Overview

The financial viability risk assessment tool presents significant advantages for small and medium enterprises, including:

- Enhanced decision-making

- Risk identification

- Regulatory compliance

- Operational efficiency

Ultimately, it fosters sustainable growth. This tool empowers organizations to proactively manage financial vulnerabilities, optimize cash flow, and improve stakeholder engagement. These elements are essential for navigating economic challenges and ensuring long-term success. By leveraging this tool, businesses can not only mitigate risks but also position themselves for future growth.

Introduction

In the competitive landscape of small and medium businesses, the quest for financial stability and sustainable growth has never been more crucial. The Financial Viability Risk Assessment (FVRA) tool emerges as a game-changer, offering organizations a comprehensive approach to evaluate their financial health and identify vulnerabilities. By harnessing advanced analytics and real-time insights, businesses can proactively address potential risks, streamline operations, and enhance decision-making processes. Moreover, as the market continues to evolve, the FVRA not only equips companies to navigate uncertainties but also empowers them to optimize their cash conversion cycles and ensure compliance with regulatory standards. This article delves into the multifaceted benefits of the FVRA tool, highlighting its role in fostering resilience and driving long-term success in an ever-changing economic environment.

Transform Your Small/ Medium Business: Comprehensive Financial Viability Risk Assessment Services

