Overview

This article outlines five essential leadership strategies that CFOs can employ during crises to effectively navigate challenges. These strategies include:

- Maintaining open communication

- Prioritizing employee well-being

- Making data-driven decisions

- Fostering collaboration

- Adapting quickly

Evidence supports these strategies, demonstrating that transparent communication enhances job satisfaction and that organizations with diverse leadership teams perform better. This emphasizes the critical role of proactive and empathetic leadership in ensuring resilience and effective crisis management.

Introduction

In today's unpredictable business landscape, the role of leadership during a crisis is undeniably critical. As organizations grapple with challenges ranging from economic downturns to unforeseen global events, the effectiveness of leadership can either bolster or undermine a company's resilience. CFOs, in particular, find themselves at the forefront of navigating these turbulent waters, tasked not only with making swift decisions but also with fostering a culture of trust and transparency within their teams.

By prioritizing employee well-being, leveraging data-driven insights, and implementing strategic communication, leaders can effectively steer their organizations toward stability and growth. This article delves into essential strategies that CFOs must adopt to enhance their leadership effectiveness during crises, ensuring they are well-equipped to meet both immediate challenges and long-term objectives.

Understand the Importance of Leadership in Crisis Management

Effective leadership strategies in crisis transcend mere decision-making; they fundamentally revolve around instilling confidence and nurturing a resilient organizational culture. CFOs hold a pivotal role in shaping their organization’s response to adversity, as their management approach profoundly influences overall resilience. Effective leaders prioritize transparent communication, employee well-being, and a clear vision—key components of leadership strategies in crisis that are essential for navigating turbulent times.

In turnaround scenarios, decisive action becomes critical; businesses must stabilize their financial position and refine operations to safeguard both short and long-term value. Statistics reveal that organizations with exceptional guidance experience 147% higher earnings per share, underscoring the financial benefits of robust management during crises. Furthermore, companies investing in management development are more likely to outpace their competitors, highlighting the necessity of strong training programs to equip leaders for future challenges.

Notably, a study found that 86 percent of high-potential workers reported feelings of fatigue by the end of the day, a 27 percent increase from the previous year, emphasizing the importance of addressing employee fatigue through effective leadership. To implement these leadership strategies in crisis, financial executives should develop and pilot initiatives that facilitate a reduced decision-making cycle, ensuring their teams remain focused on strategic objectives, even amidst uncertainty.

By adopting a proactive, empathetic, and flexible approach, and utilizing real-time analytics to assess business health, financial leaders can enhance their response to challenges, apply lessons learned, and foster long-term organizational success.

