Overview

This article presents five essential financial turnaround strategies that businesses can implement to achieve success. These strategies include:

- Cost reduction

- Revenue enhancement

- Debt restructuring

- Operational improvements

- Strategic planning

Each strategy is accompanied by practical steps and real-world examples, illustrating how targeted actions can stabilize financial performance and foster sustainable growth in organizations facing economic challenges. By applying these strategies, businesses can navigate financial difficulties with confidence and emerge stronger.

Introduction

In the dynamic realm of business, financial challenges can emerge unexpectedly, compelling organizations to seek effective turnaround strategies. These methodologies extend beyond mere survival; they are meticulously crafted to rejuvenate financial health and enhance operational effectiveness, empowering companies to emerge more robust.

From cost reduction and revenue enhancement to debt restructuring and operational improvements, a holistic approach is imperative for navigating these tumultuous times. By conducting comprehensive financial assessments and developing detailed turnaround plans, businesses can establish clear objectives and allocate resources judiciously.

Yet, the journey does not conclude there; the precise execution of these strategies and the continuous monitoring of progress are vital for attaining sustainable growth. This article explores the intricacies of financial turnaround strategies, providing insights and actionable steps for organizations determined to reclaim their financial footing and thrive in a competitive marketplace.

Understand Financial Turnaround Strategies

Monetary recovery approaches are organized methods intended to rejuvenate a company's economic well-being through effective financial turnaround strategies and operational efficiency. These approaches begin with a comprehensive evaluation of the current economic landscape, identifying critical issues, and implementing targeted actions to stabilize and improve performance. Key strategies include:

- Cost Reduction: Streamlining operations to eliminate unnecessary expenses is crucial. Recent data suggests that can significantly enhance a small business's economic health, allowing for better cash flow management and increased profitability.

- Revenue Enhancement: This involves identifying new revenue streams or optimizing existing ones. Companies that effectively diversify their income streams frequently observe a significant enhancement in their economic stability.

- Debt Restructuring: Engaging in discussions with creditors to obtain more favorable payment conditions can alleviate economic pressure. This strategy is particularly vital for medium-sized companies facing liquidity challenges, as it can lead to reduced liabilities and improved cash flow.

- Operational Improvements: Enhancing processes to boost efficiency and productivity is essential. Companies that adopt technology-enabled solutions often experience significant operational gains, contributing to overall financial recovery. In fact, the computer systems and design industry is expected to create over 574,000 positions in the next decade, underscoring the significance of technology adoption in fostering operational enhancements.

- Strategic Planning and Real-time Analytics: Identifying underlying organizational issues and planning solutions based on real-time data is critical for effective decision-making. By consistently tracking performance and applying lessons learned, companies can adjust swiftly to evolving situations and improve their recovery plans. Furthermore, grasping the cash conversion cycle is essential, as it assists companies in managing their cash flow more efficiently and enhancing their economic performance. The 'Test & Measure' method guarantees that companies can confirm their plans through data-informed decision-making, enabling modifications based on real-time insights, which is essential for successfully managing financial turnaround strategies. As the landscape changes, staying updated on recent trends and expert views on recovery strategies will enable businesses to make educated choices and attain sustainable growth. For instance, the home health and personal care sector is expected to see considerable job growth, fueled by an aging population. This demonstrates how operational enhancements and revenue growth strategies can lead to successful economic recoveries in particular industries.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive monetary assessment, follow these essential steps:

- Gather Fiscal Statements: Compile the last three years of fiscal statements, including income statements, balance sheets, and cash flow statements. This historical data is vital for understanding the company's economic position.

- Analyze Key Metrics: Evaluate critical economic ratios such as liquidity, profitability, and leverage ratios. These metrics offer a glimpse of the company's economic well-being and operational efficiency, which is essential for pinpointing areas requiring enhancement.

- Identify Trends: Examine trends in revenue, expenses, and cash flow to gauge the company's financial trajectory. Recognizing these patterns can help pinpoint potential issues before they escalate.

- Benchmark Against Industry Standards: Compare your findings with industry benchmarks. This comparison will highlight areas where the company may be underperforming, enabling focused approaches to improve performance. Significantly, small and medium-sized enterprises are urged to implement best practices from larger companies to scale efficiently and prevent typical budgeting errors.

