Overview

The article outlines seven essential stakeholder management principles that every CFO must grasp to effectively engage with and manage the expectations of various parties invested in the organization's financial health. It underscores the critical nature of clear communication and understanding stakeholder needs. Furthermore, leveraging technology for engagement and continuously monitoring and adapting strategies are highlighted as vital components for fostering strong relationships. Ultimately, these principles drive sustainable growth and enhance the organization's financial stability.

Introduction

In the intricate world of finance, the role of a CFO extends far beyond managing numbers; it encompasses a critical responsibility—stakeholder management. As organizations pivot towards a more service-oriented economy, understanding and engaging diverse stakeholders has never been more vital. From investors and employees to customers and regulatory bodies, each group brings unique expectations that can significantly influence a company's financial trajectory.

In 2025, the stakes are higher, and the need for timely financial planning and transparent communication is paramount. Moreover, by harnessing technology and adopting strategic engagement practices, CFOs can not only navigate challenges but also unlock opportunities for sustainable growth.

This article delves into the essential components of effective stakeholder management, offering insights into how CFOs can:

- Build strong relationships

- Proactively manage expectations

- Continuously adapt their strategies for success in an ever-evolving financial landscape.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder management principles are a vital process for CFOs, encompassing the identification, analysis, and engagement of individuals or groups invested in the organization's financial health. This includes a diverse array of participants such as investors, employees, customers, and regulatory bodies. In 2025, the importance of effective management of involved parties has escalated, particularly as the new services economy places greater emphasis on employees as key participants. Prompt and precise financial planning is vital to satisfy their expectations and promote a culture of trust.

For financial leaders, grasping the distinct needs and viewpoints of these individuals is essential. By aligning financial strategies with the expectations of interested parties, financial leaders can navigate challenges more effectively and seize opportunities for sustainable growth. Research shows that for most firms, software constitutes the second-largest budget expenditure after payroll, emphasizing the necessity for CFOs to utilize technology in engaging with interested parties.

Transform Your Small/ Medium Business offers technology-driven turnaround and restructuring consulting, highlighting teamwork and fundamental principles of transparency, results, and innovation, which can greatly improve management of interested parties. Interested in discovering how to improve your FP&A approach with the right software tools? This guide is here to assist.

Effective approaches for engaging interested parties in finance are based on stakeholder management principles that involve clear communication, transparency, and responsiveness. Chief Financial Officers who embody traits such as strong financial insight, strategic vision, and effective communication are better positioned to drive fiscal plans and contribute to their organizations' long-term success. The case study titled 'Qualities of a Great Financial Officer' illustrates that financial leaders who possess these essential qualities are more skilled at managing relationships with involved parties, which is critical in today's dynamic environment.

Expert opinions underscore that utilizing tools and frameworks, such as those provided by Gartner, can empower financial officers to make faster, smarter decisions that align with critical organizational priorities. By prioritizing stakeholder management principles and employing continuous business performance monitoring through real-time analytics, financial leaders can ensure that their financial strategies are not only effective but also resonate with the diverse interests of all involved.

Identifying Key Stakeholders: Who Matters Most?

