Overview

This article delineates five pivotal steps essential for orchestrating a successful business crisis turnaround. These steps encompass:

- Defining the crisis

- Conducting a financial assessment

- Developing a strategic plan

- Implementing the strategy

- Evaluating for long-term success

Each step is fortified by practical actions and considerations, such as:

- Engaging stakeholders

- Monitoring key performance indicators

- Fostering adaptability

Collectively, these strategies significantly enhance an organization's resilience and its capability to navigate crises effectively.

Introduction

In the unpredictable landscape of modern business, crises can strike at any moment, leaving organizations scrambling for solutions. Understanding the nature of these crises—whether financial, operational, or reputational—is the first step toward effective management and recovery. By systematically identifying symptoms, engaging stakeholders, and conducting thorough assessments, businesses can craft strategic turnaround plans that not only address immediate challenges but also pave the way for long-term resilience.

This article delves into essential steps for navigating crises, including:

- Defining the problem

- Assessing financial health

- Implementing robust strategies

- Preparing for future uncertainties

With the right approach, organizations can emerge stronger, more agile, and ready to thrive in a competitive environment.

Define the Business Crisis

To effectively tackle a business crisis turnaround, it is crucial to start by accurately defining the type of crisis your organization is experiencing. Crises can appear in different forms, including economic distress—such as cash flow issues or insolvency—and operational challenges, like supply chain disruptions or workforce shortages. Here are essential steps to navigate this process:

- Identify Symptoms: Monitor for indicators such as declining sales, rising customer complaints, or increased employee turnover, which often signal underlying issues.

- Categorize the Crisis: Classify the crisis as economic, operational, or reputational. This classification will inform your strategic response and resource allocation.

- Gather Data: Compile relevant data to assess the crisis's scope and impact. This should include financial statements, customer feedback, and employee surveys, providing a comprehensive view of the situation. Utilize real-time analytics to continually assess your organization's health and modify plans as needed.

- Engage Stakeholders: Involve key stakeholders—management, employees, and external advisors—to gather diverse perspectives and insights, fostering a collaborative approach to problem-solving. This engagement can support a shortened decision-making cycle, allowing your team to take decisive action.

- Document Findings: Create a detailed report that outlines the crisis definition, symptoms, and initial insights from stakeholders. This document will serve as a vital reference for subsequent actions and strategies, ensuring that lessons learned are operationalized for future resilience.

Grasping the nuances of organizational crises is essential for effective management. Recent statistics suggest that small to medium enterprises often face various crises, with economic distress being a common symptom. For example, a considerable amount of enterprises report cash flow difficulties as a precursor to more serious financial issues. Moreover, the system can handle 1.666 alarms each second, emphasizing the urgency and frequency of crises that organizations encounter. As an Interim Manager remarked, "His experience in transition management and his thorough understanding of the market are vital resources to assist companies in recovering from the crisis." By implementing these steps, organizations can better position themselves to achieve a business crisis turnaround and initiate necessary transformations. Furthermore, embracing digital transformation initiatives can enhance operational capabilities and ensure competitiveness in the market. By implementing essential risk mitigation strategies, organizations can bolster their resilience and navigate through challenging times.

Conduct a Comprehensive Financial Assessment

Conducting a comprehensive economic evaluation is crucial for achieving a business crisis turnaround. Here are the essential steps:

- Review Financial Statements: Begin by analyzing the balance sheet, income statement, and cash flow statement. This offers a clear view of the overall economic condition and highlights possible areas for enhancement. As Tim Stobierski remarks, "If you wish to explore crafting monetary statements, download our free statement templates to begin practicing."

- Identify Key Metrics: Focus on critical economic ratios, including liquidity ratios, profitability margins, debt-to-equity ratios, and Return on Equity (ROE). These metrics are essential for assessing performance and comprehending the organization's economic stability. Utilizing real-time analytics can streamline decision-making and enhance the accuracy of these assessments.

- Assess Cash Flow: Examine cash flow patterns to pinpoint any shortfalls or surpluses. Understanding cash flow dynamics is essential for maintaining operational continuity and planning for future needs. The break-even point, where revenue becomes sufficient to cover total costs, is a key consideration in this analysis.

- Evaluate Liabilities: Compile a comprehensive list of current and long-term liabilities. This evaluation assists in elucidating the monetary responsibilities the company encounters and guides approaches for handling debt efficiently. Involving economic consultants can offer greater understanding of these intricacies, ensuring that enterprises are well-informed in their decision-making processes.

- Benchmark Against Industry Standards: Compare your monetary metrics with industry benchmarks. This analysis can reveal areas of concern or opportunity, guiding strategic decisions to enhance performance. Monitoring specific KPIs can help management identify which metrics to focus on for improving company performance. Continuous performance monitoring through real-time analytics can operationalize lessons learned and foster relationship-building with stakeholders.

