Overview

The article discusses seven effective strategies for reducing the Total Cost of Ownership (TCO), emphasizing the importance of a comprehensive approach that includes operational expenses, maintenance, and training. By implementing strategies such as optimizing supply chain management, investing in technology, and engaging employees in cost-saving initiatives, organizations can uncover hidden costs and enhance financial decision-making, ultimately leading to significant long-term savings.

Introduction

In today's competitive business landscape, understanding the Total Cost of Ownership (TCO) is essential for organizations aiming to make informed financial decisions. TCO extends beyond the initial purchase price, encompassing all costs associated with a product or service throughout its lifecycle.

For CFOs, this comprehensive analysis is vital, especially as many companies face financial pressures and must ensure that every dollar spent aligns with long-term strategic goals. By delving into operational expenses, maintenance, and potential disposal costs, organizations can uncover hidden savings and enhance their budgeting processes.

This article explores effective strategies for reducing TCO, leveraging data analytics, and fostering employee engagement, all while emphasizing the importance of sustainability practices in achieving financial and operational excellence.

As businesses navigate these complexities, adopting a proactive approach to TCO can lead to sustainable growth and a competitive edge in the market.

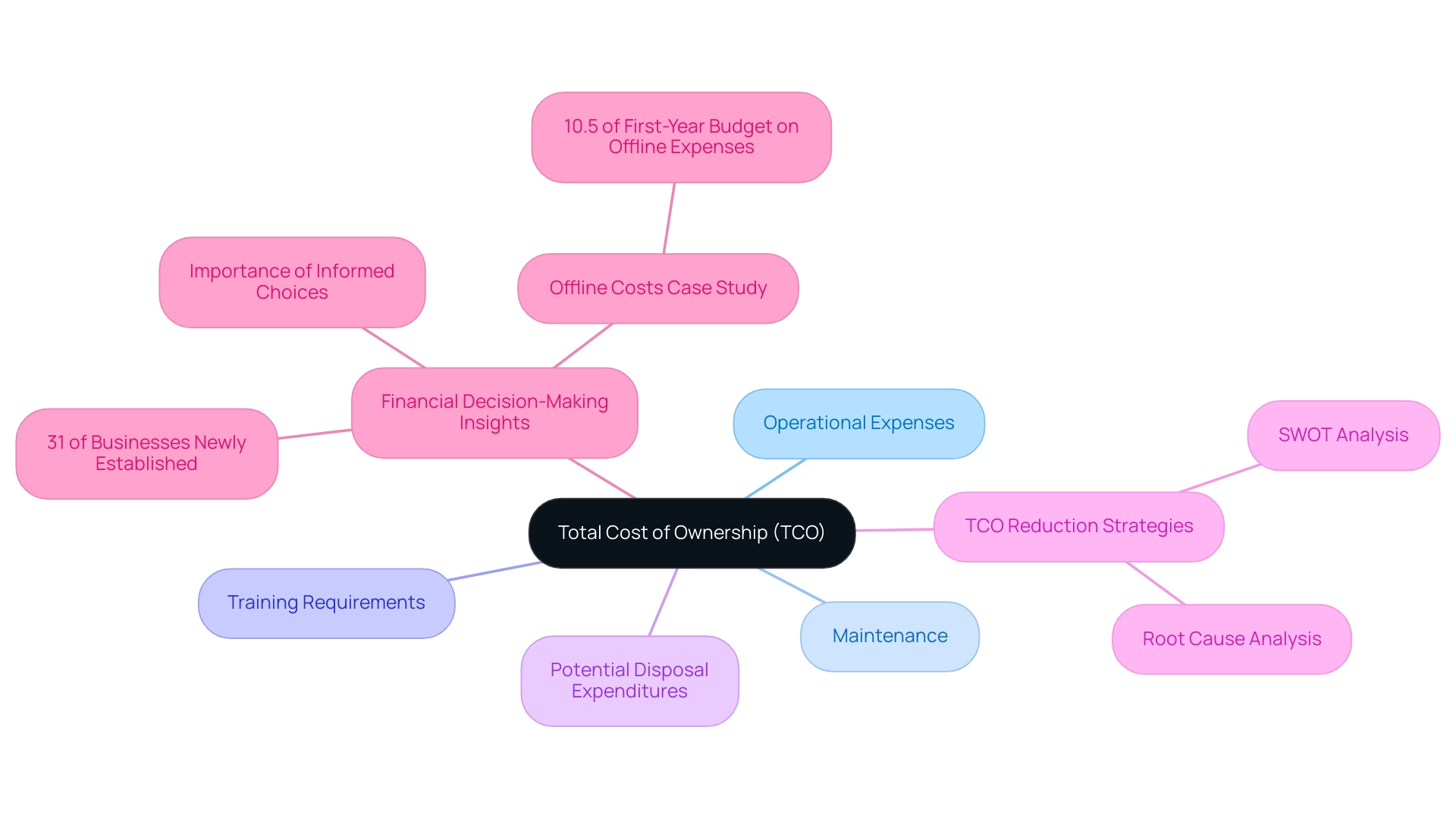

Understanding Total Cost of Ownership (TCO): Definition and Importance

Total Cost of Ownership (TCO) includes a comprehensive assessment of all expenses associated with a product or service throughout its entire lifecycle, highlighting the importance of total cost of ownership reduction strategies. This analysis goes beyond the initial purchase price to encompass:

- Operational expenses

- Maintenance

- Training requirements

- Potential disposal expenditures

For CFOs and decision-makers, grasping TCO is vital, particularly noting that 31% of enterprises are newly fledged, created for three years or less, emphasizing the significance of making informed financial choices early on.

By meticulously considering total cost of ownership reduction strategies, organizations can unveil hidden costs that often go unnoticed, thereby enabling more accurate budgeting and informed procurement decisions. As Angela Petulla, Director of Online Marketing at altLINE, notes, 'Creating content that helps readers better understand their financing options is essential for informed decision-making.' This strategic approach not only enhances profitability but also supports sustainable financial practices in an evolving commercial landscape.

Moreover, our team will utilize methodologies such as:

- SWOT analysis

- Root cause analysis

