Overview

This article presents a systematic approach to effective turnaround management in Brisbane, highlighting critical principles such as crisis stabilization, leadership change, stakeholder engagement, and data-driven decision-making. These principles are vital for revitalizing struggling enterprises, offering a structured framework for assessing financial health, developing strategic plans, implementing necessary changes, and continuously evaluating progress to ensure sustainable growth.

Moreover, by focusing on these key areas, organizations can navigate challenges more effectively and foster resilience. The integration of data-driven insights allows for informed decision-making, which is essential in today’s dynamic business environment. In addition, engaging stakeholders throughout the process not only builds trust but also enhances collaboration, paving the way for successful outcomes.

Consequently, embracing these principles can lead to significant improvements in operational efficiency and profitability. It is imperative for business leaders to adopt this structured approach, ensuring that they are well-equipped to face the complexities of turnaround management. The time to act is now—implement these strategies to revitalize your organization and secure a prosperous future.

Introduction

In the dynamic and ever-evolving landscape of business, the ability to navigate crises and implement effective turnaround strategies can be the defining factor between survival and failure.

Turnaround management transcends mere quick fixes; it necessitates a structured approach that encompasses everything from crisis stabilization to stakeholder engagement. By grasping the fundamental principles of turnaround management and conducting thorough financial assessments, organizations can craft strategic plans that not only address immediate concerns but also lay the groundwork for sustainable growth.

This article explores the essential steps for crafting and executing a successful turnaround strategy, underscoring the significance of:

- Data-driven decisions

- Continuous monitoring

- Adaptability in the face of challenges

Understand Turnaround Management Principles

Turnaround management Brisbane represents a systematic approach to revitalizing a struggling enterprise. The key principles include:

- Crisis Stabilization: Address immediate issues to stabilize operations and prevent further decline.

- Leadership Change: A change in leadership is often necessary to introduce fresh perspectives and drive the turnaround.

- Stakeholder Engagement: Involving key stakeholders—employees, creditors, and customers—gains support and insights essential for recovery.

- Data-Driven Decisions: Utilize data analytics to identify problems and measure progress effectively. This includes testing hypotheses to ensure strategies are effective and yield maximum returns on invested capital.

- Streamlined Decision-Making: Facilitate a shortened decision-making cycle throughout the recovery process, allowing your team to take decisive action rapidly.

- Continuous Monitoring: Implement real-time analytics to consistently diagnose organizational health and adjust strategies as necessary.

- Focus on Core Competencies: Concentrate on the entity's strengths while addressing weaknesses to ensure sustainable growth.

Operationalizing lessons learned during the turnaround process fosters strong, lasting relationships, and by understanding these principles, you can navigate the complexities of turnaround management Brisbane more effectively to enhance overall business performance.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive financial assessment, follow these essential steps:

- Gather Financial Records: Compile the last three years of fiscal statements, including income statements, balance sheets, and cash flow statements. This historical data is crucial for understanding trends and performance.

- Analyze Key Ratios: Calculate vital monetary ratios such as liquidity, profitability, and leverage ratios. These metrics offer insights into the company's economic health and operational efficiency, assisting in identifying strengths and weaknesses.

- Identify Cash Flow Issues: Scrutinize cash flow statements to uncover potential problems, such as persistent negative cash flow trends or elevated operating costs. Tackling these problems early can avert more considerable economic distress. Mastering the cash conversion cycle is crucial, as it can improve cash flow and profitability, offering a strong basis for turnaround plans.

- Evaluate Liabilities: Assess outstanding debts and obligations to gain a comprehensive understanding of the company's monetary commitments. This evaluation is critical for developing strategies to manage and reduce liabilities effectively.

- Benchmark Against Industry Standards: Compare your findings with industry benchmarks to pinpoint areas for improvement. This comparison not only highlights performance gaps but also provides a roadmap for strategic enhancements. Continuous monitoring through real-time analytics can facilitate this process, allowing for timely adjustments and relationship-building with stakeholders.

