Overview

The article primarily addresses effective turnaround strategies for distressed companies, highlighting solutions such as:

- Comprehensive consulting

- Interim management

- Financial assessments

These strategies are essential as they can stabilize operations, optimize resources, and enhance financial health. Consequently, they enable companies to recover and thrive in challenging economic environments. By implementing these approaches, organizations can not only navigate their difficulties but also position themselves for future success.

Introduction

In the competitive landscape of small and medium businesses, the path to recovery and growth often lies in strategic consulting. Companies face mounting pressures—from financial instability to shifting market demands—making turnaround consulting a beacon of hope. This comprehensive approach not only addresses immediate operational challenges but also lays the groundwork for long-term success.

By leveraging tailored strategies, interim management, and financial assessments, businesses can navigate their unique obstacles and emerge stronger. Statistics reveal that a significant number of small businesses struggle to survive; thus, the importance of expert guidance becomes clear.

This article delves into the multifaceted world of turnaround consulting, exploring how businesses can harness these services to optimize operations, enhance financial health, and ultimately thrive in an ever-evolving marketplace.

Transform Your Small/ Medium Business: Comprehensive Turnaround Consulting

Comprehensive turnaround consulting entails a meticulous analysis of an organization's operations, finances, and market positioning. At Transform Your Small/Medium Enterprise, our consultants collaborate closely with owners to pinpoint vulnerabilities and devise tailored strategies that tackle specific challenges. Our services include distressed company solutions such as comprehensive turnaround and restructuring consulting, interim management, and financial evaluations, all designed to assist small to medium enterprises in saving money, optimizing operations, and boosting revenues. This process frequently involves restructuring operations, optimizing resource allocation, and implementing cost-saving measures. Notably, companies engaging in our turnaround consulting experience significant improvements in recovery rates, with numerous clients reporting favorable ROI through our innovative 'Rapid30' plan, which emphasizes swift decision-making and real-time analytics. As one client stated, "Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years." By addressing both immediate needs and long-term objectives, companies can emerge more resilient and competitive in their markets. Additionally, with 70% of consumers unwilling to purchase from companies with inadequate security measures, addressing these operational risks is essential for effective turnaround strategies.

Financial Assessment Services: Preserve Cash and Reduce Liabilities

Carrying out a financial evaluation is a vital step for implementing distressed company solutions, involving a thorough examination of financial statements, cash flow, and liabilities. This meticulous process uncovers opportunities for significant cost reductions, such as renegotiating contracts, eliminating superfluous expenses, and optimizing inventory management. Companies that conduct strategic financial evaluations can attain average cost reductions of up to 20%, which is essential for stabilizing operations and establishing a financial cushion against future obstacles.

In recent years, the environment for small enterprises has been especially difficult, with an average of 96,548 small enterprises vanishing each year between 2016 and 2020. Furthermore, in predominantly male-owned enterprises, 42,422 were established while 37,223 vanished during the same timeframe, emphasizing the instability in the market. This underscores the necessity of effective financial assessments to ensure longevity and resilience in the market. By concentrating on cash preservation and liability reduction, companies can not only navigate crises but also position themselves for sustainable growth.

Our comprehensive Financial Assessment services are designed to identify underlying operational issues and work collaboratively with clients to create actionable plans that mitigate weaknesses and allow for reinvestment in key strengths. Expert opinions highlight that businesses should prioritize these assessments as a proactive measure, enabling them to make informed decisions that safeguard their financial health. As Warren Buffett wisely stated, 'If you don’t find a way to make money while you sleep, you will work until you die.' Ultimately, a robust financial assessment service is part of distressed company solutions that are indispensable for small to medium enterprises aiming to thrive in uncertain economic conditions, especially in light of rising labor costs, which reached a peak of 13% in December 2021.

Interim Management Solutions: Provide Leadership During Crisis

Interim leadership solutions involve placing seasoned executives into pivotal roles on a temporary basis. These professionals bring extensive experience and a fresh perspective, enabling organizations to effectively navigate crises. By implementing immediate changes, they stabilize operations and lay the groundwork for long-term recovery. This approach not only addresses pressing challenges but also fosters sustainable growth.

