Overview

The key benefits of interim business management for CFOs are substantial:

- Enhanced operational efficiency

- Improved cash flow

- Capability to navigate financial distress with expertise

Interim managers bring specialized knowledge and fresh perspectives that empower organizations to implement targeted strategies. Moreover, they streamline processes and facilitate the faster execution of strategic initiatives. Consequently, these advantages position organizations for sustainable growth, making interim management a compelling solution for today’s financial challenges.

Introduction

In the dynamic landscape of small and medium enterprises, the necessity for agile and effective leadership has reached unprecedented levels. Interim management stands out as a compelling solution, granting organizations access to seasoned professionals capable of implementing immediate changes and driving strategic initiatives without the long-term commitment associated with permanent hires.

These experts not only introduce fresh perspectives and specialized skills but also significantly enhance operational efficiency and financial performance during critical transitions. As businesses confront escalating challenges—from economic volatility to the imperative for rapid innovation—leveraging interim management can yield substantial improvements in execution speed and overall stability.

This article explores the multifaceted advantages of interim management, illustrating how tailored strategies can foster growth, streamline operations, and ensure compliance, ultimately positioning organizations for sustainable success in an ever-evolving market.

Transform Your Small/ Medium Business: Expert Interim Management Solutions

Interim business management provides a strategic advantage for small and medium enterprises by granting access to seasoned leaders capable of instigating prompt change. These professionals bring fresh perspectives and specialized expertise, which are essential for navigating challenging circumstances. By implementing interim business management, organizations can swiftly address urgent operational needs without the long-term commitments associated with permanent staff. This flexibility promotes adaptability in strategy execution, a critical factor for maintaining momentum during uncertain times.

Notably, firms that utilize interim business management during pivotal transitions experience 30-40% faster execution of their strategic initiatives, highlighting the substantial impact these experts can have on business performance. Moreover, mastering the cash conversion cycle is vital for enhancing overall business performance. Temporary supervisors can implement specific tactics such as:

- Improving inventory turnover

- Accelerating receivables collection

- Extending payables

to ensure efficient cash flow management. As industries increasingly confront pressures to reduce their environmental impact, interim business management by temporary managers equipped with crisis and risk management skills is invaluable in guiding organizations through economic volatility and supply chain challenges.

As Jon Younger emphasizes, is essential for tackling these issues. By focusing on project acquisition, digital transformation, and professional growth, interim business management not only stabilizes operations but also prepares organizations for sustainable advancement.

To implement interim business management solutions effectively, CFOs should assess their current operational challenges and identify specific areas where temporary expertise can drive immediate improvements. This includes leveraging real-time analytics to evaluate organizational health and apply lessons learned, ensuring that decision-making processes are both swift and informed.

The cost for these interim management solutions is $99.00, providing a clear understanding of the investment required for performance enhancement.

Improved Cash Flow: Enhancing Liquidity Through Interim Management

Interim business management is essential as interim managers play a crucial role in executing cash flow strategies that significantly enhance liquidity for struggling enterprises. By conducting thorough analyses of existing financial practices, they identify inefficiencies and introduce targeted measures, such as tighter credit controls and streamlined invoicing processes. These strategies not only preserve cash but also optimize working capital, enabling businesses to maintain operational stability while positioning themselves for future growth.

Statistics indicate that organizations employing temporary management can experience an average cash flow enhancement of up to 30%, according to industry reports. This underscores the effectiveness of these leaders in navigating financial challenges. For instance, a recent case study titled 'Balancing Growth and Stability' illustrates how CFOs can strategically allocate resources to safeguard stability while pursuing growth, demonstrating the evolving role of financial leadership in complex environments.

Expert opinions affirm that interim business management by temporary leaders improves liquidity by fostering a culture of financial discipline and accountability. Their ability to implement —such as Just-in-Time (JIT) inventory management—aligns inventory orders with production schedules, thereby reducing storage costs and waste. This approach not only frees up cash for better utilization but also supports sustainable growth initiatives. Strategies to reduce excess inventory can further liberate cash, allowing for more effective resource allocation.

