Overview

This article delves into the critical questions CFOs must address for effective stakeholder management. It underscores the necessity of:

- Identifying key stakeholders

- Understanding their historical context

- Clarifying roles

- Assessing values

- Fostering collaboration

Each of these components is essential for aligning financial strategies with stakeholder expectations, thereby enhancing overall organizational success. This is further illustrated by the discussion on the benefits of proactive engagement and clear communication, which serve as vital tools for CFOs aiming to navigate the complexities of stakeholder relationships.

Introduction

Navigating the intricate landscape of financial decision-making demands that chief financial officers (CFOs) master the art of stakeholder management. By identifying and engaging key stakeholders—from investors to employees—CFOs can align their financial strategies with the diverse interests that drive organizational success.

However, the challenge lies not only in recognizing who these stakeholders are but also in understanding what they truly value and how their historical interactions can inform current practices.

How can CFOs effectively leverage this knowledge to foster collaboration and enhance financial outcomes?

Identify Key Stakeholders: Who Influences Your Financial Decisions?

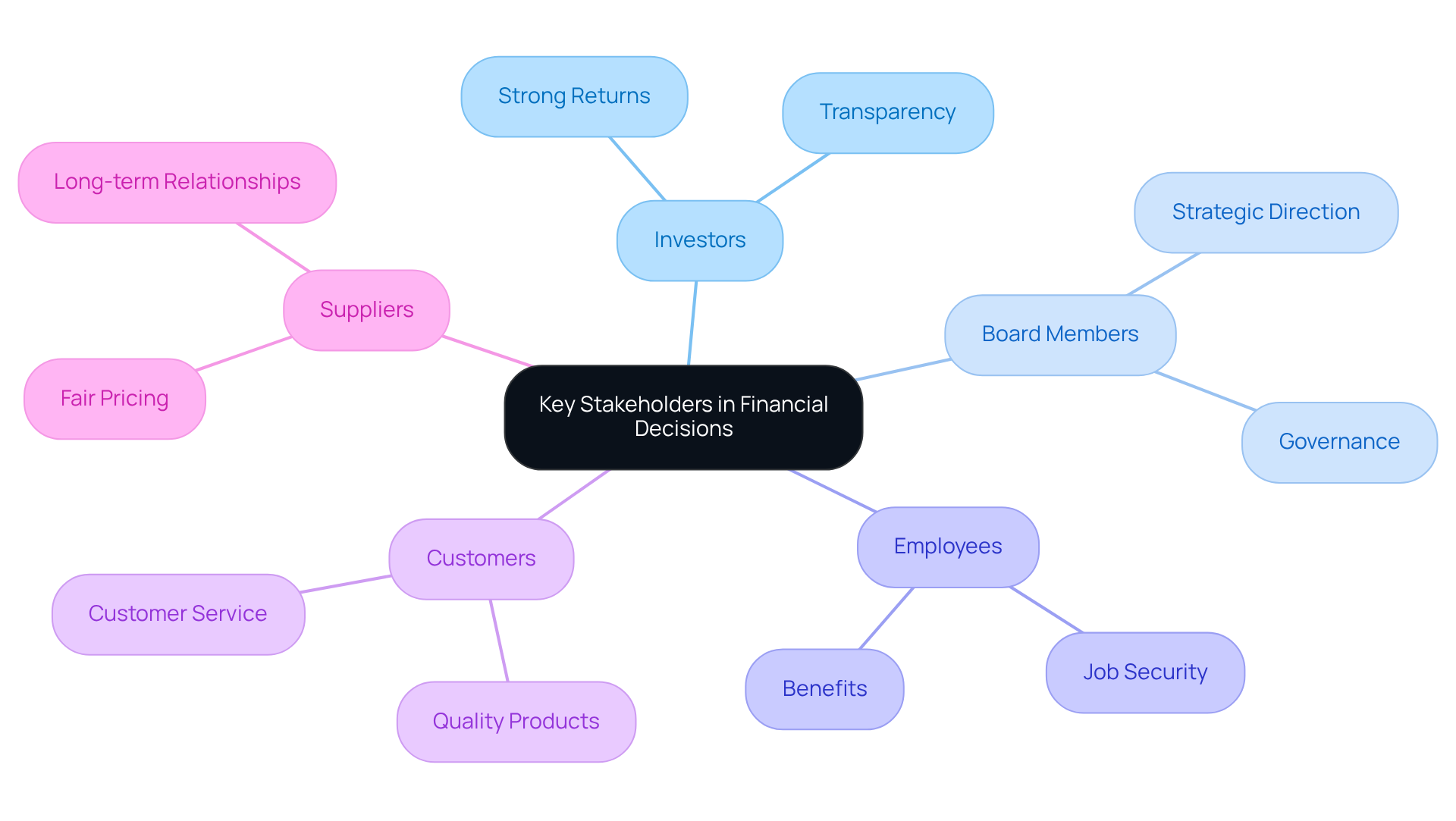

CFOs must prioritize mapping important parties by identifying the 5 key questions of stakeholder management, which include key groups such as:

- Investors

- Board members

- Employees

- Customers

- Suppliers

Each group possesses distinct interests in the organization's economic well-being. For instance, investors seek strong returns, while employees prioritize job security and benefits. Involving these interested parties through regular updates and feedback sessions is crucial for aligning monetary strategies with their expectations. This proactive approach not only enhances decision-making but also builds trust, which is essential for navigating the complexities of finance in 2025. Companies that excel in engaging their parties can experience a significant boost in profits, underscoring the value of effective communication and relationship management.

Understand Stakeholder History: What Background Information is Essential?