Transform Your Small/Medium Business provides extensive turnaround and restructuring consulting services, including interim leadership, financial evaluation, and bankruptcy case oversight. Our expertise enables companies to save money, streamline operations, reduce overhead, and increase revenues, ensuring that organizations can concentrate on their core activities while we manage the intricacies of turnaround processes.

Statistics indicate that companies employing temporary leadership during crises experience significantly shorter recovery periods, with many reporting improved operational efficiency and enhanced decision-making capabilities. Our customized strategy facilitates a reduced decision-making cycle during the turnaround process, enabling teams to take decisive action to safeguard their operations.

Successful examples abound, showcasing how interim leaders have provided distressed company solutions by swiftly identifying issues and executing strategic initiatives. Insights from leadership consultants highlight that effective crisis coordination relies on the ability to adapt swiftly and utilize the expertise of interim executives, ultimately resulting in a more resilient organization.

As Bill George, former CEO of Medtronic, aptly stated, "Before you change the world, you have to change yourself." This underscores the importance of leadership transformation during crises.

Additionally, our commitment to operationalizing lessons learned through the turnaround process ensures that businesses not only recover but also thrive in the long run. This training fosters accountability and initiative, enabling interim leaders to effectively assess and manage risks during crises.

Benefits of Interim Management:

- Immediate stabilization of operations

- Enhanced decision-making capabilities

- Shorter recovery times

- Improved operational efficiency

- Ability to swiftly identify and address underlying issues

Incorporating these elements not only enhances the credibility of the section but also provides a more rounded view of the role of interim management in crisis situations, aligning with the target audience's need for expert opinions.

Restructuring Consulting: Realign Strategies for Recovery

Restructuring consulting plays a pivotal role in realigning a company's strategies, processes, and resources to boost operational efficiency and profitability. This approach often requires redefining commercial models, streamlining operations, and reallocating resources toward more profitable areas. A flexible mindset is essential; organizations that embrace adaptability can quickly react to market changes and position themselves for enduring success.

At Transform Your Small/Medium Enterprise, we provide distressed company solutions along with comprehensive turnaround and restructuring consulting services customized for small to medium enterprises. Our strategy encompasses interim management, financial evaluations, and an emphasis on operational efficiency, ensuring that your organization can save money and increase revenues. The Organizational Design and Capability Analysis framework includes a comprehensive 10-step process that organizations can follow to enhance their operational efficiency. For example, our 'Rapid30' plan has proven effective in identifying organizational issues and executing prompt, actionable approaches that result in substantial enhancements in financial and operational positions within just 100 days. One client noted, "Within 100 days of meeting the SMB team, my business was in a better position financially and strategically than it had been in years."

As we progress through 2025, prevailing trends in restructuring consulting highlight the incorporation of planning, execution, and financing expertise. According to PwC Germany and Strategy&, our capabilities stem from the smooth combination of planning, execution, and financial expertise during transformations, which secures lasting competitive benefits and promotes stability and trust with stakeholders. By leveraging these insights and our proven methodologies, distressed company solutions enable businesses to effectively realign their strategies for recovery, ensuring they are well-equipped to navigate the complexities of today's market landscape.

Bankruptcy Case Management: Navigate Legal Challenges Effectively

Bankruptcy case oversight is a critical process that involves managing the legal intricacies of filing for bankruptcy, including the preparation of documentation, court appearances, and negotiations with creditors. Effective oversight not only guarantees adherence to legal obligations but also offers distressed company solutions to protect the company's assets during turbulent times.

Involving seasoned advisors, such as those from Transform Your Small/Medium Company, can significantly enhance an organization's capacity to navigate these challenges, minimizing interruptions and improving recovery prospects through comprehensive turnaround and restructuring consulting services, including interim leadership.

Statistics reveal that the median gross household income for bankruptcy applicants in 2019 ranged from $35,000 to $70,000, indicating that debt, rather than income, is often the primary factor leading to bankruptcy. This underscores the necessity for companies to adopt distressed company solutions that include effective bankruptcy case handling strategies focused on addressing underlying financial issues. The substantial costs associated with outdated software, estimated at $1.52 trillion, further illustrate the financial pressures that can propel companies toward insolvency, highlighting the importance of efficient operational practices.