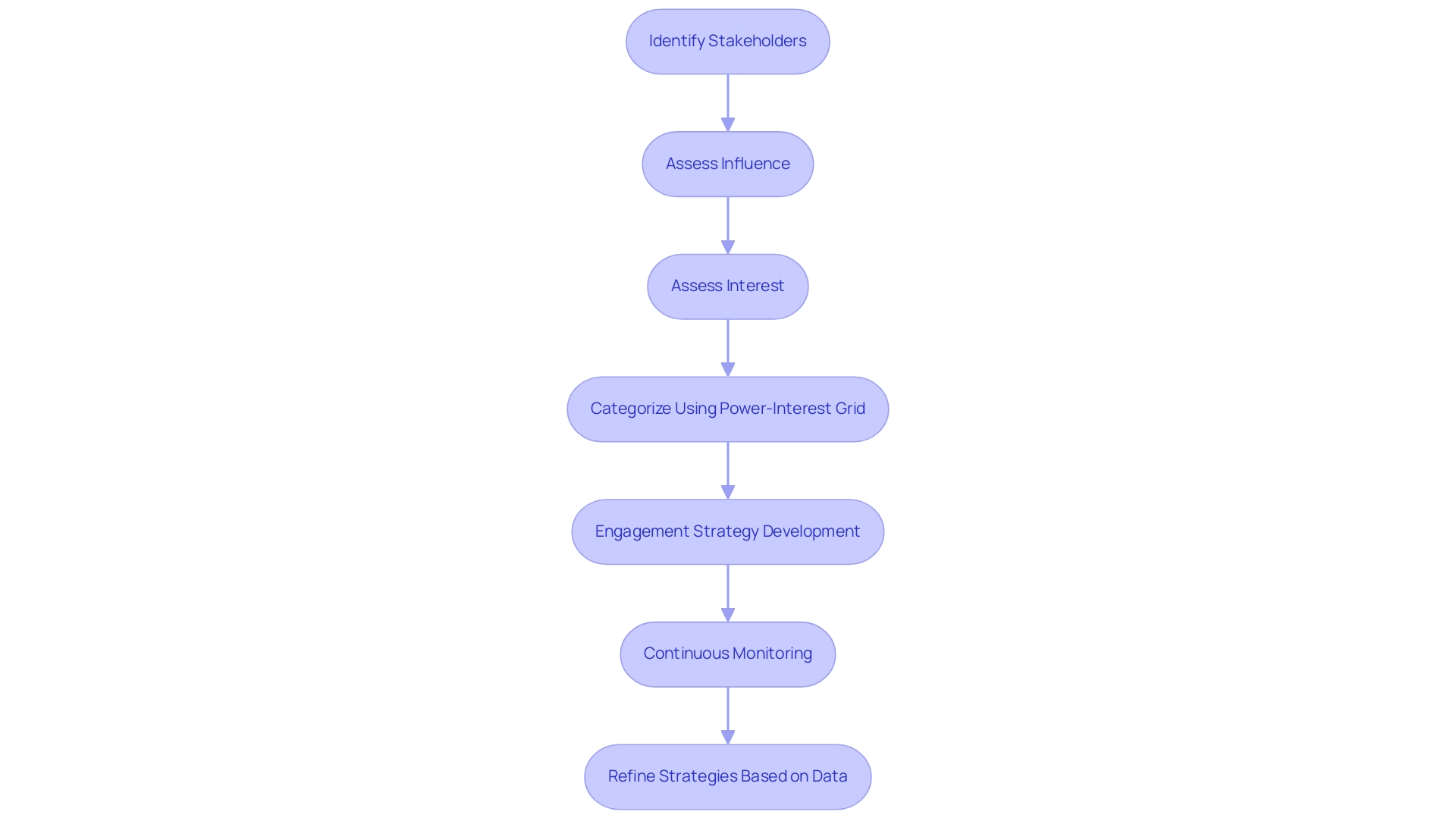

Recognizing essential participants is vital for any organization, particularly for financial leaders who must adeptly navigate intricate financial environments using stakeholder management principles. This process entails mapping out individuals or groups with a vested interest in the organization’s success, guided by principles that encompass shareholders, customers, suppliers, and regulatory agencies. A comprehensive analysis of involved parties is crucial to identify who holds the most influence and interest in financial decisions, in alignment with stakeholder management principles.

Utilizing tools such as the Power-Interest Grid empowers CFOs to categorize participants based on their level of influence and interest. This classification enables customized approaches that adhere to stakeholder management principles, significantly enhancing communication and cooperation. For instance, parties with substantial influence and interest should be prioritized for regular updates and involvement in decision-making processes, while those with lower influence may require less frequent engagement.

Statistics reveal that 78% of projects succeed with active participation from involved parties, compared to only 40% with minimal involvement. This underscores the importance of stakeholder management principles for effectively managing key individuals. Furthermore, as 39% of social media users expect prompt responses, CFOs must adapt their communication strategies accordingly to meet these expectations, ensuring timely and relevant interactions.

In 2025, stakeholder management principles will require recognizing essential participants not only through traditional methods but also by leveraging technology-driven tools that facilitate real-time analysis and interaction. For example, Transform Your Small/Medium Business conducts analyses of interested parties during their Discovery Workshop and Discovery Phase to understand clients' needs and translate them into technological solutions. This approach fosters a streamlined decision-making cycle based on stakeholder management principles, enabling decisive actions that maintain business health.