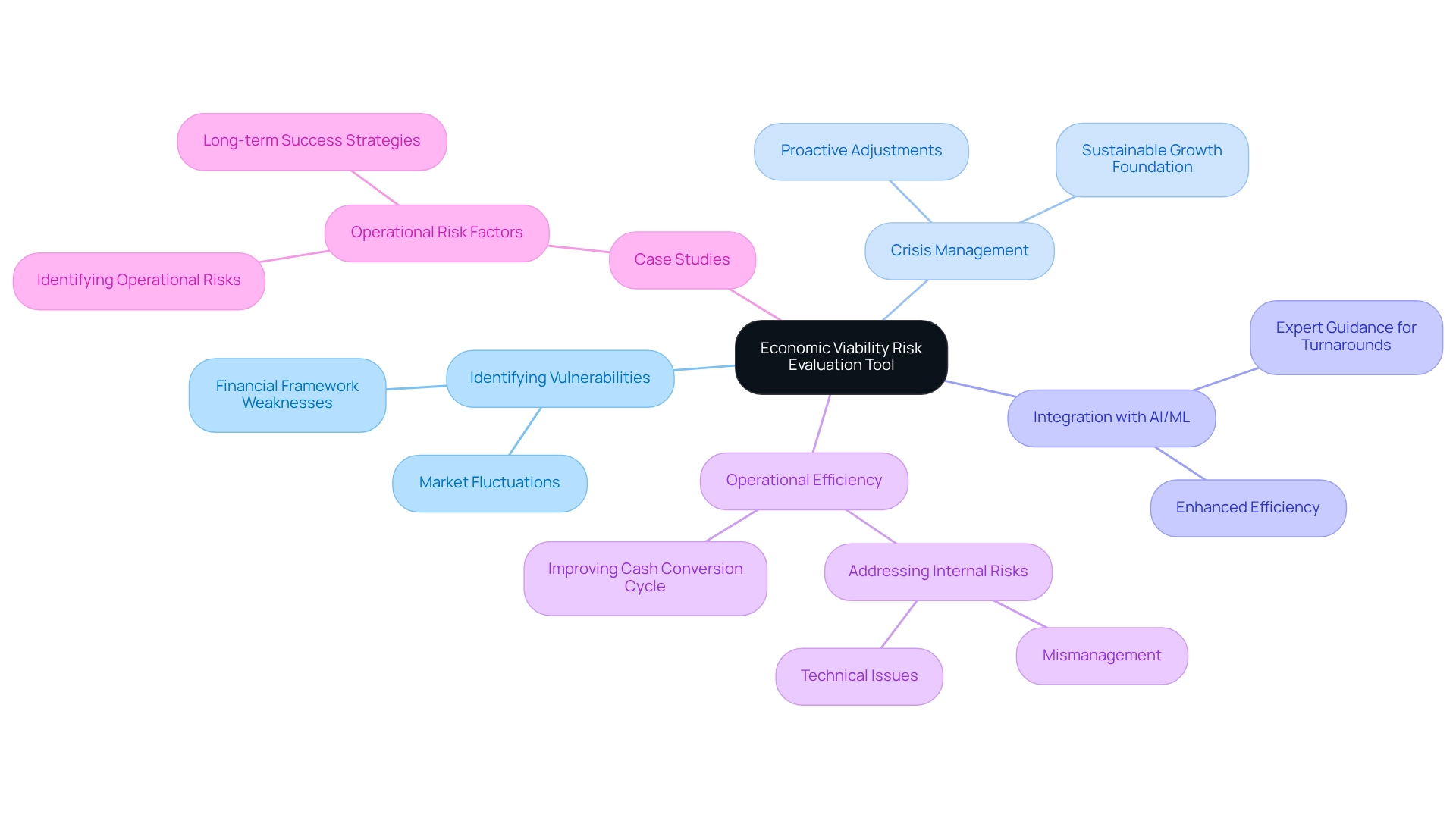

The Economic Viability Risk Evaluation instrument is essential for small and medium enterprises aiming to thoroughly assess their monetary well-being. By leveraging this tool, organizations can identify vulnerabilities within their financial frameworks, allowing for timely and effective adjustments. This proactive strategy not only facilitates crisis management but also establishes a foundation for sustainable growth. The instrument serves as a strategic guide for achieving economic stability, enabling companies to navigate challenging times with confidence.

Frequent revisions to the financial risk management strategy, supported by ongoing evaluations, are vital for maintaining resilience and flexibility in an ever-changing market environment. Furthermore, the integration of AI/ML strategies within the framework enhances its efficiency, providing expert guidance for SMB turnarounds and optimizing the cash conversion cycle. Successful implementation of the instrument has been shown to improve operational efficiency, as operational risks often stem from internal shortcomings such as mismanagement or technical issues. Case studies underscore the significance of addressing these internal operational risks to sustain efficiency and secure long-term success.

Moreover, the instrument aligns with the strategies outlined in 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Performance,' further assisting companies in enhancing their effectiveness. Ultimately, this resource represents a significant advantage for small and medium enterprises striving to improve their economic well-being and foster long-term success.

Improved Decision-Making: Leveraging the FVRA Tool for Strategic Financial Insights

The financial viability risk assessment tool serves as a pivotal resource for leaders, providing them with essential data that informs strategic decision-making, particularly in mastering the cash conversion cycle. By examining economic metrics and trends, organizations can make informed choices regarding:

- Investments

- Cost-reduction strategies

- Resource distribution

This data-driven approach minimizes risks associated with financial decisions by incorporating a financial viability risk assessment tool, thereby enhancing the overall strategic direction of the organization. Moreover, with accurate insights and real-time analytics, leaders can pivot quickly in response to market changes, ensuring their business remains competitive while effectively monitoring performance for continuous improvement.

Priced at $99.00, the device incorporates 20 strategies for optimizing the cash conversion cycle, facilitating ongoing performance monitoring and enabling organizations to adapt swiftly to evolving market conditions.