CFOs must prioritize the collection of thorough information on previous interactions with interested parties, including:

- Historical economic performance

- Communication styles

- Any past grievances

This historical data is crucial for informing current strategies and preventing the repetition of past mistakes. For instance, if an interested party has previously expressed concerns regarding transparency, the CFO can take proactive steps by offering comprehensive monetary reports and frequent updates to address these issues directly.

Moreover, understanding the historical context enables chief financial officers to foresee possible objections or support during budgetary discussions, fostering a more cooperative atmosphere. By leveraging insights from previous interactions, financial executives can enhance their communication approaches, ultimately resulting in stronger relationships and improved financial outcomes.

Furthermore, conducting a comprehensive business review can inform these strategies, ensuring alignment with company goals. Integrating real-time analytics into this process allows financial leaders to consistently observe participant engagement and adjust their strategies as necessary, enhancing strengths and applying insights gained from prior interactions.

Clarify Stakeholder Roles: What Responsibilities Does Each Stakeholder Hold?

Financial executives must establish clear definitions for the roles of each participant group to enhance collaboration and communication. For instance, while investors are responsible for providing capital, the finance team manages budget allocations. By delineating these roles, CFOs can foster a more unified environment where participants understand their contributions and responsibilities.

Regular meetings should be instituted to ensure alignment on financial strategies and responsibilities, reinforcing accountability among all parties involved. This organized approach not only empowers participants but also leads to improved project success rates.

Organizations with clearly defined participant plans experience an impressive 83% success rate, in stark contrast to the mere 32% observed in those without. Moreover, clarity in roles has been proven to boost employee efficiency by 53%, highlighting the essential nature of this practice in driving organizational success.

Assess Stakeholder Values: What Matters Most to Your Stakeholders?