Moreover, temporary leaders leverage real-time analytics to consistently assess organizational health, facilitating rapid decision-making that is vital during turnaround processes. As Jason Carlson, CFO of Mood Media, states, "Embracing digital and integrated solutions can transform a critical vulnerability into a strategic asset, positioning SMBs for sustainable growth and success in the digital age." This perspective emphasizes the significance of temporary leaders in harnessing technology to enhance financial oversight and apply lessons learned.

In summary, the strategic actions of interim business management are instrumental in enhancing liquidity, ensuring that enterprises are well-equipped to thrive even in challenging economic landscapes.

Strategic Leadership: Leveraging Experienced Interim Executives

Seasoned executives in interim business management deliver invaluable strategic guidance during organizational transitions, leveraging their extensive knowledge and industry expertise. Their capacity to assess an organization's current state enables them to identify key challenges and devise actionable plans tailored to specific needs. not only assists organizations in navigating immediate operational hurdles but also ensures alignment with long-term objectives. By mastering the cash conversion cycle, temporary leaders implement strategies that enhance business performance, streamline decision-making, and facilitate real-time analytics for effective turnaround management. Priced at $99.00, these strategies present a compelling value proposition for organizations seeking improvement.

Statistics reveal that temporary managers typically serve for 6 to 12 months, a timeframe that can yield significant enhancements in organizational performance. For instance, optimizing staffing models under temporary leadership has been shown to elevate overall organizational value by 25%. Furthermore, case studies demonstrate that the cost-effectiveness of interim business management—where temporary managers are compensated for designated durations—can lead to reduced overall expenditures compared to permanent hires, thus preserving cash flow during critical periods. By focusing on performance enhancement, particularly during potentially distracting year-end periods, temporary executives empower teams to maintain momentum and foster sustainable growth. As Ross Gordon articulates, 'Candidates who perform well in PE portfolio companies relish challenges and are comfortable with change,' underscoring the adaptability and effectiveness of temporary leaders.

Additionally, with over a decade of experience in educating, advising, and placing interim executives across 40 countries, organizations like IMW highlight the global reach and expertise that interim executives bring to the table. Our pragmatic approach incorporates a 'Test & Measure' strategy, ensuring that every hypothesis is rigorously tested to deliver maximum return on invested capital in both the short and long term.

Operational Efficiency: Streamlining Processes with Interim Management

includes interim managers who play a vital role in streamlining operations to enhance efficiency within small enterprises. They begin by conducting thorough evaluations of current processes to identify bottlenecks and inefficiencies, revealing underlying organizational issues that require immediate attention. By collaborating with teams to implement best practices and leveraging new technologies, these leaders optimize workflows, leading to substantial reductions in overhead costs and enhanced productivity. For instance, organizations that have optimized their staffing models through temporary management have reported a remarkable 25% increase in overall value, specifically due to strategic staffing adjustments.

Moreover, involving temporary managers, whose daily fees typically range from 1,000 to 2,000 euros, can result in considerable cost savings by avoiding additional expenses associated with full-time employment, while ensuring prompt contributions to the organization. This approach not only preserves cash flow but also positions the business for sustainable growth. The integration of diverse talent within temporary management teams has also been shown to drive innovation, potentially increasing revenue by 10%, as diverse teams are linked to higher levels of creativity and problem-solving.

Furthermore, in certain situations, the temporary leader may even assume the permanent position, ensuring continuity and stability. By concentrating on operational efficiency and evaluating hypotheses to assess investment returns, temporary leaders enable transformative change that empowers organizations to handle crises effectively and emerge stronger. To implement interim business management strategies effectively, CFOs should conduct a thorough assessment of their current operational challenges and identify areas where temporary expertise can provide immediate impact.

