Overview

The article discusses seven essential operational resilience strategies that CFOs should implement to ensure their organizations can effectively anticipate, respond to, and recover from disruptive events. These strategies are supported by the emphasis on real-time data analytics, regular reviews, and staff training, which collectively enhance financial stability and operational efficiency in the face of unforeseen challenges.

Introduction

In a world where disruptions can strike at any moment, operational resilience has emerged as a critical focus for organizations, particularly from a financial leadership perspective. Chief Financial Officers (CFOs) are at the forefront of navigating these challenges, tasked with ensuring that their organizations not only survive but thrive amidst uncertainty. By anticipating and preparing for potential crises, CFOs can safeguard financial stability and operational efficiency.

This article delves into the multifaceted approach necessary for enhancing operational resilience, exploring key strategies such as:

- Integrating risk management

- Crafting robust business continuity plans

- Leveraging technology

- Investing in staff development

With insights into real-time analytics and proactive financial assessments, the discussion highlights how CFOs can effectively position their organizations to withstand and recover from unforeseen events, ensuring long-term success in an unpredictable landscape.

Understanding Operational Resilience: A CFO's Perspective

Operational resilience strategies are defined as an entity's capacity to anticipate, prepare for, respond to, and recover from disruptive events. This concept is especially essential for CFOs, as it has a direct correlation with financial stability and efficiency. An organization that employs operational resilience strategies is capable of maintaining critical functions during crises, safeguarding financial resources, and enabling a swift rebound.

Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive actions and preserve your business. Furthermore, we consistently track the success of our strategies via our client dashboard, which offers real-time business analytics including cash flow projections, performance metrics, and assessments. These analytics are crucial for assessing and enhancing operational performance, directly impacting financial stability.

According to Protiviti, 61% of leaders recognize 'attracting and retaining talent' as a top risk in 2034, highlighting the significance of human capital in enhancing strength. The case study titled 'Future Risks and Workforce Challenges' emphasizes that attracting and retaining talent, along with adapting to technological advancements, are ongoing challenges for companies. Grasping these dynamics enables CFOs to align financial strategies with functional capabilities, promoting a culture of adaptability across the company.

By emphasizing agility and innovation in business strategies, alongside utilizing data analytics for market intelligence, CFOs can navigate future uncertainties and workforce challenges effectively. By focusing on business sustainability and employing operational resilience strategies along with real-time analytics, CFOs can guarantee their entities are well-prepared to succeed in an unpredictable environment.

Integrating Risk Management into Operational Resilience

Integrating threat management into operational resilience strategies is crucial for organizations to successfully handle possible disruptions. CFOs play an essential role in this integration by collaborating closely with management teams to identify financial challenges, operational vulnerabilities, and external threats. Alarmingly, almost one-third of companies indicated being victims of fraud or financial crime in the past five years, emphasizing the urgency of incorporating strong management practices.