Evaluate Current Leadership Strategies and Identify Gaps

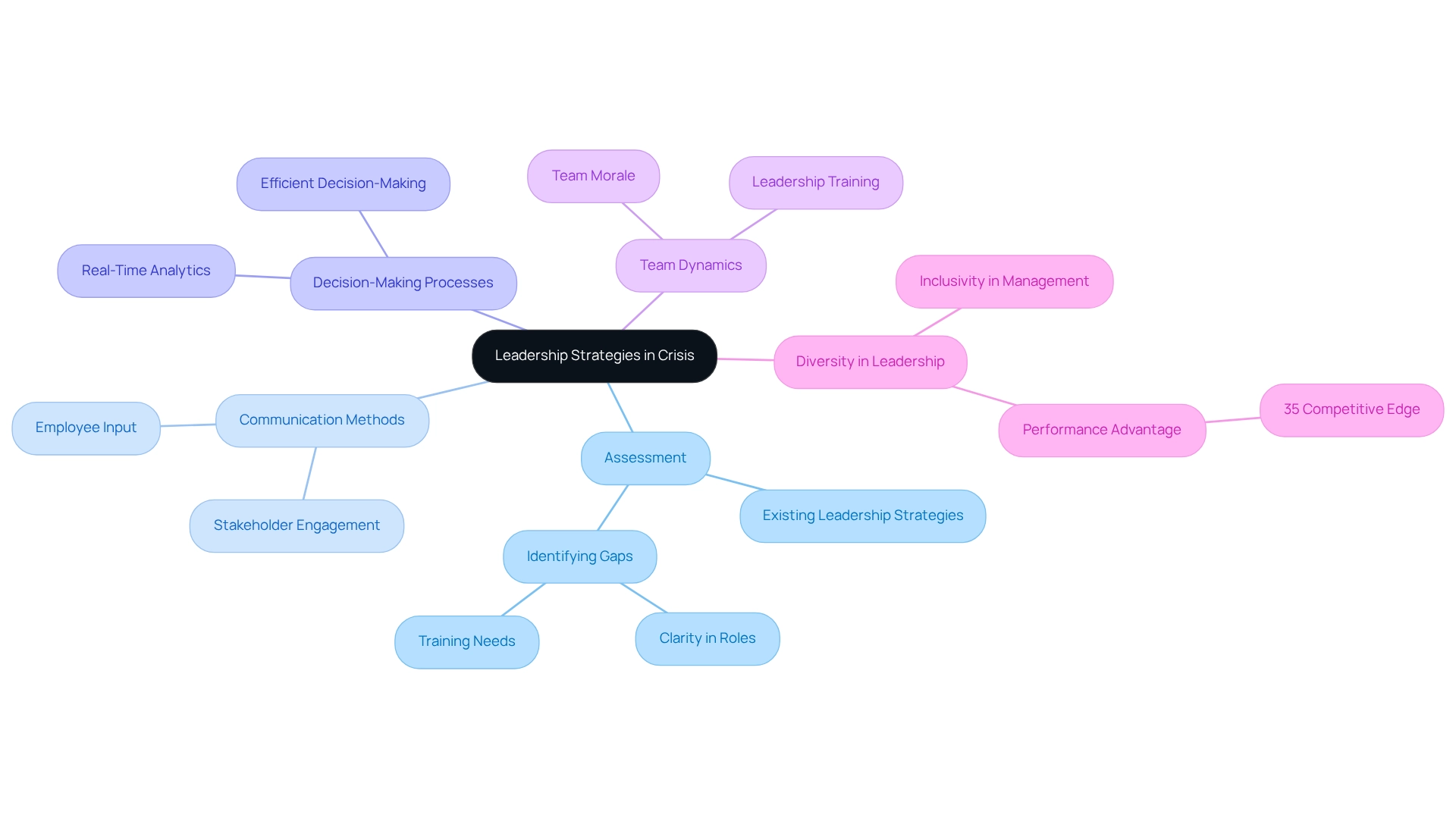

To effectively manage an emergency, CFOs must conduct a comprehensive assessment of their existing leadership strategies in crisis. This evaluation should encompass communication methods, decision-making processes, and team dynamics. Recognizing gaps that may obstruct efficient emergency response is essential; for instance, a lack of clarity in roles or insufficient training for team members can significantly hinder performance. Engaging with input from employees and stakeholders provides critical perspectives on the organization's management landscape. By identifying these gaps, CFOs can introduce targeted enhancements, ultimately improving leadership strategies in crisis and enhancing management effectiveness during emergencies.

Significantly, organizations with diverse executive teams have demonstrated a 35% advantage over their rivals, underscoring the importance of leadership strategies in crisis scenarios. Furthermore, the Asia Pacific region is noteworthy, with 27% of women occupying senior management roles, emphasizing the necessity for inclusivity in positions of authority. As guidance in 2025 is anticipated to be more human-focused, emphasizing compassion and ongoing education, finance executives who adopt leadership strategies in crisis will be better positioned to navigate their organizations through challenging periods.

Moreover, investing in management training can yield substantial organizational benefits, including enhanced financial performance and . To further refine their approaches, financial executives should prioritize efficient decision-making processes and leverage real-time analytics to continuously assess business performance. This strategy not only aids in evaluating business wellness but also implements insights gleaned from past experiences, highlighting the importance of reviewing and enhancing leadership strategies in crisis during challenging times.

Implement Key Leadership Actions During a Crisis

In times of crisis, CFOs must implement several essential leadership strategies to effectively navigate challenges:

- Communicate Regularly: Maintaining open lines of communication with all stakeholders is vital. Regular updates not only alleviate uncertainty but also foster trust within the organization. Statistics indicate that employees who experience transparent communication report 12 times higher job satisfaction compared to those in environments with poor communication. It is essential that only authorized personnel communicate on behalf of the company during an emergency, and staff should be supplied with talking points for external inquiries.

- Prioritize Employee Well-being: Supporting employees is crucial during turbulent times. This support can manifest through mental health resources, flexible work arrangements, and open forums for discussion, ensuring that staff feel valued and heard. In line with YuLife's beliefs, well-being should be available daily for all staff, emphasizing the significance of prioritizing their mental health in challenging times.