Legal experts emphasize that a proactive approach to bankruptcy can yield better asset recovery outcomes. As Hannah Huerta, a Marketing Specialist at PDCflow, points out, grasping the nuances of accounts receivable and payment strategies is crucial for effective management. By implementing best practices in 2025, such as thorough documentation and strategic negotiations, organizations can bolster their chances of a successful turnaround.

Moreover, with bankruptcy filings projected to surpass 11,000 weekly by 2026, the urgency for small enterprises to implement distressed company solutions to adeptly navigate legal challenges becomes increasingly critical for recovery and growth. Transform Your Small/Medium Business's commitment to operationalizing lessons learned through the turnaround process ensures continuous performance monitoring and relationship-building, essential for long-term success.

Technology-Enabled Consulting: Enhance Operational Efficiency

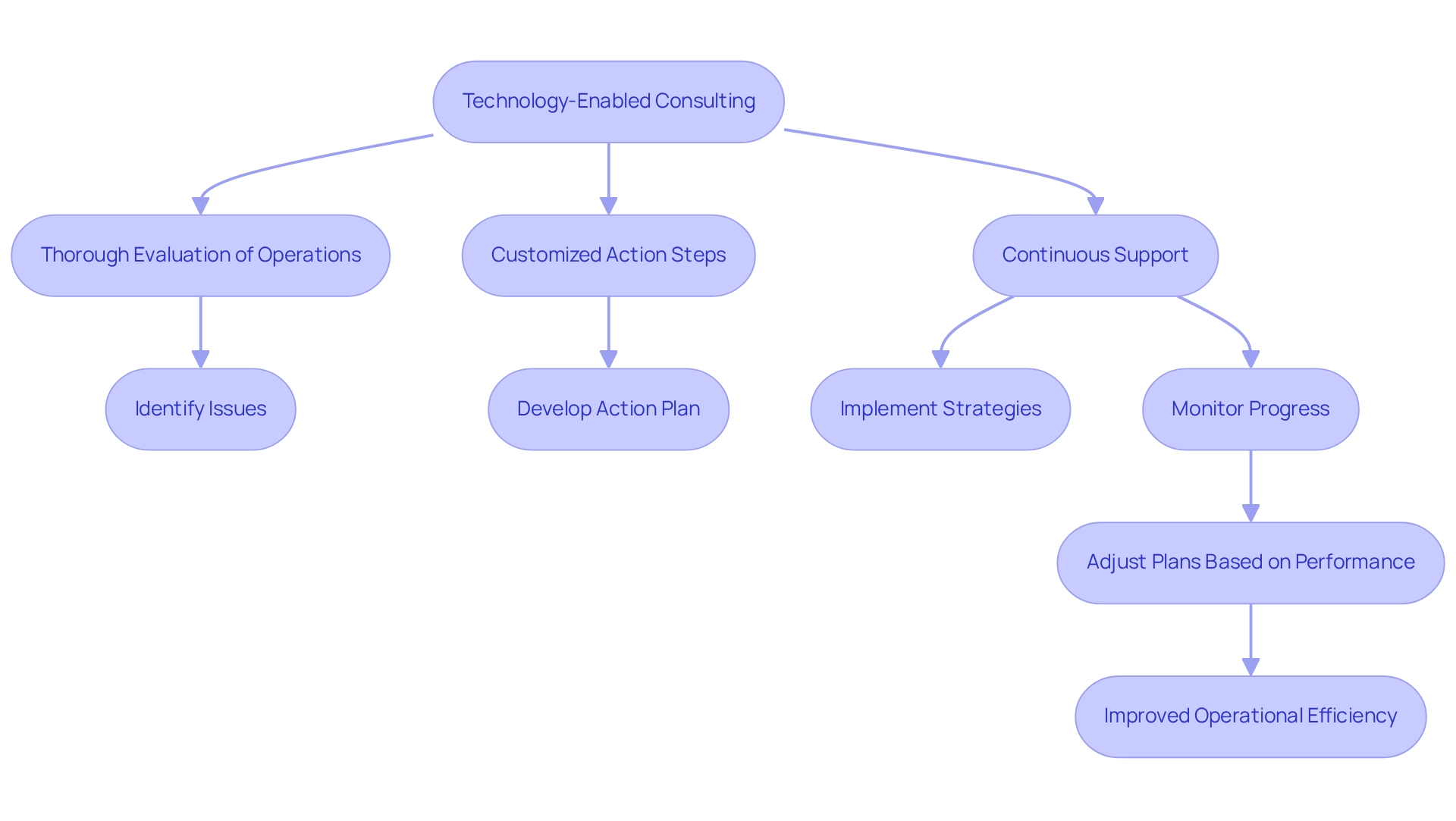

Technology-enabled consulting utilizes digital tools and platforms to significantly elevate operational efficiency in distressed company solutions. By implementing advanced software solutions for project management, financial tracking, and customer relationship management, organizations can streamline their processes and enhance internal communication. This strategic adoption of technology not only boosts productivity but also serves as distressed company solutions, equipping companies with the agility to respond swiftly to evolving market conditions.

For instance, the SMB team's 'Rapid30' plan exemplifies a transformative approach that provides distressed company solutions, enabling organizations to swiftly diagnose issues and implement effective turnaround strategies. This plan encompasses features such as:

- A thorough evaluation of operations

- Customized action steps

- Continuous support to guarantee successful execution

A satisfied customer shared, "Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years."

Recent statistics indicate that 53% of enterprises struggle with client retention, underscoring the critical need for distressed company solutions that foster stronger customer relationships. By leveraging technology, companies can enhance their engagement approaches, ultimately improving retention rates.

Moreover, ongoing performance evaluation through real-time analytics enables organizations to implement lessons learned, ensuring that plans are modified based on performance data. Case studies demonstrate that tools like NotebookLM have revolutionized how consultants synthesize insights from meetings, enabling quicker access to vital information and driving operational improvements.

As Gopal Srinivasan, Alphabet Google AI Alliance Lead, notes, "Creating and sharing different types of enablement content has transformed our practice, allowing us to quickly find the information we need with just one click."

As companies increasingly adopt these technologies, they position themselves for sustainable growth and improved performance.

