Overview

The article outlines four key strategies that CFOs can implement to enhance financial health:

- Cost management

- Revenue diversification

- Cash flow optimization

- Monetary training

These strategies are substantiated by evidence demonstrating that:

- Regular financial assessments

- Leveraging technology

- Adopting data-driven approaches

significantly enhance decision-making and operational efficiency. Consequently, these practices position organizations for sustainable long-term success.

Introduction

In today's fiercely competitive business environment, the financial health of an organization is crucial for its success and longevity. CFOs are tasked with navigating a complex array of metrics that unveil the true state of their company's finances. From liquidity ratios that assess short-term obligations to profitability margins that indicate operational efficiency, understanding these key indicators is essential for strategic decision-making.

As businesses confront economic uncertainties, the necessity for robust financial strategies becomes even more critical. This article explores the essential metrics for assessing financial health, actionable strategies for improvement, and the pivotal role of technology in enhancing financial management, ultimately equipping organizations to thrive in a rapidly evolving market.

Define Financial Health: Key Metrics and Importance

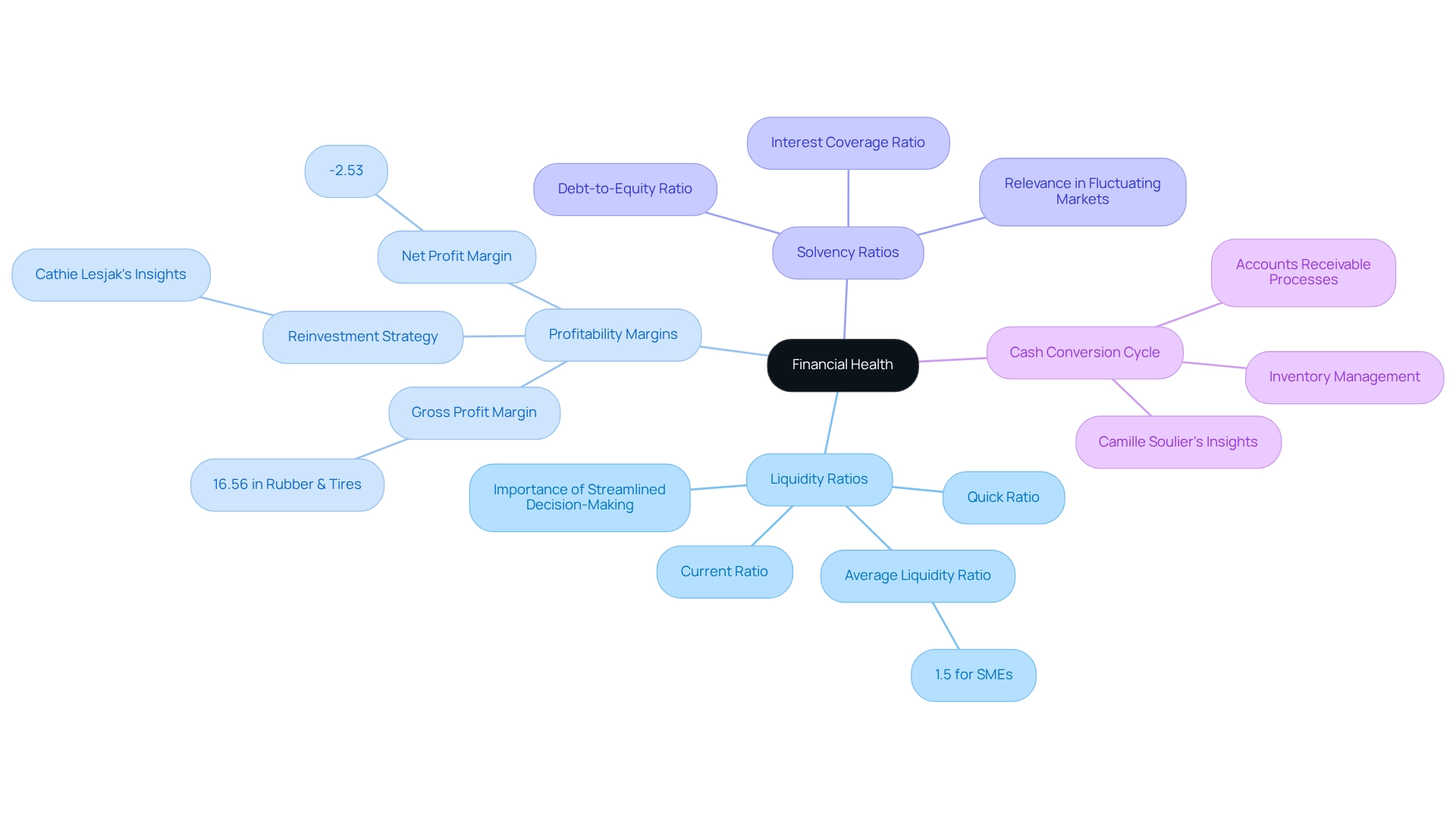

Financial health improvement serves as a vital indicator of an organization's capacity to effectively manage its financial resources. Key metrics that CFOs should prioritize include:

- Liquidity Ratios: These ratios, particularly the current ratio and quick ratio, evaluate a company's ability to meet short-term obligations. Recent trends suggest that sustaining a healthy liquidity ratio is crucial for managing economic uncertainties, particularly for small to medium enterprises in 2025. Current statistics indicate that the average liquidity ratio for small to medium enterprises is approximately 1.5, suggesting a strong capacity to cover short-term obligations. Streamlined decision-making processes can further enhance this capability, allowing companies to act swiftly in response to financial challenges.

- Profitability Margins: Metrics such as gross profit margin, which averages 16.56% in the Rubber & Tires industry, and net profit margin, currently at -2.53%, reveal how effectively an organization converts sales into profits. Understanding these margins is crucial for strategic reinvestment. For example, Cathie Lesjak, CFO of HP, highlights the significance of redirecting savings into the organization for long-term growth. This disciplined reinvestment approach not only boosts future value but also aligns with the core principles of effective management. Ongoing observation of these metrics via real-time analytics, including our client dashboard, can assist executives in recognizing trends and making informed choices that enhance profitability.

- Solvency Ratios: Ratios such as debt-to-equity and interest coverage ratios evaluate long-term stability and the capability to fulfill obligations. These metrics are increasingly relevant as businesses face fluctuating market conditions. By implementing turnaround lessons and utilizing real-time analytics, financial leaders can better grasp their company's economic condition and make proactive adjustments to their strategies.

- Cash Conversion Cycle: Mastering the cash conversion cycle is crucial for enhancing cash flow and profitability. Approaches like enhancing inventory management and refining accounts receivable processes can greatly contribute to financial health improvement for a company. For CFOs, understanding these economic health metrics is crucial. They not only provide insights into operational efficiency but also inform strategic decisions that can significantly enhance overall business performance. As Camille Soulier observes, aligning team efforts with monetary results is essential for driving organizational success. This alignment can be achieved through regular budget assessments and transparent communication of how individual contributions affect the company's economic health.