Risk Identification: Utilizing the FVRA Tool to Pinpoint Financial Vulnerabilities

The financial viability risk assessment tool plays a crucial role in identifying monetary vulnerabilities within organizations. By conducting a thorough evaluation, companies can uncover potential risks associated with cash flow, debt levels, and operational inefficiencies. This proactive approach empowers organizations to tackle issues before they escalate into significant challenges, thereby protecting their financial stability.

As we look toward 2025, small businesses are increasingly embracing risk management strategies that incorporate the financial viability risk assessment tool, recognizing its significance in navigating uncertainties and improving decision-making processes.

The Consumer Financial Protection Bureau (CFPB) underscores the necessity of equitable and transparent markets, highlighting the importance of evaluations in ensuring compliance and protecting consumer interests. Statistics reveal that organizations employing risk assessments have effectively identified vulnerabilities, resulting in improved cash flow management and operational efficiency.

A recent example illustrates this point: state regulators mandated Block to pay $80 million for violations, underscoring the consequences of inadequate risk management. Furthermore, the CFPB's legal actions against major banks, including lawsuits for allowing fraud to persist on the Zelle payment platform, accentuate the critical need for recognizing economic vulnerabilities and ensuring compliance.

These instances reinforce the law's effectiveness in enabling companies to make informed decisions and foster sustainable growth. Additionally, case studies reveal how early risk identification through the financial viability risk assessment tool has favorably impacted economic well-being, equipping companies to adapt to the current regulatory landscape and efficiently address cash flow challenges while implementing lessons learned.

Regulatory Compliance: Ensuring Adherence with the FVRA Tool's Structured Assessments

The financial viability risk assessment tool serves as a comprehensive framework that empowers enterprises to ensure compliance with essential economic regulations while facilitating efficient decision-making and real-time analytics. By systematically evaluating monetary practices and reporting standards, organizations can pinpoint areas of non-compliance and enact necessary corrective measures. This proactive strategy not only mitigates the risk of incurring legal penalties but also enhances the organization's reputation among stakeholders.

