Introduction

In a world where economic uncertainties loom large, the ability to preserve cash flow has emerged as a critical priority for businesses striving for resilience and success. Cash flow is not merely a financial metric; it represents the lifeblood of an organization, enabling it to meet obligations, seize opportunities, and weather unforeseen challenges.

As companies navigate the complexities of the modern marketplace, understanding and implementing effective cash flow management strategies becomes paramount. This article delves into essential tactics that empower organizations to optimize their cash flow, enhance operational efficiency, and build a robust financial foundation for the future.

By leveraging advanced technology, engaging stakeholders, and continuously monitoring performance, businesses can transform their cash flow practices into a strategic advantage that drives sustainable growth.

Understanding the Importance of Cash Flow Preservation

Cash flow preservation plans act as the lifeblood of any business, especially in today's unpredictable economic landscape. Effective management of finances is not merely a strategic option; it's essential to a company's capability to prosper. When financial resources are optimally managed, organizations can comfortably meet their operational expenses, seize growth opportunities, and effectively navigate unexpected challenges.

With 22.4% of small enterprises seeking bank loans to manage finances, the significance of mastering the conversion cycle becomes clear. This entails executing 20 strategies aimed at improving business performance and optimizing financial resources. A strong financial position empowers companies to endure economic downturns without resorting to drastic measures such as layoffs or asset liquidations.

Additionally, leveraging streamlined decision-making processes and real-time analytics can significantly enhance performance monitoring, allowing CFOs to make informed choices swiftly. Moreover, sustaining robust liquidity positively impacts a company’s creditworthiness, easing access to financing when required. Recent findings indicate that fully automated systems enhance financial management and operational efficiency, with 95% of firms reporting improved accuracy and 84% experiencing increased savings and growth.

Attributes like predictive analytics for accounts payable (AP) and accounts receivable (AR) processes promote shorter payment cycles and improved liquidity timing. Establishing an emergency fund is vital for financial stability; setting aside money in a high-savings account can provide a safety net during tough times. By prioritizing cash flow preservation plans and integrating advanced strategies, organizations can achieve greater operational flexibility and long-term sustainability, ultimately positioning themselves for success in uncertain times.

For those eager to master the conversion cycle, our offering is available for $99.00, providing invaluable insights and tools for optimal performance.

Key Strategies for Effective Cash Flow Preservation

- Refinance Existing Debt: Assess your current loan agreements for potential refinancing at lower interest rates. This strategic move can significantly lower monthly payments, which can support cash flow preservation plans and free up funds for essential operational expenditures. Specialists recommend that cash flow preservation plans, including efficient debt restructuring, can improve liquidity by up to 30%, enabling companies to allocate resources towards expansion efforts.

- Streamline Operations: Conduct a comprehensive review of operational processes to pinpoint inefficiencies. Embracing lean management principles can lead to substantial cost reductions. A recent study indicates that businesses adopting these practices enhance operational efficiency by 25%, resulting in improved financial management.

- Negotiate Payment Terms: Engage with suppliers to negotiate extended payment terms. This flexibility allows more time to settle invoices without incurring late fees, which is essential for effective cash flow preservation plans. Effective negotiation can result in a 10% enhancement in financial metrics, offering a buffer for unexpected expenses.

- Implement Financial Flow Forecasting: Establish a robust financial flow forecasting system with clear and customizable reporting capabilities to monitor financial flow and trends effectively. By anticipating monetary needs and potential shortfalls, organizations can make informed financial decisions. The use of advanced forecasting software, such as HighRadius Cash Flow Forecasting, can enhance global forecast precision by 95% and decrease idle funds by up to 50%, optimizing liquidity. Furthermore, SAP Treasury and Risk Management software provides strong liquidity forecasting, particularly designed for SAP-based ERPs, although it may encounter compatibility issues with other systems.