Implement Strategies for Financial Health Improvement

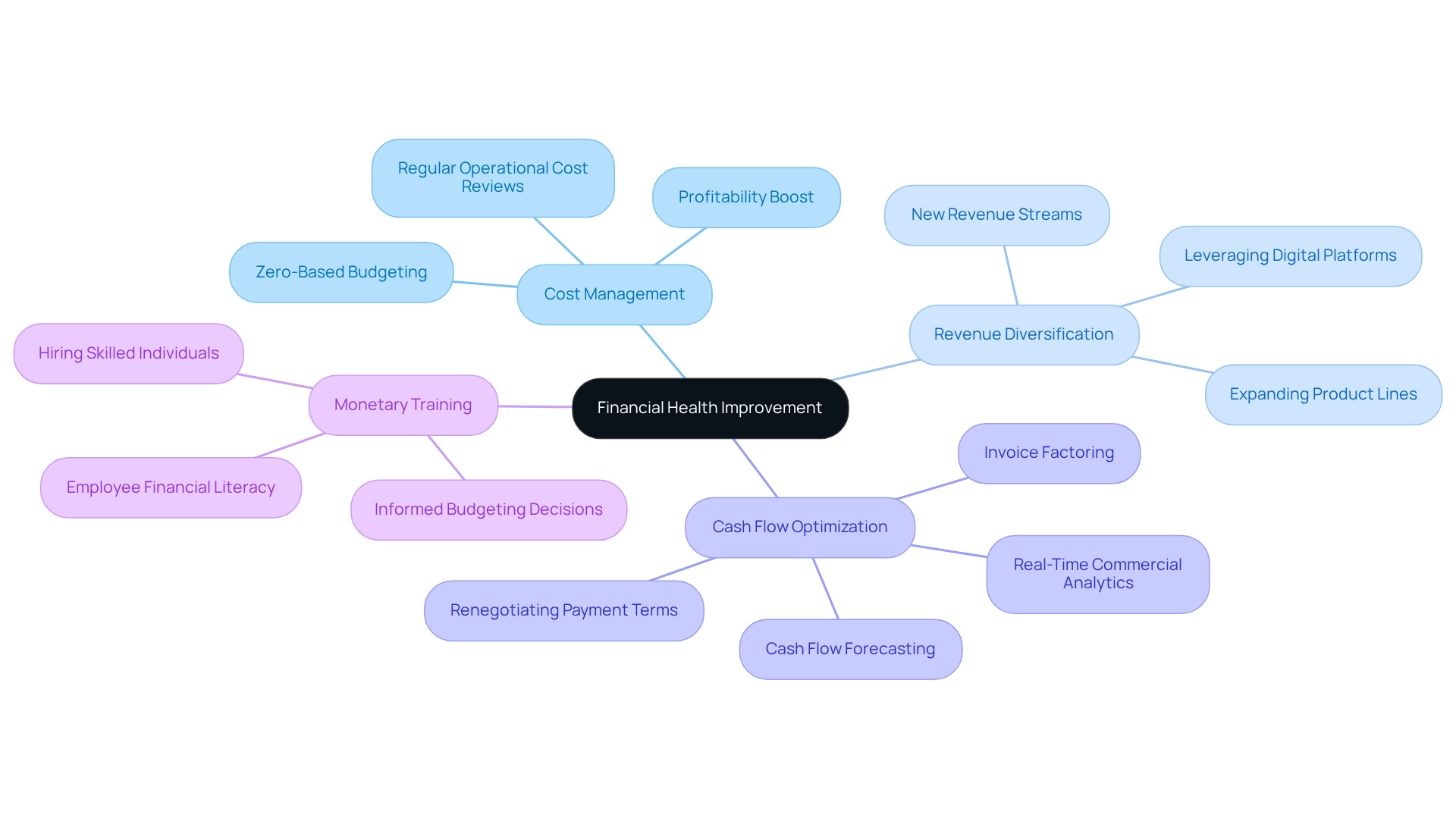

To enhance financial health, CFOs should implement the following strategies:

- Cost Management: Conduct regular reviews of operational costs to boost profitability. Adopting zero-based budgeting can effectively highlight unnecessary expenditures, allowing for more strategic allocation of resources. Based on recent statistics, efficient expense control strategies can result in a notable rise in profitability for small to medium enterprises in 2025.

- Revenue Diversification: Actively seek new revenue streams to mitigate reliance on a single source. This may involve expanding product lines, exploring new markets, or leveraging digital platforms to reach broader audiences. Case studies have demonstrated that companies that effectively diversify their revenue sources enjoy enhanced financial stability and resilience.

- Cash Flow Optimization: Establish strong cash flow forecasting and oversight practices to maintain liquidity. Techniques such as invoice factoring and renegotiating payment terms can significantly enhance cash flow stability. Moreover, implementing real-time commercial analytics through a client dashboard can provide CFOs with the insights required to make informed decisions rapidly, thus enhancing cash flow management efficiency. Streamlined decision-making processes allow for timely actions that preserve business health and enhance profitability.

- Monetary Training: Prioritize monetary literacy instruction for employees to enhance better budgeting and economic decision-making throughout the organization. As Brian Roberts, CFO of Lyft, states, "From a finance hiring perspective, you need to hire the best athletes who want to be part of a high-performance team." Enabling staff with economic knowledge can lead to more informed choices that positively impact the bottom line.

These strategies not only contribute to financial health improvement but also strategically position the organization for sustainable long-term success.