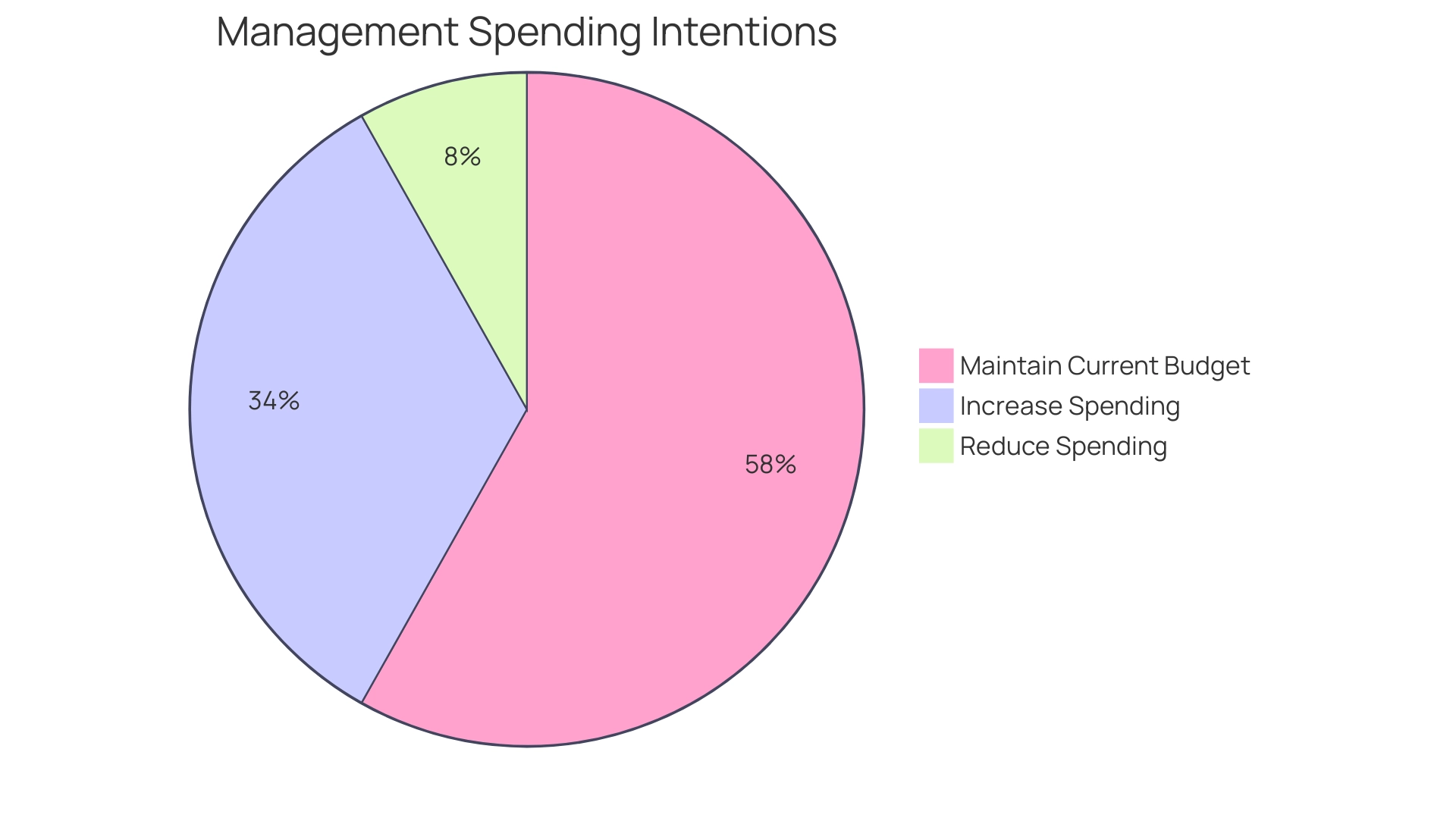

According to the PwC Pulse Survey:

- 33% of leaders in the field plan to increase their spending on management initiatives.

- 57% will maintain their current budgets.

- 8% intend to reduce spending.

This reflects a growing recognition of the significance of management. Moreover, 77% of corporate compliance experts stress the importance of remaining updated on Environmental, Social, and Governance (ESG) advancements, which are becoming more significant in the current business environment.

Creating a thorough management framework allows entities to actively brace for uncertainties, guaranteeing that financial resources are distributed efficiently to alleviate possible disruptions. This approach not only safeguards assets but also greatly improves a company's overall robustness. The adoption of advanced technologies like AI and machine learning is gaining traction; in fact, 43% of professionals under revenue pressure express a strong interest in deploying these tools to combat financial crime.

This illustrates how entities are utilizing technology in reaction to the difficulties presented by financial crime, emphasizing the essential requirement for CFOs to stay strategically concentrated on management as a fundamental aspect of business endurance.