In 2025, statistics suggest that a notable proportion of small enterprises face challenges with cash flow management, highlighting the necessity for comprehensive monetary evaluations. As Mario Draghi observed, "to prevent falling into insignificance, Europe must allocate 5% of its GDP to regain its 'muscular' stature," emphasizing the significance of investment in turnaround management. Moreover, the case study on Robert Kiyosaki serves as a reminder for CFOs to approach budget forecasts critically, ensuring that they do not depend solely on potentially alarmist predictions. Furthermore, understanding how the stock market perceives government ownership can impact distress-resolution strategies, making it essential for CFOs to consider these external factors during their assessments.

Conducting this thorough financial assessment will yield a clear picture of the financial landscape, illuminating critical areas that require immediate attention and strategic intervention. By implementing a shortened decision-making cycle, organizations can respond swiftly to the insights gained from this assessment, putting into practice lessons learned to enhance overall business performance.

Develop a Strategic Turnaround Plan

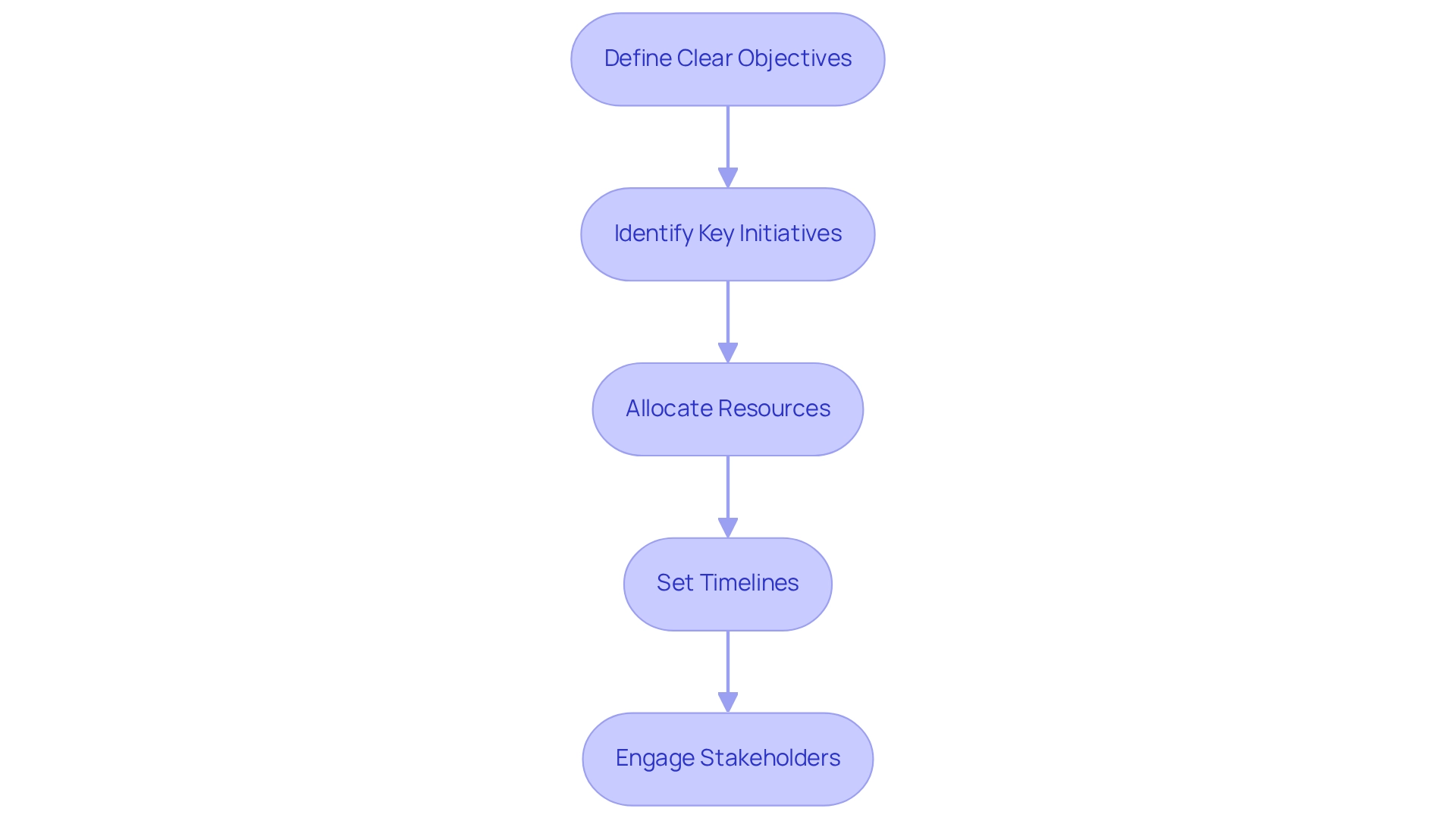

To create a strategic recovery plan, consider the following steps:

- Define Clear Objectives: Establish specific, measurable goals for recovery, such as improving cash flow by a certain percentage or reducing operational costs. This clarity will focus efforts on cash preservation and efficiency.

- Identify Key Initiatives: Determine the initiatives required to achieve these objectives, such as restructuring debt, cutting unnecessary expenses, or enhancing revenue streams. Comprehensive turnaround management Brisbane and restructuring consulting services can provide valuable insights into these initiatives.

- Allocate Resources: Assess the resources needed for each initiative, including financial, human, and technological resources. Engaging interim management can provide hands-on executive leadership to ensure effective resource allocation and crisis resolution.

- Set Timelines: Create a timeline for implementing each initiative, ensuring that milestones are realistic and achievable. Continuous business performance monitoring through real-time analytics will help track progress and make necessary adjustments.

- Engage Stakeholders: Communicate the plan to all stakeholders to gain their support and input, which is crucial for successful execution. Establishing connections and promoting teamwork will increase the chances of meeting recovery goals, and this strategic plan will direct your efforts in turnaround management Brisbane, helping to maintain focus on achieving recovery objectives while utilizing professional restructuring services to reveal value and minimize expenses.

Implement the Turnaround Strategy

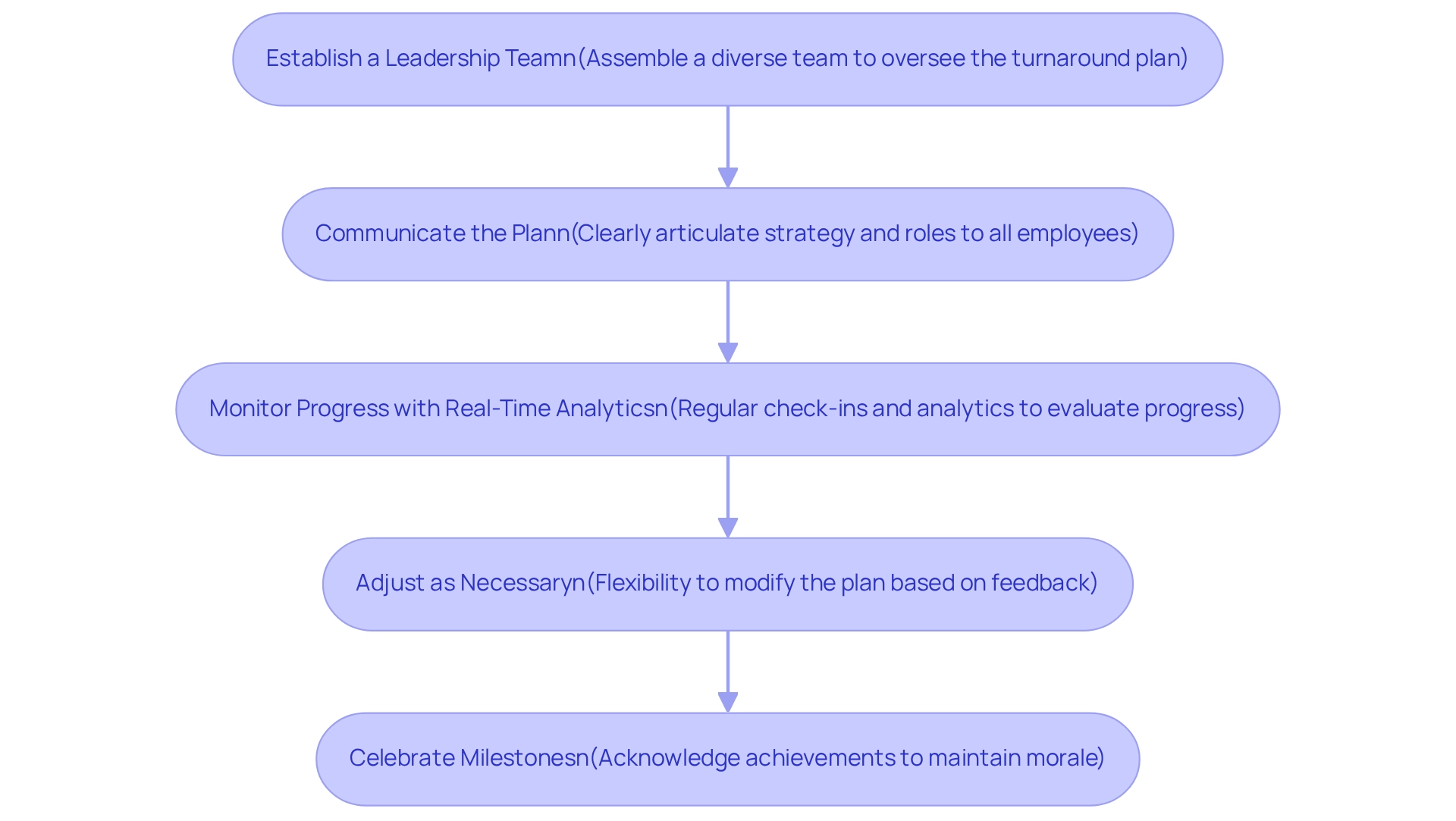

To implement your turnaround strategy effectively, consider the following steps:

- Establish a Leadership Team: Assemble a dedicated team tasked with overseeing the execution of the turnaround plan. This team should include individuals with diverse expertise to address various challenges.

- Communicate the Plan: Clearly articulate the strategy to all employees, ensuring that everyone understands their specific roles and responsibilities. Effective communication fosters alignment and commitment across the organization.