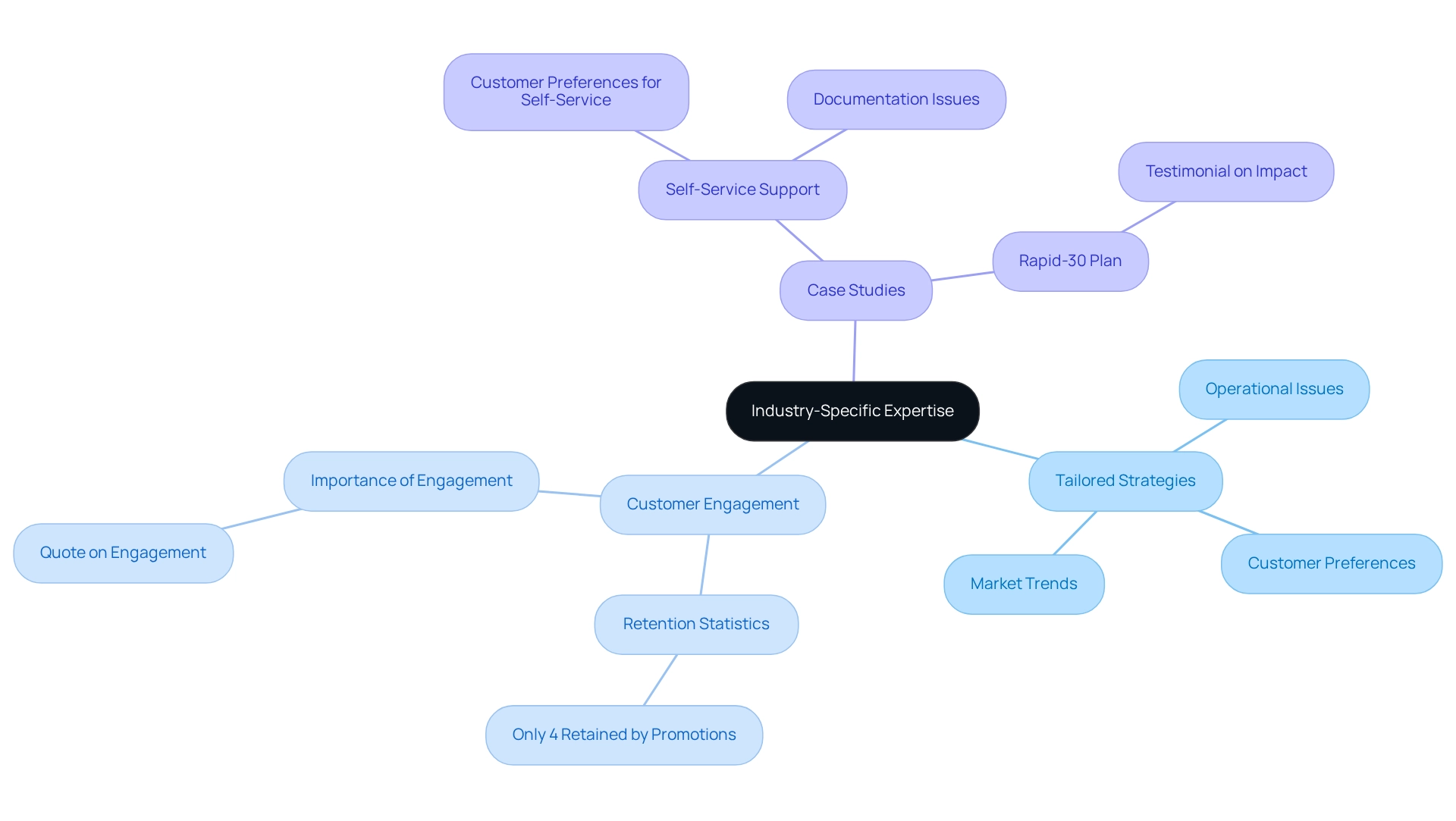

Industry-Specific Expertise: Tailored Solutions for Retail and Restaurants

Industry-specific expertise is crucial for addressing the distinct challenges and opportunities within the retail and restaurant sectors. Consultants possessing in-depth knowledge of these industries can craft tailored strategies that effectively tackle operational issues, align with customer preferences, and respond to evolving market trends. For instance, the pandemic has significantly impacted both employee and customer emotions, complicating support interactions and necessitating a nuanced approach to service delivery. As one expert noted, "When people are engaged and thriving with you, there’s less reason for them to leave for a company that might not offer the same growth opportunities." This highlights the importance of fostering engagement to retain customers.

Moreover, Transform Your Small/ Medium Enterprise utilizes a comprehensive review as part of its client engagement process, ensuring that key stakeholders are aligned and that underlying issues are identified. This strategic planning is essential for reinforcing strengths and addressing weaknesses. A case study on self-service support reveals that while customers prefer self-service solutions, many companies fail to provide adequate documentation, leading to dissatisfaction and missed opportunities for efficient service. By focusing on these industry-specific nuances, businesses can implement solutions that drive growth and enhance customer satisfaction. This targeted approach is essential for successful turnarounds, as evidenced by recent trends indicating that only about 4% of customers who threaten to leave can be retained through promotions, a stark decline from the previous average of 20%. This statistic underscores the need for innovative and engaging strategies that resonate with customers, ultimately leading to a more sustainable recovery.

Furthermore, the Rapid-30 plan provided by Transform Your Small/ Medium Business delivers a structured framework for users to navigate their challenges effectively. A recent customer shared, "The Rapid-30 plan transformed our approach and helped us identify key areas for improvement, leading to a significant turnaround in our operations." This testimonial reflects the positive impact of tailored strategies on client success.

