Overview

The article delineates four pivotal strategies for preserving the value of distressed businesses:

- Focusing on core asset protection

- Optimizing cash flow

- Conducting comprehensive financial assessments

- Leveraging technology for operational efficiency

These strategies are bolstered by practical examples and techniques that underscore the significance of:

- Maintaining customer relationships

- Enhancing liquidity

- Utilizing real-time data to facilitate informed decisions

Ultimately, these measures are crucial for ensuring the sustainability and recovery of the organization.

Introduction

In the ever-evolving landscape of business, particularly during challenging times, the ability to preserve value and optimize cash flow is paramount. Distressed businesses encounter unique hurdles; however, with the right strategies, they can not only survive but thrive. This article explores essential tactics for safeguarding core assets, enhancing liquidity, and leveraging technology to drive operational efficiency.

By conducting comprehensive financial assessments and implementing innovative cash flow optimization techniques, organizations can navigate financial distress and emerge stronger on the other side.

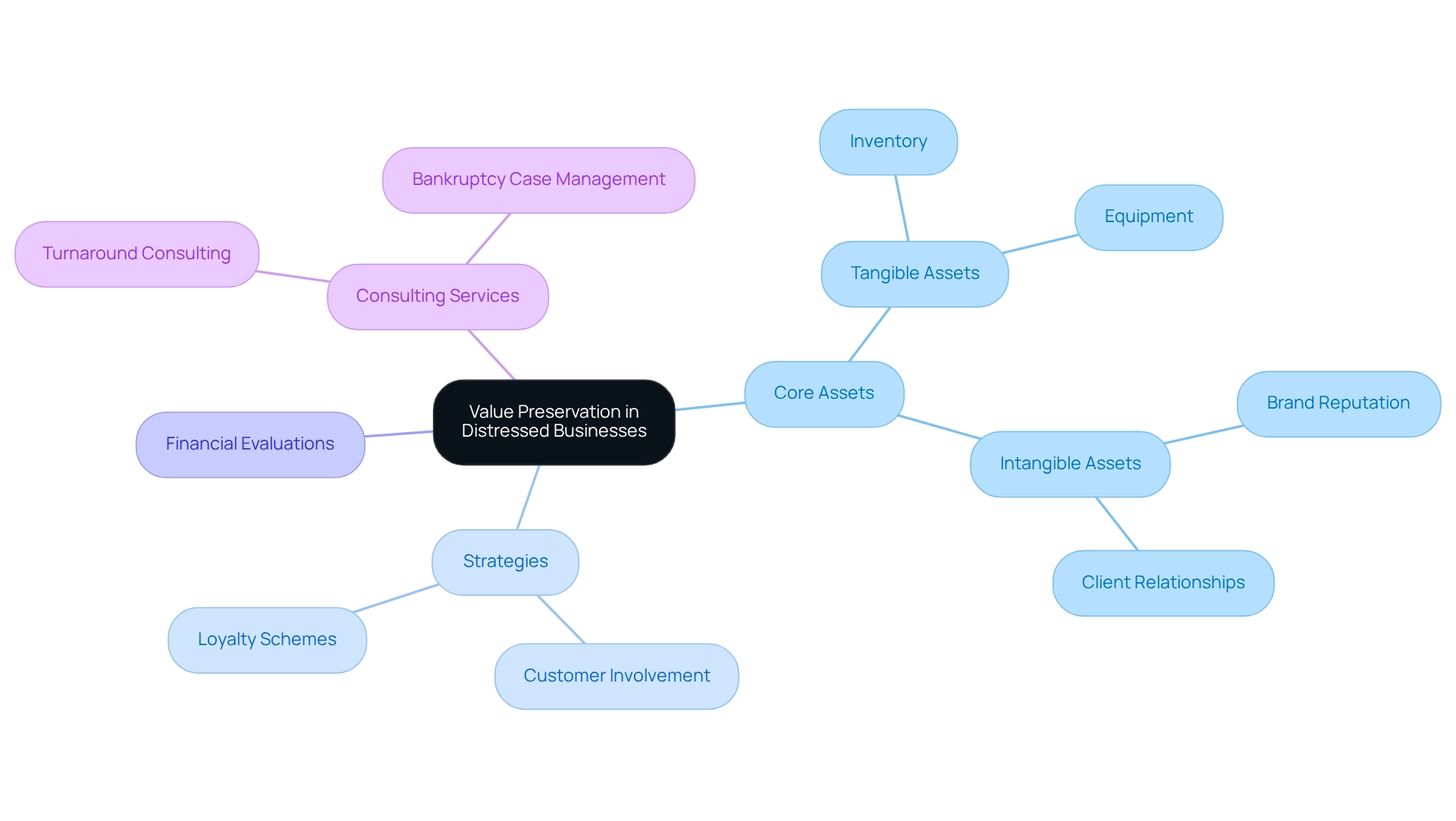

Understand Value Preservation in Distressed Businesses

Understanding is critical for maintaining the company's overall worth. This process involves identifying and protecting core assets, which include not only tangible assets like inventory and equipment but also intangible assets such as brand reputation and client relationships. A clear understanding of what defines value for the organization enables leaders to prioritize their efforts effectively.

For instance, consider a retail company facing financial difficulties. It might focus on preserving its clientele and brand loyalty, essential components for future recovery. Strategies may include:

- Boosting customer involvement through targeted marketing initiatives.

- Establishing loyalty schemes designed to strengthen brand value during challenging periods, which focuses on distressed business value preservation.

Moreover, conducting comprehensive financial evaluations aids in recognizing opportunities to conserve funds and reduce obligations, ensuring the enterprise remains sustainable over time. By leveraging thorough turnaround and restructuring consulting services, including bankruptcy case management, organizations can streamline operations and enhance decision-making processes. This approach is bolstered by real-time analytics, which monitor performance and operationalize lessons learned throughout the turnaround process.

