Overview

The four strategies for enhancing financial recovery performance in business are:

- Conducting comprehensive financial assessments

- Implementing turnaround and restructuring strategies

- Leveraging interim management for transformational change

- Aligning financial strategies with operational needs

Each strategy is underpinned by practical examples and research, illustrating how thorough evaluations, strategic restructuring, interim expertise, and cohesive financial-operations alignment can significantly bolster an organization's financial health and recovery efforts. These approaches not only provide a roadmap for recovery but also serve as a call to action for organizations seeking to improve their financial stability.

Introduction

In a landscape where small and medium-sized businesses frequently confront financial instability, the significance of strategic financial management is paramount. Comprehensive financial assessments are the bedrock for pinpointing critical challenges and opportunities, empowering businesses to adeptly navigate turbulent economic waters.

From executing turnaround strategies to leveraging interim management for transformational change, organizations must embrace a multifaceted approach to ensure sustainability and growth. By aligning financial strategies with operational needs, businesses can cultivate resilience, enhance productivity, and ultimately secure their position in a competitive marketplace.

This article explores essential strategies designed to empower businesses to surmount financial hurdles and flourish in an ever-evolving environment.

Conduct Comprehensive Financial Assessments

A comprehensive economic assessment requires a thorough examination of all monetary statements, including balance sheets, income statements, and cash flow statements. Key metrics such as liquidity ratios, profitability margins, and debt levels are essential for this analysis. Recent trends indicate that 37% of small enterprise owners have considered ending operations due to late payment issues, underscoring the importance of maintaining healthy liquidity ratios.

Moreover, according to the Small Business Credit Survey, 54% of U.S. small enterprises sought a loan or line of credit in 2018, emphasizing the economic challenges these companies encounter. By utilizing financial analysis tools, organizations can effectively visualize trends and detect anomalies. For instance, a retail operation may reveal low inventory turnover rates, indicating a need for enhanced inventory management practices.

Timely recognition of such issues allows organizations to adopt proactive measures, ultimately safeguarding cash and diminishing liabilities. This strategic method is essential for improving cash flow management, particularly in the retail industry, where enhancing financial recovery performance can greatly influence operational stability and growth.

As highlighted by the U.S. Small Business Administration, there are 28.8 million small firms in the United States, employing 56.8 million individuals, which underscores the vital role of these entities in the economy.

Furthermore, insights from the case study titled 'Impact on Stakeholders' reveal that the liquidity pool market impacts various stakeholders by offering flexible repayment terms and non-dilutive financing options. This allows companies to maintain cash flow stability during low-revenue periods without equity dilution. This emphasizes the importance of thorough economic evaluations for small enterprises, especially when incorporating expert advice and AI/ML approaches to simplify decision-making and improve performance tracking.

Implement Turnaround and Restructuring Strategies

Turnaround methods encompass a variety of approaches, including cost-cutting measures, contract renegotiation, and operational streamlining. For instance, a restaurant experiencing declining sales may redesign its menu to emphasize high-margin items, thereby reducing food waste and enhancing profitability. Restructuring debt is another essential strategy; companies should actively negotiate with creditors for more advantageous terms or contemplate debt consolidation to ease monetary burdens. Significantly, research shows that 71.2% of participants strongly concurred that liquidity and cash flow issues were major internal challenges, emphasizing the necessity of tackling these factors.

Practical examples demonstrate the efficacy of these approaches. Companies that have successfully navigated bankruptcy through strategic restructuring often serve as valuable case studies. For example, a recent case study on capital expenditure planning in the restaurant industry revealed that establishments prioritizing investments in technology and facilities achieved higher revenue growth. This highlights the significance of incorporating capital expenditures into budget planning. Moreover, effective turnaround strategies for small enterprises can differ greatly depending on their distinct traits, as various strategies may produce different outcomes based on the particular attributes of the restaurant sector. Insights from turnaround advisors highlight that innovative commercial models are crucial during periods of decline.

With the comprehensive turnaround and restructuring consulting services provided by Transform Your Small/ Medium Enterprise, including thorough financial assessments, interim management, bankruptcy case management, and the Rapid30 plan, organizations can identify opportunities to preserve cash and reduce liabilities. By applying customized approaches, companies can enhance their financial recovery performance and set themselves up for enduring growth in the long run. Nonetheless, it is crucial to recognize common pitfalls in implementing these approaches, such as underestimating the significance of cash flow management or neglecting to adjust to evolving market conditions. Client testimonials further emphasize the effectiveness of these strategies, showcasing the transformative impact of our services on enterprises facing financial challenges.