- Monitor Progress with Real-Time Analytics: Implement regular check-ins to evaluate progress against the established timeline and objectives. Utilize real-time business analytics through a client dashboard to assess employee productivity metrics, which gauge how effectively employees are contributing to the company's goals and identify areas needing improvement.

- Adjust as Necessary: Stay flexible and ready to modify the plan based on feedback and evolving circumstances. This adaptability is crucial for navigating unexpected challenges, especially in competitive environments like the mid-sized telecom sector facing market saturation. The SMB team emphasizes testing hypotheses and operationalizing lessons learned to enhance decision-making processes.

- Celebrate Milestones: Acknowledge and celebrate achievements throughout the process to maintain morale and motivation among the team. Acknowledging progress strengthens dedication to the recovery efforts.

Effective guidance and a readiness to adjust are crucial for the successful implementation of turnaround management Brisbane in a recovery plan. For instance, a recent case study involving a boutique luxury brand highlighted how revitalizing brand identity and improving sales performance were pivotal in reversing a decline in market share. Specific strategies included enhancing customer engagement and optimizing product offerings. By concentrating on these aspects, organizations can effectively steer their recovery journeys. As Julia T., a consulting firm owner, remarked, "The wide selection of frameworks is very beneficial to me as an independent consultant," underscoring the significance of structured methods in management recovery. The transformative experience with the SMB team, particularly through their 'Rapid30' plan, illustrates how turnaround management Brisbane can effectively assist in recovery, leading to significant growth and a focus on customers.