Risk Management: Ensuring Compliance and Stability During Transitions

Interim business management is crucial as interim leaders play a pivotal role in managing risk and ensuring compliance with regulatory requirements and internal policies during business transitions. They conduct comprehensive assessments of potential risks and implement targeted strategies to effectively mitigate them. By fostering stability and ensuring adherence to legal standards, protect organizations from potential pitfalls during periods of change.

Notably, 57% of corporate risk and compliance experts have observed that compliance positions have become more specialized, underscoring the necessity for interim leaders to possess specific compliance skills. Furthermore, statistics reveal that 40% of supply chain experts prioritize risk management and resilience, highlighting how interim business management leaders can effectively address these challenges through robust risk management strategies during transitions.

By facilitating a streamlined decision-making process, interim leaders empower companies to act swiftly, thereby maintaining operational health. The utilization of real-time analytics via client dashboards enables continuous monitoring of business performance, ensuring that strategies are adjusted as required.

Case studies indicate that organizations utilizing interim business management often achieve higher compliance rates, demonstrating their ability to implement stringent standards and training programs. As Anna Fitzgerald, Senior Content Marketing Director, asserts, 'Employee training is one of the most effective cost mitigators of data breaches,' emphasizing the significance of training programs led by interim leaders. This unwavering commitment to compliance not only safeguards the organization but also enhances its reputation and operational efficiency during transitions.

Turnaround Expertise: Navigating Financial Distress with Interim Management

Interim business management with turnaround expertise plays a crucial role in guiding organizations through financial distress. They begin by conducting a thorough assessment of the company's financial health, pinpointing critical issues that require immediate attention. Defining specific requirements and objectives is essential to ensure that the temporary manager aligns with the company's strategic goals. With a strategic approach, these leaders develop tailored to the unique challenges faced by the business.

To master the cash conversion cycle, temporary executives implement targeted strategies such as:

- Optimizing inventory management

- Accelerating receivables collection

- Extending payables without harming supplier relationships

By restructuring debt and enhancing operational efficiencies, they stabilize the organization and pave the way for recovery. Employing real-time analytics, temporary supervisors consistently observe organizational performance, enabling rapid decision-making and modifications as necessary. For example, in a significant case study named "Executing Under Pressure," temporary turnaround leaders effectively guided initiatives that required making difficult choices, reorganizing teams, and closing unprofitable divisions. Their proactive leadership not only improved internal alignment but also revitalized customer relationships, resulting in tangible improvements in performance and stakeholder confidence.

Statistics show that companies that implement interim business management experience higher turnaround success rates, with many achieving significant financial recovery. In Austria, for example, approximately 27% of part-time roles are filled by interim managers, underscoring the growing reliance on these professionals in times of crisis. Their capacity to navigate intricate financial challenges, test hypotheses, and apply lessons learned makes them invaluable assets for entities aiming to overcome adversity and achieve sustainable growth.

