Overview

This article presents five essential steps for conducting effective crisis financial assessments:

- Gathering necessary financial data

- Conducting a comprehensive analysis

- Interpreting results to develop actionable strategies

- Implementing continuous monitoring and adjustments

This structured approach not only helps companies identify financial weaknesses but also uncovers opportunities for improvement. By ensuring that proactive measures are taken, organizations can stabilize and enhance their economic health during challenging times. Take these steps to safeguard your financial future.

Introduction

In the face of financial turmoil, businesses must navigate a complex landscape to ensure survival and recovery. Crisis financial assessments serve as a vital tool, offering a detailed examination of a company's financial health and illuminating pathways for improvement. By identifying weaknesses and seizing opportunities, organizations can proactively manage risks, optimize cash flow, and implement strategies that not only address immediate concerns but also lay the groundwork for long-term stability.

This article delves into the essential steps for conducting effective crisis financial assessments, from gathering critical data to developing actionable strategies. Moreover, it emphasizes the importance of continuous monitoring for sustained success.

Understand the Importance of Crisis Financial Assessments

Crisis financial assessments of resources are essential for enterprises that are facing economic hardship. They offer a comprehensive overview of a company's financial health, enabling leaders to pinpoint weaknesses and identify opportunities for improvement. Recognizing the importance of crisis financial assessments allows companies to implement proactive measures that mitigate risks, sustain cash flow, and devise effective recovery plans.