Evaluate and Adjust the Turnaround Approach

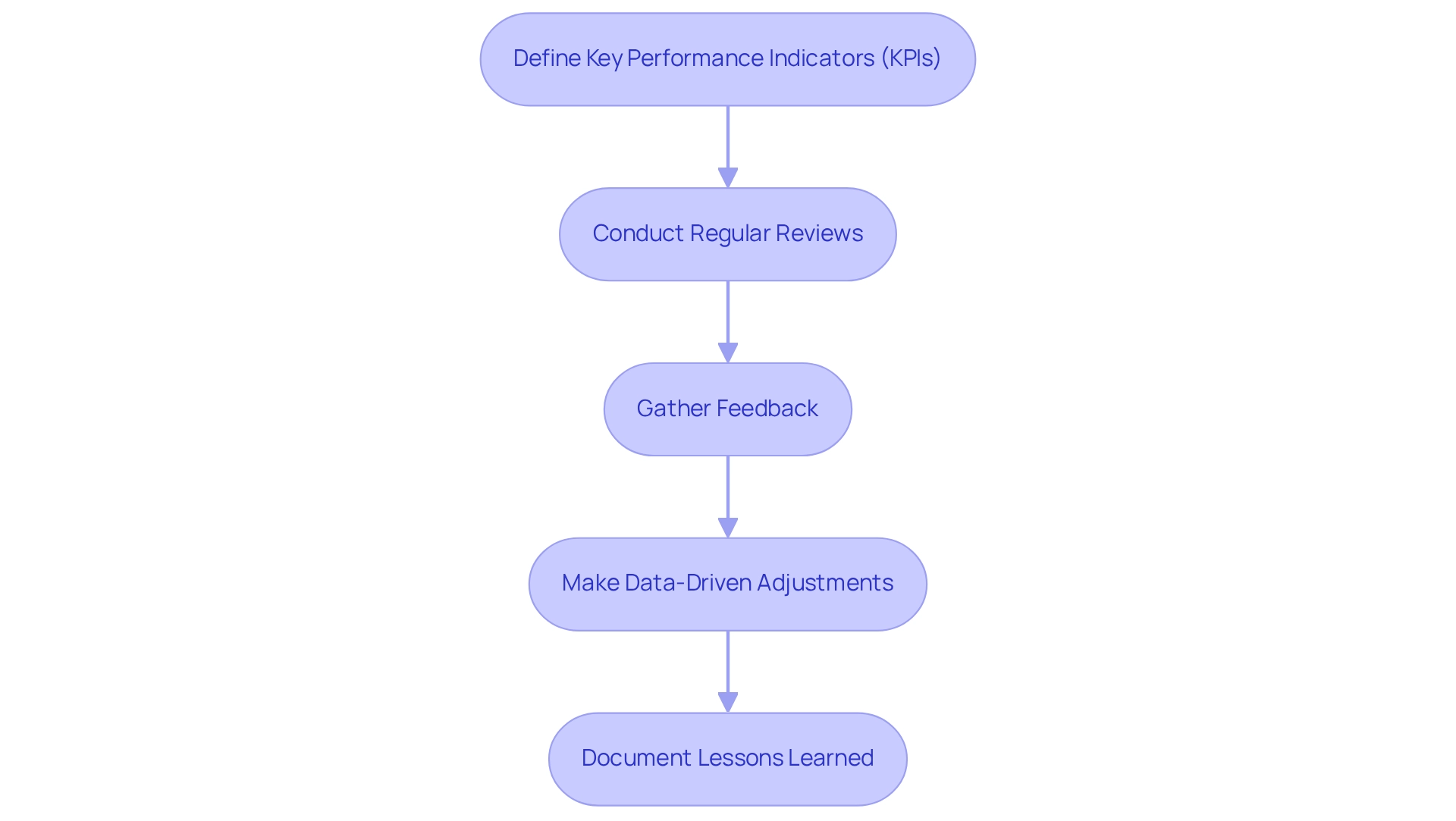

To effectively assess and modify your approach, consider these essential steps:

- Define Key Performance Indicators (KPIs): Establish KPIs to measure the success of the turnaround initiatives, such as revenue growth, cost reductions, and customer satisfaction.

- Conduct Regular Reviews: Schedule regular reviews to assess performance against the KPIs and overall objectives. Utilize real-time business analytics through our client dashboard to monitor progress continuously.

- Gather Feedback: Solicit feedback from stakeholders, including employees and customers. This will provide insights into the effectiveness of the changes and allow you to operationalize these lessons for future strategies.

- Make Data-Driven Adjustments: Use the data collected to make informed adjustments to the plan as needed. This ensures a pragmatic approach that tests hypotheses for maximum return on invested capital.

- Document Lessons Learned: Keep a record of what worked and what didn’t. This practice will inform future turnaround efforts and foster strong relationships through a commitment to learning and adapting.

This ongoing evaluation process is crucial. It will help ensure that the turnaround strategy remains relevant and effective in achieving long-term success.