Tailored Solutions: Customizing Interim Management for Unique Business Needs

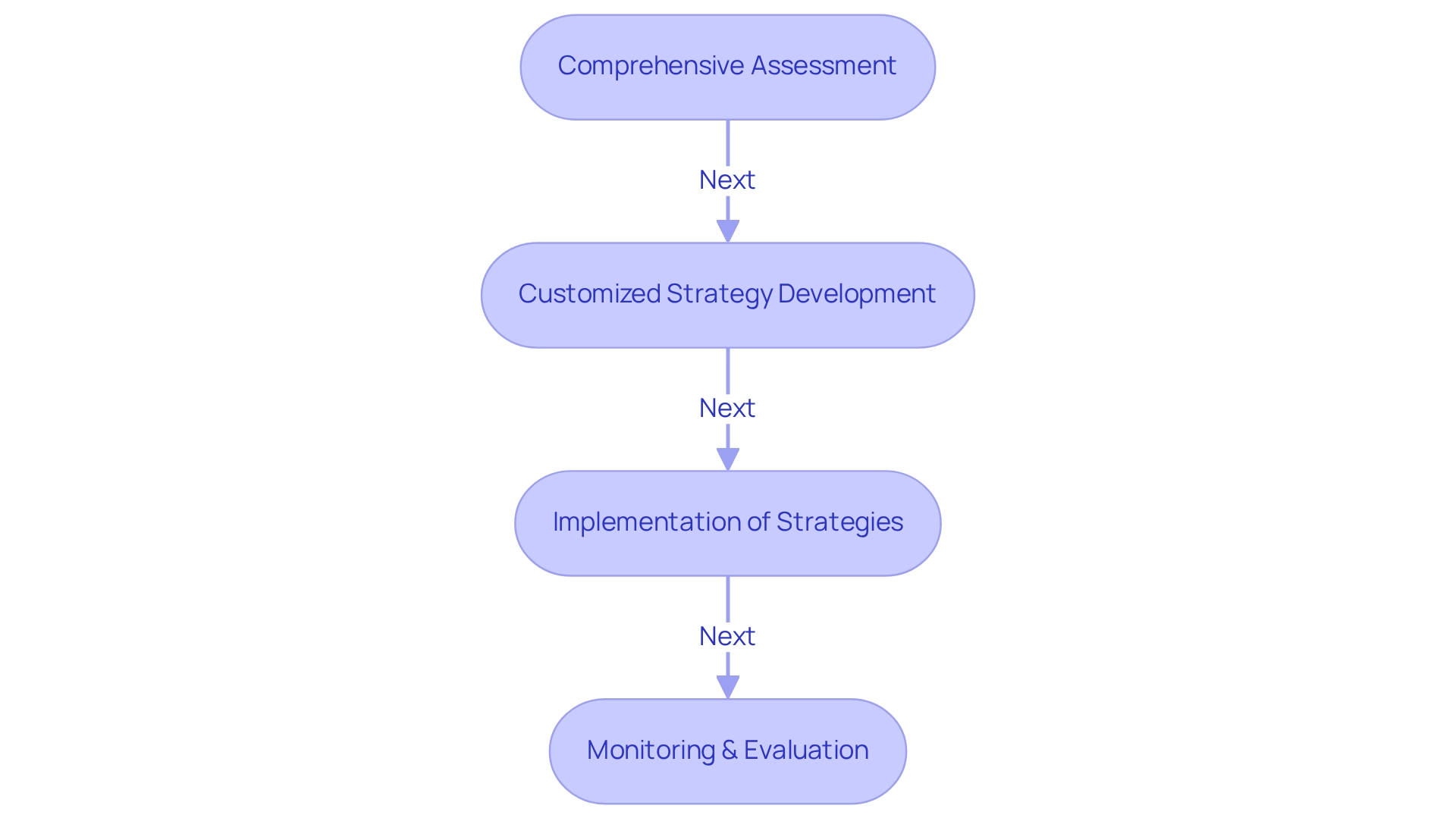

Interim business management solutions are not one-size-fits-all; they can be meticulously tailored to meet the distinct needs of each organization, particularly in the context of industry-specific challenges. By conducting a comprehensive assessment of the specific challenges and objectives, temporary leaders can craft customized strategies that effectively tackle pressing issues. This customized method not only enhances the value of the temporary engagement but also guarantees alignment with the company's long-term objectives.

For instance, a recent case study highlighted how customized temporary management strategies were employed to address operational transformation challenges in a mid-sized retail company. The temporary executive implemented targeted change management initiatives that resulted in a 30% increase in operational efficiency within six months. This example illustrates the critical challenges leading to temporary assignments, such as change management and operational transformation, which are driving the demand for experienced temporary executives.

Statistics show that entities that employ tailored temporary management solutions achieve a 25% greater success rate in reaching their strategic goals compared to those that do not. This effectiveness is mostly ascribed to the thoughtful choice of temporary leaders who align with the culture and particular needs of the entity. As Megan Moody, CPA, emphasizes, "Select the appropriate specialists and your temporary leaders will be prepared to handle everything from compliance intricacies to complex financial landscapes." This underscores the significance of selecting the right specialists, particularly during critical transitions.

