Overview

This article delineates five essential steps for mastering distressed asset restructuring. It begins with a comprehensive financial assessment, followed by strategic planning, implementation, and ongoing monitoring. The importance of identifying the root causes of distress cannot be overstated, as engaging stakeholders and maintaining flexibility throughout the process are crucial for ensuring effective recovery and sustainable growth. Embrace these steps to navigate the complexities of asset restructuring successfully.

Introduction

In the ever-evolving landscape of business, companies frequently grapple with distressed assets that jeopardize their viability. Distressed asset restructuring emerges as a beacon of hope, offering a strategic pathway to reorganize financial and operational frameworks. By delving into the root causes of distress—whether stemming from mismanagement, market fluctuations, or economic downturns—organizations can implement targeted turnaround strategies.

This article explores the critical steps involved in navigating this complex process:

- Conducting comprehensive financial assessments

- Developing a strategic restructuring plan

- Executing the restructuring plan

- Engaging stakeholders

- Continuous monitoring

With a focus on stakeholder engagement and continuous monitoring, stakeholders can make informed decisions that pave the way for sustainable recovery and growth.

Understand Distressed Asset Restructuring

The process of distressed asset restructuring is a critical undertaking aimed at reorganizing a company's economic and operational framework to enhance its viability and recover value from underperforming assets. Identifying the root causes of a company's distress—such as ineffective management, shifts in market dynamics, or economic downturns—is vital for implementing effective interventions. Key concepts include:

- Distressed Asset Restructuring: This refers to the process of addressing assets that have experienced significant depreciation in value due to the economic instability of the owning entity. For instance, in 2018, there were 13,678 business bankruptcy submissions out of a total of 475,575 bankruptcy filings, highlighting the prevalence of distressed asset restructuring in the market. The prevalence of Chapter 7 liquidations, which constituted 63.1% of all bankruptcy filings, indicates that numerous companies face substantial economic distress without viable recovery options, underscoring the need for distressed asset restructuring as part of effective turnaround strategies designed to restore a company's profitability and operational efficiency. A considerable number of bankruptcy filers cite aggressive debt collection practices as a contributing factor to their financial difficulties, with 77% indicating it influenced their decision to file. This underscores the necessity of implementing effective turnaround strategies, particularly distressed asset restructuring, that address both operational and external pressures.

Transform Your Small/Medium Business offers comprehensive turnaround and restructuring consulting services tailored specifically for small to medium enterprises. Our strategy incorporates interim management services that provide practical executive leadership for crisis resolution and business issue identification, utilizing the Rapid-30 method for transformational change. We conduct thorough evaluations focused on cash preservation, efficiency, and risk mitigation to uncover value and reduce costs, alongside bankruptcy case management to navigate complex economic situations. Furthermore, our streamlined decision-making process and real-time analytics facilitate effective performance monitoring throughout the distressed asset restructuring journey. By understanding these elements, stakeholders can navigate the distressed asset restructuring process more effectively, making informed decisions that lead to sustainable recovery and growth. Moving forward, it is imperative to develop a tailored action plan that addresses the specific challenges faced by the organization.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive financial assessment, follow these essential steps:

- Gather Economic Statements: Compile the last three years of economic statements, including balance sheets, income statements, and cash flow statements. This historical data is crucial for identifying trends and anomalies.

- Analyze Key Ratios: Calculate vital economic ratios, such as liquidity ratios, profitability ratios, and leverage ratios. Strong liquidity ratios indicate a lower likelihood of default, while poor ratios may signal potential risks. Regular evaluations, preferably on a yearly basis, help maintain a clear understanding of economic health, as organizations should refresh assessments at least once a year for all key suppliers.

- Identify Cash Flow Issues: Scrutinize cash flow statements to uncover patterns in cash inflow and outflow, particularly focusing on operational cash flow. Understanding these dynamics is essential for pinpointing areas that may require immediate intervention. Mastering the cash conversion cycle through effective strategies can significantly enhance cash flow and profitability.

- Evaluate Liabilities: Create a comprehensive list of all current and long-term liabilities, including debts and obligations. This assessment provides insight into the company's financial obligations and assists in prioritizing renovation efforts. Streamlined decision-making methods enable faster responses to these obligations.

- Assess Asset Value: Determine the fair market value of assets, such as inventory, real estate, and equipment. This evaluation is vital for measuring potential recovery value and guiding strategic decisions throughout the reorganization process. Continuous business performance monitoring through real-time analytics supports the evaluation of distressed asset restructuring, ensuring that organizations remain agile in their approach.