- Make Data-Driven Decisions: Leveraging financial data and analytics is essential for informed decision-making. This method enables financial executives to evaluate the crisis's effect precisely and formulate suitable reactions, ensuring that plans are based in reality. By testing hypotheses and employing real-time analytics, CFOs can oversee business health continuously and modify approaches as necessary, maximizing the return on invested capital.

- Foster Collaboration: Encouraging teamwork across departments can yield diverse perspectives and innovative solutions. Collaboration not only enhances problem-solving but also strengthens the organizational culture during challenging times.

- Adapt Quickly: The ability to pivot strategies in response to new information is critical. Adaptability in emergency management allows organizations to react efficiently to changing situations, guaranteeing resilience and continuity. By applying lessons learned from past experiences, financial leaders can streamline decision-making processes and enhance overall performance monitoring.

A case study from the early pandemic highlights the importance of preparedness; a survey revealed that 75% of companies faced , with 90% anticipating lasting impacts. This interconnectedness emphasizes the need for financial leaders to be proactive in emergency planning and communication. As Zach Capers, a senior analyst at Capterra, notes, "Keep in mind that each member should have a backup person chosen to ensure coverage in case the primary is absent or otherwise unavailable during the event." This underscores the necessity for preparedness and clear communication strategies.

Create a Tailored Crisis Management Plan for Your Organization

For CFOs to efficiently handle challenges, it is vital to develop a customized emergency management strategy that incorporates leadership strategies in crisis. The process involves several key steps:

- Risk Evaluation: Start by recognizing possible emergencies that could affect your organization, including financial, operational, and reputational hazards. Statistics show that almost two-thirds of organizations encounter understaffed cybersecurity teams, which can worsen vulnerabilities during an emergency. This highlights the critical need for CFOs to assess cybersecurity risks as part of .

- Define Roles and Responsibilities: Clearly outline the duties of each team member during an emergency. Form a disaster management team with specified roles to guarantee prompt and efficient action.

- Develop Response Protocols: Create specific procedures for responding to various types of crises. This should include communication plans, operational adjustments, and resource allocation. Effective risk treatment strategies, such as avoidance and reduction, should be integrated into these protocols. Moreover, leveraging real-time analytics through a client dashboard can help monitor the effectiveness of these protocols and adjust them as necessary.

- Training and Drills: Regular training sessions are crucial. Conduct drills to ensure that all team members comprehend their roles and can react swiftly when an emergency occurs. This preparation is vital, as studies show that just one hour of downtime can cost small businesses up to $10,000. Furthermore, the costs associated with post-incident activities can be significant, with $179,209 spent on containment and $125,221 on remediation, underscoring the necessity of thorough training and preparedness. Incorporating lessons learned from past incidents into training can enhance team readiness and operational efficiency, operationalizing these lessons for future crises.

- Review and Revise: Continuously assess and update the emergency management plan based on lessons learned from previous incidents and evolving organizational needs. Nearly 75% of executives think substantial adjustments are required in their strategy for business continuity planning and emergency management. This serves as a prompt for financial officers to adjust their leadership strategies in crisis, taking into account the changing challenges. A thorough financial assessment can also uncover opportunities for cash preservation and liability reduction, further strengthening the organization’s resilience. Evaluating hypotheses during this review process can guarantee that the approaches employed are effective and based on data.

By adhering to these steps, financial leaders can develop a strong management plan that not only tackles urgent challenges but also prepares the organization for sustained resilience and growth.

Review and Adapt Leadership Strategies After a Crisis

In the wake of an emergency, CFOs must reevaluate their leadership strategies in crisis to enhance readiness for future challenges. This critical process encompasses several key steps:

- Conduct a Post-Mortem Analysis: Assess the effectiveness of measures implemented during the emergency. Gather input from team members and stakeholders to gain a comprehensive understanding of which approaches succeeded and which fell short.

- Identify Lessons Learned: Document crucial insights that can guide future emergency management efforts. Focus on areas such as communication effectiveness, decision-making processes, and team dynamics to bolster overall responsiveness. Implementing these lessons is vital for establishing strong, lasting connections within the organization and ensuring that insights are effectively integrated into future strategies.

- Update the Crisis Management Plan: Revise based on findings from the analysis. Incorporate new strategies and protocols that reflect the lessons learned, ensuring a more robust framework for future incidents. This revision should include a commitment to real-time analytics that continuously monitor business performance and health, utilizing tools such as dashboards and performance metrics.