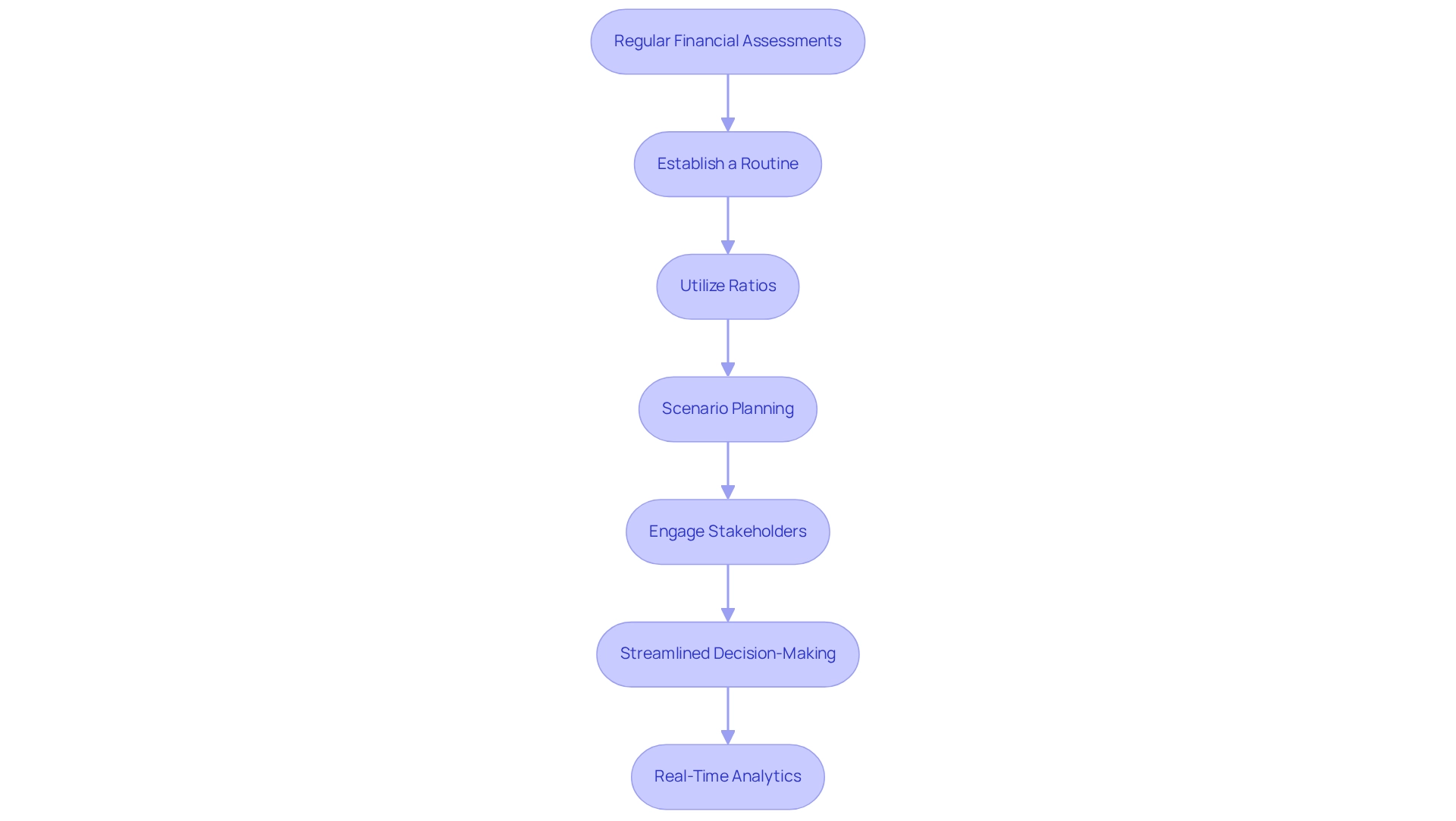

Conduct Regular Financial Assessments for Cash Preservation

Conducting regular monetary evaluations is crucial for preserving cash and ensuring overall economic stability. CFOs should adopt the following strategies:

- Establish a Routine: Implement quarterly reviews of accounts to meticulously analyze cash flow statements, balance sheets, and income statements. This routine aids in recognizing trends and possible problems early.

- Utilize Ratios: Leverage key ratios to assess liquidity and operational efficiency. Ratios like the current ratio and quick ratio can identify areas requiring enhancement, facilitating informed decision-making.

- Scenario Planning: Develop various economic scenarios to evaluate potential effects on cash flow. This proactive method enables organizations to develop contingency plans, ensuring resilience in changing market conditions.

- Engage Stakeholders: Involve department heads in the budget evaluation process. Their insights into operational challenges can reveal opportunities for cash preservation and improve overall monetary strategy.

- Streamlined Decision-Making: Support a shortened decision-making cycle throughout the turnaround process. This enables your team to take decisive action to protect your enterprise, ensuring that monetary evaluations lead to timely interventions.

- Real-Time Analytics: Utilize a client dashboard that provides real-time analytics to continually monitor the success of your monetary plans. This continuous evaluation aids in diagnosing your company's health and modifying strategies as necessary, emphasizing the importance of regular monetary assessments in today's economic environment.

A case study from Notion CFO & Advisors showcases the effectiveness of customized support in cash flow forecasting, illustrating how expert insights can result in informed choices that drive growth and stability. Furthermore, statistics show that the typical small business proprietor is more inclined to obtain funds to endure or reduce debt, highlighting the necessity of regular monetary evaluations in today's economic environment. By adopting these best practices, organizations can effectively manage cash flow, reduce economic risks, and achieve financial health improvement for sustainable growth.