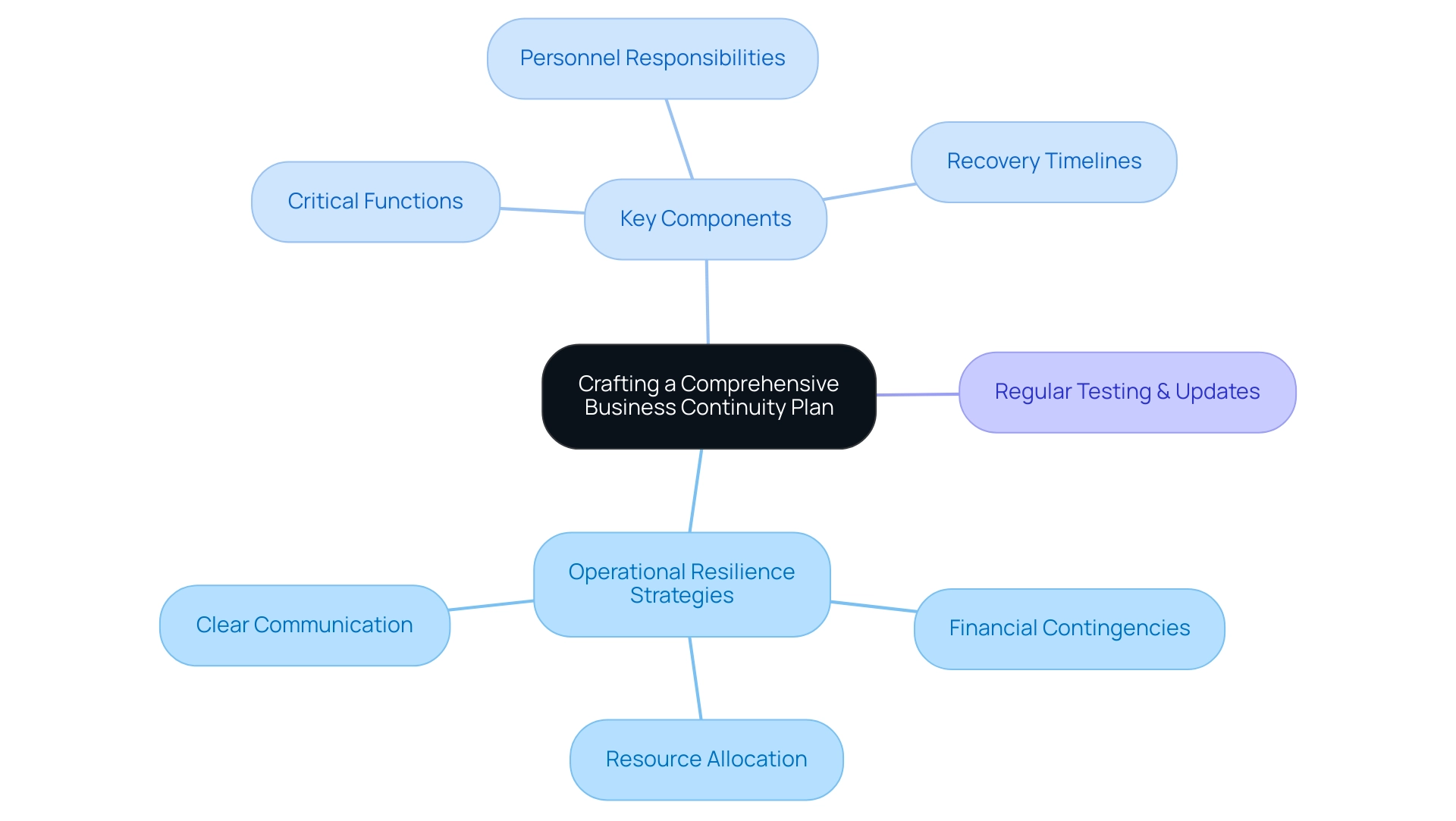

Crafting a Comprehensive Business Continuity Plan

A robust business continuity plan is crucial for implementing operational resilience strategies during crises. With statistics revealing that 51% of businesses affected by natural disasters close their doors within two years, the urgency for CFOs to spearhead the development of these plans cannot be overstated. Such plans should encompass operational resilience strategies, including:

- Financial contingencies

- Resource allocation

- Clear communication

Key components must address:

- Critical functions

- Define personnel responsibilities

- Establish recovery timelines

Regular testing and updates are vital to ensure that these plans remain effective in real-world scenarios. By utilizing C2 Meridian's Risk Management module and the client dashboard, organizations can evaluate the impact of uncertainties automatically, monitor performance in real-time, and enhance their preparedness, enabling a shortened decision-making cycle that supports decisive action.

Significantly, only 10% of insider management budgets are designated for pre-incident activities, underscoring a substantial gap that CFOs must tackle. Furthermore, as we look towards 2034, the case study titled 'Future Risks: 2034 Projections' emphasizes the need for agility and innovation in business strategies, especially in light of ongoing challenges such as talent attraction and retention, which 61% of leaders have identified as a top risk.

Leveraging Technology for Enhanced Resilience

In the evolving landscape of resilience, leveraging technology has become indispensable. By 2025, a significant 70% of entities are projected to adopt DevOps and infrastructure automation, as noted by Gartner. Chief Financial Officers should actively explore digital tools and platforms that enable streamlined decision-making and real-time data analysis.

Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business. We emphasize the 'Update & Adjust' approach, ensuring that we continually monitor success through our client dashboard, which provides real-time business analytics to diagnose your business health. The adoption of cloud-based solutions ensures that critical information remains accessible during unexpected disruptions, while automation plays a crucial role in streamlining processes and reducing risks.