- Invest in Leadership Development: Strengthen leadership capabilities within the organization by providing targeted training and resources. This investment ensures that leaders possess the necessary skills and adopt effective leadership strategies in crisis to navigate future crises, supporting a streamlined decision-making process.

- Foster a Culture of Resilience: Cultivate an organizational mindset that values adaptability and resilience. Encourage teams to view challenges as opportunities for growth, preparing them to respond effectively to unforeseen circumstances. Rachel Marcuse, COO at ReadySet, highlights that quieter staff may need encouragement to voice their ideas in remote work settings, underscoring the importance of communication in fostering resilience.

Statistics reveal that 1 in 5 small to medium-sized business executives lacks a recovery plan, emphasizing the necessity of these strategies. Furthermore, with nearly 600,000 companies shutting down annually in the U.S. due to various challenges, the significance of effective risk management and guidance cannot be overstated. As Jim Lucy asserts, "Effective leadership during a crisis is not just about making decisions; it's about fostering an environment where every team member feels empowered to contribute." By implementing leadership strategies in crisis, CFOs can position their organizations for sustainable growth and resilience in the face of adversity.

Conclusion

Effective leadership during a crisis is not just beneficial; it is essential for navigating challenges and fostering organizational resilience. This article outlines key strategies that CFOs can adopt to enhance their leadership effectiveness, emphasizing the critical importance of transparent communication, employee well-being, and data-driven decision-making. By prioritizing these elements, leaders can cultivate a culture of trust and adaptability, enabling their organizations to weather turbulent times and emerge stronger.

Moreover, the necessity of evaluating current leadership strategies and identifying gaps cannot be overstated. Engaging with employees and stakeholders provides invaluable insights that can lead to targeted improvements. As organizations increasingly recognize the value of diverse and inclusive leadership, CFOs must adapt to evolving trends to remain competitive and effective in crisis management.

Creating a tailored crisis management plan is another pivotal step towards ensuring organizational resilience. By conducting thorough risk assessments, defining roles, and implementing training programs, CFOs can prepare their teams to respond swiftly and effectively during crises. Continuous review and adaptation of these strategies will further enhance readiness for future challenges.

In conclusion, the role of CFOs in shaping leadership during crises is undeniably critical. By embracing proactive and empathetic leadership approaches, investing in development, and fostering a culture of resilience, organizations can not only survive crises but also thrive in their aftermath. The commitment to continuous improvement and strategic foresight will ultimately position organizations for sustainable growth in an unpredictable business landscape.

Frequently Asked Questions

What are the key components of effective leadership strategies in crisis?

Effective leadership strategies in crisis revolve around instilling confidence, nurturing a resilient organizational culture, transparent communication, employee well-being, and maintaining a clear vision.

What role do CFOs play in crisis management?

CFOs play a pivotal role in shaping their organization’s response to adversity through their management approach, which significantly influences overall resilience.

Why is decisive action critical during turnaround scenarios?

Decisive action is critical in turnaround scenarios to stabilize the financial position of businesses and refine operations, safeguarding both short and long-term value.

How do organizations with exceptional guidance perform financially during crises?

Organizations with exceptional guidance experience 147% higher earnings per share, highlighting the financial benefits of robust management during crises.

What impact does employee fatigue have on leadership in crisis?

A study found that 86 percent of high-potential workers reported feelings of fatigue by the end of the day, a 27 percent increase from the previous year, indicating the importance of addressing employee fatigue through effective leadership.

What should CFOs do to improve their leadership strategies in crisis?

CFOs should conduct a comprehensive assessment of existing leadership strategies, identify gaps, engage with employee input, and introduce targeted enhancements to improve management effectiveness during emergencies.

What advantages do diverse executive teams have in crisis situations?

Organizations with diverse executive teams have demonstrated a 35% advantage over their rivals, emphasizing the importance of inclusivity in leadership during crises.

How can financial executives enhance their response to challenges?

Financial executives can enhance their response by adopting a proactive, empathetic, and flexible approach, utilizing real-time analytics to assess business health, and applying lessons learned from past experiences.

What is the significance of investing in management training during crises?

Investing in management training can yield substantial benefits, including enhanced financial performance and improved employee engagement, which are crucial during challenging times.

What are the anticipated trends in leadership guidance by 2025?

Leadership guidance in 2025 is expected to be more human-focused, emphasizing compassion and ongoing education, which will help finance executives navigate organizations through challenging periods.