Overview

This article delineates seven essential restructuring advisory services that CFOs can leverage to navigate economic challenges and bolster organizational stability. These services—comprising interim management, operational efficiency strategies, and customized CFO solutions—are pivotal for pinpointing areas ripe for improvement and executing effective turnaround strategies. The significance of these services is underscored by compelling case studies and expert insights presented throughout the article.

Introduction

In today's volatile economic landscape, small and medium businesses stand at a critical juncture, confronting financial challenges that necessitate immediate and effective solutions. Comprehensive turnaround and restructuring consulting services have emerged as vital lifelines, delivering tailored strategies that empower organizations not only to survive but to thrive.

From in-depth financial assessments to interim management and operational efficiency initiatives, these services are meticulously designed to pinpoint critical areas for improvement and implement actionable plans that drive sustainable growth.

As businesses navigate the complexities of restructuring, grasping the nuances of these consulting services is essential for charting a course toward stability and success.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

and are essential for small and medium enterprises facing economic difficulties. Transform Your Small/Medium Business provides a complete range of services, including comprehensive evaluations of resources, interim management, and . By pinpointing key areas for improvement, our consultants facilitate streamlined operations, cost reductions, and . For instance, adopting sophisticated resource management practices can lead to significant cash flow enhancements, enabling companies to seize growth opportunities. This proactive strategy not only stabilizes operations but also lays the groundwork for sustainable long-term success.

Our have proven beneficial for numerous clients. A recent survey of 52 small and medium-sized plastics processing companies highlighted the necessity for , reinforcing the notion that one-size-fits-all solutions are ineffective across different sectors. This underscores the importance of adapting strategies to meet the unique challenges faced by various industries.

As we progress through 2025, the landscape of , with emerging trends emphasizing the importance of adaptability in response to market dynamics. Val Srinivas, a senior research leader at Deloitte, observes that "the ability to pivot and adjust strategies in real-time is crucial for organizations aiming to thrive in today's fast-paced environment." Standard Chartered's pledge of US$1.5 billion to its 'Fit for Growth' program demonstrates an increasing awareness of the necessity for strategic investment in transformation initiatives.

Ultimately, the influence of restructuring advisory services extends beyond immediate monetary relief; these services significantly enhance the operational efficiency and economic well-being of small businesses, preparing them for future growth and resilience.

Epiq Global: Expert Financial Assessment for Cash Preservation

Transform Your Small/Medium Business excels in delivering expert evaluations that are vital for . These assessments encompass a thorough analysis of monetary statements, , and . By identifying inefficiencies and revealing potential savings, companies can safeguard funds that might otherwise be overlooked. For instance, a may uncover excessive overhead expenses, which can be mitigated by renegotiating supplier agreements or optimizing operational procedures. This proactive strategy for cash management is essential for companies aiming to navigate economic challenges successfully.

In 2025, the importance of cash preservation has become even more pronounced, with studies indicating that a substantial portion of revenue often originates from a small percentage of clients. Consequently, prioritizing monetary adjustments based on spending habits is crucial for sustainable growth. Moreover, expert insights suggest that not only enhance cash flow but also empower small enterprises to identify and rectify inefficiencies, ultimately leading to improved operational performance.

Our team advocates for a streamlined decision-making cycle during the turnaround process, allowing your team to take decisive action to sustain your enterprise. Continuous monitoring through our client dashboard provides real-time business analytics to assess , ensuring that financial strategies are adapted as necessary. To engage with our offerings, please click the '' button.

CohnReznick: Interim Management Solutions for Effective Restructuring

, often referred to as restructuring advisory services, are essential during organizational changes, providing companies with specialized expertise and decisive leadership. Transform Your Small/Medium Business offers , including that allow organizations to focus on their core operations.

Interim managers, such as interim CFOs, can quickly assess the current situation, implement necessary changes, and guide teams through transitions. Their capacity to address critical issues promptly is vital for stabilizing operations and sustaining momentum, particularly through restructuring advisory services. For instance, an , ensuring compliance with regulations while prioritizing .

As Tom Studebaker, Managing Director and Co-Head of TRS at Portage Point, notes, "His highly engaged, hands-on approach – influenced by a distinctive mix of turnaround and operational experience – will be an invaluable asset to both our practice and the broader firm." This proactive leadership not only aids organizations in navigating challenges but also cultivates a culture of adaptability and resilience, ultimately driving sustainable growth through restructuring advisory services during significant change.