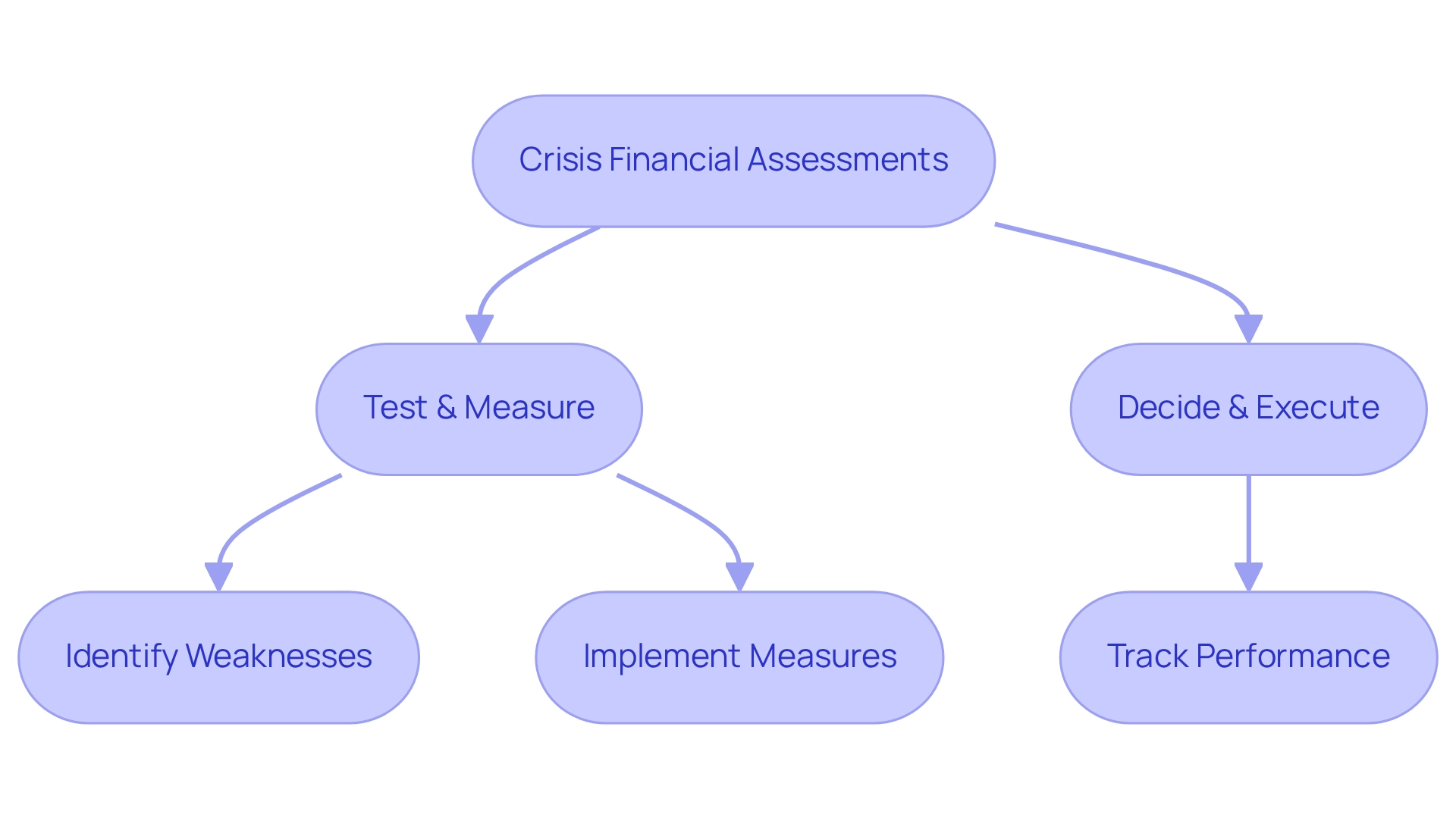

Our approach focuses on uncovering underlying issues and collaboratively developing strategies to address them, ensuring that decision-making cycles are expedited for prompt action. We utilize a 'Test & Measure' methodology to validate our strategies, maximizing the return on invested capital.

Furthermore, our 'Decide & Execute' framework facilitates rapid decision-making throughout the turnaround process. This approach not only aids in urgent crisis management but also lays the groundwork for long-term economic stability and growth. By continuously tracking performance through our client dashboard, we provide real-time analytics that help implement lessons learned.