Cash Conversion Cycle Management: Optimize Working Capital

Cash conversion cycle oversight is crucial for small enterprises aiming to enhance the duration required to convert investments in inventory and accounts receivable into cash flow. Effective cash handling serves as a safety net against economic uncertainties and unforeseen expenses. By refining procedures such as inventory oversight, invoicing, and payment collection, companies can significantly boost liquidity and mitigate the risk of cash flow shortages.

20 Strategies for Optimal Business Performance:

- Enhance invoicing processes to ensure timely payments.

- Negotiate better payment terms with suppliers to improve cash flow.

- Closely monitor inventory levels to avoid overstocking and stockouts.

- Implement trade credit insurance to safeguard against customer insolvency risks.

- Optimize payment collection strategies to reduce Days Sales Outstanding.

Effective oversight of the cash conversion cycle not only supports operational stability but also facilitates growth initiatives. A favorable cash conversion cycle, characterized by shorter Days Inventory Outstanding and Days Sales Outstanding, alongside longer Days Payables Outstanding, indicates a company's efficiency in converting inventory into cash while managing payables effectively. This approach is vital for maintaining financial health and stability, particularly in uncertain economic climates. As highlighted in the case study 'Indicators of a Good Cash Conversion Cycle,' these indicators are essential for assessing a company's financial health. As businesses navigate through challenging times, optimizing working capital through strategic cash flow management becomes a cornerstone for sustainable success.

Overcoming Client Hesitation: Strategies to Close More Deals

Addressing customer hesitation requires a deep understanding of the underlying concerns and a proactive approach to resolving them. Key strategies include:

- Clear Communication: Articulate the benefits of proposed solutions in straightforward terms, ensuring clients grasp the potential impact on their operations.

- Success Stories: Share relevant case studies that highlight past successes, demonstrating how similar businesses have benefited from your services. Customers are more likely to convert when shown specific information that illustrates the tangible advantages of a solution. A notable example is the case study titled 'Utilizing Data to Support Solutions,' which shows how quantifiable results can effectively illustrate the value of offerings and facilitate decision-making.

- Data-Driven Insights: Utilize quantifiable results from previous engagements, such as the 'Rapid30' plan developed by the SMB team, to showcase the value of your offerings. This not only builds credibility but also facilitates informed decision-making. Clients have reported significant improvements in their financial and strategic positions within a short timeframe after implementing this plan.

- Open Dialogue: Foster an environment of open communication where customers feel comfortable voicing their concerns. This transparency can significantly enhance trust and rapport.

- Expert Guidance: Leverage insights from sales experts, such as Nick Kane, who has trained over 15,000 sales professionals worldwide. He emphasizes that objections should not be taken personally; they are a natural part of the sales process. Understanding this can help consultants navigate discussions more effectively.

- Tailored Solutions: Customize your approach based on the unique needs of each individual, demonstrating a commitment to their specific challenges and goals. As Hope Nakazato, VP of Business Development, notes, as the industry continues to evolve rapidly, it is essential to adapt to market and regulatory shifts.

- Comprehensive Review: Begin with a thorough assessment to align key stakeholders and understand the situation of the customer beyond the numbers, ensuring that the proposed solutions are relevant and impactful.

- Testimonials: Include endorsements from pleased customers who have effectively overcome their challenges with the assistance of the SMB team, offering social proof of the efficacy of your approaches.

By applying these strategies, such as the thorough business assessment and strategic planning provided by the SMB team, consultants can effectively assist customers in making informed choices and adopting essential changes through distressed company solutions, ultimately resulting in successful deal closures even amidst reluctance.

Client-Centric Approach: Understand Unique Needs for Success

A user-focused approach is essential for effective consulting, emphasizing the importance of actively listening to individuals to understand their unique needs, challenges, and goals. By fostering meaningful dialogue and conducting thorough evaluations, consultants can develop customized solutions that resonate deeply with customers. This method not only enhances customer satisfaction but also significantly increases the likelihood of successful outcomes, as the solutions are specifically tailored to address unique pain points and deliver measurable results.

Transform Your Small/Medium Business underscores this approach through its comprehensive turnaround and restructuring consulting services, which encompass financial assessments and interim management. In fact, statistics reveal that personalized consulting solutions lead to greater customer satisfaction, with 80% of consumers expecting support representatives to fully address their needs.

