Overview

This article presents four pivotal strategies for achieving financial stabilization within CFO operations. It emphasizes the importance of:

- Conducting comprehensive financial assessments

- Managing cash flow effectively

- Ensuring compliance with financial regulations

- Striking a balance between long-term objectives and short-term necessities

Each strategy is substantiated by practical examples and actionable recommendations, such as the utilization of real-time analytics and the execution of regular evaluations. Collectively, these approaches enhance financial health and foster organizational agility, positioning CFOs to navigate the complexities of today’s financial landscape.

Introduction

In the ever-evolving landscape of business finance, Chief Financial Officers (CFOs) face the daunting task of navigating complex financial waters while ensuring their organizations remain competitive and compliant. This article delves into essential strategies that CFOs can employ to:

- Conduct comprehensive financial assessments

- Implement effective cash flow management

- Balance long-term goals with short-term needs

By harnessing advanced analytics and fostering a culture of accountability, CFOs can enhance their financial oversight and drive sustainable growth. Moreover, with insights drawn from real-world examples, this guide aims to equip financial leaders with the tools necessary to thrive in a dynamic business environment, ultimately ensuring their organizations not only survive but flourish.

Conduct Comprehensive Financial Assessments

A comprehensive fiscal assessment demands an in-depth examination of all monetary statements, including balance sheets, income statements, and cash flow statements. CFOs must prioritize key performance indicators (KPIs) such as liquidity ratios, profitability margins, and debt levels to effectively assess economic health. Importantly, saving a dollar and reinvesting it into the business can significantly enhance its future worth, underscoring the economic advantages of thorough evaluations.

The adoption of advanced fiscal analytics tools, alongside comprehensive accounts payable (AP) and expenditure management software, can greatly enhance this process, providing real-time insights into performance metrics and improving efficiency in managing data movement across the organization. For instance, a retail client improved their cash flow by 30% after identifying inefficiencies in inventory management through a thorough evaluation. To ensure financial stabilization, regular evaluations should be conducted quarterly, allowing for timely modifications to strategies as necessary.

Moreover, involving external auditors or fiscal consultants can provide an unbiased perspective on the organization’s economic situation, which is essential for financial stabilization, ensuring that potential issues are recognized and addressed proactively. As Neil Williams, CFO of Intuit, asserts, "When you are planning a big company change, don't underestimate the amount of communication you need to do." This approach not only promotes transparency but also enhances the overall effectiveness of resource management practices.

Furthermore, focusing on recruiting and nurturing finance talent is essential, as efficient assessments contribute to building a high-performance finance team, ultimately leading to improved business results. Chief financial officers should also be vigilant about common pitfalls in financial assessments to avoid misapplication of the practice. By mastering the conversion cycle and utilizing real-time analytics, financial leaders can enhance liquidity and profitability, ensuring their organizations remain agile and responsive in a dynamic business environment.

Implement Effective Cash Flow Management Strategies

To handle monetary movement efficiently, CFOs should implement several key strategies:

- Revenue Projection: Utilize past data in conjunction with present market trends to precisely anticipate future financial inflows. This proactive approach enables better planning and preparation for potential shortfalls, ensuring that businesses can navigate financial uncertainties with confidence and work towards financial stabilization. A minor adjustment in monetary projections can result in substantial differences in computed present value, highlighting the necessity of accurate forecasting.

- Optimize Receivables and Payables: Streamline invoicing processes to facilitate timely collections. Moreover, negotiating advantageous payment terms with suppliers can prolong payables without facing penalties, thus enhancing liquidity. A recent study highlighted that nearly half of businesses have automated only a few accounts receivable tasks, indicating a significant opportunity for efficiency improvements through automation. Creating a robust monetary culture and responsibility within the organization can further improve financial flow practices across all levels, which is essential for achieving financial stabilization. This reserve acts as a financial buffer, providing peace of mind during periods of uncertainty and allowing businesses to respond swiftly to challenges.

- Implement Real-Time Analytics: Utilize real-time business analytics to continually monitor financial health and operational performance. This approach enables financial leaders to make informed decisions quickly, operationalizing lessons learned from past experiences to enhance overall business performance. For example, a dining establishment client effectively improved their revenue management by adopting a more assertive collections policy, decreasing their average receivable days from 45 to 30. This strategic change greatly enhanced their liquidity, showcasing the concrete advantages of efficient resource management.

- Common Pitfalls: Chief Financial Officers should be mindful of typical mistakes in resource management, such as overestimating inflows or underestimating costs, which can result in economic strain. By recognizing these potential misapplications, financial officers can better navigate the complexities of cash flow management.