By following these steps, organizations can identify critical areas needing immediate attention, thereby shaping an effective restructuring strategy that promotes sustainable growth. Furthermore, adopting best practices for monetary evaluations, as detailed in the case study 'Best Practices for Effective Supplier Financial Risk Management,' can result in more resilient supply chains. This involves creating clear evaluation standards, maintaining open dialogue with suppliers, and frequently updating monetary assessments. Additionally, understanding productivity measures—output as units produced over time—and efficiency measures—cost per unit produced—provides valuable insights into the financial assessment process, ensuring that organizations not only survive but thrive in challenging environments.

Develop a Strategic Restructuring Plan

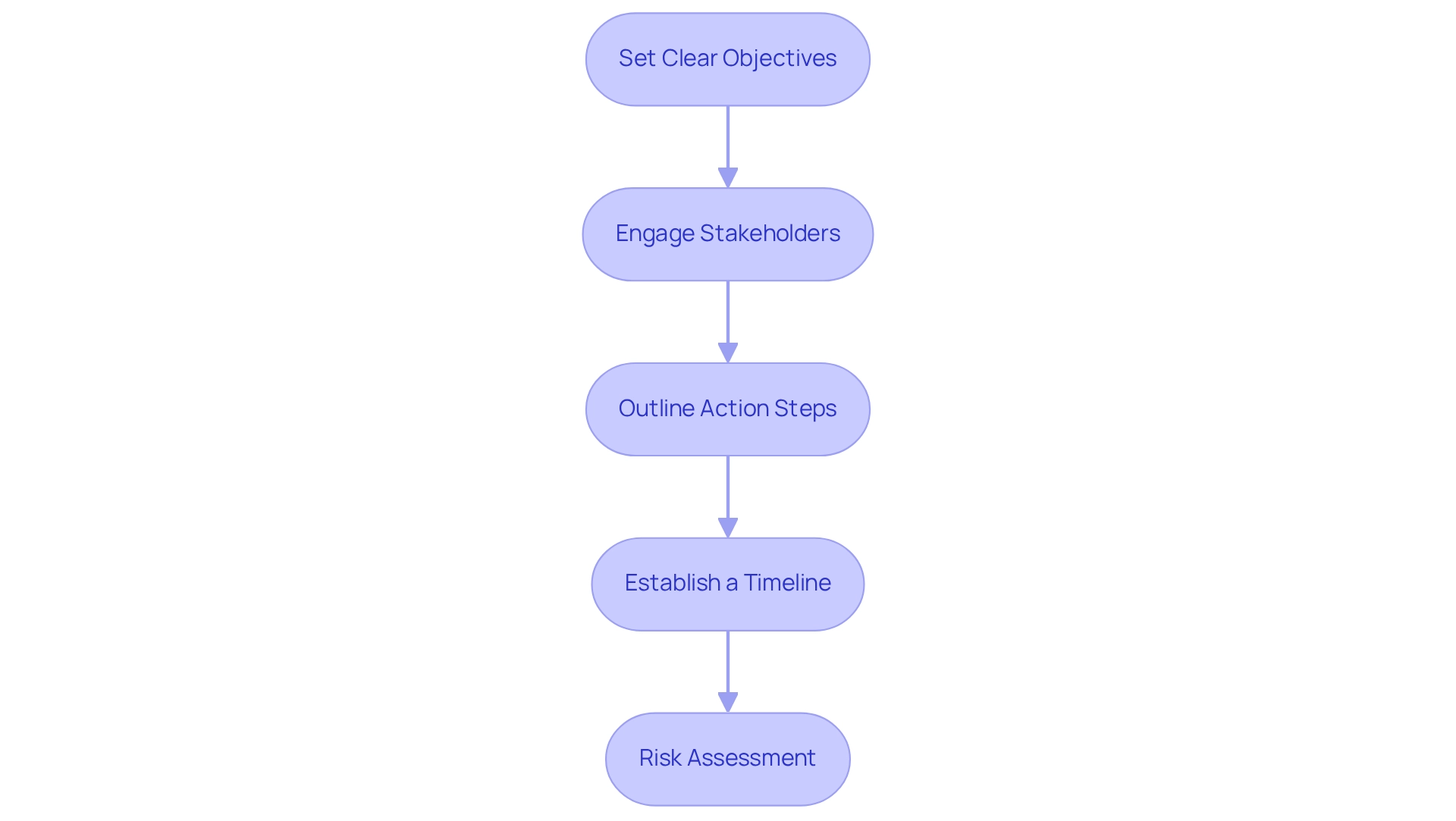

Creating a strategic reorganization plan is essential for effectively navigating distressed asset restructuring.