In 2025, the significance of adherence in financial reporting cannot be overstated, particularly as data indicates that small enterprises face a higher rate of regulatory compliance failures. For instance, under the Digital Operational Resilience Act (DORA), a Register of Information report must be submitted to the Supervisory Authority for classifying third-party ICT services that support critical functions, underscoring the regulatory landscape that CFOs must navigate. It is vital to integrate the financial viability risk assessment tool into a broader compliance strategy to preserve operational integrity and foster trust within the marketplace. The tool's ability to deliver real-time business analytics facilitates continuous monitoring of compliance efforts, allowing organizations to adapt strategies promptly based on performance data.

As Dov Goldman, VP of Risk Strategy, articulates, 'The Digital Operational Resilience Act (DORA) is transforming how institutions handle risk.' This statement underscores the importance of organized evaluations, akin to those offered in effectively tackling compliance challenges. Furthermore, case studies—such as those concerning pollution incidents and legal disputes management—demonstrate how monetary evaluations can aid in compliance, further emphasizing the role of the assessment mechanism in ensuring adherence to regulations like DORA.

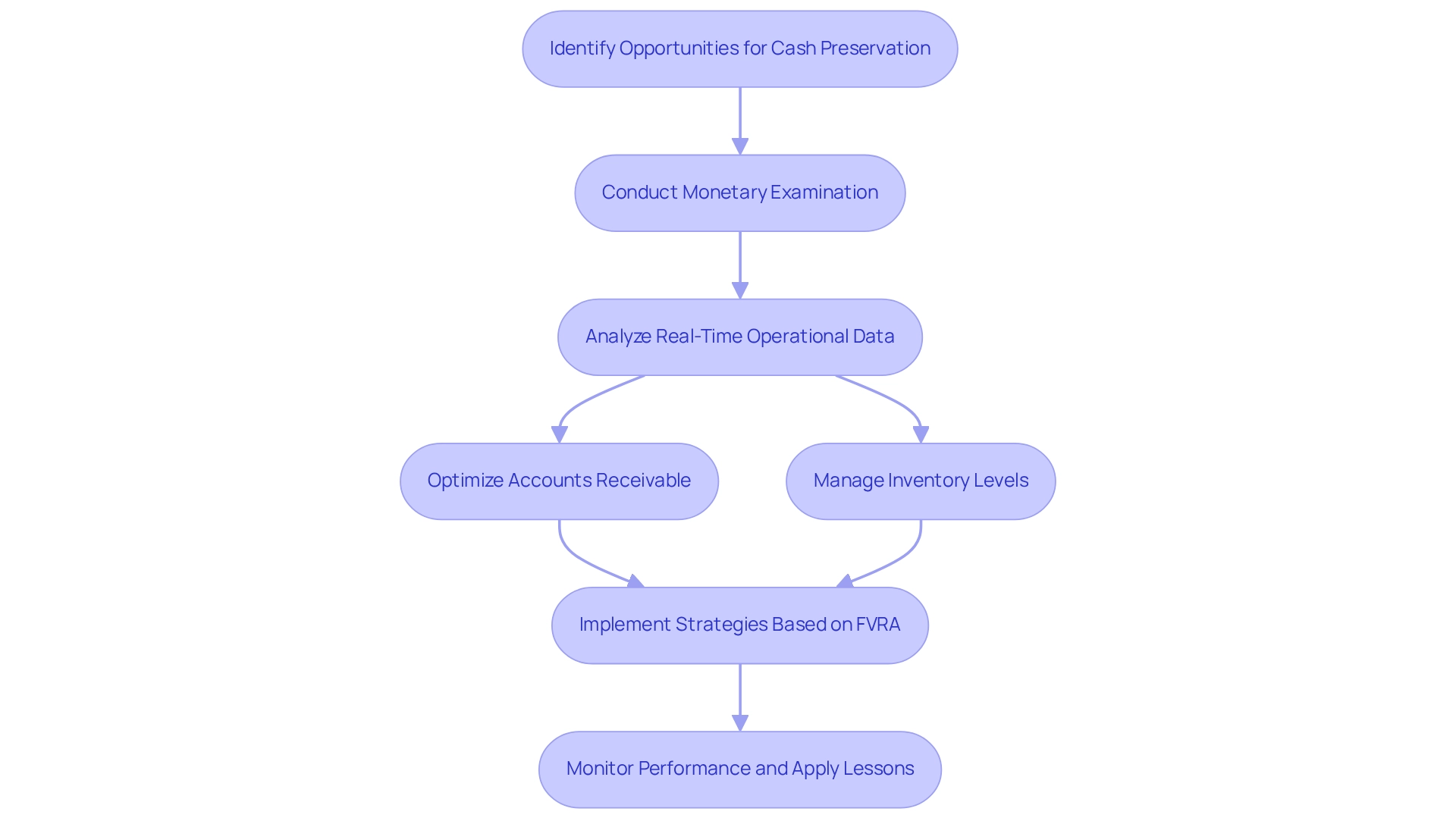

Cash Preservation: Enhancing Liquidity Management with the FVRA Tool

The FVRA tool is essential for enhancing liquidity management by pinpointing opportunities for cash preservation. Through comprehensive monetary examination and real-time operational analytics, including insights from our client dashboard, companies can identify areas for cash flow enhancement, such as optimizing accounts receivable and managing inventory levels.