- Engage Stakeholders: Involve key stakeholders in the assessment process. Their insights can offer valuable viewpoints and encourage support for the financial turnaround strategies developed from the evaluation. Carrying out this comprehensive monetary assessment is vital for guiding the subsequent steps in the turnaround process.

With almost half (49%) of small enterprise owners characterizing their operations as stable yet not expanding, a thorough economic assessment can reveal opportunities for sustainable growth and operational efficiency. Moreover, 44% of small enterprise owners assert they lack the resources and knowledge required for successful AI implementation, emphasizing the importance of financial turnaround strategies and to allocate resources efficiently. By leveraging best practices from industry leaders and operationalizing lessons learned, organizations can avoid common pitfalls and strategically position themselves for success. As noted by MountainSeed, gaining insights into individual client profitability and product line performance can lead to strategic investments in the most successful offerings.

Create a Detailed Turnaround Plan

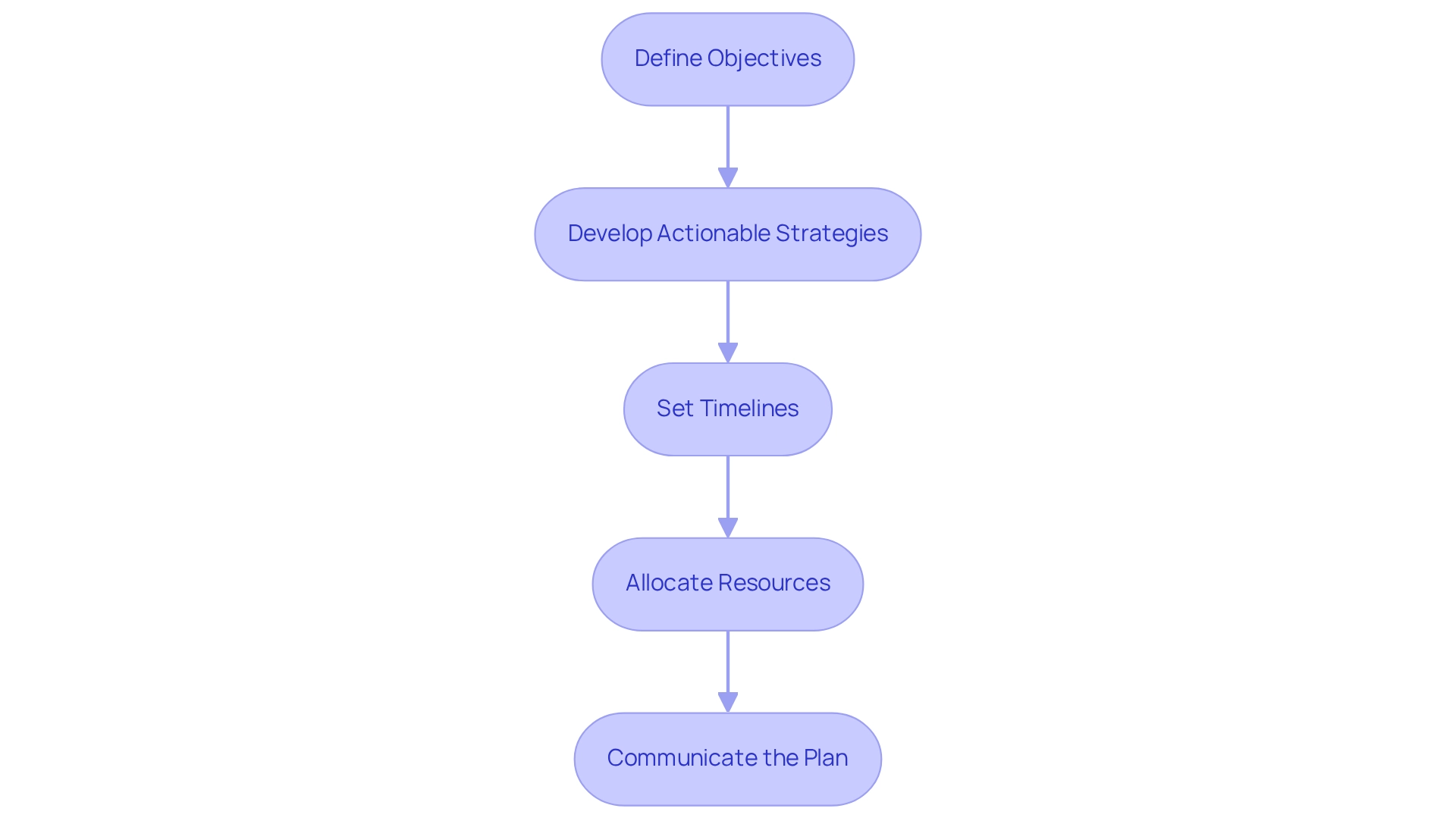

Creating a detailed turnaround plan involves several critical steps that can significantly enhance a business's chances of recovery and growth:

- Define Objectives: Start by clearly outlining , such as improving cash flow, reducing debt, or increasing profitability. Setting specific, measurable objectives is essential for tracking progress.