Gather Necessary Financial Data and Resources

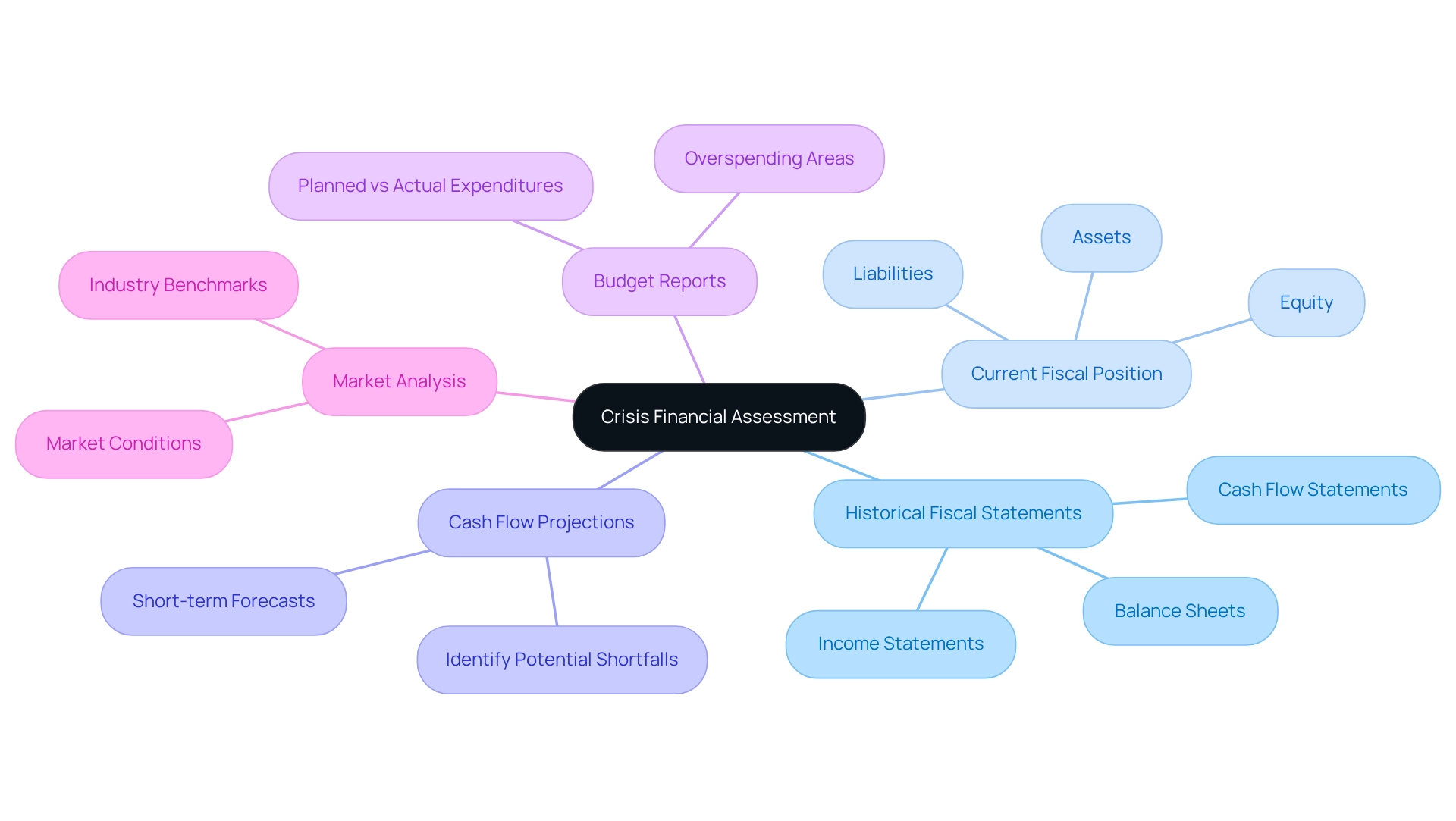

To conduct a thorough crisis financial assessment, begin by gathering essential economic data. This includes:

- Historical Fiscal Statements: Collect at least three years of income statements, balance sheets, and cash flow statements to identify trends and anomalies.

- Current Fiscal Position: Assess your current assets, liabilities, and equity to understand your immediate economic health.

- Cash Flow Projections: Create short-term cash flow forecasts to anticipate future cash needs and identify potential shortfalls.

- Budget Reports: Review your budget to compare planned versus actual expenditures, highlighting areas of overspending.

- Market Analysis: Gather industry benchmarks and market conditions to contextualize your economic data.

By systematically identifying underlying issues and planning solutions based on crisis financial assessments, you can operationalize lessons learned and improve your business's performance. Moreover, testing hypotheses related to these financial metrics will help maximize returns on investments. Incorporating AI/ML strategies can further refine your analysis and decision-making processes. Having this data organized and accessible will facilitate a more effective analysis in the next steps, particularly in optimizing your cash conversion cycle.

