Overview

This article explores how CFOs can enhance financial operations through four pivotal strategies:

- Conducting comprehensive financial assessments

- Implementing effective cash flow management

- Ensuring compliance and managing financial risks

- Leveraging technology for operational efficiency

Each strategy is bolstered by compelling examples and authoritative statistics that illustrate their effectiveness in enhancing decision-making, improving liquidity, and fostering innovation. Ultimately, these strategies position CFOs as strategic leaders within their organizations.

Introduction

In a rapidly evolving financial landscape, Chief Financial Officers (CFOs) are stepping into a pivotal role that extends far beyond traditional number-crunching. As strategic visionaries, they are tasked with:

- Conducting comprehensive financial assessments

- Implementing effective cash flow management strategies

- Ensuring compliance

- Leveraging technology for operational efficiency

This article delves into essential practices that empower CFOs to:

- Navigate complex financial challenges

- Uncover valuable insights

- Drive sustainable growth

By embracing a proactive approach and fostering collaboration within their teams, CFOs can enhance decision-making processes and secure a competitive edge in an increasingly dynamic marketplace.

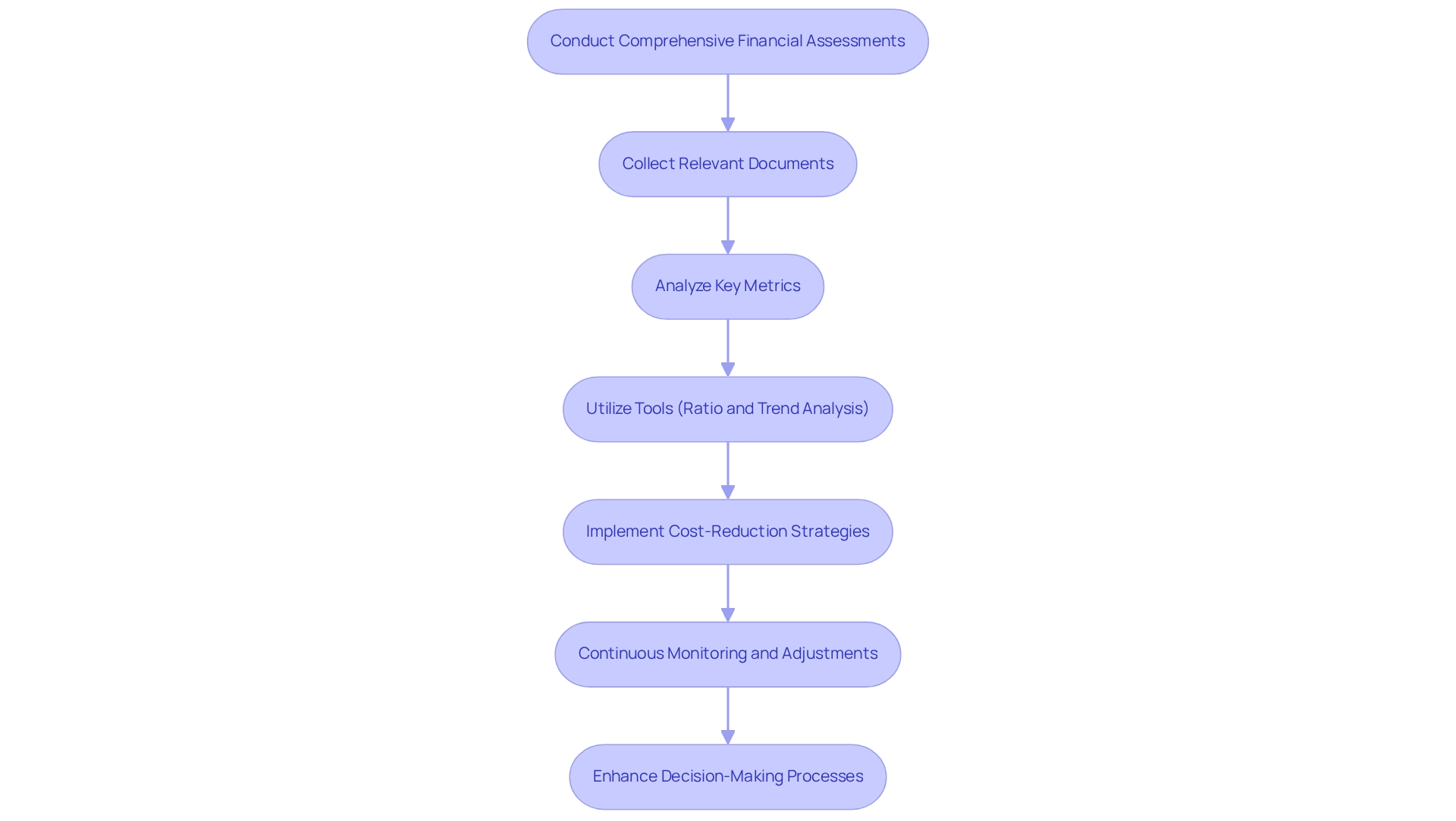

Conduct Comprehensive Financial Assessments

must prioritize thorough evaluations by systematically collecting all relevant documents, such as income statements, balance sheets, and cash flow statements. This process demands a comprehensive analysis of key metrics, including liquidity ratios, profitability margins, and operational efficiency indicators. By utilizing tools like ratio analysis and trend analysis, financial leaders can uncover valuable insights into the organization's financial trajectory. For instance, a recent assessment for a retail client revealed a 15% increase in operational costs, prompting the implementation of targeted cost-reduction strategies that significantly enhanced profitability.

As financial leaders evolve into strategic visionaries and key drivers of business success, it is essential to conduct regular assessments quarterly. This approach allows for continuous monitoring and timely adjustments to adapt to changing business conditions. Such proactive strategies not only foster greater confidence in cash flow visibility—an area where 98% of finance leaders currently express concerns—but also position financial executives as strategic visionaries capable of driving sustainable growth and innovation.

Moreover, with 67% of North American financial officers relying heavily on their CAOs, collaboration in these assessments becomes crucial. By identifying and creating actionable plans, financial executives can enhance decision-making processes through financial operations refinement and operationalize turnaround lessons. Recent trends indicate that financial leaders are increasingly willing to embrace higher risks, rising from 29% to 40%. This underscores the importance of comprehensive financial assessments in fostering innovation and securing a competitive edge in the marketplace.

Implement Effective Cash Flow Management Strategies