Furthermore, organizations that invest in understanding client needs are better positioned to anticipate future challenges and opportunities, ultimately driving sustainable growth and performance improvements. Notably, 79% of retailers are investing in personalization, the highest of any industry, highlighting the critical nature of this approach.

Additionally, companies that align their workforce capabilities with personalization goals can better anticipate the expertise needed for future growth, as demonstrated in the case study titled 'Investing in Talent for Personalization.' This alignment is crucial for organizations, especially in distressed situations, where distressed company solutions can significantly impact turnaround strategies.

Moreover, personalized calls to action convert 202% better than standard calls to action, underscoring the effectiveness of customized approaches in achieving superior outcomes.

Conclusion

In the realm of small and medium businesses, turnaround consulting emerges as a transformative lifeline, providing essential strategies to navigate challenges and drive growth. The multifaceted approach outlined in this article encompasses comprehensive services such as financial assessments, interim management, and restructuring consulting. These elements work in concert to enhance operational efficiency, preserve cash flow, and ultimately position businesses for sustainable success.

Key strategies, such as the 'Rapid30' plan, underscore the importance of swift decision-making and real-time analytics, allowing companies to address immediate issues while laying the groundwork for long-term recovery. Moreover, by tailoring solutions to specific industries like retail and restaurants, consultants can effectively tackle unique challenges and leverage opportunities within these sectors.

As businesses face increasing pressures, from economic uncertainties to evolving consumer preferences, the significance of expert guidance cannot be overstated. Engaging in strategic consulting not only mitigates risks but also fosters resilience, ensuring that organizations can thrive in a competitive landscape. By prioritizing a client-centric approach and leveraging industry-specific expertise, businesses can navigate their unique obstacles and emerge stronger, more agile, and better prepared for the future.

In conclusion, embracing turnaround consulting is not merely a reactive measure; it is a proactive investment in a business's longevity and prosperity. The path to recovery and growth is paved with tailored strategies and expert insights, empowering small and medium enterprises to not only survive but flourish in an ever-evolving marketplace.

Frequently Asked Questions

What is comprehensive turnaround consulting?

Comprehensive turnaround consulting involves a detailed analysis of an organization's operations, finances, and market positioning, aimed at identifying vulnerabilities and creating tailored strategies to address specific challenges.

What services are offered under turnaround consulting?

Services include distressed company solutions such as comprehensive turnaround and restructuring consulting, interim management, and financial evaluations, all designed to help small to medium enterprises save money, optimize operations, and boost revenues.

How does financial evaluation contribute to distressed company solutions?

Financial evaluation is crucial as it involves a thorough examination of financial statements, cash flow, and liabilities, uncovering opportunities for cost reductions that help stabilize operations and create a financial cushion.

What benefits do companies experience from conducting strategic financial evaluations?

Companies that conduct strategic financial evaluations can achieve average cost reductions of up to 20%, which is essential for stabilizing operations and positioning themselves for sustainable growth.

What is the role of interim leadership solutions in turnaround consulting?

Interim leadership solutions involve placing experienced executives in temporary roles to stabilize operations, implement immediate changes, and lay the groundwork for long-term recovery.

What are the benefits of using interim management during crises?

Benefits include immediate stabilization of operations, enhanced decision-making capabilities, shorter recovery times, improved operational efficiency, and the ability to quickly identify and address underlying issues.

How does the 'Rapid30' plan work?

The 'Rapid30' plan emphasizes swift decision-making and real-time analytics, leading to significant improvements in recovery rates and favorable ROI for companies engaging in turnaround consulting.

Why is addressing operational risks important for turnaround strategies?

Addressing operational risks is essential because 70% of consumers are unwilling to purchase from companies with inadequate security measures, which can impact a company's reputation and financial health.

How does Transform Your Small/Medium Enterprise ensure long-term success for clients?

The organization focuses on both immediate needs and long-term objectives, enabling companies to emerge more resilient and competitive in their markets. Additionally, they operationalize lessons learned during the turnaround process to foster accountability and initiative.