Moreover, the rising need for interim business management emphasizes the significance of this customized method, as companies more frequently pursue seasoned executives to lead them through intricate transitions. By employing a practical approach to data, temporary leaders can test hypotheses and make swift decisions based on real-time analytics, continually monitoring performance to ensure effective implementation of lessons learned. In summary, tailoring interim business management solutions not only addresses but also positions companies for long-term sustainable growth and success.

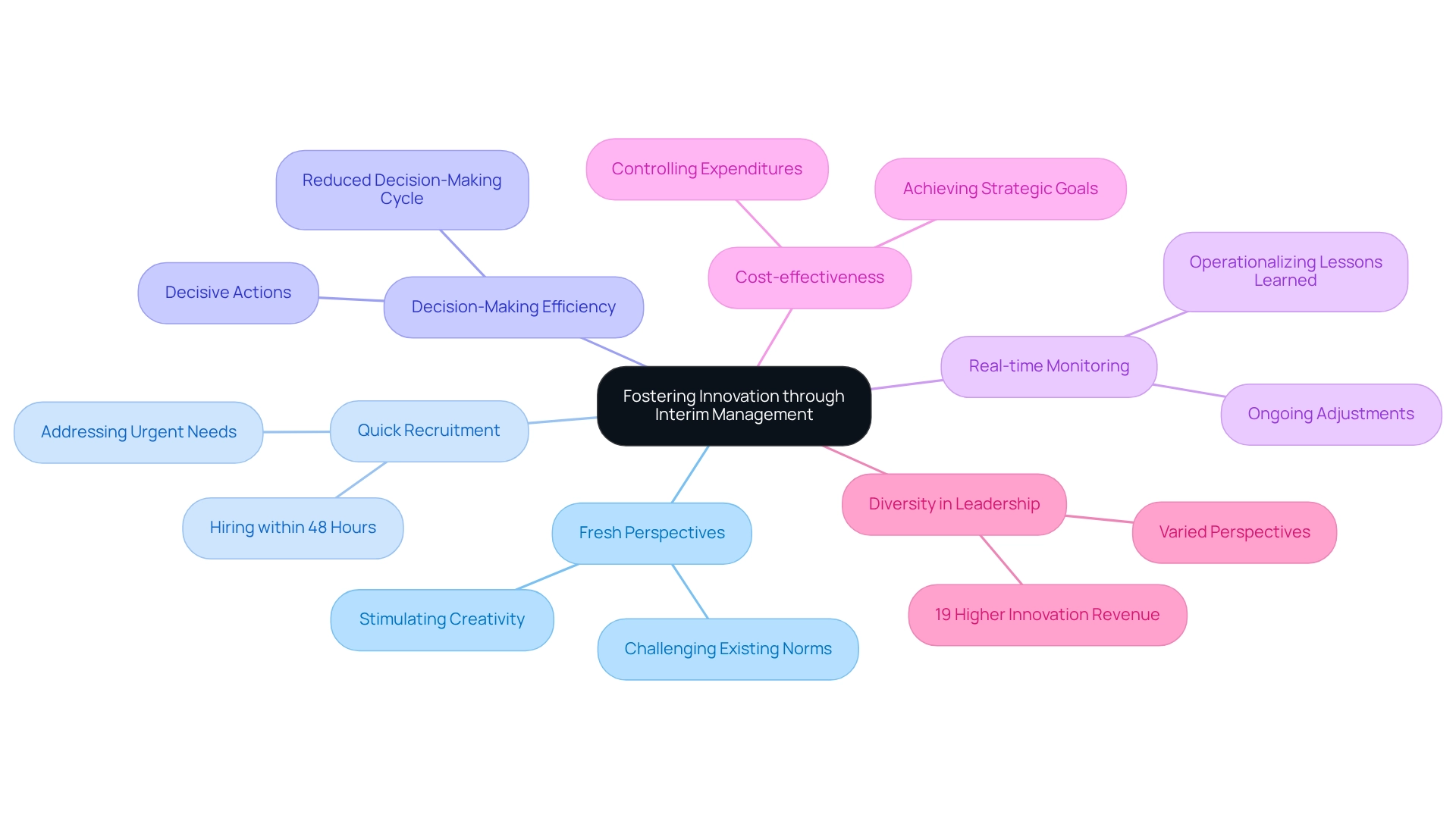

Fostering Innovation: Driving Change Through Interim Management

Interim leaders play a pivotal role in fostering a culture of innovation by encouraging teams to explore new ideas and methodologies. Their fresh perspectives challenge existing norms and stimulate creativity, allowing enterprises to adapt to evolving market dynamics. As Samuele Deidda, Marketing Growth Associate at Consultport, observes, 'Interim business management offers an essential link for entities navigating periods of transition, crisis, or strategic realignment.' By leveraging innovative practices and advanced technologies, temporary leaders not only facilitate immediate improvements but also lay the groundwork for sustainable growth.

The quick recruitment procedure for temporary leaders enables organizations to promptly tackle pressing requirements, as shown by Consultport's capability to connect clients with appropriate candidates within 48 hours. This efficiency highlights the potential for temporary leadership to drive significant change and foster an environment where innovation flourishes. Moreover, temporary leaders facilitate a reduced decision-making cycle during the turnaround process, allowing decisive actions that maintain organizational health.

They continually monitor the success of implemented strategies through real-time business analytics, allowing for ongoing adjustments and operationalization of lessons learned. The cost-effectiveness of employing temporary leaders is a significant benefit, enabling companies to control expenditures efficiently while still reaching their strategic goals. Companies that embrace diversity in their leadership teams have been shown to achieve , highlighting the importance of varied perspectives in enhancing creative outcomes. Ultimately, interim business management involves temporary leaders who act as catalysts for transformation, guiding entities through periods of transition while instilling a forward-thinking mindset.