A relevant case study on Legacy IT Transformation highlights how entities are addressing challenges with outdated infrastructure. Many are pushing towards agile methodologies, facilitating technology-enabled change that addresses legacy IT issues and enhances compliance efficiency. Moreover, with 61% of entities employing some degree of security AI and automation, investing in strong cybersecurity measures has never been more crucial to protect functional integrity against emerging threats.

Additionally, the Sec's focus on registrants' policies, internal controls, and governance practices underscores the importance of compliance in crisis management. By embracing these technological advancements, companies can strengthen their operational resilience strategies, thereby improving their responsiveness and adaptability to enhance overall durability in the face of challenges. This strategic approach is not only essential for maintaining business continuity but also aligns with the latest trends that emphasize the importance of operational resilience strategies in crisis management.

Prioritizing Financial Assessment and Cash Flow Management

Effective financial assessment and robust cash flow management are paramount for implementing operational resilience strategies in today's economic landscape. CFOs must prioritize regular financial reviews to pinpoint areas needing attention and identify potential opportunities for improvement. Utilizing advanced cash flow forecasting models enables companies to anticipate financial demands and make informed strategic decisions.

Acknowledging that interest rates average around 20%, the cost of financing gaps due to delayed customer payments can quickly escalate, particularly when financing inventory for over 30 days incurs additional costs. Tim Berry, an entrepreneur, aptly notes:

One of the toughest years my company had was when we doubled sales and almost went broke... Yes, of course you want to grow; we all want to grow our businesses.

But be careful because growth costs cash. To navigate these challenges, our team supports a shortened decision-making cycle throughout the turnaround process, allowing your entity to take decisive action to preserve its financial health. This includes a systematic approach to evaluating options and implementing strategies swiftly.

Maintaining a healthy cash reserve acts as a buffer during challenging times, ensuring smooth operations even in the face of disruptions. Real-time business analytics, provided through our client dashboard, continually diagnose your business health, enabling CFOs to monitor performance and make necessary adjustments to strategies. This 'Update & Adjust' methodology ensures that entities remain agile and responsive to changing conditions.

Businesses are encouraged to adopt various strategies to manage cash flow effectively in a volatile economic climate, including:

- Tightening accounts receivables

- Innovating payment processes

By concentrating on these financial health strategies and utilizing streamlined decision-making and analytics, CFOs can significantly enhance their operational resilience strategies, improving their entity's ability to withstand unforeseen events and ensuring long-term stability and success.