- Develop Actionable Strategies: Identify targeted strategies for each objective. This may include implementing cost-cutting measures, enhancing revenue through marketing initiatives, or streamlining operations to improve efficiency. For instance, the Dr Pepper Snapple Group's adoption of financial services automation led to a cost reduction of $2.5 million, showcasing the impact of strategic operational improvements. Moreover, financial turnaround strategies that focus on speeding up the receipt of payments from clients can greatly enhance available cash flow, which is essential during a recovery. Testing every hypothesis in your strategy ensures that you are maximizing the return on invested capital in both the short and long term.

- Set Timelines: Establish realistic timelines for each action item. This ensures that progress can be monitored effectively and adjustments can be made as necessary. Timelines should be flexible yet firm enough to maintain momentum, allowing for a shortened decision-making cycle that empowers your team to take decisive action.

- Allocate Resources: Assess and allocate the necessary resources for implementation, including personnel, budget, and technology. Ensuring that the right resources are in place is crucial for implementing the recovery plan successfully. Remember, inefficient communication can waste valuable time; for example, spending three hours a day on emails can add up to 20 weeks and five months per year. Utilizing real-time business analytics through a client dashboard can help continually diagnose your business health and optimize resource allocation.

- Communicate the Plan: Transparency is key. Share the recovery plan with all stakeholders to foster collaboration and buy-in. Effective communication helps align everyone’s efforts towards common goals. As Gary Vaynerchuk wisely stated, "Legacy is greater than currency," emphasizing the importance of long-term profitability through informed decision-making and applying the lessons learned throughout the recovery process.

By following these steps, organizations can create a comprehensive recovery plan that not only offers clarity and direction but also utilizes financial turnaround strategies to position them for sustainable growth. In 2025, businesses that prioritize informed decision-making and focus on long-term profitability will be better equipped to navigate challenges and seize opportunities.

Execute Turnaround Strategies Effectively

To implement financial turnaround strategies effectively, consider the following key practices:

- Establish a Leadership Team: Form a dedicated group responsible for managing the implementation of the recovery plan. This team should include members with diverse expertise to address various aspects of the business. Each Executive Assistant works 40 hours per week, emphasizing the significance of committed resources in implementing recovery strategies.

- Monitor Progress Regularly: Implement a robust system for tracking progress against established timelines and objectives. Regular monitoring of financial turnaround strategies allows for timely adjustments and ensures that the strategies remain on course. Employing real-time analytics via a client dashboard can offer a comprehensive perspective on performance, enabling necessary modifications and ongoing assessment of organizational health.

- Communicate Frequently: Maintain open lines of communication with all stakeholders. Frequent updates foster alignment and enable the team to address concerns promptly, which is vital for maintaining trust and engagement. This ensures consistency, strong rapport, and long-term impact on your business operations.

- Be Flexible: Adapt strategies based on real-time feedback and evolving circumstances. Adaptability is crucial in managing the intricacies of a recovery, enabling the organization to adjust as necessary. The capability to evaluate hypotheses and make swift choices based on data can greatly improve the efficiency of financial turnaround strategies.

- Celebrate Milestones: Recognize and celebrate achievements throughout the process. Recognizing progress enhances morale and motivation, strengthening the dedication to the recovery objectives. As shown by clients who have successfully adopted the 'Rapid30' plan, celebrating milestones can lead to and enhanced financial positioning.

Effective implementation of these approaches requires steadfast dedication and flexibility, ensuring that the organization stays focused on its goals and can react to challenges as they occur.