Leverage Interim Management for Transformational Change

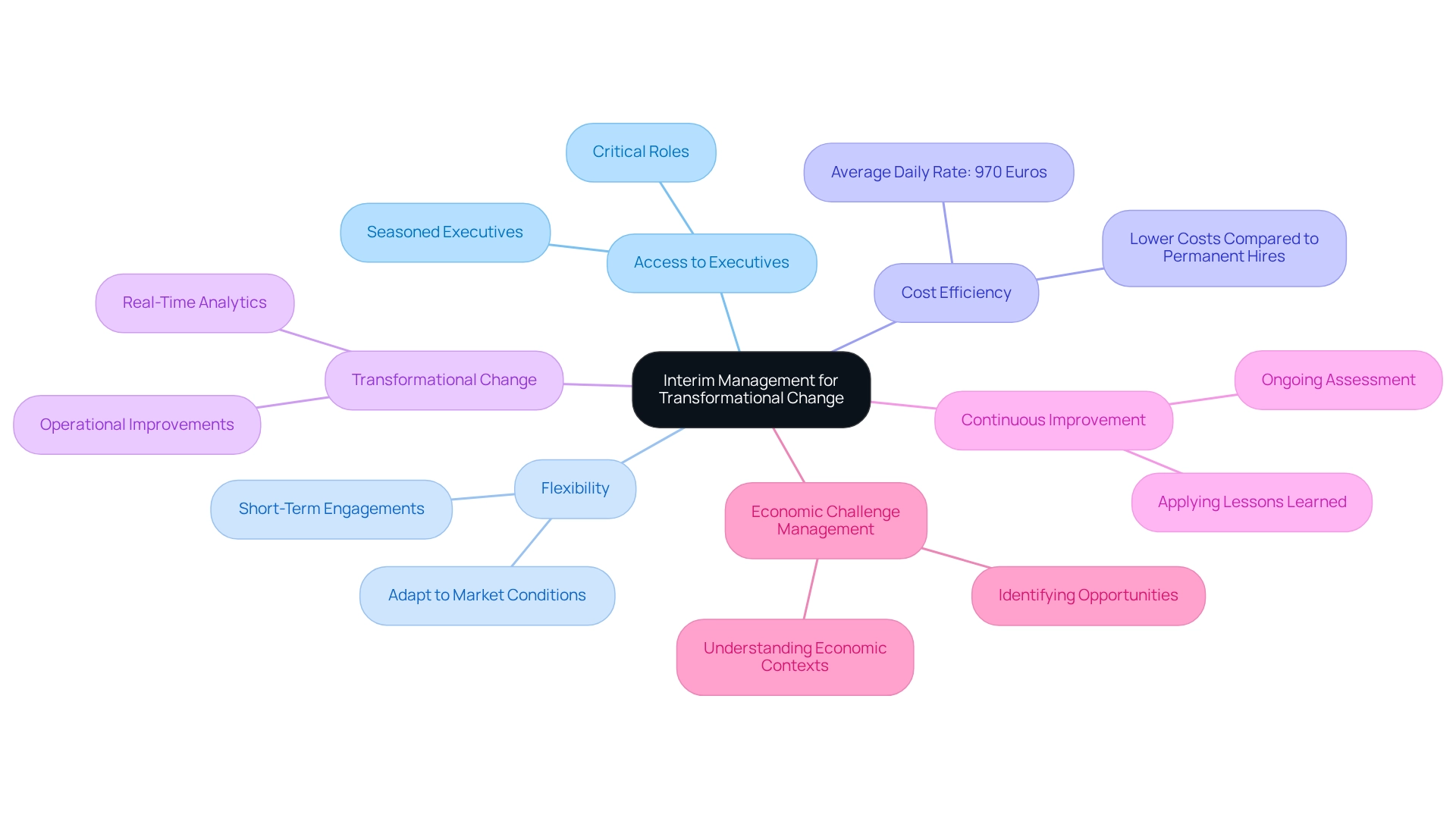

Interim management strategically positions seasoned executives in critical roles temporarily to lead recovery initiatives. These professionals are adept at swiftly evaluating organizational challenges, implementing necessary changes, and mentoring existing staff, thereby fostering a culture of improvement. For instance, a company grappling with operational inefficiencies may engage an interim COO to optimize processes and enhance productivity. This approach not only facilitates prompt action but also provides the flexibility to adapt to changing market conditions without the long-term commitment associated with permanent staff, ultimately enhancing financial recovery performance. As a cost-efficient solution during recovery periods, interim management has proven invaluable in driving transformational change, particularly within small to medium-sized enterprises. The typical interim daily rate in the UK, reaching 970 euros, underscores the value placed on these executives and highlights their cost-effectiveness compared to permanent employees.

The growing availability of interim talent signifies a shift in the sector, enabling organizations to access seasoned professionals capable of addressing specific challenges. Moreover, interim managers leverage real-time analytics to continuously assess financial recovery performance and diagnose organizational health, ensuring that strategies are adjusted as needed. They are dedicated to operationalizing lessons learned throughout the turnaround process to enhance their financial recovery performance and the effectiveness of their interventions. Case studies illustrate how these managers, equipped with a profound understanding of economic contexts, can pinpoint opportunities and tackle underlying issues, positioning themselves as essential problem solvers during challenging times. For example, the document titled 'Economic Context and Interim Management' emphasizes the necessity for interim managers to grasp economic environments and identify opportunities within organizations, showcasing their role in confronting current economic challenges.

