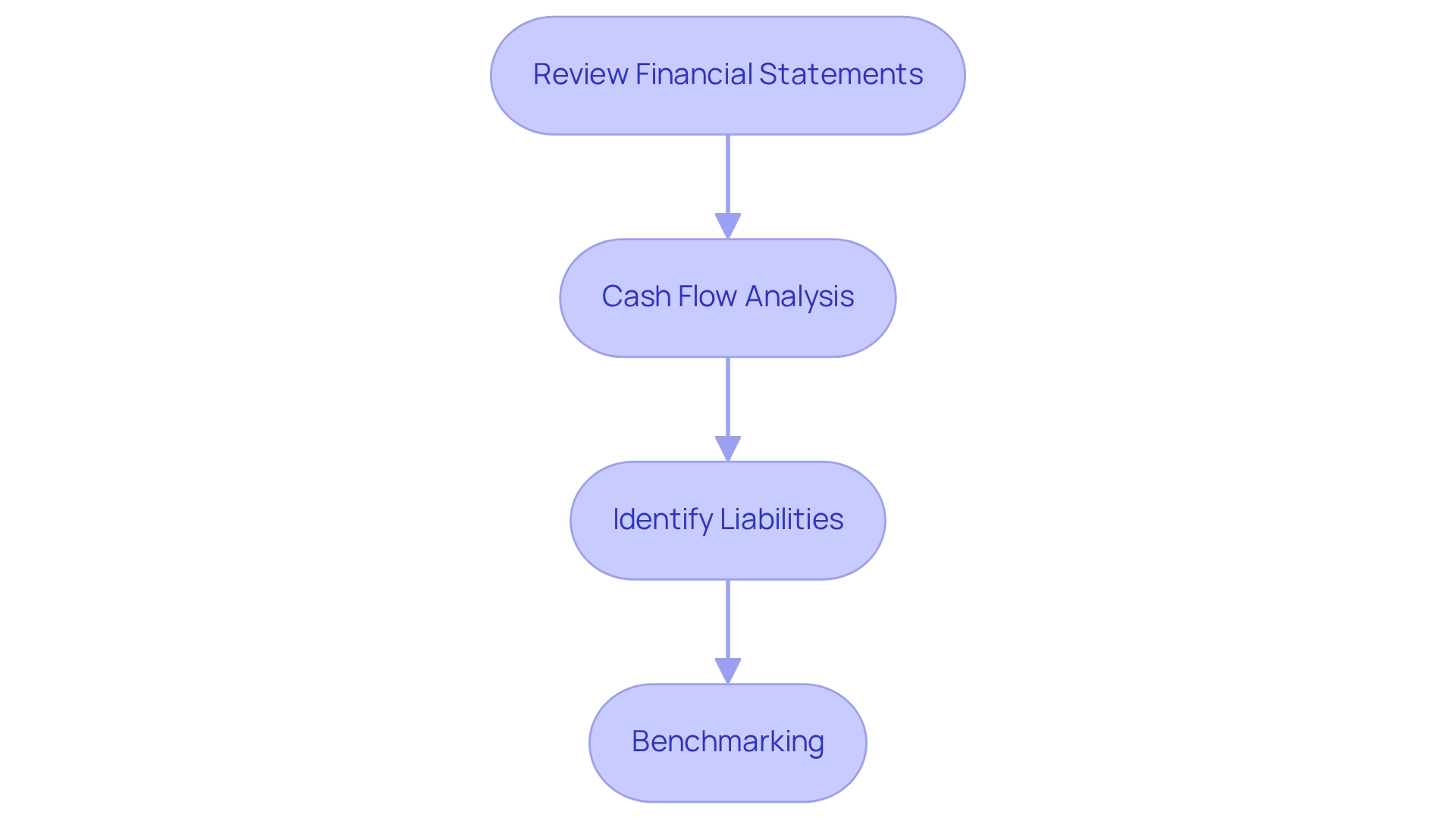

To initiate a successful distressed business recovery, businesses must conduct a comprehensive financial assessment. This entails examining financial statements, cash flow forecasts, and business expenses while utilizing expert advice and advanced technologies. Key steps include:

- Review Financial Statements: Examine balance sheets, income statements, and cash flow statements to identify trends and anomalies, utilizing insights from a Business Valuation Report to inform your analysis.

- Cash Flow Analysis: Assess cash inflows and outflows to determine liquidity and operational sustainability. Tools like cash flow forecasting can help predict future cash needs, supported by real-time analytics for more accurate projections.

- Identify Liabilities: Catalog all debts and obligations to understand the total financial burden. This includes loans, unpaid invoices, and other liabilities, which can be prioritized based on their impact on recovery.