Chief Financial Officers can significantly enhance liquidity management through the implementation of essential strategies. First and foremost, utilizing financial flow forecasting tools is crucial for anticipating future monetary requirements and identifying potential deficits. Notably, 25% of CFOs express uncertainty regarding the attainment of their financial flow goals, underscoring the critical need for precise forecasting.

For example, a restaurant client successfully employed a 13-week financial flow projection to navigate seasonal fluctuations, facilitating effective planning for inventory acquisitions and staffing needs. Additionally, improving accounts receivable processes—such as shortening payment terms and incentivizing timely payments—can lead to substantial improvements in cash inflow. Regular reviews and negotiations of payment terms with suppliers further aid in managing cash outflows.

It is also essential to highlight that 67% of North American financial executives rely heavily on their CAOs, emphasizing the collaborative nature of flow management. Maintaining a reserve of funds equivalent to at least three months of operating costs is vital, as it equips companies to better handle unforeseen economic challenges.

Furthermore, by adopting a practical approach to data, CFOs can assess various hypotheses regarding financial flow management, enabling quicker decision-making processes that sustain business vitality. Continuous monitoring of liquidity through real-time analytics can assist in evaluating economic health and applying lessons learned, ensuring that strategies remain effective.

The case study titled ' vs. Financial Statements' illustrates that while traditional financial reports may convey a certain narrative, cash flow reveals the true economic health of a business. By focusing on these strategies and seeking expert guidance when necessary, finance leaders can ensure financial operations refinement for a more robust operational framework.

Ensure Compliance and Manage Financial Risks

CFOs must establish a robust compliance framework that incorporates , including regular audits and strict adherence to accounting regulations such as GAAP or IFRS. A proactive risk management strategy is essential, involving the identification of potential monetary risks, including credit, market, and operational risks.

For instance, a hospitality client faced considerable economic exposure due to fluctuating occupancy rates. By diversifying revenue streams and implementing dynamic pricing strategies, they effectively mitigated this risk. This aligns with findings that a significant number of organizations have experienced cyber incidents linked to third-party vendors, underscoring the risks associated with outsourcing.

Moreover, cultivating a culture of adherence within the organization is crucial; this can be accomplished by educating personnel on regulatory standards and ethical monetary practices. Leveraging technology for real-time compliance monitoring can significantly enhance financial operations refinement and risk management efforts, ensuring that organizations remain agile and responsive to emerging challenges.

Recent statistics indicate that:

- 57% of corporate risk and compliance professionals report that compliance roles have become more specialized, underscoring the importance of tailored strategies in today’s intricate economic landscape.