Furthermore, our commitment to operationalizing lessons learned throughout the turnaround process guarantees that organizations can continually adjust and enhance their strategies. Statistics reveal that interim CEOs can create a rapid impact by addressing critical issues promptly, underscoring the value they bring to organizations during transitions.

Huron Consulting Group: Operational Efficiency Strategies for Turnaround Success

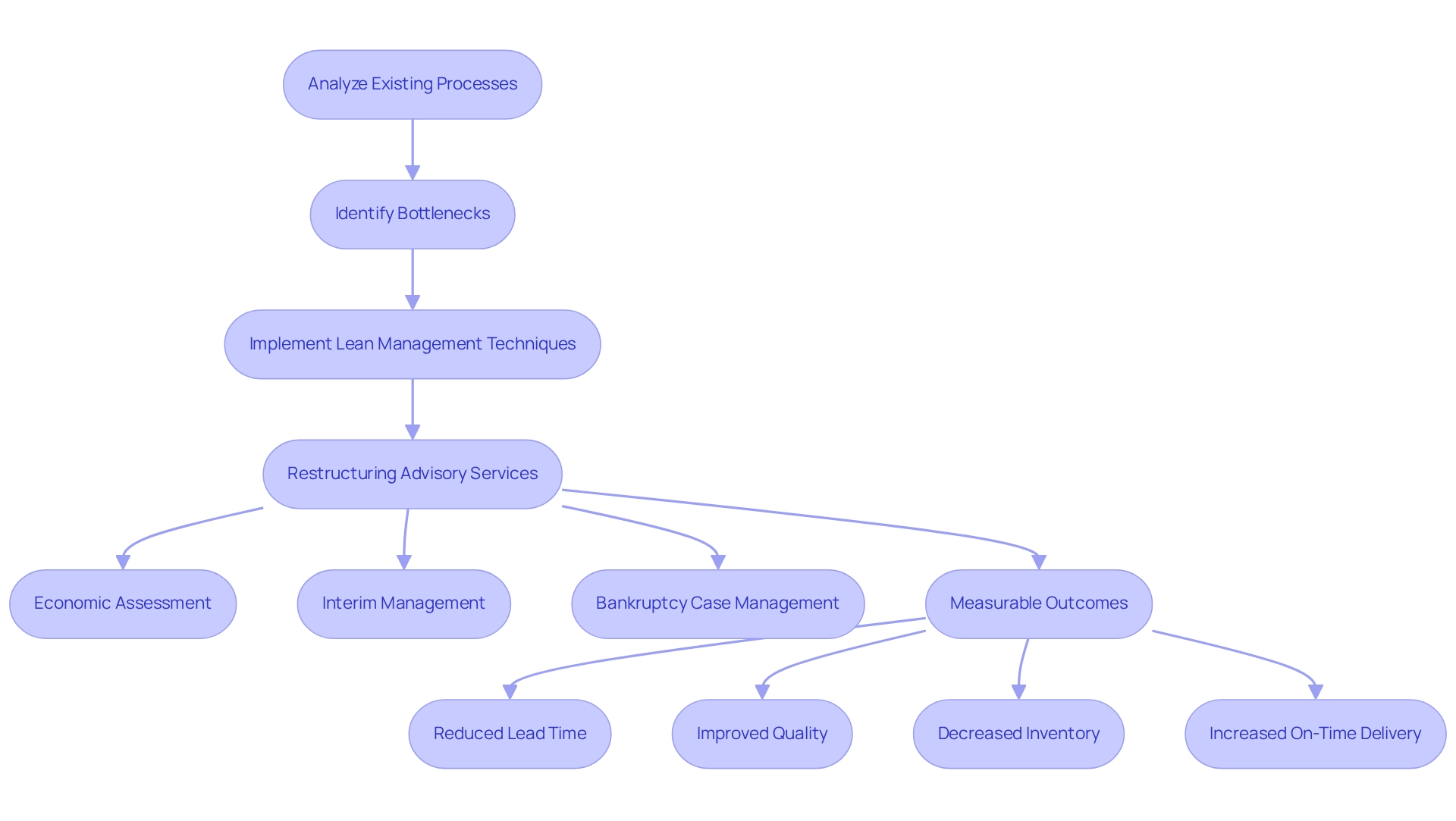

are vital for successful organizational turnarounds. By meticulously analyzing existing processes and pinpointing bottlenecks, organizations can streamline operations and significantly reduce costs.

Our , which include:

- Economic assessment

enable organizations to adapt swiftly to market fluctuations. Moreover, the implementation of has proven to enhance productivity and minimize waste, leading to substantial improvements in .

