Overview

This article presents seven financial action plans that CFOs can implement to drive business success. It focuses on critical areas such as cash flow management, risk management, and stakeholder communication. Each action plan is bolstered by strategies and tools designed to enhance operational efficiency and financial performance. The discussion underscores the significance of data-driven decision-making and transparent communication, essential for fostering trust and achieving strategic goals.

Introduction

In the competitive landscape of small and medium businesses, financial health is paramount for sustainability and growth. With ever-evolving market dynamics, CFOs are not only tasked with maintaining liquidity but also with implementing strategic initiatives that drive profitability and operational efficiency. From conducting comprehensive financial assessments to mastering cash flow management and regulatory compliance, the role of financial leadership has never been more critical. This article delves into essential strategies that CFOs can employ to enhance business performance, mitigate risks, and foster long-term growth. By ensuring that organizations remain resilient in the face of financial challenges, CFOs can secure a prosperous future.

Transform Your Small/ Medium Business: Comprehensive Financial Assessment Services

Conducting a thorough economic assessment is essential for any organization aiming to optimize performance. This process involves analyzing key fiscal statements, cash flow, and . CFOs must focus on identifying areas where costs can be reduced and revenues can be increased. Moreover, employing tools such as ratios and benchmarking against industry standards provides valuable insights into performance and areas for enhancement.

In addition, leveraging expert guidance through a Business Valuation Report can significantly enhance the assessment process, particularly when integrating AI/ML strategies for SMB turnaround. Routine evaluations are crucial, assisting companies in adjusting to evolving market circumstances and sustaining financial stability. Consequently, [mastering the liquidity conversion cycle](https://smbdistress.com/product/mastering-the-cash-conversion-cycle-20-strategies-for-optimal-business-performance) through focused strategies can further elevate business performance. By prioritizing these assessments, organizations can ensure they remain competitive and financially sound.

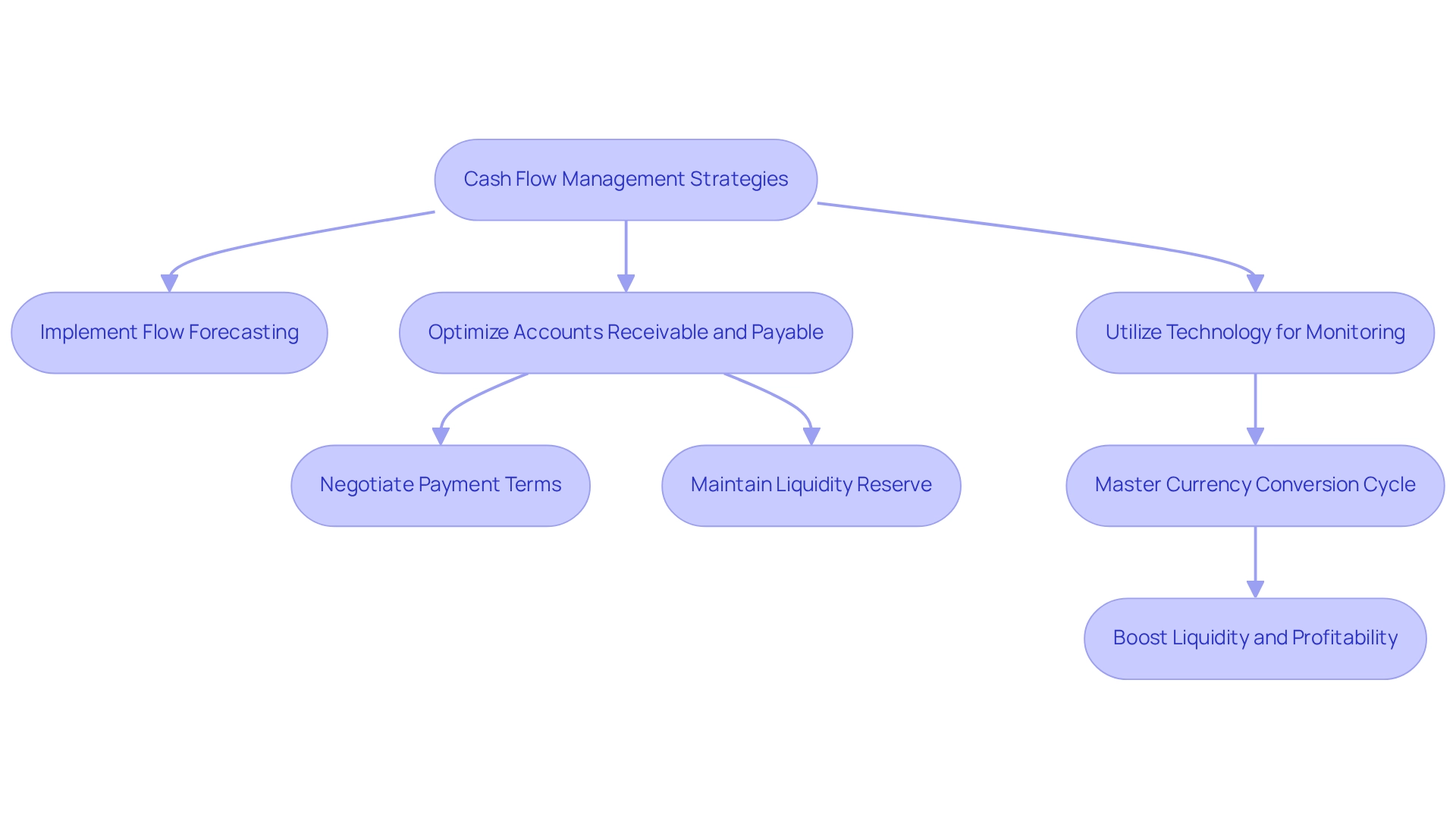

Cash Flow Management: Strategies for Sustaining Liquidity

CFOs must implement flow forecasting in their financial action plans to accurately predict upcoming financial requirements and identify potential deficits. By optimizing accounts receivable and payable, negotiating improved payment conditions with suppliers, and preserving a liquidity reserve, financial flexibility can be significantly enhanced.