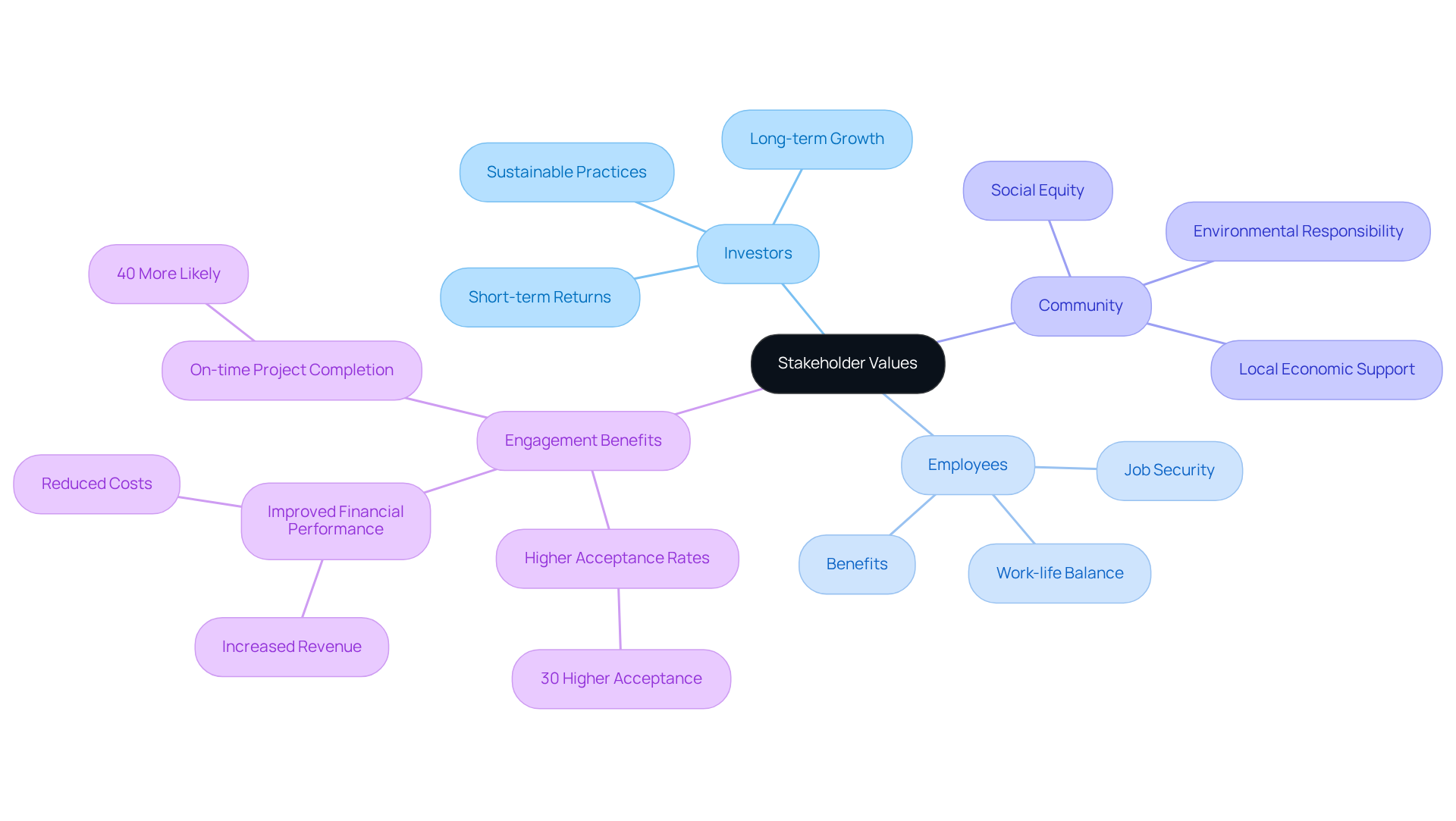

Chief financial officers must proactively conduct surveys or foster conversations to gauge what holds the most significance for their constituents. For example, while investors may prioritize short-term returns, employees typically value job security and benefits. Understanding these diverse values enables CFOs to tailor financial strategies that align with the expectations of stakeholders. If stakeholders demonstrate a strong interest in sustainable practices, the CFO can explore green financing options or investments in sustainable technologies. This alignment not only addresses the needs of stakeholders but also bolsters the organization's reputation and long-term viability.