In 2025, the significance of monetary evaluations in the context of business crisis turnaround cannot be overstated. Effective monetary analysis not only assists in identifying weaknesses but also emphasizes opportunities for growth. For example, a case study on resource efficiency analysis showed that companies with a low return on assets (ROA) relative to industry averages frequently mismanaged their investments, highlighting the necessity for comprehensive economic examination. By utilizing these insights and following best practices in financial evaluation, companies can greatly enhance their prospects for a business crisis turnaround and achieve sustainable growth.

Develop a Strategic Turnaround Plan

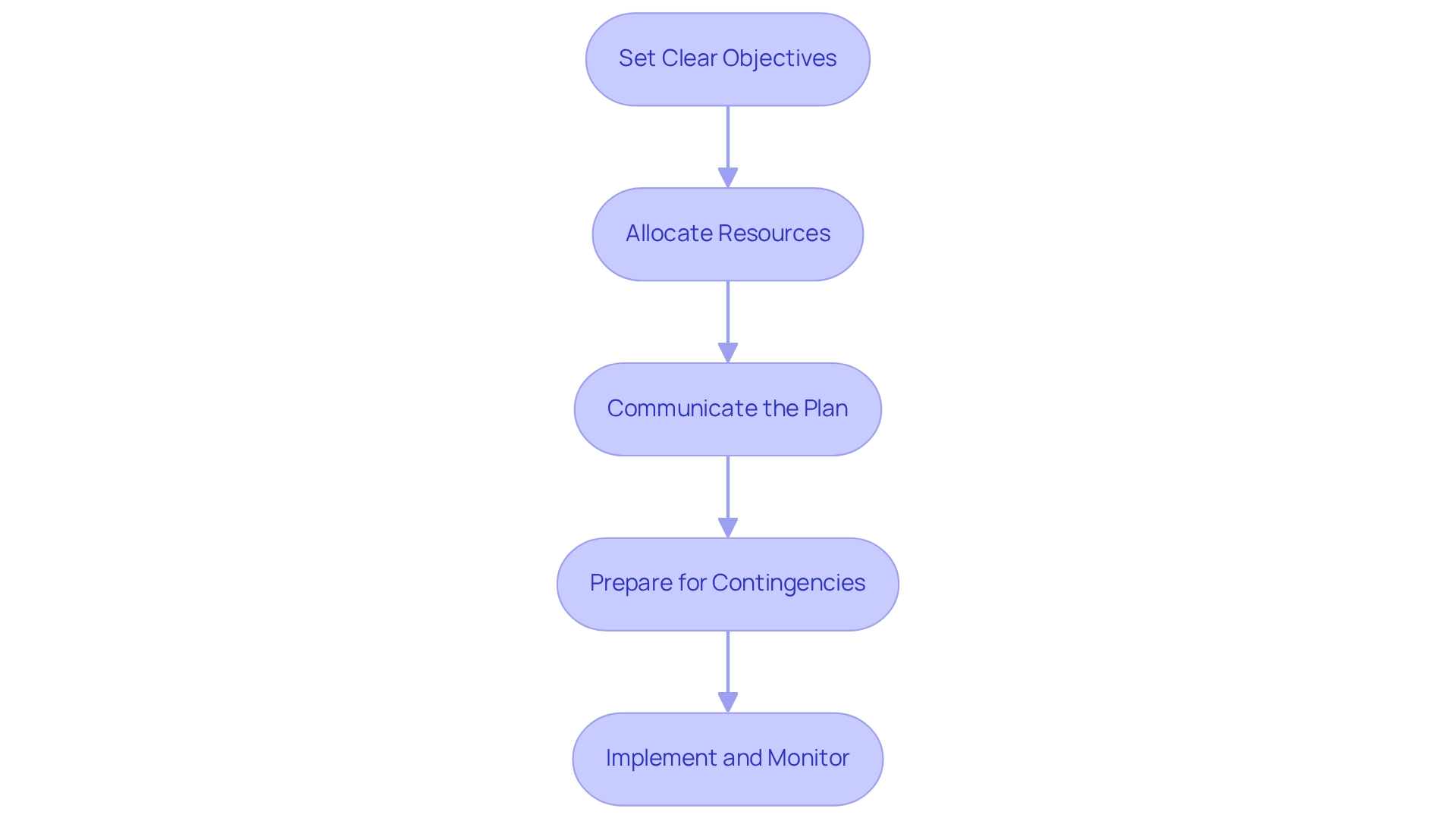

To create an effective plan for a business crisis turnaround, consider the following steps:

- Set Clear Objectives: Clearly define what success means for your business. This may include monetary goals, operational improvements, or repositioning in the market.