to identify underlying issues, working collaboratively to create a plan that mitigates weaknesses and allows the organization to reinvest in key strengths. As companies continue to face financial pressures, the importance of total cost of ownership reduction strategies in decision-making processes becomes even more pronounced, ensuring that every dollar spent is justified by its long-term value. For instance, companies that supplement online sales with in-person sales incur additional offline expenses, which can significantly impact overall cost assessments; on average, they spend 10.5% of their first-year budget on .

Therefore, testing hypotheses and employing real-time analytics become essential for operationalizing lessons learned and enhancing performance monitoring in the quest for business turnaround. By ensuring that expenditures are aligned with long-term strategic goals, organizations can maximize their return on investment.

Effective Strategies for Reducing Total Cost of Ownership

- Conduct a comprehensive TCO analysis to initiate your expense reduction journey by thoroughly evaluating all expenditures associated with your products or services, applying total cost of ownership reduction strategies. This analysis should encompass direct expenses, such as purchase prices and installation fees, alongside indirect expenses like maintenance, training, and potential operational disruptions. It's important to note that small and medium-sized enterprises (SMEs) may take more time to break-even on the overall expense of ownership for advanced procurement analytics software. By utilizing detailed data, you can pinpoint specific areas for substantial savings, which are essential for implementing total cost of ownership reduction strategies, paving the way for more informed financial decisions and enabling streamlined decision-making.

- Optimize Supply Chain Management: Enhance your supply chain efficiency by negotiating improved terms with suppliers, consolidating shipments, and minimizing lead times. The adoption of just-in-time inventory methods not only lowers holding expenses but also alleviates waste. Recent insights reveal that half of organizations now view cloud computing as an essential element of their data protection strategy, underscoring the need for agile supply chains that can quickly adapt to changing conditions. This corresponds with the increasing trend of organizations aiming to better manage and optimize their cloud expenses through real-time analytics.

- Invest in Technology Solutions: Embrace technology to automate workflows and boost overall efficiency. For instance, cloud computing can significantly reduce IT overhead expenses while providing scalable solutions tailored to your evolving business needs. Flexera highlights that Microsoft Azure Stack's usage surged to 37% in 2022, surpassing VMware vSphere at 31%. This demonstrates the increasing trend towards cloud-based solutions for financial management, reinforcing the significance of incorporating advanced technologies into your strategy to enhance performance monitoring and investment returns.