- Reduce Overhead Costs: Perform a meticulous analysis of both fixed and variable costs to identify trimming opportunities. This may involve renegotiating leases or cutting non-essential services. Companies that have conducted this analysis report an average of 15% decrease in overhead expenses, which is essential for cash flow preservation plans and significantly improves liquidity.

- Increase Revenue Streams: Identify and explore additional revenue opportunities, such as diversifying product lines or entering new markets. Implementing cash flow preservation plans can significantly enhance liquidity by diversifying income sources. Companies that diversify effectively see revenue increases of 20% or more, strengthening their financial position.

- Enhance Credit Management: Revamp the credit control process to ensure timely collection of receivables. Implementing stricter credit policies can reduce the risk of bad debts, significantly enhancing liquidity. Implementing effective credit management strategies has been shown to accelerate collections by 30%, which is crucial for cash flow preservation plans and enhancing overall liquidity.

Operationalizing Lessons Learned: Throughout the turnaround process, it is crucial to apply insights gained from past experiences to refine revenue management strategies continually. This iterative method guarantees that companies stay nimble and adaptable to evolving financial environments.

Case Study Insight: The SAP Treasury and Risk Management software offers strong liquidity forecasting abilities and connects with various financial systems for real-time insights, enabling efficient decision-making. While it provides thorough reporting, it is most appropriate for SAP-based ERPs and may present compatibility issues with other systems, emphasizing the significance of choosing the right tools for effective flow management. Furthermore, leveraging a client dashboard can enhance continuous monitoring of organizational health, allowing CFOs to make informed decisions swiftly.

The Role of Technology in Cash Flow Management

In today's swiftly changing economic environment, mastering the conversion cycle is essential for companies pursuing optimal performance. This article outlines 20 strategies for improving business performance through efficient financial management and the implementation of cash flow preservation plans. The adoption of advanced monetary management software not only streamlines essential processes such as invoicing and automates payment reminders but also offers real-time visibility into liquidity.

This efficiency is particularly important, as nearly 60% of treasury professionals report that manual forecasting significantly hinders both efficiency and accuracy. By implementing strategies for streamlined decision-making and leveraging real-time analytics, organizations can enhance their operational agility. HighRadius asserts that its software can enhance global forecast precision by 95%, increase productivity by 70%, and decrease idle funds by up to 50%, demonstrating the significant advantages of financial management technology.

Moreover, SAP's Treasury and Risk Management software provides strong liquidity forecasting capabilities, highlighting the crucial role of technology in enhancing financial management. With advanced analytics, companies can recognize monetary trends that enable informed forecasting and decision-making. By fully utilizing these technological advancements and strategies, organizations can develop cash flow preservation plans to protect their revenue and obtain strategic insights that influence essential economic decisions.

For only $99.00, these strategies and tools can significantly improve your business's economic performance.