Conclusion

The journey of turnaround management is intricate, necessitating a well-structured approach to effectively navigate the challenges faced by struggling businesses. Understanding key principles such as crisis stabilization, stakeholder engagement, and data-driven decision-making allows organizations to lay a solid foundation for revitalization. Conducting a comprehensive financial assessment is crucial, as it illuminates the financial health of the business and uncovers areas requiring immediate attention.

Developing a strategic turnaround plan is the next vital step, where clear objectives and key initiatives are defined, resources allocated, and timelines established. Engaging stakeholders throughout this process fosters collaboration and enhances the likelihood of success. The implementation phase demands strong leadership and effective communication to ensure alignment and commitment across the organization. Moreover, continuous monitoring using real-time analytics enables timely adjustments to the strategy, ensuring responsiveness to evolving circumstances.

Lastly, evaluating and adjusting the turnaround approach is essential for long-term sustainability. By defining key performance indicators and regularly reviewing progress, businesses can adapt their strategies based on feedback and data insights, ensuring they remain on the path to recovery. This iterative process not only strengthens the organization but also cultivates a culture of learning and resilience.

In conclusion, turnaround management transcends mere quick fixes; it embodies a comprehensive, ongoing effort that requires dedication and adaptability. Embracing these principles and practices can transform challenges into opportunities for growth, ultimately leading to a more robust and sustainable business future.

Frequently Asked Questions

What is turnaround management in Brisbane?

Turnaround management in Brisbane is a systematic approach to revitalizing a struggling enterprise, focusing on key principles like crisis stabilization, leadership change, stakeholder engagement, and data-driven decisions.

What are the key principles of turnaround management?

The key principles include:\n- Crisis Stabilization: Addressing immediate issues to stabilize operations.\n- Leadership Change: Introducing new leadership for fresh perspectives.\n- Stakeholder Engagement: Involving employees, creditors, and customers for support.\n- Data-Driven Decisions: Using data analytics to identify problems and measure progress.\n- Streamlined Decision-Making: Shortening decision-making cycles for rapid action.\n- Continuous Monitoring: Implementing real-time analytics to assess organizational health.\n- Focus on Core Competencies: Concentrating on strengths while addressing weaknesses.

How can organizations stabilize operations during a crisis?

Organizations can stabilize operations by addressing immediate issues that are causing decline and implementing strategies to prevent further deterioration.

Why is leadership change often necessary in turnaround management?

Leadership change is often necessary to introduce fresh perspectives and drive the turnaround process effectively.

How does stakeholder engagement contribute to turnaround management?

Engaging key stakeholders such as employees, creditors, and customers helps gain support and insights that are essential for recovery.

What role does data analytics play in turnaround management?

Data analytics is used to identify problems, measure progress, and test hypotheses to ensure that strategies are effective and yield maximum returns on invested capital.

What is the importance of streamlined decision-making in the recovery process?

Streamlined decision-making facilitates a shortened cycle, allowing teams to take decisive action rapidly, which is crucial during the recovery process.

How can continuous monitoring benefit an organization in turnaround management?

Continuous monitoring through real-time analytics allows organizations to consistently diagnose their health and adjust strategies as necessary.

Why is it important to focus on core competencies during a turnaround?

Focusing on core competencies ensures that organizations concentrate on their strengths while addressing weaknesses, leading to sustainable growth.

What steps should be taken to conduct a comprehensive financial assessment?

Steps include gathering financial records, analyzing key ratios, identifying cash flow issues, evaluating liabilities, and benchmarking against industry standards.

What financial records are essential for a comprehensive assessment?

Essential records include the last three years of fiscal statements, such as income statements, balance sheets, and cash flow statements.

How can cash flow issues impact a business?

Persistent negative cash flow trends or elevated operating costs can lead to significant economic distress, making it crucial to address these issues early.

What is the significance of benchmarking against industry standards?

Benchmarking helps identify areas for improvement and highlights performance gaps, providing a roadmap for strategic enhancements.

How can organizations respond to insights gained from a financial assessment?

By implementing a shortened decision-making cycle, organizations can respond swiftly to insights from the assessment, enhancing overall business performance.