- Set Clear Objectives: Clearly define the goals of the restructuring—such as reducing debt, improving cash flow, or enhancing operational efficiency. This clarity is essential, as 98% of leaders recognize that plan execution often requires more time than development.

- Engage Stakeholders: Actively involve key stakeholders—management, employees, creditors, and investors—to gather insights and foster buy-in. Effective stakeholder involvement is crucial; misalignment can impede organizational efficiency, with two-thirds of IT and HR functions frequently noted as inconsistent with corporate objectives. As emphasized by HBR, a culture that fosters effective execution must reward collaboration, ambition, agility, and a readiness to adapt.

- Outline Action Steps: Identify specific actions necessary to achieve the objectives, such as renegotiating debt terms, cutting costs, or divesting non-core assets. This structured approach ensures that all efforts are directed towards the defined goals. Additionally, operationalizing the lessons learned from previous turnaround efforts can enhance the effectiveness of these actions. Testing hypotheses at each stage can further refine strategies and improve outcomes.

- Establish a Timeline: Create a detailed timeline for executing the reorganization plan, including milestones and deadlines for each action step. A well-defined timeline aids in sustaining momentum and accountability throughout the undertaking. Utilizing real-time analytics through a client dashboard can further support this by providing ongoing insights into progress and performance.

- Risk Assessment: Conduct a thorough evaluation of potential risks associated with the reorganization plan and develop strategies to mitigate them. Understanding these risks is crucial, as 61% of executives feel unprepared for strategic challenges when stepping into senior roles. This highlights the significance of preparing for possible obstacles during the reorganization process, along with ongoing assessment of business vitality through analytics.

This strategic plan serves as a guide for execution, ensuring that all actions correspond with the intended results and contribute to the overall success of the reorganization initiative.

Implement the Restructuring Plan

To implement a restructuring plan effectively, consider the following steps:

- Communicate the Plan: Ensure that the reorganization strategy is conveyed clearly to all stakeholders. This fosters understanding and alignment, which are crucial for a successful transition.

- Assign Responsibilities: Designate specific team members to oversee various aspects of the implementation. This not only ensures accountability but also empowers individuals to take ownership of their roles.

- Monitor Progress: Establish key performance indicators (KPIs) to track the implementation's progress against set objectives. For instance, checking if the $50,000 target is being met in monthly sales reports can provide concrete insights. Regularly reviewing these metrics allows for informed decision-making and timely adjustments. The SMB team's commitment to real-time business analytics through their client dashboard exemplifies how continuous monitoring can diagnose business health effectively. Their pragmatic approach to data ensures that every hypothesis is tested, maximizing the return on invested capital.

- Adjust as Necessary: Be prepared to adapt the plan based on feedback and evolving circumstances. Flexibility is essential in navigating the complexities of distressed asset restructuring. As Richard Marcinko noted, "Change hurts. It makes people insecure, confused and angry." Leaders must recognize these emotional challenges and guide their teams through them. The SMB team's strategy highlights implementing lessons learned during the turnaround phase, which can greatly improve adaptability. Clients have reported transformative experiences, particularly through the 'Rapid30' plan, showcasing the effectiveness of this flexible approach.

- Engage with Stakeholders: Maintain open lines of communication with stakeholders throughout the implementation phase. This engagement helps address concerns and fosters support, which is vital for overcoming resistance to change. Leaders should not allow their teams to cling to the past during transitions, as this can hinder progress. The transformative experience reported by clients of the SMB team, particularly through their 'Rapid30' plan, highlights the importance of stakeholder engagement in achieving successful outcomes.

Successful implementation demands diligence and the ability to adapt to unforeseen challenges, reinforcing the notion that achieving strategic goals is a series of small, deliberate steps. The cultural shift towards data-driven decision-making emphasizes the importance of KPIs in this process, enabling organizations to leverage data effectively and turn it into actionable insights.