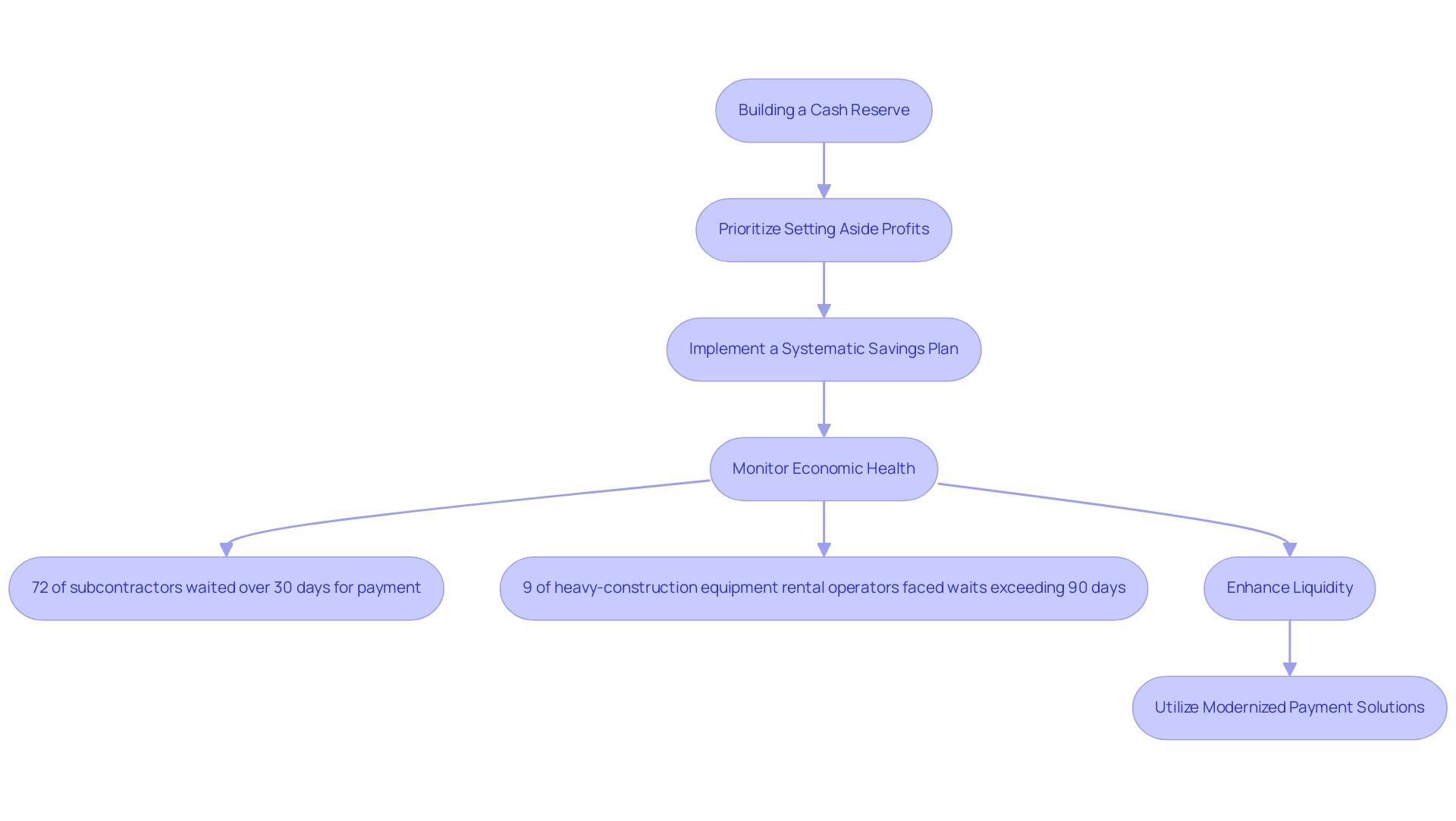

Building a Cash Reserve for Future Stability

Creating a strong monetary reserve is crucial for efficient resource management, especially in today's unpredictable economic environment. Businesses must prioritize setting aside a portion of their profits as part of their cash flow preservation plans to establish a financial safety net, enabling decisive action during downturns without resorting to external financing. Recent trends indicate that non-banking U.S. firms have significantly increased their liquid reserves to $6.9 trillion, reflecting a strategic shift toward enhanced liquidity—liquid assets now comprise $1 out of every $5 of total assets held by these firms.

To effectively build a financial reserve, implement a systematic savings plan by allocating a fixed percentage of monthly revenues to a dedicated account. This proactive method not only enhances stability but also fosters a culture of discipline within the organization. As 2024 approaches, the importance of maintaining these reserves becomes even clearer, especially considering that:

- 72% of subcontractors in the construction sector waited over 30 days for payment this year, leading to substantial operational costs estimated at $273 billion.

- 9% of heavy-construction equipment rental operators faced waits exceeding 90 days, highlighting the financial flow challenges in the industry.

These statistics highlight the critical need for modernized payment solutions and streamlined decision-making processes. By prioritizing liquidity reserves and utilizing cash flow preservation plans along with real-time analytics through our client dashboard to monitor economic health, businesses can navigate uncertainties with confidence and resilience.