- Benchmarking: Compare financial metrics against industry standards to gauge performance and identify areas for improvement. This benchmarking process should be paired with ongoing performance monitoring to guarantee that plans for distressed business recovery are efficient and flexible.

By adhering to these steps and integrating strategic insights, organizations can obtain a clear understanding of their financial condition, which is crucial for formulating effective recovery plans.

Develop Customized Turnaround Strategies for Distressed Businesses

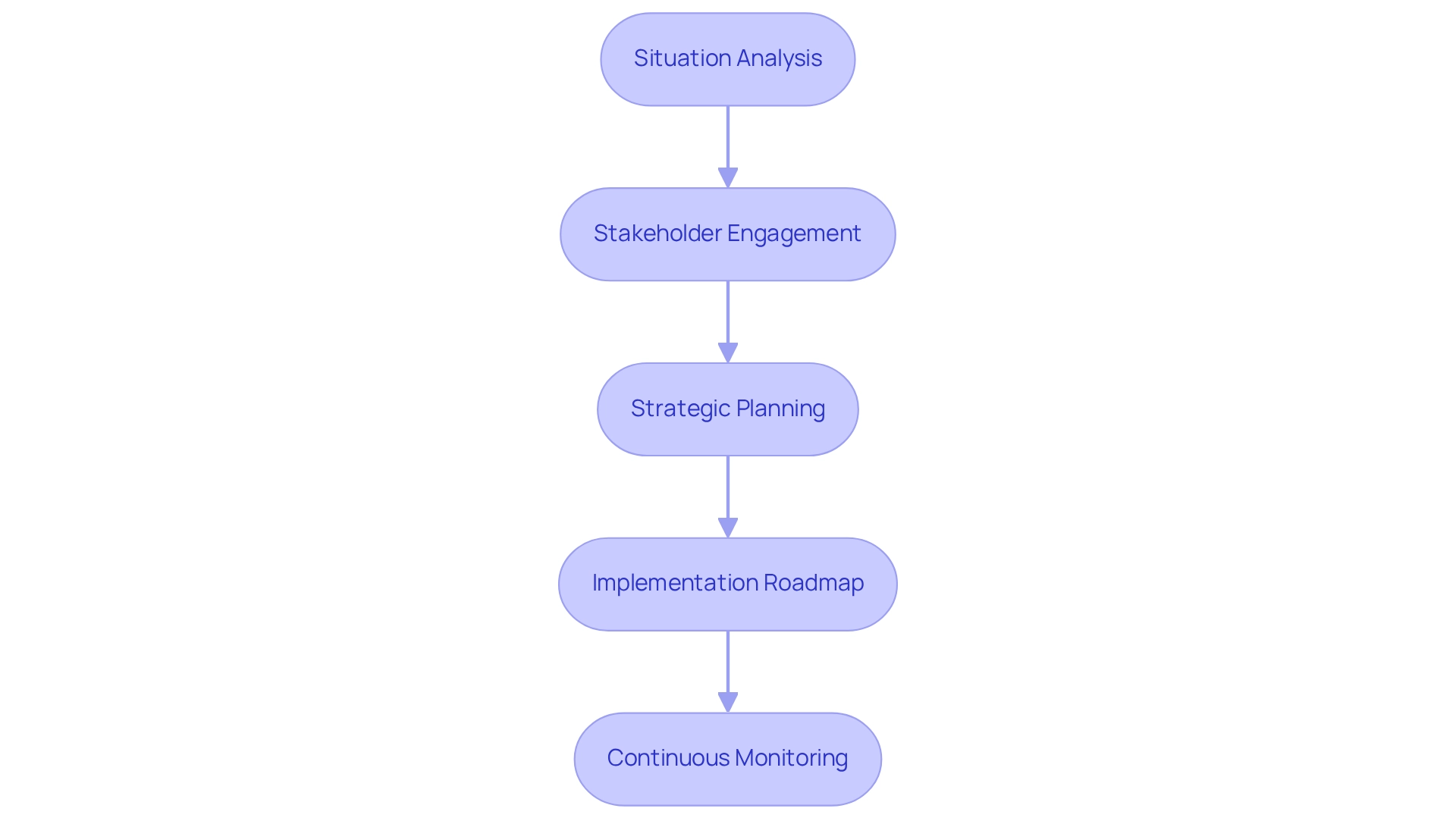

Creating customized turnaround strategies involves several key components:

-

Situation Analysis: Conduct a detailed examination of the current operational and financial condition of the organization to identify critical issues. This step is essential for testing hypotheses regarding the organization's challenges and opportunities.