For instance, a recent case study highlighted that a comprehensive lean initiative resulted in:

- A reduction of lead time from over 20 days to just 2 days

- A 60% improvement in quality

- A $200 million decrease in inventory

In addition, on-time delivery improved from 82% to 98%, and employee engagement scores increased by 26 percentage points. These strategies not only boost profitability but also prepare companies to adjust rapidly to market changes.

As Robert Waterman aptly stated, "A strategy is necessary because the future is unpredictable." By adopting these operational efficiency strategies tailored for small to medium enterprises, CFOs can cultivate a more agile organization, paving the way for sustainable long-term success.

are designed to assist organizations in executing these strategies effectively, ensuring they achieve comparable transformative outcomes.

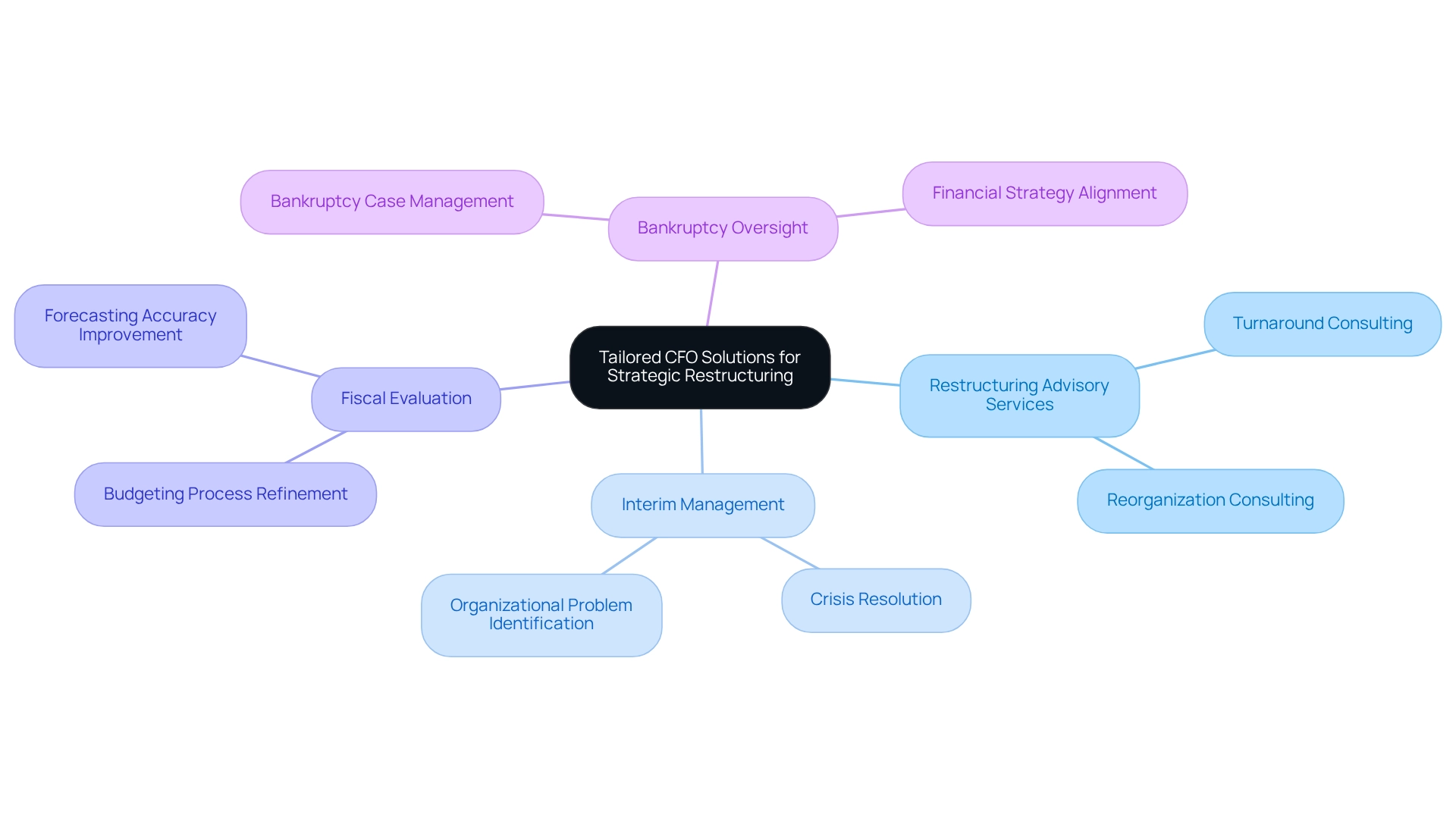

Cathcap: Tailored CFO Solutions for Strategic Restructuring

Transform Your Small/ Medium Business offers that are essential for . Our encompass comprehensive turnaround and reorganization consulting, interim management, fiscal evaluation, and bankruptcy case oversight, all meticulously designed to meet the unique needs of every enterprise. This alignment ensures that financial strategies resonate with operational objectives. For instance, a tailored CFO may implement a refined budgeting process that enhances forecasting accuracy and optimizes resource allocation. This personalized approach not only improves financial oversight but also bolsters the overarching reorganization strategy, empowering businesses to tackle challenges with greater agility.

Our provide practical executive guidance for crisis resolution and , fostering transformational change through our Rapid-30 process. By aligning financial management with operational goals, significantly enhance the likelihood of positive outcomes in reorganization efforts, which is further supported by our restructuring advisory services demonstrated in recent case studies across various organizations, showcasing their efficacy in navigating complex economic landscapes. Furthermore, statistics indicate that tailored in small enterprises, particularly in the current market landscape that demands a reassessment of traditional growth tactics. By leveraging these insights, CFOs can gain a deeper understanding of the critical role that customized solutions play in achieving sustainable growth during periods of organizational change.