For those looking to enhance their strategies, consider our 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' program, available for $99.00, to further bolster your financial management practices.

Engaging Stakeholders in Cash Flow Strategies

The active involvement of all stakeholders, including management, finance teams, and operational staff, is crucial for the success of cash flow preservation plans. As Jordan Moore from Deloitte Transactions and Business Analytics LLP points out, 'by implementing a revenue projection process that utilizes the direct method, takes operational drivers into account over trends, and encourages improved communication across the organization, companies can facilitate a more efficient and comprehensive management of overall liquidity.' The pandemic emphasized the importance of efficient financial management, prompting many companies to swiftly develop cash flow preservation plans to ensure liquidity.

Frequent gatherings to evaluate financial projections and tackle potential challenges are crucial; this method not only keeps everyone updated but also encourages creative solutions through collaborative decision-making processes. Entities that emphasize stakeholder involvement frequently encounter improved economic resilience, as cash flow preservation plans in cooperative environments promote superior liquidity management. Additionally, thorough monetary assessments concentrating on cash flow preservation plans, efficiency, and risk reduction are essential for revealing hidden value and lowering expenses.

Our comprehensive financial evaluation services pinpoint specific opportunities to conserve funds and decrease liabilities, ensuring your organization stays financially sound. The case study titled 'Avoiding Confusion Between Forecasting and Trending' illustrates that many organizations mistakenly equate revenue projection with revenue monitoring, which relies solely on historical data without considering operational dynamics. By emphasizing communication strategies and a commitment to continuous performance monitoring through real-time analytics, businesses can transform financial management from a reactive task into a proactive strategy.

We encourage you to engage with our annual financial review services to optimize your balance sheet and foster long-term partnerships, ultimately driving success in today's dynamic economic landscape.

Monitoring and Adjusting Cash Flow Strategies

Efficient oversight of financial management strategies is essential for guaranteeing sustained success through cash flow preservation plans in any organization. Companies, particularly those experiencing turnaround processes, must participate in regular assessments of financial projections to align with their cash flow preservation plans, continuously comparing them against actual performance metrics. This proactive practice not only helps identify discrepancies but also allows organizations to make necessary adjustments swiftly.

Harmonizing expansion with cash flow preservation plans remains an ongoing challenge that requires strategic planning and fiscal discipline. By applying key performance indicators (KPIs) associated with monetary management, CFOs can acquire invaluable insights into the overall financial condition of their organization. Real-time analytics, as seen in our client dashboard, support this effort by providing ongoing visibility into performance.

Our commitment to operationalizing the lessons learned throughout the turnaround process ensures that strategies are effectively implemented and refined. For instance, a case study titled 'Side Hustles for Debt Repayment' illustrates how a person effectively handled finances through strategic side hustles, ultimately establishing a cleaning enterprise valued at $1 million. By remaining watchful and flexible, businesses can quickly react to changes in the market or operational environment, which is essential for their cash flow preservation plans.

The importance of these strategies is further emphasized in a recent article titled 'How to Be a Better Business Partner in Financial Flow Planning,' which employs an analogy to illustrate how currency acts as the lifeblood of an enterprise, highlighting its crucial role in sustainability. Furthermore, our method facilitates a reduced decision-making cycle, enabling more assertive actions that maintain liquidity and improve organizational performance.

The Long-Term Benefits of Cash Flow Preservation

Maintaining liquidity goes beyond simple survival; it acts as a tactical investment in the future of any enterprise. Organizations that prioritize liquidity management, backed by efficient decision-making and real-time analytics, are strategically poised to take advantage of growth opportunities, invest in innovation, and skillfully maneuver through economic fluctuations. Vipul Taneja, VP of Finance Transformation, emphasizes that utilizing advanced tools like HighRadius Cash Flow Forecasting Software can enhance global forecast accuracy by 95%, boost productivity by 70%, and decrease unutilized funds by up to 50%.