Our team champions a streamlined decision-making cycle during the turnaround process, enabling organizations to take decisive action to safeguard their operations. By implementing strategies based on the financial viability risk assessment tool—such as improving the cash conversion cycle through efficient receivables management and inventory optimization—organizations can ensure they maintain adequate liquidity to meet operational needs and effectively navigate economic challenges.

Continuous performance monitoring allows them to apply turnaround lessons, reinforcing their financial resilience.

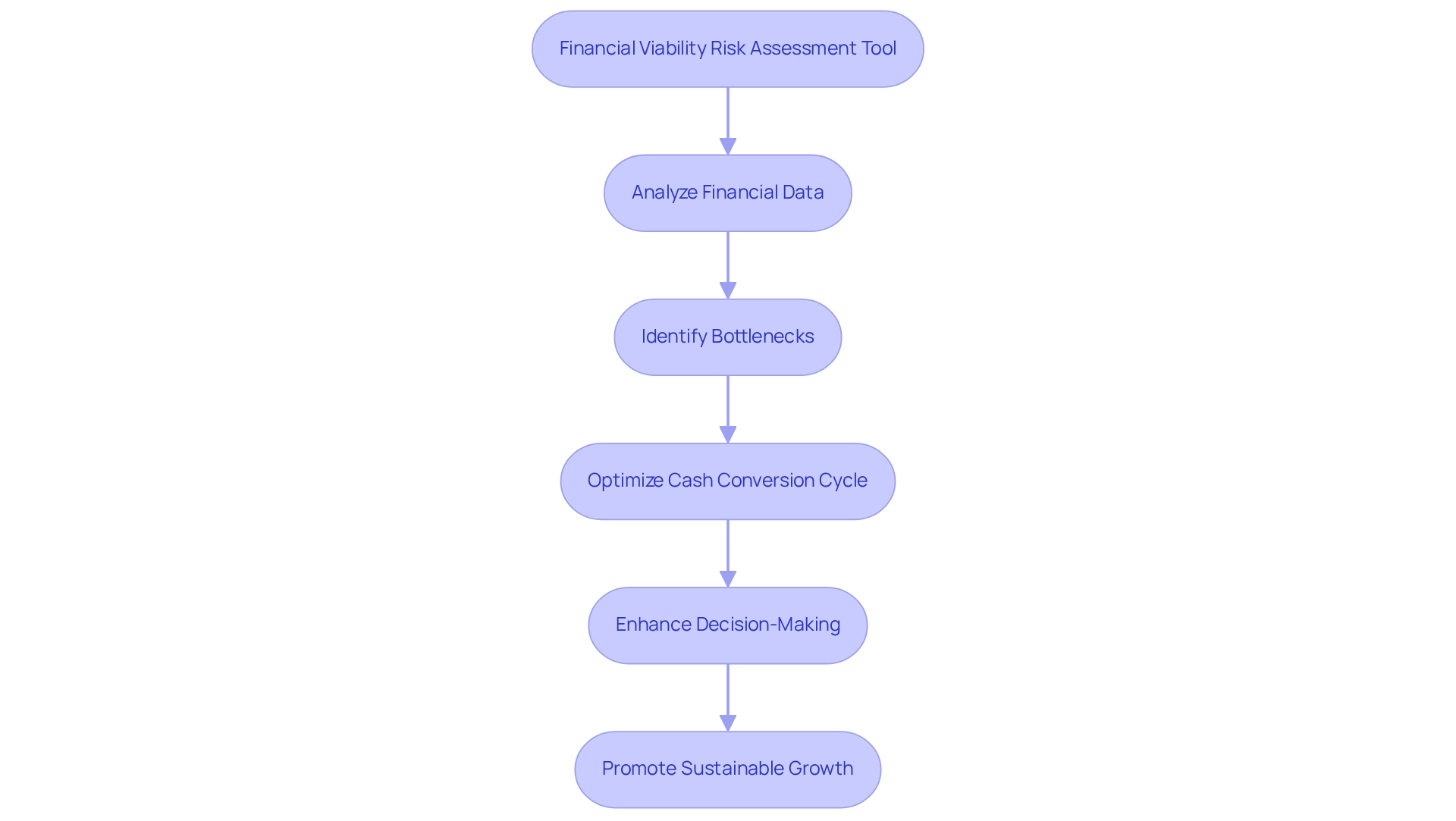

Operational Efficiency: Streamlining Processes through the FVRA Tool

The financial viability risk assessment tool is essential for identifying operational inefficiencies that hinder organizational performance. By meticulously analyzing financial data alongside operational processes, organizations can pinpoint bottlenecks and redundancies that inflate costs.