Investing in Staff Training and Development for Resilience

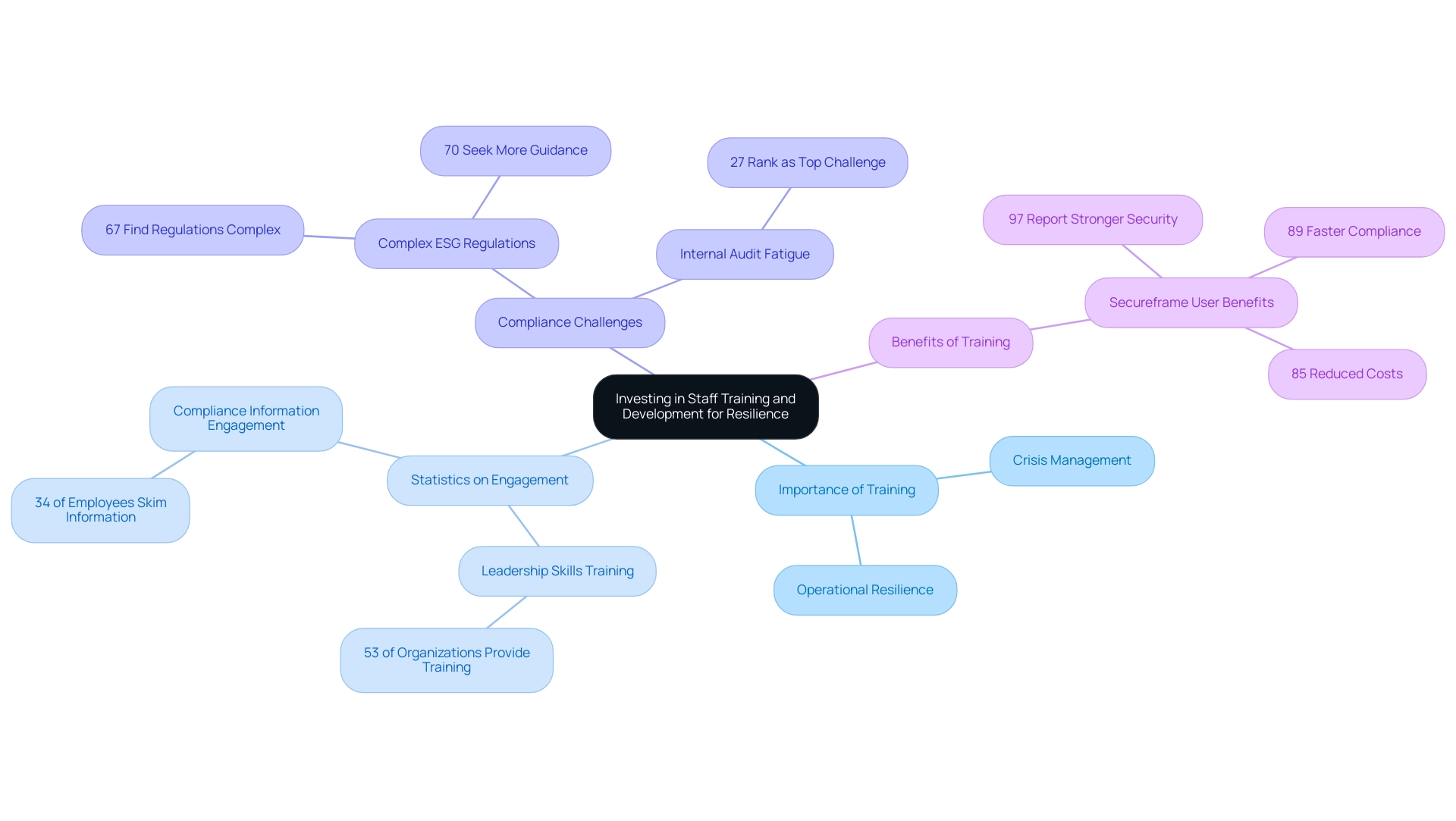

Investing in staff training and development is not just beneficial; it is essential for fostering operational resilience strategies, especially for small to medium businesses facing challenges. A striking 67% of global executives find ESG regulation overly complex, and 70% of them seek more guidance from regulators, highlighting the need for companies to better equip their workforce to navigate such complexities. CFOs should prioritize training programs that enhance employee skills and knowledge, particularly in crisis management and adaptability, ideally supported by expert advice from seasoned professionals in our firm.

Our commitment to transparency and partnership ensures that these initiatives not only encourage cross-functional collaboration, vital for effective responses to challenges, but also align with the goals of our turnaround and restructuring services. A recent statistic indicates that 53% of entities provide leadership skills training, yet only a fraction of employees—34%—report fully engaging with compliance information. This gap underscores the importance of creating a culture of continuous learning, which is crucial for turnaround strategies.

According to a survey, 27% of security and IT professionals ranked mitigating internal audit fatigue from recurring second-party and third-party assessment activities as the top compliance program challenge. By implementing customized training programs, companies can enable their teams to manage disruptions skillfully, which is a key component of effective operational resilience strategies, fostering innovation and preserving continuity. Furthermore, a case study on Secureframe users revealed that 97% reported stronger security, 89% faster compliance, and 85% reduced costs after implementing the platform.

This demonstrates the effectiveness of compliance automation in enhancing security and operational efficiency. As the landscape of crisis management evolves, investing in employee development not only mitigates risks but also positions the company for long-term success, aligning with our firm's commitment to transparency and partnership that underpin effective turnaround and restructuring efforts.

Regularly Reviewing and Updating Resilience Strategies

To sustain the effectiveness of recovery strategies, it is essential for businesses to carry out regular assessments and revisions. CFOs play a crucial role in creating a systematic timetable for assessing the robustness framework, ensuring that it includes valuable input from stakeholders and insights derived from past disruptions. By adopting a pragmatic approach, entities can test every hypothesis, delivering maximum return on invested capital.

Studies indicate that entities that review their resilience strategies at least annually are 30% more effective in adapting to unforeseen challenges. This iterative process, supported by real-time business analytics through client dashboards, allows organizations to remain agile in evolving circumstances and emerging risks. Furthermore, a shortened decision-making cycle is crucial during this process, enabling teams to take decisive actions swiftly.