-

Stakeholder Engagement: Involve key stakeholders, including employees, creditors, and suppliers, to gather insights and foster collaboration. Engaging stakeholders ensures that diverse perspectives are considered, which can lead to more effective decision-making.

-

Strategic Planning: Develop a strategic plan that outlines specific goals, timelines, and actions required to stabilize the business. This may involve cost-reduction measures, revenue improvement approaches, or restructuring plans. The SMB team's 'Rapid30' plan exemplifies a structured approach that can lead to significant improvements in a short timeframe.

-

Implementation Roadmap: Create a clear plan for executing the turnaround approach, including assigning responsibilities and setting milestones to track progress. Employing real-time analytics via client dashboards can assist in tracking the success of the implemented strategies, enabling prompt updates and modifications that are crucial for distressed business recovery.

By concentrating on these aspects, companies can create effective, customized strategies that tackle their distinct challenges and establish the foundation for recovery. Our commitment to operationalizing lessons learned throughout the turnaround process fosters strong relationships and ensures continuous performance monitoring. As one pleased client remarked, 'Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years.

Implement Interim Management to Navigate Crisis Situations

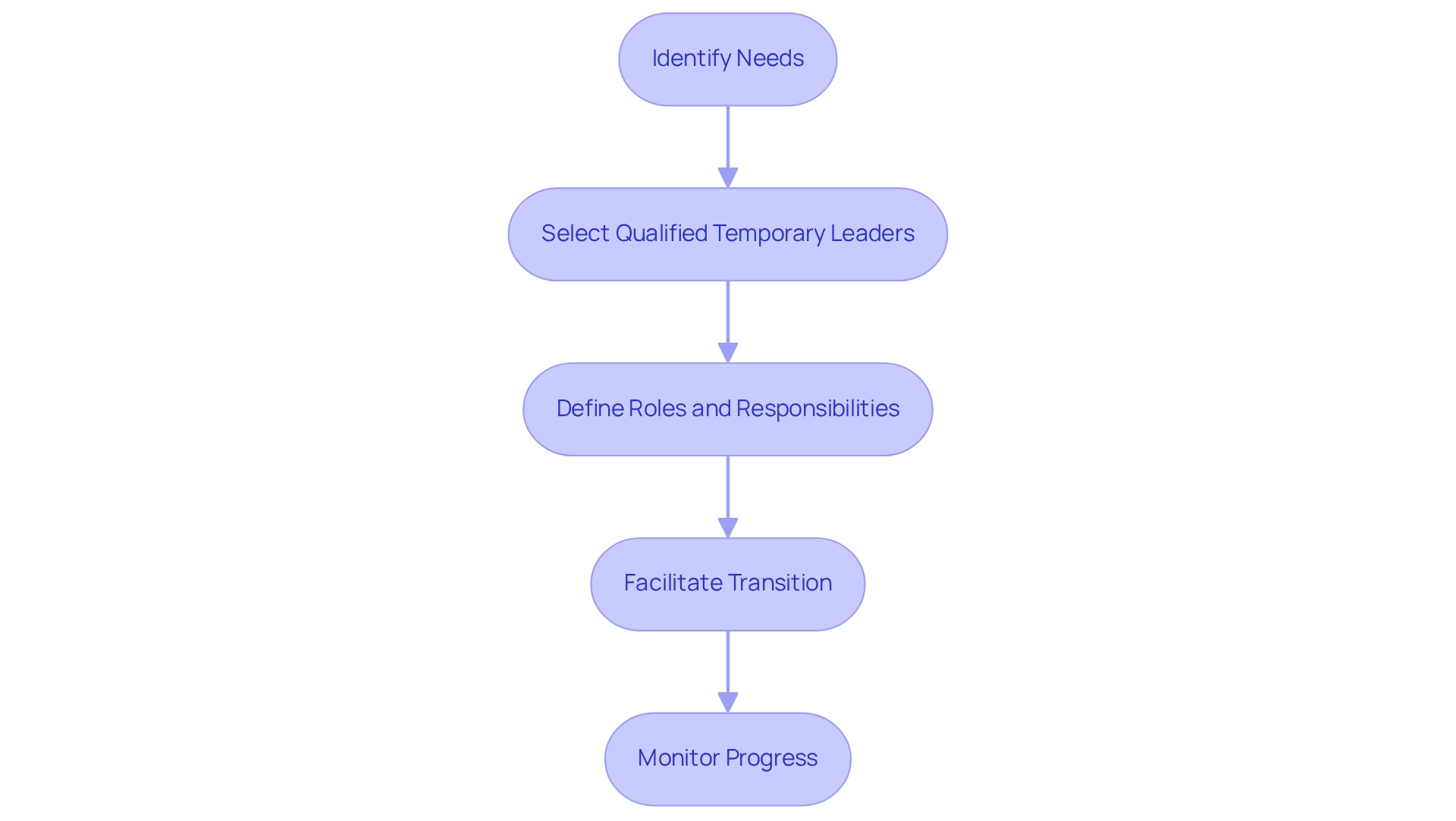

Implementing temporary management can be a game-changer for distressed businesses. To effectively utilize temporary managers, follow these steps:

- Identify Needs: Assess the specific leadership gaps and operational challenges that require immediate attention, ensuring that the temporary manager can address critical areas swiftly.

- Select Qualified Temporary Leaders: Choose temporary managers with relevant experience and a proven track record in crisis management and turnaround situations, focusing on those who can leverage real-time analytics to inform their decisions.

- Define Roles and Responsibilities: Clearly outline the temporary manager's scope of work, including decision-making authority and reporting structures, to facilitate a streamlined decision-making process.

- Facilitate Transition: Ensure a smooth change by providing the temporary manager with access to essential resources and information regarding the organization, enabling them to quickly implement plans based on real-time data.

- Monitor Progress: Regularly assess the interim manager's performance and the effectiveness of executed plans through ongoing organizational performance tracking, ensuring alignment with recovery objectives and nurturing strong relationships founded on transparency and accountability.

By utilizing interim management, organizations can achieve distressed business recovery by stabilizing operations and implementing essential changes needed for recovery, supported by a framework of testing hypotheses and modifying approaches based on real-time insights.

Enhance Operational Efficiency to Support Sustainable Growth

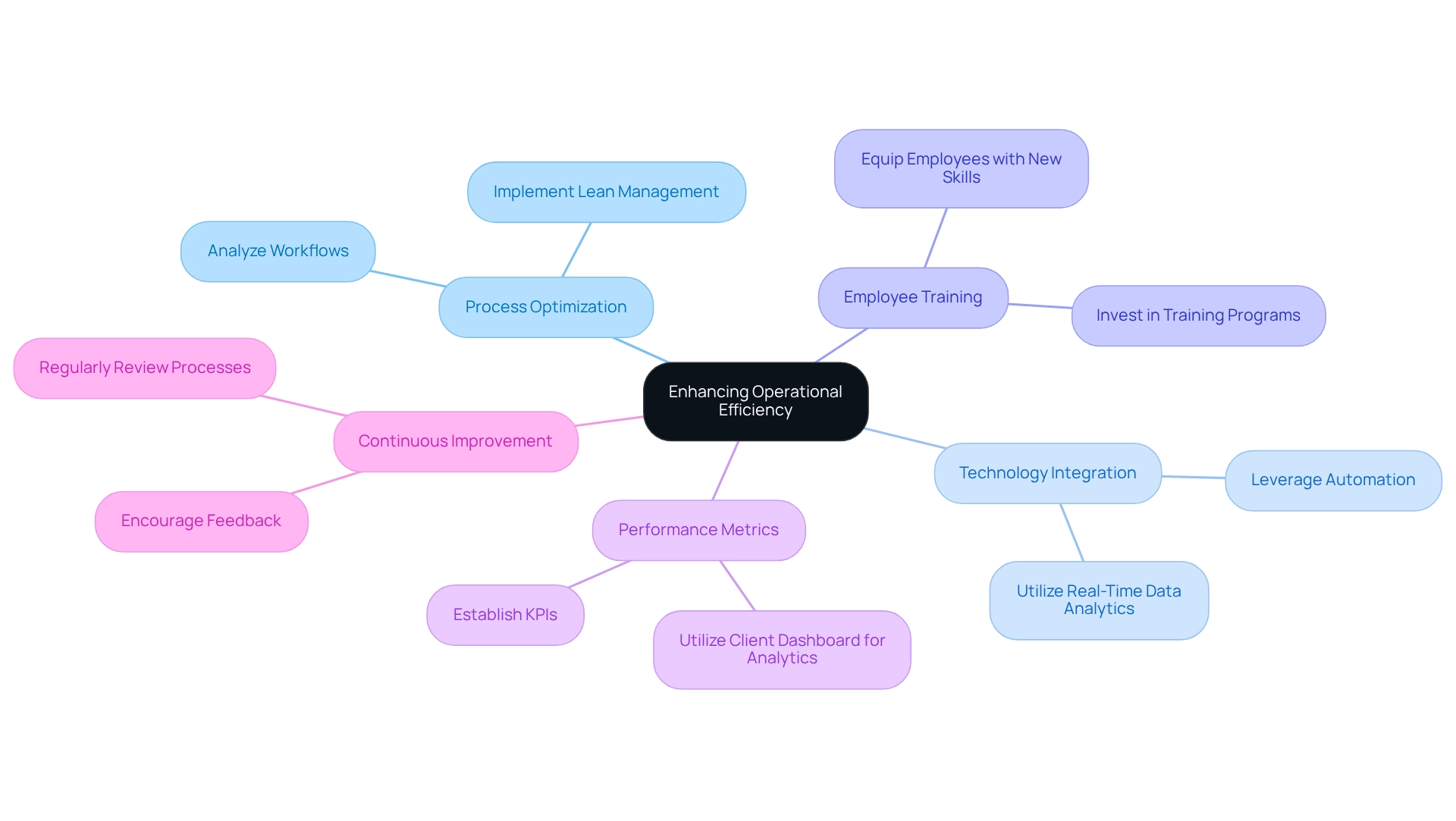

To enhance operational efficiency, companies should consider the following strategies:

- Process Optimization: Analyze existing workflows to identify bottlenecks and inefficiencies. Implement lean management techniques to streamline processes.

- Technology Integration: Leverage technology solutions, such as automation and real-time data analytics, to improve productivity and decision-making. This approach enables a more nimble reaction to challenges and facilitates a reduced decision-making cycle.

- Employee Training: Invest in training programs to equip employees with the skills needed to adapt to new processes and technologies.

- Performance Metrics: Establish key performance indicators (KPIs) to measure efficiency and track enhancements over time. Utilizing a client dashboard can offer real-time analytics, enabling continuous monitoring of organizational health and facilitating informed decision-making.

- Continuous Improvement: Foster a culture of continuous improvement by encouraging feedback and regularly reviewing processes to identify further optimization opportunities. This includes operationalizing lessons learned from turnaround strategies to build stronger relationships and enhance overall performance, all vital for distressed business recovery. By focusing on these strategies, businesses can significantly enhance their operational efficiency, thereby supporting sustainable growth and resilience in the face of future challenges.

Conclusion