Conduct a Comprehensive Financial Analysis

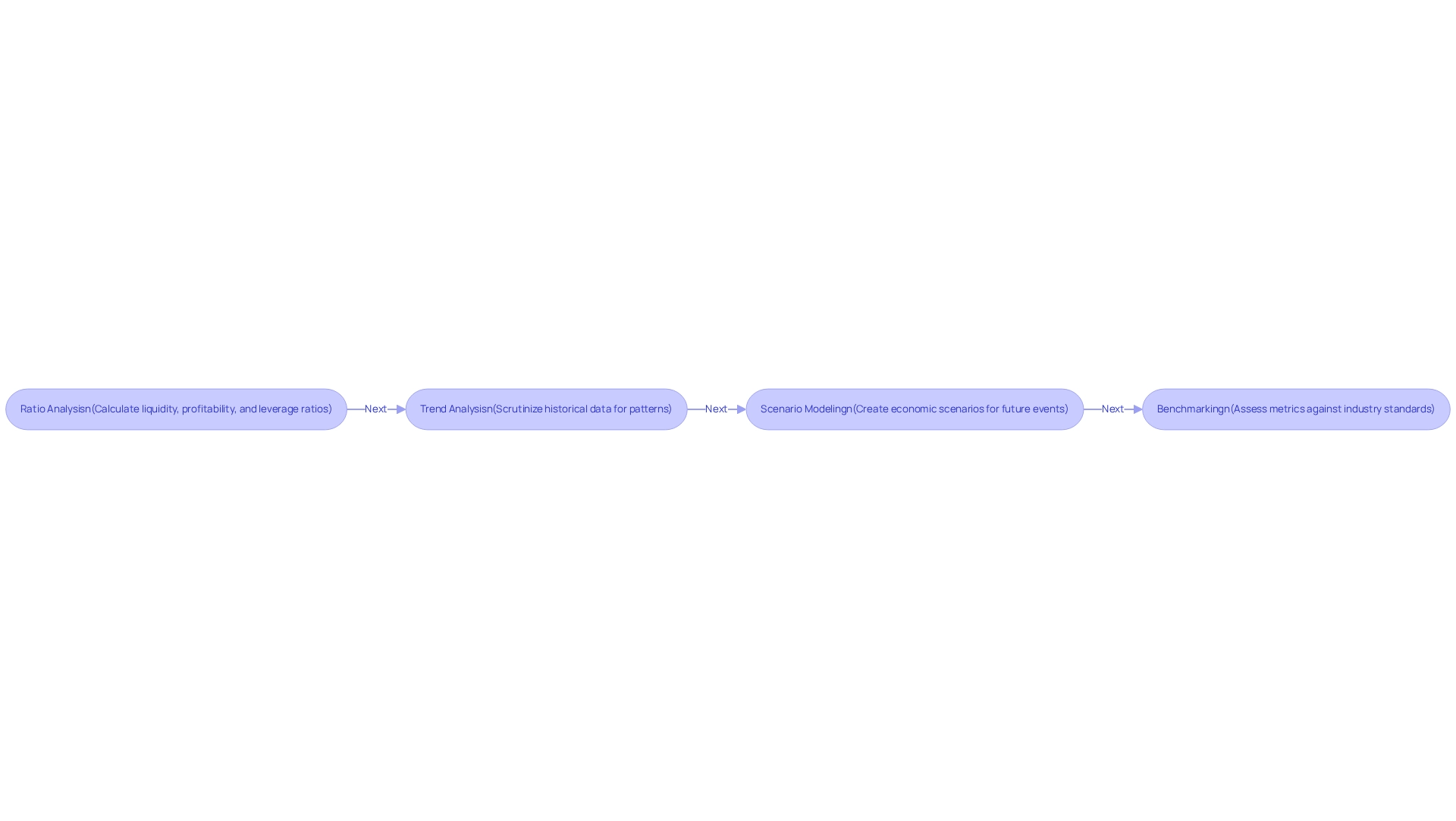

After gathering the necessary monetary data, the subsequent step is to conduct a comprehensive analysis. This entails:

- Ratio Analysis: Calculate essential economic ratios, including liquidity ratios (current ratio, quick ratio), profitability ratios (net profit margin, return on equity), and leverage ratios (debt-to-equity ratio) to evaluate overall health. Understanding these ratios is crucial for mastering the cash conversion cycle, significantly enhancing organizational performance.

- Trend Analysis: Scrutinize historical data to uncover trends in revenue, expenses, and cash flow. Identify patterns that may reveal underlying issues or opportunities. Continuous monitoring of these trends facilitates efficient decision-making and real-time operational adjustments.

- Scenario Modeling: Create various economic scenarios based on potential future events (e.g., sales decline, cost increases) to understand their impact on your economic position. This proactive approach aids in strategic enhancement by identifying potential risks and opportunities.

- Benchmarking: Assess your economic metrics against industry standards to evaluate your performance relative to competitors. This benchmarking process is vital for identifying challenges and devising strategies that can yield measurable investment returns, while crisis financial assessments will provide a clear overview of your monetary condition and highlight areas requiring urgent attention, ensuring that your business is well-prepared for peak performance.