For instance, during the pandemic, Luke's Lobster successfully pivoted to e-commerce to meet surging demand, demonstrating the need for flexibility in business strategies. Similarly, Airbnb co-founder Brian Chesky led the initiative to launch the 'Frontline Stays' program, offering housing to frontline workers while maintaining operational capacity. These case studies demonstrate not only the adaptability required in recovery strategies but also the broader implications for frameworks that must evolve in response to real-time market conditions.

By proactively participating in these evaluations and utilizing real-time analytics, organizations can ensure their strategies are relevant and effective, ultimately enhancing their ability to navigate future challenges. As Sandra Oh Lin, founder of KiwiCo, aptly noted, 'So very quickly, we decided to basically pull back or remain conservative on marketing spend,' reflecting the need for strategic adjustments based on real-time feedback and market conditions. These best practices underscore the crucial role of stakeholder input in refining operational resilience strategies and fortifying organizational resilience in an unpredictable landscape, fostering strong lasting relationships that enhance collaboration and support.

Conclusion

Operational resilience is not just a strategic advantage; it is a necessity for organizations striving to thrive in an unpredictable environment. Throughout the article, key strategies have been highlighted that CFOs can implement to enhance resilience, including:

- Integrating risk management

- Crafting comprehensive business continuity plans

- Leveraging technology

- Investing in staff development

Each of these components plays a crucial role in ensuring that organizations can effectively anticipate, respond to, and recover from disruptions.

By embedding risk management into the organizational culture, CFOs can proactively identify vulnerabilities and allocate resources effectively. The importance of a robust business continuity plan cannot be overstated, as it serves as a lifeline during crises, ensuring that critical functions remain operational. Moreover, the strategic use of technology facilitates real-time data analysis, enabling swift decision-making and fostering agility in response to emerging challenges.

Furthermore, investing in employee training and development is essential for building a workforce capable of navigating complexities and driving innovation. As organizations face increasing pressures, the emphasis on continuous learning and adaptability becomes paramount. Regularly reviewing and updating resilience strategies ensures that they remain relevant and effective, allowing organizations to pivot quickly in response to changing market conditions.

In conclusion, the journey toward operational resilience requires a multifaceted approach that aligns financial strategy with operational capabilities. By prioritizing these strategies, CFOs can position their organizations not only to survive disruptions but to emerge stronger and more competitive in the long run. The commitment to fostering resilience ultimately paves the way for sustainable success in an ever-evolving landscape.

Frequently Asked Questions

What are operational resilience strategies?

Operational resilience strategies refer to an entity's capacity to anticipate, prepare for, respond to, and recover from disruptive events. They are crucial for maintaining critical functions during crises and safeguarding financial resources.

Why are operational resilience strategies important for CFOs?

For CFOs, operational resilience strategies are essential as they directly correlate with financial stability and efficiency, enabling organizations to withstand disruptions and recover swiftly.

How does the team support decision-making during crises?

The team supports a shortened decision-making cycle throughout the turnaround process, allowing teams to take decisive actions and preserve the business.

What tools are used to track the success of operational resilience strategies?

The success of operational resilience strategies is tracked via a client dashboard that provides real-time business analytics, including cash flow projections, performance metrics, and assessments.

What challenges do organizations face regarding talent management?

Attracting and retaining talent is recognized as a top risk by 61% of leaders, highlighting the importance of human capital in enhancing organizational strength.

How can CFOs navigate future uncertainties and workforce challenges?

CFOs can navigate uncertainties by emphasizing agility and innovation in business strategies and utilizing data analytics for market intelligence.

What role does threat management play in operational resilience?

Integrating threat management into operational resilience strategies is crucial for handling potential disruptions, and CFOs collaborate with management teams to identify financial challenges and operational vulnerabilities.

What statistics highlight the urgency of strong management practices?

Almost one-third of companies reported being victims of fraud or financial crime in the past five years, underscoring the need for robust management practices.

What are the spending intentions of leaders regarding management initiatives?

According to the PwC Pulse Survey, 33% of leaders plan to increase spending on management initiatives, 57% will maintain their current budgets, and 8% intend to reduce spending.

How is technology being utilized to combat financial crime?

Advanced technologies like AI and machine learning are gaining traction, with 43% of professionals under revenue pressure expressing a strong interest in deploying these tools to combat financial crime.

Why is it important for CFOs to focus on management as part of business endurance?

A thorough management framework allows organizations to brace for uncertainties and ensures efficient distribution of financial resources, thereby safeguarding assets and improving overall robustness.