Implement Cash Flow Optimization Techniques

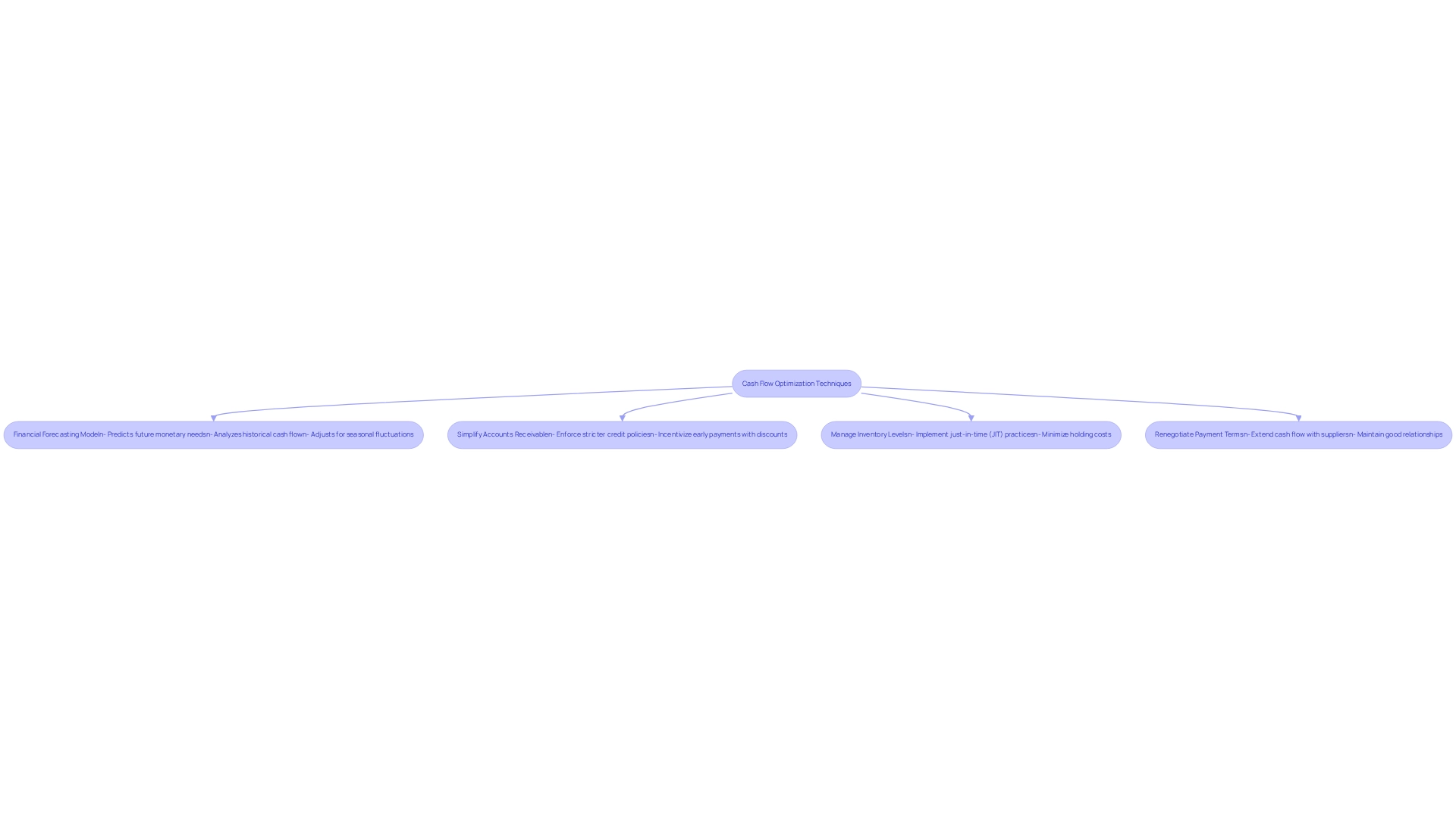

To enhance liquidity, companies must implement essential techniques, particularly those outlined in the whitepaper ',' available at no cost for a limited time.

First and foremost, establishing a robust financial forecasting model is crucial. This model assists in predicting future monetary requirements and identifying potential deficits before they arise, involving a thorough analysis of historical cash flow patterns and adjustments for seasonal fluctuations.

Moreover, companies should simplify their accounts receivable processes by enforcing stricter credit policies and incentivizing early payments through discounts. For instance, a restaurant might offer a 5% discount to customers who settle their bills immediately rather than on credit.

In addition, effectively managing inventory levels can free up funds; organizations should consider just-in-time (JIT) inventory practices to minimize holding costs, as highlighted in the whitepaper.

Lastly, renegotiating payment terms with suppliers can extend cash flow without jeopardizing relationships. By concentrating on these areas and leveraging insights from the CCC strategies, businesses can significantly enhance their liquidity and support distressed business value preservation against unforeseen expenses.

As one satisfied customer remarked, 'The strategies outlined are practical and easy to implement. We’ve observed a notable enhancement in our liquidity.