Moreover, mastering the currency conversion cycle through 20 targeted strategies can substantially boost both liquidity and profitability. These strategies are available for just $99.

Utilizing technology for not only provides insights that assist in making prompt economic decisions but also streamlines the decision-making process, enabling executives to efficiently oversee business health.

To optimize financial flow management, chief financial officers are strongly encouraged to adopt these financial action plans and continuously assess their effectiveness.

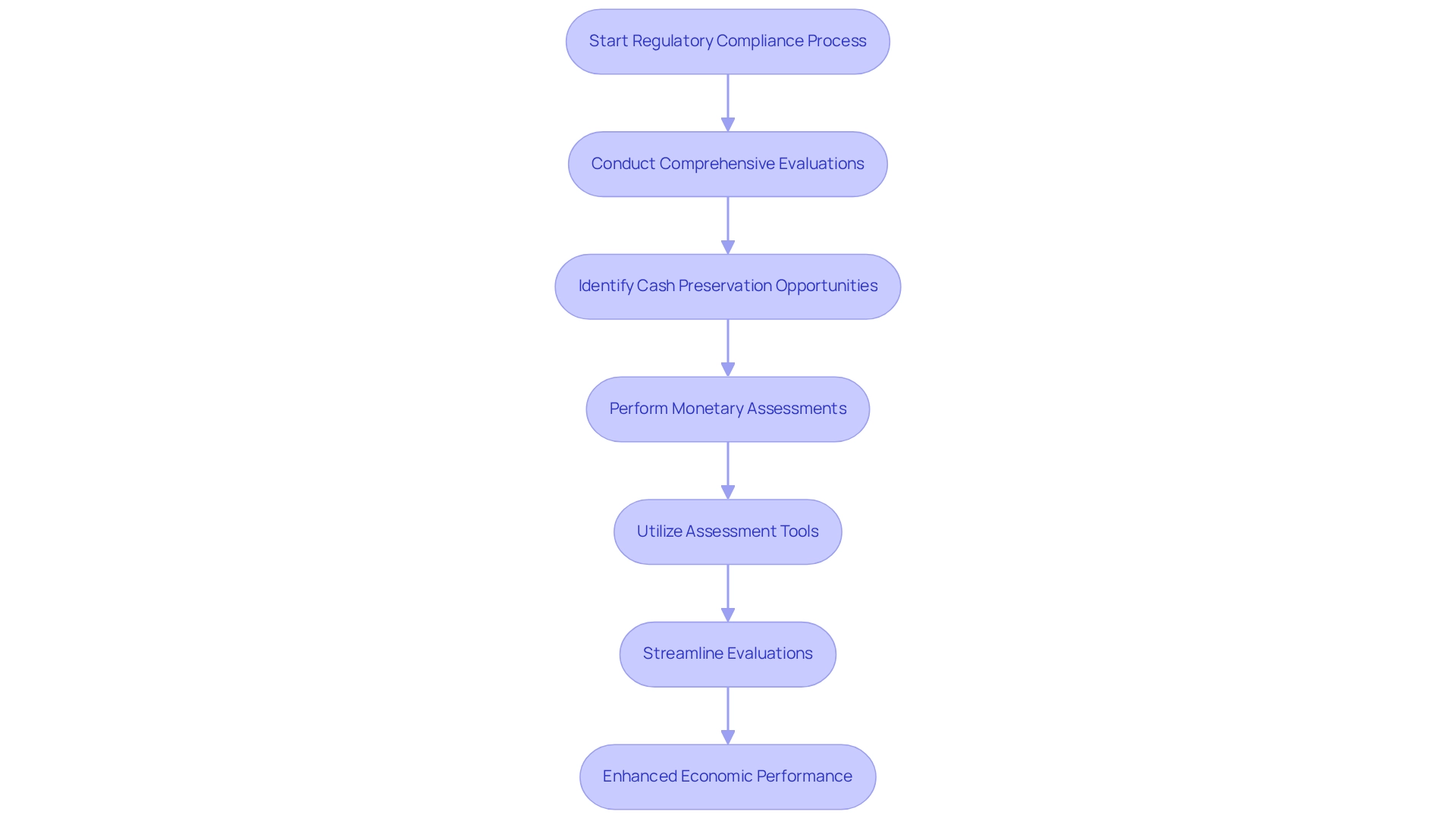

Regulatory Compliance: Ensuring Adherence to Financial Standards

CFOs must prioritize comprehensive evaluations to identify opportunities for cash preservation and liability reduction. By performing thorough monetary assessments, they can reveal value and lower expenses—crucial steps for stabilizing the economic standing of the business. Moreover, utilizing can streamline the process of evaluating economic health and ensuring effective risk mitigation. Frequent evaluations assist in pinpointing areas for enhancement and boost operational efficiency, ultimately aiding the organization's economic recovery and performance enhancement.