Additionally, measuring Engagement ROI can quantify the value of participant involvement by evaluating the costs and benefits of engagement efforts, assisting organizations in refining their stakeholder management principles.

A thorough participant analysis that adheres to stakeholder management principles aids project managers in allocating resources efficiently and mitigating risks associated with dissatisfaction. By embracing these principles, CFOs can fortify relationships with interested parties, ultimately leading to improved financial outcomes and organizational success. Continuous monitoring through real-time analytics ensures that the effectiveness of these strategies is assessed based on stakeholder management principles, allowing for timely adjustments and fostering stronger connections with involved parties.

Moreover, by testing and measuring the impact of involvement efforts, organizations can refine their strategies based on data-driven insights, ensuring that relationship management remains effective and aligned with overarching business objectives.

Establishing Clear Communication Channels for Effective Engagement

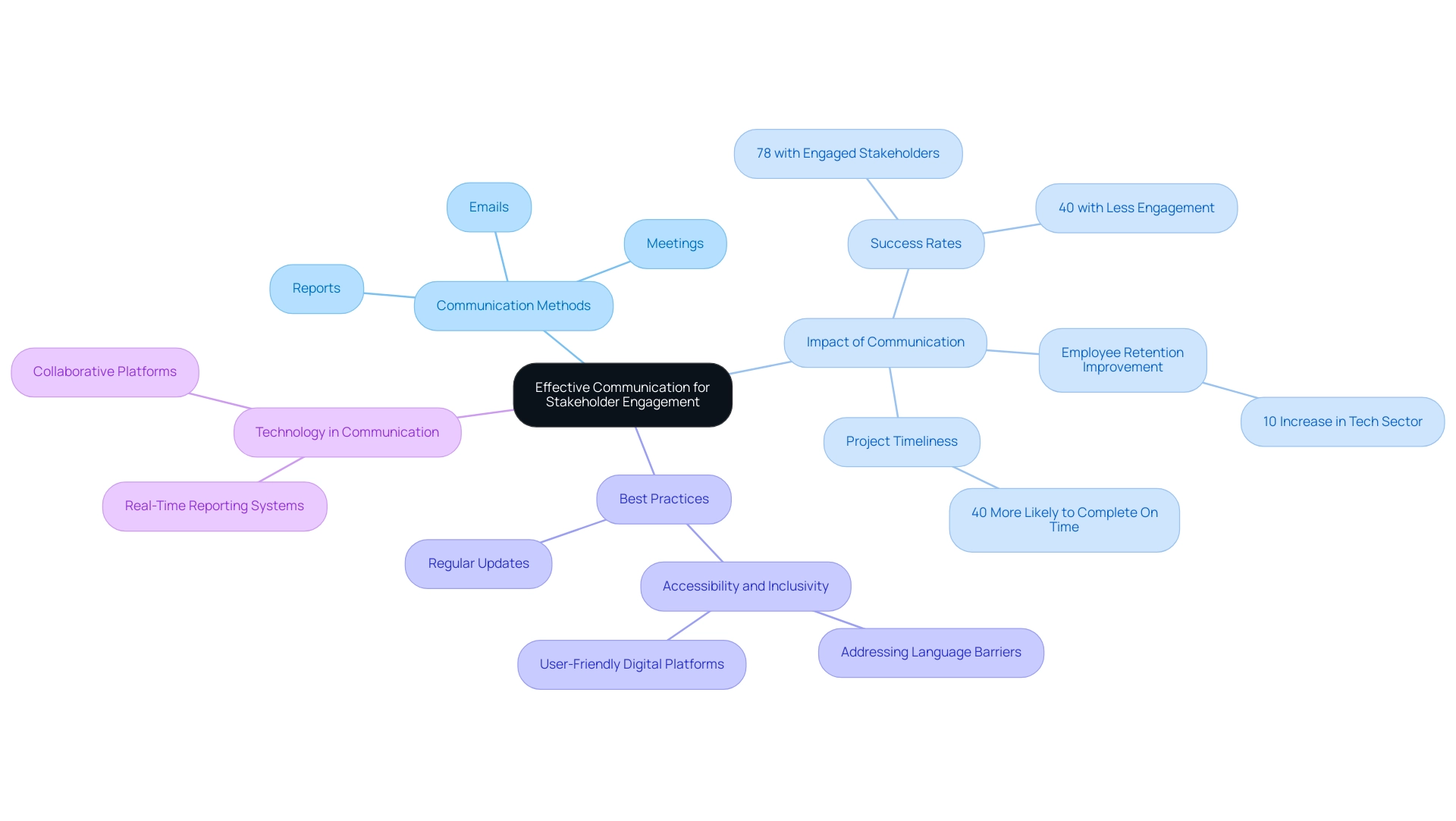

Creating transparent communication pathways is crucial for the effective application of stakeholder management principles by financial leaders maneuvering through intricate financial environments in 2025. Employing a diverse range of communication methods—such as emails, meetings, and detailed reports—demonstrates stakeholder management principles by allowing CFOs to keep interested parties well-informed about financial performance and strategic initiatives. Regular updates not only promote transparency but also cultivate trust, which is essential for effective stakeholder management principles. Studies indicate that organizations with involved parties see a 78% success rate in projects, compared to just 40% when engagement is absent.

Furthermore, building trust with partners can lead to a 10% improvement in employee retention in the tech sector, underscoring the broader impact of effective communication.

Moreover, leveraging technology can significantly enhance communication efficiency. Tools such as collaborative platforms and real-time reporting systems ensure that interested parties receive timely and relevant information, thereby reinforcing their confidence in the organization’s ability to deliver on its promises. For instance, companies that implement effective communication plans with interested parties are 40% more likely to complete projects on time and within budget.

This is especially significant in the context of business turnaround strategies, where real-time analytics can guide swift decision-making and operational adjustments.

Best practices for CFO communication with interested parties should align with stakeholder management principles, ensuring accessibility and inclusivity in all communication channels. A case study on accessibility emphasizes the significance of addressing diverse participant needs, such as language barriers and technical constraints. For instance, a CFO could implement alternative communication channels, such as translated materials or user-friendly digital platforms, to ensure that all participants can engage meaningfully with the information shared.