Monitor and Adjust Restructuring Efforts

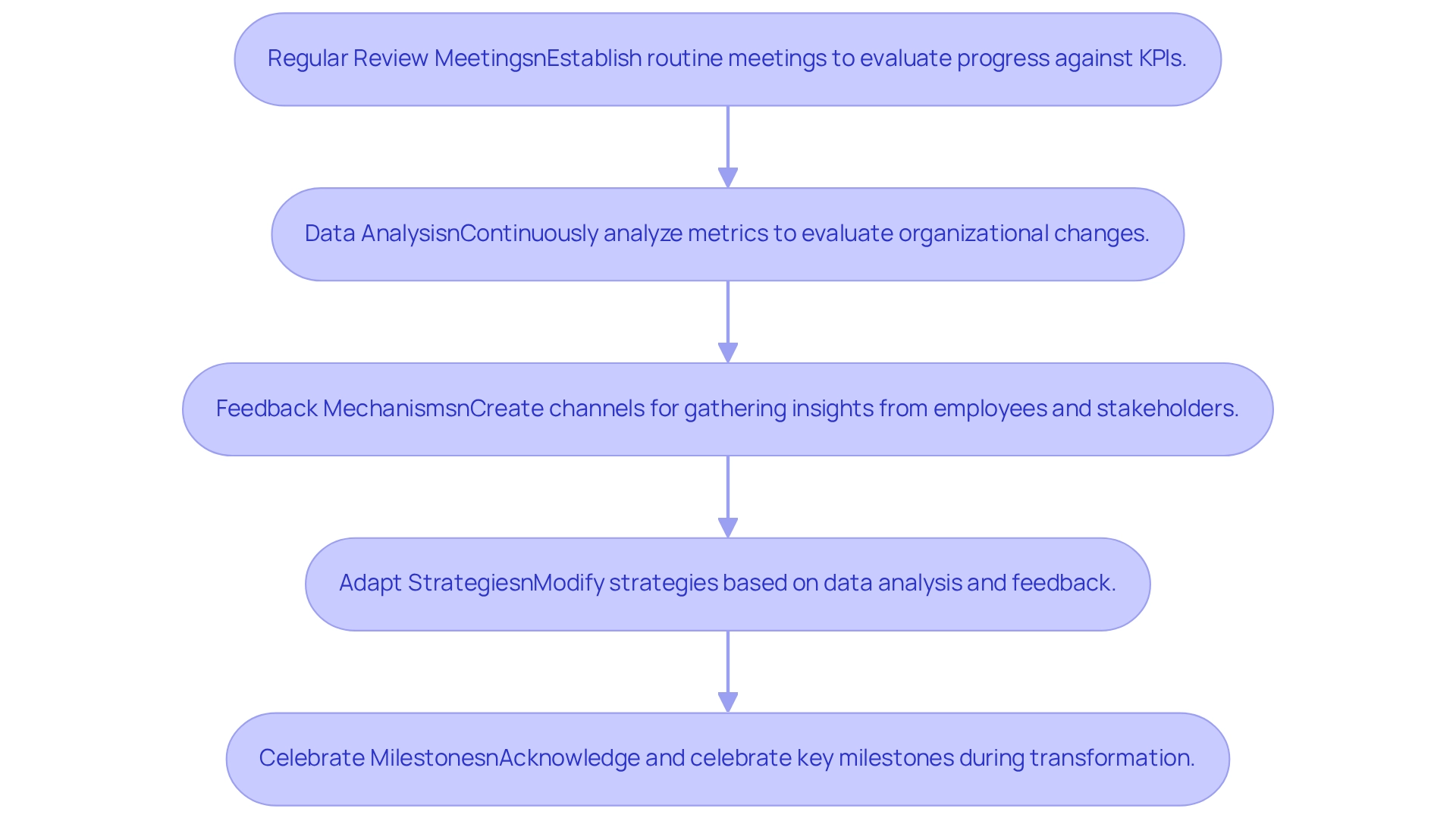

Effectively monitoring and adjusting organizational changes is crucial for achieving sustainable growth. Here are key strategies to implement:

- Regular Review Meetings: Establish a routine of meetings with stakeholders to evaluate progress against key performance indicators (KPIs) and address any emerging challenges. Frequent discussions foster transparency and collaboration, supporting a shortened decision-making cycle that allows for decisive action.

- Data Analysis: Continuously analyze financial and operational metrics to evaluate the effect of organizational changes. Successful organizations often leverage real-time analytics to identify trends and make informed decisions. In reality, research indicates that businesses that employ industry standards and peer evaluations can improve their reorganization approaches considerably, optimizing return on invested capital.