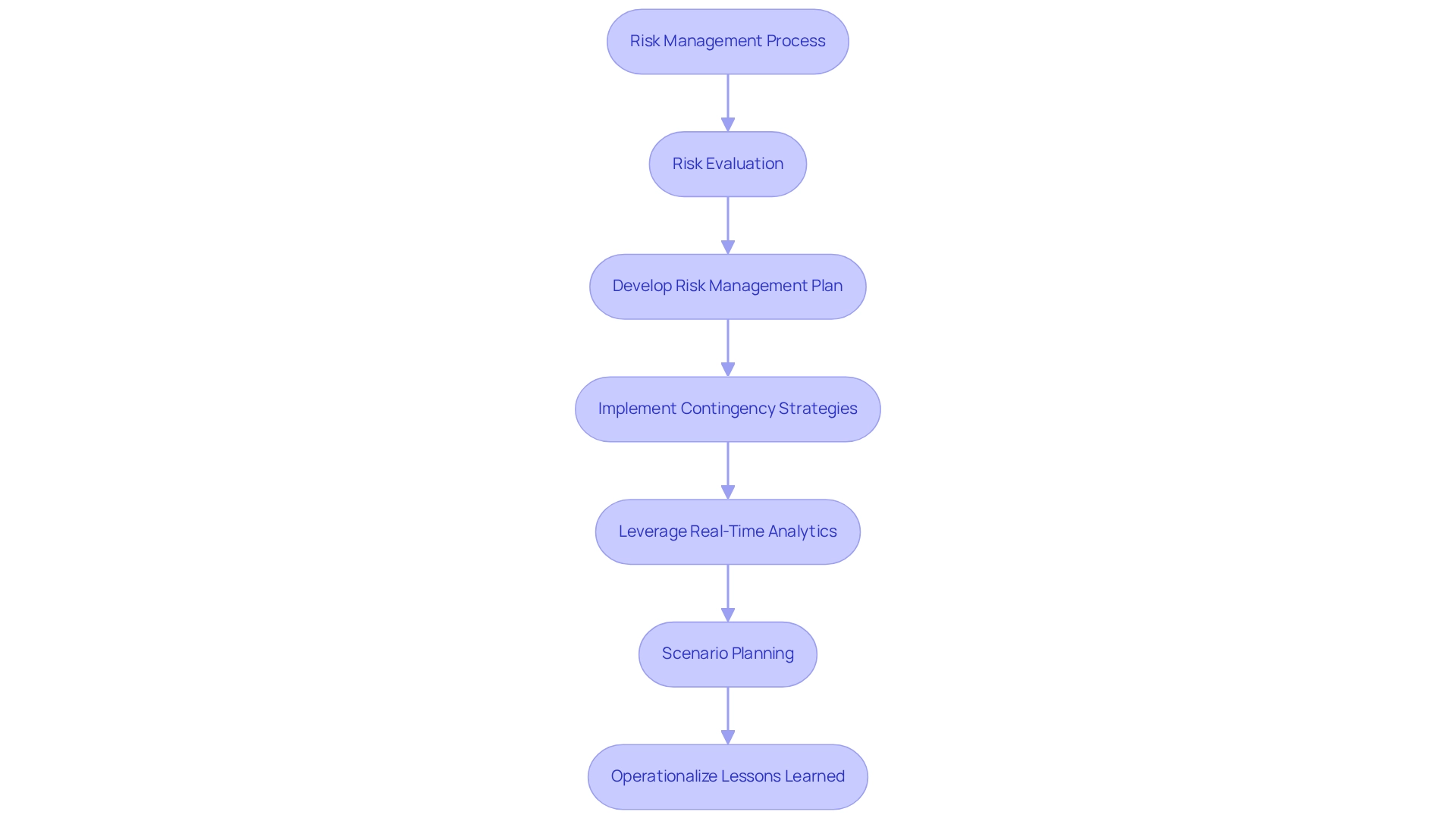

Risk Management: Identifying and Mitigating Financial Threats

Chief Financial Officers must conduct a comprehensive risk evaluation to identify monetary, operational, and market risks. Developing a robust risk management plan that encompasses contingency strategies, insurance coverage, and regular monitoring is essential for mitigating these risks. Moreover, by leveraging real-time analytics through client dashboards, financial executives can continuously assess organizational health and adjust strategies as needed.

Participating in scenario planning, supported by data-driven insights and hypothesis testing, equips organizations to navigate potential financial disruptions, ensuring resilience in the face of challenges. This proactive approach not only enhances risk management but also fosters strong relationships by during the turnaround process, all while facilitating a shortened decision-making cycle.