Furthermore, the client engagement process should commence with a thorough business review to align key participants and better understand the business environment, enabling strategic planning that tackles underlying issues and strengthens advantages.

In conclusion, open communication is not merely a best practice; it is a strategic necessity that boosts trust and involvement of interested parties in decision-making processes. As financial leaders continue to adapt to changing business environments, prioritizing effective communication, supported by real-time analytics and streamlined decision-making, will be essential to fostering strong relationships with interested parties.

Understanding Stakeholder Needs and Expectations

Understanding the needs and expectations of interested parties is paramount for CFOs aiming to align financial strategies with broader organizational objectives through stakeholder management principles. Active listening and feedback collection are essential for adhering to these principles. Methods such as surveys, interviews, and focus groups can be employed to gather valuable insights into the viewpoints of involved parties.

A recent study revealed that 78% of projects succeed when participants are actively involved, while only 40% succeed with reduced involvement. This statistic underscores the essential role of participant contribution in financial initiatives.

In 2025, CFOs must prioritize understanding the needs of those involved by implementing structured feedback mechanisms. This includes creating individual learning plans and competency development approaches, which have been emphasized as strategic priorities in recent discussions. Metrics on communication quality, task completion rates, and participant satisfaction are vital for assessing the return on investment (ROI) of involvement efforts.

Moreover, the integration of real-time analytics can significantly enhance decision-making processes. By continually monitoring the success of engagement strategies through dashboards that provide real-time business analytics, CFOs can diagnose the health of participants and adjust their approaches accordingly. This pragmatic approach, grounded in stakeholder management principles, ensures that every hypothesis is tested, maximizing the return on invested capital in both the short and long term.

In a case study focused on a catchment improvement program, participant assessments were conducted to identify cropping systems that could enhance water quality. This process included interviewing various participants, resulting in the identification of five distinct groups based on sustainability preferences. Such evaluations encourage open dialogues and promote agreement, illustrating how insights obtained can directly impact financial strategies and choices.

By addressing the concerns and priorities of involved parties using stakeholder management principles and utilizing real-time analytics, financial leaders can significantly boost satisfaction and backing for financial initiatives, ultimately enhancing organizational performance. The combination of expert insights and strategic feedback systems will enable financial leaders to manage the complexities of relationships effectively.