For instance, Ambassador Foods successfully implemented ERP software to streamline their management processes, resulting in enhanced decision-making capabilities and improved operational efficiency. Such transformations, inspired by insights from the act, empower companies to reduce expenses and boost profitability. As smaller enterprises increasingly prioritize operational efficiency, leveraging the financial viability risk assessment tool becomes essential for thriving in competitive markets.

Additionally, the financial viability risk assessment tool highlights inefficiencies and optimizes the cash conversion cycle by identifying areas for cash flow improvement. Statistics reveal that enterprises conducting thorough financial assessments can achieve substantial enhancements in operational efficiency, underscoring the necessity of identifying and addressing inefficiencies to elevate overall profitability.

Furthermore, the negative correlation between corporate strategy and market uncertainty accentuates the urgent need for operational efficiency in today's unpredictable environment. Understanding the relationship between ownership structure and manufacturing performance, influenced by competitive intensity, underscores the importance of tailored evaluations for various business models.

As CFOs navigate these challenges, the financial viability risk assessment tool serves as a vital asset for strategic decision-making and fiscal planning, ultimately promoting sustainable growth. By consistently monitoring performance and applying turnaround lessons, organizations can ensure they are well-prepared to adapt and thrive in a dynamic commercial landscape.

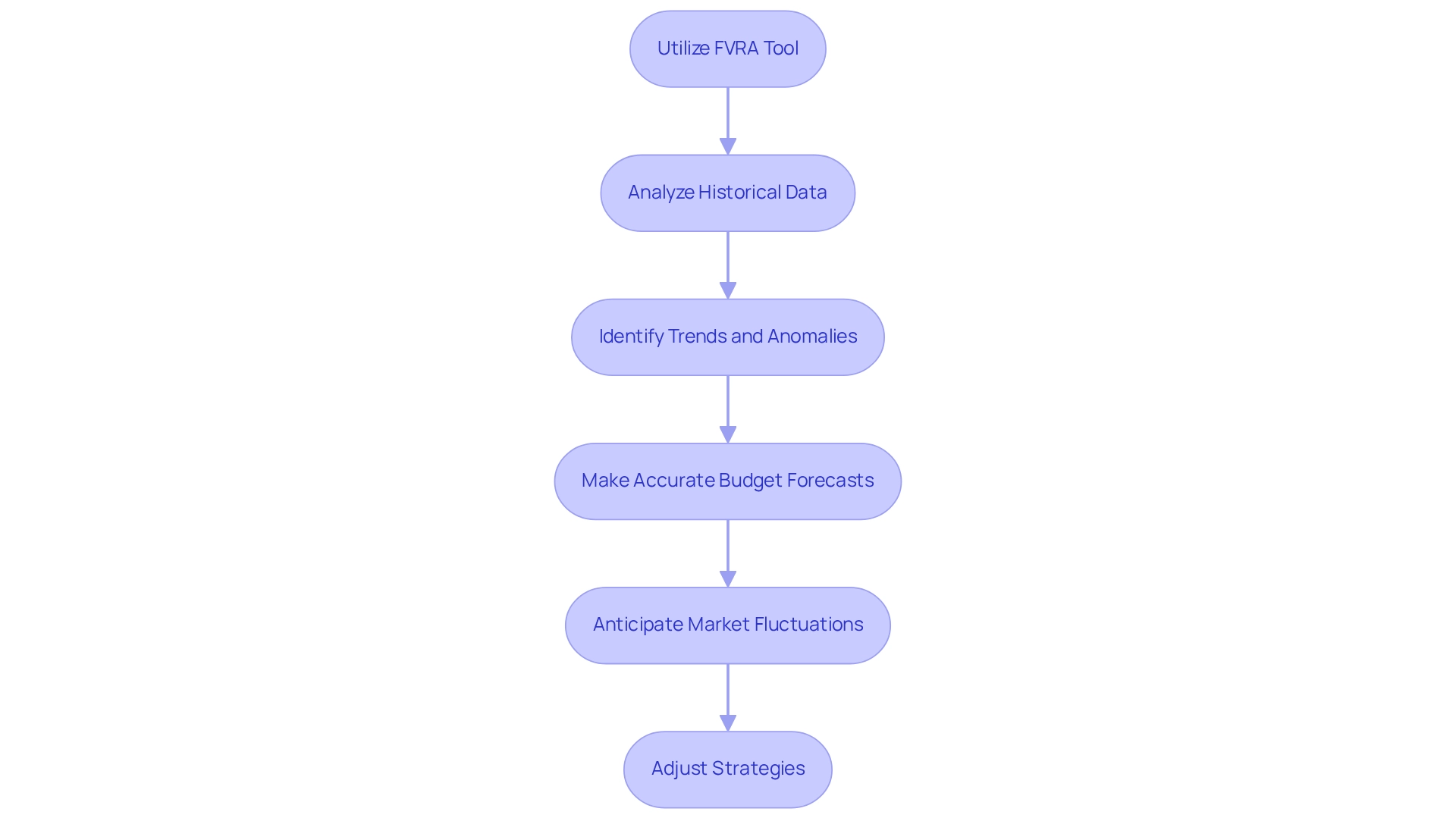

Enhanced Financial Forecasting: Utilizing the FVRA Tool for Accurate Projections

The financial viability risk assessment tool significantly enhances monetary forecasting, providing a comprehensive analysis of historical data alongside current economic conditions. This tool serves as a financial viability risk assessment tool with advanced analytics functions that empower organizations to identify trends and anomalies, leading to more accurate budget forecasts that are vital for effective planning and strategy. By leveraging insights from the FVRA assessment, organizations can anticipate market fluctuations and proactively adjust their strategies, ensuring agility in a constantly evolving commercial landscape.

Notably, precise monetary forecasts are crucial, as only one-third of small enterprises survive beyond the ten-year mark, underscoring the necessity for robust fiscal planning. Furthermore, employing historical data analysis can yield improved forecasting accuracy, with research indicating that companies utilizing sophisticated evaluation methods can enhance their economic outcomes by as much as 20%. Our pragmatic approach incorporates a 'Test & Measure' methodology, rigorously testing every hypothesis to maximize returns on invested capital. This enables CFOs to effectively operationalize turnaround lessons.

As Rami Ali, Senior Product Marketing Manager, articulates, 'To secure a Small Business Association (SBA) loan, you’ll need a thorough understanding of your finances so you can show the lender how your funds will be used and when the loan will be paid back.' This insight positions the financial viability risk assessment tool as a crucial asset for CFOs who aim to navigate monetary uncertainties and promote sustainable growth.