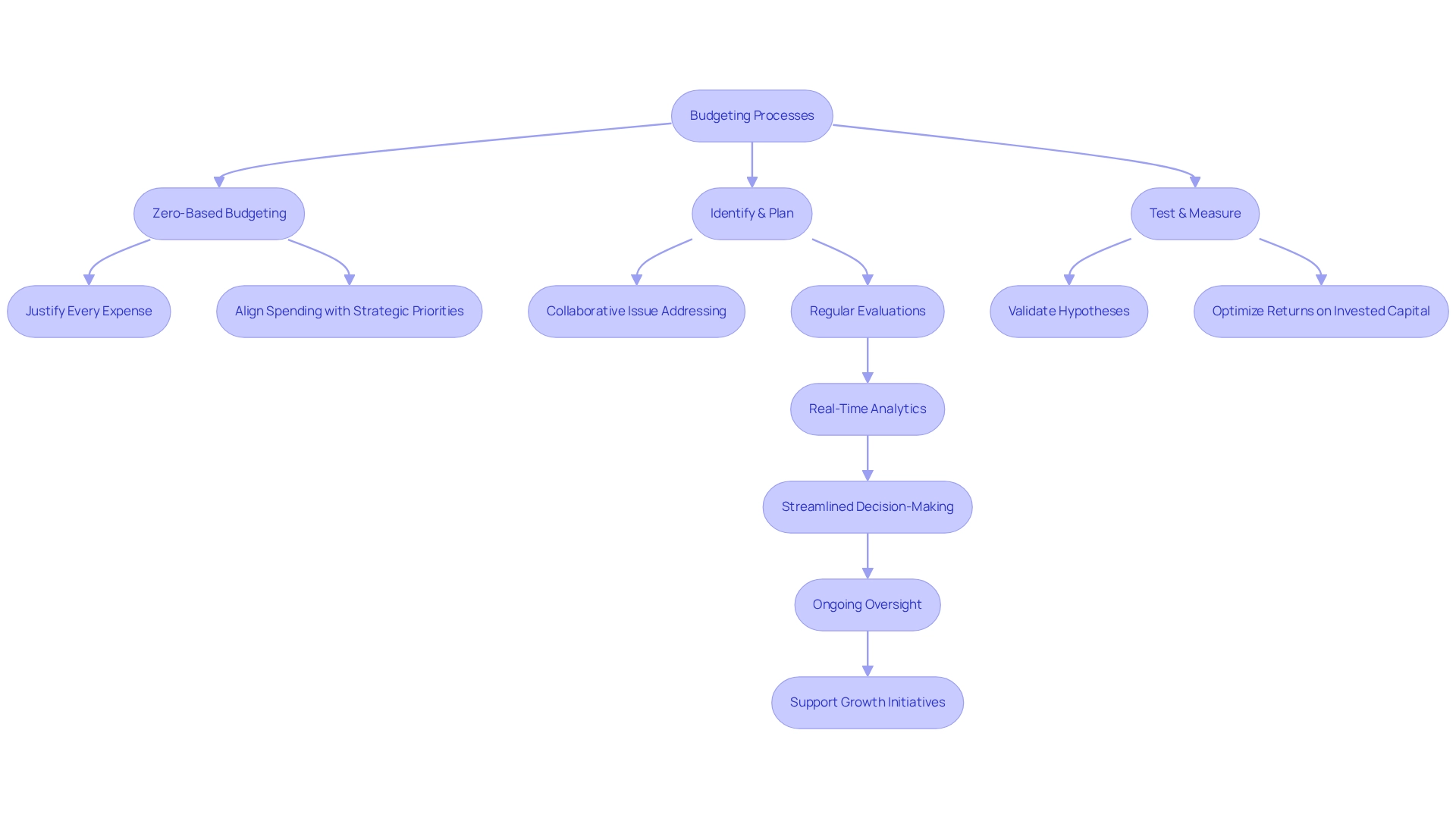

Budgeting Processes: Aligning Financial Resources with Strategic Goals

Chief Financial Officers should consider implementing a zero-based budgeting approach, where every expense must be justified for each new period. This method not only encourages but also aligns spending with strategic priorities. By integrating the 20 Strategies for Optimal Performance and mastering the cash conversion cycle, financial executives can enhance overall performance and ensure effective resource allocation to support growth initiatives.

Moreover, the 'Identify & Plan' method empowers financial leaders to collaboratively address fundamental issues, while the 'Test & Measure' strategy ensures that each hypothesis is validated to optimize returns on invested capital. Regular evaluations and adjustments based on performance indicators, coupled with real-time analytics, facilitate streamlined decision-making and ongoing oversight of business performance. Consequently, this approach ultimately promotes successful economic recovery.