Studies indicate that businesses integrating input from stakeholders into their financial plans experience a 30% higher acceptance rate of new initiatives, underscoring the critical role of engagement from these groups in achieving successful economic outcomes. Moreover, case studies reveal that organizations with effective engagement strategies are 40% more likely to complete projects on time and within budget, illustrating the tangible benefits of aligning financial decisions with community values.

Collaborate for Success: What Can Be Accomplished Together with Stakeholders?

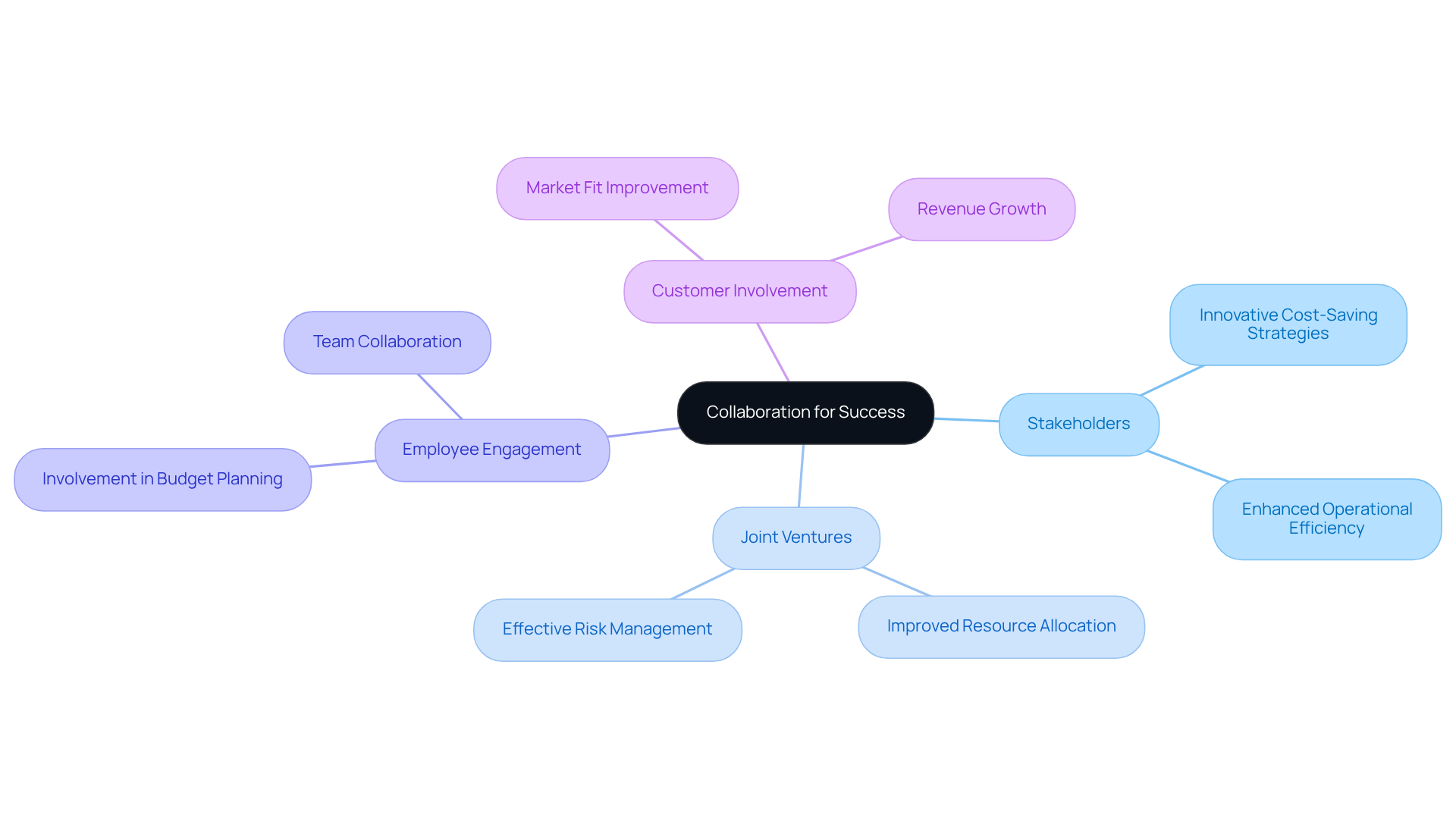

Financial executives must actively pursue collaboration opportunities with interested parties, encompassing joint ventures, partnerships, and projects that harness the strengths of diverse groups. For instance, involving employees in budget planning discussions can yield innovative cost-saving strategies and enhance operational efficiency. Engaging customers in product development not only improves market fit but also drives revenue growth. By fostering a cooperative atmosphere, financial executives can leverage the collective knowledge of their stakeholders, enabling them to address economic challenges more effectively.

Successful joint ventures initiated by chief financial officers have demonstrated significant impacts on performance, illustrating how strategic partnerships can enhance resource allocation and risk management. The commitment to operationalizing lessons learned during the turnaround process is crucial, as evidenced by the case study on 'Team Collaboration in Finance,' which reveals how fostering teamwork within the finance department can lead to improved decision-making.

Furthermore, utilizing a client dashboard for real-time business analytics empowers CFOs to continuously monitor business health and make informed decisions. As we approach 2025, the advantages of joint ventures in financial planning will become increasingly essential, equipping organizations to adapt to market changes and optimize their financial strategies.

Conclusion

Effective stakeholder management is crucial for CFOs aiming to navigate the complexities of financial decision-making. By identifying and engaging key stakeholders—such as investors, board members, employees, customers, and suppliers—CFOs can align their financial strategies with the diverse interests of these groups. This alignment not only enhances trust and communication but also leads to improved financial outcomes and organizational success.

The article outlines several key considerations for CFOs, including:

- The importance of understanding stakeholder history

- Clarifying roles

- Assessing values

- Fostering collaboration