Financial Assessments: Identifying Opportunities for Cash Preservation

Interim managers play a pivotal role in conducting that uncover opportunities for cash preservation and deliver maximum return on invested capital. They meticulously analyze cash flow patterns and liabilities, employing various techniques to optimize working capital. By prioritizing cash management, these leaders enable organizations to maintain liquidity and effectively navigate financial challenges.

For instance, in a case study titled 'Transformational Change in Healthcare Management,' a temporary Chief Restructuring Officer (CRO) implemented new processes that fostered a performance-driven culture, significantly enhancing stakeholder satisfaction and alignment. This illustrates how temporary management can yield significant enhancements in financial well-being. Moreover, interim managers support a shortened decision-making cycle by quickly assessing financial data and implementing strategies that enhance responsiveness to market changes.

By utilizing real-time commercial analytics through client dashboards, they continually monitor the success of their strategies, allowing for timely updates and adjustments that enhance cash flow margins. Statistics indicate that effective cash preservation strategies can significantly enhance an organization's cash flow margin, calculated as cash flow from operations divided by net revenue. By employing a pragmatic approach to data and testing each hypothesis, temporary leaders not only discover cash flow opportunities but also execute strategies that guarantee sustainable financial stability for small to medium-sized enterprises.

As noted by Samuele Deidda, 'Interim business management offers an essential link for entities navigating phases of transition, crisis, or strategic realignment.' Furthermore, companies can discover the suitable temporary manager by collaborating with specialized consultancies or platforms that connect entities with skilled temporary executives.

Sustainable Growth: Achieving Long-Term Success with Interim Management

Interim business management serves as a pivotal catalyst, addressing immediate challenges while laying the groundwork for sustainable growth. By implementing targeted strategies—such as financial assessment, operational streamlining, and cultivating a culture of continuous improvement—interim leaders empower organizations to enhance resilience and adapt to shifting market dynamics. This includes mastering the cash conversion cycle through 20 strategic approaches that bolster organizational performance.