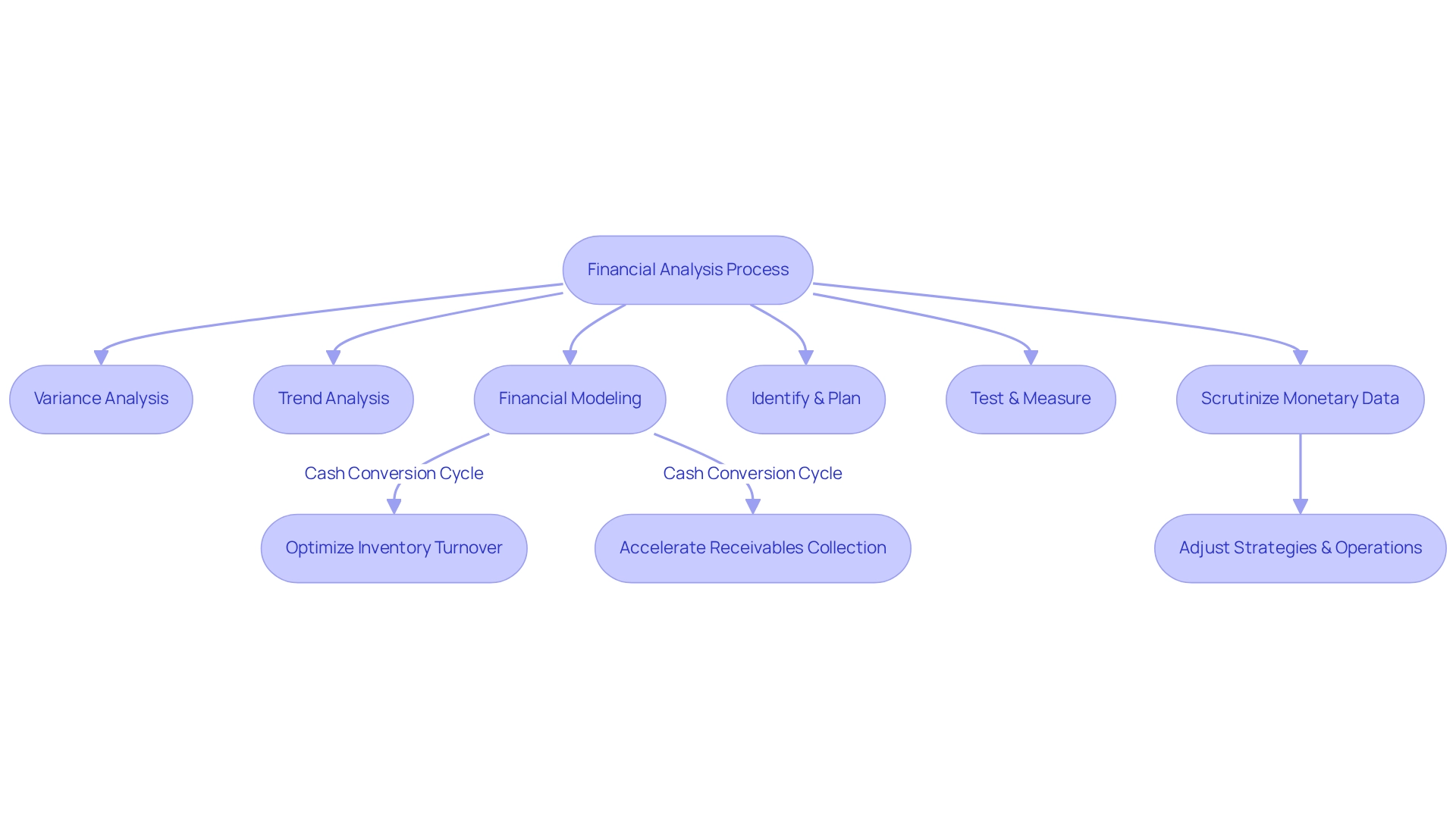

Financial Analysis: Leveraging Data for Informed Decision-Making

Chief Financial Officers must leverage analytical tools to evaluate key performance indicators (KPIs) and identify trends that inform strategic decision-making. Techniques such as variance analysis, trend analysis, and yield valuable insights into profitability and operational efficiency. By mastering the cash conversion cycle—through strategies like optimizing inventory turnover and accelerating receivables collection—financial leaders can significantly enhance their decision-making processes.

Implementing the 'Identify & Plan' approach empowers teams to collaboratively tackle underlying business challenges. Moreover, the 'Test & Measure' methodology guarantees that every hypothesis is validated, ensuring maximum return on invested capital. Consistently scrutinizing monetary data, coupled with real-time analytics, enables Chief Financial Officers to proactively adjust strategies and operations, effectively addressing weaknesses while capitalizing on strengths.

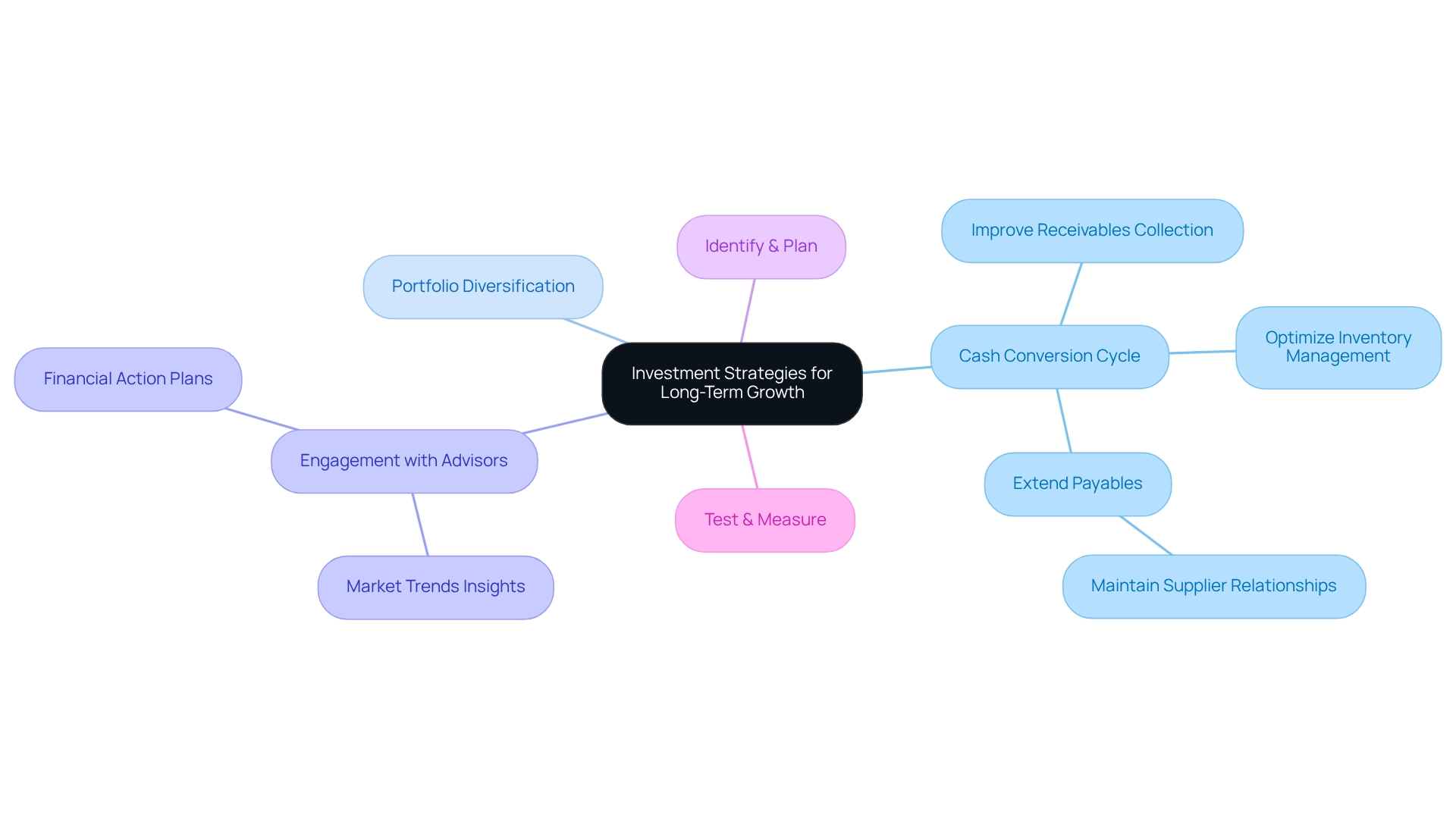

Investment Strategies: Fostering Long-Term Financial Growth

CFOs must rigorously evaluate potential investment opportunities by analyzing return on investment (ROI) and ensuring alignment with strategic goals. Mastering the is essential for enhancing business performance, as it facilitates streamlined decision-making and real-time analytics that significantly impact monetary recovery.