- Implement Preventive Maintenance Programs: Establishing a robust preventive maintenance program can dramatically decrease long-term operational expenses. Regular maintenance helps avert equipment failures and extends asset lifespans. Creating a proactive inspection and servicing schedule minimizes downtime, ensuring continuous operational efficiency, which is crucial for performance monitoring.

- Train Employees Effectively: Allocate resources towards comprehensive training initiatives that equip employees with the skills needed to adeptly handle new systems or equipment. This investment minimizes errors and inefficiencies, ultimately resulting in decreased operational expenses. Studies indicate that companies focusing on employee training experience enhanced productivity and morale, fostering a culture of continuous improvement.

- Evaluate Outsourcing Options: Assess the feasibility of outsourcing non-core functions to specialized service providers. This strategy can result in substantial savings through total cost of ownership reduction strategies while enabling your organization to focus on its primary objectives. Recent case studies reveal that companies like Drift and Obsidian have effectively reduced their cloud expenditures through strategic outsourcing and focused management practices, illustrating the potential for streamlined decision-making.

- Review and Adjust Contracts Regularly: Conduct periodic reviews of contracts with your vendors and service providers to ensure optimal value. Regular renegotiation of terms or switching providers can yield , enhancing your overall financial health. Staying proactive in contract management is essential in today’s dynamic market landscape, aligning with strategic business improvement goals. Additionally, it's crucial to collaborate with your team during the planning process to address weaknesses effectively. Testing hypotheses related to these strategies will ensure you maximize your return on invested capital.