Identify Key Initiatives: Conduct a thorough monetary evaluation to pinpoint specific initiatives that tackle the root causes of the crisis. This could involve implementing cost-cutting measures, restructuring debt, or enhancing operational efficiencies. A comprehensive financial review can help identify opportunities to preserve cash and reduce liabilities, ensuring your business remains resilient. - Allocate Resources: Assess the necessary resources—financial, human, and technological—to successfully execute the identified initiatives. Efficient resource distribution is essential for enhancing impact, particularly when utilizing interim management services for practical executive leadership during the transition process.

Establish a Timeline: Develop a realistic timeline for the execution of the improvement plan, incorporating milestones to monitor progress and adjust strategies as needed. - Communicate the Plan: Ensure that the turnaround plan is communicated clearly to all stakeholders. Transparency fosters alignment and trust, which are vital during challenging periods. Emphasizing collaboration and core values of transparency, results, and innovation will enhance stakeholder engagement.

- Prepare for Contingencies: Anticipate potential challenges and devise contingency plans to address them proactively, ensuring that the organization remains agile in the face of unforeseen obstacles.

By following these structured steps, businesses can enhance their performance and effectively manage a business crisis turnaround, ultimately achieving sustainable growth. Remember, a plan is not merely the result of organization; it is its starting point.

Implement the Turnaround Strategy

Executing a recovery plan demands careful implementation to guarantee success:

- Assign Responsibilities: Clearly designate team members to lead specific initiatives within the recovery plan. This fosters accountability and ensures that each aspect of the strategy is managed effectively. Consider incorporating return on investment and value chain analysis to guide these assignments, ensuring that responsibilities align with strategic goals.

- Monitor Progress: Establish key performance indicators (KPIs) to evaluate the effectiveness of initiatives and track progress against established timelines. Research indicates that organizations that actively monitor KPIs during a business crisis turnaround experience a significantly higher success rate, with some studies reporting up to 70% effectiveness in achieving turnaround goals. Furthermore, in high-pollution industries, sustainability is driving financial restructuring, making it crucial to adapt KPIs to meet regulatory compliance and environmental standards. Utilizing real-time business analytics through a client dashboard can enhance this monitoring process, allowing for immediate adjustments based on performance data.

- Maintain Open Communication: Foster transparent communication among all stakeholders. Frequent updates and transparent conversations assist in resolving issues swiftly and ensure everyone is aligned with the goals.

- Adapt as Necessary: Be prepared to modify the approach based on real-time feedback and changing circumstances. Adaptability is crucial; successful transformations often necessitate iterative modifications to the initial plan. As David Tang, CEO and Founder of Flevy, highlights, grasping how to assess the success of a recovery plan through KPIs is essential for effective adaptation. This dedication to revising and adapting approaches based on real-time analytics is essential for sustaining momentum.

- Celebrate Milestones: Recognizing and celebrating small wins can significantly boost team morale and motivation. Recognizing progress strengthens dedication to the recovery efforts.

- Document Lessons Learned: Throughout the implementation process, meticulously record what approaches are effective and which are not. This knowledge will be essential for guiding future recovery plans and improving overall organizational resilience. Implementing these lessons learned cultivates strong, enduring connections within the team and with stakeholders.

In a notable case study, a boutique luxury brand successfully executed a recovery strategy by enhancing brand visibility and customer engagement, ultimately regaining lost sales and market share. This example highlights the significance of customized strategies in the context of business crisis turnaround scenarios and demonstrates how the outlined steps can result in practical success. As Vince Lombardi wisely stated, 'The difference between a successful person and others is not a lack of strength, not a lack of knowledge, but rather a lack in will.' This sentiment resonates deeply in the context of business transformations, where determination and strategic execution are paramount.

Evaluate and Adjust for Long-Term Success

To secure long-term success after implementing a recovery strategy, consider the following essential steps:

- Conduct Regular Reviews: Establish a routine for evaluating the effectiveness of the turnaround plan. Utilize key performance indicators (KPIs) as benchmarks to measure progress and identify areas needing adjustment. The SMB team's 'Rapid30' plan illustrates this method, enabling companies to swiftly identify problems and apply effective solutions, resulting in substantial enhancements in financial and strategic standings within a brief period.

- Solicit Feedback: Actively gather insights from employees, customers, and stakeholders. This feedback is invaluable for identifying areas for enhancement and ensuring that the approach aligns with the needs of all parties involved. Research indicates that organizations engaging in regular feedback practices are more likely to achieve long-term success, with data showing that 63% of remote workers receiving consistent feedback remain engaged, underscoring the importance of communication in maintaining momentum.