- Feedback Mechanisms: Create channels for gathering insights from employees and stakeholders regarding the restructuring process. This feedback is essential for grasping the practical realities and can direct necessary modifications, ensuring that plans are implemented effectively.

- Adapt Strategies: Be prepared to modify strategies based on the insights gained from data analysis and stakeholder feedback. Flexibility is crucial to ensure that the reorganization plan remains effective and aligned with organizational goals, allowing for continuous monitoring of business health through client dashboards.

- Celebrate Milestones: Acknowledge and celebrate key milestones reached during the transformation journey. Recognizing progress not only boosts morale but also reinforces commitment among stakeholders.

As Aaron Ross wisely stated, "Just take any step, whether small or large. And then another and repeat day after day. It may take months, maybe years, but the path to success will become clear." By actively participating in distressed asset restructuring, companies can manage the complexities of reorganization more effectively, ultimately improving their prospects for long-term success. Case studies have shown that organizations that prioritize regular monitoring and adapt their strategies accordingly significantly improve their outcomes in distressed asset restructuring, ensuring operational continuity and successful transitions.

Conclusion

Navigating the intricacies of distressed asset restructuring requires a comprehensive understanding of both the challenges and opportunities that lie ahead. By conducting thorough financial assessments, organizations can pinpoint the root causes of distress and devise targeted turnaround strategies. Engaging stakeholders throughout the process not only fosters collaboration but also ensures that the restructuring plan aligns with the collective vision of all parties involved.

The strategic restructuring plan serves as a roadmap, guiding companies through the implementation phase with clear objectives and actionable steps. Continuous monitoring and flexibility are paramount, enabling businesses to adapt to evolving circumstances and optimize their approaches based on real-time data and feedback. Celebrating milestones along the way can further enhance morale and commitment, reinforcing a culture of resilience and adaptability.

Ultimately, distressed asset restructuring is not merely about survival; it is an opportunity for transformation and sustainable growth. By embracing these structured processes and focusing on stakeholder engagement, organizations can turn challenges into stepping stones for future success. The journey may be complex, but with the right strategies in place, businesses can emerge stronger and more capable of thriving in an ever-evolving marketplace.

Frequently Asked Questions

What is distressed asset restructuring?

Distressed asset restructuring is the process of reorganizing a company's economic and operational framework to enhance its viability and recover value from underperforming assets, especially when those assets have significantly depreciated in value due to economic instability.

Why is identifying the root causes of a company's distress important?

Identifying the root causes, such as ineffective management or shifts in market dynamics, is vital for implementing effective interventions that can help restore a company's profitability and operational efficiency.

What statistics highlight the prevalence of distressed asset restructuring?

In 2018, there were 13,678 business bankruptcy submissions out of 475,575 total bankruptcy filings, with Chapter 7 liquidations constituting 63.1% of all filings, indicating a significant number of companies facing economic distress.

What factors contribute to financial difficulties for many companies?

A considerable number of bankruptcy filers cite aggressive debt collection practices as a contributing factor, with 77% indicating it influenced their decision to file for bankruptcy.

What services does Transform Your Small/Medium Business offer?

They provide comprehensive turnaround and restructuring consulting services tailored for small to medium enterprises, including interim management services, evaluations focused on cash preservation and efficiency, bankruptcy case management, and real-time analytics for performance monitoring.

What are the essential steps for conducting a comprehensive financial assessment?

The essential steps include gathering economic statements, analyzing key ratios, identifying cash flow issues, evaluating liabilities, and assessing asset value.

How can organizations identify cash flow issues?

By scrutinizing cash flow statements to uncover patterns in cash inflow and outflow, particularly focusing on operational cash flow, organizations can pinpoint areas that may require immediate intervention.

Why is it important to assess the fair market value of assets?

Assessing the fair market value of assets is vital for measuring potential recovery value and guiding strategic decisions throughout the reorganization process.

What best practices can enhance financial evaluations?

Best practices include creating clear evaluation standards, maintaining open dialogue with suppliers, frequently updating monetary assessments, and understanding productivity and efficiency measures.

How can organizations ensure they thrive in challenging environments?

By following the steps for financial assessment and adopting best practices, organizations can identify critical areas needing immediate attention, shaping effective restructuring strategies that promote sustainable growth.