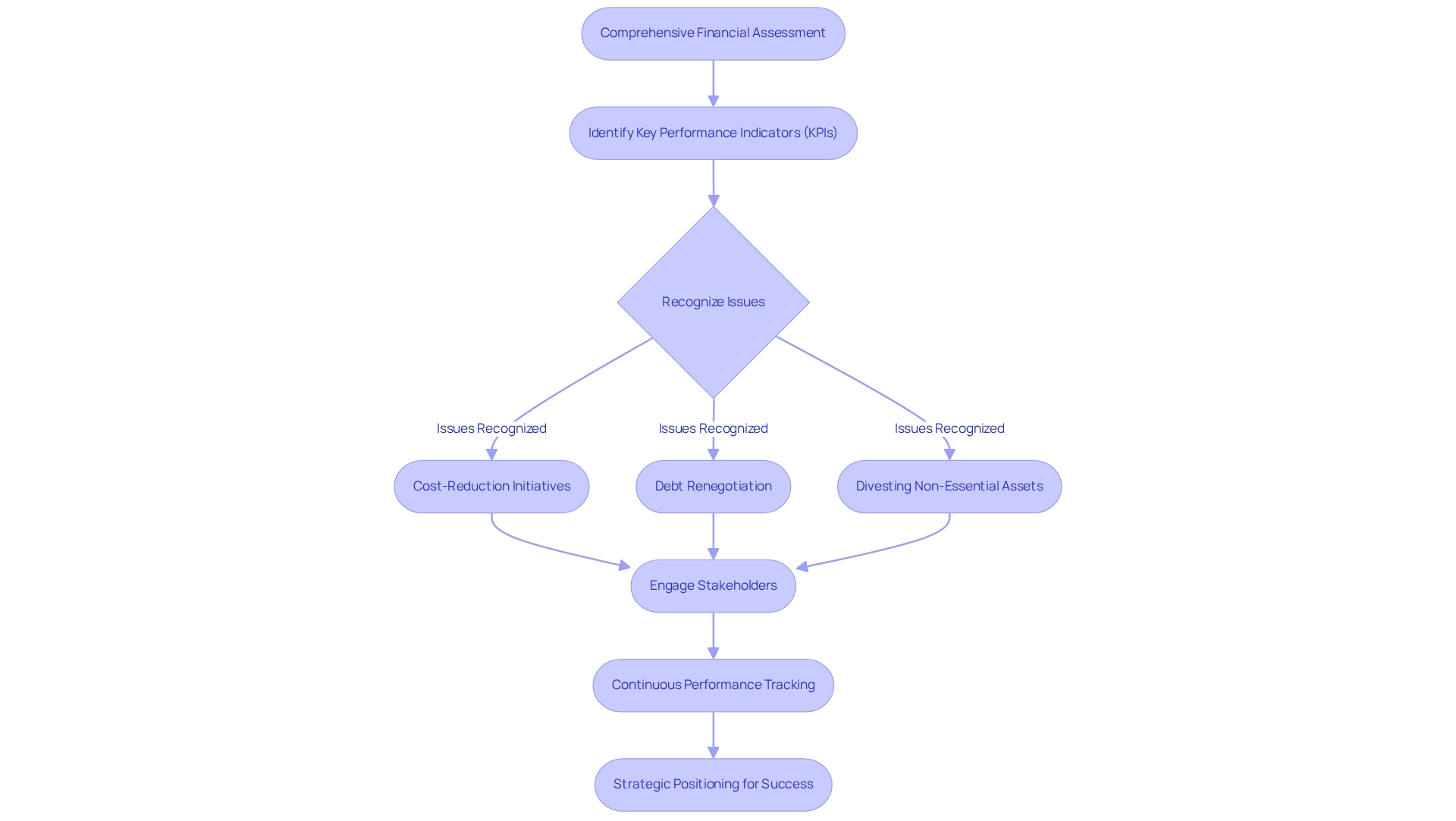

Conduct Comprehensive Financial Assessments and Restructuring

Conducting a comprehensive financial evaluation requires a meticulous examination of all aspects of an organization's financial health, including income statements, balance sheets, and cash flow statements. This analysis should pinpoint key performance indicators (KPIs) that reveal areas of concern, such as declining sales or rising liabilities.

By leveraging real-time analytics, organizations can enhance their decision-making processes and promptly address emerging challenges. Once these issues are recognized, companies can devise a restructuring strategy focused on distressed business value preservation that may encompass:

- Cost-reduction initiatives

- Debt renegotiation

- Divesting non-essential assets

For example, a hospitality business experiencing dwindling occupancy rates might restructure by concentrating on its most profitable services or seeking partnerships with local attractions to increase visitor traffic.