Leveraging Data Analytics to Identify Cost Reduction Opportunities

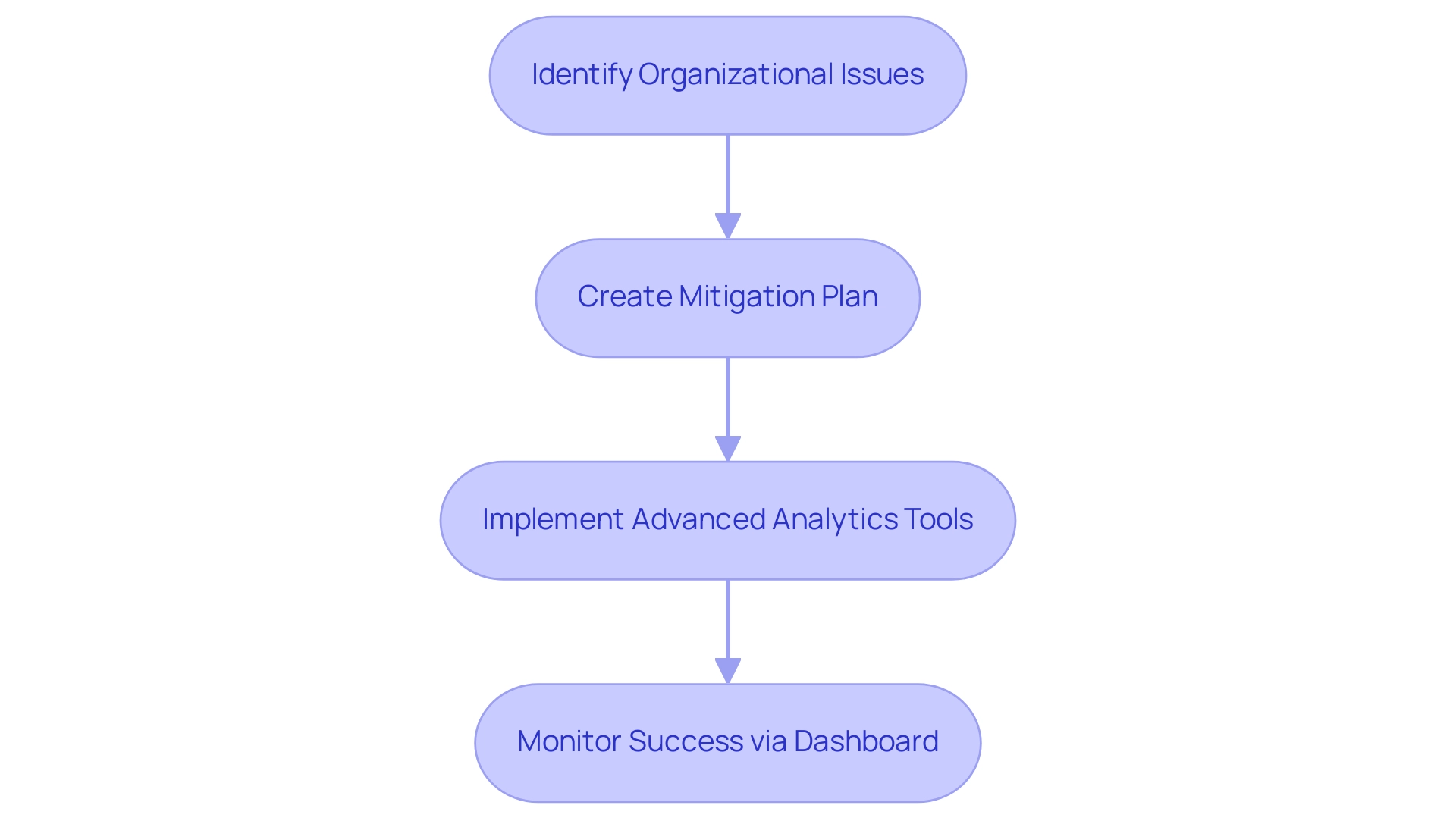

Data analytics serves as a crucial tool for CFOs seeking to uncover total cost of ownership reduction strategies within their organizations. By meticulously analyzing spending patterns, operational efficiencies, and supplier performance, companies can derive actionable insights that support total cost of ownership reduction strategies, leading to substantial savings. Our approach facilitates a shortened decision-making cycle during the turnaround process, enabling your team to take decisive action to preserve your enterprise.

We start by identifying underlying organizational issues and collaboratively creating a plan to mitigate weaknesses and reinvest in key strengths. Recent trends indicate that 54% of enterprises are exploring cloud computing and intelligence (BI) for data analytics, shifting away from traditional data centers to achieve greater flexibility and scalability, as demonstrated in the case study on Cloud Computing in Data Analytics. Advanced analytics tools empower organizations to monitor asset usage rates effectively, which supports total cost of ownership reduction strategies by enhancing inventory management and minimizing excess stock.

We continually monitor the success of our plans through our client dashboard, which provides real-time business analytics to assess your business health. Furthermore, the implementation of predictive analytics allows firms to anticipate potential operational issues, which is particularly beneficial in reducing repair costs and minimizing downtime, aligning with total cost of ownership reduction strategies through proactive interventions. As highlighted by experts at McKinsey, this technological evolution represents , underscoring the need for CFOs to leverage data-driven strategies.

The influence of data analytics reaches beyond single entities; it benefits businesses of all sizes by streamlining decision-making processes and fostering a culture of continuous improvement, positioning firms to thrive in an increasingly competitive landscape. Additionally, we adopt a pragmatic approach by testing every hypothesis to ensure maximum return on invested capital in both the short and long term.

Engaging Employees in Cost-Saving Initiatives

To effectively lower total expenses of ownership (TCO), companies must focus on total cost of ownership reduction strategies and prioritize active employee involvement in the identification of savings opportunities. Companies with a high employee engagement rate—averaging around 70% among top performers—demonstrate the power of a motivated workforce. In fact, a company is considered to have a good employee engagement rate if it stands around 72%, which is above current averages.

By fostering an environment that encourages teams to share their insights through brainstorming sessions or suggestion boxes, organizations can tap into a wealth of innovative ideas. Implementing incentive programs that reward employees for their cost-cutting suggestions not only boosts participation but also reinforces a culture of collaboration. As Emily Liou, a career happiness coach, notes,

I don’t hear as many people saying 'I want to make more money' or 'I want to climb the corporate ladder.'

Now, it's 'I want to feel more connected to my work.' This sentiment emphasizes the need for open communication, where employees feel valued and heard—key drivers of engagement that can lead to significant operational savings. Furthermore, with 70% of managers lacking formal training in leading hybrid teams, addressing these gaps can enhance engagement and unlock unique savings opportunities.

It's also important to note that 43% of workers prefer to receive recognition in with their manager, underscoring the significance of personalized engagement approaches. By utilizing the shared expertise and experience of your workforce, organizations can uncover innovative solutions that align with total cost of ownership reduction strategies while also promoting a more engaged and connected team.