Effective strategies for mastering the cash conversion cycle include:

- Optimizing inventory management

- Improving receivables collection

- Extending payables without jeopardizing supplier relationships

Furthermore, diversifying investment portfolios can mitigate risks while promoting growth. Engaging with financial advisors provides valuable insights into market trends and investment opportunities, leading to the development of financial action plans that resonate with the company's long-term vision and ensure that investments are strategically planned and measured for maximum returns.

Additionally, implementing the 'Identify & Plan' process empowers financial executives to pinpoint underlying business issues, while the 'Test & Measure' approach guarantees that every hypothesis is rigorously tested to maximize return on invested capital.

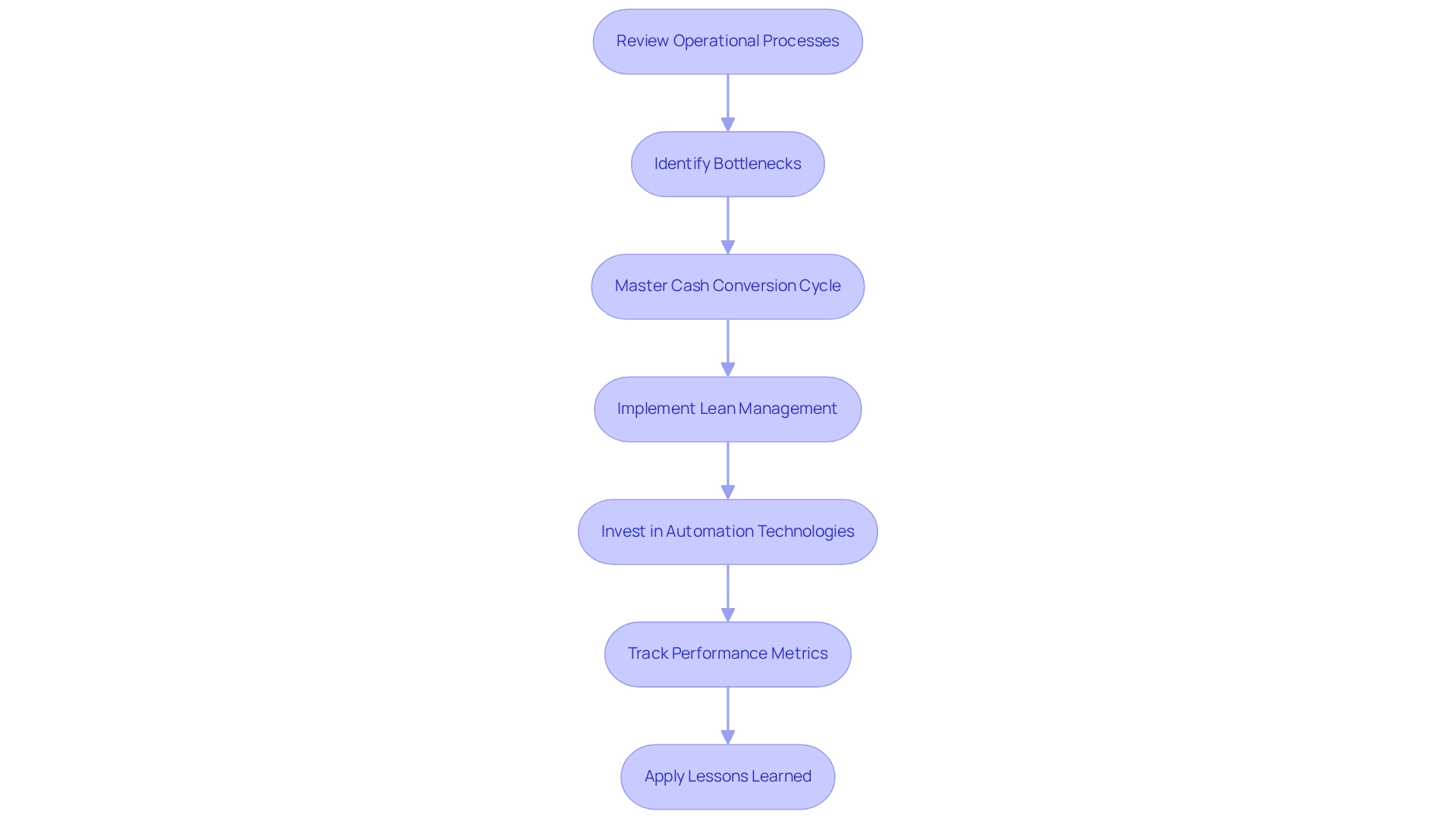

Operational Efficiency: Streamlining Processes for Cost Reduction

CFOs must undertake a comprehensive review of operational processes to pinpoint bottlenecks and inefficiencies. By mastering the cash conversion cycle and implementing lean management principles, they can effectively streamline operations and reduce costs. Moreover, investing in automation technologies significantly enhances this process, enabling quick decision-making and that support continuous business performance monitoring. Consistently tracking performance metrics ensures that operational enhancements are sustained over time, empowering financial leaders to apply turnaround lessons and optimize returns on investment.