Furthermore, engaging stakeholders, including creditors and employees, during the restructuring process can promote transparency and collaboration, essential elements for successful implementation. This and relationship development through real-time analytics can facilitate the integration of lessons learned, ensuring that organizations are strategically positioned for sustained success.

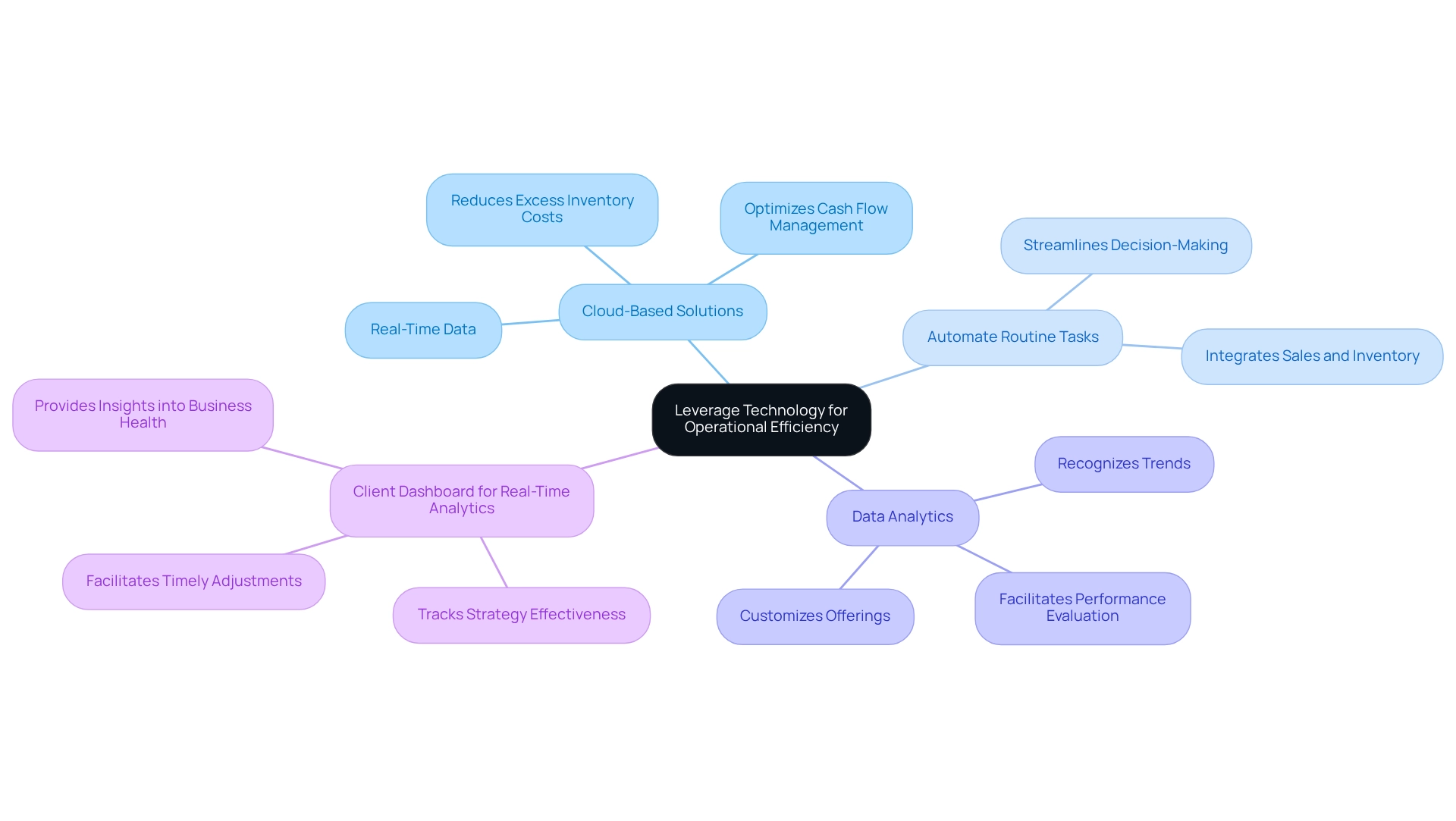

Leverage Technology for Operational Efficiency

Leverage Technology for Operational Efficiency

- Implement Cloud-Based Solutions: Utilizing cloud-based inventory management systems provides real-time data, enabling informed decisions about stock levels and reducing excess inventory costs. This is crucial for mastering the cash conversion cycle, as timely data optimizes cash flow management.