- Adjust Strategies: Stay flexible and ready to pivot or refine strategies based on evaluation outcomes and shifts in the market landscape. This adaptability is crucial for maintaining relevance and effectiveness in a dynamic commercial environment. The SMB group's dedication to ongoing observation via real-time analytics guarantees that enterprises can make knowledgeable decisions rapidly, testing assumptions and applying lessons learned throughout the recovery process.

- Focus on Sustainability: Implement practices that foster long-term sustainability, such as continuous improvement initiatives and comprehensive employee training programs. These efforts not only enhance operational efficiency but also contribute to a resilient organizational culture. Notably, 80% of companies plan to increase their investment in customer experience, emphasizing the importance of aligning turnaround strategies with customer needs.

- Reassess Economic Well-Being: Regularly review monetary statements to confirm that the entity remains on solid economic footing. This ongoing assessment helps identify potential risks early and allows for timely interventions. The success stories from the SMB team demonstrate how proactive fiscal management can lead to significant enhancements in performance.

- Plan for Future Crises: Develop a proactive crisis management plan to prepare for potential future challenges. This foresight ensures that the organization is resilient and adaptable, ready to navigate uncertainties effectively, and incorporating these strategies can significantly enhance the likelihood of a successful business crisis turnaround. By focusing on regular feedback, sustainability, and financial health, businesses can achieve a business crisis turnaround and position themselves for long-term growth and resilience, similar to the clients who have benefited from the SMB team's innovative approach.

Conclusion

Navigating a business crisis demands a structured approach, starting with a clear definition of the crisis type. By identifying symptoms, categorizing the crisis, and engaging stakeholders, organizations can achieve a comprehensive understanding of their challenges. This foundational step paves the way for a thorough financial assessment, essential for pinpointing weaknesses and opportunities for improvement. Regularly reviewing financial statements and key metrics keeps businesses attuned to their financial health, enabling informed decision-making moving forward.

The development of a strategic turnaround plan represents the next critical phase, where clear objectives and key initiatives are established. Effective resource allocation and transparent communication with stakeholders significantly enhance the likelihood of successful implementation. As organizations execute their turnaround strategies, monitoring progress through key performance indicators (KPIs) and maintaining open lines of communication fosters adaptability and accountability—both essential for navigating the complexities of a crisis.

Ultimately, the journey does not conclude with the implementation of a turnaround strategy. Continuous evaluation and adjustment are vital for securing long-term success. By soliciting feedback, focusing on sustainability, and planning for future crises, businesses can cultivate resilience in an ever-changing landscape. Embracing these practices not only facilitates recovery but also positions organizations to thrive amid uncertainties, reinforcing the principle that with the right strategies in place, businesses can emerge from crises stronger and more agile than before.

Frequently Asked Questions

What are the different types of crises an organization can experience?

Organizations can experience various types of crises, including economic distress (such as cash flow issues or insolvency) and operational challenges (like supply chain disruptions or workforce shortages).

What are the essential steps to navigate a business crisis?

The essential steps include identifying symptoms, categorizing the crisis, gathering data, engaging stakeholders, and documenting findings.

How can symptoms of a crisis be identified?

Symptoms can be identified by monitoring indicators such as declining sales, rising customer complaints, and increased employee turnover.

Why is it important to categorize a crisis?

Categorizing a crisis as economic, operational, or reputational helps inform strategic responses and resource allocation.

What type of data should be gathered during a crisis?

Relevant data to gather includes financial statements, customer feedback, and employee surveys to assess the crisis's scope and impact.

How can stakeholder engagement benefit crisis management?

Engaging stakeholders—such as management, employees, and external advisors—can provide diverse perspectives and insights, supporting a collaborative approach and shortening decision-making cycles.

What should be included in the documentation of findings during a crisis?

The documentation should outline the crisis definition, symptoms, and initial insights from stakeholders, serving as a vital reference for subsequent actions and strategies.

Why is conducting a comprehensive economic evaluation important during a crisis?

A comprehensive economic evaluation helps identify weaknesses and opportunities for growth, which is crucial for achieving a business crisis turnaround.

What are the key financial statements to review during an economic evaluation?

The key financial statements to review include the balance sheet, income statement, and cash flow statement.

What key metrics should be identified during an economic evaluation?

Key metrics include liquidity ratios, profitability margins, debt-to-equity ratios, and Return on Equity (ROE).

How can cash flow patterns be assessed?

Cash flow patterns can be assessed by examining shortfalls or surpluses to maintain operational continuity and plan for future needs.

What is the significance of benchmarking against industry standards?

Benchmarking against industry standards can reveal areas of concern or opportunity, guiding strategic decisions to enhance performance.

How can real-time analytics assist in crisis management?

Real-time analytics can streamline decision-making, enhance the accuracy of assessments, and facilitate continuous performance monitoring.