Monitor Progress and Adjust Strategies

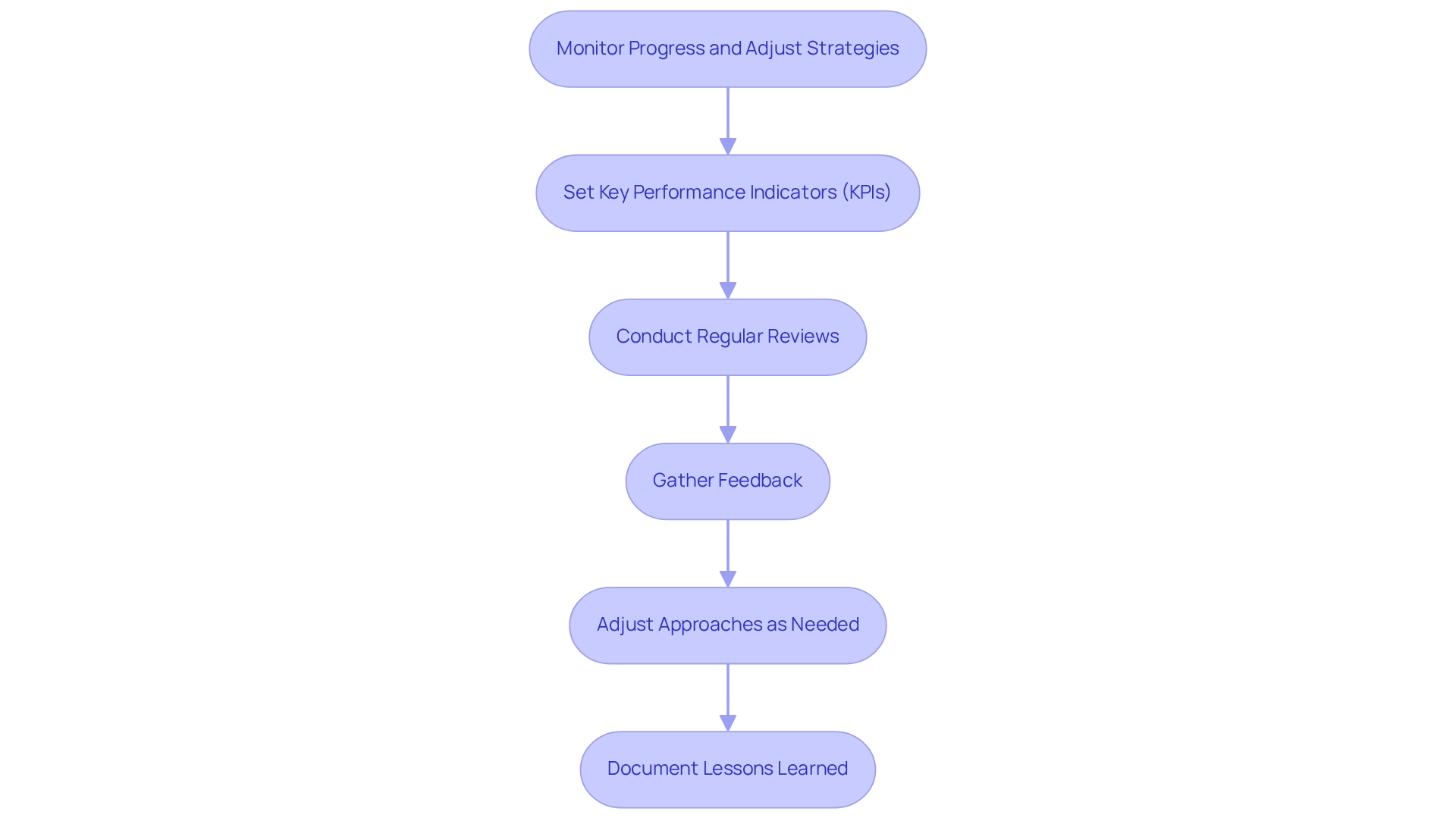

To effectively monitor progress and adjust response strategies, consider the following steps:

- Set (KPIs): Establish KPIs that directly align with your recovery objectives. These metrics are essential for measuring success and guiding decision-making, ensuring that your team can test hypotheses and deliver maximum return on invested capital.

- Conduct Regular Reviews: Implement a schedule for regular review meetings to evaluate progress against the KPIs and overall goals. Research shows that regular review meetings greatly improve performance in small to medium enterprises (SMEs), with statistics demonstrating that organizations that conduct frequent reviews experience a noticeable enhancement in their efficiency. This aligns with the need for real-time business analytics, facilitated by tools such as the client dashboard, to continuously assess your business health.