- Automate Routine Tasks: Software solutions can automate routine tasks, streamlining decision-making processes. For instance, a restaurant can use a point-of-sale system that integrates with inventory management to automatically track sales and adjust orders accordingly.

- Employ Data Analytics: Data analytics assists companies in recognizing trends and consumer preferences, facilitating ongoing performance evaluation. This allows companies to customize their offerings more effectively, improving client satisfaction.

Client Dashboard for Real-Time Analytics: Establishing a client dashboard enables organizations to track the effectiveness of their strategies and teams in real-time. This tool provides , facilitating timely adjustments and strategic decision-making.

By embracing these technological strategies, businesses can reduce costs, improve service delivery, and build stronger relationships with customers, which is essential for retention during challenging times.

Conclusion

Navigating the complexities of financial distress demands a multifaceted approach that emphasizes value preservation, cash flow optimization, comprehensive assessments, and the strategic utilization of technology. By prioritizing core assets, businesses can effectively safeguard their essential capabilities and sustain customer loyalty—an imperative for recovery. Furthermore, employing targeted marketing and loyalty programs can significantly enhance these efforts, ensuring that the brand remains robust even in challenging times.

Optimizing cash flow through precise forecasting, streamlined accounts receivable processes, and effective inventory management is crucial for maintaining liquidity. These techniques not only facilitate the identification of potential shortfalls before they materialize but also liberate cash that can be utilized to address unforeseen expenses. Additionally, renegotiating payment terms with suppliers offers much-needed flexibility without jeopardizing vital relationships.

Comprehensive financial assessments empower businesses to pinpoint key performance indicators and formulate actionable restructuring plans. Engaging stakeholders throughout this process cultivates a collaborative atmosphere that is essential for successful implementation. Moreover, leveraging technology via cloud-based solutions, automation, and data analytics significantly enhances operational efficiency, enabling businesses to make informed decisions and respond swiftly to market fluctuations.

Ultimately, the strategies outlined herein underscore that with the appropriate tools and methodologies, distressed businesses can not only survive but also thrive. By concentrating on value preservation, cash flow optimization, and the adoption of technological advancements, organizations can emerge from financial challenges stronger and more resilient, poised to seize new opportunities on their path to recovery.

Frequently Asked Questions

What is distressed business value preservation?

Distressed business value preservation is the process of identifying and protecting core assets of a company to maintain its overall worth, including both tangible assets like inventory and equipment, and intangible assets such as brand reputation and client relationships.

Why is understanding value important for an organization?

A clear understanding of what defines value for the organization enables leaders to prioritize their efforts effectively, ensuring that they focus on the most critical components for sustaining the business.

What strategies can a retail company use to preserve value during financial difficulties?

A retail company can boost customer involvement through targeted marketing initiatives and establish loyalty schemes designed to strengthen brand value during challenging periods.

How can financial evaluations assist in distressed business value preservation?

Conducting comprehensive financial evaluations helps identify opportunities to conserve funds and reduce obligations, ensuring the enterprise remains sustainable over time.

What role do turnaround and restructuring consulting services play in value preservation?

Turnaround and restructuring consulting services, including bankruptcy case management, help organizations streamline operations and enhance decision-making processes, contributing to value preservation.

How does real-time analytics support the value preservation process?

Real-time analytics monitor performance and operationalize lessons learned throughout the turnaround process, aiding organizations in making informed decisions and improving their strategies.