Leverage Technology for Enhanced Financial Management

To enhance financial management, CFOs must strategically leverage technology in several key areas:

- Implement Financial Software: Advanced financial management software, such as NetSuite or QuickBooks, is essential for effective budgeting, forecasting, and reporting. These tools automate processes, reduce mistakes, and provide a robust foundation for operational activities. As Tyler Sloat, the Chief Financial Officer of Zuora, observes, 'The subscription market is enormous now,' underscoring the necessity for financial leaders to adapt to market trends through technology.

- Data Analytics: Utilizing data analytics tools empowers chief financial officers to gain valuable insights into monetary performance and identify emerging trends. This data-driven approach facilitates informed decision-making, ultimately enhancing profitability and operational efficiency. In fact, 67% of North American CFOs rely heavily on CAOs, highlighting the collaborative aspect of financial management and the importance of leveraging technology alongside skilled personnel. Continuous monitoring through real-time analytics can also assist in operationalizing lessons learned, ensuring that strategies are adjusted based on performance outcomes.

- Cloud Solutions: Embracing cloud-based financial solutions ensures real-time access to essential data. This capability fosters enhanced collaboration among teams and accelerates decision-making processes, which is vital in today’s fast-paced corporate environment. Cathie Lesjak, CFO of HP, emphasizes that systematically conserving and reinvesting funds into the business can significantly enhance its future value, reinforcing the importance of organized financial management through technology.

- AI and Automation: Exploring AI-driven tools can significantly streamline routine financial tasks, such as invoice processing and reconciliation. By automating these functions, financial leaders can free up valuable time to focus on strategic planning and long-term economic well-being. This approach aligns with the need for swift decision-making and effective turnaround strategies, ensuring that businesses remain agile and responsive to market changes.

The case study titled 'Corporate Culture and Finance' illustrates how CFOs can align financial strategies with company objectives, enhancing the overall effectiveness of fiscal practices. Integrating these technologies not only strengthens financial management capabilities but also positions organizations for sustainable growth and financial health improvement.

Conclusion

Understanding and improving financial health is paramount for organizations aiming to thrive in a competitive landscape. Key metrics such as liquidity ratios, profitability margins, solvency ratios, and the cash conversion cycle provide CFOs with essential insights into their company's financial stability and operational efficiency. By prioritizing these indicators, organizations can make informed strategic decisions that enhance overall performance and resilience.

Implementing targeted strategies—such as cost management, revenue diversification, cash flow optimization, and financial training—further strengthens financial health. These approaches not only address immediate challenges but also lay the groundwork for sustainable long-term success. Regular financial assessments, coupled with scenario planning and stakeholder engagement, ensure that businesses remain agile and capable of navigating economic fluctuations.

Moreover, leveraging technology is equally vital in enhancing financial management. Advanced financial software, data analytics, cloud solutions, and AI-driven tools empower CFOs to streamline operations, gain valuable insights, and make data-driven decisions. As organizations embrace these innovations, they position themselves for improved financial health and the ability to respond swiftly to market changes.

In conclusion, a proactive approach to financial health—rooted in understanding key metrics, implementing effective strategies, and leveraging technology—equips organizations with the tools necessary to not only survive but thrive in an ever-evolving business environment. Prioritizing these elements is essential for fostering resilience and ensuring sustainable growth in the face of uncertainties.

Frequently Asked Questions

What is the significance of financial health improvement for an organization?

Financial health improvement is a vital indicator of an organization's capacity to effectively manage its financial resources.

What are liquidity ratios and why are they important?

Liquidity ratios, such as the current ratio and quick ratio, evaluate a company's ability to meet short-term obligations. They are crucial for managing economic uncertainties, especially for small to medium enterprises, with an average liquidity ratio of approximately 1.5 indicating a strong capacity to cover short-term obligations.

How do profitability margins impact an organization's financial health?

Profitability margins, including gross profit margin and net profit margin, reveal how effectively an organization converts sales into profits. Understanding these metrics is essential for strategic reinvestment and long-term growth, as demonstrated by CFOs like Cathie Lesjak of HP.

What are solvency ratios and their relevance?

Solvency ratios, such as debt-to-equity and interest coverage ratios, evaluate long-term stability and the capability to fulfill obligations. These metrics are increasingly important as businesses face fluctuating market conditions.

What is the cash conversion cycle and why is it important?

The cash conversion cycle measures how quickly a company can convert its investments in inventory and accounts receivable into cash flow. Mastering this cycle is crucial for enhancing cash flow and profitability.

How can CFOs utilize economic health metrics?

CFOs can use economic health metrics to gain insights into operational efficiency and make strategic decisions that enhance overall business performance. Regular budget assessments and transparent communication are essential for aligning team efforts with monetary results.