Moreover, a commitment to efficient decision-making and real-time analytics, facilitated by a client dashboard, enables swift adjustments and effective oversight of organizational health, ensuring that entities can respond rapidly to changing circumstances. This dedication to long-term success positions businesses advantageously for growth in an increasingly competitive landscape.

Significantly, the demand for temporary talent has surged by 310%, highlighting a growing recognition of their value in driving strategic initiatives. Successful examples abound, such as the leadership strategies employed at Southwest Airlines, where , akin to Disney's philosophy of 'To make people happy,' combined with effective cost management under temporary leadership, has consistently resulted in profitability.

These insights underscore the critical role of interim business management in achieving sustainable growth and navigating the complexities of today's business environment.

Conclusion

Interim management emerges as a vital strategy for small and medium enterprises navigating the complexities of today's business landscape. By engaging seasoned professionals, organizations can implement immediate changes, enhance operational efficiency, and drive strategic initiatives without the long-term commitments required for permanent hires. The flexibility and specialized expertise offered by interim leaders enable companies to address pressing challenges, optimize cash flow, and streamline processes, ultimately resulting in a significant boost in performance.

The statistics speak volumes: businesses leveraging interim management can achieve faster execution of strategic initiatives, improved cash flow, and a heightened capacity for innovation and risk management. These advantages are not merely theoretical; they translate into tangible outcomes that foster resilience and sustainable growth. Tailored solutions provided by interim executives ensure that organizations can navigate transitions effectively, aligning immediate actions with long-term objectives.

As the demand for interim talent continues to rise, recognizing the strategic value of these leaders becomes essential for businesses aiming to thrive in an ever-evolving market. By prioritizing interim management, organizations position themselves not only to overcome current challenges but also to lay a robust foundation for future success. Embracing this approach can lead to transformative change, ultimately empowering businesses to achieve their goals with agility and confidence.

Frequently Asked Questions

What is interim business management?

Interim business management involves the use of experienced leaders on a temporary basis to drive strategic change and address urgent operational needs within an organization.

How does interim business management benefit small and medium enterprises?

It provides access to seasoned leaders who can instigate prompt change, bring fresh perspectives, and implement specialized expertise, allowing organizations to adapt quickly to challenging circumstances without long-term commitments.

What impact does interim business management have on strategic initiatives?

Firms utilizing interim business management during pivotal transitions can execute their strategic initiatives 30-40% faster, significantly enhancing business performance.

What specific tactics can interim managers implement to improve cash flow?

Interim managers can improve inventory turnover, accelerate receivables collection, and extend payables to ensure efficient cash flow management.

How does interim business management help organizations during economic volatility?

Interim managers equipped with crisis and risk management skills can guide organizations through economic challenges and supply chain issues, emphasizing the importance of effective crisis management.

What should CFOs consider when implementing interim business management solutions?

CFOs should assess current operational challenges and identify specific areas where temporary expertise can drive immediate improvements, leveraging real-time analytics for informed decision-making.

What is the cost associated with interim management solutions?

The cost for interim management solutions is $99.00, which provides a clear understanding of the investment required for performance enhancement.

How do interim managers enhance liquidity for struggling enterprises?

They conduct thorough analyses of financial practices to identify inefficiencies and implement targeted measures such as tighter credit controls and streamlined invoicing processes, which preserve cash and optimize working capital.

What statistics support the effectiveness of interim management in improving cash flow?

Organizations employing temporary management can experience an average cash flow enhancement of up to 30%, indicating the significant impact of these leaders on financial challenges.

How long do interim managers typically serve in organizations?

Temporary managers generally serve for 6 to 12 months, a timeframe that can lead to significant enhancements in organizational performance.

What is the value proposition of interim business management?

The strategies offered by interim managers present a compelling value proposition for organizations seeking improvement, as they can lead to reduced overall expenditures compared to permanent hires while enhancing performance.