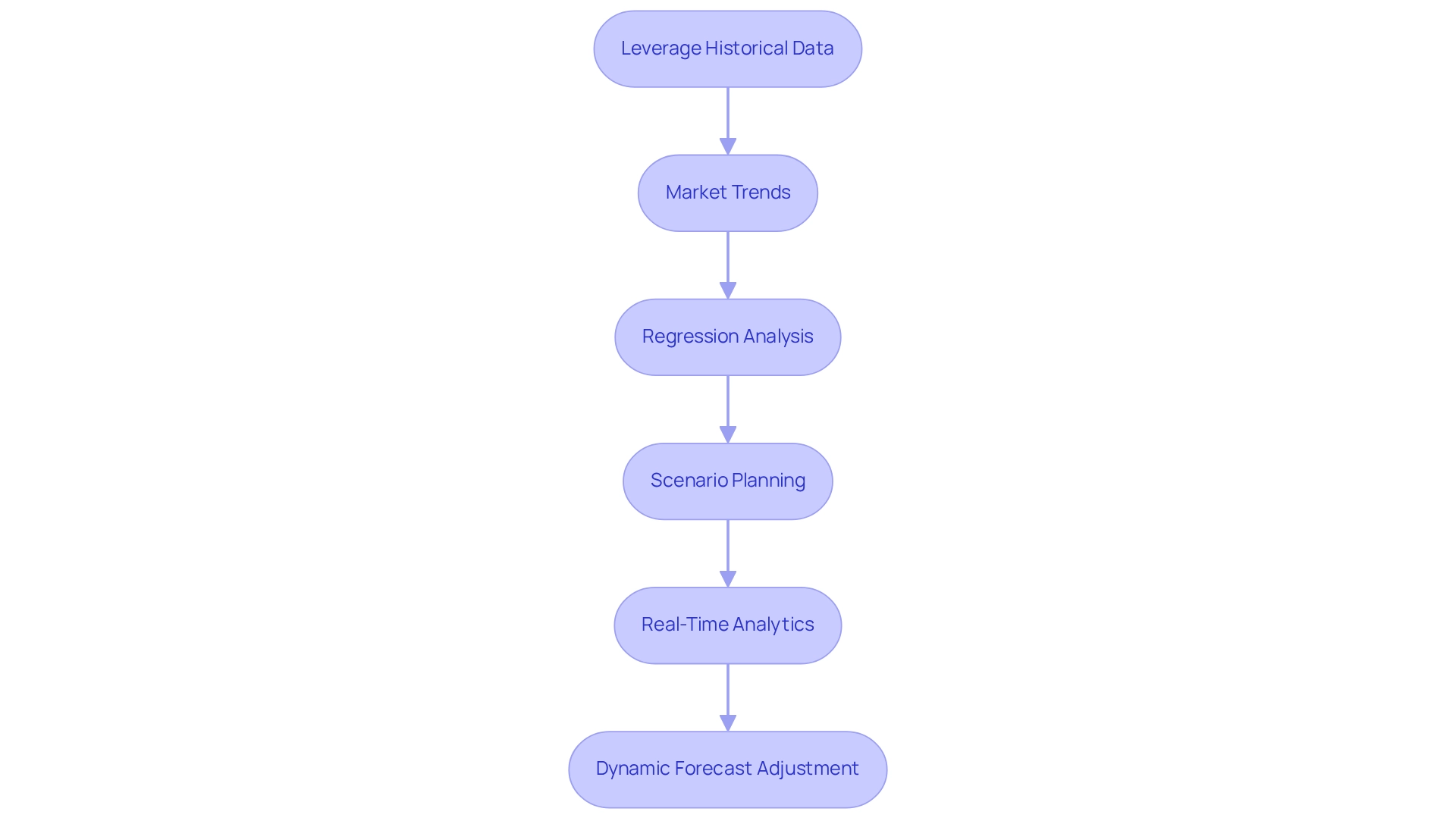

Financial Forecasting: Anticipating Future Financial Conditions

Financial executives must leverage historical data and market trends to craft precise financial forecasts. Techniques such as regression analysis and scenario planning significantly enhance forecasting accuracy. Moreover, by integrating real-time analytics through our client dashboard, financial executives can monitor ongoing performance and dynamically adjust forecasts. This strategy not only enables businesses to remain agile and responsive to fluctuating market conditions but also facilitates a . Consequently, this allows for decisive actions that safeguard business health while benefiting from a shortened decision-making cycle.