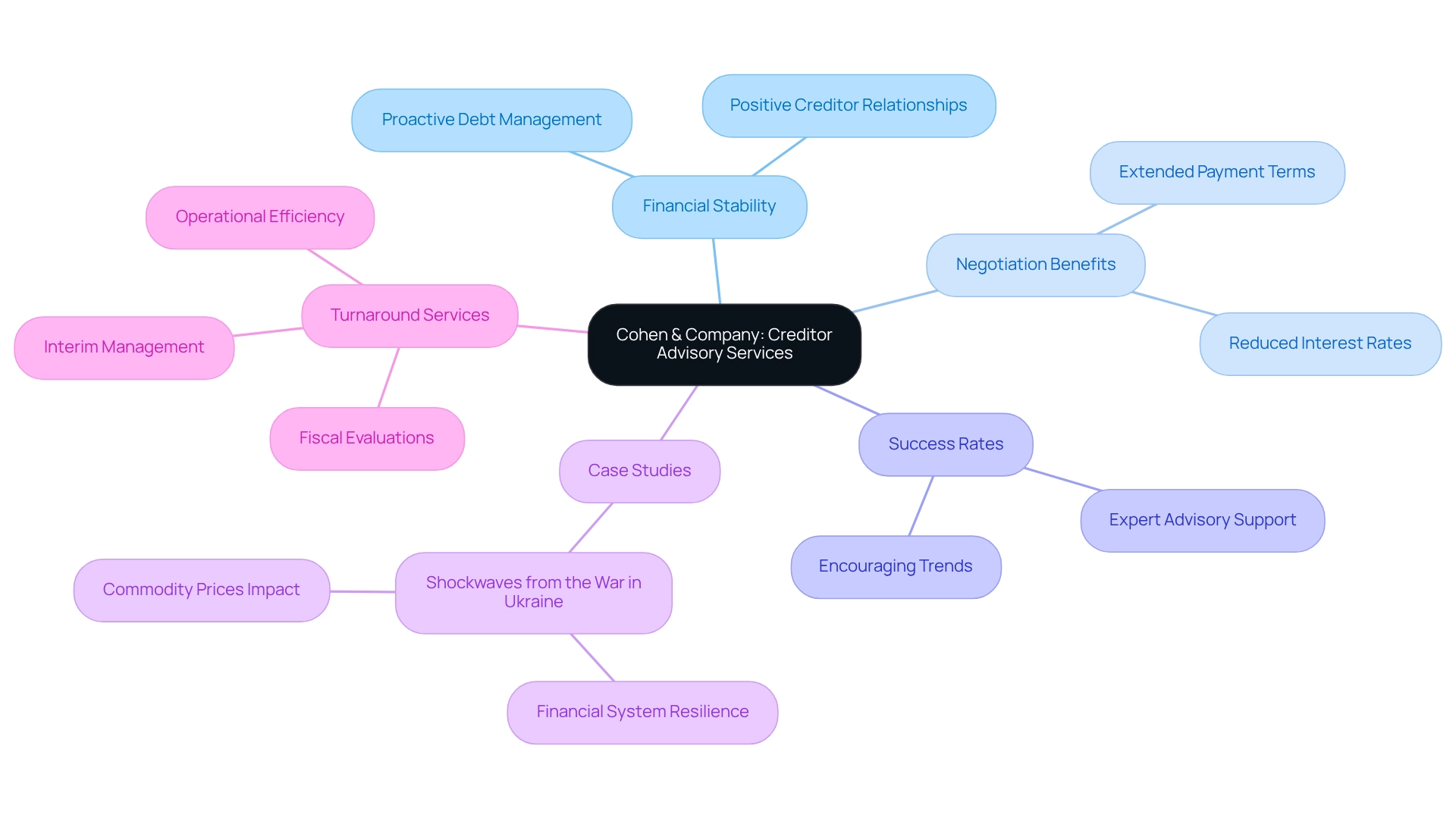

Cohen & Company: Creditor Advisory Services for Financial Stability

Cohen & Company provides essential creditor consulting services that are pivotal for ensuring . These services empower enterprises to adeptly navigate the intricate landscape of negotiations with creditors, thereby safeguarding their interests throughout the process. A proficient creditor consultant can facilitate the modification of , yielding more favorable terms such as extended payment periods or reduced interest rates. This proactive approach not only stabilizes the organization financially but also fosters positive relationships with creditors, which is vital during challenging times.

In recent years, the success rates of debt renegotiation discussions for small businesses have exhibited encouraging trends, with numerous firms reporting enhanced outcomes through . The role of has become increasingly critical, particularly in light of , including the ongoing repercussions of the COVID-19 crisis across various sectors.

Cohen & Company's track record in creditor consultation is underscored by a multitude of success stories, showcasing their ability to offer to guide clients through complex restructuring processes. For example, the case study titled "Shockwaves from the War in Ukraine Test the Financial System’s Resilience" illustrates the hurdles faced by enterprises during crises and underscores the importance of effective creditor guidance in navigating these turbulent times. As companies continue to grapple with economic uncertainties, the expertise offered by creditor advisors remains an indispensable resource for sustaining economic stability and fostering long-term growth. Furthermore, our comprehensive turnaround and restructuring advisory services focus on meticulous fiscal evaluations, interim management, and operational efficiency, ensuring that companies can effectively maintain cash flow and reduce liabilities.

Kroll: Debtor Advisory Services for Navigating Financial Challenges

Transform Your Small/Medium Business's plays a crucial role for companies facing monetary challenges. It offers strategic guidance that enhances and overall economic health. These offerings enable CFOs to perform comprehensive , pinpointing opportunities for and liability minimization.

By utilizing our extensive turnaround and , including interim management, CFOs can identify areas for renegotiation or consolidation, resulting in substantial savings. For instance, companies utilizing our restructuring advisory services have reported credit card balances that are 45% lower among engaged users, illustrating the effectiveness of these strategies.

Moreover, our are essential for enhancing economic results. Our client engagement process begins with a thorough organizational review to align key stakeholders and comprehend the situation beyond the figures.

By crafting plans that address immediate financial concerns and reinforce strengths, CFOs can navigate turbulent financial waters and lay the groundwork for sustainable growth and long-term viability with the help of restructuring advisory services. Participating in these consultative offerings is crucial for enterprises striving to become more resilient.

Take action today to secure your business's and thrive in a challenging economic landscape.