Building Strong Relationships: The Foundation of Stakeholder Trust

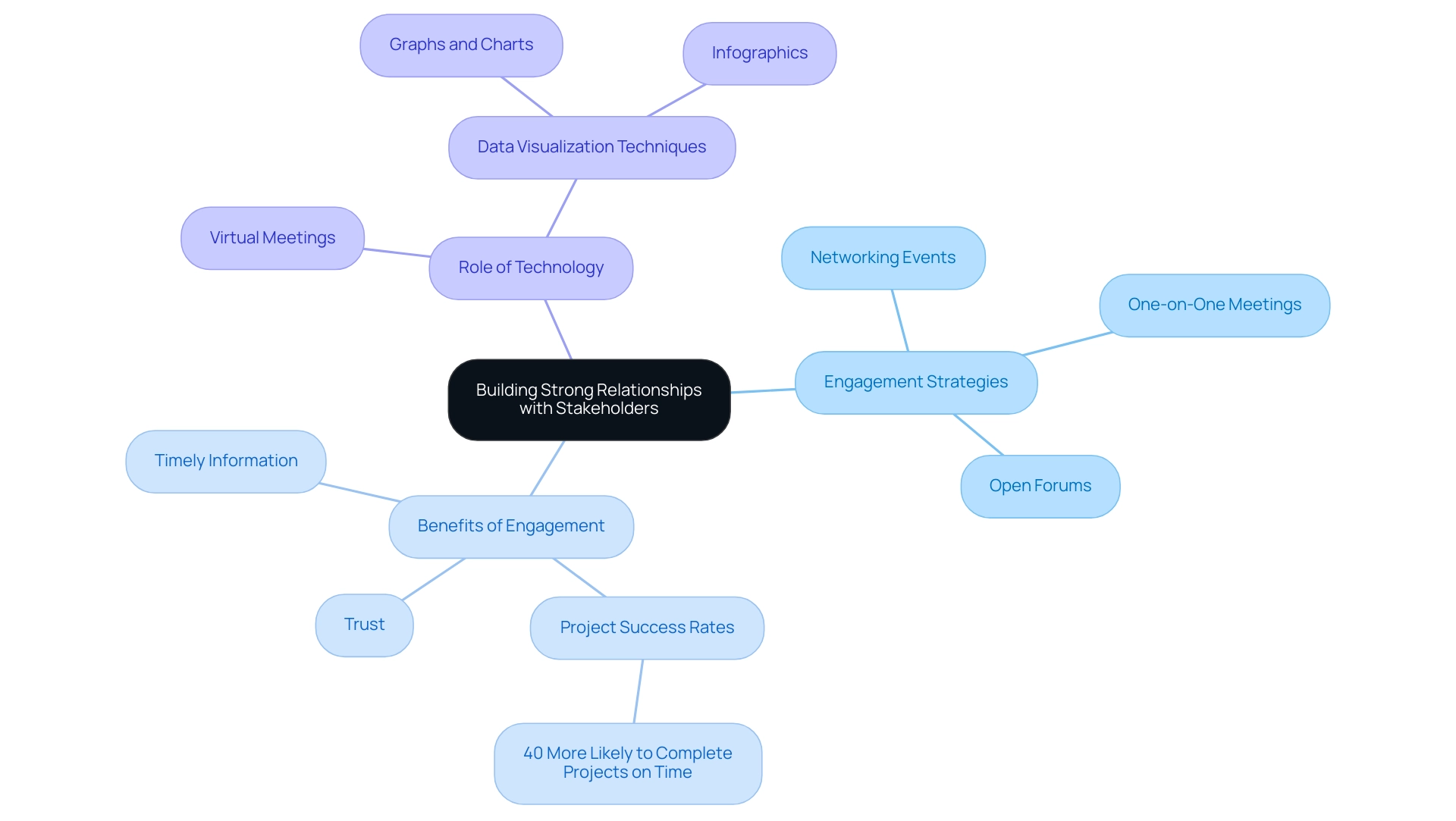

Building strong connections with interested parties is essential for fostering trust and collaboration within an organization by utilizing stakeholder management principles. Chief financial officers must prioritize relationship-building by engaging with interested parties through regular interactions, such as:

- Networking events

- One-on-one meetings

- Open forums for discussion

This proactive approach not only demonstrates a genuine interest in the concerns of involved parties but also cultivates a supportive atmosphere that promotes acceptance of financial plans and initiatives through stakeholder management principles.