Ensure Compliance with Financial Regulations

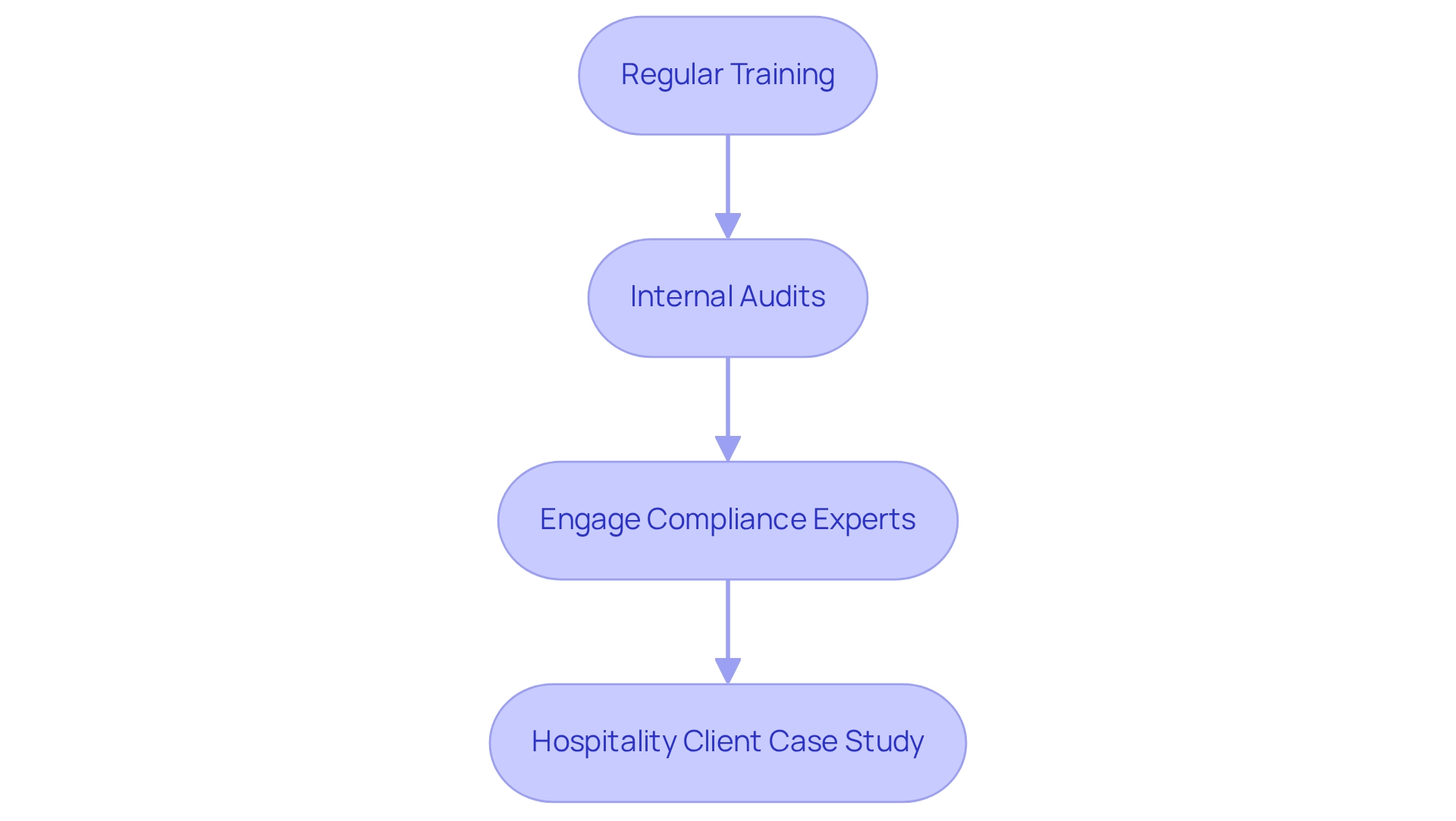

CFOs must remain vigilant regarding the latest monetary regulations, ensuring their organizations comply with all pertinent laws. This imperative includes several critical actions:

- Regular Training: Conduct comprehensive training sessions for finance teams to cover compliance requirements and updates to regulations.

- Internal Audits: Establish a systematic timetable for routine internal audits to assess adherence to reporting standards and internal controls.

- Engage Compliance Experts: Consider hiring or consulting with compliance specialists to guarantee that all aspects of operational activities align with regulatory standards.

For instance, a hospitality client faced substantial fines due to non-compliance with tax regulations. After implementing a robust compliance program, they not only avoided future penalties but also improved their reporting accuracy. This case underscores the importance of proactive compliance measures, prompting organizations to take immediate action in fortifying their regulatory frameworks.

Balance Long-Term Goals with Short-Term Needs

Chief Financial Officers should adopt a dual strategy for planning that effectively addresses both short-term operational requirements and long-term strategic goals.