This trend highlights the critical significance of resource planning in enhancing efficiency and achieving sustainable growth. As one industry leader remarked, 'Resource planning has become essential and has contributed to this positive evolution.'

Key Benefits of Utilizing Interim Management:

- Instant access to seasoned executives for essential positions.

- Flexibility to adjust to evolving market conditions.

- Cost efficiency in comparison to permanent hires.

- Capability to instigate transformational change and enhance efficiency through real-time analytics.

- Dedication to applying lessons learned for ongoing improvement.

- Proficiency in managing economic challenges and recognizing opportunities.

Align Financial Strategies with Operational Needs

To effectively connect monetary strategies with functional requirements, firms must conduct regular assessments of their budget plans alongside performance metrics. This process involves establishing distinct monetary goals that directly align with functional aims, such as enhancing production efficiency or minimizing overhead expenses. For example, a manufacturing firm may implement a just-in-time inventory system, which not only decreases carrying costs but also ensures adherence to production schedules. Such strategic alignment promotes collaboration between finance and operations teams, fostering a cohesive approach that enhances decision-making and drives recovery efforts.

Our team will identify underlying business issues and work collaboratively to develop a plan that mitigates weaknesses, enabling the business to reinvest in key strengths. Routine monetary assessments are vital, as they empower organizations to adjust their strategies in response to evolving practical circumstances, ultimately facilitating enhanced financial recovery performance and sustainable growth. Furthermore, fiscal reporting is crucial for franchise operations, enabling owners to monitor performance, ensure compliance, and make informed decisions across multiple locations. This underscores the necessity for robust monetary supervision in practical situations. Additionally, we adopt a pragmatic approach to data; we rigorously test every hypothesis to maximize return on invested capital in both the short and long term. Technology fluency is increasingly important alongside traditional financial knowledge in FP&A roles, highlighting the evolving nature of financial management and its integration with operational strategies.

Conclusion

Strategic financial management is essential for the survival and growth of small and medium-sized businesses grappling with financial instability. Comprehensive financial assessments form the bedrock for identifying challenges and opportunities, empowering organizations to make informed decisions. By grasping key financial metrics and trends, businesses can proactively tackle issues such as liquidity and cash flow management, ultimately bolstering operational stability and growth.

Implementing turnaround and restructuring strategies is vital for businesses aiming for recovery. Tailored approaches, including cost-cutting measures and debt restructuring, can significantly enhance financial health. Real-world examples illustrate the effectiveness of these strategies, highlighting the importance of adaptability and innovation in overcoming financial hurdles. Engaging with turnaround consultants can yield invaluable insights and support, assisting businesses in navigating their unique challenges effectively.

Leveraging interim management presents a powerful solution for driving transformational change. Experienced executives can step in to assess organizational challenges and implement necessary improvements without the long-term commitment associated with permanent hires. This flexibility enables businesses to adapt to evolving conditions while benefiting from real-time analytics to monitor performance and ensure continuous improvement.

Finally, aligning financial strategies with operational needs is crucial for sustainable growth. Regular reviews of financial plans alongside operational performance metrics foster a cohesive environment where finance and operations collaborate towards common goals. By promoting collaboration and utilizing advanced technology, businesses can enhance decision-making and propel recovery efforts.

In conclusion, adopting a multifaceted approach to financial management equips businesses with the necessary tools to navigate economic uncertainties and secure their competitive edge. By prioritizing comprehensive assessments, strategic restructuring, interim leadership, and operational alignment, organizations can cultivate resilience and thrive in an ever-evolving marketplace.

Frequently Asked Questions

What is required for a comprehensive economic assessment?

A comprehensive economic assessment requires a thorough examination of all monetary statements, including balance sheets, income statements, and cash flow statements.

What key metrics are important for economic analysis?

Key metrics important for economic analysis include liquidity ratios, profitability margins, and debt levels.

What recent trend has been observed among small enterprise owners regarding late payments?

Recent trends indicate that 37% of small enterprise owners have considered ending operations due to late payment issues.

How many small enterprises sought loans or lines of credit in 2018 according to the Small Business Credit Survey?

According to the Small Business Credit Survey, 54% of U.S. small enterprises sought a loan or line of credit in 2018.

How can financial analysis tools benefit organizations?

Financial analysis tools can help organizations effectively visualize trends and detect anomalies, allowing for timely recognition of issues and proactive measures to safeguard cash and diminish liabilities.

Why is cash flow management particularly important in the retail industry?

Cash flow management is essential in the retail industry because enhancing financial recovery performance can greatly influence operational stability and growth.

How many small firms are there in the United States, and how many individuals do they employ?

There are 28.8 million small firms in the United States, employing 56.8 million individuals.

What role does the liquidity pool market play for stakeholders?

The liquidity pool market impacts various stakeholders by offering flexible repayment terms and non-dilutive financing options, allowing companies to maintain cash flow stability during low-revenue periods without equity dilution.

What approaches can improve economic evaluations for small enterprises?

Incorporating expert advice and AI/ML approaches can simplify decision-making and improve performance tracking for small enterprises.