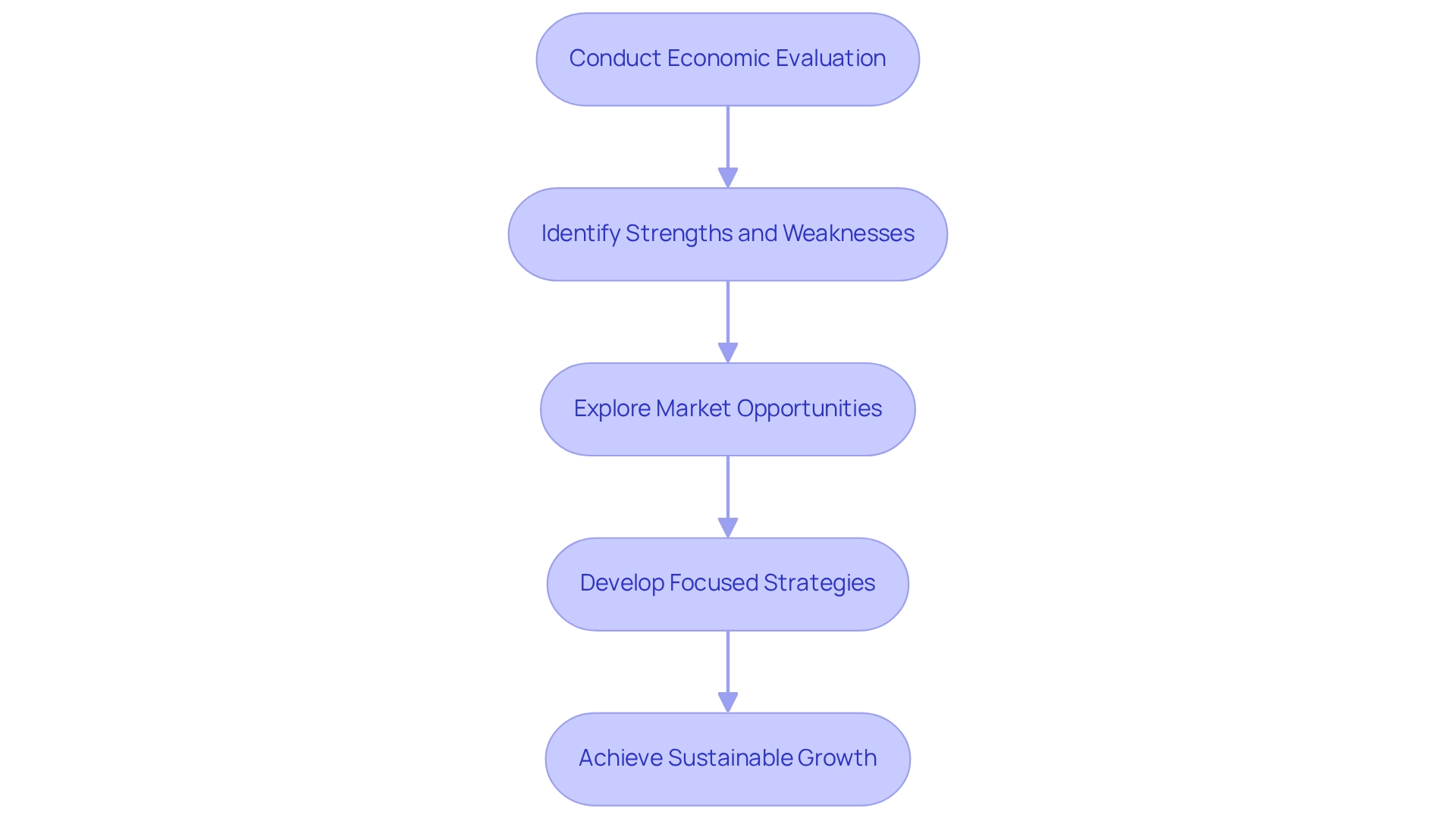

G2 Capital Advisors: Strategic Assessments for Informed Restructuring Decisions

Transform Your Small/Medium Business excels in providing strategic evaluations essential for informed organizational changes. Our extensive include detailed economic evaluations, interim management, and customized specifically for small to medium enterprises. These assessments deliver a thorough evaluation of a business's , market position, and operational efficiency. By identifying strengths and weaknesses, we empower CFOs to develop advisory services that significantly enhance the likelihood of successful reorganization.

For instance, a strategic evaluation may uncover previously neglected market opportunities, crucial for fostering growth during the reorganization phase. This data-driven methodology enables CFOs to make decisions that are not only informed but also aligned with their overarching business objectives. In 2025, the significance of these evaluations is underscored by the fact that 303 reorganization announcements were made by troubled companies in China, highlighting the essential need for robust strategic assessments in addressing economic challenges.

Moreover, case studies, such as that of Sichuan Joint-WIT Medical, illustrate the mixed outcomes of [restructuring advisory services](https://researchgate.net/publication/46546098_Financial_distress_resolution_in_China_-_two_case_studies), reinforcing the necessity of thorough assessments to guide effective decision-making. The stock market's perception that government ownership negatively impacts companies' distress-resolution strategies adds another layer of complexity to these assessments. As Gulnur Muradoglu notes, "We offer a broad understanding of how the firms cope with distress in a recently liberalized financial market like China where distress itself is a very recent phenomenon."

Ultimately, are indispensable instruments for CFOs seeking to achieve sustainable growth and operational resilience in today's intricate commercial environment.