In the journey towards recovery, businesses must prioritize thorough financial assessments, tailored turnaround strategies, and effective interim management. By conducting comprehensive financial evaluations, organizations gain invaluable insights into their operations, allowing them to pinpoint inefficiencies and identify critical areas for improvement. This foundational step sets the stage for developing customized strategies that address unique challenges, ensuring that recovery efforts are both targeted and effective.

The implementation of interim management plays a crucial role in navigating crisis situations. Qualified interim leaders provide the necessary expertise and guidance to stabilize operations and guide organizations through turbulent times. By defining clear roles and responsibilities, businesses can streamline decision-making processes and enhance accountability, ultimately leading to a more effective recovery.

Moreover, enhancing operational efficiency through process optimization, technology integration, and continuous improvement fosters sustainable growth. By investing in employee training and establishing performance metrics, organizations create a resilient framework that not only supports recovery but also positions them for long-term success.

In conclusion, the path to recovery is multifaceted, requiring a strategic approach that combines financial insight, tailored strategies, and effective management. By embracing these principles, businesses can recover from distress and thrive in an increasingly competitive landscape, ensuring resilience and sustainable growth for the future.

Frequently Asked Questions

What is the first step in initiating a successful distressed business recovery?

The first step is to conduct a comprehensive financial assessment, which includes reviewing financial statements, cash flow forecasts, and business expenses while utilizing expert advice and advanced technologies.

How should financial statements be reviewed during the recovery process?

Financial statements such as balance sheets, income statements, and cash flow statements should be examined to identify trends and anomalies, using insights from a Business Valuation Report to inform the analysis.

What is the purpose of cash flow analysis in distressed business recovery?

Cash flow analysis is used to assess cash inflows and outflows to determine liquidity and operational sustainability, with tools like cash flow forecasting helping to predict future cash needs.

Why is it important to identify liabilities during the recovery process?

Identifying liabilities is crucial to catalog all debts and obligations, allowing businesses to understand their total financial burden and prioritize these based on their impact on recovery.

How does benchmarking contribute to the recovery process?

Benchmarking involves comparing financial metrics against industry standards to gauge performance and identify areas for improvement, which should be paired with ongoing performance monitoring for effective recovery planning.

What is the overall goal of following these key steps in distressed business recovery?

By following these steps and integrating strategic insights, organizations can gain a clear understanding of their financial condition, which is essential for formulating effective recovery plans.