- Set SMART Goals: Establish Specific, Measurable, Achievable, Relevant, and Time-bound goals that align with both immediate and future objectives. This structured approach not only clarifies priorities but also enhances accountability within the finance team. By setting SMART goals, financial leaders can ensure their financial planning is focused and effective, ultimately driving better outcomes.

- Master the Fund Conversion Cycle: Understanding and improving the fund conversion cycle is crucial for enhancing business performance. By implementing strategies to shorten the time required to convert investments into liquid assets, financial leaders can improve liquidity and reinvest in core strengths. This focus on cash flow management supports both immediate operational needs and long-term growth.

- Regular Review Meetings: Conduct frequent meetings with key stakeholders to assess progress towards these goals. A survey by Forrester found that 65% of financial executives report enhanced data security as a direct result of operational shifts, underscoring the importance of equipping finance teams with the right tools. This practice facilitates timely adjustments to strategies, ensuring the organization remains agile in response to changing circumstances.

- Resource Allocation: Strategically allocate resources to support both immediate operational needs and long-term investments, such as technology upgrades or market expansion. Effective resource management is essential for ensuring financial stabilization while sustaining growth and addressing current challenges. For instance, a retail company that adopted a new budgeting forecasting tool was able to allocate resources more effectively, resulting in a 15% increase in profitability over the subsequent fiscal year.

- Continuous Performance Monitoring: Utilize real-time analytics to continuously monitor business performance. This approach not only aids in promptly identifying issues but also fosters relationship-building through transparent communication with stakeholders. By operationalizing lessons learned from performance data, financial leaders can enhance decision-making processes and drive strategic improvements.

- Avoid Common Mistakes: Chief Financial Officers should be vigilant about common pitfalls in budget planning, such as neglecting to regularly update objectives or failing to communicate effectively with stakeholders. By proactively addressing these areas, CFOs can refine their financial planning processes, ultimately promoting financial stabilization and improved business health.

Conclusion

CFOs play a pivotal role in navigating the complexities of business finance, ensuring organizational growth and resilience. By conducting comprehensive financial assessments, they can gauge their organization’s financial health through key performance indicators and optimize processes that enhance cash flow and profitability.

Effective cash flow management is essential for financial stability. Strategies such as cash flow forecasting, optimizing receivables and payables, and maintaining a cash reserve equip CFOs to handle unexpected challenges. Moreover, utilizing real-time analytics facilitates quick adjustments and informed decision-making, thereby improving liquidity and operational performance.

Compliance with financial regulations holds equal importance. Regular training, internal audits, and collaboration with compliance experts ensure organizations meet legal obligations, safeguarding against penalties and fostering stakeholder trust.

Balancing long-term goals with short-term needs is vital for sustainable growth. By setting SMART goals, mastering the cash conversion cycle, and strategically allocating resources, CFOs can effectively align immediate needs with future aspirations. Continuous performance monitoring and proactive communication keep organizations agile in a changing market landscape.

In conclusion, the CFO’s role is critical in steering organizations toward success. By implementing these strategies, financial leaders can enhance oversight capabilities and drive sustainable growth, positioning their organizations to thrive in a competitive environment.

Frequently Asked Questions

What is involved in a comprehensive fiscal assessment?

A comprehensive fiscal assessment requires an in-depth examination of all monetary statements, including balance sheets, income statements, and cash flow statements.

What key performance indicators (KPIs) should CFOs prioritize during fiscal assessments?

CFOs should prioritize liquidity ratios, profitability margins, and debt levels to effectively assess the economic health of the organization.

How can saving and reinvesting money impact a business?

Saving a dollar and reinvesting it into the business can significantly enhance its future worth, highlighting the economic advantages of thorough evaluations.

What tools can enhance the fiscal assessment process?

The adoption of advanced fiscal analytics tools, along with comprehensive accounts payable (AP) and expenditure management software, can enhance the assessment process by providing real-time insights into performance metrics and improving data management efficiency.

Can you provide an example of how fiscal evaluations can improve cash flow?

A retail client improved their cash flow by 30% after identifying inefficiencies in inventory management through a thorough evaluation.

How often should financial evaluations be conducted for effective management?

Regular evaluations should be conducted quarterly to allow for timely modifications to strategies as necessary.

What role do external auditors or fiscal consultants play in financial assessments?

Involving external auditors or fiscal consultants provides an unbiased perspective on the organization’s economic situation, which is essential for financial stabilization and recognizing potential issues proactively.

Why is communication important during significant company changes?

Effective communication is crucial when planning significant company changes, as it promotes transparency and enhances the overall effectiveness of resource management practices.

What is the significance of recruiting and nurturing finance talent?

Recruiting and nurturing finance talent is essential for efficient assessments, which contribute to building a high-performance finance team and ultimately lead to improved business results.

What should CFOs be cautious about during financial assessments?

CFOs should be vigilant about common pitfalls in financial assessments to avoid misapplication of the practice and ensure effective evaluations.