Interpret Results and Develop Actionable Strategies

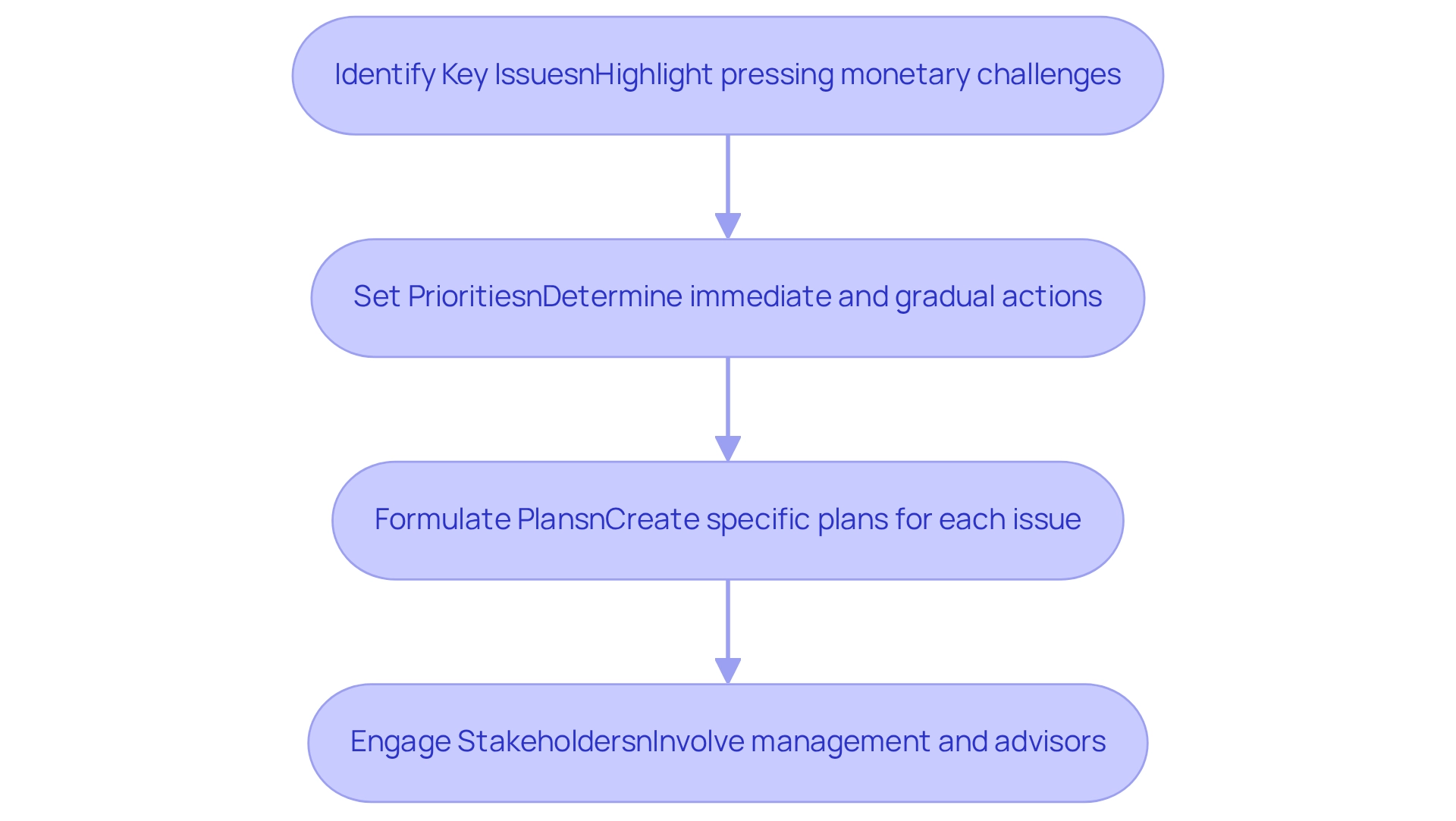

After conducting your crisis financial assessments, it's time to interpret the results and develop actionable strategies. Consider the following steps:

- Identify Key Issues: Highlight the most pressing monetary challenges identified during your analysis, such as cash flow shortages or excessive debt. Our group will collaborate to pinpoint these underlying concerns, ensuring a thorough comprehension of your monetary landscape.

- Set Priorities: Determine which issues require immediate attention and which can be managed gradually. Prioritize actions according to their possible effect on economic stability, incorporating crisis financial assessments to facilitate efficient decision-making.

- Formulate Plans: Create specific plans to tackle each recognized issue. For instance, if cash flow is a concern, consider options such as renegotiating payment terms with suppliers or reducing discretionary spending. This tactical planning will allow you to reinvest in essential strengths and enhance overall performance.

- Engage Stakeholders: Involve important stakeholders, including management and investment advisors, in the planning development process to ensure buy-in and collaboration. Their perspectives will be crucial in evaluating and assessing the impact of your strategies.