This enables organizations to make informed decisions that promote sustainability and growth. The abbreviated decision-making process enables faster reactions to financial challenges, ensuring that companies can adjust rapidly to evolving circumstances. Furthermore, ongoing performance monitoring promotes a culture of accountability and discipline, resulting in improved operational efficiency and profitability.

A case study titled 'Partnering for Financial Management' illustrates that as companies expand, overseeing liquidity can become more intricate. By collaborating with informed financial organizations and applying lessons learned, small enterprise owners can manage liquidity challenges and access customized financial products, ultimately securing their financial future. By committing to cash flow preservation plans, businesses not only lay down a solid foundation for sustainable growth but also drive better business outcomes and resilience against market volatility in 2024 and beyond.

Conclusion

Preserving cash flow is not just a crucial aspect of financial management; it is the cornerstone of business resilience and growth in today's unpredictable economic environment. By implementing effective strategies such as:

- Refinancing debt

- Streamlining operations

- Enhancing credit management

organizations can significantly improve their cash flow, enabling them to meet obligations and seize opportunities as they arise. Additionally, leveraging technology and real-time analytics allows for better forecasting and decision-making, ensuring that businesses remain agile in the face of challenges.

Establishing a cash reserve is equally vital, providing a safety net that empowers companies to navigate downturns without resorting to drastic measures. Engaging stakeholders in cash flow strategies fosters a collaborative culture that enhances financial resilience and uncovers hidden value within the organization. Continuous monitoring and adjusting of cash flow practices are essential for long-term success, allowing businesses to adapt swiftly to market changes and operational dynamics.

Ultimately, mastering cash flow management transforms it from a reactive task into a proactive strategy that drives sustainable growth. By prioritizing cash flow preservation, organizations position themselves not only to survive but to thrive, laying a robust foundation for future success in an ever-evolving marketplace. Now is the time to take decisive action and integrate these strategies to secure a prosperous financial future.

Frequently Asked Questions

Why are cash flow preservation plans important for businesses?

Cash flow preservation plans are crucial for businesses as they help manage finances effectively, allowing organizations to meet operational expenses, seize growth opportunities, and navigate unexpected challenges, especially in an unpredictable economic landscape.

What percentage of small enterprises seek bank loans for financial management?

Approximately 22.4% of small enterprises seek bank loans to manage their finances.

How can companies improve their financial position during economic downturns?

Companies can improve their financial position by mastering the conversion cycle and implementing strategies that enhance business performance, which allows them to endure economic downturns without drastic measures like layoffs or asset liquidations.

What role does technology play in financial management?

Technology, such as automated systems and real-time analytics, enhances financial management by improving accuracy, operational efficiency, and performance monitoring, enabling CFOs to make informed decisions quickly.

What are some strategies for preserving cash flow?

Key strategies for preserving cash flow include refinancing existing debt, streamlining operations, negotiating payment terms with suppliers, implementing financial flow forecasting, reducing overhead costs, increasing revenue streams, and enhancing credit management.

How can establishing an emergency fund benefit a business?

Establishing an emergency fund provides a financial safety net during tough times, allowing businesses to take decisive action without resorting to external financing.

What is the impact of predictive analytics on accounts payable and accounts receivable?

Predictive analytics for accounts payable and accounts receivable can promote shorter payment cycles and improved liquidity timing, helping businesses manage their cash flow more effectively.

What is the significance of stakeholder involvement in cash flow management?

Active involvement of all stakeholders is crucial for the success of cash flow preservation plans, as it facilitates efficient management of overall liquidity and encourages creative solutions through collaborative decision-making.

How can companies enhance their credit management processes?

Companies can enhance their credit management processes by implementing stricter credit policies, ensuring timely collection of receivables, and reducing the risk of bad debts, which significantly improves liquidity.

What are the benefits of using cash flow forecasting software?

Cash flow forecasting software can enhance global forecast precision, increase productivity, decrease idle funds, and provide real-time visibility into liquidity, thereby improving overall financial management.