By leveraging historical data, clearly defining responsibilities, and actively seeking stakeholder input, CFOs can create a more cohesive financial strategy that reflects the priorities of all parties involved. The benefits of such engagement are evident; organizations that prioritize stakeholder collaboration experience higher project success rates and improved acceptance of new initiatives.

Ultimately, the significance of stakeholder management cannot be overstated. As financial landscapes evolve, the ability to effectively engage and collaborate with stakeholders will become increasingly vital. CFOs are encouraged to adopt a proactive approach, utilizing insights from stakeholder interactions to inform their financial strategies and drive sustainable growth. Embracing this collaborative mindset not only enhances decision-making but also positions organizations to thrive in an ever-changing financial environment.

Frequently Asked Questions

Who are the key stakeholders that influence financial decisions?

The key stakeholders include investors, board members, employees, customers, and suppliers. Each group has distinct interests in the organization's economic well-being.

What interests do different stakeholders have regarding the organization?

Investors seek strong returns, employees prioritize job security and benefits, while other stakeholders may have varied interests related to their engagement with the organization.

Why is it important to involve stakeholders in financial decision-making?

Involving stakeholders through regular updates and feedback sessions enhances decision-making, builds trust, and aligns monetary strategies with their expectations, which is essential for navigating financial complexities.

What historical information should CFOs collect about stakeholders?

CFOs should collect information on historical economic performance, communication styles, and any past grievances related to their interactions with stakeholders.

How does understanding stakeholder history benefit CFOs?

Understanding stakeholder history helps CFOs inform current strategies, prevent past mistakes, and foresee possible objections or support during budgetary discussions, fostering a more cooperative atmosphere.

What role does real-time analytics play in stakeholder engagement?

Real-time analytics allows financial leaders to consistently observe participant engagement and adjust their strategies as necessary, enhancing strengths and applying insights gained from prior interactions.

How can effective communication and relationship management impact a company's profits?

Companies that excel in engaging their stakeholders through effective communication and relationship management can experience a significant boost in profits, highlighting the importance of these practices.