Turnaround Support: How the FVRA Tool Aids in Restructuring Efforts

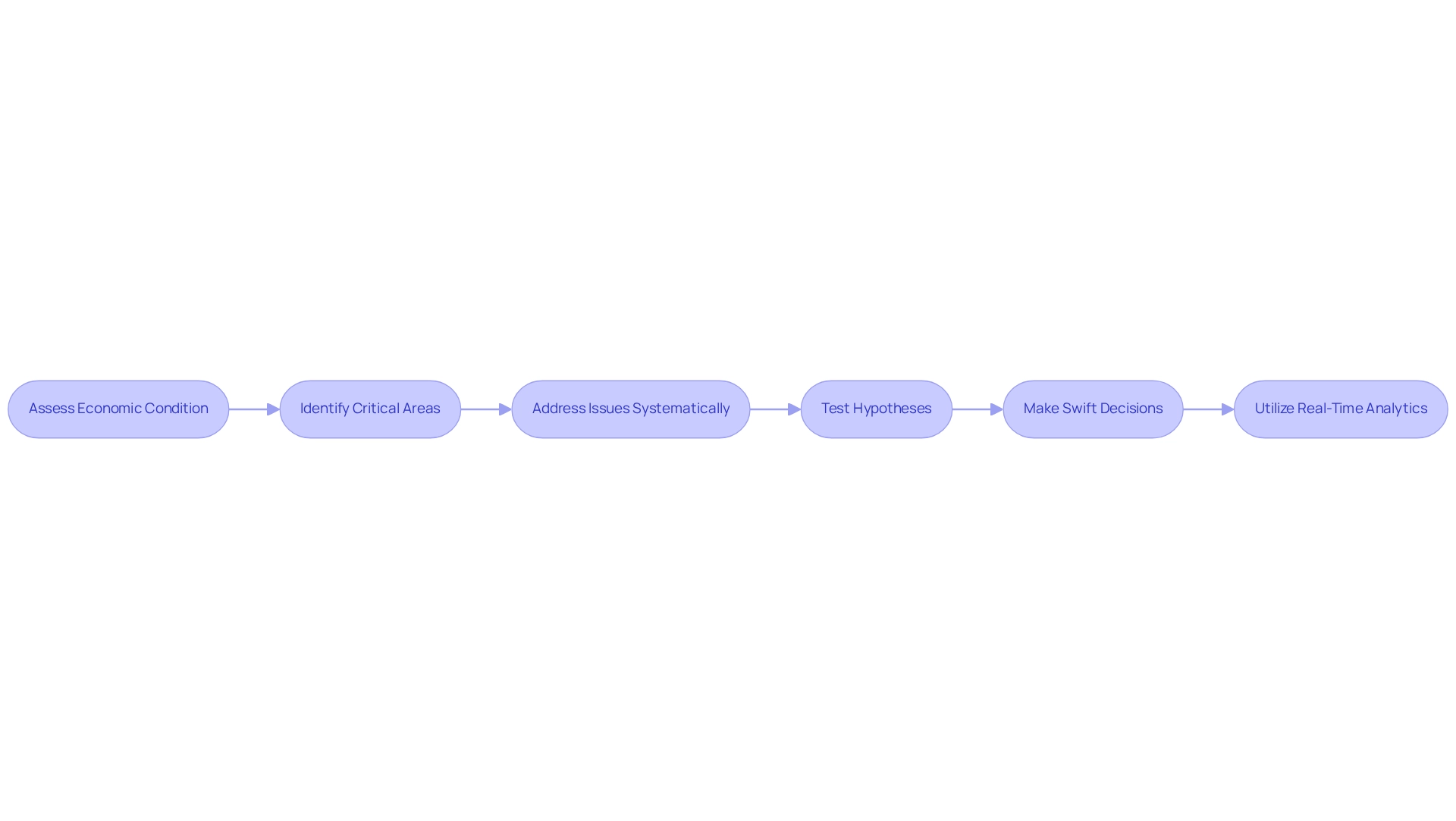

The tool is essential in aiding recovery initiatives by offering a clear view of an organization's economic condition. During restructuring initiatives, companies can use the financial viability risk assessment tool to identify critical areas that require immediate attention, such as debt management and operational adjustments. By addressing these issues systematically, organizations can implement effective turnaround strategies that restore financial stability and position them for future growth.

SMB's strategy emphasizes testing hypotheses and making swift choices, which are crucial for maintaining organizational vitality. Moreover, the incorporation of real-time analytics via client dashboards enables ongoing performance monitoring, ensuring that companies can modify their strategies according to current data. This commitment to operationalizing lessons learned fosters strong relationships and enhances the overall effectiveness of the turnaround process.

Stakeholder Engagement: Improving Communication through the FVRA Tool

The financial viability risk assessment tool significantly enhances stakeholder involvement by providing clear and transparent fiscal assessments that can be effectively communicated. By leveraging insights from the financial viability risk assessment tool, businesses can identify underlying issues and collaboratively plan solutions, cultivating trust and collaboration among stakeholders, including investors, employees, and suppliers. This openness is essential for aligning interests and keeping all parties informed about the organization's economic status and strategic direction.

In 2025, organizations that emphasize monetary transparency will likely encounter challenges akin to those faced by Bellevue, which dealt with regulatory issues while implementing its transit-oriented development plan. Bellevue's experience underscores the need for effective communication in complex situations, as the city successfully aligned its planning with Washington's Growth Management Act despite funding limitations. Moreover, expert views emphasize that effective communication through monetary instruments, facilitated by a financial viability risk assessment tool, not only enhances stakeholder involvement but also cultivates a culture of accountability and common objectives.

Leah's insight into the Sedex community emphasizes the importance of making connections, stating, "Making those connections within the Sedex community is invaluable to us; we’re all working towards the same goals." By clearly expressing fiscal evaluations and employing strategies to master the cash conversion cycle, such as optimizing inventory turnover and streamlining receivables, businesses can ensure that stakeholders are not only informed but also engaged in the decision-making process, ultimately driving sustainable growth.

Additionally, as organizations strive to improve communication with stakeholders in SMEs in 2025, using a financial viability risk assessment tool to address the challenges of interpreting and implementing financial assessments will be essential for fostering trust and collaboration.

Sustainable Growth: Long-Term Benefits of Implementing the FVRA Tool

Implementing the financial viability risk assessment tool yields significant long-term benefits that are crucial for sustainable growth. Our team identifies underlying business issues and collaborates to create a plan that mitigates weaknesses, enabling businesses to reinvest in key strengths. Ongoing monetary evaluations empower organizations to pinpoint and address vulnerabilities, adapting swiftly to evolving market conditions and maintaining a competitive edge. Insights obtained from the Act not only bolster immediate economic stability but also establish a solid foundation for future success. Entities that prioritize their economic stability through relevant regulations are strategically positioned to achieve their growth goals and adeptly navigate challenges.