Paladin Management Group: Bankruptcy Planning and Management Expertise

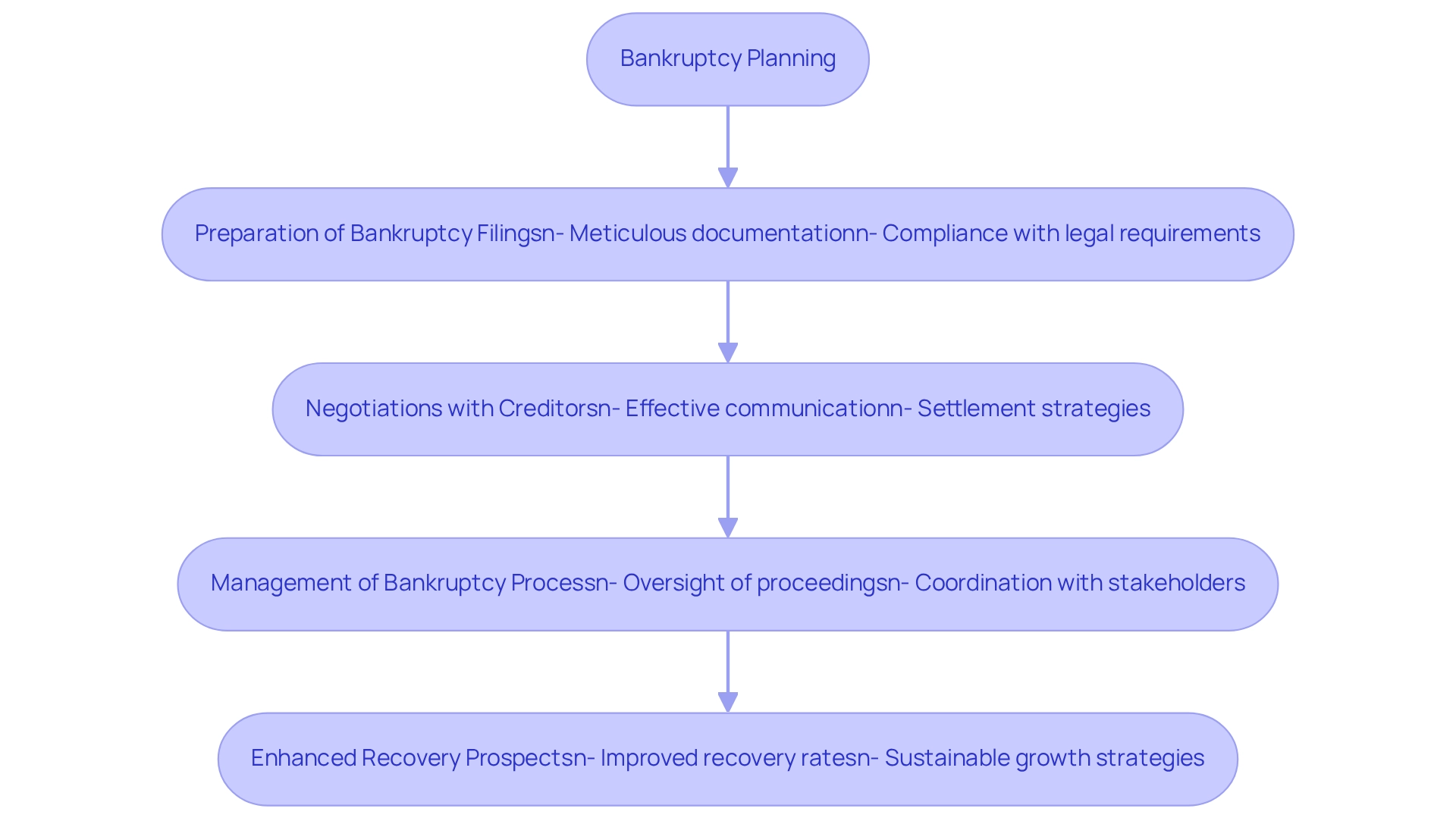

Proficiency in bankruptcy planning and management is crucial for companies confronting insolvency. Our comprehensive strategies, supported by from seasoned professionals, significantly minimize losses and enhance recovery prospects. We provide meticulous preparation of bankruptcy filings, effective negotiations with creditors, and thorough management of the . This proactive approach simplifies the complexities associated with bankruptcy and positions organizations for a .

In 2025, companies utilizing , including [restructuring advisory services](https://bls.gov/ooh/business-and-financial/accountants-and-auditors.htm), such as those offered by Transform Your Small/Medium Enterprise, are expected to experience enhanced recovery rates. Statistics suggest that such services can elevate recovery rates for small enterprises by as much as 30%. This underscores the importance of leveraging advisory services.

Moreover, our commitment to streamlined decision-making and real-time analytics empowers CFOs to continuously monitor business performance and operationalize lessons learned throughout the turnaround process.