By converting your analysis into clear plans, you can take decisive action to enhance your economic situation and maximize your return on invested capital.

Implement Continuous Monitoring and Adjustments

Implementing continuous monitoring and adjustments is essential for maintaining economic health during and after crisis financial assessments. Follow these steps:

-

Establish Key Performance Indicators (KPIs): Define KPIs that align with your monetary goals, such as cash flow targets, expense ratios, and revenue growth rates. This will assist in evaluating hypotheses regarding your monetary strategies, particularly during crisis financial assessments:

- Schedule regular reviews of reports and performance statements to monitor progress against your KPIs.

- Employ real-time analytics via your client dashboard to acquire insights into your company's health and make informed decisions swiftly.

-

Adjust Approaches as Needed: Be ready to alter your approaches based on performance data and shifting market conditions. Adaptability is essential for addressing persistent obstacles, and a reduced decision-making timeframe can improve your agility.

-

Engage in Scenario Planning: Regularly evaluate possible future situations and their effects on your monetary approaches, enabling proactive modifications. This approach operationalizes the lessons learned during the turnaround process, utilizing crisis financial assessments to maintain a focus on continuous monitoring and leverage real-time analytics, allowing businesses to adapt to new challenges and ensure their financial strategies remain effective.

Conclusion

Crisis financial assessments are essential for businesses navigating financial distress. By delivering a comprehensive overview of a company's financial health, these assessments empower leaders to pinpoint weaknesses and identify opportunities for improvement. The significance of gathering critical financial data, conducting thorough analyses, and formulating actionable strategies cannot be overstated. Each step, from historical financial evaluations to scenario modeling, equips organizations with the insights necessary for informed decision-making and proactive measures.

Moreover, the implementation of continuous monitoring and adjustments guarantees that businesses stay agile and responsive to ever-changing market conditions. Establishing key performance indicators and consistently reviewing financial reports cultivates a culture of accountability and strategic foresight. The ability to adapt strategies based on real-time data is vital for maintaining financial stability during crises and beyond.

Ultimately, effective crisis financial assessments not only tackle immediate challenges but also establish a foundation for long-term growth and resilience. By adopting a proactive approach to financial management, organizations can navigate financial turmoil with confidence, ensuring they emerge stronger and more capable of seizing future opportunities. The journey toward financial recovery and stability commences with a commitment to understanding and enhancing one’s financial landscape.

Frequently Asked Questions

What is the purpose of crisis financial assessments for enterprises?

Crisis financial assessments provide a comprehensive overview of a company's financial health, helping leaders identify weaknesses and opportunities for improvement, which allows for proactive measures to mitigate risks and sustain cash flow.

How does the approach to crisis financial assessments work?

The approach focuses on uncovering underlying issues and collaboratively developing strategies to address them, ensuring expedited decision-making cycles for prompt action. It utilizes a 'Test & Measure' methodology to validate strategies and maximize returns on invested capital.

What is the 'Decide & Execute' framework?

The 'Decide & Execute' framework facilitates rapid decision-making throughout the turnaround process, aiding in urgent crisis management while laying the groundwork for long-term economic stability and growth.

What tools are used to track performance during the crisis financial assessment process?

A client dashboard is used to provide real-time analytics that help implement lessons learned and track performance continuously.

What data is essential for conducting a thorough crisis financial assessment?

Essential data includes historical fiscal statements, current fiscal position, cash flow projections, budget reports, and market analysis.

How can historical fiscal statements assist in a crisis financial assessment?

Historical fiscal statements, such as income statements, balance sheets, and cash flow statements from the past three years, help identify trends and anomalies in financial performance.

Why are cash flow projections important in a crisis financial assessment?

Cash flow projections are crucial for anticipating future cash needs and identifying potential shortfalls, allowing companies to plan accordingly.

How can incorporating AI/ML strategies enhance crisis financial assessments?

Incorporating AI/ML strategies can refine analysis and decision-making processes, leading to more effective assessments and optimized cash conversion cycles.

What is the outcome of systematically identifying underlying issues in crisis financial assessments?

Systematically identifying underlying issues allows businesses to operationalize lessons learned and improve overall performance.