- 52% of compliance experts claim that insufficient data and information about partners expose businesses to third-party risks, emphasizing the need for robust data management in compliance frameworks.

- 67% of North American Chief Financial Officers depend greatly on their Chief Accounting Officers, highlighting the necessity of creating robust compliance frameworks to support financial operations refinement.

Furthermore, conducting thorough fiscal assessments can uncover opportunities to preserve cash and reduce liabilities, while continuous monitoring through real-time analytics can facilitate informed decision-making and operational adjustments, ultimately enhancing business performance.

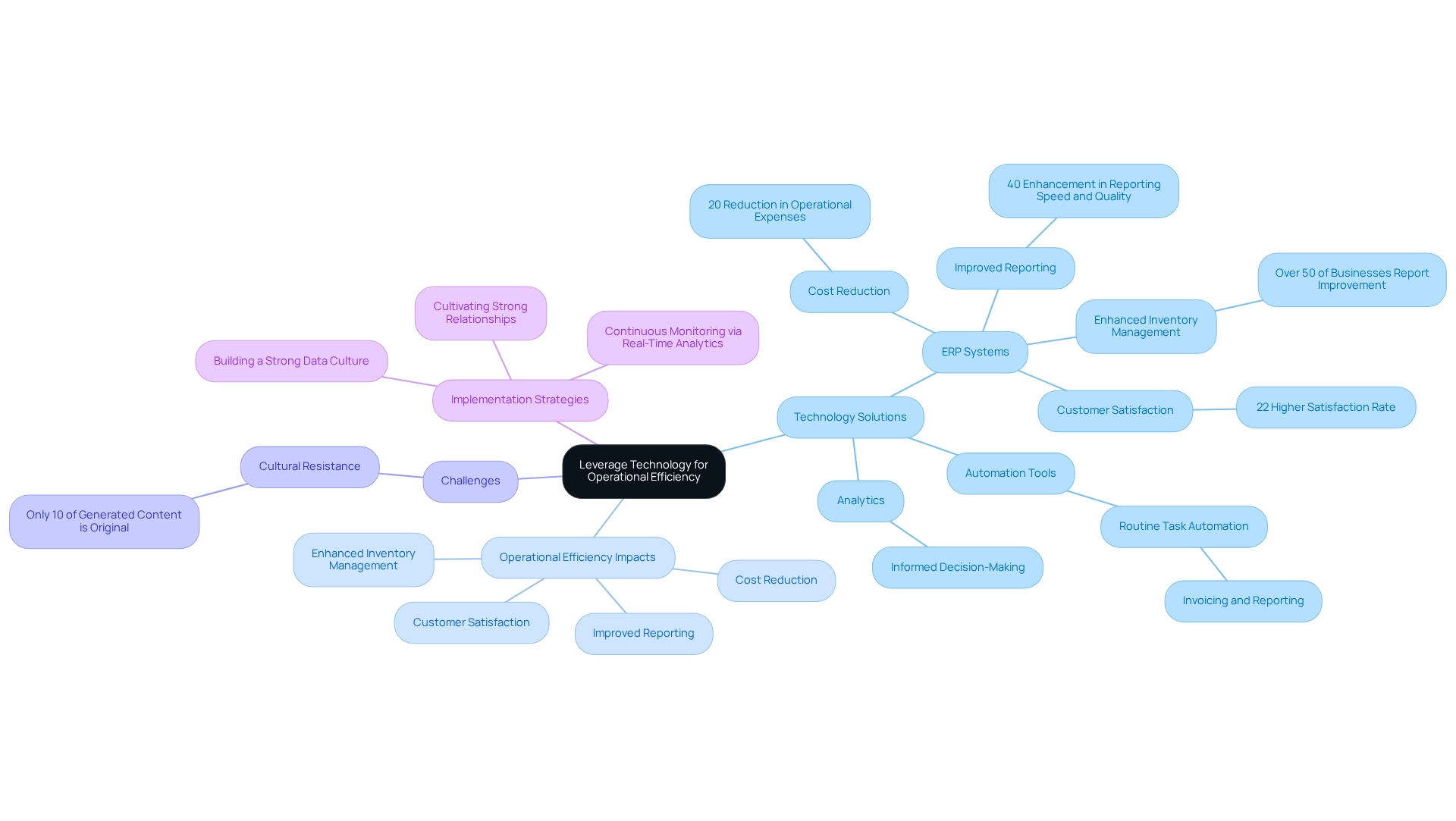

Leverage Technology for Operational Efficiency

CFOs must actively pursue technology solutions that support financial operations refinement and enhance operational efficiency. Deploying cloud-based resource management systems not only provides immediate access to information but also fosters collaboration among departments. For instance, that integrated its financial data with supply chain management through an ERP system achieved an impressive 20% reduction in operational expenses.