Research indicates that companies with effective engagement of interested parties are 40% more likely to complete projects on schedule and within budget, underscoring the tangible advantages of strong relationships. Moreover, C-suite leaders require timely information for essential budget choices, making it vital for financial officers to uphold clear communication and transparency with interested parties by adhering to stakeholder management principles. To facilitate this, leveraging real-time business analytics through a client dashboard can significantly enhance decision-making processes, allowing CFOs to respond swiftly to the needs of interested parties and market changes while benefiting from a shortened decision-making cycle.

To enhance trust, CFOs can adopt specific networking strategies tailored for 2025, such as utilizing technology to facilitate virtual meetings and employing data visualization techniques to simplify complex information. For example, using graphs, charts, and infographics can aid individuals in better engaging with statistical findings, ensuring that data is accessible and understandable. As Mikkel Dengsøe notes, understanding the varying perceptions of data roles is crucial; what may seem like a 'quick data pull' can involve significant time and effort, highlighting the need for clear communication based on stakeholder management principles. Additionally, navigating organizational dynamics requires identifying champions, creating cross-functional teams, and maintaining clear communication, all of which are informed by stakeholder management principles.

Continuous monitoring of business performance through client dashboards can provide real-time insights that inform interactions and decision-making. Case studies show that parties who involve analysts early in projects and acknowledge their contributions can significantly enhance their relationships, leading to more effective data utilization and improved project outcomes. By nurturing these connections and implementing lessons from the turnaround process, financial leaders not only enhance their relationships with interested parties but also prepare their organizations for lasting growth and success.

Proactively Managing Stakeholder Expectations

Proactively managing the expectations of involved parties is paramount for CFOs. This process commences with setting realistic goals and effectively communicating them in line with stakeholder management principles. Establishing clear performance metrics and timelines not only keeps interested parties informed about progress but also highlights potential challenges. For instance, organizations that prioritize transparency and measurable commitments in their engagements with stakeholders can experience up to a 10% improvement in employee retention, particularly within the technology sector.

CFOs must address expectations upfront by leveraging stakeholder management principles to mitigate risks and prevent dissatisfaction among interested parties. Regular check-ins and updates are essential for aligning stakeholders with organizational objectives and financial strategies. Transform Your Small/Medium Business will identify underlying business issues through comprehensive analysis and feedback from involved parties, collaborating to create a strategic plan that mitigates weaknesses and allows the business to reinvest in key strengths.

A case study titled "Engagement ROI: Quantifying the Value of Participant Involvement" underscores the significance of measuring the return on investment (ROI) from participant involvement. It illustrates how measuring engagement ROI can refine approaches, enhance relationships with stakeholders, and elevate overall project success by monitoring various engagement metrics.

Moreover, expert insights suggest that brands best positioned to thrive in today's environment are those that adhere to stakeholder management principles by being transparent about their values and commitments, particularly regarding Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI). As Kari Alldredge, a partner at McKinsey, asserts, "Brands best positioned to gain share in this environment will be transparent about what they stand for; make and honor measurable commitments to ESG and DEI; build their direct and indirect relationships with consumers across digital and physical touchpoints; and harness talent and technology." By leveraging talent and technology, financial leaders can forge stronger connections with partners across both digital and physical touchpoints, ultimately driving sustainable growth.

Additionally, we at Transform Your Small/Medium Business adopt a pragmatic approach to data, rigorously testing every hypothesis to deliver maximum return on invested capital in both the short and long term, while continuously measuring investment returns to ensure strategic alignment.

Monitoring and Adapting Strategies for Continuous Improvement

Monitoring and adapting management strategies is essential for fostering continuous improvement within organizations. Financial leaders must conduct regular evaluations of their engagement initiatives, utilizing instruments such as satisfaction surveys and engagement metrics to measure effectiveness. Transform Your Small/ Medium Business facilitates a shortened decision-making cycle throughout the turnaround process, empowering CFOs to take decisive action to preserve their business.

For instance, the TrACER study demonstrated that involving an External Stakeholder Advisory Group (ESAG) from the outset significantly enhanced study design and implementation, with members feeling respected and valued throughout the process. This case underscores the importance of early formation of interest groups and maintaining open lines of communication.