Benchmarking Against Industry Standards

Benchmarking against industry standards acts as an essential strategy for recognizing opportunities to implement total cost of ownership reduction strategies. Recent data indicates that 62% of companies ignored potential savings of up to $317 million for every $10 billion in revenue last year, emphasizing the significance of efficient financial management. By systematically comparing your organization’s performance metrics with those of industry peers, you can uncover inefficiencies and areas where expenses significantly exceed industry norms.

Employing real-time analytics via our client dashboard facilitates ongoing observation of your organization's well-being, allowing rapid decision-making that is crucial for recovery plans. This analysis requires gathering data on key performance indicators (KPIs) pertinent to your sector. Once you recognize gaps in performance, you can apply targeted total cost of ownership reduction strategies to address these discrepancies, thereby reducing expenses and improving your competitive advantage.

Furthermore, as Oliver Munro underscores, global warehousing property expenses increased 10.1% in 2023, highlighting the urgent need for businesses to remain proactive. Regular benchmarking not only facilitates a continuous assessment of performance but also ensures that your entity remains agile and responsive to evolving market conditions. In the context of attracting and retaining talent—a top-cited challenge among manufacturers—effective cost management becomes even more critical.

, with 62% of leaders in the manufacturing and supply chain sectors expecting this to be a major short-term challenge, highlight the need for a skilled workforce to support operational efficiency.

Additionally, the case study titled 'Best Practices for Service Organizations' outlines how organizations can enhance their service capabilities through regular performance reviews and a commitment to upskilling teams. By adopting a culture of benchmarking and leveraging real-time analytics, CFOs can effectively align operational approaches with industry standards, ensuring total cost of ownership reduction strategies that support sustainable financial health and competitiveness in an increasingly challenging landscape. Furthermore, it is essential to continually 'Update & Adjust' plans based on real-time data to optimize performance.

Integrating insights from 'Mastering the Cash Conversion Cycle' can offer specific strategies for enhancing cash flow and minimizing expenses, ultimately aiding CFOs in their quest for operational excellence. Lastly, the pricing for these strategies is set at $99.00, making them accessible for organizations aiming to enhance their financial performance.

Sustainability Practices as Cost Reduction Strategies

Incorporating sustainability practices into business operations is not merely a moral obligation; it can significantly aid in implementing total cost of ownership reduction strategies. For instance, the adoption of energy-efficient technologies has proven to significantly reduce utility expenses. Initiatives aimed at waste reduction can also lead to lower disposal expenses, while sustainable sourcing often results in enhanced supplier relationships and potential decreases in material expenses.

As Deloitte reports, 54% of Gen Z and 48% of millennials are actively pushing their employers towards sustainability practices, highlighting a significant shift in workforce expectations. Businesses that prioritize these practices are better positioned to enhance their reputations among consumers and stakeholders alike. This proactive approach not only reduces operational costs but also attracts environmentally conscious customers, creating a competitive edge in the marketplace.

Furthermore, the case study titled '' illustrates that 46% of Gen Z and 42% of millennials have changed or are planning to change jobs due to climate concerns. Aligning cost-cutting approaches with sustainability objectives can thus serve as a powerful catalyst for success in today's evolving business landscape, underscoring the need for CFOs to implement total cost of ownership reduction strategies.

Regularly Review and Adjust Financial Strategies

To effectively sustain efforts in total cost of ownership reduction strategies, organizations must prioritize the regular review and adjustment of their financial strategies. Establishing a systematic schedule for periodic assessments of financial performance, cost structures, and operational efficiencies is essential. By diligently analyzing financial data and performance metrics, CFOs can pinpoint specific areas that necessitate adjustments or enhancements.

Streamlined decision-making processes, supported by real-time analytics, empower teams to take decisive action swiftly, particularly during business turnarounds. Furthermore, employing a 'Test & Measure' approach is crucial; by testing hypotheses, organizations can maximize returns on invested capital. Being attuned to industry trends and competitor approaches is invaluable, as it provides insights into potential market shifts.

As Dave Goodsell, Executive Director at Natixis Center for Investor Insight, aptly states,

If the first principle of future proofing a business is keeping the clients you already have, the second is finding more clients.