Strong organizational skills are vital for managing , ensuring that all aspects of the [bankruptcy process](https://bls.gov/ooh/business-and-financial/accountants-and-auditors.htm) are handled efficiently. CFOs can leverage these insights to guarantee their organizations recover from bankruptcy with a robust strategy for sustainable growth, particularly in a sector where the primary employers of accountants and auditors comprise accounting firms and finance industries.

Capstone Partners: Comprehensive Restructuring Services for Business Stability

Transform Your Small/Medium Company provides a comprehensive suite of essential for achieving long-term stability. Our services include:

- Monetary reorganization

- Operational enhancements

- Strategic planning

All specifically designed to address the unique challenges faced by small to medium enterprises. By implementing , , interim management services, and , we empower organizations to save money, streamline operations, and reduce overhead costs.

For instance, by redesigning operational processes, we enhance efficiency and lower expenses, which is essential in today’s competitive landscape. This holistic approach not only stabilizes businesses but also positions them for sustainable growth by utilizing [restructuring advisory services](https://muckle-llp.com/insights/legal-commentary/insolvency-predictions-2025).

With 1.78 million and 65.3% of small firms reporting profitability, a significant market exists for these services. Many business owners express optimism about the future, and CFOs can leverage these comprehensive offerings to ensure their organizations are equipped to navigate challenges and seize new opportunities.

Moreover, (KPIs) is crucial; our restructuring advisory services assist businesses in monitoring these metrics, leading to improved performance and strategic growth, thereby reinforcing the importance of a robust restructuring strategy.

Conclusion

The journey through the complexities of turnaround and restructuring consulting underscores the vital role these services play in empowering small and medium businesses to not only survive but thrive amidst a challenging economic landscape. By implementing a comprehensive approach that encompasses financial assessments, interim management, and operational efficiency strategies, organizations can pinpoint critical areas for improvement and execute tailored solutions that drive sustainable growth.

As businesses confront unique challenges, the significance of customized strategies cannot be overstated. Evidence from numerous case studies demonstrates that one-size-fits-all solutions fall short; instead, businesses must embrace adaptable and proactive measures to navigate their specific circumstances. Insights from industry experts further emphasize the necessity for agility and strategic investment in restructuring initiatives, ensuring organizations can pivot effectively as market dynamics evolve.

Ultimately, engaging with comprehensive turnaround and restructuring consulting services is essential for enhancing operational efficiency and financial health. These services empower businesses to preserve cash, manage debt effectively, and implement transformational changes that lead to long-term stability. As the economic landscape continues to shift, the ability to leverage expert guidance in restructuring efforts becomes increasingly vital for achieving lasting success and resilience in the face of adversity.

Frequently Asked Questions

What services does Transform Your Small/Medium Business provide for companies facing economic difficulties?

Transform Your Small/Medium Business offers a complete range of services, including comprehensive evaluations of resources, interim management, and operational efficiency strategies to help companies improve their operations, reduce costs, and enhance revenue generation.

Why are tailored turnaround strategies important for small and medium enterprises?

Tailored turnaround strategies are important because they address the unique challenges faced by different companies based on their size and financial strength. A one-size-fits-all solution is often ineffective, as highlighted by a survey of plastics processing companies.

How is the landscape of turnaround consulting evolving?

The landscape is evolving to emphasize adaptability in response to market dynamics, with organizations needing to pivot and adjust strategies in real-time to thrive in a fast-paced environment.

What is the significance of cash preservation for small businesses in 2025?

Cash preservation is crucial as studies indicate that a significant portion of revenue often comes from a small percentage of clients. Prioritizing monetary adjustments based on spending habits is essential for sustainable growth.

How can Transform Your Small/Medium Business help with cash management?

The company provides expert evaluations that analyze monetary statements, cash flow projections, and operational costs, helping businesses identify inefficiencies and potential savings to safeguard funds.

What role do interim managers play in restructuring advisory services?

Interim managers, such as interim CFOs, provide specialized expertise and leadership during organizational changes. They assess situations quickly, implement necessary changes, and guide teams through transitions to stabilize operations.

What are the benefits of having an interim CFO during restructuring?

An interim CFO can oversee financial operations, ensure regulatory compliance, and prioritize cost reduction strategies, which are vital for stabilizing operations and maintaining momentum during transitions.

How does Transform Your Small/Medium Business ensure continuous improvement during the turnaround process?

The company operationalizes lessons learned throughout the turnaround process, allowing organizations to continually adjust and enhance their strategies for better outcomes.