For instance, companies that have integrated economic viability evaluations through the financial viability risk assessment tool report enhanced operational efficiency and improved decision-making capabilities, ultimately leading to higher profitability. The financial viability risk assessment tool also facilitates the 'Test & Measure' approach, enabling organizations to test hypotheses and effectively measure investment returns.

As articulated in the Financial Services and Markets Act 2023, a robust regulatory framework underpins the necessity for comprehensive economic evaluations, particularly within a resilient banking system capable of enduring stress periods. Furthermore, the recent case study on AI adoption in banking services illustrates how firms are optimizing internal processes through monetary evaluations, thereby enhancing operational efficiency. As the economic landscape continues to evolve, leveraging the financial viability risk assessment tool becomes essential for small enterprises striving to secure a competitive edge and ensure long-term sustainability. The Economic Policy Committee has also emphasized that, despite rising risks in the sector, ongoing fiscal evaluations are vital for mitigating these risks and fostering sustainable growth.

Actionable Tip for CFOs: Regularly utilize the financial viability risk assessment tool not only to assess financial viability but also to test various business hypotheses, ensuring that your organization can adapt and thrive in a changing market.

Conclusion

The Financial Viability Risk Assessment (FVRA) tool emerges as an essential asset for small and medium businesses dedicated to strengthening their financial health and achieving sustainable growth. By delivering a thorough evaluation of financial vulnerabilities, the FVRA enables organizations to proactively tackle challenges that may impede their success. This proactive strategy not only enhances crisis management but also cultivates long-term resilience in a constantly changing market environment.

Furthermore, the FVRA improves decision-making capabilities by offering critical insights derived from real-time analytics. This data-driven approach empowers business leaders to make informed decisions regarding investments, operational efficiencies, and adherence to regulatory standards. As illustrated through various case studies, the incorporation of the FVRA into financial management practices has resulted in improved cash flow management, greater operational efficiency, and a more robust methodology for risk identification.

Ultimately, the adoption of the FVRA tool transcends immediate financial stability; it lays the foundation for future success. Organizations that harness the insights provided by the FVRA are better equipped to navigate uncertainties and seize growth opportunities. As the financial landscape continues to evolve, the integration of such comprehensive assessment tools will be crucial for small and medium enterprises striving to excel and maintain a competitive advantage in their respective markets.

Frequently Asked Questions

What is the purpose of the Economic Viability Risk Evaluation instrument?

The Economic Viability Risk Evaluation instrument helps small and medium enterprises assess their financial well-being by identifying vulnerabilities within their financial frameworks, enabling timely adjustments and supporting sustainable growth.

How does the instrument contribute to crisis management?

By identifying financial vulnerabilities, the instrument allows organizations to implement proactive strategies that facilitate effective crisis management and establish a foundation for economic stability.

Why are frequent revisions to the financial risk management strategy important?

Frequent revisions, supported by ongoing evaluations, are essential for maintaining resilience and flexibility in a constantly changing market environment.

How does the integration of AI/ML strategies enhance the instrument's effectiveness?

The integration of AI/ML strategies improves the efficiency of the financial viability risk assessment tool, providing expert guidance for small and medium business turnarounds and optimizing the cash conversion cycle.

What are some benefits of implementing the Economic Viability Risk Evaluation instrument?

Successful implementation improves operational efficiency, addresses internal operational risks, and aligns with strategies for optimal performance, ultimately aiding small and medium enterprises in achieving financial stability and long-term success.

What role does the financial viability risk assessment tool play in strategic decision-making?

It provides essential data that informs leaders on investments, cost-reduction strategies, and resource distribution, thus minimizing risks associated with financial decisions.

How does the tool assist organizations in adapting to market changes?

With accurate insights and real-time analytics, the tool enables leaders to pivot quickly in response to market changes, ensuring competitiveness and continuous performance monitoring.

What is the cost of the financial viability risk assessment tool?

The tool is priced at $99.00 and incorporates 20 strategies for optimizing the cash conversion cycle.

What vulnerabilities can the financial viability risk assessment tool help identify?

The tool helps uncover potential risks related to cash flow, debt levels, and operational inefficiencies, allowing organizations to tackle issues proactively.

How are small businesses recognizing the significance of risk management strategies?

Small businesses are increasingly adopting risk management strategies that include the financial viability risk assessment tool to navigate uncertainties and improve decision-making processes.

What examples illustrate the consequences of inadequate risk management?

Examples include Block being mandated to pay $80 million for violations and the CFPB's legal actions against major banks for failing to address fraud, highlighting the critical need for recognizing economic vulnerabilities.

How can early risk identification impact a company's economic well-being?

Early risk identification through the financial viability risk assessment tool can favorably impact economic well-being by equipping companies to adapt to regulatory landscapes and efficiently address cash flow challenges.