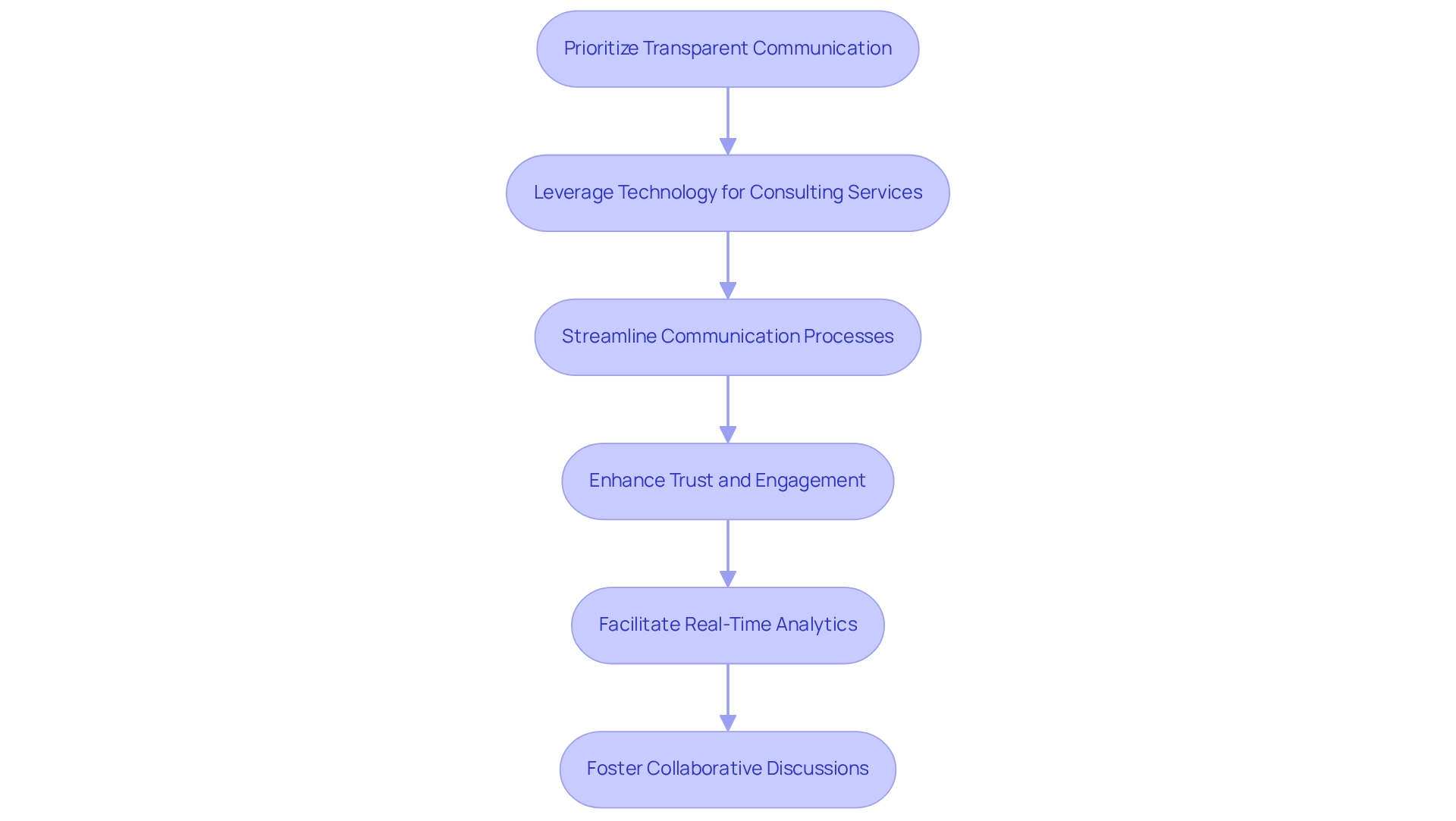

Stakeholder Communication: Building Trust Through Financial Transparency

CFOs must prioritize clear and transparent communication with stakeholders concerning fiscal performance and strategic initiatives. By leveraging technology-enabled turnaround consulting services, they can streamline communication processes, ensuring that regular updates and detailed financial reports are readily accessible. This approach not only enhances trust and engagement but also facilitates that inform discussions and decision-making. Moreover, continuous business performance monitoring provides operational insights that enrich open forums for discussion, fostering a collaborative environment that emphasizes transparency, results, and innovation.

Conclusion

The CFO's role is essential for the financial health and sustainability of small and medium businesses. This article underscores the importance of comprehensive financial assessments to uncover cost-saving opportunities and revenue growth strategies. By employing financial ratios and industry benchmarks, CFOs can enhance operational efficiency and overall performance.

Effective cash flow management is critical for maintaining liquidity and forecasting future needs. Strategies such as optimizing accounts receivable and payable, along with real-time cash flow tracking, empower CFOs to make informed decisions that stabilize finances. Additionally, prioritizing regulatory compliance through thorough financial reviews mitigates risks and supports long-term success.

Risk management is vital, as identifying potential threats and developing contingency plans protects against financial disruptions. Utilizing real-time analytics and scenario planning allows CFOs to adapt strategies in a changing market. Aligning budgeting processes with strategic goals through zero-based budgeting ensures efficient resource allocation.

Moreover, leveraging financial analysis tools enhances decision-making by enabling continuous monitoring of key performance indicators. This proactive approach allows CFOs to capitalize on strengths and adjust strategies as needed. Investment strategies focused on return on investment solidify a foundation for growth.

In summary, implementing these strategies fosters operational efficiency and financial recovery while promoting transparent stakeholder communication. By adopting these practices, CFOs can position their organizations to thrive in a competitive environment, ensuring resilience and paving the way for sustainable growth. These proactive measures are essential for any CFO committed to securing a prosperous future for their business.

Frequently Asked Questions

Why is conducting a thorough economic assessment important for organizations?

Conducting a thorough economic assessment is essential for optimizing performance, as it involves analyzing key fiscal statements, cash flow, and operational efficiency to identify areas for cost reduction and revenue increase.

What tools can CFOs use to enhance their economic assessments?

CFOs can employ tools such as financial ratios and benchmarking against industry standards to gain valuable insights into performance and identify areas for enhancement.

How can a Business Valuation Report assist in the assessment process?

A Business Valuation Report can provide expert guidance that enhances the assessment process, particularly when integrating AI/ML strategies for small and medium-sized business (SMB) turnaround.

What is the significance of routine evaluations in financial assessments?

Routine evaluations are crucial for helping companies adjust to evolving market circumstances and maintain financial stability.

What strategies can improve the liquidity conversion cycle?

Mastering the liquidity conversion cycle through focused strategies can significantly elevate business performance.

What role does flow forecasting play in financial action plans?

Flow forecasting helps CFOs accurately predict upcoming financial requirements and identify potential deficits, enhancing financial flexibility.

How can optimizing accounts receivable and payable improve financial health?

By negotiating improved payment conditions with suppliers and preserving a liquidity reserve, organizations can significantly enhance their financial flexibility.

What is the cost of the targeted strategies for mastering the currency conversion cycle?

The targeted strategies for mastering the currency conversion cycle are available for $99.

How does technology aid in revenue flow monitoring?

Utilizing technology for instantaneous revenue flow monitoring provides insights that assist in making prompt economic decisions and streamlines the decision-making process.

What should CFOs prioritize to enhance cash preservation and reduce liabilities?

CFOs must prioritize comprehensive evaluations to identify opportunities for cash preservation and liability reduction through thorough monetary assessments.

How can assessment tools streamline the evaluation process?

Assessment tools can simplify the process of evaluating economic health and ensuring effective risk mitigation, ultimately aiding in the organization's economic recovery and performance enhancement.