A participant from the ESAG remarked, "I feel like when I suggested something or when I observed something that I shared, I never felt that it just went into a dark hole and you don't even know if people care. They actually come back and ask more questions to clarify exactly what my concerns are or exactly what my suggestions are." This highlights the significance of stakeholder management principles in involving interested parties, which can be further enhanced by real-time business analytics available through our client dashboard that consistently assesses organizational health.

Moreover, statistics reveal that only two members departed from the project throughout the six-year research timeframe, emphasizing the success of ongoing involvement approaches. By actively pursuing and integrating input from interested parties, financial leaders can leverage stakeholder management principles to adjust their plans and better align with organizational objectives and the expectations of those involved. This responsiveness, supported by continuous performance monitoring, not only strengthens relationships but also drives collaboration and alignment—critical components for long-term project success.

As we approach 2025, with the environment of stakeholder interaction evolving, financial leaders must prioritize ongoing enhancement in their stakeholder management principles. This includes measuring engagement to detect potential disengagement early, thereby preventing miscommunication and project failure. By embracing a culture of feedback and adaptation, and operationalizing lessons from the turnaround process, CFOs can ensure that their financial strategies remain relevant and effective in achieving sustainable growth.

Conclusion

Proactive stakeholder management is essential for CFOs navigating the complexities of today's financial landscape. By building strong relationships, understanding stakeholder needs, and establishing clear communication channels, CFOs can foster trust and collaboration among diverse groups, including investors, employees, and regulatory bodies. Moreover, the importance of leveraging technology cannot be overstated; it enhances engagement and allows for real-time feedback that informs decision-making.

Continuous monitoring and adapting strategies are critical for ensuring stakeholder expectations are met and that financial strategies align with organizational objectives. The data-driven insights gained from regular assessments and stakeholder feedback can significantly improve project outcomes and overall organizational performance. As organizations move towards a more service-oriented economy, the role of the CFO in managing stakeholder relationships will only grow in significance.

Ultimately, effective stakeholder management transcends finance; it is a strategic imperative that drives sustainable growth and long-term success. By prioritizing transparency, engagement, and responsiveness, CFOs can position their organizations to thrive in an ever-evolving financial landscape. The future of finance hinges on the ability to connect with stakeholders meaningfully and adapt to their changing expectations, ensuring that all parties are aligned in their pursuit of shared goals.

Frequently Asked Questions

What is stakeholder management and why is it important for CFOs?

Stakeholder management involves identifying, analyzing, and engaging individuals or groups invested in an organization's financial health. For CFOs, it is crucial as it helps navigate financial environments, align strategies with stakeholder expectations, and promote a culture of trust.

Who are considered stakeholders in an organization?

Stakeholders include a diverse array of participants such as investors, employees, customers, suppliers, and regulatory bodies, all of whom have a vested interest in the organization’s success.

How has the importance of stakeholder management changed by 2025?

By 2025, the effective management of stakeholders has become even more critical, particularly due to the new services economy that emphasizes employees as key participants. Prompt financial planning is essential to meet their expectations.

What tools can CFOs use to manage stakeholders effectively?

CFOs can utilize tools like the Power-Interest Grid to categorize stakeholders based on their level of influence and interest, allowing for customized engagement strategies.

What are the benefits of active stakeholder participation in projects?

Statistics indicate that 78% of projects succeed with active stakeholder participation, compared to only 40% with minimal involvement, highlighting the importance of engaging key individuals.

How can technology enhance stakeholder management?

Technology-driven tools facilitate real-time analysis and interaction, enabling CFOs to adapt their communication strategies and engage stakeholders more effectively.

What is Engagement ROI and how does it relate to stakeholder management?

Engagement ROI measures the value of stakeholder involvement by evaluating the costs and benefits of engagement efforts, helping organizations refine their stakeholder management strategies.

What are some key principles of effective stakeholder management?

Effective stakeholder management is based on clear communication, transparency, and responsiveness. CFOs who embody strong financial insight and strategic vision are better positioned to manage relationships successfully.

How can continuous monitoring improve stakeholder engagement strategies?

Continuous monitoring through real-time analytics allows organizations to assess the effectiveness of their strategies, make timely adjustments, and foster stronger connections with stakeholders.

How can organizations refine their stakeholder management strategies?

By testing and measuring the impact of involvement efforts using data-driven insights, organizations can refine their strategies to ensure effective relationship management aligned with business objectives.