- Gather Feedback: Actively seek feedback from team members and stakeholders. This input is crucial for identifying obstacles and areas that require improvement, ensuring that all perspectives are considered. By implementing the lessons learned through the recovery process, you can cultivate strong, lasting relationships within your team.

- Adjust Approaches as Needed: Be prepared to pivot or modify plans based on performance data and feedback. Quick, informed choices are essential in recovery situations, as they can guide the organization toward restoration.

- Document Lessons Learned: Keep a thorough account of what methods are effective and which are not. This documentation will be invaluable for informing future improvement efforts and refining your approach. For instance, Allison Dunn's Business Coaching has demonstrated that through strategic leadership and effective financial turnaround strategies, businesses can clarify their paths and implement actionable plans that lead to significant improvements in performance. By continuously monitoring and adjusting their financial turnaround strategies, businesses can adeptly navigate the complexities of a turnaround, significantly increasing their chances of achieving sustainable success. The commitment to operationalizing lessons learned, combined with emerging technologies such as AI and blockchain, can further streamline these processes, making it easier to adapt to changing circumstances and enhance the effectiveness of monitoring efforts.

Conclusion

The complexities of financial turnaround strategies underscore their critical role in revitalizing a company's financial health and operational effectiveness. By employing a structured methodology that encompasses:

- Cost reduction

- Revenue enhancement

- Debt restructuring

- Operational improvements

organizations can stabilize and enhance their performance. A thorough financial assessment serves as the foundation for these strategies, enabling businesses to identify key metrics, analyze trends, and benchmark against industry standards. This comprehensive approach not only reveals opportunities for growth but also aligns the organization towards a common goal.

Creating a detailed turnaround plan is essential for directing efforts and ensuring accountability. By defining clear objectives, developing actionable strategies, and establishing realistic timelines, businesses can effectively navigate the challenges of recovery. The execution phase emphasizes the necessity of a dedicated leadership team, regular monitoring, and open communication, all of which are vital for maintaining momentum and adapting to evolving circumstances.

Ultimately, continuous monitoring and the willingness to adjust strategies based on performance data are crucial for achieving sustainable success. Businesses that embrace these practices will not only recover from financial setbacks but also emerge stronger and more resilient in a competitive marketplace. As organizations prioritize informed decision-making and operational efficiency, they position themselves to seize opportunities and thrive in an ever-changing business landscape.

Frequently Asked Questions

What are monetary recovery approaches?

Monetary recovery approaches are organized methods aimed at restoring a company's economic health through effective financial turnaround strategies and operational efficiency.

What are the key strategies involved in monetary recovery?

Key strategies include cost reduction, revenue enhancement, debt restructuring, operational improvements, and strategic planning with real-time analytics.

How does cost reduction benefit a business?

Cost reduction involves streamlining operations to eliminate unnecessary expenses, which can significantly enhance a small business's economic health, improve cash flow management, and increase profitability.

What does revenue enhancement entail?

Revenue enhancement involves identifying new revenue streams or optimizing existing ones to improve economic stability.

Why is debt restructuring important for companies?

Debt restructuring is crucial as it allows companies to negotiate more favorable payment terms with creditors, alleviating economic pressure, particularly for medium-sized companies facing liquidity challenges.

What role do operational improvements play in financial recovery?

Operational improvements enhance processes to boost efficiency and productivity, often leading to significant operational gains and contributing to overall financial recovery.

How can strategic planning and real-time analytics aid in recovery?

Strategic planning and real-time analytics help identify organizational issues and enable data-informed decision-making, allowing companies to adjust their recovery plans based on performance tracking and evolving situations.

What steps are involved in conducting a comprehensive monetary assessment?

Steps include gathering fiscal statements, analyzing key metrics, identifying trends, benchmarking against industry standards, and engaging stakeholders.

Why is it important to benchmark against industry standards during a monetary assessment?

Benchmarking against industry standards highlights areas of underperformance, enabling focused approaches to improve performance and implement best practices.

How can engaging stakeholders benefit the financial assessment process?

Engaging stakeholders provides valuable insights and encourages support for the financial turnaround strategies developed from the assessment.

What is the significance of understanding cash conversion cycles in financial recovery?

Grasping the cash conversion cycle helps companies manage their cash flow more efficiently, enhancing overall economic performance.