This highlights the significance of a proactive method to financial plan evaluation, ensuring entities stay agile and responsive in their pursuit of ongoing cost-saving opportunities. In 2024, a heightened focus on these practices will be critical, as 45% of financial advisors are already emphasizing the risks associated with cash in the current inflationary environment, reminding clients that cash is not risk-free due to inflation and reinvestment risks.

Furthermore, during times of volatility, 36% of advisors are boosting their use of active ETFs, which have become popular as they provide clients access to actively managed approaches with the advantages of ETFs. By implementing these approaches and utilizing real-time analytics, including the use of a client dashboard for ongoing monitoring, organizations can enhance financial performance and effectively apply total cost of ownership reduction strategies, while promoting and relationship-building with stakeholders. The growing trend of utilizing active ETFs, as seen in the case study where 53% of advisors plan to incorporate them as core holdings in client portfolios, exemplifies how financial strategies can be adjusted to navigate market conditions.

Conclusion

Understanding the Total Cost of Ownership (TCO) is paramount for organizations striving for financial efficiency and strategic alignment. By moving beyond the initial purchase price and evaluating all associated costs throughout a product's lifecycle, CFOs can uncover hidden expenses that impact the bottom line. Implementing comprehensive TCO analyses, optimizing supply chain management, and investing in technology solutions are critical strategies that can lead to substantial savings. Additionally, fostering employee engagement and leveraging data analytics empower organizations to identify cost-reduction opportunities effectively.

Embracing sustainability practices not only enhances a company's reputation but also contributes to long-term cost savings and operational efficiency. As businesses face increasing financial pressures, the need for regular reviews and adjustments of financial strategies becomes increasingly vital. By continuously benchmarking against industry standards and remaining agile in response to market shifts, organizations can maximize their return on investment and maintain a competitive edge.

In today’s dynamic business environment, a proactive approach to TCO is essential for achieving sustainable growth and operational excellence. By prioritizing these strategies, organizations can ensure that every dollar spent contributes to long-term success, ultimately positioning themselves as leaders in their respective industries.

Frequently Asked Questions

What is Total Cost of Ownership (TCO)?

Total Cost of Ownership (TCO) is a comprehensive assessment of all expenses associated with a product or service throughout its entire lifecycle, including operational expenses, maintenance, training requirements, and potential disposal expenditures.

Why is understanding TCO important for CFOs and decision-makers?

Understanding TCO is vital for CFOs and decision-makers because it helps them make informed financial choices early on, particularly as 31% of enterprises are newly established and may not fully grasp their long-term costs.

How can organizations reduce TCO?

Organizations can reduce TCO by employing reduction strategies that uncover hidden costs, enabling more accurate budgeting and informed procurement decisions, ultimately enhancing profitability and supporting sustainable financial practices.

What methodologies are mentioned for identifying underlying issues related to TCO?

The methodologies mentioned for identifying underlying issues related to TCO include SWOT analysis and root cause analysis.

What role does real-time analytics play in managing TCO?

Real-time analytics are essential for operationalizing lessons learned and enhancing performance monitoring, ensuring expenditures align with long-term strategic goals to maximize return on investment.

What are some strategies for optimizing TCO?

Strategies for optimizing TCO include conducting a comprehensive TCO analysis, optimizing supply chain management, investing in technology solutions, implementing preventive maintenance programs, training employees effectively, evaluating outsourcing options, and regularly reviewing and adjusting contracts.

How does preventive maintenance contribute to TCO reduction?

Preventive maintenance contributes to TCO reduction by decreasing long-term operational expenses, preventing equipment failures, and extending asset lifespans, which ensures continuous operational efficiency.

What is the significance of employee training in TCO management?

Effective employee training minimizes errors and inefficiencies, leading to decreased operational expenses and enhanced productivity, thereby fostering a culture of continuous improvement.

How can outsourcing affect TCO?

Outsourcing non-core functions to specialized service providers can lead to substantial savings and allow organizations to focus on their primary objectives, thereby contributing to TCO reduction.

Why is it important to regularly review contracts with vendors?

Regularly reviewing contracts with vendors is important to ensure optimal value, as renegotiating terms or switching providers can yield substantial cost reductions and enhance overall financial health.