Moreover, automation tools for routine tasks such as invoicing and reporting can free up valuable time for finance teams, thereby contributing to financial operations refinement and enabling them to focus on strategic initiatives. The adoption of analytics empowers CFOs to make informed decisions based on predictive insights, ultimately contributing to financial operations refinement and improving financial performance.

Research indicates that companies utilizing ERP systems experience a 40% enhancement in reporting speed and quality, automating information gathering for consistent, real-time reports. Additionally, over 50% of businesses report that ERP systems significantly enhance inventory management, highlighting their value in operational efficiency. According to Deloitte, firms with ERP integration enjoy a 22% higher customer satisfaction rate due to improved information accuracy and streamlined processes.

However, organizations frequently struggle to maximize their information capabilities due to cultural resistance, with only 10% of generated content being original. Establishing a robust data culture is crucial for organizations to fully leverage ERP systems and achieve financial operations refinement to enhance decision-making.

By continuously monitoring business performance through real-time analytics via a client dashboard and operationalizing lessons learned, CFOs can ensure their organizations remain agile and responsive to evolving market conditions. Additionally, cultivating strong relationships within the organization is vital for successful operationalization and effective technology leverage.

Conclusion

CFOs are pivotal to the financial health and strategic direction of their organizations. Through comprehensive financial assessments, they identify key metrics that drive decision-making and foster sustainable growth. Regular evaluations enhance cash flow visibility and empower CFOs to implement targeted strategies that address operational inefficiencies while enhancing profitability.

Effective cash flow management stands as another cornerstone of a CFO's responsibilities. By utilizing forecasting tools and optimizing accounts receivable processes, CFOs ensure their organizations maintain financial resilience amidst unexpected challenges. Moreover, fostering collaboration with their teams enhances the effectiveness of cash management strategies, allowing for timely adjustments that align with organizational goals.

Compliance and risk management are equally vital to a CFO's role. Establishing a robust compliance framework and proactively identifying financial risks protect the organization from potential pitfalls. By leveraging technology for real-time monitoring and fostering a culture of compliance, CFOs navigate the complexities of today’s financial landscape while upholding ethical practices.

Finally, embracing technology is essential for operational efficiency. By integrating advanced financial management systems and automation tools, CFOs streamline processes, enhance data accuracy, and ultimately drive better financial performance. As organizations evolve, fostering a strong data culture becomes critical for maximizing the benefits of these technologies.

In summary, the modern CFO must be a strategic visionary, adept at navigating complex financial challenges, driving collaboration, and leveraging technology. By embracing these practices, CFOs secure a competitive edge and significantly contribute to their organization's success in a dynamic marketplace.

Frequently Asked Questions

What documents should chief financial officers collect for evaluations?

Chief financial officers should systematically collect all relevant documents, including income statements, balance sheets, and cash flow statements.

What key metrics should be analyzed during financial evaluations?

Key metrics to analyze include liquidity ratios, profitability margins, and operational efficiency indicators.

How can financial leaders uncover insights into the organization's financial trajectory?

Financial leaders can utilize tools like ratio analysis and trend analysis to uncover valuable insights into the organization's financial trajectory.

What was a recent finding from a financial assessment for a retail client?

A recent assessment revealed a 15% increase in operational costs, which led to the implementation of targeted cost-reduction strategies that significantly enhanced profitability.

How often should financial leaders conduct assessments?

Financial leaders should conduct regular assessments quarterly to allow for continuous monitoring and timely adjustments to adapt to changing business conditions.

What concerns do finance leaders have regarding cash flow visibility?

98% of finance leaders express concerns about cash flow visibility.

What role do CAOs play in financial assessments?

67% of North American financial officers rely heavily on their CAOs, making collaboration in these assessments crucial for identifying underlying business issues and creating actionable plans.

What trend is observed regarding financial leaders' willingness to take risks?

There is an increasing willingness among financial leaders to embrace higher risks, with the percentage rising from 29% to 40%.

Why are comprehensive financial assessments important for financial leaders?

Comprehensive financial assessments are important as they foster innovation and help secure a competitive edge in the marketplace.